Indkaldelse til ordinær generalforsamling - JØP

Indkaldelse til ordinær generalforsamling - JØP

Indkaldelse til ordinær generalforsamling - JØP

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

16<br />

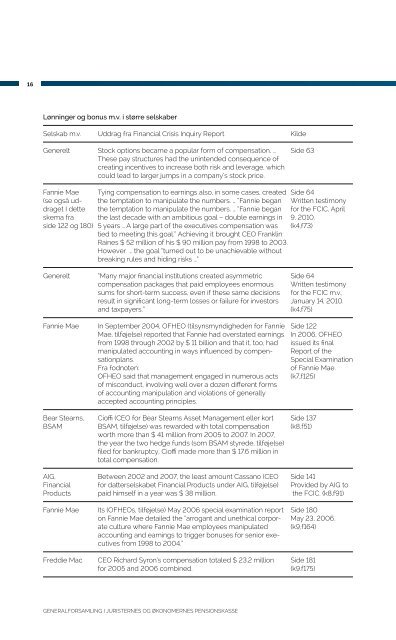

Lønninger og bonus m.v. i større selskaber<br />

Selskab m.v. Uddrag fra Financial Crisis Inquiry Report Kilde<br />

Generelt Stock options became a popular form of compensation, … Side 63<br />

These pay structures had the unintended consequence of<br />

creating incentives to increase both risk and leverage, which<br />

could lead to larger jumps in a company’s stock price.<br />

Fannie Mae Tying compensation to earnings also, in some cases, created Side 64<br />

(se også ud- the temptation to manipulate the numbers. … “Fannie began Written testimony<br />

draget I dette the temptation to manipulate the numbers. … “Fannie began for the FCIC, April<br />

skema fra the last decade with an ambitious goal – double earnings in 9, 2010.<br />

side 122 og 180) 5 years … A large part of the executives compensation was (k4,f73)<br />

tied to meeting this goal.” Achieving it brought CEO Franklin<br />

Raines $ 52 million of his $ 90 million pay from 1998 to 2003.<br />

However … the goal “turned out to be unachievable without<br />

breaking rules and hiding risks …”<br />

Generelt “Many major financial institutions created asymmetric Side 64<br />

compensation packages that paid employees enormous Written testimony<br />

sums for short-term success, even if these same decisions for the FCIC m.v.,<br />

result in significant long-term losses or failure for investors January 14, 2010.<br />

and taxpayers.” (k4,f75)<br />

Fannie Mae In September 2004, OFHEO (<strong>til</strong>synsmyndigheden for Fannie Side 122<br />

Mae, <strong>til</strong>føjelse) reported that Fannie had overstated earnings In 2006, OFHEO<br />

from 1998 through 2002 by $ 11 billion and that it, too, had issued its final<br />

manipulated accounting in ways influenced by compen- Report of the<br />

sationplans. Special Examination<br />

Fra fodnoten: of Fannie Mae.<br />

OFHEO said that management engaged in numerous acts (k7,f125)<br />

of misconduct, involving well over a dozen different forms<br />

of accounting manipulation and violations of generally<br />

accepted accounting principles.<br />

Bear Stearns, Cioffi (CEO for Bear Stearns Asset Management eller kort Side 137<br />

BSAM BSAM, <strong>til</strong>føjelse) was rewarded with total compensation (k8,f51)<br />

worth more than $ 41 million from 2005 to 2007. In 2007,<br />

the year the two hedge funds (som BSAM styrede, <strong>til</strong>føjelse)<br />

filed for bankruptcy, Cioffi made more than $ 17.6 million in<br />

total compensation.<br />

AIG, Between 2002 and 2007, the least amount Cassano (CEO Side 141<br />

Financial for datterselskabet Financial Products under AIG, <strong>til</strong>føjelse) Provided by AIG to<br />

Products paid himself in a year was $ 38 million. the FCIC. (k8,f91)<br />

Fannie Mae Its (OFHEOs, <strong>til</strong>føjelse) May 2006 special examination report Side 180<br />

on Fannie Mae detailed the “arrogant and unethical corpor- May 23, 2006.<br />

ate culture where Fannie Mae employees manipulated (k9,f164)<br />

accounting and earnings to trigger bonuses for senior exe-<br />

cutives from 1998 to 2004.”<br />

Freddie Mac CEO Richard Syron’s compensation totaled $ 23.2 million Side 181<br />

for 2005 and 2006 combined. (k9.f175)<br />

GENERALFORSAMLING I JURISTERNES OG ØKONOMERNES PENSIONSKASSE