- Page 1 and 2: Nationaløkonomisk Tidsskrift 141 (

- Page 3 and 4: Nationaløkonomisk Tidsskrift 141 (

- Page 5 and 6: EQUITY PRICES, SHARE PRICE VALUATIO

- Page 7 and 8: EQUITY PRICES, SHARE PRICE VALUATIO

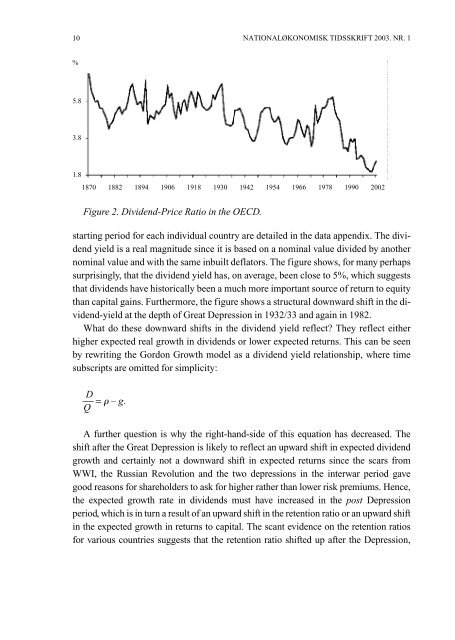

- Page 9: EQUITY PRICES, SHARE PRICE VALUATIO

- Page 13 and 14: EQUITY PRICES, SHARE PRICE VALUATIO

- Page 15 and 16: EQUITY PRICES, SHARE PRICE VALUATIO

- Page 17 and 18: EQUITY PRICES, SHARE PRICE VALUATIO

- Page 19 and 20: EQUITY PRICES, SHARE PRICE VALUATIO

- Page 21 and 22: EQUITY PRICES, SHARE PRICE VALUATIO

- Page 23 and 24: EQUITY PRICES, SHARE PRICE VALUATIO

- Page 25 and 26: EQUITY PRICES, SHARE PRICE VALUATIO

- Page 27 and 28: EQUITY PRICES, SHARE PRICE VALUATIO

- Page 29 and 30: EQUITY PRICES, SHARE PRICE VALUATIO

- Page 31 and 32: EQUITY PRICES, SHARE PRICE VALUATIO

- Page 33 and 34: EQUITY PRICES, SHARE PRICE VALUATIO

- Page 35 and 36: Nationaløkonomisk Tidsskrift 141 (

- Page 37 and 38: KONSEKVENSER AF AT HARMONISERE SELS

- Page 39 and 40: KONSEKVENSER AF AT HARMONISERE SELS

- Page 41 and 42: KONSEKVENSER AF AT HARMONISERE SELS

- Page 43 and 44: KONSEKVENSER AF AT HARMONISERE SELS

- Page 45 and 46: KONSEKVENSER AF AT HARMONISERE SELS

- Page 47 and 48: KONSEKVENSER AF AT HARMONISERE SELS

- Page 49 and 50: KONSEKVENSER AF AT HARMONISERE SELS

- Page 51 and 52: KONSEKVENSER AF AT HARMONISERE SELS

- Page 53 and 54: Nationaløkonomisk Tidsskrift 141 (

- Page 55 and 56: HAR KOMMUNAL SKAT OG SERVICE BETYDN

- Page 57 and 58: HAR KOMMUNAL SKAT OG SERVICE BETYDN

- Page 59 and 60: HAR KOMMUNAL SKAT OG SERVICE BETYDN

- Page 61 and 62:

HAR KOMMUNAL SKAT OG SERVICE BETYDN

- Page 63:

HAR KOMMUNAL SKAT OG SERVICE BETYDN

- Page 66 and 67:

66 NATIONALØKONOMISK TIDSSKRIFT 20

- Page 89 and 90:

Nationaløkonomisk Tidsskrift 141 (

- Page 91 and 92:

PROGRESSIVE SKATTER, UDDANNELSER OG

- Page 93 and 94:

PROGRESSIVE SKATTER, UDDANNELSER OG

- Page 95 and 96:

PROGRESSIVE SKATTER, UDDANNELSER OG

- Page 97 and 98:

PROGRESSIVE SKATTER, UDDANNELSER OG

- Page 99 and 100:

PROGRESSIVE SKATTER, UDDANNELSER OG

- Page 101 and 102:

PROGRESSIVE SKATTER, UDDANNELSER OG

- Page 103 and 104:

PROGRESSIVE SKATTER, UDDANNELSER OG

- Page 105 and 106:

PROGRESSIVE SKATTER, UDDANNELSER OG

- Page 107 and 108:

PROGRESSIVE SKATTER, UDDANNELSER OG

- Page 109 and 110:

PROGRESSIVE SKATTER, UDDANNELSER OG

- Page 111 and 112:

PROGRESSIVE SKATTER, UDDANNELSER OG

- Page 113 and 114:

DEBAT OG KOMMENTARER 113 et usædva

- Page 115 and 116:

DEBAT OG KOMMENTARER 115 Mogensen p

- Page 117 and 118:

DEBAT OG KOMMENTARER 117 Om lange t

- Page 119 and 120:

DEBAT OG KOMMENTARER 119 Hvem kan u

- Page 121 and 122:

DEBAT OG KOMMENTARER 121 internatio

- Page 123 and 124:

DEBAT OG KOMMENTARER 123 Det bør o

- Page 125 and 126:

DEBAT OG KOMMENTARER 125 Tabel 6. C

- Page 127:

DEBAT OG KOMMENTARER 127 enige i, a

- Page 130 and 131:

Nationaløkonomisk Tidsskrift 141 (

- Page 132 and 133:

132 når op på 47%, når beskæfti

- Page 134 and 135:

134 mod 90% af svinekødet går til

- Page 136 and 137:

136 serne er overvurderet, undervur

- Page 279 and 280:

Nationaløkonomisk Tidsskrift 141 (

- Page 281 and 282:

PRISEN PÅ STILHED 25 ÅR SENERE 28

- Page 283 and 284:

PRISEN PÅ STILHED 25 ÅR SENERE 28

- Page 285 and 286:

PRISEN PÅ STILHED 25 ÅR SENERE 28

- Page 287 and 288:

PRISEN PÅ STILHED 25 ÅR SENERE 28

- Page 289 and 290:

PRISEN PÅ STILHED 25 ÅR SENERE 28

- Page 291 and 292:

PRISEN PÅ STILHED 25 ÅR SENERE 29

- Page 293 and 294:

PRISEN PÅ STILHED 25 ÅR SENERE 29

- Page 295 and 296:

PRISEN PÅ STILHED 25 ÅR SENERE 29

- Page 297 and 298:

PRISEN PÅ STILHED 25 ÅR SENERE 29

- Page 299 and 300:

PRISEN PÅ STILHED 25 ÅR SENERE 29

- Page 301 and 302:

FORBRUG AF FJERNVARME OG ELEKTRICIT

- Page 303 and 304:

FORBRUG AF FJERNVARME OG ELEKTRICIT

- Page 305 and 306:

FORBRUG AF FJERNVARME OG ELEKTRICIT

- Page 307 and 308:

FORBRUG AF FJERNVARME OG ELEKTRICIT

- Page 309 and 310:

FORBRUG AF FJERNVARME OG ELEKTRICIT

- Page 311 and 312:

FORBRUG AF FJERNVARME OG ELEKTRICIT

- Page 313 and 314:

FORBRUG AF FJERNVARME OG ELEKTRICIT

- Page 315 and 316:

FORBRUG AF FJERNVARME OG ELEKTRICIT

- Page 317 and 318:

FORBRUG AF FJERNVARME OG ELEKTRICIT

- Page 319 and 320:

REAGERER AKTIEMARKEDET PÅ INDFØRE

- Page 321 and 322:

REAGERER AKTIEMARKEDET PÅ INDFØRE

- Page 323 and 324:

REAGERER AKTIEMARKEDET PÅ INDFØRE

- Page 325 and 326:

REAGERER AKTIEMARKEDET PÅ INDFØRE

- Page 327 and 328:

REAGERER AKTIEMARKEDET PÅ INDFØRE

- Page 329 and 330:

REAGERER AKTIEMARKEDET PÅ INDFØRE

- Page 331 and 332:

REAGERER AKTIEMARKEDET PÅ INDFØRE

- Page 333 and 334:

REAGERER AKTIEMARKEDET PÅ INDFØRE

- Page 335 and 336:

REAGERER AKTIEMARKEDET PÅ INDFØRE

- Page 337 and 338:

REAGERER AKTIEMARKEDET PÅ INDFØRE

- Page 339 and 340:

Nationaløkonomisk Tidsskrift 141 (

- Page 341 and 342:

DANSKE VIRKSOMHEDERS VALG AF FORSKN

- Page 343 and 344:

DANSKE VIRKSOMHEDERS VALG AF FORSKN

- Page 345 and 346:

DANSKE VIRKSOMHEDERS VALG AF FORSKN

- Page 347 and 348:

DANSKE VIRKSOMHEDERS VALG AF FORSKN

- Page 349 and 350:

DANSKE VIRKSOMHEDERS VALG AF FORSKN

- Page 351 and 352:

DANSKE VIRKSOMHEDERS VALG AF FORSKN

- Page 353 and 354:

DANSKE VIRKSOMHEDERS VALG AF FORSKN

- Page 355 and 356:

DANSKE VIRKSOMHEDERS VALG AF FORSKN

- Page 357 and 358:

DANSKE VIRKSOMHEDERS VALG AF FORSKN

- Page 359 and 360:

DANSKE VIRKSOMHEDERS VALG AF FORSKN

- Page 361 and 362:

DANSKE VIRKSOMHEDERS VALG AF FORSKN

- Page 363 and 364:

DANSKE VIRKSOMHEDERS VALG AF FORSKN

- Page 365 and 366:

SYMPOSIUM FOR HECTOR ESTRUP 365 nor

- Page 367 and 368:

SYMPOSIUM FOR HECTOR ESTRUP 367 gen

- Page 369 and 370:

SYMPOSIUM FOR HECTOR ESTRUP 369 hed

- Page 371 and 372:

SYMPOSIUM FOR HECTOR ESTRUP 371 lig

- Page 373 and 374:

SYMPOSIUM FOR HECTOR ESTRUP 373 for

- Page 375 and 376:

SYMPOSIUM FOR HECTOR ESTRUP 375 Lit

- Page 377 and 378:

SYMPOSIUM FOR HECTOR ESTRUP 377 her

- Page 379 and 380:

SYMPOSIUM FOR HECTOR ESTRUP 379 typ

- Page 381 and 382:

SYMPOSIUM FOR HECTOR ESTRUP 381 ...

- Page 383 and 384:

SYMPOSIUM FOR HECTOR ESTRUP 383 Det

- Page 385 and 386:

SYMPOSIUM FOR HECTOR ESTRUP 385 bev

- Page 387 and 388:

SYMPOSIUM FOR HECTOR ESTRUP 387 Raw

- Page 389 and 390:

SYMPOSIUM FOR HECTOR ESTRUP 389 hvi

- Page 391 and 392:

SYMPOSIUM FOR HECTOR ESTRUP 391 kom

- Page 393 and 394:

SYMPOSIUM FOR HECTOR ESTRUP 393 Hvi

- Page 395 and 396:

SYMPOSIUM FOR HECTOR ESTRUP 395 3.

- Page 397 and 398:

SYMPOSIUM FOR HECTOR ESTRUP 397 cip

- Page 399 and 400:

SYMPOSIUM FOR HECTOR ESTRUP 399 Vid

- Page 401 and 402:

SYMPOSIUM FOR HECTOR ESTRUP 401 kan

- Page 403 and 404:

SYMPOSIUM FOR HECTOR ESTRUP 403 I m

- Page 405 and 406:

SYMPOSIUM FOR HECTOR ESTRUP 405 ged

- Page 407 and 408:

SYMPOSIUM FOR HECTOR ESTRUP 407 har

- Page 409 and 410:

Nationaløkonomisk Tidsskrift 141 (

- Page 411 and 412:

DEBAT OG KOMMENTARER 411 Forskellen

- Page 413 and 414:

DEBAT OG KOMMENTARER 413 tion som i

- Page 415 and 416:

DEBAT OG KOMMENTARER 415 Danske ene

- Page 417 and 418:

DEBAT OG KOMMENTARER 417 1,8 1,6 1,

- Page 419 and 420:

olieforbrug, industri, transport sa

- Page 421 and 422:

DEBAT OG KOMMENTARER 421 Litteratur

- Page 423 and 424:

DEBAT OG KOMMENTARER 423 Bilag 1. A

- Page 425 and 426:

DEBAT OG KOMMENTARER 425 ling på F

- Page 427 and 428:

DEBAT OG KOMMENTARER 427 ve succes.

- Page 429 and 430:

DEBAT OG KOMMENTARER 429 anvendt i

- Page 431 and 432:

DEBAT OG KOMMENTARER 431 Svar på k

- Page 433 and 434:

DEBAT OG KOMMENTARER 433 Det må st

- Page 435 and 436:

BOGANMELDELSER 435 af den dobbelte

- Page 437 and 438:

BOGANMELDELSER 437 - Niels Kærgår

- Page 439 and 440:

BOGANMELDELSER 439 komplementære i

- Page 441 and 442:

BOGANMELDELSER 441 de, og arbejdsma

- Page 443 and 444:

BOGANMELDELSER 443 kelte planter ha