Blick aus Asien

Blick aus Asien

Blick aus Asien

Sie wollen auch ein ePaper? Erhöhen Sie die Reichweite Ihrer Titel.

YUMPU macht aus Druck-PDFs automatisch weboptimierte ePaper, die Google liebt.

Schwerpunktthema<br />

Will Euro problems hurt Asian<br />

monetary integration?<br />

Whereas the Euro was on the brink of faltering, Asia is contemplating increased financial<br />

integration: Financial markets are becoming more open, the Chiang Mai Initiative has been<br />

multilateralised and China has once again unpegged the Yuan from the US-Dollar. Andrew<br />

Sheng takes a look at lessons Asia can learn from Europe’s difficulties and further steps to<br />

be taken for regional financial cooperation.<br />

<strong>Blick</strong> <strong>aus</strong> <strong>Asien</strong><br />

At the 10th Anniversary of the Euro’s<br />

launch in 2009, there were some sugges -<br />

tions that one-day the Euro might even<br />

take over the role of the US dollar as the<br />

dominant reserve currency. After all, the<br />

US dollar had been depreciating due to<br />

the subprime crisis against the Euro. Less<br />

than a year later, the Euro is sliding as a<br />

result of the Greek debt crisis.<br />

Doubters are now pointing to a political<br />

and structural crisis of the Euro,<br />

and focusing on the need for stronger<br />

fiscal discipline. The Maastricht Treaty,<br />

that led to the creation of the euro area,<br />

was unable to bind the euro area members<br />

to fiscal discipline. If even the<br />

uber-fiscally conservative Germany<br />

could not meet the limits of 3% of GDP<br />

fiscal deficit due to the high costs of<br />

funding the re-unification of Germany,<br />

why should the smaller states adhere<br />

to the Treaty?<br />

The structural flaw of the Euro zone is<br />

that even though there may be a unified<br />

European Central Bank and a converging<br />

European financial supervisory system,<br />

there is no unified fiscal system. Thus,<br />

once a member country runs a large fiscal<br />

deficit, there is no central body to<br />

effectively coordinate fiscal policy.<br />

Proponents of Asian monetary integration<br />

point to growth in trade integration<br />

as a pre-condition for future<br />

financial integration. Those who think<br />

that Asian integration is a pipe dream<br />

say that there is currently no political<br />

consensus, not even the makings of a<br />

unified monetary or currency policy, and<br />

little convergence on supervisory policy.<br />

Further, there are hardly any discussions<br />

within Asia on common fiscal policies.<br />

The Euro problems are more warning<br />

signals to Asian reforms on what not to<br />

do and what to avoid, rather than positive<br />

indicators of the road to integration.<br />

But not all the lessons are negative. I can<br />

think of several ‘green shoots’ coming<br />

out of the Euro problems for Asia.<br />

The first is that you can’t hurry the<br />

process. It takes time to get consensus on<br />

what is right for a large community of<br />

different interests and different cultures.<br />

If you ask ten Asian economists on what<br />

they think the future of Asian integration<br />

is, I am sure you will get more than<br />

ten opinions. Common thinking is nonexistent,<br />

let alone common institutions.<br />

At least, European bureaucracies have<br />

been talking and bargaining with each<br />

other for more than 50 years through the<br />

centers’ of power in Brussels, Basel and<br />

Frankfurt.<br />

Secondly, talk about Asian monetary<br />

integration has always been defensive<br />

rather than offensive, in the sense that<br />

some pooling of resources (such as an<br />

Asian Monetary Fund) could hopefully<br />

defend weaker Asian currencies from<br />

excessive speculation and instability.<br />

The reason why multilateralisation of<br />

the Chiang Mai initiatives took quite a<br />

long time to arrange is that immediately<br />

follow ing the Asian financial crisis<br />

threats of instability receded, and thus<br />

there was little urgency to getting any<br />

agreement done. The problems of the<br />

Euro have given the Asian integration<br />

process more urgency.<br />

Thirdly, in the last decade, differences<br />

in country income and wealth levels<br />

have become less unequal. With Japan in<br />

the doldrums and the rise of China,<br />

India, Gulf states and East Asia-ex<br />

Japan; Asian countries are now more<br />

evenly matched. Ten years ago, Japan<br />

was the sole advanced country, but<br />

today, China, India, Korea and Indonesia<br />

are members of the G20. Seven of the<br />

Asia Pacific’s financial centres are<br />

amongst the top 15 in the world according<br />

to the City of London Global Financial<br />

Centre Index.<br />

Fourthly, the return of the RMB to a<br />

more flexible currency arrangement and<br />

the upward revaluation of the Asian currencies<br />

in recent months indicate that<br />

the financial markets are reflecting the<br />

shifting economic weight towards the<br />

East. Asia will be receiving more hot<br />

money flows and will have to cope with<br />

the same pressures that plagued East<br />

Asia in the early 1990s, just before the<br />

Asian financial crisis.<br />

Fifth, the official attitude towards<br />

more controls over the speculative barbar<br />

ians at the gate has changed, even as<br />

Germany unilaterally banned naked short<br />

selling and the IMF has acknow ledged<br />

that capital controls are part of the<br />

macro-economic toolkits. The balance of<br />

power between markets and the central<br />

banks in managing currency stability has<br />

tilted back towards central banks.<br />

None of the above positive signs add<br />

up to greater impetus for Asian monetary<br />

integration. Indeed, there is no sign<br />

that there is greater sense of regional<br />

cooperation, since Korea was also willing<br />

to put currency issues on the agenda of<br />

G20 in Toronto.<br />

Much will depend on how China plays<br />

her cards in the near future. Shanghai<br />

has already been designated as the international<br />

financial centre for China and<br />

the RMB is becoming an important trade<br />

currency, particularly with neighbouring<br />

countries. The sheer weight of excess<br />

savings in the surplus countries will<br />

clearly give Asian financial centers’ more<br />

clout in the recycling of global funds.<br />

What is not obvious is how Asian<br />

policy-makers are institutionalising the<br />

process.<br />

The process of Asian financial integration<br />

must depend first and foremost<br />

on the degree of deepening in Asian<br />

financial institutions. The process of<br />

creating diverse financial institutions has<br />

happened too slowly relative to the<br />

needs of the rising middle class and<br />

aging demographics. Asia has always<br />

prided itself on growth with relatively<br />

little financial repression, in the sense<br />

that depositors received only slightly<br />

negative real interest rates, with the<br />

benefits of repression given to the export<br />

and manufacturing sectors. In recent<br />

years, however, the rise of inflation has<br />

hurt the savers, but the benefits to the<br />

borrowers have been unevenly spread.<br />

Perhaps the next phase of Asian<br />

financial integration will be less officially<br />

driven, and more market led<br />

through the removal of the barriers to<br />

Asian financial institutions integrating<br />

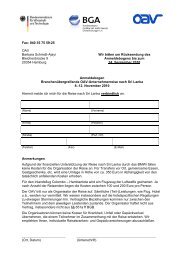

Asiatisches Währungsnetzwerk<br />

Land<br />

Brunei<br />

China (+ Hongkong)<br />

Indonesien<br />

Japan<br />

Kambodscha<br />

Korea, Republik<br />

Laos<br />

Malaysia<br />

Myanmar<br />

Philippinen<br />

Singapur<br />

Thailand<br />

Vietnam<br />

Beitrag in Mio. USD<br />

30<br />

38.400<br />

4.552<br />

38.400<br />

120<br />

19.200<br />

30<br />

4.552<br />

60<br />

4.552<br />

4.552<br />

4.552<br />

1.000<br />

within the region. Allowing more Asian<br />

financial institutions into each others’<br />

domestic markets is more of a concrete<br />

step towards regional integration than<br />

visionary statements.<br />

Witness how Malaysia has allowed<br />

Chinese, Indian, Indonesia, Japanese and<br />

Middle East financial institutions into its<br />

home market. If this process accelerates<br />

and spreads, Asian financial integration<br />

will happen through the ramen bowl of<br />

inter-connected institutions. Note that I<br />

am not talking about spaghetti.<br />

The article has been published at<br />

www.eastasiaforum.org on July 5th, 2010<br />

Die Chiang Mai-Initiative geht auf einen<br />

Gipfel der ASEAN+3 Staaten (ASEAN sowie<br />

China, Japan und Südkorea) im Jahr 2000 in<br />

der thailändischen Stadt Chiang Mai<br />

zu rück. Ziel war – als Reaktion auf die <strong>Asien</strong>krise<br />

– die Bildung eines asiatischen Netzwerks<br />

bilateraler Währungs-Swap-Abkommen,<br />

um die Liquidität der Mitgliedsstaaten<br />

bei künftigen Krisen zu sichern. Im Zuge der<br />

weltweiten Finanz- und Wirtschaftskrise<br />

wurde 2009 beschlossen, die Initiative multilateral<br />

<strong>aus</strong>zurichten. Im März 2010 wurde<br />

entsprechend ein asiatischer Fonds in Höhe<br />

von 120 Milliarden US-Dollar eingerichtet,<br />

in den die beteiligten Länder mit unterschiedlichen<br />

Anteilen einzahlen. Schwergewichte<br />

sind China mit Hongkong, Japan und Korea.<br />

Diese großen Beitragszahler dürfen nicht<br />

mehr Geld <strong>aus</strong> dem Fonds entnehmen als<br />

sie eingezahlt haben. Die anderen Staaten<br />

dürfen ein Vielfaches ihrer Einlagen <strong>aus</strong>leihen<br />

– je nach zugeteiltem Multiplikator.<br />

Beitrag in Prozent<br />

0,025 %<br />

32,0 %<br />

3,8 %<br />

32,0 %<br />

0,1 %<br />

16,0 %<br />

0,025 %<br />

3,8 %<br />

0,05 %<br />

3,8 %<br />

3,8 %<br />

3,8 %<br />

0,8 %<br />

Multiplikator<br />

5,0<br />

1,0<br />

2,5<br />

1,0<br />

5,0<br />

2,5<br />

5,0<br />

2,5<br />

5,0<br />

2,5<br />

2,5<br />

2,5<br />

5,0<br />

Andrew Sheng is Adjunct Professor<br />

at the University of Malaya and<br />

Tsinghua University, Beijing.<br />

www.eastasiaforum.org/2010/07/05/willeuro-problems-hurt-asian-monetaryintegration/<br />

06<br />

I Insight Asia-Pacific<br />

Insight Asia-Pacific I 07