Commission’s recently completed f<strong>in</strong>ancial literacy study documents the extreme limitations ofdisclosure as an effective <strong>in</strong>vestor protection tool. 7 In a market <strong>in</strong> which brokers and advisersuse comparable titles and offer similar services and when brokerage firms spends millions ofdollars on market<strong>in</strong>g campaigns designed to blur those dist<strong>in</strong>ctions, there is simply no basis forbeliev<strong>in</strong>g that disclosure alone would resolve that confusion. Indeed, the Commission hasalready been down that road (as we will discuss further below) and realized the impossibility ofdesign<strong>in</strong>g a disclosure to effectively convey such a complex set of issues <strong>in</strong> a way that typical<strong>in</strong>vestors are likely to comprehend. 8The key po<strong>in</strong>t is this: the relevance of <strong>in</strong>vestor confusion is not that it is the problemCommission rulemak<strong>in</strong>g is <strong>in</strong>tended to solve, but rather that it elim<strong>in</strong>ates as viable optionscerta<strong>in</strong> disclosure-based regulatory approaches that the Commission might otherwise consi<strong>der</strong>.The existence of widespread <strong>in</strong>vestor confusion also exposes the absurdity of suggest<strong>in</strong>g that<strong>in</strong>action is acceptable s<strong>in</strong>ce <strong>in</strong>vestors can simply choose whether they prefer to deal with an<strong>in</strong>vestment adviser, who is subject to a fiduciary duty, or a broker-dealer, who is not. Investorswho cannot dist<strong>in</strong>guish between brokers and advisers and who do not un<strong>der</strong>stand that these twotypes of <strong>in</strong>vestment professionals are subject to different legal standards when they offer advicesimply cannot make an <strong>in</strong>formed choice. Thus, widespread <strong>in</strong>vestor confusion not only limitsthe regulatory alternatives available to the Commission, but it also highlights the need forCommission action to address this market failure. Past Commission actions, not statutory differences, created the problem the Commissionnow seeks to solve.Over the years, the Commission has repeatedly suggested that the difference <strong>in</strong> standardsof conduct that apply to <strong>in</strong>vestment advice offered by broker-dealers and <strong>in</strong>vestment advisersresults from the fact that broker-dealers are subject to a statutory exclusion from the def<strong>in</strong>ition of<strong>in</strong>vestment adviser un<strong>der</strong> the Investment Advisers Act. An unbiased read<strong>in</strong>g of the statute, thelegislative history, and the record of past Commission action (and <strong>in</strong>action) demonstratesconclusively, however, that it is not the statutory exclusion itself, but rather the Commission’soverly broad <strong>in</strong>terpretation of that exclusion, that has allowed brokers to rebrand themselves asadvisers and offer extensive <strong>in</strong>vestment advice without be<strong>in</strong>g regulated un<strong>der</strong> the Advisers Act.CFA has previously detailed this argument <strong>in</strong> a comment letter on the legislative history beh<strong>in</strong>dthe broker-dealer exclusion, which we <strong>in</strong>corporate by reference. 9 While we will not reargue theissue <strong>in</strong> detail, a few of the key po<strong>in</strong>ts bear repeat<strong>in</strong>g.When Congress adopted the Investment Advisers Act of 1940, it adopted a very broaddef<strong>in</strong>ition of <strong>in</strong>vestment advice, essentially cover<strong>in</strong>g anyone <strong>in</strong> the bus<strong>in</strong>ess of giv<strong>in</strong>g adviceabout securities for compensation. That def<strong>in</strong>ition clearly would have swept <strong>in</strong> brokers un<strong>der</strong> theauspices of the Advisers Act absent an exclusion. In craft<strong>in</strong>g that exclusion, Congress rejected7 Staff of the Securities and Exchange Commission, Study Regard<strong>in</strong>g F<strong>in</strong>ancial Literacy Among Investors (AsRequired by Section 917 of the Dodd-Frank Wall Street Reform and Consumer Protection Act), August 20<strong>12</strong>.8 See Siegel & Gale, LLC and Gelb Consult<strong>in</strong>g Group, Inc., Results of Investor Focus Group Interviews AboutProposed Brokerage Account Disclosures, Report to the Securities and Exchange Commission, March 10, 2005.9 Letter from CFA Director of Investor Protection Barbara Roper to SEC Secretary Jonathan Katz regard<strong>in</strong>g“Certa<strong>in</strong> Broker-Dealers Deemed Not to be Investment Advisers,” File No. S7-25-99, (February 7, 2005). A copyof that letter is available here.4

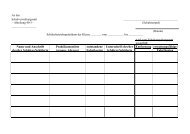

tes „Arbeitspaket“ (vorwiegend aus Anmeldebogen und Gesamtbeurteilungsbogen)aus. Es dient <strong>der</strong> Optimierung und Intensivierung <strong>der</strong> Beratung,För<strong>der</strong>ung und Betreuung dieser Jugendlichen und erfor<strong>der</strong>t die aktiveE<strong>in</strong>beziehung <strong>der</strong> verantwortlichen Lehrkräfte, <strong>der</strong> Eltern und <strong>der</strong>Schüler<strong>in</strong>nen und Schüler. Die Schule unterstützt diesen Prozess <strong>in</strong>haltlichdurch Kommunikation im Unterricht und ggf. <strong>in</strong> Elternveranstaltungen undlogistisch durch Bündelung und zeitnahe Rückgabe <strong>der</strong> Unterlagen des Arbeitspaketesan die Reha-Beratung, damit von dort dann die passgenaueE<strong>in</strong>zelberatung und Unterstützung <strong>der</strong> Schüler<strong>in</strong>nen und Schüler geschehenkann.<strong>12</strong>. Qualifizierung <strong>der</strong> Lehrkräfte durch FortbildungDie Planung und Realisierung e<strong>in</strong>es schul- und standortbezogenen Konzeptes<strong>der</strong> Berufs- und Studienorientierung ist e<strong>in</strong>e Aufgabe aller Lehrer<strong>in</strong>nenund Lehrer <strong>der</strong> Schulen <strong>der</strong> Sekundarstufen I und II. Kenntnisse überberufliche Strukturen, Ausbildungs- und Studienmöglichkeiten, über dasBeschäftigungssystem selbst sowie über die Bed<strong>in</strong>gungen, die sich ausden strukturellen Verän<strong>der</strong>ungen <strong>der</strong> Wirtschafts- und Arbeitswelt ergeben,s<strong>in</strong>d e<strong>in</strong>e Voraussetzung für e<strong>in</strong>e qualifizierte Bearbeitung <strong>der</strong> Probleme,die Schüler<strong>in</strong>nen und Schüler beim E<strong>in</strong>stieg <strong>in</strong> das Berufsleben erwarten.Um Lehrer<strong>in</strong>nen und Lehrer auf diese Aufgaben vorzubereiten, soll Fortbildungauch <strong>–</strong> soweit möglich <strong>–</strong> unter Mitwirkung von Fachkräften <strong>der</strong> Arbeitsverwaltungund <strong>der</strong> Jugendhilfe sowie <strong>der</strong> Wirtschaft angeboten werden.Ziel und Inhalt von Fortbildungsangeboten ist es, Lehrkräfte zu befähigen,<strong>in</strong> ihrer Schule e<strong>in</strong> auf die Situation ihrer Schüler<strong>in</strong>nen und Schüler bezogenesCurriculum <strong>der</strong> Berufs- und Studienorientierung zu entwickeln. Dazugehören die Information und die Ause<strong>in</strong>an<strong>der</strong>setzung mit Modellen systematischer<strong>Berufsorientierung</strong>, die sich <strong>in</strong> <strong>der</strong> Praxis bewährt haben.Weiterh<strong>in</strong> soll <strong>in</strong> Fortbildungsveranstaltungen die Möglichkeit geboten werden,Erwartungen und Ansprüche <strong>der</strong> Wirtschafts- und Arbeitswelt zu verdeutlichenund schulische Anfor<strong>der</strong>ungen so auszurichten, dass Schulabgänger<strong>in</strong>nenund Schulabgänger <strong>in</strong> Ausbildung, Studium und Beruf bestehenkönnen.Die Schulen s<strong>in</strong>d aufgerufen, im Rahmen ihrer Fortbildungsplanung Fragen<strong>der</strong> Berufs- und Studienorientierung zu berücksichtigen. Es empfiehltsich, <strong>in</strong> schul<strong>in</strong>terne Fortbildungsmaßnahmen neben Mo<strong>der</strong>ator<strong>in</strong>nen undMo<strong>der</strong>atoren <strong>der</strong> staatlichen Lehrerfortbildung und Fachkräften <strong>der</strong> Arbeitsverwaltungnach Möglichkeit auch Vertreter<strong>in</strong>nen und Vertreter <strong>der</strong>örtlichen Wirtschaft e<strong>in</strong>zubeziehen.13. Qualifizierung <strong>der</strong> Lehrkräfte durch LehrerbetriebspraktikaUm Lehrkräften <strong>der</strong> Sekundarstufen I und II die Möglichkeit zu geben, außerhalbihres üblichen Tätigkeitsfeldes die Wirtschafts- und Arbeitsweltund ihre allgeme<strong>in</strong>en <strong>Zu</strong>sammenhänge durch eigene Mitarbeit <strong>in</strong> Betriebenkennen zu lernen, sollen verstärkt Lehrerbetriebspraktika durchgeführtwerden. Dadurch sollen Lehrkräfte ihre Beratungskompetenz erhöhen undErfahrungen sammeln zur Auflösung von Rollenstereotypen <strong>in</strong> frauen- undmännertypischen Berufen.Lehrerbetriebspraktika werden <strong>in</strong> <strong>der</strong> Eigenverantwortung <strong>der</strong> Schuledurchgeführt; sie werden von <strong>der</strong> Schulleiter<strong>in</strong> o<strong>der</strong> dem Schulleiter genehmigt.Bei Bedarf berät die zuständige Schulaufsicht die Schulen.Lehrerbetriebspraktika sollen für Lehrkräfte allgeme<strong>in</strong> bilden<strong>der</strong> Schulenbis zu zwei, für Lehrkräfte am Berufskolleg bis zu vier Wochen dauern.Es ist anzustreben, dass <strong>in</strong> Absprache mit <strong>der</strong> örtlichen Wirtschaft im Rahmenvon Lehrerbetriebspraktika e<strong>in</strong> Personalaustausch zwischen Lehrkräftenund mit <strong>der</strong> betrieblichen Ausbildung befassten Personen erfolgt.In diesem Fall übernehmen die am Austausch Beteiligten jeweils Aufgaben<strong>in</strong> Schule bzw. Betrieb, die ihren Fähigkeiten entsprechen.Lehrerbetriebspraktika s<strong>in</strong>d dienstliche Veranstaltungen. Der Dienstherrübernimmt den Dienstunfallschutz, sofern nicht e<strong>in</strong>e betriebliche Versicherunge<strong>in</strong>tritt. Mittel für Reisekosten für die Fahrt vom Wohnort zum Betriebstehen nicht zur Verfügung. Den Lehrkräften sollten deshalb höchstensvergleichbare Kosten wie beim Weg zu ihrer Schule entstehen.14. Abstimmung, Inkrafttreten, AußerkrafttretenDer Run<strong>der</strong>lass ist mit <strong>der</strong> <strong>der</strong> Regionaldirektion Nordrhe<strong>in</strong>-Westfalen <strong>der</strong>Bundesagentur für Arbeit abgestimmt und tritt mit dem Zeitpunkt <strong>der</strong> Veröffentlichung<strong>in</strong> Kraft. Der Run<strong>der</strong>lass vom 23. 9. 1999 (<strong>BASS</strong> <strong>12</strong> <strong>–</strong> <strong>21</strong><strong>Nr</strong>. 1) tritt zum gleichen Zeitpunkt außer Kraft.Der Run<strong>der</strong>lass wird im ABl. <strong>NRW</strong>. veröffentlicht; e<strong>in</strong>e Veröffentlichung imAmtlichen Schulblatt ist nicht zugelassen.