Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Legal eagle<br />

this value, the current fees will increase by £85<br />

to £300 or more.<br />

Astronomical fees will apply for estates valued at<br />

£500,000 and above. These fees will be as follows:<br />

• £4,000 for estates valued between £500,000<br />

and £1m<br />

• £8,000 for estates valued between £1m<br />

and £1.6m<br />

• £12,000 for estates valued between<br />

1.6m to £2m<br />

• £20,000 for estates valued at £2m and above.<br />

Advertorial<br />

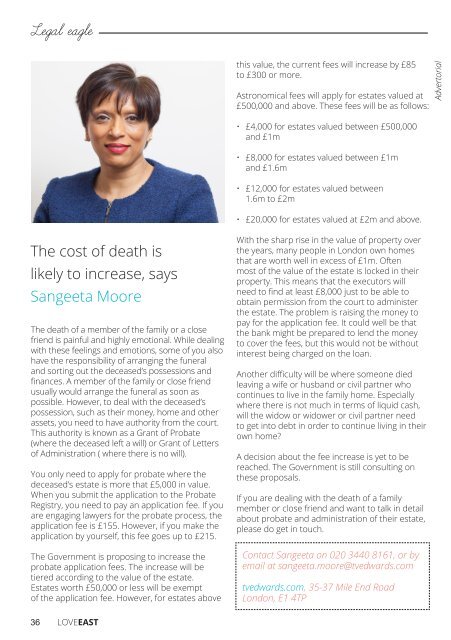

The cost of death is<br />

likely to increase, says<br />

Sangeeta Moore<br />

The death of a member of the family or a close<br />

friend is painful and highly emotional. While dealing<br />

with these feelings and emotions, some of you also<br />

have the responsibility of arranging the funeral<br />

and sorting out the deceased’s possessions and<br />

finances. A member of the family or close friend<br />

usually would arrange the funeral as soon as<br />

possible. However, to deal with the deceased’s<br />

possession, such as their money, home and other<br />

assets, you need to have authority from the court.<br />

This authority is known as a Grant of Probate<br />

(where the deceased left a will) or Grant of Letters<br />

of Administration ( where there is no will).<br />

You only need to apply for probate where the<br />

deceased’s estate is more that £5,000 in value.<br />

When you submit the application to the Probate<br />

Registry, you need to pay an application fee. If you<br />

are engaging lawyers for the probate process, the<br />

application fee is £155. However, if you make the<br />

application by yourself, this fee goes up to £215.<br />

The Government is proposing to increase the<br />

probate application fees. The increase will be<br />

tiered according to the value of the estate.<br />

Estates worth £50,000 or less will be exempt<br />

of the application fee. However, for estates above<br />

With the sharp rise in the value of property over<br />

the years, many people in London own homes<br />

that are worth well in excess of £1m. Often<br />

most of the value of the estate is locked in their<br />

property. This means that the executors will<br />

need to find at least £8,000 just to be able to<br />

obtain permission from the court to administer<br />

the estate. The problem is raising the money to<br />

pay for the application fee. It could well be that<br />

the bank might be prepared to lend the money<br />

to cover the fees, but this would not be without<br />

interest being charged on the loan.<br />

Another difficulty will be where someone died<br />

leaving a wife or husband or civil partner who<br />

continues to live in the family home. Especially<br />

where there is not much in terms of liquid cash,<br />

will the widow or widower or civil partner need<br />

to get into debt in order to continue living in their<br />

own home?<br />

A decision about the fee increase is yet to be<br />

reached. The Government is still consulting on<br />

these proposals.<br />

If you are dealing with the death of a family<br />

member or close friend and want to talk in detail<br />

about probate and administration of their estate,<br />

please do get in touch.<br />

Contact Sangeeta on 020 3440 8161, or by<br />

email at sangeeta.moore@tvedwards.com<br />

tvedwards.com, 35-37 Mile End Road<br />

London, E1 4TP<br />

36 LOVEEAST