Colas RA

Colas RA

Colas RA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

simplified consolidated financial statements<br />

10<br />

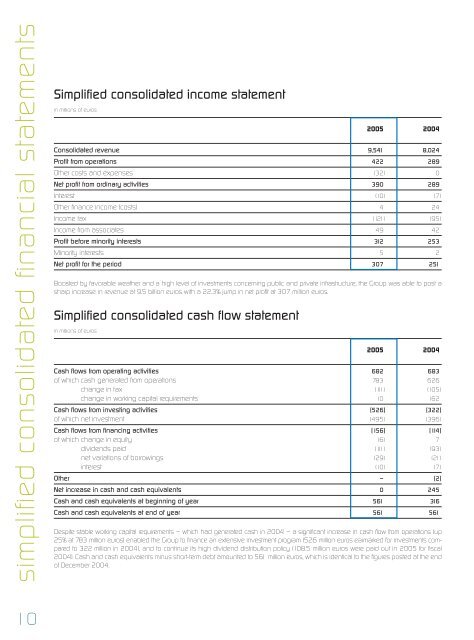

Simplified consolidated income statement<br />

in millions of euros<br />

2005 2004<br />

Consolidated revenue 9,541 8,024<br />

Profit from operations 422 289<br />

Other costs and expenses (32) 0<br />

Net profit from ordinary activities 390 289<br />

Interest (10) (7)<br />

Other finance income (costs) 4 24<br />

Income tax (121) (95)<br />

Income from associates 49 42<br />

Profit before minority interests 312 253<br />

Minority interests 5 2<br />

Net profit for the period 307 251<br />

Boosted by favorable weather and a high level of investments concerning public and private infrastructure, the Group was able to post a<br />

sharp increase in revenue at 9.5 billion euros with a 22.3% jump in net profit at 307 million euros.<br />

Simplified consolidated cash flow statement<br />

in millions of euros<br />

2005 2004<br />

Cash flows from operating activities 682 683<br />

of which cash generated from operations 783 626<br />

change in tax (111) (105)<br />

change in working capital requirements 10 162<br />

Cash flows from investing activities (526) (322)<br />

of which net investment (495) (396)<br />

Cash flows from financing activities (156) (114)<br />

of which change in equity (6) 7<br />

dividends paid (111) (93)<br />

net variations of borrowings (29) (21)<br />

interest (10) (7)<br />

Other – (2)<br />

Net increase in cash and cash equivalents 0 245<br />

Cash and cash equivalents at beginning of year 561 316<br />

Cash and cash equivalents at end of year 561 561<br />

Despite stable working capital requirements – which had generated cash in 2004 – a significant increase in cash flow from operations (up<br />

25% at 783 million euros) enabled the Group to finance an extensive investment program (526 million euros earmarked for investments compared<br />

to 322 million in 2004), and to continue its high dividend distribution policy (108.5 million euros were paid out in 2005 for fiscal<br />

2004). Cash and cash equivalents minus short-term debt amounted to 561 million euros, which is identical to the figures posted at the end<br />

of December 2004.