Fulfilling - Maine Community Foundation

Fulfilling - Maine Community Foundation

Fulfilling - Maine Community Foundation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

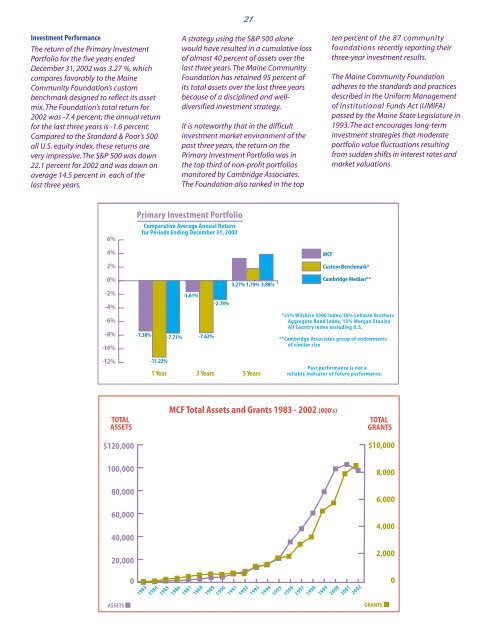

Investment Performance<br />

The return of the Primary Investment<br />

Portfolio for the five years ended<br />

December 31, 2002 was 3.27 %, which<br />

compares favorably to the <strong>Maine</strong><br />

<strong>Community</strong> <strong>Foundation</strong>’s custom<br />

benchmark designed to reflect its asset<br />

mix. The <strong>Foundation</strong>’s total return for<br />

2002 was -7.4 percent; the annual return<br />

for the last three years is -1.6 percent.<br />

Compared to the Standard & Poor’s 500<br />

all U.S. equity index, these returns are<br />

very impressive. The S&P 500 was down<br />

22.1 percent for 2002 and was down on<br />

average 14.5 percent in each of the<br />

last three years.<br />

6%<br />

4%<br />

2%<br />

0%<br />

-2%<br />

-4%<br />

-6%<br />

-8%<br />

-10%<br />

-12%<br />

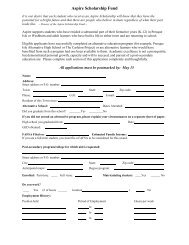

TOTAL<br />

ASSETS<br />

$120,000<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

ASSETS<br />

0<br />

Primary Investment Portfolio<br />

Comparative Average Annual Return<br />

for Periods Ending December 31, 2002<br />

-7.38%<br />

-11.22%<br />

-7.71%<br />

-1.61%<br />

-7.62%<br />

-2.78%<br />

21<br />

A strategy using the S&P 500 alone<br />

would have resulted in a cumulative loss<br />

of almost 40 percent of assets over the<br />

last three years. The <strong>Maine</strong> <strong>Community</strong><br />

<strong>Foundation</strong> has retained 95 percent of<br />

its total assets over the last three years<br />

because of a disciplined and welldiversified<br />

investment strategy.<br />

It is noteworthy that in the difficult<br />

investment market environment of the<br />

past three years, the return on the<br />

Primary Investment Portfolio was in<br />

the top third of non-profit portfolios<br />

monitored by Cambridge Associates.<br />

The <strong>Foundation</strong> also ranked in the top<br />

3.27% 1.79% 3.88%<br />

1 Year 3 Years 5 Years<br />

MCF<br />

Custom Benchmark*<br />

Cambridge Median**<br />

*55% Wilshire 5000 Index/30% Lehman Brothers<br />

Aggregate Bond Index; 15% Morgan Stanley<br />

All Country Index excluding U.S.<br />

**Cambridge Associates group of endowments<br />

of similar size<br />

Past performance is not a<br />

reliable indicator of future performance.<br />

MCF Total Assets and Grants 1983 - 2002 (000's)<br />

1983<br />

1984<br />

1985<br />

1986<br />

1987<br />

1988<br />

1989<br />

1990<br />

1991<br />

1992<br />

1993<br />

1994<br />

1995<br />

1996<br />

1997<br />

1998<br />

ten percent of the 87 community<br />

foundations recently reporting their<br />

three-year investment results.<br />

The <strong>Maine</strong> <strong>Community</strong> <strong>Foundation</strong><br />

adheres to the standards and practices<br />

described in the Uniform Management<br />

of Institutional Funds Act (UMIFA)<br />

passed by the <strong>Maine</strong> State Legislature in<br />

1993. The act encourages long-term<br />

investment strategies that moderate<br />

portfolio value fluctuations resulting<br />

from sudden shifts in interest rates and<br />

market valuations.<br />

1999<br />

2000<br />

2001<br />

2002<br />

TOTAL<br />

GRANTS<br />

$10,000<br />

GRANTS<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0