2006 Annual Report - Lopez Holdings Corporation

2006 Annual Report - Lopez Holdings Corporation

2006 Annual Report - Lopez Holdings Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

48<br />

A n n u a l R e p o r t 2 0 0 6<br />

- 2 -<br />

<strong>2006</strong><br />

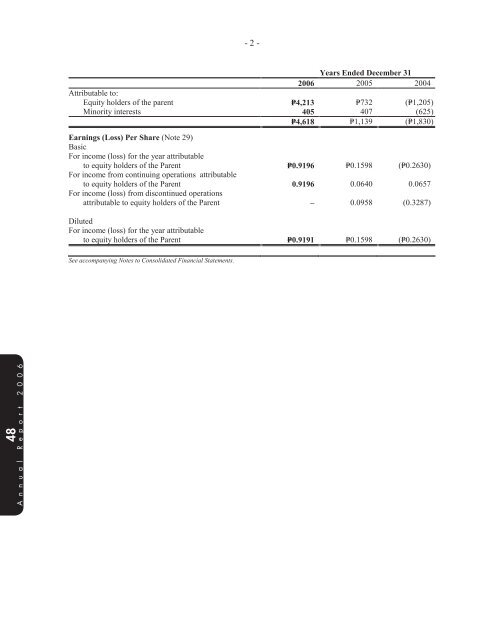

Years Ended December 31<br />

2005 2004<br />

Attributable to:<br />

Equity holders of the parent P=4,213 P=732 (P=1,205)<br />

Minority interests 405 407 (625)<br />

P=4,618 P=1,139 (P=1,830)<br />

Earnings (Loss) Per Share (Note 29)<br />

Basic<br />

For income (loss) for the year attributable<br />

to equity holders of the Parent P=0.9196 P=0.1598 (P=0.2630)<br />

For income from continuing operations attributable<br />

to equity holders of the Parent 0.9196 0.0640 0.0657<br />

For income (loss) from discontinued operations<br />

attributable to equity holders of the Parent – 0.0958 (0.3287)<br />

Diluted<br />

For income (loss) for the year attributable<br />

to equity holders of the Parent P=0.9191 P=0.1598 (P=0.2630)<br />

See accompanying Notes to Consolidated Financial Statements.<br />

*SGVMC209576*<br />

BENPRES HOLDINGS CORPORATION AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY<br />

(Amounts in Millions)<br />

Capital<br />

Stock<br />

(Note 31)<br />

Total Equity Attributable to Equity Holders of the Parent<br />

Additional<br />

Paid-In<br />

Share in<br />

Equity<br />

Adjustment<br />

from<br />

Translation<br />

Unrealized<br />

Gain on<br />

Fair Value<br />

Adjustments<br />

of Availablefor-sale<br />

Investments Deficit Total<br />

Minority Total<br />

Capital<br />

Interests Equity<br />

At December 31, 2005<br />

Equity adjustment from<br />

P=4,581 P=6,766 P=233 P=396 (P=9,239) P=2,737 P=5,946 P=8,683<br />

translation during the year<br />

Adjustment for unrealized gain<br />

on fair value adjustment of<br />

– – (722) – – (722) (132) (854)<br />

available-for-sale investments<br />

Total expense for the year<br />

– – – 635 – 635 – 635<br />

directly recognized in equity – – (722) 635 – (87) (132) (219)<br />

Net income for the year – – – – 4,213 4,213 405 4,618<br />

Issuance of treasury shares<br />

Total income and expense<br />

– – – – – – 22 22<br />

for the year – – ( 722) 635 4,213 4,126 295 4,421<br />

At December 31, <strong>2006</strong> P=4,581 P=6,766 (P=489) P=1,031 (P=5,026) P=6,863 P=6,241 P=13,104<br />

At December 31, 2004, as<br />

reported P=4,581 P=6,766 P=820 P=– (P=10,214) P=1,953 P=6,030 P=7,983<br />

Effect of adoption of PAS 39<br />

(Note 4) – – 77 1,044 243 1,364 29 1,393<br />

At December 31, 2004, as<br />

restated 4,581 6,766 897 1,044 (9,971) 3,317 6,059 9,376<br />

Equity adjustment from<br />

translation during the year – – (664) – – (664) (43) (707)<br />

Adjustment for unrealized gain<br />

on fair value adjustment of<br />

available-for-sale investments – – – (648) – (648) – (648)<br />

Total expense for the year<br />

directly recognized in equity – – (664) (648) – (1,312) (43) (1,355)<br />

Net income for the year – – – – 732 732 407 1,139<br />

Total income and expense<br />

for the year – – (664) (648) 732 (580) 364 ( 216)<br />

Minority interest attributable to<br />

deconsolidated subsidiary – – – – – – (477) (477)<br />

At December 31, 2005 P=4,581 P=6,766 P=233 P=396 (P=9,239) P=2,737 P=5,946 P=8,683<br />

At December 31, 2003 P=4,581 P=6,766 P=53 P=– (P=9,009) P=2,391 P=6,489 P=8,880<br />

Equity adjustment from<br />

translation during the year – – 767 – – 767 3 770<br />

Net loss for the year – – – – (1,205) (1,205) (625) (1,830)<br />

Total income and expense<br />

for the year – – 767 – (1,205) (438) (622) (1,060)<br />

Minority interest – – – – – – 88 88<br />

Deposit for future stock<br />

subscription – – – – – – 287 287<br />

Dividends – – – – – – (212) (212)<br />

At December 31, 2004 P=4,581 P=6,766 P=820 P=– (P=10,214) P=1,953 P=6,030 P=7,983<br />

See accompanying Notes to Consolidated Financial Statements.<br />

A n n u a l R e p o r t 2 0 0 6<br />

49