9. The Pharmaceutical Industry - PMMI

9. The Pharmaceutical Industry - PMMI

9. The Pharmaceutical Industry - PMMI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

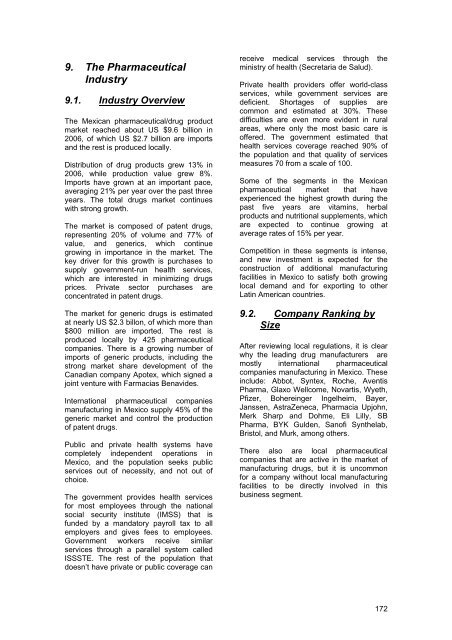

<strong>9.</strong> <strong>The</strong> <strong>Pharmaceutical</strong><br />

<strong>Industry</strong><br />

<strong>9.</strong>1. <strong>Industry</strong> Overview<br />

<strong>The</strong> Mexican pharmaceutical/drug product<br />

market reached about US $<strong>9.</strong>6 billion in<br />

2006, of which US $2.7 billion are imports<br />

and the rest is produced locally.<br />

Distribution of drug products grew 13% in<br />

2006, while production value grew 8%.<br />

Imports have grown at an important pace,<br />

averaging 21% per year over the past three<br />

years. <strong>The</strong> total drugs market continues<br />

with strong growth.<br />

<strong>The</strong> market is composed of patent drugs,<br />

representing 20% of volume and 77% of<br />

value, and generics, which continue<br />

growing in importance in the market. <strong>The</strong><br />

key driver for this growth is purchases to<br />

supply government-run health services,<br />

which are interested in minimizing drugs<br />

prices. Private sector purchases are<br />

concentrated in patent drugs.<br />

<strong>The</strong> market for generic drugs is estimated<br />

at nearly US $2.3 billon, of which more than<br />

$800 million are imported. <strong>The</strong> rest is<br />

produced locally by 425 pharmaceutical<br />

companies. <strong>The</strong>re is a growing number of<br />

imports of generic products, including the<br />

strong market share development of the<br />

Canadian company Apotex, which signed a<br />

joint venture with Farmacias Benavides.<br />

International pharmaceutical companies<br />

manufacturing in Mexico supply 45% of the<br />

generic market and control the production<br />

of patent drugs.<br />

Public and private health systems have<br />

completely independent operations in<br />

Mexico, and the population seeks public<br />

services out of necessity, and not out of<br />

choice.<br />

<strong>The</strong> government provides health services<br />

for most employees through the national<br />

social security institute (IMSS) that is<br />

funded by a mandatory payroll tax to all<br />

employers and gives fees to employees.<br />

Government workers receive similar<br />

services through a parallel system called<br />

ISSSTE. <strong>The</strong> rest of the population that<br />

doesn’t have private or public coverage can<br />

receive medical services through the<br />

ministry of health (Secretaria de Salud).<br />

Private health providers offer world-class<br />

services, while government services are<br />

deficient. Shortages of supplies are<br />

common and estimated at 30%. <strong>The</strong>se<br />

difficulties are even more evident in rural<br />

areas, where only the most basic care is<br />

offered. <strong>The</strong> government estimated that<br />

health services coverage reached 90% of<br />

the population and that quality of services<br />

measures 70 from a scale of 100.<br />

Some of the segments in the Mexican<br />

pharmaceutical market that have<br />

experienced the highest growth during the<br />

past five years are vitamins, herbal<br />

products and nutritional supplements, which<br />

are expected to continue growing at<br />

average rates of 15% per year.<br />

Competition in these segments is intense,<br />

and new investment is expected for the<br />

construction of additional manufacturing<br />

facilities in Mexico to satisfy both growing<br />

local demand and for exporting to other<br />

Latin American countries.<br />

<strong>9.</strong>2. Company Ranking by<br />

Size<br />

After reviewing local regulations, it is clear<br />

why the leading drug manufacturers are<br />

mostly international pharmaceutical<br />

companies manufacturing in Mexico. <strong>The</strong>se<br />

include: Abbot, Syntex, Roche, Aventis<br />

Pharma, Glaxo Wellcome, Novartis, Wyeth,<br />

Pfizer, Bohereinger Ingelheim, Bayer,<br />

Janssen, AstraZeneca, Pharmacia Upjohn,<br />

Merk Sharp and Dohme, Eli Lilly, SB<br />

Pharma, BYK Gulden, Sanofi Synthelab,<br />

Bristol, and Murk, among others.<br />

<strong>The</strong>re also are local pharmaceutical<br />

companies that are active in the market of<br />

manufacturing drugs, but it is uncommon<br />

for a company without local manufacturing<br />

facilities to be directly involved in this<br />

business segment.<br />

172

<strong>9.</strong>3. Key Players<br />

Mexico’s largest pharmaceutical companies include:<br />

Top <strong>Pharmaceutical</strong> Companies Active in Mexico (Sales in Million US$)<br />

Company Origin 2006 Sales 2005 Sales Growth<br />

Bayer de México / DF GER 863.12 748.68 15%<br />

Pfizer / DF USA 761.65 731.65 4%<br />

Novartis / DF SUI 731.20 632.50 16%<br />

Roche / DF SUI 641.68 688.16 -7%<br />

Boehringer Ingelheim Promeco / DF GER 636.44 544.25 17%<br />

GlaxoSmithKline / DF GB 558.48 510.36 9%<br />

Bristol Myers Squibb / DF USA 548.17 523.56 5%<br />

Schering Plough / DF GAR/USA 424.07 547.98 -23%<br />

Wyeth / Méx. USA 377.77 323.25 17%<br />

Eli Lilly y Cía. de México / DF USA 340.81 291.87 17%<br />

AstraZeneca / Méx. GB/SUE 296.77 241.81 23%<br />

Merck Sharp & Dome de México / DF USA 292.75 267.87 9%<br />

Merck / Méx. GER 220.86 174.26 27%<br />

Ciba Especialidades Químicas México /<br />

DF SUI 160.57 144.23 11%<br />

Proquifin / DF MX 62.04 50.83 22%<br />

Laboratorios Sophia / Jal. MX 58.68 51.70 13%<br />

6,975.06 6,472.96<br />

Source: Expansión Magazine, Top 500 Mexican companies.<br />

Top Drug and OTC Distribution Companies (sales in million US$)<br />

Company Origin 2006 Sales 2005 Sales Growth<br />

Nacional de Drogas / DF MX 2,222.22 2,037.04 9%<br />

Grupo Casa Saba / DF MX 2,185.34 2,025.35 8%<br />

Fragua Corporativo / Jal. MX 1,074.15 910.39 18%<br />

Farmacias del Ahorro / DF MX 793.52 663.06 20%<br />

Farmacias Similares / DF MX 68<strong>9.</strong>63 605.56 14%<br />

Farmacias Benavides / NL CHILE 684.96 576.26 19%<br />

Maypo / DF MX 210.35 12<strong>9.</strong>19 63%<br />

7,860.18 6,946.83<br />

Source: Expansión Magazine, Top 500 Mexican companies.<br />

173

8.4 Company Profiles<br />

A) Company Description<br />

Astra Zeneca, S.A. de C.V.<br />

<strong>Industry</strong>: <strong>Pharmaceutical</strong><br />

Sub <strong>Industry</strong>: <strong>Pharmaceutical</strong> and medical<br />

products<br />

Location: Naucalpan, State of Mexico<br />

Size (sales): US $290 million<br />

Purchasing Potential: US $220,000<br />

Specific Business<br />

Opportunities:<br />

Strapping machines<br />

Astra Zeneca is one of the leading global pharmaceutical companies manufacturing prescription<br />

and over-the-counter (OTC) products.<br />

<strong>The</strong> company has one manufacturing plant located in the area of Naucalpan, in the state of<br />

Mexico, within greater Mexico City. It is considered to be state-of-the-art for the pharmaceutical<br />

industry. <strong>The</strong> production from this plant is sold into the Mexican market and for export into<br />

Central America. <strong>The</strong> company’s operations in Mexico employ 1,100 people, from<br />

manufacturing to its dedicated sales force.<br />

B) Main Products Produced and How <strong>The</strong>y Are Packed<br />

<strong>The</strong> company’s two main products are:<br />

Product Brand Package<br />

Nexium Astra Zeneca In blister, individual boxes and collective boxes<br />

Crestor Astra Zeneca In blister, individual boxes and collective boxes<br />

Most of the company’s products are tablets, which are packed similarly as those indicated in the<br />

previous table. <strong>The</strong> company also produces spray products that are packed in individual boxes<br />

and in boxes for transporting the individual presentations to the points of sale.<br />

C) Installed Packaging Machinery<br />

Astra Zeneca uses a large number of packing machines acquired from various suppliers. <strong>The</strong><br />

following table shows some of the most relevant machines for its packing operations in Mexico.<br />

Machinery Type Brand Units Origin Average<br />

Age<br />

Individual cartoning machine Markesini 3 Italy 10<br />

Individual cartoning machine Ulhman 1 Germany 8<br />

Individual cartoning machine Klockner 1 Germany 4<br />

Strapping machine Multipack 6 Italy 8<br />

Strapping machine Pester 1 Germany 4<br />

Collective cartoning machine 3M 8 Italy 8<br />

Plastic wrapping machine Markesini 1 Italy 11<br />

Plastic wrapping machine Ulhman 1 Germany 11<br />

Plastic wrapping machine Klockner 1 Germany 4<br />

174

D) Last Packaging Machinery Purchase<br />

Over the last three years, the company has invested approximately US $2.75 million in the<br />

purchase of packing machinery. <strong>The</strong>se purchases resulted from the need to replace machinery,<br />

and to improve the efficiency of the packing operation.<br />

<strong>The</strong> most recent packing machinery purchase took place in 2007, when it acquired the<br />

following:<br />

Machinery Brand Country<br />

Cartoning machine Markesini Italy<br />

<strong>The</strong> purchase was made though the manufacturer’s distributor in Mexico.<br />

E) Future Packaging Machinery Ordering Plans<br />

Astra Zeneca develops its budget for the purchase of machinery based on the expected<br />

demand growth for it products or new plans for the introduction of additional lines to the market.<br />

<strong>The</strong> company is currently undergoing a production expansion phase and is evaluating the<br />

purchase of packing machinery in the near future. One of the purchases that has already been<br />

defined will consist of the following:<br />

Machinery Brand Units Origin Motive of<br />

purchase<br />

Strapping machine Multipack 2 Italy Expansion<br />

This purchase has an estimated budget of about US $210,000 at a 1.5 US dollar-to-euro<br />

exchange rate.<br />

F) Purchasing Policies and Financial Arrangements<br />

<strong>The</strong> decision process for the purchase of packing machinery results from the combined input of<br />

several departments within the company, including production, maintenance and management.<br />

<strong>The</strong> decision also is reached after each of these areas has reviewed a minimum of three<br />

alternative proposals that are normally requested from interested suppliers.<br />

Once a decision is reached, the technical staff of the company travels to visit with the machinery<br />

manufacturer and reviews that the machine meets the proposed specifications. <strong>The</strong> company<br />

provides an initial payment when the purchase order is signed, and the balance once the<br />

machine is in operation at the plant.<br />

G) Factors That Influence Purchasing Decisions<br />

<strong>The</strong> most important factors considered for a packing machinery purchase decision include:<br />

1. Equipment quality and efficiency.<br />

2. Price.<br />

3. Technical support.<br />

H) Comments on Preferred Brands and Existing Business Arrangements With<br />

Packaging Equipment Suppliers<br />

Astra Zeneca said that it has never used U.S. machinery, as the leading suppliers for the<br />

pharmaceutical industry are European manufacturers. <strong>The</strong> company considers European<br />

machines as being more efficient and having more advanced technology.<br />

<strong>The</strong> company indicated a preference for two German machinery brands, specifically Ulhman<br />

and Klockner.<br />

175

Astra Zeneca only provided comments about Italian and German suppliers, as those are the<br />

only ones with which it has had experience.<br />

Origin Technology Flexibility Service Price<br />

Germany Very Good Very Good Very Good Good<br />

Italy Very Good Very Good Good Good<br />

I) Strengths and Weaknesses of the Installed Machinery<br />

Brand: Ulhman<br />

Strengths:<br />

• Ease of use.<br />

• High speed.<br />

• Easy maintenance.<br />

• Simple technology.<br />

Weaknesses:<br />

• Inadequate technical support in Mexico.<br />

Brand: Klockner<br />

Strengths:<br />

• High speed.<br />

• Fast to reconfigure production.<br />

• Easy maintenance.<br />

Weaknesses:<br />

• Inadequate technical support in Mexico.<br />

• Technology too advanced for Mexican technicians.<br />

J) Trade Show Attendance / Trade Publication Information<br />

Technical staff and management from the company visit trade shows in Mexico, including<br />

ExpoPack and Expo Farma.<br />

K) Specific Interest<br />

<strong>The</strong> company is interested in receiving information from suppliers with expertise in serving the<br />

needs of the pharmaceutical industry.<br />

L) Contact Information<br />

Company Name: Astra Zeneca<br />

Contact: Mr. Javier Avila<br />

Position: Maintenance Manager<br />

Address: Super Avenida Lomas Verdes No. 67<br />

53120, Naucalpan, Estado de Mexico<br />

Telephone: (52 55) 5374 9600<br />

Fax: (52 55) 5374 9600<br />

Mail: Javier.avila@astrazeneca.com<br />

Web page: www.astrazeneca.com<br />

176

A) Company Description<br />

Bayer, S.A. de C.V.<br />

<strong>Industry</strong>: <strong>Pharmaceutical</strong><br />

Sub <strong>Industry</strong>: <strong>Pharmaceutical</strong> and OTC<br />

medicines<br />

Location: Mexico City<br />

Size (sales): US $847.4 million<br />

Purchasing Potential: US $4.5 million<br />

Specific Business<br />

Opportunities:<br />

Tablet filling and plastic<br />

wrapping machines<br />

Bayer has been selling its products in Mexico for more than a century. It built its first<br />

pharmaceutical plant in Mexico and began manufacturing in 193<strong>9.</strong> <strong>The</strong> company is currently<br />

operating three manufacturing plants in Mexico. One plant is located in Mexico City and the<br />

other two in the state of Mexico at close proximity to Mexico City.<br />

<strong>The</strong> plant in Mexico City produces pharmaceutical and consumer care products. <strong>The</strong> plant in<br />

Ecatepec (state of Mexico) manufactures for various product divisions, including material<br />

science, crop science and health care, which include diagnostic kits. <strong>The</strong> Lerma plant (state of<br />

Mexico) is the newest plant, inaugurated in 1997, producing consumer care products for the<br />

Bayer healthcare division. Most of the products are OTC, which include leading local brands like<br />

Aspirina (aspirin), Alka Seltzer and Tabcin (cold medicine).<br />

This manufacturing facility is considered to be one of the most advanced plants operated by<br />

Bayer worldwide.<br />

B) Main Products Produced and How <strong>The</strong>y Are Packed<br />

<strong>The</strong> company’s products are segmented into anti-fungal, stomach, and cold medicines and<br />

vitamins. Some of the leading products include:<br />

C) Installed Packaging Machinery<br />

Product Brand Package<br />

Alka-Seltzer Bayer Sealed plastic bag<br />

Aspirin Bayer Blister PVC aluminum<br />

Effervescent Aspirin Bayer Sealed plastic bag<br />

Antibiotics Bayer Blister<br />

Creams Bayer Tube<br />

<strong>The</strong> company has a large number of diverse packaging machines in operation at its facilities.<br />

<strong>The</strong> following table presents information about the most important examples of the machines<br />

being used.<br />

Machinery Type Brand Units Origin Average Age<br />

Sealing Machines Siebler 5 Germany One: 2 years<br />

Four: 16 years<br />

Blister Machines Bosch 1 Germany 16<br />

Blister Machines Ulhman 4 Germany 3<br />

Blister Machines CAM 1 Italy 16<br />

Carton Machines IWKA 3 Germany 4<br />

Carton Machines Bosch 1 Germany 16<br />

177

Carton Machines CAM 1 Italy 21<br />

Plastic wrapping machines Pester 3 Germany 3<br />

Pallet machines MAB 1 Italy 16<br />

Tablet filling machines Korsch 3 Germany 7<br />

Tablet filling machines Fette 1 Germany 2<br />

Envelope sealing machines Siebler 5 Germany Two: 6 years<br />

Three: 15 years<br />

<strong>The</strong> company noted that the machinery it has in operation is mostly developed to application<br />

specifications presented by Bayer to its machinery suppliers.<br />

D) Last Packaging Machinery Purchase<br />

Over the 2006-2007 period, the company spent approximately US $5.25 million in the purchase<br />

of packaging machinery.<br />

<strong>The</strong> most recent purchase was during 2007, and included the machinery presented in the<br />

following table:<br />

Machinery Brand Country<br />

Blister machine Ulhman Germany<br />

Cartoning machine Ulhman Germany<br />

E) Future Packaging Machinery Ordering Plans<br />

Bayer has developed a purchasing budget spanning over the next seven years. This budget<br />

requires the approval of both the top management of the Mexican operation, as well as the<br />

world headquarters in Germany. <strong>The</strong> planned budget estimates expenditures in packaging<br />

machinery of approximately US $2 million in 2008 and US $ 2.5 million in 200<strong>9.</strong><br />

Bayer purchases packaging machinery from suppliers specializing in the pharmaceutical<br />

industry. <strong>The</strong> next packaging machinery purchase will include the following:<br />

Machinery Units Origin Motive of<br />

purchase<br />

Tablet packaging machine T.B.D. Germany Replacement<br />

Plastic Wrapping machine T.B.D. Germany Replacement<br />

F) Purchasing Policies and Financial Arrangements<br />

Before proceeding with the supplier selection of packing machinery, the company develops a<br />

detailed analysis of the specifications that must be met by the desired machine. Purchasing is<br />

based upon the specific requirements of the company, and not on the adaptation of an existing<br />

machine into their operation.<br />

Once the company has developed the desired characteristics and specifications, it circulates<br />

the information to various potential suppliers. <strong>The</strong>se companies commonly use a basic machine<br />

model, and develop a plan to retrofit the machine for offering a custom-specified machine that<br />

meets the precise requirements outlined by Bayer.<br />

Bayer commonly requests proposals from three to four qualified packing machinery suppliers.<br />

<strong>The</strong> company usually agrees to a 50 to 60% down payment, with additional payments made<br />

during the construction of the machine. <strong>The</strong> final payment of 10% is made once the machine is<br />

in operation. <strong>The</strong> purchase contract has clear definitions of the specifications that must be met<br />

by the machine; the supplier must commit to complying with the required performance.<br />

178

G) Factors that Influence Purchasing Decisions<br />

<strong>The</strong> most important factors considered by the company when selecting new packing machinery<br />

options include:<br />

1. Machine specification.<br />

2. Technology.<br />

3. Supplier and brand reputation.<br />

H) Comments on Preferred Brands and Existing Business Arrangements with<br />

Packaging Equipment Suppliers<br />

Bayer prefers European packing machinery, mentioning that German machines have always<br />

met the technical requirements outlined by the company. It also mentioned that servicing for<br />

German machines is good, though the wait-time for spare parts is longer. <strong>The</strong> company<br />

believes that German suppliers are completely committed to servicing Bayer’s needs and will<br />

take any action, even replacing a machine, to satisfy the client. <strong>The</strong> company believes that this<br />

presents a sharp contrast with U.S. suppliers, though it did not mention any specific<br />

experiences with U.S. suppliers.<br />

<strong>The</strong> company prefers a list of German suppliers that includes Siebler, IWKA, Ulhman and<br />

Pester. <strong>The</strong> company said that it is open to considering new suppliers, even if they are not<br />

German.<br />

Bayer indicated the following perception of suppliers:<br />

Origin Technology Flexibility Service Price<br />

United States Average Very Poor Average Poor<br />

Germany Very Good Very Good Very Good Good<br />

Italy Very Good Very Good Good Good<br />

<strong>The</strong> company indicated that the exchange rate between the euro and the U.S. dollar is<br />

increasing the cost of its machines in local currency terms. It will, however, continue purchasing<br />

European machinery, for the company does not know of any alternatives that can offer the<br />

same equipment quality and efficiency.<br />

I) Strengths and Weaknesses of the Installed Machinery<br />

Brand: Ulhman<br />

Strengths:<br />

• Technology.<br />

• High output capacity.<br />

• Good customer and technical service.<br />

Weaknesses:<br />

• Wait time to receive spare parts.<br />

Brand: Korsch<br />

Strengths:<br />

• Technology.<br />

• Solid construction.<br />

• High output capacity.<br />

Weaknesses:<br />

• Waiting time to receive spare parts.<br />

• No upgrading kits.<br />

179

J) Comments Related to Asian Packaging Machinery<br />

Bayer said that it had been approached by a packing machinery supplier from India that was<br />

offering very competitive pricing. <strong>The</strong> company mentioned that as price is not a decision factor,<br />

it doesn’t have an interest in suppliers competing solely on price. <strong>The</strong> purchasing decision for<br />

the company is based on technology, reliability and brand reputation.<br />

<strong>The</strong> firm says that it knows for a fact that its suppliers are not shifting manufacturing to Asia.<br />

Over the course of the production of its machines, the company visited the factory of its<br />

suppliers in Europe between two and three times to check on the progress on the construction<br />

of its machines.<br />

K) Trade Show Attendance / Trade Publication Information<br />

Bayer visits trade shows regularly, including packing and pharmaceutical shows in Germany, as<br />

well as ExpoPack and Expo Farma in Mexico. <strong>The</strong> company does not attend trade shows in the<br />

United States. <strong>The</strong> company also receives trade publications and information from current and<br />

interested suppliers.<br />

L) Specific Interest<br />

<strong>The</strong> company is interested in receiving information from potential suppliers specializing in<br />

servicing the pharmaceutical industry. It is specifically interested in blister and cartoning<br />

machines.<br />

M) Contact Information<br />

Company Name: Bayer de Mexico S.A. de C.V.<br />

Contact: Mr. Alfredo Velez<br />

Position: Technical and Maintenance Director<br />

Address: Carretera Mexico-Toluca. Km 52.5<br />

5200 Lerma, Estado de Mexico, Mexico<br />

Telephone: (52-55) 5728-3000 ext. 4985 or 4882<br />

Fax: (52-55) 5728-3363<br />

Mail: alfredo.velezcalderon.av@bayer.com.mx<br />

Web page: www.bayer.com.mx<br />

180

A) Company Description<br />

Laboratorios Columbia S.A. de C.V.<br />

<strong>Industry</strong>: <strong>Pharmaceutical</strong><br />

Sub <strong>Industry</strong>: Trade mark drugs, natural<br />

products, other medical<br />

specialty products, OTCs and<br />

veterinary products<br />

Location: Mexico City<br />

Size (sales): US $80 million<br />

Purchasing Potential: N.A.<br />

Specific Business<br />

Opportunities:<br />

Everything for the<br />

pharmaceutical industry<br />

Laboratorios Columbia began operations in 1951. <strong>The</strong> company was acquired by Mexican<br />

businessmen in 1989, and currently has two plants in Mexico and five plants overseas.<br />

<strong>The</strong> firm manufactures semi-solid products (rubs), pills, tablets, oral suspensions, perfumes,<br />

injectable solutions and powders in more than 250 different presentations.<br />

In addition to its Mexican plants, which are located in Mexico City and in the state of Querétaro,<br />

the company has two production facilities in Spain, one in Denmark and one in Canada.<br />

B) Main Products Produced and How <strong>The</strong>y Are Packed<br />

Due to the large variety of products produced by Laboratorios Columbia, it is difficult to describe<br />

each of the packing processes. In general terms, the company packs tablets, capsules and pills<br />

in blister pack and in flasks; rubs in aluminum tubes; oral suspensions in plastic flasks; and<br />

injection solutions in bottles and ampoules. <strong>The</strong> company also packs some of its products in<br />

pouches.<br />

C) Installed Packaging Machinery<br />

<strong>The</strong> following table includes some of the machinery in operation at Laboratorios Columbia:<br />

Current Machinery Used Brand Units Origin Average<br />

Age<br />

Blister Machine, 90 p/m Uhlman 1 Germany 24<br />

Pouch Machines 60 p/m Volpak 1 Spain 14<br />

Pouch Machines 500 p/m B-matic 1 USA 12<br />

Coding Machinery 120 p/m Domino 2 USA 19<br />

Press Sealing Machines 50 p/m Devechi 1 USA 19<br />

Powder Filling Machine 45 p/m All-fill 1 USA 14<br />

Pouch Filling Machine 90 p/m Volpak 1 Spain 14<br />

Tablet Filling Machines 160 p/m Volpak 1 Spain 14<br />

Hot gum Labeling Machine Compac 1 USA 21<br />

Labeling Machine 150 p/m Libra 1 Italy 10<br />

Cartoning Machine 150 p/m BFB 1 Italy 10<br />

Cartoning Machine 200 p/m Marcesini 1 Italy 14<br />

Carton Erecting Machine 200 p/m Multipak 1 Italy 14<br />

Tablet Counting Machine 40 p/m King 1 U.K. 13<br />

Labeling Machine NJM 3 USA 7<br />

Induction Sealing Machines 50<br />

frasks<br />

Enercon 1 USA 8<br />

181

Liquid Filling Machine 180f/m IMA 1 Italy 9<br />

Tube Filling Machine 120t/m Unipack 1 Italy 14<br />

Blister Line Marcesini 1 Italy 5<br />

Filling machine Manesty 1 England 1<br />

D) Last Packaging Machinery Purchase<br />

Its last packaging machinery parchase took place in late 2007, when the company acquired a<br />

labeling machine from the Mexican manufacturer Unión.<br />

E) Future Packaging Machinery Ordering Plans<br />

Laboratorios Columbia said that it does not have packaging machinery purchasing plans in the<br />

short term. It indicated that currently, it is developing new product presentations, and once<br />

those are developed, it will analyze the type of machinery needed to produce these new<br />

presentations. Laboratorios Columbia estimates that during the second half of 2008, it will have<br />

defined the new requirements and will begin searching for suppliers in late 2008.<br />

F) Purchasing Policies and Financial Arrangements<br />

Columbia’s Engineering Department determines the types of equipment required, including the<br />

characteristics, capacity and other relevant information. After the requirements are defined, the<br />

company invites a minimum of three packaging equipment companies to provide quotes to its<br />

Engineering Department,. After receiving bids from the potential suppliers, Columbia elaborates<br />

a comparative chart and selects the one that provides the best economic conditions, times of<br />

delivery and quality.<br />

<strong>The</strong> company uses credit lines provided by the manufacturers, and grants the credits through<br />

an insurance company hired by Columbia. In some cases, the company opts for leasing<br />

contracts, which are contracted with banks or other financial agencies. In a few cases, the<br />

company pays cash to obtain a discount and to avoid exchange rate fluctuation risks.<br />

G) Factors That Influence Purchasing Decisions<br />

1. Quality.<br />

2. Technical support.<br />

3. Price.<br />

4. Delivery timing.<br />

Machinery Brand Country<br />

Labeling Machine Union Mexico<br />

H) Comments on Preferred Brands and Existing Business Arrangements With<br />

Packaging Equipment Suppliers<br />

<strong>The</strong> company does not have any pre-existing commitments to suppliers, nor a definite<br />

preference for suppliers from a particular country. It does tend to favor Italian and German<br />

machinery, however, because it believes that these machines have state-of-the-art technology.<br />

<strong>The</strong> company believes that U.S. equipment suppliers have very little to offer to the<br />

pharmaceutical industry, and only mentioned that the United States is superior for its coding<br />

machinery.<br />

182

Equipment is serviced by the company’s own technicians, who are trained by the equipment<br />

suppliers. <strong>The</strong> company purchases spare parts from the manufacturers because there is limited<br />

availability in the country.<br />

Columbia’s evaluation of packaging machinery by country of origin is as follows:<br />

Origin Technology Flexibility Service Price<br />

United States Good Good Average Good<br />

Germany Very Good Very Good Very Good Average<br />

Italy Very Good Very Good Very Good Average<br />

Spain Very Good Very Good Good Average<br />

France Very Good Very Good Good Average<br />

I) Strengths and Weaknesses of the Installed Machinery<br />

Brand: IMA<br />

Strengths:<br />

• Good technical support.<br />

• Good quality and reliability.<br />

Weaknesses:<br />

• Price: it is usually more expensive than other alternatives.<br />

Brand: Ulhman<br />

Strengths:<br />

• Very good technology.<br />

• Good quality and reliability.<br />

• Long lasting.<br />

Weaknesses:<br />

• Spare parts are not always available and take long to get to Mexico.<br />

• More expensive than similar machines.<br />

J) Trade Show Attendance / Trade Publication Information<br />

<strong>The</strong> firm uses ExpoPack in Mexico as its main source of information about new potential<br />

suppliers. It also receives information on new machinery and new packaging options from<br />

existing suppliers and from trade magazines for the pharmaceutical industrly.<br />

K) Specific Interest<br />

Laboratorios Columbia would like to receive information about potentail suppliers for blister<br />

machinery, as well as tablet packaging machinery. In general, it is interested in new packaging<br />

machinery suppliers that have high-quality equipment and competitive prices.<br />

L) Contact Information<br />

Company Name: Laboratorios Columbia, S.A. de C.V.<br />

Contact: Arq. Rafael Parada / Ing. Roberto Villena<br />

Position: Director of Project Development / Manager of Project Development<br />

Address: Calz. Del Hueso No. 160<br />

C.P. 04850, México, D.F.<br />

Telephone: (52) 5726-5555 ext. 5569<br />

Fax: (52) 5684-7613<br />

E-mail: RParada@gcolumbia.com<br />

Internet: www.gcolumbia.com.mx<br />

183

A) Company Description<br />

Russek–Loeffler, S.A. de C.V.<br />

<strong>Industry</strong>: <strong>Pharmaceutical</strong><br />

Sub <strong>Industry</strong>: Generic medicines<br />

Location: Mexico City<br />

Size (sales): US $24 million<br />

Purchasing Potential: US $ 300,000 to 800,000 for 2008<br />

Specific Business<br />

Opportunities:<br />

Liquid filling line, case filling machines.<br />

Russek–Loeffler is a private Mexican company resulting from the merger of a series of<br />

laboratories in 199<strong>9.</strong> <strong>The</strong>se include Loeffer, Agroquímico S.A de C.V, and Carter Wallace. ,<br />

Operations of the group date back to 1978 with the purchase of the Mexican Biochemistry<br />

Institute (Instituto Bioquimico de México), which belonged to Rohm and Hass. <strong>The</strong> company<br />

produces pharmaceutical products for human and veterinarian use.<br />

<strong>The</strong> company currently supplies 63 products to both markets. Demand is growing at rates of<br />

100% per year and is remaining steady at those growth levels. This can be seen by the<br />

production of generics sold under itsr own brands and through private labels for third parties.<br />

B) Main Products Produced and How <strong>The</strong>y Are Packed<br />

Russek-Loeffler produces a wide variety of pharmaceuticals. Most products are packed in<br />

blister or glass bottles. <strong>The</strong> most representative products include:<br />

Product Brand Package<br />

Capsules Itraconazol Blister<br />

Ovules Nitrofural Blister<br />

Tablets Pravastatina Blister<br />

Suppositories Glicerina Blister<br />

Injections Piremol Vial<br />

Capsules Dolcoplaz Blister<br />

Gel Benzoilo Glass Container<br />

Capsules, tablets and liquid Flamozil Bottle and Blister<br />

Liquids Metronidazol Bottle<br />

C) Installed Packaging Machinery<br />

Close to 80% of the machinery used at these labs is of European origin. Of that machinery,<br />

nearly half was purchased used from other laboratories to minimize the price. <strong>The</strong> company has<br />

an in-house shop and staff to repair and modify used equipment, which it believes provides the<br />

best return on its investment.<br />

Some of the machines it has purchased and adapted into its line include the following:<br />

Current Machinery Used Brand Units Origin Average<br />

Age<br />

Liquid filling machine Marzochi 1 Italy 3<br />

Ampoule filling machine Cozzolli 1 Italy 20<br />

Case filling machine Tiele 1 USA 10<br />

Case filling machine Jones 1 USA 13<br />

Carton machine CAM 1 Italy 3<br />

184

Liquid filling machine N.A. 1 USA 25<br />

Blister machines Bosch 1 Germany 20<br />

Cream filling machine N.A. 1 USA 23<br />

Syringe filling machine N.A. 1 Germany 10<br />

Powder filling machine N.A. 1 USA 20<br />

Ovule and suppositories filling<br />

machine<br />

Saron 1 Italy 30<br />

D) Last Packaging Machinery Purchase<br />

<strong>The</strong> last packing machinery purchase was made in March 2007, when the firm purchased a<br />

case filling machine from U.S. supplier Tiele.<br />

Machinery Brand Country<br />

Case filling machine Tiele USA<br />

E) Future Packing Machinery Ordering Plans, 2004-2005<br />

Russek–Loeffler plans to acquire a filling machine from Bosch and two case filling machines to<br />

increase productivity. It also is planning to eliminate several old machines, however the budget<br />

for these investments is still pending.<br />

Machinery Units Origin Motive of Purchase Estimate Budget<br />

Liquid filling machine 1 Germany<br />

or UK<br />

Productivity US $300,000<br />

Case filling machine 2 N.A. Expansion in<br />

production line<br />

US $200,000<br />

F) Purchasing Policies and Financial Arrangements<br />

<strong>The</strong> company has been able to maintain production and packing using a significant portion of<br />

used equipment. Because of this experience, the company always considers whether used<br />

equipment could meet its needs for additional machines. Because of the significant demand on<br />

certain lines, the company is beginning to realize that new machines might be the only option in<br />

offering the volumes and flexibility that the company requires in certain processes.<br />

<strong>The</strong> company prefers to receive financing for equipment purchases. It has obtained financing<br />

from banks and would value financing from suppliers. All final purchasing decisions need the<br />

approval of the company’s chairman.<br />

G) Factors That Influence Purchasing Decisions<br />

1. Price and payment terms .<br />

2. Availability in the market.<br />

3. Brand reputation in the Mexican market.<br />

4. Spare parts availability.<br />

5. Service and technical assistance from the supplier.<br />

H) Comments on Preferred Brands and Existing Business Arrangements With<br />

Packing Equipment Suppliers.\<br />

<strong>The</strong> company believes that European machines have a stronger penetration in the<br />

pharmaceutical industry in Mexico. It considers those machines, in general, to be superior to<br />

other alternatives. Unfortunately, under current exchange rate conditions, these machines are<br />

very expensive. However, local distributors are working to offer alternatives, such as equipment<br />

rental and service packages, to try to spread the price impact over time.<br />

<strong>The</strong> company’s perception about packing machinery by origin is as follows:<br />

185

Origin Technology Flexibility Service Price<br />

United States Good Good Good Good<br />

Germany Very Good Good Very Good Average<br />

Italy Very Good Good Good Average<br />

France Very Good Very Good Very Good Average<br />

China Average Average Poor Very Good<br />

<strong>The</strong> company believes that U.S. equipment is not the top choice for the pharmaceutical<br />

industry. <strong>The</strong> preferred choice is European equipment, but it is very expensive and spare parts<br />

are not readily available. <strong>The</strong> company said that it has had so much trouble with spare parts<br />

that it has developed an in-house shop to try to produce the spare parts needed more often.<br />

I) Strengths and Weaknesses of the Installed Machinery<br />

Brand: Sarog<br />

Strengths:<br />

• Robust machinery.<br />

• Long-lasting machines.<br />

• Trustable machines.<br />

• Precise.<br />

Weaknesses:<br />

• <strong>The</strong> price of the machine and maintenance costs are very high.<br />

• Very high costs for spare parts.<br />

Brand: Tiele<br />

Strengths:<br />

• Efficient machines.<br />

• Easy to work with.<br />

• High productivity.<br />

• Low waste of ingredients.<br />

Weaknesses:<br />

• High contract costs.<br />

J) Comments Related to Asian Packaging Machinery<br />

<strong>The</strong> company said that it has been approached by several Asian suppliers, especially from<br />

China, which have proposed very attractively priced and flexible equipment. In addition to low<br />

prices, through the Chinese embassy in Mexico the machinery suppliers are offering financing<br />

from the Chinese Commerce Department and from the Bank of China. Even as these proposals<br />

are very attractive, the company considers that the quality of the proposed machines is not<br />

good, especially because of the low quality of the metals used, which might not withstand high<br />

temperatures and might reach metal fatigue in a short period.<br />

K) Trade Show Attendance / Trade Publication Information<br />

<strong>The</strong> company reviews trade publications regularly and visits packing machinery trade shows in<br />

Mexico, the United States and Germany. <strong>The</strong> company is also abreast of the equipment used<br />

by its competitors and of the new technologies being incorporated into machinery used in the<br />

pharmaceutical industry.<br />

L) Specific Interest<br />

186

<strong>The</strong> company is facing a very significant growth in demand and is interested in learning about<br />

cost-effective alternatives to increase productivity and production capacity at its facilities.<br />

M) Contact Information<br />

Company Name: Russek-Loeffler<br />

Contact: Ing. Herbert Scholz Ojeda<br />

Position: Planning and Purchasing Director<br />

Address: Prolongacion Ing Militares # 76<br />

Col.San Lorenzo Tlatenango<br />

11210, Mexico City<br />

Telephone: (5255) 2626 7503<br />

Fax:<br />

e-mail:<br />

Web page: www.loeffler.com.mx<br />

187

A) Company Description<br />

Sanofi Aventis, S.A. de C.V.<br />

<strong>Industry</strong>: <strong>Pharmaceutical</strong><br />

Sub <strong>Industry</strong>: <strong>Pharmaceutical</strong>s, patent and<br />

over the counter drugs<br />

Location: Ocoyoacac, state of Mexico<br />

Size (sales): N/A<br />

Purchasing Potential: US $750,000 (est.)<br />

Specific Business<br />

Opportunities:<br />

Complete blister and<br />

packaging line for capsules<br />

and tablets; mixing machines,<br />

blister and liquid filling line.<br />

Sanofi Aventis resulted from the acquisition of Aventis by Sanofi in 2004, and represents one of<br />

the leading pharmaceutical companies in the world.<br />

<strong>The</strong> company manages one of the widest pharmaceutical product lines, with nearly 500 product<br />

presentations. It mantaines significat market share in Mexico, estimated at more than 7%.<br />

B) Main Products Produced and How <strong>The</strong>y Are Packed<br />

<strong>The</strong> company’s leading products are presented in the following table. Presentations for retail<br />

include tablets and capsules in glass bottles, and blister packs in carton boxes. <strong>The</strong> company<br />

also handles syrups that are bottled in glass or PET bottles. <strong>The</strong> leading product bands include:<br />

C) Installed Packaging Machinery<br />

Products<br />

Aprovel Arava<br />

Co-aprovel Profenid<br />

Lasix Solian<br />

Oroxadin Stilnox<br />

Tritace Victan<br />

Clexane Anandron<br />

Plavix Anzemet<br />

Allegra Eloxatin<br />

Enterogermina Taxotere<br />

Neomelubrina Amaryl<br />

Pulmonarom Daonil<br />

Tavanic Met-Amaryl<br />

Xatral OD Lantus<br />

Actonel<br />

<strong>The</strong> following table lists the most important machines comprising its packing infrastructure<br />

installed in Mexico. Most of the equipment is of European origin and has been in operation at its<br />

plant for more than 15 years.<br />

Machinery Type/ Brand Brand Units Origin<br />

Filling Machine CAM/ 3M 2 Italy<br />

Tray Sealing Machine CAM/ HF 2 Italy<br />

Blister Machine Ullman 2 Germany<br />

Tray Sealing Machine CAM 1 Italy<br />

Blister and Closing Machine IMA 94 1 Italy<br />

188

Blister and Cartoning line IMA C90 1 Italy<br />

Blister and Tray Sealing Line IMA C62 2 Italy<br />

Blister Machine CAM 2 Italy<br />

Most of the equipment used at the plant is reaching obsolescence, and all of the machines will<br />

need to be replaced over the following 10 years. An important problem with the machines is that<br />

they are operated with computer systems and hardware that are basically obsolete and<br />

expensive to replace. This points to the need to purchase new equipment, as retrofitting existing<br />

machines is not considered a cost-effective alternative.<br />

With future equipment selection, the company will seek equipment that is less dependant upon<br />

other systems and machines that are easier to program.<br />

D) Last Packaging Machinery Purchase<br />

<strong>The</strong> most recent purchase of packing machinery was in 2007, when the company invested more<br />

than US $3 million on the purchase of the following equipment:<br />

Machinery Brand Country Cost<br />

Weight verifier machine Mettler Italy N.A.<br />

Labeling machine IMA or Neri Italy N.A.<br />

E) Future Packaging Machinery Ordering Plans.<br />

<strong>The</strong> company has a budget of more than US $4.5 million for the purchase of packing machinery<br />

during 2008, and a similar amount for the same purpose in 200<strong>9.</strong> <strong>The</strong> next purchases will follow<br />

the order indicated in the table:<br />

Machinery Units Origin Estimated Budget<br />

Blister and packaging line for<br />

capsules and tablets<br />

1 T.B.D US $1.8 million<br />

Mixers T.B.D T.B.D T.B.D<br />

Blister line T.B.D T.B.D T.B.D<br />

Ampoules filling line T.B.D T.B.D T.B.D<br />

F) Purchasing Policies and Financial Arrangements<br />

<strong>The</strong> selection of new machinery will begin with the technical phase, during which the company<br />

will define equipment options and arrange for visits to evaluate the proposed machinery in<br />

operation. Once equipment options are defined, a final decision is made by the management of<br />

the company.<br />

G) Factors That Influence Purchasing Decisions<br />

1. Developed specifically for the desired application.<br />

2. Ease of operation.<br />

3. Production speed and versatility.<br />

4. Efficiency.<br />

H) Comments on Preferred Brands and Existing Business Arrangements With<br />

Packaging Equipment Suppliers<br />

<strong>The</strong> company prefers European machinery. However, the appreciation of the euro is making<br />

that equipment very expensive when compared to other options. <strong>The</strong> firm mentioned that the<br />

total cost of ownership between European and North American machines might be the same<br />

over the long run, considering that the service of European machines is very expensive and<br />

some times difficult to arrange.<br />

189

<strong>The</strong> company mentioned that pharmaceutical patent holders are the most important clients for<br />

packing machinery manufacturers, as producers of generic drug products use very simple and<br />

inexpensive machinery.<br />

<strong>The</strong> company made the following evaluation on their perception of suppliers based on country<br />

of origin:<br />

Origin Technology Flexibility Service Price<br />

United States Average Very Good Very Good Good<br />

Germany Good Good Good Very Poor<br />

Italy Regular Good Good Average<br />

Spain Poor Poor Poor Poor<br />

France Average Average Poor Average<br />

Japan Very Good Good Good Poor<br />

<strong>The</strong> company noted that German machinery is extremely expensive, and not only because of<br />

the current exchange rate of the euro. Machinery from that country has traditionally been priced<br />

very expensively.<br />

I) New Origin of Suppliers from Asia<br />

Sanofi-Aventis said that it has been contacted by suppliers from Asia, including equipment<br />

manufacturers from China, India and Korea. <strong>The</strong> company also said that it is aware that some<br />

of its traditional suppliers, including Fette, IMA and Ullman, are assembling their machines in<br />

Asia.<br />

J) Specific Interest<br />

<strong>The</strong> company is interested in reviewing information about packing machinery suppliers<br />

specializing in the pharmaceutical and cosmetics markets.<br />

K) Contact Information<br />

Company Name: Sanofi-Aventis<br />

Contact: Mr. Ignacio Dapic / Jorge Arrieta Ponce<br />

Position: Maintenance Manager / Maintenance Leader PPU Solids<br />

Address: Acueducto del Alto Lerma No. 2<br />

Ocoyoacac, Edo de México, 52740<br />

Telephone: (52) 5484 4400 ext. 4708 / ext. 4760 or (728) 282 8760<br />

Fax: (52 728) 282 8720<br />

Mail: ignacio.dapic@sanofi-aventis.com<br />

jorge.arrieta@sanofi-aventis.com<br />

Web page: www.sanofi-aventis.com.mx<br />

190