CBI-News Juli/Aug 298

CBI-News Juli/Aug 298

CBI-News Juli/Aug 298

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

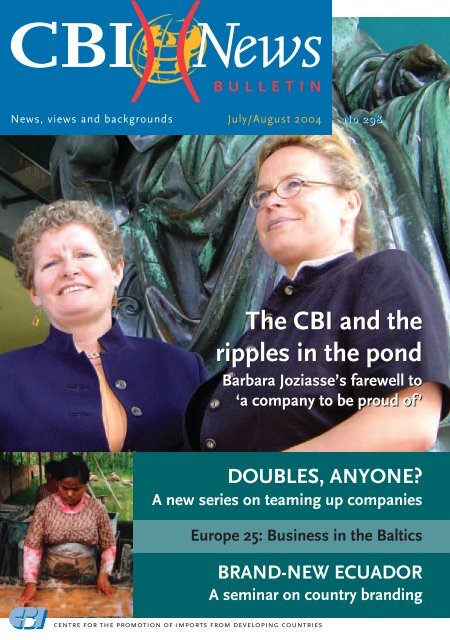

<strong>CBI</strong>)( <strong>News</strong><br />

BULLETIN<br />

<strong>News</strong>, views and backgrounds<br />

July/<strong>Aug</strong>ust 2004 No <strong>298</strong><br />

DOUBLES, ANYONE?<br />

A new series on teaming up companies<br />

Europe 25: Business in the Baltics<br />

BRAND-NEW ECUADOR<br />

A seminar on country branding<br />

centre for the promotion of imports from developing countries<br />

The <strong>CBI</strong> and the<br />

ripples in the pond<br />

Barbara Joziasse’s farewell to<br />

‘a company to be proud of’

STAFF MEMBERS <strong>CBI</strong><br />

MANAGING DIRECTOR<br />

T. Lansink<br />

INTERNATIONAL PROJECTS & TRAINING SECTION (IK)<br />

Head of Section/Deputy Director<br />

A. Wevers<br />

Project Managers<br />

L. Cuypers<br />

M.J.H. Swartjes<br />

Officers:<br />

D. Baart<br />

J. van der Loos<br />

F. Uluocak<br />

TRADE PROMOTION SECTION (HB)<br />

Head of Section<br />

D.J. de Man<br />

Programme Managers<br />

C.J. Dieleman<br />

P.J. van Gilst<br />

H. Hazelaar<br />

W. van Heumen<br />

J. Nijenhuis<br />

Officers:<br />

B. Beijersbergen van Henegouwen<br />

S. Bhawanidin<br />

C. Kerkhof<br />

MARKET INFORMATION & TRADE INTERMEDIARY SECTION (MB)<br />

Head of Section<br />

H. Verhoeven<br />

Programme Managers<br />

A. van Beuzekom (AccessGuide)<br />

J. Vereijken (Market Information)<br />

Officer:<br />

I. Halvax (Trade Intermediary Services)<br />

Secretariat:<br />

G. Dimmers<br />

ACCOUNTS & GENERAL AFFAIRS SECTION (CZ)<br />

Head of Section<br />

B. van der Pol<br />

Officers<br />

M.A.A. van der Drift<br />

T. Vooijs<br />

G. de Winkel<br />

Archives<br />

Vacancy<br />

Secretariat<br />

J.M. Geerders<br />

Mailing address<br />

<strong>CBI</strong><br />

P.O. Box 30009<br />

3001 DA Rotterdam<br />

The Netherlands<br />

Phone +31 10 201 34 34<br />

Fax +31 10 411 40 81<br />

E-mail cbi@cbi.nl<br />

Internet www.cbi.nl<br />

Office<br />

WTC-Beursbuilding, 5th floor<br />

37 Beursplein, Rotterdam<br />

The Netherlands<br />

Editorial staff<br />

H. Verhoeven (Editor-in-chief)<br />

J. Vereijken (Editorial<br />

Management)<br />

S.D. Teeuwen (Editor)<br />

Circulation 5000<br />

Frequency 6 times annually<br />

Editing and layout Admix Publieke Werken, Rotterdam<br />

Print PlantijnCasparie Den Haag<br />

THE <strong>CBI</strong>: YOUR EUROPEAN PARTNER FOR THE EUROPEAN MARKET<br />

The <strong>CBI</strong> (Centre for the Promotion of Imports from developing countries) is an<br />

agency of the Dutch Ministry of Foreign Affairs. The <strong>CBI</strong> was established in 1971.<br />

The <strong>CBI</strong>’s mission is to contribute to the economic development of developing<br />

countries by strengthening the competitiveness of companies from these countries on<br />

the EU market. The <strong>CBI</strong> considers social values and compliance with the most<br />

relevant environmental requirements to be an integral part of its policy and activities.<br />

THE <strong>CBI</strong> OFFERS VARIOUS PROGRAMMES AND SERVICES TO ITS TARGET GROUPS:<br />

MARKET INFORMATION<br />

A wide variety of tools to keep exporters and Business Support Organizations in<br />

developing countries in step with the very latest developments on the EU market.<br />

COMPANY MATCHING<br />

The company matching programme links well-versed suppliers in developing<br />

countries to reliable importing companies in the EU and vice versa.<br />

EXPORT DEVELOPMENT PROGRAMMES (EDPS)<br />

EDPs are designed to assist entrepreneurs in developing countries in entering and<br />

succeeding on the EU market and/or in consolidating or expanding their existing<br />

market share.<br />

TRAINING PROGRAMMES<br />

Training programmes for exporters and Business Support Organizations on, among<br />

others, general export marketing and management; trade promotion; management<br />

of international trade fair participation, and developing client-oriented market in-<br />

formation systems.<br />

BSO DEVELOPMENT PROGRAMME<br />

Institutional support for capacity building for selected Business Support<br />

Organizations.<br />

For detailed information on all <strong>CBI</strong> programmes and services, visit the <strong>CBI</strong><br />

website at www.cbi.nl<br />

Please write to us in English, the working language of the <strong>CBI</strong>.

) contents<br />

)(<br />

(<br />

EXPORT MARKETING & MANAGEMENT<br />

Interview: The <strong>CBI</strong> consultant Jan Ramakers: Add knowledge, mix well 5<br />

Series Europe 25: Business in the Baltics 6<br />

EUROPEAN MARKET INFORMATION<br />

Doubles, anyone? The pro-s and con-s of co-operation 10<br />

The ABC of AccessGuide 13<br />

You can influence EU law 14<br />

Maca, back on the menu 16<br />

<strong>CBI</strong> EU market surveys, excerpts from the surveys for:<br />

- the bodywear market: Shake your bodywear 17<br />

- software market & IT services: Click on offshore 18<br />

<strong>CBI</strong> NEWS<br />

New looks for the <strong>CBI</strong> 19<br />

The <strong>CBI</strong> and the ripples in the pond, Anneke Wevers taking over from<br />

Barbara Joziasse 19<br />

Welcome Norway, joining forces with major Norwegian institutes 21<br />

PROMOTIONAL EVENTS<br />

Taking the Aquatech plunge 22<br />

Trade Fair Automechanika 22<br />

Spreading the good news 23<br />

TECHNICAL ASSISTANCE & COMPANY VISITS<br />

Give me a brake, heavy traffic in the car parts sector 23<br />

SEMINARS AND WORKSHOPS<br />

Brand-new Ecuador, a new <strong>CBI</strong> seminar on country branding 25<br />

Clinically alive, new vigour into the Expro seminar Chemicals 28<br />

See you online! E-learning across the world 30<br />

MATCH BOX<br />

New suppliers from developing countries 33<br />

Interesting Manuals 33<br />

Trade fairs and conferences 33<br />

<strong>CBI</strong> Export Development Activities 34<br />

List of current <strong>CBI</strong> publications 36<br />

Coverphoto: Barbara Joziasse (right) says farewell, Anneke Wevers (left)<br />

taking over (photo: Leon Pieter den Hollander)<br />

Below: At work in the Nepalese paper industry, companies<br />

successfully co-operating.<br />

July/<strong>Aug</strong>ust 2004 page 3

The world’s biggest single<br />

market for fine and specialty<br />

chemicals is the European<br />

Union. Every major player in<br />

the sector is based here and<br />

their combined competitive<br />

power could cause quite a<br />

bang. But that doesn’t mean<br />

that if you have a small- or<br />

medium-sized enterprise in a<br />

developing country you’ll<br />

never make it in the EU.<br />

On the contrary, Europe needs<br />

you, says <strong>CBI</strong> consultant Jan<br />

Ramakers. Just make sure that<br />

when you’re brewing your<br />

export potion, you mix in<br />

plenty of market knowledge.<br />

<strong>CBI</strong> consultant Jan Ramakers elaborates on<br />

the world’s biggest single market for fine and<br />

specialty chemicals (photo De Jong & Van Es).<br />

Every company in this sector is<br />

looking at its procurement policy<br />

these days”, says Ramakers.<br />

“That means they’re looking for suitable<br />

options for placing their products<br />

outside the European Union, too. A lot<br />

of Europeans are already buying heavily<br />

in India. They may not yet have<br />

discovered smaller developing countries,<br />

like Colombia – but nobody<br />

would object to searching there.”<br />

The chemical industry, in short, is simply<br />

bubbling with activity. And as far as Jan<br />

Ramakers is concerned, that’s the way it<br />

should be: not only does it mean he has<br />

good news for all those <strong>CBI</strong>-supported<br />

companies in developing countries that he<br />

works with, but it keeps the Dutchman in<br />

business himself as well. A former chemist<br />

with DSM, where he moved from research<br />

to marketing, business development, acquisitions<br />

and screening, Ramakers shifted<br />

to consultancy in ’96, when he was asked to<br />

set up a chemicals branch for an agency in<br />

Scotland. Aided by various business courses,<br />

the tall Dutchman became a specialist<br />

in mergers and acquisitions. Five years ago<br />

he went independent. His main activity<br />

now is to monitor every move of the chemical<br />

industry’s top 45 players and their<br />

respective markets. It’s a killing job in a<br />

killing sector, but Ramakers, still based in<br />

Edinburgh, seems to have found his for-<br />

) export marketing & management ( <strong>CBI</strong> <strong>News</strong> Bulletin page 4

Add<br />

knowledge,<br />

mix well By Stephen D. Teeuwen<br />

Consultant Jan Ramakers shares a few lessons<br />

in the chemistry of European marketing<br />

mula for success, mixing the adroitness of a<br />

Dutch merchant with the cordiality of a<br />

Scottish laird. “You’ve got to enjoy what<br />

you’re doing”, he says, “and I do. The <strong>CBI</strong><br />

work is particularly rewarding in the<br />

sense that it means being involved in a very<br />

tangible form of development.” He smiles<br />

gentleman-like and adds, “Anybody<br />

would enjoy it.”<br />

QUITE A DIP<br />

If all that makes you think the European<br />

chemical industry is something like a<br />

Highland Games tournament, you’d better<br />

wake up. In recent years, the industry has<br />

been the scene of more mergers and acquisitions<br />

than you can count – and that’s not<br />

because all those Company Executive<br />

Officers love to cuddle. “Like every other<br />

industrial sector, the chemicals industry<br />

has been through quite a dip”, says<br />

Ramakers. “Still, it’s one of the strongest<br />

industries at the moment.”<br />

Powered by social trends such as rising<br />

living standards and increasing demand<br />

for new and more effective medicines, the<br />

pharma industry, for instance, registered a<br />

fairly astonishing nine-percent growth last<br />

year, says the Dutchman. “If you take a<br />

long-term view, things are looking good.<br />

There are a lot of fluctuations and a lot of<br />

complex movements going on, but the<br />

overall picture is positive. It doesn’t look as<br />

though the chemical industry is about to<br />

collapse.”<br />

NO PREJUDICE<br />

Does all that mean the European giants<br />

don’t need any help from the rest of the<br />

world, least of all from developing countries?<br />

On the contrary, says Ramakers.<br />

“Because the market is growing and economic<br />

pressure continues, Europeans are<br />

showing increasing interest in sourcing<br />

from so-called non-traditional areas, which<br />

means non-EU countries. I don’t know of<br />

any companies buying in Colombia, but it<br />

wouldn’t be strange if they did.<br />

Developing countries are certainly not<br />

looked down on by Europeans. The prejudices<br />

that exist in some sectors are nonexistent<br />

in the chemical industry. If you<br />

have a product that meets European standards<br />

and your deliveries are reliable, it<br />

doesn’t matter where you’re based.”<br />

In fact, says Ramakers, some European<br />

buyers have good reason to show particular<br />

interest in suppliers from developing<br />

countries. “Don’t forget that partnering<br />

with a company in a developing country<br />

means getting closer to the active ingredients<br />

of your chemical or pharmaceutical<br />

products. The active ingredients are, of<br />

course, the building blocks of the industry.<br />

Most companies will jump at the chance to<br />

get higher up in the value chain by teaming<br />

up with a developing country supplier.”<br />

KILO SHOPS<br />

The so-called ‘kilo shops’ popping up all<br />

over the developing and the developed<br />

world in recent years are a good illustration<br />

of the high value placed on active ingredi-<br />

ents. “Kilo shops are highly specialized<br />

companies, many of them in developing<br />

countries, that work with small quantities<br />

of active ingredients. They use them for<br />

testing and developing new products. By<br />

definition, they have very highly qualified<br />

staff: in India you might have ten expert<br />

chemists for the price of one in Europe. All<br />

that makes these businesses very interesting<br />

for European players eager to have<br />

more influence on product development.”<br />

The expertise that characterizes many kilo<br />

shops is not unusual throughout the industry<br />

in developing countries, Ramakers has<br />

found. “Many of the companies enrolled in<br />

the <strong>CBI</strong>’s export development programme<br />

offer superb all-round quality, right down<br />

to their waste treatment systems. If you<br />

visit their plants you wouldn’t be able to<br />

tell whether you were in a developing<br />

country or in Europe – in fact, some of<br />

them are better equipped than many<br />

Europeans.”<br />

MARKET KNOWLEDGE<br />

So if product quality isn’t an obstacle for<br />

India, Colombia, Tunisia and all those<br />

other developing countries, what is? If anything,<br />

says Ramakers, it’s knowledge.<br />

Market knowledge, to be more precise, is<br />

the main active ingredient many companies<br />

need to add to their formula for<br />

European success. “A good understanding<br />

of the European markets and business<br />

practices and clear, up-to-date insights into<br />

market trends and opportunities are of the<br />

utmost importance for exporters, particularly<br />

in the highly complex chemicals sector.<br />

And yet many aspiring exporters lack<br />

that knowledge and don’t know where or<br />

how to acquire it.”<br />

Ramakers gives a simple example. “One of<br />

the companies we work with is based in a<br />

country in which for years the distribution<br />

of pharmaceuticals was a state-run affair.<br />

This company only had one client and that<br />

was the state. On coming to Europe, they<br />

assumed they would be dealing with a<br />

maximum of about twenty-five potential<br />

clients – according to the number of EU<br />

member states. Their jaws dropped when<br />

they found out the state is not in the game,<br />

but at least two-hundred-and-fifty keenly<br />

commercial buyers are. The next big discovery,<br />

though, was that Europe does offer<br />

a level playing field. Coming from a developing<br />

country does not mean you automatically<br />

suffer certain competitive disadvantages.<br />

Opportunities are not boundless,<br />

but they are equal for everyone. You just<br />

have to know where and how to find<br />

them.”<br />

July/<strong>Aug</strong>ust 2004 page 5

This is the fourth in a series of articles about the ten countries that joined the<br />

European Union in May this year. The first article gave a general overview of the<br />

trade-related consequences of EU expansion. In the second and third articles<br />

we took a closer look at Poland, the Czech Republic, Hungary, Slovenia and<br />

Slovakia. In this article we continue with the Baltic States: Latvia, Estonia and<br />

Lithuania.<br />

Business in the<br />

Baltics By Ecorys-NEI / Nora Plaisir<br />

The accession referenda in all<br />

three Baltic States showed<br />

strong support for accession to<br />

the European Union. There are marked<br />

differences between the countries, however.<br />

In Lithuania the victory for the accession<br />

supporters was overwhelming,<br />

with 91 percent in favour of accession,<br />

while in Estonia and Latvia support<br />

was limited to around 67 percent. Of<br />

the nine acceding countries that held<br />

referenda, Lithuania was the second<br />

strongest accession supporter, just after<br />

Dutch Crown Prince Willem Alexander and his wife<br />

Princess Maxima recently visited Lithuania, Latvia<br />

and Estonia, expressing the importance of these new<br />

EU member-states and markets (photo Zefa).<br />

Slovakia. Estonia and Latvia showed the<br />

least support; only Malta’s percentage of<br />

YES voters was lower.<br />

The three Baltic States are relatively small<br />

compared to the other Eastern and Central<br />

European accession countries. Lithuania is<br />

the largest of the three, with a population of<br />

around 3.6 million, followed by Latvia<br />

(2.35 million) and Estonia (1.4 million). In<br />

economic terms the Baltic countries are relatively<br />

small as well. Lithuania is again the<br />

largest, with a GDP of around EUR 20 billion,<br />

while Latvia’s GDP is only around<br />

EUR 11 billion and Estonia’s around EUR 9<br />

billion. Though the smallest in size, Estonia<br />

has the highest per capita GDP at around<br />

EUR 6,500, compared to EUR 5,700 in<br />

Lithuania and EUR 4,500 in Latvia.<br />

THE MACROECONOMIC PICTURE<br />

The Baltic States have all suffered as a result<br />

of the economic crisis in Russia in the<br />

late 1990s. They have been able to recover<br />

from this economic setback in the new mil-<br />

lennium, however, and are now the fastest<br />

growing economies of the new Eastern<br />

European countries. Lithuania is the fastest<br />

growing of the three, with a GDP growth<br />

rate of around 9 percent in 2003. But Latvia<br />

and Estonia have also experienced annual<br />

growth rates of more than 6 percent since<br />

2000. Export and foreign direct investments<br />

(FDI) are the main drivers of this<br />

strong performance, but consumption is<br />

also becoming increasingly important.<br />

Macro-economic policy is prudent in the<br />

region. The governments have the fiscal<br />

) export marketing & management ( <strong>CBI</strong> <strong>News</strong> Bulletin page 6

situation under control and prices are<br />

stable. In Lithuania, prices were even declining<br />

in 2003.<br />

As a result of this economic growth, unemployment<br />

has declined, but is still high, at<br />

rates of more than 10 percent. A worrisome<br />

trend in the Baltic States is the deepening<br />

account deficit. The main reasons for growing<br />

deficits are increasing consumptionrelated<br />

imports and real appreciation of the<br />

local currencies (especially<br />

Estonia and Lithuania,<br />

whose currencies are<br />

pegged to the Euro). This<br />

appreciation has put some<br />

pressure on the competitiveness<br />

of the countries’ exports. As FDI in<br />

the region is decreasing (see below), the<br />

rising deficits are increasingly being financed<br />

by debt, although the net external<br />

debt is still relatively low.<br />

FDI AND INTERNATIONAL TRADE<br />

All three countries have been rather successful<br />

in attracting FDI since the start of<br />

their economic transition. This has contributed<br />

positively to their economic<br />

growth performance. FDI inflows have<br />

shown a fluctuating pattern, mainly because<br />

a large part of FDI was associated<br />

with privatizations of state-owned companies.<br />

Although there is now a decreasing<br />

scope for FDI as the wave of large privatisation<br />

deals passes over, EU enlargement is<br />

affecting FDI inflows positively in the<br />

Baltic States. The main attractions of the<br />

Baltic countries are their low operational<br />

costs (including low tax rates), their strategic<br />

location between the EU and Russia, a<br />

skilled work force and economic stability.<br />

Estonia has been the most successful of the<br />

three countries in attracting FDI. In 2001,<br />

the inward FDI stock as a percentage of<br />

GDP amounted to 65 percent in Estonia, the<br />

highest percentage of all Central and<br />

Eastern European countries. For Latvia and<br />

Lithuania, this figure is around 30 percent.<br />

In all three countries financial services,<br />

whole and retail trade, and manufacturing<br />

are important sectors for inward FDI.<br />

Transport, communication and real estate<br />

also become increasingly important. The<br />

main sources of FDI are the neighbouring<br />

countries in the Baltic Sea region, notably<br />

Sweden, Finland, Germany, Denmark,<br />

Russia and Norway. Estonia is also a fairly<br />

important investor in the other two Baltic<br />

States. As small and open economies, trade<br />

is important for the three Baltic States: the<br />

share of trade in goods relative to GDP<br />

varies from around 70 percent in Latvia, to<br />

some 90 percent in Lithuania and more<br />

than 130 percent in Estonia. Since the transition,<br />

the direction of exports has shifted<br />

from the Russian and other CIS* markets to<br />

the EU market. In Estonia and Latvia, more<br />

than 60 percent of the exports are directed<br />

)<br />

Main attractions of the Baltics: low costs,<br />

(<br />

location, skills and stability<br />

towards the EU. For Lithuania, the percentage<br />

is just below 50 percent.<br />

EXPORT AND IMPORT PRODUCTS<br />

Electronic equipment and wood products<br />

are the two main export products for<br />

Estonia. Value-added products are becoming<br />

increasingly important, which is<br />

reflected in the relatively high growth rates<br />

for products like furniture, transport<br />

Trade performance of leading export categories in 2002<br />

HS code Description<br />

equipment, electronic equipment and<br />

machinery. In Latvia, wood products are by<br />

far the largest export products, which reflects<br />

the large forested areas of the country.<br />

One of the main problems is that most of<br />

the products Latvia exports have little<br />

added value, like timber, zinc and wood<br />

products. Tin and zinc have experienced<br />

the highest export growth between 1998<br />

and 2002. An encouraging sign is the emergence<br />

of the electronics industry, which has<br />

expanded in recent years.<br />

For Lithuania, exports of<br />

mineral products are the<br />

most important. Re-export<br />

of oil products is the main<br />

factor here. Transport<br />

equipment, notably ships, has been the<br />

fastest growing export product over the<br />

last year. In all three countries, imports are<br />

domina-ted by electronic equipment, machinery,<br />

transport equipment and fuels.<br />

Developing countries have been able to export<br />

products to Estonia and Lithuania, notably<br />

machi-nery products, electronic<br />

equipment, mi-neral products, plastics and<br />

ships. In Latvia, developing country shares<br />

Share in<br />

national<br />

exports<br />

Value of<br />

exports<br />

to EU<br />

% x 1000 € % %<br />

Estonia<br />

85 Electrical, electronic equipment 17.7% 671,413 82.5% 16%<br />

44 Wood and articles of wood, wood charcoal 12.1% 431,942 77.8% 5%<br />

94 Furniture, lighting, signs, prefabricated<br />

buildings 7.0% 255,314 79.2% 19%<br />

27 Mineral fuels, oils, distillation products, etc 5.3% 89,388 36.4% 15%<br />

87 Vehicles other than railway, tramway 4.9% 86,070 38.3% 16%<br />

84<br />

Latvia<br />

Nuclear reactors, boilers, machinery, etc 4.3% 97,349 48.6% 11%<br />

44 Wood and articles of wood, wood charcoal 33.5% 688,484 84.6% 5%<br />

72 Iron and steel 5.5% 59,682 45.1% 4%<br />

94 Furniture, lighting, signs, prefabricated<br />

buildings 5.4% 104,201 79.5% 11%<br />

62 Articles of apparel, accessories, not knit<br />

or crochet 5.1% 106,610 86.5% 0%<br />

76 Aluminium and articles thereof 4.2% 93,255 91.1% 44%<br />

85<br />

Lithuania<br />

Electrical, electronic equipment 3.5% 31,574 36.7% 5%<br />

27 Mineral fuels, oils, distillation products, etc 18.6% 502,229 46.4% 18%<br />

87 Vehicles other than railway, tramway 8.1% 61,450 13.0% 25%<br />

62 Articles of apparel, accessories, not knit<br />

or crochet 7.1% 393,170 94.8% 7%<br />

89 Ships, boats and other floating structures 7.1% 166,278 40.5% 82%<br />

85 Electrical, electronic equipment 6.2% 161,207 45.0% 10%<br />

44 Wood and articles of wood, wood charcoal 5.3% 196,339 63.2% 13%<br />

Source: ITC UNCTAD/WTO (converted into euros using an exchange rate of 1.06 €/USD)<br />

Percentage<br />

of exports<br />

to EU<br />

Average<br />

annual<br />

growth<br />

1998<br />

– 2002<br />

July/<strong>Aug</strong>ust 2004 page 7

in imports are still very low. Between 1998<br />

and 2002, growth in developing country<br />

imports was 13 percent in Estonia, 11 percent<br />

in Lithuania, and only 3 percent in<br />

Latvia. There are marked differences between<br />

products, however. Imports of a<br />

number of food and textile and clothing<br />

products from developing countries have<br />

grown significantly, at rates of more than 20<br />

percent.<br />

WAGES AND CONSUMPTION<br />

Estonia has the highest average wage per<br />

month of the Baltic countries, at some<br />

EURO 500 per month, compared to just<br />

under EURO 300 per month in Latvia and<br />

Lithuania. The average monthly wage in<br />

Estonia is comparable to the average wage<br />

in the Czech Republic; wages in Latvia and<br />

Lithuania are among the lowest of the<br />

accession countries.<br />

As wages increase, purchasing power is rising,<br />

in turn causing a growing demand for<br />

consumption goods. Lithuania’s retail<br />

trade turnover has experienced annual<br />

growth rates of more than 20 percent over<br />

the last years. In response to this growing<br />

demand, supply of consumption goods is<br />

also increasing, and it is therefore important<br />

for new products to offer extra quality<br />

or some originality. For many years, people<br />

associated expensive imported products<br />

(particularly from the West) with high<br />

quality or other advantages. Nowadays, a<br />

good price-quality ratio is becoming more<br />

important. This may lead to better opportunities<br />

for developing country exports. On<br />

the consumer market, there is an increasing<br />

demand for clothing, shoes and food products.<br />

Opportunities may also lie in supplying<br />

companies that are producing for<br />

the export market. On account of their<br />

strong growth, they are not always able to<br />

meet their demand for inputs locally. There<br />

is, for example, a rising demand for computer<br />

parts, and inputs for the chemical industry.<br />

DOING BUSINESS IN THE BALTIC<br />

Although the Baltic States are similar in<br />

many respects, it is important to realize<br />

that these countries each have their own<br />

culture, language and customs and have<br />

become more nationalistic since their independence.<br />

But the three countries also have<br />

a number of things in common. The people<br />

are generally friendly, though reserved,<br />

and open to contacts with foreigners.<br />

English is the most commonly used language<br />

in the business community, although<br />

the older generation does not always speak<br />

Lots of useful information in dedicated databases on<br />

the Internet.<br />

a foreign language. Most companies have a<br />

hierarchical organizational structure, and<br />

people attach importance to the use of<br />

people’s titles. In business, specific and<br />

straightforward questions are not considered<br />

impolite and often lead to clear<br />

answers. Small gifts or invitations for lunch<br />

or dinner are always very much appreciated.<br />

All three Baltic countries have a relatively<br />

flat distribution structure: many importing<br />

companies or wholesale traders<br />

sell products directly to retail stores or even<br />

to end users, which makes distribution relatively<br />

cheap. Because of this flat distribution<br />

structure, and also because the Baltic<br />

countries are relatively small, it may be difficult<br />

to find a specialized local agent for<br />

Trade performance of leading import categories in 2002<br />

HS code Description<br />

certain products. Some companies therefore<br />

decide to work with one agent for all<br />

three Baltic States. Because of the rivalry<br />

between the three countries, it may be better<br />

to work with a Swedish or Finnish company<br />

with good regional knowledge. If you<br />

work with local agents, it is important to<br />

know that there is no specific legislation for<br />

agents in any of the Baltic States. When<br />

drawing up contracts with local agents, it is<br />

therefore advisable to get the support of a<br />

lawyer with good knowledge of national<br />

legislation.<br />

* CIS stands for Commonwealth of Independant<br />

States, which consists of 12 of the 15 states of the<br />

former Sovjet Union.<br />

The data in this article were drawn from different<br />

sources, most notably the IMF (IFS and country<br />

reports) and the ITC. Other useful information was<br />

taken from the website of the European Commission,<br />

the Dutch EVD 'partner in export', the UNCTAD<br />

World Investment Reports, the World Bank<br />

EU-8 Quarterly Economic Report, and a database for<br />

business and public information on the Baltics<br />

(www.balticdata.info).<br />

Share in<br />

national<br />

imports<br />

Value of<br />

exports<br />

to EU<br />

% x 1000 € % %<br />

Estonia<br />

84 Nuclear reactors, boilers, machinery, etc 12.9% 1,496,697 11.4% 0%<br />

87 Vehicles other than railway, tramway 10.9% 1,266,382 6.2% -5%<br />

85 Electrical, electronic equipment 9.7% 1,121,005 15.2% 4%<br />

27 Mineral fuels, oils, distillation products, etc 7.1% 818,931 20.3% 9%<br />

39 Plastics and articles thereof 5.1% 593,199 9.2% 6%<br />

72<br />

Latvia<br />

Iron and steel 4.5% 519,947 7.1% 3%<br />

84 Nuclear reactors, boilers, machinery, etc 12.1% 520,418 3.4% 6%<br />

27 Mineral fuels, oils, distillation products, etc 9.3% 398,593 0.2% 5%<br />

85 Electrical, electronic equipment 9.2% 394,503 5.4% 8%<br />

87 Vehicles other than railway, tramway 9.1% 391,616 0.9% 7%<br />

30 Pharmaceutical products 4.5% 195,148 3.7% 8%<br />

39<br />

Lithuania<br />

Plastics and articles thereof 4.1% 175,967 1.8% 13%<br />

27 Mineral fuels, oils, distillation products, etc 16.5% 1,345,870 0.2% 16%<br />

87 Vehicles other than railway, tramway 10.8% 883,663 3.0% 13%<br />

84 Nuclear reactors, boilers, machinery, etc 9.9% 806,413 16.2% 5%<br />

85 Electrical, electronic equipment 7.5% 610,630 19.8% 9%<br />

89 Ships, boats and other floating structures 4.5% 365,390 38.3% 117%<br />

39 Plastics and articles thereof 4.2% 343,088 10.6% 10%<br />

Source: ITC UNCTAD/WTO (converted into euros using an exchange rate of 1.06 €/USD)<br />

Percentage<br />

of imports<br />

from<br />

developing<br />

countries<br />

) export marketing & management ( <strong>CBI</strong> <strong>News</strong> Bulletin page 8<br />

Average<br />

annual<br />

growth<br />

1998<br />

– 2002

Collect your key to the Baltics here<br />

Approaching the local business community<br />

in the Baltic States does not require a lot<br />

of time, but neither is it easy. The three<br />

countries share the problem that not all<br />

their companies are registered with the<br />

Chamber of Commerce, as this is not obligatory.<br />

There are several organizations that<br />

can provide information about local companies,<br />

however, and there are also increasing<br />

numbers of commercial consultancy<br />

companies eager to provide information.<br />

In Estonia, knowledge of local companies<br />

can be obtained from the Estonian<br />

Investment Agency (www.eia.ee), the<br />

Chamber of Commerce in Tallinn<br />

(www.koda.ee) and the Estonian Trade<br />

Council (www.etc.ee). The website<br />

www.infopluss.ee also has a large number<br />

of companies in its database.<br />

In Latvia, the Latvian Investment and<br />

Development Agency has electronic business<br />

guides with contacts of local companies<br />

by sector, at www.lda.gov.lv,<br />

www.exim.lv and www.kontakti.lv. In addition,<br />

the Chamber of Commerce has<br />

some information, at www.chamber.lv.<br />

In Lithuania, the Lithuanian Development<br />

Agency can help with identifying commercial<br />

partners in the country, through its<br />

own website (www.lda.lt) or through the<br />

related website www.tradeport.lt, which<br />

provides information about business opportunities<br />

in Lithuania.<br />

TRADE FAIRS<br />

Participation in trade fairs can be another<br />

important way of establishing contacts<br />

with the local community. It is also a useful<br />

way of promoting your products. Trade<br />

fairs are regularly organized in the Baltic<br />

capitals, and many business people also<br />

visit trade fairs in the Nordic countries.<br />

The Lithuanian Exhibition Centre<br />

(www.litexpo.lt) has a complete overview<br />

of all trade fairs and exhibitions in the<br />

Lithuanian capital Vilnius.<br />

The Latvian Chamber of Commerce<br />

(www.chamber.lv) lists all trade fairs organized<br />

in Latvia. Two companies organize<br />

trade fairs in Latvia: BT1 (www.bt1.lv)<br />

and Prima Skonto (www.prima.lv). The<br />

website of Estonian Fairs (www.fair.ee)<br />

gives an overview of trade fairs organized<br />

in Estonia.<br />

A picturesque view of the city of Vilnius, Lithuania<br />

(photo Zefa).<br />

July/<strong>Aug</strong>ust 2004 page 9

By Chris Goes<br />

In today’s dynamic and rapidly<br />

changing world economy the issue<br />

of cooperation is becoming more<br />

and more important. But before you<br />

throw in your lot with another company,<br />

it’s good to be aware of the risks. As<br />

fifty percent of all cooperation ventures<br />

fail, you may find yourself wasting a lot<br />

of energy and money if you don’t prepare<br />

yourself properly. In this first of<br />

three articles on the subject, we’ll be<br />

looking at what might trigger you to<br />

consider cooperation and the pro’s and<br />

con’s of cooperation.<br />

Let’s get one thing straight: cooperation<br />

can be very profitable. In fact, the issue<br />

of cooperation is more relevant today<br />

than ever in international business.<br />

Market research among enterprises in<br />

the Netherlands has proven that companies<br />

that cooperate with other companies<br />

have a better market performance<br />

than companies that do not. In<br />

one particular survey, 75% of the companies<br />

said their turnover and profits<br />

increased after joining arms with another<br />

business. In most European enterprises,<br />

cooperation has become a structural<br />

part of management. So if you’re<br />

an exporter in a developing country, it<br />

makes sense to consider cooperation.<br />

THE PROCESS OF COOPERATION<br />

Considering the need of co-operating<br />

with other companies, the following<br />

steps could be helpful:<br />

1. A particular event or incident could<br />

initiate the need to co-operate with<br />

other companies.<br />

2. When it has become evident what<br />

prompted this need for co-operation,<br />

then gradually the pros and cons of<br />

such a co-operation can be formulated.<br />

In Article 2 the objectives of cooperation<br />

will be the focus.<br />

3. After careful consideration of all the<br />

pros and cons, the decision of<br />

whether to embark on this joint effort<br />

should be made.<br />

4. The next step is to determine with<br />

whom co-operation is desired –<br />

those companies who have the required<br />

knowledge, skills and finances<br />

to meet your objectives. Note<br />

that there are several types and<br />

forms of co-operation.<br />

5. The following phase is that this cooperation<br />

will go into effect. In this<br />

early stage, minor difficulties should<br />

be examined. Trusting your partners<br />

Doubles, any<br />

is a must for accomplishing your objectives<br />

for this co-operation.<br />

6. In this next phase, co-operation should<br />

commence as planned.<br />

7. After a specific period of time, the goals<br />

set and possible improvements should<br />

be discussed. This is further developed<br />

in Article 3.<br />

THE TRIGGER<br />

A trigger is a specific experience or discovery<br />

that makes you want to pursue a particular<br />

idea. Such triggers can vary from<br />

meeting other entrepreneurs to reading<br />

about the worsening economy. Here are<br />

some examples of triggers:<br />

• Globalization (multinationals, emerging<br />

countries)<br />

• Changing consumer behaviour<br />

• Technological developments<br />

• Insufficient domestic markets (and the<br />

need to export)<br />

The process of globalization is affecting<br />

The first in a series<br />

of three articles on<br />

the gall and glory of<br />

teaming up with other<br />

companies<br />

every marketplace and in these marketplaces<br />

world players are gaining influence.<br />

Also, emerging countries like China, India<br />

and others and their fast growing<br />

economies are heavily impacting the dayto-day<br />

lives of people all over the world.<br />

Rising oil and steel prices and the resulting<br />

rise of interest rates and in some cases inflation,<br />

will affect cost prices and margins.<br />

Teaming up with other companies to con-<br />

) export marketing & management ( <strong>CBI</strong> <strong>News</strong> Bulletin page 10

one?<br />

centrate your joint purchasing power can<br />

be a solution to the problem of unfavourable<br />

raw materials prices or other issues<br />

such as energy, transport and the like.<br />

These issues affect consumer behaviour.<br />

But so do many other developments – demographic<br />

trends (like ageing), cultural<br />

trends and ecological or environmental<br />

trends. Alert entrepreneurs can turn these<br />

changes to their advantage, but often you<br />

can’t make them do so on your own. For instance,<br />

you might join forces with a group<br />

of companies to develop a line of products<br />

and aim it at a specific target group in<br />

Europe, like senior citizens.<br />

The rate at which technological developments<br />

are taking place is another example<br />

that may necessitate co-operation. In many<br />

sectors, new products have to be developed<br />

all the time and at high speed. Cooperation<br />

in research and development can<br />

help you meet this challenge.<br />

Again, many entrepreneurs across the<br />

globe have run up against challenges they<br />

realize they cannot accomplish alone. Let’s<br />

say, for instance, that your machines can<br />

produce more than you can sell on your<br />

domestic market. So you want to export.<br />

This means acquiring knowledge of foreign<br />

markets, export transactions, export<br />

packaging, other calculation methods, foreign<br />

payment risks, other languages and<br />

more. To acquire knowledge in this fields,<br />

you can do three things:<br />

1. Buy the knowledge in hard cash<br />

2. Develop the knowledge in-house, which<br />

will take considerable time<br />

3. Cooperate with others, agreeing on counter<br />

services, cost and income sharing.<br />

In most cases, entrepreneurs will prefer one<br />

of the first two methods. There are, however,<br />

many reasons why the third method<br />

might be the most profitable in the long run.<br />

THE PRO-S AND CON-S<br />

Before embarking on a cooperation adventure,<br />

you need to consider all the possible<br />

advantages and disadvantages. Let’s start<br />

with the bad news:<br />

- Image loss (joining forces and cooperating<br />

with larger partners will result in<br />

losing some of your identity and image;<br />

whether this is serious or not depends<br />

on how necessary your image is for<br />

marketing purposes – the improved<br />

time-to-market and added value your<br />

partner offers may be more relevant).<br />

- Setting up a cooperation form is timeconsuming<br />

and difficult (think of the<br />

time you might need to convince a partner<br />

that your idea is better than his; or<br />

the time you’ll need to carefully explore<br />

whether cooperation is worth your<br />

while or not).<br />

- Loss of independence (if you’re a real<br />

entrepreneur, you probably feel very<br />

strongly about your independence, although<br />

you may find it useful to look at<br />

dependency purely from the point of<br />

view of business opportunities).<br />

- Spill-over of knowledge (your partner<br />

may run off with your knowledge. This<br />

often explains why negotiators are not<br />

willing to tell all until they have complete<br />

trust in their partner. But there are<br />

measures you can take to prevent excessive<br />

spill-over).<br />

HOW TO REDUCE THE RISKS<br />

There are numerous actions you can take to<br />

reduce some of these risks:<br />

• Cooperate with several partners to prevent<br />

dependency and to spread risks.<br />

• Make use of a written contract to prevent<br />

misuse of power, especially if one<br />

of the partners is large and the other<br />

small (but remember that it can cost a lot<br />

of time and money to compose a contract<br />

and failure to comply on either side<br />

can cause a lot of legal hassle).<br />

• Work on open communication and mutual<br />

trust.<br />

• Involve a third party to prevent spillover<br />

and abuse of trust – an independent<br />

authority who can monitor the way<br />

in which each partner uses the other’s<br />

knowledge and can be called on in case<br />

of perceived misuse.<br />

THE GOOD NEWS<br />

Fortunately, there’s also a lot of good news<br />

about cooperation.<br />

- Cooperation can improve your chances<br />

of success in the long run.<br />

- It brings possibilities within your reach<br />

that you can’t reach on your own (put<br />

two entrepreneurs together and they<br />

will come up with at least ten good<br />

ideas they might realize together, as<br />

entrepreneurs have a strong desire to<br />

create, perform and act).<br />

- Especially if you’re a small company, cooperation<br />

can enable you to reap the<br />

benefits of your partner’s competencies.<br />

If your competencies are not competitive,<br />

cooperation can be very successful.<br />

- Cooperation can help you reduce costs,<br />

increase turnover and improve efficiency.<br />

This is perhaps one of the strongest<br />

reasons to cooperate: the ‘Togetherwe-are-stronger’<br />

argument creates immediate<br />

success and can be measured<br />

very well.<br />

- Cooperation can shield you from the<br />

power of large multinationals as well as<br />

local governments.<br />

OVER TO YOU<br />

Now that you know some of the main risks<br />

and promises of cooperation, you’ll have to<br />

decide for yourself whether or not you<br />

want to enter a form of cooperation with<br />

another business. In the next article we’ll<br />

look at your cooperation objectives and at<br />

various forms of cooperation.<br />

July/<strong>Aug</strong>ust 2004 page 11

At work in the Nepalese paper industry, an example of successful co-operation that provides thousands of jobs.<br />

In 1996 a group of struggling entrepreneurs<br />

in the handmade paper industry<br />

in Nepal joined forces, setting up a<br />

branch association called ‘Handpass’. A<br />

few years and a lot of hard work later,<br />

they’ve created jobs for thousands of<br />

their fellow-countrymen and -women.<br />

The Nepalese handmade paper manufacturers<br />

were triggered into working<br />

together by two factors:<br />

• They were struggling individually as<br />

well as sectorally<br />

• Their local market had become too<br />

small, while international demand<br />

was growing.<br />

Considering the pro’s and con’s, the entrepreneurs<br />

decided to form an association,<br />

allowing not only exporters and<br />

converters to register, but paper makers<br />

as well.<br />

OBJECTIVES<br />

After a few years, they drafted a plan in<br />

which they formulated the following<br />

objectives:<br />

•To strengthen and promote handmade<br />

paper enterprises in Nepal;<br />

A group of paper<br />

makers join forces,<br />

providing thousands<br />

of Nepalese with<br />

an income<br />

•To preserve the traditional Nepali handmade<br />

paper craft and products, as these<br />

represent the most ancient and simplest<br />

methods of paper-making;<br />

•To produce sustainable raw material and<br />

to develop a common market;<br />

•To contribute to the national economy by<br />

creating new jobs (there are about 170<br />

cottage and small-scale handmade paper<br />

enterprises operating in different parts of<br />

the country today, providing jobs for<br />

thousands of people);<br />

•To promote and sustain Nepali handmade<br />

paper made from the Lokta plant<br />

as a unique kind of paper;<br />

•To market the trade mark ‘Nepali<br />

Handmade Paper’.<br />

Currently, Handpass has 60 member com-<br />

panies. Cooperation between the members<br />

and through the association is becoming<br />

more and more effective. As the domestic<br />

market is still too small to absorb all the<br />

paper the companies can produce and as<br />

the Lokta Paper is more expensive and exclusive<br />

than other kinds of paper, export<br />

was soon an obvious option.<br />

A SECTOR EXPORT MARKETING<br />

PLAN<br />

Members of Handpass were soon exporting<br />

fairly successfully. However, to ensure<br />

structural and sustainable export growth,<br />

the association established a so-called<br />

Sector Export Marketing Plan (SEMP) with<br />

the support of the <strong>CBI</strong>. The consumer plays<br />

the leading role in this plan and consumer<br />

groups have been defined in order to develop<br />

marketable product lines. Also, the<br />

association is researching the distribution<br />

channels through which it can reach these<br />

consumer groups. Product lines can include<br />

similarly designed products from<br />

different member companies. Cooperation<br />

is the key word.<br />

) export marketing & management ( <strong>CBI</strong> <strong>News</strong> Bulletin page 12

By Ariane van Beuzekom<br />

In this second of four articles, we<br />

continue our introduction of the diversity<br />

of themes and issues you<br />

can find in the <strong>CBI</strong>’s online database,<br />

AccessGuide. Check your understanding<br />

of the database and some of the<br />

key issues in trading with the European<br />

Union. And don’t forget this series presents<br />

only a small selection of the many<br />

issues treated in the database.<br />

Good practices have been deve-<br />

G<br />

loped for many sectors in recent<br />

years. The so-called good agricultural<br />

practice (GAP) developed by the largest<br />

European retailer group, EUREP (Euro-<br />

Retailer Produce Working Group), is a<br />

very relevant one if you’re trading with<br />

any of its members. The GAP standards<br />

were developed in order to promote<br />

good production practices in the agricultural<br />

sector and thus to ensure food<br />

safety. The EUREP group made them<br />

compulsory for all their suppliers in<br />

January 2004.<br />

The so-called good manufacturing<br />

practice (GMP) developed for the production<br />

of pharmaceutical or medicinal<br />

products is another good example. It<br />

contains principles and guidelines developed<br />

by the European Union.<br />

AccessGuide covers many more kinds<br />

of good practice.<br />

Help! If you can’t find the infor-<br />

H<br />

mation you’re looking for in<br />

AccessGuide, you’re having problems<br />

understanding the information presented,<br />

or you think crucial information<br />

is missing, please do not hesitate to contact<br />

us at the <strong>CBI</strong>. You can use the<br />

‘Contact us’ button on the site or email<br />

us at accessguide@cbi.nl.<br />

‘H’ also stands for hygiene requirements.<br />

These are of growing impor-<br />

A B C D E F G H I J K L M<br />

N O P Q R S T U V W X Y Z<br />

The ABC of AccessGuide<br />

The <strong>CBI</strong>’s online database for non-tariff trade barriers, Part 2: G – M<br />

tance in the food processing industry. The<br />

EU legally obliges food processors within<br />

its borders to implement the hygiene management<br />

system known as HACCP. Food<br />

processors from third countries supplying<br />

the EU are not yet legally obliged to comply<br />

with HACCP requirements, although<br />

many importers do insist on HACCP implementation<br />

as a guarantee for hygiene<br />

management. In 2006 the HACCP requirements<br />

will become a legal requirement for<br />

exporters from developing countries as<br />

well. Stay tuned to AccessGuide to keep<br />

abreast with developments.<br />

HOW TO USE<br />

THE WEBSITE<br />

AccessGuide covers a far wider range of<br />

topics related to non-tariff trade barriers<br />

than can be dealt with in this introductory<br />

series. To find out for yourself, go to<br />

the AccessGuide homepage:<br />

www.cbi.nl/accessguide. From there,<br />

you’ll find three main ways of locating all<br />

the relevant requirements you need to<br />

know about for exporting to the EU:<br />

1. Click on the product sector of your<br />

interest and you’ll find an overview of<br />

the most important legislative and<br />

market requirements.<br />

2. Use the Keyword Search: type a keyword<br />

and click on the arrow. If your<br />

keyword is specific (e.g. tomato) and<br />

you do not get search results, try a more<br />

general keyword (e.g. vegetable).<br />

3. Use the Quick Search: choose your product<br />

group and the export market to<br />

which you want to export (European<br />

Union, Germany, the Netherlands,<br />

United Kingdom or not specified) and<br />

click on the arrow.<br />

‘I’ stands for the internationally ac-<br />

I<br />

cepted social standards (conventions)<br />

of the International Labour Organization<br />

(ILO) of the United Nations. The most fundamental<br />

ILO conventions cover: (1) the<br />

right to union membership and to negotiate;<br />

(2) non-discrimination; (3) forced<br />

labour; (4) minimum age; (5) working<br />

hours; (6) equal remuneration; (7) minimum<br />

wages; and (8) occupational health<br />

and safety. These social standards of the<br />

ILO are often used as a basis for other social<br />

requirements laid down by buyers in many<br />

sectors. In AccessGuide you will find a link<br />

to the ILO database on all social initiatives<br />

as well as the most important social<br />

requirements demanded in each specific<br />

sector.<br />

These days the Internet is a veritable<br />

J<br />

jungle of information. The lack<br />

of information of times past has been replaced<br />

by an information overload. The<br />

AccessGuide database provides practical<br />

information and selected links to other<br />

Internet sites that are relevant for exporters<br />

to the EU. This means you don’t have to<br />

spend a lot of time looking for information<br />

on the Internet; you just go to AccessGuide<br />

and use the provided information and additional<br />

links to get a full understanding of<br />

the European requirements relevant for<br />

your product sector.<br />

What do kiwi fruit, kumquat and<br />

K<br />

kohlrabi have in common? They are<br />

all three subject to EU legislation on the<br />

(limited) presence of pesticide residues, socalled<br />

maximum residue levels (MRLs). In<br />

AccessGuide you will find an up-to-date<br />

outline of this legislation as well as useful<br />

links to other databases that provide the<br />

MRLs for all crop-pesticide combinations.<br />

Keeping track of current limits could hardly<br />

be easier – or shall we say it could hardly<br />

be a lot more difficult.<br />

) european market information ( July/<strong>Aug</strong>ust 2004 page 13

Did you know that the<br />

L<br />

AccessGuide database provides<br />

almost 2000 selected links to<br />

other websites? That it contains all<br />

the EU legislation regarding environmental<br />

and consumer health<br />

and safety issues? That internationally<br />

the word regulation is being<br />

used to refer to legislation in general,<br />

but that technically it is a specific<br />

instrument of the EU, such as a<br />

directive, to directly implement a<br />

law in all the member states? That<br />

all legislation is obligatory and<br />

therefore of the utmost importance?<br />

That compliance with legislative requirements<br />

is often not enough on<br />

the European market – you also<br />

have to comply to additional nonlegislative<br />

requirements laid down<br />

by your buyer, consumer groups<br />

and other market parties?<br />

A management system is an<br />

M<br />

instrument to help your company<br />

comply with certain environmental,<br />

social or health and safety<br />

standards. A management system is<br />

an organizational structure defining<br />

responsibilities, procedures, processes<br />

and provisions for the establishment<br />

of certain goals.<br />

Numerous internationally applied<br />

management systems can be found<br />

in AccessGuide, such as ISO 9000,<br />

ISO 14000, SA8000, OHSAS 18000,<br />

QS 9000, SQF and more.<br />

In the next issue of the <strong>CBI</strong> <strong>News</strong><br />

Bulletin we’ll take a look at the<br />

letters N - S.<br />

B C<br />

N O P<br />

D<br />

Q<br />

You can influence<br />

Let’s face it: if the European Union<br />

looks like a fortress from the outside,<br />

its legislation is the fortress’s<br />

guarded tower. The EU’s rules and regulations<br />

are so numerous and so complicated<br />

– and the institutes and committees who<br />

devise them so inaccessible – that getting<br />

into Europe to do business is like setting up<br />

shop in a labyrinth. Even the EU’s efforts in<br />

recent years to harmonize its laws and procedures<br />

have not exactly paved the way for<br />

exporters from developing countries. But if<br />

you look carefully, you will find a few windows<br />

and doors in the tower walls. Yes,<br />

you can influence European lawmaking.<br />

Here are a few examples.<br />

In several recent cases the EU has given<br />

stakeholders the opportunity to voice their<br />

opinion on new policy strategies, proposals<br />

for new legislation or the effects of existing<br />

legislation. During a consultation period<br />

the stakeholders were invited to comment<br />

on certain issues from their own experience<br />

and perspective. The invitation was extended<br />

to EU member states as well as governments<br />

of third countries, trade associations,<br />

individual producers, researchers<br />

and the like.<br />

A few examples<br />

prove the European<br />

fortress is not as<br />

impenetrable as it<br />

looks<br />

By Ariane van Beuzekom<br />

The <strong>CBI</strong> is convinced stakeholders in developing<br />

countries can make use of these<br />

opportunities to inform European legislators<br />

and ultimately to influence the rulemaking<br />

processes. In the <strong>CBI</strong>’s experience,<br />

for instance, trade partners in developing<br />

countries sometimes need longer transition<br />

periods to implement new requirements or<br />

to develop the technology needed to meet<br />

new standards. Rather than staying quiet<br />

and suffering the negative consequences,<br />

the <strong>CBI</strong> believes you can stand up and<br />

speak up.<br />

VEHICLE RECYCLING<br />

In July 2003 the so-called end-of-life vehicles<br />

directive was enforced in all EU member<br />

states. Its aim was to make the disman-<br />

) european market information ( <strong>CBI</strong> <strong>News</strong> Bulletin page 14

EU law<br />

(photo: Ecoandino.CAC, Peru)<br />

tling and recycling of vehicles more environment-friendly.<br />

One of the most important<br />

requirements in the directive is that<br />

components of vehicles may not contain<br />

certain specific heavy metals, including<br />

lead. The <strong>CBI</strong> received reports from several<br />

manufacturers and exporters of equipment<br />

parts from developing countries that<br />

this new law made things impossible for<br />

them. Their companies use lead for soldering<br />

and because of a lack of technical and<br />

financial capacity to develop suitable alternatives<br />

for lead, they were unable to comply<br />

with the EU requirements in time.<br />

Other reported bottlenecks were the different<br />

implementations of the directive in the<br />

EU member-states that caused confusion to<br />

exporters from developing countries. The<br />

Dutch interpretation of exempting replacement<br />

parts meant for cars which are marketed<br />

before July 2003 turned out to be the<br />

most favourable for manufacturers from<br />

developing countries.<br />

The EU announced a consultation round<br />

from January to March this year on the revision<br />

of exemptions: interested parties<br />

were given the opportunity to tell the<br />

Commission about the difficulties of implementing<br />

the directive’s requirements.<br />

The <strong>CBI</strong> informed several car industry associations<br />

in various developing countries<br />

about the consultation round and urged<br />

them to make use of the opportunity to<br />

make themselves heard. Unfortunately, not<br />

a single developing country responded.<br />

However, their needs will not go entirely<br />

unnoticed, as the <strong>CBI</strong> did inform the<br />

Commission on behalf of the individual exporters<br />

who had reported their difficulties<br />

to the <strong>CBI</strong>. In total, sixty stakeholders submitted<br />

a response.<br />

Very recently the technical committee in<br />

Brussels decided to follow the Dutch interpretation<br />

of the directive, which is a positive<br />

result for manufacturers from developing<br />

countries exporting mainly to the<br />

replacement markets. You can read the<br />

submissions on the EU website (see below).<br />

CHEMICALS<br />

In 2001, the EU adopted a white paper<br />

setting out the strategy for a future<br />

policy for chemicals. Dubbed ‘REACH’,<br />

for Registration, Evaluation and<br />

Authorization of Chemicals, it described<br />

the transferral of responsibilities from government<br />

to industry with regard to data<br />

collection and the registration of potential<br />

risks of chemicals. It also provided an extension<br />

of these responsibilities along the<br />

manufacturing and supply chain and the<br />

availability of data to the public. Because of<br />

the far-reaching implications, the EU set up<br />

a consultation round on the Internet from<br />

May to July 2003. The response was huge:<br />

968 people responded to a questionnaire,<br />

6,400 sent in contributions by mail or email,<br />

and a declaration was submitted signed by<br />

429 organizations and 22,464 citizens.<br />

Several parties in developing countries<br />

were among the respondents.<br />

On the basis of this feedback, a proposal<br />

was drafted. That proposal is now being<br />

considered by the European Parliament<br />

and the EU’s Council of Ministers for adoption<br />

under the so-called co-decision procedure.<br />

Again, the submitted comments are<br />

available on the EU website (below).<br />

ELECTRICAL EQUIPMENT<br />

In line with the end-of-life vehicles directive,<br />

the EU has also decided that electrical<br />

and electronic equipment introduced on<br />

the market after July 1, 2006, may no longer<br />

contain certain heavy metals and brominated<br />

flame retardants commonly used in<br />

these products. The substances in question<br />

are lead, mercury, cadmium and hexavalent<br />

chromium, and polybrominated<br />

biphenyls (PBB) or polybrominated<br />

diphenyl ethers (PBDE) in new electrical<br />

and electronic equipment put on the market<br />

as of July 2006. The EU has launched a<br />

stakeholder consultation dea-ling with<br />

exemptions. Again, the use of lead for soldering<br />

is a bottleneck for some manufacturers<br />

in developing countries. Lacking the<br />

money and the technology to replace the<br />

lead at short notice, these industries are<br />

likely to lose their footing on the market –<br />

unless they grab the opportunity to raise<br />

their voices. If this affects your company,<br />

read the stakeholder consultation document<br />

on the EU website (below). Although<br />

the consultation has been closed on June<br />

5th you can follow the results on the<br />

Internet.<br />

NOVEL FOOD<br />

In 2002, the EU had to report on the implementation<br />

of the Novel Food Regulation<br />

that came into force in 1997. In the accompanying<br />

article you can read how the <strong>CBI</strong><br />

and a few Peruvian participants in the<br />

<strong>CBI</strong>’s export development programme for<br />

organic food ingredients stepped in and<br />

changed things for the better, the so-called<br />

Maca-case (see next page).<br />

If you have questions on this subject, please contact<br />

the <strong>CBI</strong> at accessguide@cbi.nl. EU consultation<br />

rounds that may be of interest to you will be announced<br />

on our AccessGuide database news page at<br />

www.cbi.nl/accessguide (section <strong>News</strong>).<br />

For more information on the examples given in this article, go to the EU website:<br />

Vehicles<br />

http://europa.eu.int/comm/environment/waste/submissions.htm<br />

Chemicals<br />

http://europa.eu.int/comm/environment/chemicals/consultation.htm<br />

Electronics<br />

http://europa.eu.int/comm/environment/waste/pdf_comments/weee_consultation.pdf<br />

http://europa.eu.int/comm/environment/waste/weee_index.htm<br />

July/<strong>Aug</strong>ust 2004 page 15

The <strong>CBI</strong> helps pull down a barrier that kept Peru from<br />

exporting an exotic root to the EU<br />

As every parent, teacher, policeman or<br />

judge can tell you, no rule in the world<br />

is so perfect it has no exceptions. The<br />

European Union’s ‘novel foods regulation’<br />

is one more rule that taken too<br />

rigidly began to make life very complicated<br />

for certain Peruvian exporters –<br />

until the <strong>CBI</strong> stepped in. It took some<br />

effort to convince the EU that traditional<br />

products like maca should not be<br />

barred from the EU market by too strict<br />

authorization procedures. Luckily for<br />

the Peruvians, the EU listened. Anyone<br />

for some maca?<br />

Designed for the safety assessment of<br />

newly designed food products, the novel<br />

foods regulation also includes exotic traditional<br />

foods newly introduced on the<br />

European market: the moment these<br />

food products were first imported, they<br />

were classified as ‘new’ and became subject<br />

to the regulation. But as the example<br />

of the Peruvian root called ‘maca’ shows,<br />

being new in Europe does not mean<br />

you’ve never heard about food safety before.<br />

Peru’s maca exporters, it turned out,<br />

have a long track record of food safety.<br />

NEW LAW ON NEW FOODS<br />

The novel foods regulation came into<br />

force on May 15, 1997. Its principal objective<br />

is to protect public health against<br />

the potential risks of newly developed<br />

food products. The regulation deals with<br />

food and food ingredients that are new<br />

on the market and therefore need to be<br />

submitted to strict safety assessments before<br />

being placed on the market. Novel<br />

foods are products produced from, containing<br />

or consisting of genetically modified<br />

organisms (GMO’s); products<br />

with a new or intentionally modified primary<br />

molecular structure; products that<br />

consist of, or are isolated from, microorganisms,<br />

fungi or algae or plants and<br />

animals; or products made through a<br />

new production process. In September<br />

2002 the EU was obliged to report on the<br />

implementation of the regulation and a<br />

discussion paper was prepared in order<br />

to give interested parties the possibility<br />

to react. From that time on the novel<br />

foods regulation was subjected to<br />

several discussions.<br />

EXOTIC TRADITIONAL FOODS<br />

The discussion point the <strong>CBI</strong> focussed<br />

By Ariane van Beuzekom<br />

Maca,<br />

back on<br />

the menu!<br />

on during the consultation round was the<br />

treatment of so-called exotic traditional<br />

foods that are seen by the EU as a novel<br />

food and therefore included in the regulation.<br />

In practice this implies that exotic traditional<br />

foods that have been in use for a<br />

long time in the countries where they are<br />

grown, should be subjected to the same<br />

strict procedures for innovative products<br />

that have no such history.<br />

The debate was no mere theoretical debate.<br />

As an organization that deals constantly<br />

with growers of exotic traditional foods<br />

aiming to access the EU market, the <strong>CBI</strong><br />

was alerted to the fact that efforts by<br />

Peruvian growers to export the traditional<br />

maca root to the EU were severely hampered<br />

by the novel food regulation. Several<br />

cases were reported of maca shipments not<br />

being allowed into the EU. The <strong>CBI</strong> stated<br />

to the EU that the regulation effectually<br />

poses a trade barrier for exporters from developing<br />

countries growing these exotic<br />

traditional foods.<br />

VERY COSTLY<br />

Maca (Lepidium meyenii Walp/Chakon) is<br />

a high-altitude Andean plant of the<br />

Brassicaceae/Cruciferae, or mustard, family.<br />

It has been grown for centuries by indigenous<br />

peoples in the Puna highlands of<br />

Peru, both as a staple food crop and for<br />

medicinal purposes. It is now finding applications<br />

as a food and as a pharmaceutical<br />

ingredient. In order to export maca, the<br />

growers had to make sure it applied to<br />

the very strict procedures of the novel<br />

food regulation. This included putting the<br />

product through a complete safety assessment<br />

procedure and providing scientific<br />

evidence, which is very costly and must be<br />

paid for by the exporter. As a result, exporters<br />

of maca were confronted with impossible<br />

expenses. The alternative given by<br />

the regulation was to provide evidence that<br />

the root had been consumed ‘to a significant<br />

degree within the EU before 15 May<br />

1997’. This proved to be a difficult task as<br />

well. <strong>CBI</strong> consultant Dolf Eshuis, who assisted<br />

the Peruvian exporters, put a lot of<br />

effort into providing evidence of earlier exports,<br />

but due to the small volumes involved<br />

and poor export and import administration,<br />

he couldn’t make a case for<br />

maca.<br />

LOBBYING IN BRUSSELS<br />

The <strong>CBI</strong> then mobilized forces to alert<br />

Brussels to the maca case. This was done in<br />

cooperation with Dolf Eshuis, who has contacts<br />

with importers and Peruvian exporters,<br />

Dutch controlling authorities and<br />

ministe-rial representatives. The Dutch<br />

Ministry of Development Cooperation’s<br />

Sustainable Economic Development department<br />

(DDE) and the Coherence Unit<br />

took up the maca case as well, pleading<br />

with the Dutch representative in the EU<br />

novel foods commission to stick up for exporters<br />

of exotic traditional foods from developing<br />

countries. The efforts paid off in<br />

the end. After several meetings in Brussels,<br />

the maca case finally grabbed some attention.<br />

By May this year, maca food products<br />

were exempted from the novel foods procedures.<br />

That means they now have merely<br />

to comply with the simplified procedure<br />

related to existing foods.<br />

MORE BARRIERS TO GO<br />

For Peru’s maca growers, this is good<br />

news. They can now export their food<br />

products to the EU market without facing<br />

unreasonable requirements. However, for<br />

many other exotic traditional foods the<br />

door to the EU is not yet open. The <strong>CBI</strong> is<br />

eager to reduce trade barriers for these<br />

products as well, for the simple reason that<br />

leaving the barriers in place will deprive<br />

Europeans of some great flavours and traditional<br />

communities in developing countries<br />

from export opportunities that will<br />

help safeguard their future production.<br />

Useful links:<br />

• Analysis of legislation on Novel Foods and<br />

GMO’s in AccessGuide:<br />

www.cbi.nl/accessguide<br />

• Novel Foods website of the EU:<br />

http://europa.eu.int/comm/food/fs/novel_foo<br />

d/nf_index_en.html<br />

) european market information ( <strong>CBI</strong> <strong>News</strong> Bulletin page 16

The <strong>CBI</strong> regularly publishes EU market surveys. An overview of recently published surveys and some highlights per<br />

survey are presented on the following pages. The complete surveys can be downloaded – free of charge for exporters<br />

and business support organizations in developing countries – from our website at www.cbi.nl. Go to the download<br />

plaza in the exporters or business support section of the website and click on market surveys. Alternatively, hard<br />