Request for Information - Harvard Business School Press

Request for Information - Harvard Business School Press

Request for Information - Harvard Business School Press

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

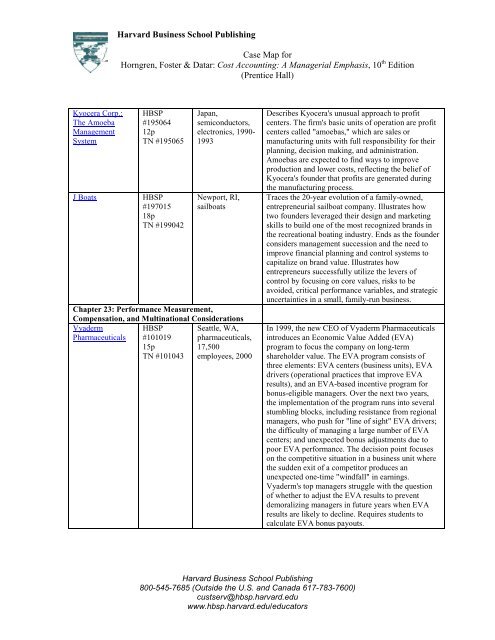

Kyocera Corp.:<br />

The Amoeba<br />

Management<br />

System<br />

<strong>Harvard</strong> <strong>Business</strong> <strong>School</strong> Publishing<br />

Case Map <strong>for</strong><br />

Horngren, Foster & Datar: Cost Accounting: A Managerial Emphasis, 10 th Edition<br />

(Prentice Hall)<br />

HBSP<br />

#195064<br />

12p<br />

TN #195065<br />

J Boats HBSP<br />

#197015<br />

18p<br />

TN #199042<br />

Japan,<br />

semiconductors,<br />

electronics, 1990-<br />

1993<br />

Newport, RI,<br />

sailboats<br />

Chapter 23: Per<strong>for</strong>mance Measurement,<br />

Compensation, and Multinational Considerations<br />

Vyaderm HBSP Seattle, WA,<br />

Pharmaceuticals #101019 pharmaceuticals,<br />

15p<br />

17,500<br />

TN #101043 employees, 2000<br />

Describes Kyocera's unusual approach to profit<br />

centers. The firm's basic units of operation are profit<br />

centers called "amoebas," which are sales or<br />

manufacturing units with full responsibility <strong>for</strong> their<br />

planning, decision making, and administration.<br />

Amoebas are expected to find ways to improve<br />

production and lower costs, reflecting the belief of<br />

Kyocera's founder that profits are generated during<br />

the manufacturing process.<br />

Traces the 20-year evolution of a family-owned,<br />

entrepreneurial sailboat company. Illustrates how<br />

two founders leveraged their design and marketing<br />

skills to build one of the most recognized brands in<br />

the recreational boating industry. Ends as the founder<br />

considers management succession and the need to<br />

improve financial planning and control systems to<br />

capitalize on brand value. Illustrates how<br />

entrepreneurs successfully utilize the levers of<br />

control by focusing on core values, risks to be<br />

avoided, critical per<strong>for</strong>mance variables, and strategic<br />

uncertainties in a small, family-run business.<br />

In 1999, the new CEO of Vyaderm Pharmaceuticals<br />

introduces an Economic Value Added (EVA)<br />

program to focus the company on long-term<br />

shareholder value. The EVA program consists of<br />

three elements: EVA centers (business units), EVA<br />

drivers (operational practices that improve EVA<br />

results), and an EVA-based incentive program <strong>for</strong><br />

bonus-eligible managers. Over the next two years,<br />

the implementation of the program runs into several<br />

stumbling blocks, including resistance from regional<br />

managers, who push <strong>for</strong> "line of sight" EVA drivers;<br />

the difficulty of managing a large number of EVA<br />

centers; and unexpected bonus adjustments due to<br />

poor EVA per<strong>for</strong>mance. The decision point focuses<br />

on the competitive situation in a business unit where<br />

the sudden exit of a competitor produces an<br />

unexpected one-time "windfall" in earnings.<br />

Vyaderm's top managers struggle with the question<br />

of whether to adjust the EVA results to prevent<br />

demoralizing managers in future years when EVA<br />

results are likely to decline. Requires students to<br />

calculate EVA bonus payouts.<br />

<strong>Harvard</strong> <strong>Business</strong> <strong>School</strong> Publishing<br />

800-545-7685 (Outside the U.S. and Canada 617-783-7600)<br />

custserv@hbsp.harvard.edu<br />

www.hbsp.harvard.edu/educators