Request for Information - Harvard Business School Press

Request for Information - Harvard Business School Press

Request for Information - Harvard Business School Press

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

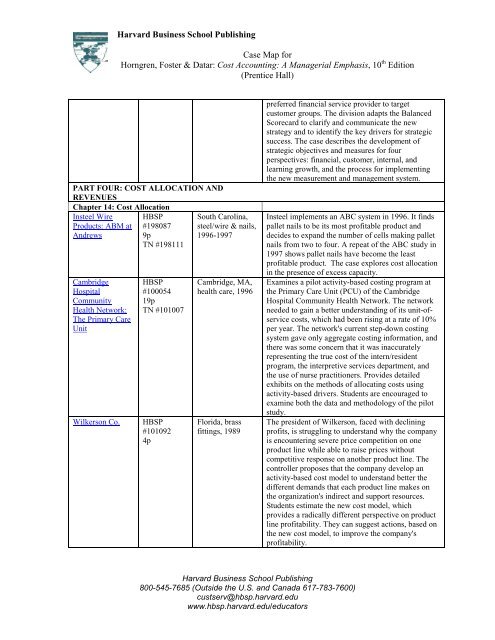

<strong>Harvard</strong> <strong>Business</strong> <strong>School</strong> Publishing<br />

Case Map <strong>for</strong><br />

Horngren, Foster & Datar: Cost Accounting: A Managerial Emphasis, 10 th Edition<br />

(Prentice Hall)<br />

PART FOUR: COST ALLOCATION AND<br />

REVENUES<br />

Chapter 14: Cost Allocation<br />

Insteel Wire<br />

Products: ABM at<br />

Andrews<br />

Cambridge<br />

Hospital<br />

Community<br />

Health Network:<br />

The Primary Care<br />

Unit<br />

HBSP<br />

#198087<br />

9p<br />

TN #198111<br />

HBSP<br />

#100054<br />

19p<br />

TN #101007<br />

Wilkerson Co. HBSP<br />

#101092<br />

4p<br />

South Carolina,<br />

steel/wire & nails,<br />

1996-1997<br />

Cambridge, MA,<br />

health care, 1996<br />

Florida, brass<br />

fittings, 1989<br />

preferred financial service provider to target<br />

customer groups. The division adapts the Balanced<br />

Scorecard to clarify and communicate the new<br />

strategy and to identify the key drivers <strong>for</strong> strategic<br />

success. The case describes the development of<br />

strategic objectives and measures <strong>for</strong> four<br />

perspectives: financial, customer, internal, and<br />

learning growth, and the process <strong>for</strong> implementing<br />

the new measurement and management system.<br />

Insteel implements an ABC system in 1996. It finds<br />

pallet nails to be its most profitable product and<br />

decides to expand the number of cells making pallet<br />

nails from two to four. A repeat of the ABC study in<br />

1997 shows pallet nails have become the least<br />

profitable product. The case explores cost allocation<br />

in the presence of excess capacity.<br />

Examines a pilot activity-based costing program at<br />

the Primary Care Unit (PCU) of the Cambridge<br />

Hospital Community Health Network. The network<br />

needed to gain a better understanding of its unit-ofservice<br />

costs, which had been rising at a rate of 10%<br />

per year. The network's current step-down costing<br />

system gave only aggregate costing in<strong>for</strong>mation, and<br />

there was some concern that it was inaccurately<br />

representing the true cost of the intern/resident<br />

program, the interpretive services department, and<br />

the use of nurse practitioners. Provides detailed<br />

exhibits on the methods of allocating costs using<br />

activity-based drivers. Students are encouraged to<br />

examine both the data and methodology of the pilot<br />

study.<br />

The president of Wilkerson, faced with declining<br />

profits, is struggling to understand why the company<br />

is encountering severe price competition on one<br />

product line while able to raise prices without<br />

competitive response on another product line. The<br />

controller proposes that the company develop an<br />

activity-based cost model to understand better the<br />

different demands that each product line makes on<br />

the organization's indirect and support resources.<br />

Students estimate the new cost model, which<br />

provides a radically different perspective on product<br />

line profitability. They can suggest actions, based on<br />

the new cost model, to improve the company's<br />

profitability.<br />

<strong>Harvard</strong> <strong>Business</strong> <strong>School</strong> Publishing<br />

800-545-7685 (Outside the U.S. and Canada 617-783-7600)<br />

custserv@hbsp.harvard.edu<br />

www.hbsp.harvard.edu/educators