Kenmore European Industrial Fund Limited - Hemscott IR

Kenmore European Industrial Fund Limited - Hemscott IR

Kenmore European Industrial Fund Limited - Hemscott IR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

08 <strong>Kenmore</strong> <strong>European</strong> <strong>Industrial</strong> <strong>Fund</strong> <strong>Limited</strong> Report and Accounts 2007<br />

Investment Manager’s Review<br />

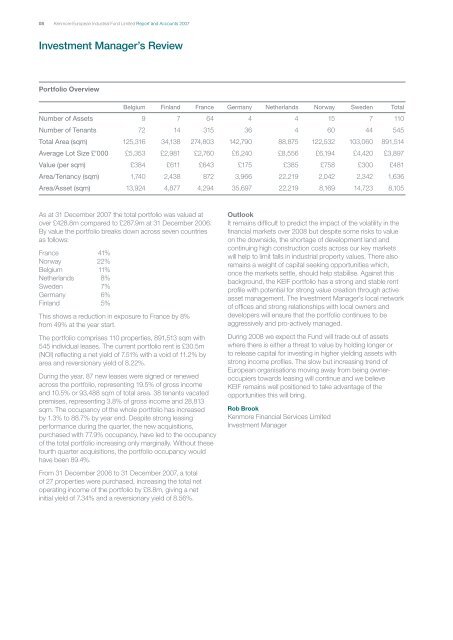

Portfolio Overview<br />

Belgium Finland France Germany Netherlands Norway Sweden Total<br />

Number of Assets 9 7 64 4 4 15 7 110<br />

Number of Tenants 72 14 315 36 4 60 44 545<br />

Total Area (sqm) 125,316 34,138 274,803 142,790 88,875 122,532 103,060 891,514<br />

Average Lot Size £’000 £5,353 £2,981 £2,760 £6,240 £8,556 £6,194 £4,420 £3,897<br />

Value (per sqm) £384 £611 £643 £175 £385 £758 £300 £481<br />

Area/Tenancy (sqm) 1,740 2,438 872 3,966 22,219 2,042 2,342 1,636<br />

Area/Asset (sqm) 13,924 4,877 4,294 35,697 22,219 8,169 14,723 8,105<br />

As at 31 December 2007 the total portfolio was valued at<br />

over £428.8m compared to £287.9m at 31 December 2006.<br />

By value the portfolio breaks down across seven countries<br />

as follows:<br />

France 41%<br />

Norway 22%<br />

Belgium 11%<br />

Netherlands 8%<br />

Sweden 7%<br />

Germany 6%<br />

Finland 5%<br />

This shows a reduction in exposure to France by 8%<br />

from 49% at the year start.<br />

The portfolio comprises 110 properties, 891,513 sqm with<br />

545 individual leases. The current portfolio rent is £30.5m<br />

(NOI) reflecting a net yield of 7.51% with a void of 11.2% by<br />

area and reversionary yield of 8.22%.<br />

During the year, 87 new leases were signed or renewed<br />

across the portfolio, representing 19.5% of gross income<br />

and 10.5% or 93,488 sqm of total area. 38 tenants vacated<br />

premises, representing 3.8% of gross income and 28,813<br />

sqm. The occupancy of the whole portfolio has increased<br />

by 1.3% to 88.7% by year end. Despite strong leasing<br />

performance during the quarter, the new acquisitions,<br />

purchased with 77.9% occupancy, have led to the occupancy<br />

of the total portfolio increasing only marginally. Without these<br />

fourth quarter acquisitions, the portfolio occupancy would<br />

have been 89.4%.<br />

From 31 December 2006 to 31 December 2007, a total<br />

of 27 properties were purchased, increasing the total net<br />

operating income of the portfolio by £8.8m, giving a net<br />

initial yield of 7.34% and a reversionary yield of 8.56%.<br />

Outlook<br />

It remains difficult to predict the impact of the volatility in the<br />

financial markets over 2008 but despite some risks to value<br />

on the downside, the shortage of development land and<br />

continuing high construction costs across our key markets<br />

will help to limit falls in industrial property values. There also<br />

remains a weight of capital seeking opportunities which,<br />

once the markets settle, should help stabilise. Against this<br />

background, the KEIF portfolio has a strong and stable rent<br />

profile with potential for strong value creation through active<br />

asset management. The Investment Manager’s local network<br />

of offices and strong relationships with local owners and<br />

developers will ensure that the portfolio continues to be<br />

aggressively and pro-actively managed.<br />

During 2008 we expect the <strong>Fund</strong> will trade out of assets<br />

where there is either a threat to value by holding longer or<br />

to release capital for investing in higher yielding assets with<br />

strong income profiles. The slow but increasing trend of<br />

<strong>European</strong> organisations moving away from being owneroccupiers<br />

towards leasing will continue and we believe<br />

KEIF remains well positioned to take advantage of the<br />

opportunities this will bring.<br />

Rob Brook<br />

<strong>Kenmore</strong> Financial Services <strong>Limited</strong><br />

Investment Manager