Kenmore European Industrial Fund Limited - Hemscott IR

Kenmore European Industrial Fund Limited - Hemscott IR

Kenmore European Industrial Fund Limited - Hemscott IR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26 <strong>Kenmore</strong> <strong>European</strong> <strong>Industrial</strong> <strong>Fund</strong> <strong>Limited</strong> Report and Accounts 2007<br />

Notes to the Accounts<br />

As at 3 December 2007<br />

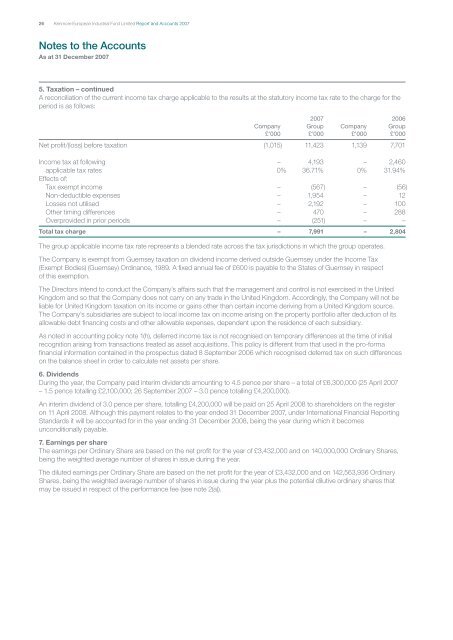

. Taxation – continued<br />

A reconciliation of the current income tax charge applicable to the results at the statutory income tax rate to the charge for the<br />

period is as follows:<br />

2007 2006<br />

Company Group Company Group<br />

£’000 £’000 £’000 £’000<br />

Net profit/(loss) before taxation (1,015) 11,423 1,139 7,701<br />

Income tax at following – 4,193 – 2,460<br />

applicable tax rates 0% 36.71% 0% 31.94%<br />

Effects of:<br />

Tax exempt income – (567) – (56)<br />

Non-deductible expenses – 1,954 – 12<br />

Losses not utilised – 2,192 – 100<br />

Other timing differences – 470 – 288<br />

Overprovided in prior periods – (251) – –<br />

Total tax charge – 7, – 2,804<br />

The group applicable income tax rate represents a blended rate across the tax jurisdictions in which the group operates.<br />

The Company is exempt from Guernsey taxation on dividend income derived outside Guernsey under the Income Tax<br />

(Exempt Bodies) (Guernsey) Ordinance, 1989. A fixed annual fee of £600 is payable to the States of Guernsey in respect<br />

of this exemption.<br />

The Directors intend to conduct the Company’s affairs such that the management and control is not exercised in the United<br />

Kingdom and so that the Company does not carry on any trade in the United Kingdom. Accordingly, the Company will not be<br />

liable for United Kingdom taxation on its income or gains other than certain income deriving from a United Kingdom source.<br />

The Company’s subsidiaries are subject to local income tax on income arising on the property portfolio after deduction of its<br />

allowable debt financing costs and other allowable expenses, dependent upon the residence of each subsidiary.<br />

As noted in accounting policy note 1(h), deferred income tax is not recognised on temporary differences at the time of initial<br />

recognition arising from transactions treated as asset acquisitions. This policy is different from that used in the pro-forma<br />

financial information contained in the prospectus dated 8 September 2006 which recognised deferred tax on such differences<br />

on the balance sheet in order to calculate net assets per share.<br />

6. Dividends<br />

During the year, the Company paid interim dividends amounting to 4.5 pence per share – a total of £6,300,000 (25 April 2007<br />

– 1.5 pence totalling £2,100,000; 26 September 2007 – 3.0 pence totalling £4,200,000).<br />

An interim dividend of 3.0 pence per share, totalling £4,200,000 will be paid on 25 April 2008 to shareholders on the register<br />

on 11 April 2008. Although this payment relates to the year ended 31 December 2007, under International Financial Reporting<br />

Standards it will be accounted for in the year ending 31 December 2008, being the year during which it becomes<br />

unconditionally payable.<br />

7. Earnings per share<br />

The earnings per Ordinary Share are based on the net profit for the year of £3,432,000 and on 140,000,000 Ordinary Shares,<br />

being the weighted average number of shares in issue during the year.<br />

The diluted earnings per Ordinary Share are based on the net profit for the year of £3,432,000 and on 142,563,936 Ordinary<br />

Shares, being the weighted average number of shares in issue during the year plus the potential dilutive ordinary shares that<br />

may be issued in respect of the performance fee (see note 2(a)).