Town Assessment Roll - Schoharie County

Town Assessment Roll - Schoharie County

Town Assessment Roll - Schoharie County

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

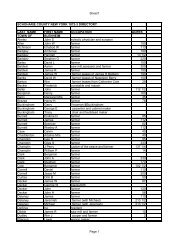

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 1<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 171.-3-11.2 ****************<br />

125 Creamery Rd 405J209007<br />

171.-3-11.2 283 Res w/Comuse SR STAR 41834 0 0 46,650<br />

119 Creamery LLC Gilboa-Conesvil 433401 15,000 BUSINESS 47610 7,500 7,500 7,500<br />

119 Creamery Rd Also 119 & 131 Creamery R 300,000 COUNTY TAXABLE VALUE 292,500<br />

N Blenheim, NY 12131 FRNT 369.65 DPTH TOWN TAXABLE VALUE 292,500<br />

ACRES 2.25 SCHOOL TAXABLE VALUE 245,850<br />

EAST-0502748 NRTH-1324803<br />

DEED BOOK 882 PG-49<br />

FULL MARKET VALUE 375,000<br />

******************************************************************************************************* 181.-1-20 ******************<br />

Avenue of the Stars 405J190012<br />

181.-1-20 312 Vac w/imprv COUNTY TAXABLE VALUE 16,800<br />

3G Developers LLC Gilboa-Conesvil 433401 14,500 TOWN TAXABLE VALUE 16,800<br />

19397 State Route 23 Subdivision 16,800 SCHOOL TAXABLE VALUE 16,800<br />

Davenport, NY 13750 Camper<br />

FRNT 275.71 DPTH<br />

ACRES 6.30<br />

EAST-0497633 NRTH-1312800<br />

DEED BOOK 788 PG-65<br />

FULL MARKET VALUE 21,000<br />

******************************************************************************************************* 136.-2-8 *******************<br />

527 Eminence Rd 405J177008<br />

136.-2-8 270 Mfg housing COUNTY TAXABLE VALUE 46,500<br />

AAAZ, Inc. Middleburgh 433801 25,000 TOWN TAXABLE VALUE 46,500<br />

c/o Richard V Smith Nice Mobile Home 46,500 SCHOOL TAXABLE VALUE 46,500<br />

527 Eminence Rd FRNT 420.00 DPTH<br />

Summit, NY 12175 ACRES 3.50<br />

EAST-0483780 NRTH-1344525<br />

DEED BOOK 872 PG-180<br />

FULL MARKET VALUE 58,125<br />

******************************************************************************************************* 161.-1-20 ******************<br />

431 Bear Ladder Rd 405J101100<br />

161.-1-20 312 Vac w/imprv COUNTY TAXABLE VALUE 6,000<br />

Acker Virginia Middleburgh 433801 4,000 TOWN TAXABLE VALUE 6,000<br />

431 Bear Ladder Rd 2 Car Garage 6,000 SCHOOL TAXABLE VALUE 6,000<br />

Fultonham, NY 12071 flooded<br />

FRNT 430.00 DPTH<br />

ACRES 1.00<br />

EAST-0509226 NRTH-1332926<br />

DEED BOOK 470 PG-290<br />

FULL MARKET VALUE 7,500<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 2<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 172.-1-3 *******************<br />

135 Bear Ladder Rd 405J101116<br />

172.-1-3 311 Res vac land COUNTY TAXABLE VALUE 3,000<br />

Adair Arnold Gene Gilboa-Conesvil 433401 3,000 TOWN TAXABLE VALUE 3,000<br />

Adair Judith Christine FRNT 500.00 DPTH 375.00 3,000 SCHOOL TAXABLE VALUE 3,000<br />

626 Poutre Ave ACRES 0.89 AG001 Ag dist #1 .89 AC<br />

Schenectady, NY 12306 EAST-0507641 NRTH-1326270 .00 UN<br />

DEED BOOK 394 PG-173<br />

FULL MARKET VALUE 3,750<br />

******************************************************************************************************* 172.-2-19.1 ****************<br />

Bruck Rd Off 405J174009<br />

172.-2-19.1 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 3<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 172.-2-25 ******************<br />

153 Bruck Rd 92 PCT OF VALUE USED FOR EXEMPTION PURPOSES 405J174011<br />

172.-2-25 210 1 Family Res WAR VET/C 41122 6,750 0 0<br />

Adam Gerhard E Gilboa-Conesvil 433401 23,600 WAR VET/T 41123 0 9,000 0<br />

Adam Ellen New Home W/out Bldgs 219,000 RES STAR 41854 0 0 22,500<br />

Mountain Rd Windmill COUNTY TAXABLE VALUE 212,250<br />

PO Box 860 FRNT 320.00 DPTH TOWN TAXABLE VALUE 210,000<br />

No Blenheim, NY 12131 ACRES 31.20 SCHOOL TAXABLE VALUE 196,500<br />

EAST-0508930 NRTH-1324478<br />

DEED BOOK 368 PG-1003<br />

FULL MARKET VALUE 273,750<br />

******************************************************************************************************* 171.-1-8 *******************<br />

1472 North Rd 405J101258<br />

171.-1-8 240 Rural res RES STAR 41854 0 0 22,500<br />

Aitken James H Gilboa-Conesvil 433401 20,000 COUNTY TAXABLE VALUE 200,000<br />

1472 North Rd 1 Sty & Barns 200,000 TOWN TAXABLE VALUE 200,000<br />

North Blenheim, NY 12131 Shell Unlivable SCHOOL TAXABLE VALUE 177,500<br />

FRNT 695.00 DPTH<br />

ACRES 13.60 BANK FARETS<br />

EAST-0500370 NRTH-1324354<br />

DEED BOOK 854 PG-104<br />

FULL MARKET VALUE 250,000<br />

******************************************************************************************************* 171.-1-9 *******************<br />

1462 North Rd 405J101085<br />

171.-1-9 210 1 Family Res COUNTY TAXABLE VALUE 109,000<br />

Aitken James H Gilboa-Conesvil 433401 20,000 TOWN TAXABLE VALUE 109,000<br />

1472 North Rd 1 1/2 Sty & Garage 109,000 SCHOOL TAXABLE VALUE 109,000<br />

North Blenheim, NY 12131 FRNT 550.00 DPTH<br />

ACRES 10.00<br />

EAST-0499644 NRTH-1324408<br />

DEED BOOK 890 PG-8<br />

FULL MARKET VALUE 136,250<br />

******************************************************************************************************* 160.-1-19 ******************<br />

735 Burnt Hill Rd 405J101002<br />

160.-1-19 920 Priv Hunt/Fi FORST LND 47460 67,436 67,436 67,436<br />

Al-Les-Ernie Inc Gilboa-Conesvil 433401 84,900 COUNTY TAXABLE VALUE 58,164<br />

Doctors Club Inc AKA Wooded & 2 Sty Camp 125,600 TOWN TAXABLE VALUE 58,164<br />

c/o Robert Kelly Cert of amendment in fold SCHOOL TAXABLE VALUE 58,164<br />

Doctors Club Inc FRNT 3725.00 DPTH<br />

175 Oxyoke Dr ACRES 182.30<br />

Kensington, CT 06037 EAST-0496978 NRTH-1335768<br />

DEED BOOK 264 PG-357<br />

MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 157,000<br />

UNDER RPTL480A UNTIL 2021<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 4<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 170.-1-7.126 ***************<br />

Welch Rd off 405J206006<br />

170.-1-7.126 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 5<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 161.-2-11 ******************<br />

2196 State Route 30 405J101157<br />

161.-2-11 210 1 Family Res RES STAR 41854 0 0 22,500<br />

Alley Leonard Jr Gilboa-Conesvil 433401 8,200 COUNTY TAXABLE VALUE 62,500<br />

Alley Robin M Remodeled House& New 2 Ca 62,500 TOWN TAXABLE VALUE 62,500<br />

2196 State Route 30 FRNT 310.00 DPTH 152.00 SCHOOL TAXABLE VALUE 40,000<br />

North Blenheim, NY 12131 ACRES 0.56 BANKWELLFAR AG001 Ag dist #1 .56 AC<br />

EAST-0510821 NRTH-1331837 .00 UN<br />

DEED BOOK 632 PG-90<br />

FULL MARKET VALUE 78,125<br />

******************************************************************************************************* 181.-1-40 ******************<br />

Quarry Rd Off 405J183018<br />

181.-1-40 314 Rural vac10 COUNTY TAXABLE VALUE 38,000<br />

Antaki Michael Gilboa-Conesvil 433401 38,000 TOWN TAXABLE VALUE 38,000<br />

78 Leicester St FRNT 765.59 DPTH 38,000 SCHOOL TAXABLE VALUE 38,000<br />

Port Chester, NY 10573 ACRES 101.15<br />

EAST-0499564 NRTH-1326838<br />

DEED BOOK 811 PG-218<br />

FULL MARKET VALUE 47,500<br />

******************************************************************************************************* 171.-2-5 *******************<br />

1507 North Rd 405J101187<br />

171.-2-5 210 1 Family Res COUNTY TAXABLE VALUE 132,000<br />

Antaki Michael F Gilboa-Conesvil 433401 45,500 TOWN TAXABLE VALUE 132,000<br />

Antaki Joanne Log Cabin 30 X 50 132,000 SCHOOL TAXABLE VALUE 132,000<br />

78 Leicester St Not Finished<br />

Portchester, NY 10573 FRNT 1544.64 DPTH<br />

ACRES 84.02<br />

EAST-0501641 NRTH-1325312<br />

DEED BOOK 533 PG-244<br />

FULL MARKET VALUE 165,000<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 6<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 170.-2-20 ******************<br />

Blenheim Hill Rd 405J180008<br />

170.-2-20 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 7<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 172.-2-19.22 ***************<br />

152 Thiems Dream Ln 405J202003<br />

172.-2-19.22 210 1 Family Res COUNTY TAXABLE VALUE 136,000<br />

Bacchi Joseph M Gilboa-Conesvil 433401 16,800 TOWN TAXABLE VALUE 136,000<br />

Bacchi Barbara E 6.82A comb w/this(172.-2- 136,000 SCHOOL TAXABLE VALUE 136,000<br />

325 Warren St ACRES 11.51<br />

West Babylon, NY 11704 EAST-0507449 NRTH-1323375<br />

DEED BOOK 902 PG-180<br />

FULL MARKET VALUE 170,000<br />

******************************************************************************************************* 170.-2-8.18 ****************<br />

935 Blenheim Hill Rd 405J199014<br />

170.-2-8.18 210 1 Family Res COUNTY TAXABLE VALUE 135,000<br />

Balakirsky Nathan Jefferson 433601 15,000 TOWN TAXABLE VALUE 135,000<br />

Balakirsky Debra 50 X 50 Home 135,000 SCHOOL TAXABLE VALUE 135,000<br />

66 Camelot Ct Garage Apartment<br />

Piscataway, NJ 08854 FRNT 552.12 DPTH<br />

ACRES 5.10 BANK FARETS<br />

EAST-0489430 NRTH-1326415<br />

DEED BOOK 773 PG-201<br />

FULL MARKET VALUE 168,750<br />

******************************************************************************************************* 160.-2-14 ******************<br />

161 Silver Mine Rd 405J184029<br />

160.-2-14 260 Seasonal res COUNTY TAXABLE VALUE 15,800<br />

Bamundo James P Gilboa-Conesvil 433401 11,000 TOWN TAXABLE VALUE 15,800<br />

242 Riviera Pkwy Downhill Site 15,800 SCHOOL TAXABLE VALUE 15,800<br />

Lindenhurst, NY 11757 ACRES 5.34 AG001 Ag dist #1 5.34 AC<br />

EAST-0502985 NRTH-1330240 .00 UN<br />

DEED BOOK 398 PG-681<br />

FULL MARKET VALUE 19,750<br />

******************************************************************************************************* 181.-1-59 ******************<br />

334 Quarry Rd 405J180001<br />

181.-1-59 260 Seasonal res COUNTY TAXABLE VALUE 41,000<br />

Barrett Nan Gilboa-Conesvil 433401 14,000 TOWN TAXABLE VALUE 41,000<br />

c/o Nancy Della Fiora Level Bldg Site 41,000 SCHOOL TAXABLE VALUE 41,000<br />

PO Box 331 FRNT 200.00 DPTH<br />

Stamford, NY 12167 ACRES 5.10<br />

EAST-0495220 NRTH-1316372<br />

DEED BOOK 880 PG-12<br />

FULL MARKET VALUE 51,250<br />

******************************************************************************************************* 169.-3-8 *******************<br />

589 Blenheim Hill Rd 405J176006<br />

169.-3-8 312 Vac w/imprv COUNTY TAXABLE VALUE 14,300<br />

Bartell James A Jefferson 433601 13,200 TOWN TAXABLE VALUE 14,300<br />

Bartell Deborah M Small Camp Trlr 14,300 SCHOOL TAXABLE VALUE 14,300<br />

8 Seville Ln FRNT 188.08 DPTH<br />

Stony Brook, NY 11790 ACRES 5.00<br />

EAST-0480823 NRTH-1323226<br />

DEED BOOK 706 PG-8<br />

FULL MARKET VALUE 17,875<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 8<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 161.-2-20 ******************<br />

123 Jacob Hager Ln 405J101012<br />

161.-2-20 210 1 Family Res COUNTY TAXABLE VALUE 67,700<br />

Bartholomew Howard R Gilboa-Conesvil 433401 13,700 TOWN TAXABLE VALUE 67,700<br />

Bartholomew Sherrie J Reconstructed Old Hse & C 67,700 SCHOOL TAXABLE VALUE 67,700<br />

148 River St ACRES 3.30 AG001 Ag dist #1 3.30 AC<br />

PO Box 986 EAST-0510284 NRTH-1332241 .00 UN<br />

Middleburgh, NY 12122 DEED BOOK 777 PG-22<br />

FULL MARKET VALUE 84,625<br />

******************************************************************************************************* 148.-1-15 ******************<br />

456 Cole Hollow Rd 405J187008<br />

148.-1-15 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 9<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 171.-2-4 *******************<br />

159 Creamery Rd 75 PCT OF VALUE USED FOR EXEMPTION PURPOSES 405J101176<br />

171.-2-4 240 Rural res WAR VET/C 41122 6,750 0 0<br />

Becker Kenneth P Gilboa-Conesvil 433401 35,000 WAR VET/T 41123 0 9,000 0<br />

Becker Betty M Solar Home 100,700 SR STAR 41834 0 0 46,650<br />

PO Box 910 FRNT 90.00 DPTH COUNTY TAXABLE VALUE 93,950<br />

No Blenheim, NY 12131 ACRES 87.60 TOWN TAXABLE VALUE 91,700<br />

EAST-0501723 NRTH-1326853 SCHOOL TAXABLE VALUE 54,050<br />

DEED BOOK 384 PG-427<br />

FULL MARKET VALUE 125,875<br />

******************************************************************************************************* 172.-2-2.2 *****************<br />

1933 State Route 30 405J191018<br />

172.-2-2.2 210 1 Family Res COUNTY TAXABLE VALUE 64,000<br />

Begos Cassandra Gilboa-Conesvil 433401 5,000 TOWN TAXABLE VALUE 64,000<br />

107 Glen Rd Apt #6A older 2 story remodeled 64,000 SCHOOL TAXABLE VALUE 64,000<br />

Yonkers, NY 10704 FRNT 220.00 DPTH 82.00 AG001 Ag dist #1 .30 AC<br />

ACRES 0.30 BANK FARETS .00 UN<br />

EAST-0508073 NRTH-1326408<br />

DEED BOOK 787 PG-311<br />

FULL MARKET VALUE 80,000<br />

******************************************************************************************************* 171.-2-1 *******************<br />

Westkill Rd 405J101207<br />

171.-2-1 260 Seasonal res COUNTY TAXABLE VALUE 45,000<br />

Bender Lynn Gilboa-Conesvil 433401 31,000 TOWN TAXABLE VALUE 45,000<br />

Hanks Thompson W 1 1/2 Story Camp 45,000 SCHOOL TAXABLE VALUE 45,000<br />

8374 Putnam Rd FRNT 2810.00 DPTH<br />

Sherman, NY 14781 ACRES 32.00<br />

EAST-0499495 NRTH-1329159<br />

DEED BOOK 364 PG-622<br />

FULL MARKET VALUE 56,250<br />

******************************************************************************************************* 170.-1-7.123 ***************<br />

Welch Rd 405J205001<br />

170.-1-7.123 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 10<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 169.-3-16 ******************<br />

520 Blenheim Hill Rd 405J175009<br />

169.-3-16 210 1 Family Res COUNTY TAXABLE VALUE 64,700<br />

Biedenkapp Ronald R Jefferson 433601 21,000 TOWN TAXABLE VALUE 64,700<br />

Biedenkapp Shannon L Ranch-Nice 64,700 SCHOOL TAXABLE VALUE 64,700<br />

520 Blenheim Hill Rd FRNT 860.00 DPTH<br />

Stamford, NY 12167 ACRES 9.36 BANK FARETS<br />

EAST-0479165 NRTH-1322304<br />

DEED BOOK 728 PG-83<br />

FULL MARKET VALUE 80,875<br />

******************************************************************************************************* 180.-1-12 ******************<br />

Anderson Rd Off 405J101061<br />

180.-1-12 322 Rural vac>10 COUNTY TAXABLE VALUE 21,000<br />

Blenheim Hill Beehive Club Inc Jefferson 433601 21,000 TOWN TAXABLE VALUE 21,000<br />

c/o Carl S Eklund Mostly Open Flat To <strong>Roll</strong>i 21,000 SCHOOL TAXABLE VALUE 21,000<br />

377 Cornell Rd ACRES 35.80<br />

Stamford, NY 12167 EAST-0484437 NRTH-1320004<br />

DEED BOOK 835 PG-97<br />

FULL MARKET VALUE 26,250<br />

******************************************************************************************************* 180.-1-13 ******************<br />

Anderson Rd 405J185014<br />

180.-1-13 322 Rural vac>10 COUNTY TAXABLE VALUE 20,600<br />

Blenheim Hill Beehive Club Inc Jefferson 433601 20,600 TOWN TAXABLE VALUE 20,600<br />

c/o Carl S Eklund FRNT 115.00 DPTH 20,600 SCHOOL TAXABLE VALUE 20,600<br />

377 Cornell Rd ACRES 26.20<br />

Stamford, NY 12167 EAST-0483569 NRTH-1320460<br />

DEED BOOK 835 PG-97<br />

FULL MARKET VALUE 25,750<br />

******************************************************************************************************* 161.-2-14 ******************<br />

State Route 30 off 405J187016<br />

161.-2-14 322 Rural vac>10 COUNTY TAXABLE VALUE 30,000<br />

Blenheim Inc Gilboa-Conesvil 433401 30,000 TOWN TAXABLE VALUE 30,000<br />

2718 Falls Rd Hill-Woods-Part Open 30,000 SCHOOL TAXABLE VALUE 30,000<br />

Marcellus, NY 13108 ACRES 49.82<br />

EAST-0510124 NRTH-1329227<br />

DEED BOOK 759 PG-86<br />

FULL MARKET VALUE 37,500<br />

******************************************************************************************************* 170.-3-10 ******************<br />

167 Rogers Jones Rd 405J101021<br />

170.-3-10 210 1 Family Res RES STAR 41854 0 0 22,500<br />

Bliss Lawrence Jr Jefferson 433601 11,600 COUNTY TAXABLE VALUE 37,000<br />

Bliss Suzie Small Ranch, Shoddy 37,000 TOWN TAXABLE VALUE 37,000<br />

167 Rogers Jones Rd On Bank SCHOOL TAXABLE VALUE 14,500<br />

Jefferson, NY 12093 ACRES 4.00<br />

EAST-0492530 NRTH-1326505<br />

DEED BOOK 616 PG-73<br />

FULL MARKET VALUE 46,250<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 11<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 158.-3-6.11 ****************<br />

North Rd 405J176016<br />

158.-3-6.11 314 Rural vac10 COUNTY TAXABLE VALUE 14,500<br />

Bonnes Ondes Inc Jefferson 433601 14,500 TOWN TAXABLE VALUE 14,500<br />

414 Peace St Bldg Lot 14,500 SCHOOL TAXABLE VALUE 14,500<br />

Pelle, IA 50219 ACRES 12.70<br />

EAST-0477476 NRTH-1328511<br />

DEED BOOK 682 PG-108<br />

FULL MARKET VALUE 18,125<br />

******************************************************************************************************* 158.-3-6.21 ****************<br />

North Rd 405J202005<br />

158.-3-6.21 314 Rural vac10 COUNTY TAXABLE VALUE 18,000<br />

Bonnes Ondes Inc Jefferson 433601 18,000 TOWN TAXABLE VALUE 18,000<br />

414 Peace St ACRES 10.11 18,000 SCHOOL TAXABLE VALUE 18,000<br />

Pelle, IA 50219 EAST-0478139 NRTH-1330970<br />

DEED BOOK 682 PG-108<br />

FULL MARKET VALUE 22,500<br />

******************************************************************************************************* 181.-2-5.122 ***************<br />

State Route 30 405J204002<br />

181.-2-5.122 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 12<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 181.-2-5.131 ***************<br />

State Route 30 405J205006<br />

181.-2-5.131 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 13<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 170.-2-18 ******************<br />

132 Munsell Ln 405J179004<br />

170.-2-18 260 Seasonal res COUNTY TAXABLE VALUE 50,700<br />

Brofman Darlene Jefferson 433601 12,200 TOWN TAXABLE VALUE 50,700<br />

75-08 Bell Blvd Apt 6h Nice Camp & Deck 50,700 SCHOOL TAXABLE VALUE 50,700<br />

Bayside, NY 11364 ACRES 5.30<br />

EAST-0488088 NRTH-1324288<br />

DEED BOOK 468 PG-125<br />

FULL MARKET VALUE 63,375<br />

******************************************************************************************************* 159.-2-1 *******************<br />

1378 Westkill Rd 405J101013<br />

159.-2-1 260 Seasonal res COUNTY TAXABLE VALUE 38,300<br />

Brown Edward Jefferson 433601 23,500 TOWN TAXABLE VALUE 38,300<br />

Brown Christopher R Older Camp 38,300 SCHOOL TAXABLE VALUE 38,300<br />

208 Spring Dale Way FRNT 2641.49 DPTH<br />

Schenectady, NY 12306 ACRES 34.70<br />

EAST-0492719 NRTH-1330957<br />

DEED BOOK 889 PG-298<br />

FULL MARKET VALUE 47,875<br />

******************************************************************************************************* 170.-2-21 ******************<br />

142 Munsell Ln 405J179003<br />

170.-2-21 260 Seasonal res COUNTY TAXABLE VALUE 48,000<br />

Bugash Edward Jr Jefferson 433601 12,000 TOWN TAXABLE VALUE 48,000<br />

289 Tenafly Rd ACRES 5.00 48,000 SCHOOL TAXABLE VALUE 48,000<br />

Tenafly, NJ 07670 EAST-0488284 NRTH-1324439<br />

DEED BOOK 390 PG-964<br />

FULL MARKET VALUE 60,000<br />

******************************************************************************************************* 160.-2-8 *******************<br />

103 Silver Mine Rd 405J184013<br />

160.-2-8 210 1 Family Res COUNTY TAXABLE VALUE 106,000<br />

Burkard Donna Gilboa-Conesvil 433401 14,000 TOWN TAXABLE VALUE 106,000<br />

Lutz, Robert Irrevoc Trust 28 X 50 Chalet 106,000 SCHOOL TAXABLE VALUE 106,000<br />

233 Linton Ave Nice Site AG001 Ag dist #1 5.34 AC<br />

Lindenhurst, NY 11757 FRNT 1067.51 DPTH .00 UN<br />

ACRES 5.34<br />

EAST-0504352 NRTH-1330433<br />

DEED BOOK 850 PG-183<br />

FULL MARKET VALUE 132,500<br />

******************************************************************************************************* 171.-4-6.4 *****************<br />

State Route 30 Off 405J207004<br />

171.-4-6.4 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 14<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 171.-4-6.9 *****************<br />

State Route 30 405J207014<br />

171.-4-6.9 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 15<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 136.-1-6 *******************<br />

815 Betty Brook Rd 405J101142<br />

136.-1-6 240 Rural res COUNTY TAXABLE VALUE 40,000<br />

Campbell Kenneth T Coblskll-Richmn 432602 15,000 TOWN TAXABLE VALUE 40,000<br />

Rampulla David Secluded Older 2 Sty 40,000 SCHOOL TAXABLE VALUE 40,000<br />

530 S Gannon Ave ACRES 14.00<br />

Staten Island, NY 10314-4345 EAST-0487466 NRTH-1348350<br />

DEED BOOK 919 PG-82<br />

FULL MARKET VALUE 50,000<br />

******************************************************************************************************* 172.-2-6 *******************<br />

Dave Brown Mtn Rd 405J189015<br />

172.-2-6 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 16<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 161.-2-16 ******************<br />

State Route 30 405J189025<br />

161.-2-16 120 Field crops COUNTY TAXABLE VALUE 21,000<br />

Caron Clement Gilboa-Conesvil 433401 21,000 TOWN TAXABLE VALUE 21,000<br />

Caron Jeanne Tillable Land 21,000 SCHOOL TAXABLE VALUE 21,000<br />

2094 State Route 30 FRNT 780.00 DPTH AG001 Ag dist #1 7.00 AC<br />

North Blenheim, NY 12131 ACRES 7.00 .00 UN<br />

EAST-0509130 NRTH-1330517<br />

DEED BOOK 488 PG-244<br />

FULL MARKET VALUE 26,250<br />

******************************************************************************************************* 161.-2-18 ******************<br />

2086 State Route 30 405J178003<br />

161.-2-18 240 Rural res RES STAR 41854 0 0 22,500<br />

Caron Clement Gilboa-Conesvil 433401 26,000 COUNTY TAXABLE VALUE 266,000<br />

Caron Jeanne 270/lg Gar/new Hse 266,000 TOWN TAXABLE VALUE 266,000<br />

2094 State Route 30 Also 2094 State Route 30 SCHOOL TAXABLE VALUE 243,500<br />

North Blenheim, NY 12131 FRNT 500.00 DPTH AG001 Ag dist #1 14.50 AC<br />

ACRES 14.50 .00 UN<br />

EAST-0508932 NRTH-1329701<br />

DEED BOOK 461 PG-49<br />

FULL MARKET VALUE 332,500<br />

******************************************************************************************************* 159.-1-24 ******************<br />

Westkill Rd Off 405J175010<br />

159.-1-24 322 Rural vac>10 COUNTY TAXABLE VALUE 5,000<br />

Caruso Nicholas Jefferson 433601 5,000 TOWN TAXABLE VALUE 5,000<br />

257 Lamport Blvd Wooded Across Stream 5,000 SCHOOL TAXABLE VALUE 5,000<br />

Staten Island, NY 10305 ACRES 12.45<br />

EAST-0484821 NRTH-1331897<br />

DEED BOOK 868 PG-258<br />

FULL MARKET VALUE 6,250<br />

******************************************************************************************************* 191.-1-12.2 ****************<br />

102 Avenue of the Stars 405J191004<br />

191.-1-12.2 240 Rural res COUNTY TAXABLE VALUE 72,000<br />

Cascetta Vincenzo Gilboa-Conesvil 433401 25,300 TOWN TAXABLE VALUE 72,000<br />

Cascetta Antonio Older Farm House & Barn 72,000 SCHOOL TAXABLE VALUE 72,000<br />

129 Jackson St FRNT 1550.00 DPTH<br />

Brooklyn, NY 11211 ACRES 15.48<br />

EAST-0499255 NRTH-1311495<br />

DEED BOOK 542 PG-36<br />

FULL MARKET VALUE 90,000<br />

******************************************************************************************************* 171.-3-8 *******************<br />

1719 State Route 30 405J101045<br />

171.-3-8 210 1 Family Res COUNTY TAXABLE VALUE 20,000<br />

Castle Helen B Gilboa-Conesvil 433401 6,800 TOWN TAXABLE VALUE 20,000<br />

161 Guinea Rd Older 1 1/2 Sty 20,000 SCHOOL TAXABLE VALUE 20,000<br />

Gilboa, NY 12076 FRNT 100.00 DPTH 180.00<br />

ACRES 0.36<br />

EAST-0503361 NRTH-1324491<br />

DEED BOOK 828 PG-151<br />

FULL MARKET VALUE 25,000<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 17<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 171.-4-6.1 *****************<br />

State Route 30 405J101150<br />

171.-4-6.1 322 Rural vac>10 COUNTY TAXABLE VALUE 65,000<br />

Castle Mountain Music Ltd Gilboa-Conesvil 433401 65,000 TOWN TAXABLE VALUE 65,000<br />

297 State Route 10 Upland, Wooded, Rocky 65,000 SCHOOL TAXABLE VALUE 65,000<br />

Stamford, NY 12167 FRNT 1300.00 DPTH<br />

ACRES 22.83<br />

EAST-0500038 NRTH-1322080<br />

DEED BOOK 799 PG-171<br />

FULL MARKET VALUE 81,250<br />

******************************************************************************************************* 181.-2-5.124 ***************<br />

State Route 30 off 405J204004<br />

181.-2-5.124 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 18<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 181.-1-29 ******************<br />

Quarry Rd Off 405J182017<br />

181.-1-29 314 Rural vac10 COUNTY TAXABLE VALUE 16,000<br />

Chapman Matthew Gilboa-Conesvil 433401 16,000 TOWN TAXABLE VALUE 16,000<br />

969 Kingsley Rd Wooded Hill 16,000 SCHOOL TAXABLE VALUE 16,000<br />

Gilboa, NY 12076 ACRES 25.00<br />

EAST-0507980 NRTH-1318656<br />

DEED BOOK 689 PG-135<br />

FULL MARKET VALUE 20,000<br />

******************************************************************************************************* 182.-1-3 *******************<br />

Kingsley Rd Off 405J189007<br />

182.-1-3 322 Rural vac>10 COUNTY TAXABLE VALUE 8,000<br />

Chapman Matthew Gilboa-Conesvil 433401 8,000 TOWN TAXABLE VALUE 8,000<br />

969 Kingsley Rd Wooded Narrow Strip <strong>Town</strong> 8,000 SCHOOL TAXABLE VALUE 8,000<br />

Gilboa, NY 12076 ACRES 13.00<br />

EAST-0509519 NRTH-1319440<br />

DEED BOOK 689 PG-135<br />

FULL MARKET VALUE 10,000<br />

******************************************************************************************************* 149.-1-2 *******************<br />

Cole Hollow Rd 405J101028<br />

149.-1-2 322 Rural vac>10 COUNTY TAXABLE VALUE 23,800<br />

Chumacas Grace M Living Trst Middleburgh 433801 23,800 TOWN TAXABLE VALUE 23,800<br />

Chumacas Grace M Upland, Wooded 23,800 SCHOOL TAXABLE VALUE 23,800<br />

91 Fawn Hill Rd FRNT 480.00 DPTH<br />

Tuxedo, NY 10987 ACRES 31.00<br />

EAST-0507368 NRTH-1338531<br />

DEED BOOK 735 PG-176<br />

FULL MARKET VALUE 29,750<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 19<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 159.-3-5.2 *****************<br />

882 North Rd 405J203002<br />

159.-3-5.2 270 Mfg housing COUNTY TAXABLE VALUE 57,500<br />

Cicero Michael Jefferson 433601 18,000 TOWN TAXABLE VALUE 57,500<br />

Cicero Patricia A FRNT 700.00 DPTH 57,500 SCHOOL TAXABLE VALUE 57,500<br />

206 Peekskill Ave ACRES 18.00<br />

Medford, NY 11763 EAST-0485327 NRTH-1328134<br />

DEED BOOK 726 PG-335<br />

FULL MARKET VALUE 71,875<br />

******************************************************************************************************* 159.-3-6 *******************<br />

868 North Rd 405J182006<br />

159.-3-6 270 Mfg housing COUNTY TAXABLE VALUE 39,500<br />

Cicero Paul Jefferson 433601 26,200 TOWN TAXABLE VALUE 39,500<br />

Cicero Laura Mobile Home On Slab 12 X 39,500 SCHOOL TAXABLE VALUE 39,500<br />

264 Bridgeport Ave FRNT 710.00 DPTH<br />

Medford, NY 11763 ACRES 17.50<br />

EAST-0484719 NRTH-1328454<br />

DEED BOOK 589 PG-37<br />

FULL MARKET VALUE 49,375<br />

******************************************************************************************************* 169.-3-3.2 *****************<br />

188 Ethel Wood Rd 405J201020<br />

169.-3-3.2 271 Mfg housings COUNTY TAXABLE VALUE 25,000<br />

Cooper David B Sr Jefferson 433601 22,000 TOWN TAXABLE VALUE 25,000<br />

Cooper Lucinda A FRNT 1785.96 DPTH 25,000 SCHOOL TAXABLE VALUE 25,000<br />

121 Edie Rd ACRES 30.71<br />

Saratoga Springs, NY 12866 EAST-0480704 NRTH-1325056<br />

DEED BOOK 689 PG-167<br />

FULL MARKET VALUE 31,250<br />

******************************************************************************************************* 169.-3-3.11 ****************<br />

275 Ethel Wood Rd 405J101029<br />

169.-3-3.11 240 Rural res COUNTY TAXABLE VALUE 126,000<br />

Cooper David Brian Sr Jefferson 433601 80,500 TOWN TAXABLE VALUE 126,000<br />

Cooper Lucinda Ann Old Farm House & Barns 126,000 SCHOOL TAXABLE VALUE 126,000<br />

121 Edie Rd FRNT 1660.00 DPTH<br />

Saratoga Springs, NY 12866 ACRES 128.50<br />

EAST-0480001 NRTH-1326877<br />

DEED BOOK 772 PG-244<br />

FULL MARKET VALUE 157,500<br />

******************************************************************************************************* 191.-1-2 *******************<br />

562 Quarry Rd 405J189009<br />

191.-1-2 270 Mfg housing COUNTY TAXABLE VALUE 42,000<br />

Cordova David Gilboa-Conesvil 433401 17,000 TOWN TAXABLE VALUE 42,000<br />

Cordova Ellen FRNT 453.57 DPTH 42,000 SCHOOL TAXABLE VALUE 42,000<br />

100 N Kings Ave ACRES 5.25<br />

Massapequa, NY 11758 EAST-0498997 NRTH-1312796<br />

DEED BOOK 735 PG-4<br />

FULL MARKET VALUE 52,500<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 20<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 171.-1-12.2 ****************<br />

1410 North Rd 405J196003<br />

171.-1-12.2 210 1 Family Res Fire/EMS 41690 2,250 2,250 2,250<br />

Cornell Lyndon Gilboa-Conesvil 433401 9,000 RES STAR 41854 0 0 22,500<br />

Cornell Marie Small Farm & Building 110,000 COUNTY TAXABLE VALUE 107,750<br />

1410 North Rd Also See Deed 577/3 TOWN TAXABLE VALUE 107,750<br />

North Blenheim, NY 12131 FRNT 230.00 DPTH SCHOOL TAXABLE VALUE 85,250<br />

ACRES 1.00<br />

EAST-0498668 NRTH-1325322<br />

DEED BOOK 584 PG-99<br />

FULL MARKET VALUE 137,500<br />

******************************************************************************************************* 158.-3-5.12 ****************<br />

687 North Rd 405J205009<br />

158.-3-5.12 210 1 Family Res RES STAR 41854 0 0 22,500<br />

Cornell Lyndon E Jefferson 433601 8,000 COUNTY TAXABLE VALUE 40,000<br />

Cornell Marie Star belongs to buyer 40,000 TOWN TAXABLE VALUE 40,000<br />

1410 North Rd contract sale SCHOOL TAXABLE VALUE 17,500<br />

North Blenheim, NY 12131 FRNT 396.00 DPTH<br />

ACRES 2.00<br />

EAST-0480684 NRTH-1330740<br />

DEED BOOK 765 PG-3<br />

FULL MARKET VALUE 50,000<br />

******************************************************************************************************* 158.-3-5.111 ***************<br />

North Rd 405J174003<br />

158.-3-5.111 322 Rural vac>10 COUNTY TAXABLE VALUE 26,700<br />

Cornell Lyndon E Jefferson 433601 26,700 TOWN TAXABLE VALUE 26,700<br />

1410 North Rd Older Hse & Garage 26,700 SCHOOL TAXABLE VALUE 26,700<br />

North Blenheim, NY 12131 FRNT 970.00 DPTH<br />

ACRES 34.00<br />

EAST-0480346 NRTH-1331400<br />

DEED BOOK 755 PG-305<br />

FULL MARKET VALUE 33,375<br />

******************************************************************************************************* 158.-3-5.112 ***************<br />

639 North Rd 405J207018<br />

158.-3-5.112 311 Res vac land COUNTY TAXABLE VALUE 2,000<br />

Cornell Lyndon E Jefferson 433601 2,000 TOWN TAXABLE VALUE 2,000<br />

Cornell Marie M FRNT 210.00 DPTH 2,000 SCHOOL TAXABLE VALUE 2,000<br />

1410 North Rd ACRES 1.00<br />

N Blenheim, NY 12131 EAST-0479641 NRTH-1331502<br />

DEED BOOK 843 PG-206<br />

FULL MARKET VALUE 2,500<br />

******************************************************************************************************* 171.-1-5.22 ****************<br />

North Rd 405J205010<br />

171.-1-5.22 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 21<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 171.-1-12.1 ****************<br />

1418 North Rd 24 PCT OF VALUE USED FOR EXEMPTION PURPOSES 405J101044<br />

171.-1-12.1 240 Rural res COM VET/C 41132 7,014 0 0<br />

Cornell Lyndon E Gilboa-Conesvil 433401 53,700 COM VET/T 41133 0 7,014 0<br />

Cornell Marie A Nice Ranch Att Garage 116,900 RES STAR 41854 0 0 22,500<br />

1418 North Rd Also See Deed 577/3 COUNTY TAXABLE VALUE 109,886<br />

North Blenheim, NY 12131 FRNT 2270.00 DPTH TOWN TAXABLE VALUE 109,886<br />

ACRES 103.30 SCHOOL TAXABLE VALUE 94,400<br />

EAST-0498090 NRTH-1324593<br />

DEED BOOK 929 PG-141<br />

FULL MARKET VALUE 146,125<br />

******************************************************************************************************* 191.-1-11.1 ****************<br />

1101 State Route 30 405J101087<br />

191.-1-11.1 270 Mfg housing RES STAR 41854 0 0 22,500<br />

Cornell Lyndon E Gilboa-Conesvil 433401 18,000 COUNTY TAXABLE VALUE 38,000<br />

Cornell Marie A 27 X 48 Doublewide 38,000 TOWN TAXABLE VALUE 38,000<br />

1410 North Rd 1997 Fleetwood small offi SCHOOL TAXABLE VALUE 15,500<br />

North Blenheim, NY 12131 land contract--Eileen Tin<br />

FRNT 480.00 DPTH<br />

ACRES 3.50<br />

EAST-0499542 NRTH-1311061<br />

DEED BOOK 410 PG-89<br />

FULL MARKET VALUE 47,500<br />

******************************************************************************************************* 170.-1-7.127 ***************<br />

Welch Rd off 405J206007<br />

170.-1-7.127 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 22<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 170.-1-2 *******************<br />

773 Blenheim Hill Rd 405J101031<br />

170.-1-2 240 Rural res VETS EFCL 41002 81,196 0 0<br />

Cottone Josephine Jefferson 433601 202,000 VETS EFCL 41003 0 79,933 0<br />

Marsello Andrea Trlr & Camp 214,000 COUNTY TAXABLE VALUE 132,804<br />

135 Sunrise Ter life est Josephine Cotton TOWN TAXABLE VALUE 134,067<br />

Washington, NJ 07882 FRNT 8015.00 DPTH SCHOOL TAXABLE VALUE 214,000<br />

ACRES 399.00<br />

EAST-0484551 NRTH-1324518<br />

DEED BOOK 760 PG-105<br />

FULL MARKET VALUE 267,500<br />

******************************************************************************************************* 169.-3-1 *******************<br />

Blenheim Hill Rd Off 405K500401<br />

169.-3-1 940 Reforstation RPTL406(6) 33302 152,600 0 0<br />

<strong>County</strong> Of <strong>Schoharie</strong> Jefferson 433601 152,600 COUNTY TAXABLE VALUE 0<br />

Attn: <strong>County</strong> Treasurer See Also 229/588 152,600 TOWN TAXABLE VALUE 152,600<br />

PO Box 9 ACRES 208.80 SCHOOL TAXABLE VALUE 152,600<br />

<strong>Schoharie</strong>, NY 12157 EAST-0477146 NRTH-1324832<br />

DEED BOOK 194 PG-208<br />

FULL MARKET VALUE 190,750<br />

******************************************************************************************************* 170.-2-8.19 ****************<br />

959 Blenheim Hill Rd 405J199016<br />

170.-2-8.19 210 1 Family Res COUNTY TAXABLE VALUE 42,000<br />

<strong>County</strong> of <strong>Schoharie</strong> Jefferson 433601 14,000 TOWN TAXABLE VALUE 42,000<br />

PO Box 9 House-Needs Work 42,000 SCHOOL TAXABLE VALUE 42,000<br />

<strong>Schoharie</strong>, NY 12157 FRNT 491.08 DPTH<br />

ACRES 4.03<br />

EAST-0489835 NRTH-1326320<br />

DEED BOOK 916 PG-236<br />

FULL MARKET VALUE 52,500<br />

******************************************************************************************************* 170.-2-22 ******************<br />

109 Munsell Ln 405J177010<br />

170.-2-22 260 Seasonal res COUNTY TAXABLE VALUE 34,000<br />

Crandall Arthur R Jefferson 433601 13,000 TOWN TAXABLE VALUE 34,000<br />

c/o Charles H Fudger Res 34,000 SCHOOL TAXABLE VALUE 34,000<br />

91 Alpine Meadow Rd See Also 705/49<br />

Porter Corners, NY 12859 FRNT 832.00 DPTH<br />

ACRES 5.00<br />

EAST-0487313 NRTH-1324967<br />

DEED BOOK 375 PG-119<br />

FULL MARKET VALUE 42,500<br />

******************************************************************************************************* 136.-2-15 ******************<br />

116 Rossman Hill Rd 405J187009<br />

136.-2-15 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 23<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 158.-3-6.4 *****************<br />

North Rd Off 405J201008<br />

158.-3-6.4 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 24<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 159.-3-3 *******************<br />

843 North Rd 405J101156<br />

159.-3-3 210 1 Family Res COUNTY TAXABLE VALUE 74,600<br />

Dallara Mark J Jefferson 433601 16,300 TOWN TAXABLE VALUE 74,600<br />

Greenfield Ellen J Older Hse & Garage 74,600 SCHOOL TAXABLE VALUE 74,600<br />

172 St Marks Ave FRNT 404.10 DPTH<br />

Brooklyn, NY 11238 ACRES 5.17<br />

EAST-0484475 NRTH-1329497<br />

DEED BOOK 405 PG-165<br />

FULL MARKET VALUE 93,250<br />

******************************************************************************************************* 181.-1-17 ******************<br />

283 Avenue of the Stars 405J190011<br />

181.-1-17 210 1 Family Res COUNTY TAXABLE VALUE 117,000<br />

Davies Kenneth Graham Gilboa-Conesvil 433401 21,000 TOWN TAXABLE VALUE 117,000<br />

283 Avenue of the Stars 1 1/2 Story 1200' Square 117,000 SCHOOL TAXABLE VALUE 117,000<br />

Blenheim, NY 12131 FRNT 1087.63 DPTH<br />

ACRES 11.05<br />

EAST-0497919 NRTH-1313556<br />

DEED BOOK 921 PG-111<br />

FULL MARKET VALUE 146,250<br />

******************************************************************************************************* 159.-1-6 *******************<br />

1015 Westkill Rd 405J101170<br />

159.-1-6 260 Seasonal res COUNTY TAXABLE VALUE 100,000<br />

DeLorenzo Joann Jefferson 433601 20,000 TOWN TAXABLE VALUE 100,000<br />

202 Woodland Dr 1 1/2 Sty 100,000 SCHOOL TAXABLE VALUE 100,000<br />

Osprey, FL 34229 2 Car Garage<br />

FRNT 234.00 DPTH<br />

ACRES 15.40<br />

EAST-0484418 NRTH-1335734<br />

DEED BOOK 872 PG-146<br />

FULL MARKET VALUE 125,000<br />

******************************************************************************************************* 191.-1-13.2 ****************<br />

Avenue of the Stars 405J191019<br />

191.-1-13.2 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 25<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 171.-6-6 *******************<br />

Eastside Rd Off 405J187006<br />

171.-6-6 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 26<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 181.-1-8 *******************<br />

Avenue of the Stars 405J189017<br />

181.-1-8 314 Rural vac10 COUNTY TAXABLE VALUE 11,000<br />

Dolker John Middleburgh 433801 11,000 TOWN TAXABLE VALUE 11,000<br />

PO Box 885 Wooded-Logged L.l. 11,000 SCHOOL TAXABLE VALUE 11,000<br />

North Blenheim, NY 12131 ACRES 17.60<br />

EAST-0506695 NRTH-1335781<br />

DEED BOOK 536 PG-48<br />

FULL MARKET VALUE 13,750<br />

******************************************************************************************************* 161.-1-1.1 *****************<br />

226 Spur Rd 55 PCT OF VALUE USED FOR EXEMPTION PURPOSES 405J101043<br />

161.-1-1.1 210 1 Family Res CW_15_VET/ 41162 6,750 0 0<br />

Dolker John Middleburgh 433801 62,000 AGED S 41804 0 0 36,300<br />

PO Box 885 Hse & Barns 132,000 SR STAR 41834 0 0 46,650<br />

N Blenheim, NY 12131 FRNT 2845.00 DPTH COUNTY TAXABLE VALUE 125,250<br />

ACRES 103.30 TOWN TAXABLE VALUE 132,000<br />

EAST-0508753 NRTH-1336244 SCHOOL TAXABLE VALUE 49,050<br />

DEED BOOK 533 PG-297<br />

FULL MARKET VALUE 165,000<br />

******************************************************************************************************* 161.-1-11 ******************<br />

Bear Ladder Rd 405J184009<br />

161.-1-11 312 Vac w/imprv COUNTY TAXABLE VALUE 4,600<br />

Dolker John Middleburgh 433801 1,200 TOWN TAXABLE VALUE 4,600<br />

PO Box 885 Old Barn-Storage 4,600 SCHOOL TAXABLE VALUE 4,600<br />

North Blenheim, NY 12131 FRNT 190.00 DPTH 75.00 AG001 Ag dist #1 .10 AC<br />

ACRES 0.10 .00 UN<br />

EAST-0511305 NRTH-1334824<br />

DEED BOOK 398 PG-118<br />

FULL MARKET VALUE 5,750<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 27<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 161.-1-17 ******************<br />

Bear Ladder Rd 405J101266<br />

161.-1-17 105 Vac farmland COUNTY TAXABLE VALUE 41,000<br />

Dolker John Middleburgh 433801 41,000 TOWN TAXABLE VALUE 41,000<br />

PO Box 885 Pastureland, Light Wood 41,000 SCHOOL TAXABLE VALUE 41,000<br />

North Blenheim, NY 12131 FRNT 1090.00 DPTH<br />

ACRES 74.70<br />

EAST-0509485 NRTH-1334341<br />

DEED BOOK 398 PG-126<br />

FULL MARKET VALUE 51,250<br />

******************************************************************************************************* 161.-1-27.311 **************<br />

Bear Ladder Rd Off 405J196002<br />

161.-1-27.311 322 Rural vac>10 COUNTY TAXABLE VALUE 21,000<br />

Dolker John Middleburgh 433801 21,000 TOWN TAXABLE VALUE 21,000<br />

PO Box 885 Upland Open & Wooded 21,000 SCHOOL TAXABLE VALUE 21,000<br />

N Blenheim, NY 12131 ACRES 36.20<br />

EAST-0508610 NRTH-1333298<br />

DEED BOOK 579 PG-215<br />

FULL MARKET VALUE 26,250<br />

******************************************************************************************************* 169.-3-23 ******************<br />

161 Ericson Ln 405J184001<br />

169.-3-23 260 Seasonal res COUNTY TAXABLE VALUE 95,000<br />

Donahue Steven A Jefferson 433601 16,200 TOWN TAXABLE VALUE 95,000<br />

Donahue Joann R 1 1/2 Story Cabin & Deck 95,000 SCHOOL TAXABLE VALUE 95,000<br />

307 S 10th St Storage Shed<br />

New Hyde Park, NY 11040 ACRES 9.57<br />

EAST-0478783 NRTH-1323510<br />

DEED BOOK 743 PG-142<br />

FULL MARKET VALUE 118,750<br />

******************************************************************************************************* 169.-3-22 ******************<br />

118 Ericson Ln 405J181006<br />

169.-3-22 270 Mfg housing RES STAR 41854 0 0 22,500<br />

Dorosky Matthew Donald Jefferson 433601 15,000 COUNTY TAXABLE VALUE 79,000<br />

Dorosky Kimberly Sue New Double Wide 79,000 TOWN TAXABLE VALUE 79,000<br />

118 Ericson Ln Deck SCHOOL TAXABLE VALUE 56,500<br />

Jefferson, NY 12093 FRNT 217.00 DPTH<br />

ACRES 5.01 BANK FARETS<br />

EAST-0480146 NRTH-1323286<br />

DEED BOOK 773 PG-36<br />

FULL MARKET VALUE 98,750<br />

******************************************************************************************************* 161.-1-29 ******************<br />

245 Cole Hollow Rd 405J190002<br />

161.-1-29 270 Mfg housing RES STAR 41854 0 0 22,500<br />

Downs John J Middleburgh 433801 6,400 COUNTY TAXABLE VALUE 28,000<br />

263 Cole Hollow Rd 14 X 70 New Mobile Home 28,000 TOWN TAXABLE VALUE 28,000<br />

West Fulton, NY 12194 FRNT 140.00 DPTH 140.00 SCHOOL TAXABLE VALUE 5,500<br />

ACRES 0.50<br />

EAST-0507938 NRTH-1336436<br />

DEED BOOK 586 PG-228<br />

FULL MARKET VALUE 35,000<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 28<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 149.-1-7 *******************<br />

263 Cole Hollow Rd 53 PCT OF VALUE USED FOR EXEMPTION PURPOSES 405J101052<br />

149.-1-7 240 Rural res WAR VET/C 41122 6,750 0 0<br />

Downs Maurice Middleburgh 433801 48,000 WAR VET/T 41123 0 8,268 0<br />

Downs Rhonda Older 2 Sty & Out Bldgs 104,000 AG LANDS 41730 22,108 22,108 22,108<br />

263 Cole Hollow Rd New Garage RES STAR 41854 0 0 22,500<br />

West Fulton, NY 12194 Also See Bk 550 Pg 113 COUNTY TAXABLE VALUE 75,142<br />

FRNT 300.00 DPTH TOWN TAXABLE VALUE 73,624<br />

MAY BE SUBJECT TO PAYMENT ACRES 83.80 SCHOOL TAXABLE VALUE 59,392<br />

UNDER AGDIST LAW TIL 2019 EAST-0506486 NRTH-1336920<br />

DEED BOOK 550 PG-109<br />

FULL MARKET VALUE 130,000<br />

******************************************************************************************************* 149.-1-8 *******************<br />

Cole Hollow Rd 405J101189<br />

149.-1-8 322 Rural vac>10 AG LANDS 41730 16,707 16,707 16,707<br />

Downs Maurice Middleburgh 433801 28,000 COUNTY TAXABLE VALUE 11,293<br />

Downs Rhonda Steep Gully, Wooded 28,000 TOWN TAXABLE VALUE 11,293<br />

263 Cole Hollow Rd FRNT 1020.00 DPTH SCHOOL TAXABLE VALUE 11,293<br />

West Fulton, NY 12194 ACRES 53.50<br />

EAST-0505118 NRTH-1337623<br />

MAY BE SUBJECT TO PAYMENT DEED BOOK 550 PG-111<br />

UNDER AGDIST LAW TIL 2019 FULL MARKET VALUE 35,000<br />

******************************************************************************************************* 161.-1-13 ******************<br />

516 Bear Ladder Rd 405J101220<br />

161.-1-13 260 Seasonal res COUNTY TAXABLE VALUE 27,000<br />

Downs Maurice Middleburgh 433801 8,800 TOWN TAXABLE VALUE 27,000<br />

263 Cole Hollow Rd FRNT 860.00 DPTH 27,000 SCHOOL TAXABLE VALUE 27,000<br />

West Fulton, NY 12194 ACRES 2.80 AG001 Ag dist #1 2.80 AC<br />

EAST-0511183 NRTH-1333625 .00 UN<br />

DEED BOOK 477 PG-170<br />

FULL MARKET VALUE 33,750<br />

******************************************************************************************************* 161.-1-27.2 ****************<br />

Bear Ladder Rd Off 405J196001<br />

161.-1-27.2 322 Rural vac>10 COUNTY TAXABLE VALUE 22,000<br />

Downs Maurice Middleburgh 433801 22,000 TOWN TAXABLE VALUE 22,000<br />

263 Cole Hollow Rd Upland Open & Wooded 22,000 SCHOOL TAXABLE VALUE 22,000<br />

West Fulton, NY 12194 ACRES 44.30<br />

EAST-0506578 NRTH-1335059<br />

DEED BOOK 681 PG-181<br />

FULL MARKET VALUE 27,500<br />

******************************************************************************************************* 161.-1-27.32 ***************<br />

Bear Ladder Rd Off 405J199015<br />

161.-1-27.32 322 Rural vac>10 COUNTY TAXABLE VALUE 4,000<br />

Downs Maurice Middleburgh 433801 4,000 TOWN TAXABLE VALUE 4,000<br />

263 Cole Hollow Rd ACRES 8.00 4,000 SCHOOL TAXABLE VALUE 4,000<br />

West Fulton, NY 12149 EAST-0508064 NRTH-1334343<br />

DEED BOOK 648 PG-198<br />

FULL MARKET VALUE 5,000<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 29<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 161.-1-27.312 **************<br />

Bear Ladder Rd 405J202008<br />

161.-1-27.312 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 30<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 161.-1-9 *******************<br />

590 Bear Ladder Rd 405J180005<br />

161.-1-9 210 1 Family Res AGED S 41804 0 0 16,750<br />

Easterbrook Cathy D Middleburgh 433801 10,000 SR STAR 41834 0 0 46,650<br />

Tinker Sharon 1 1/2 Sty Log Cabin 67,000 COUNTY TAXABLE VALUE 67,000<br />

590 Bear Ladder Rd FRNT 370.00 DPTH 200.00 TOWN TAXABLE VALUE 67,000<br />

West Fulton, NY 12194 ACRES 0.80 SCHOOL TAXABLE VALUE 3,600<br />

EAST-0511188 NRTH-1335576 AG001 Ag dist #1 .80 AC<br />

DEED BOOK 739 PG-62 .00 UN<br />

FULL MARKET VALUE 83,750<br />

******************************************************************************************************* 180.-1-11 ******************<br />

Cornell Rd 405J183026<br />

180.-1-11 321 Abandoned ag COUNTY TAXABLE VALUE 20,600<br />

Eklund Carl S Jefferson 433601 20,600 TOWN TAXABLE VALUE 20,600<br />

Eklund Deborah Mostly Flat & Open 20,600 SCHOOL TAXABLE VALUE 20,600<br />

377 Cornell Rd FRNT 56.88 DPTH<br />

Stamford, NY 12167 ACRES 34.40<br />

EAST-0485528 NRTH-1319753<br />

DEED BOOK 398 PG-876<br />

FULL MARKET VALUE 25,750<br />

******************************************************************************************************* 149.-1-4.1 *****************<br />

Cole Hollow Rd Off 405J181003<br />

149.-1-4.1 321 Abandoned ag COUNTY TAXABLE VALUE 24,000<br />

Engle Eugene E Middleburgh 433801 24,000 TOWN TAXABLE VALUE 24,000<br />

PO Box 62 Abandoned Ag 24,000 SCHOOL TAXABLE VALUE 24,000<br />

Fultonham, NY 12071 ACRES 21.00<br />

EAST-0508274 NRTH-1337610<br />

DEED BOOK 814 PG-139<br />

FULL MARKET VALUE 30,000<br />

******************************************************************************************************* 149.-1-4.2 *****************<br />

Cole Hollow Rd 405J199017<br />

149.-1-4.2 321 Abandoned ag COUNTY TAXABLE VALUE 8,000<br />

Engle Eugene E Middleburgh 433801 8,000 TOWN TAXABLE VALUE 8,000<br />

Fisher Kandi A Abandoned Ag & Out Bldgs 8,000 SCHOOL TAXABLE VALUE 8,000<br />

248 Cole Hollow Rd Pond<br />

West Fulton, NY 12194 FRNT 675.00 DPTH<br />

ACRES 7.00<br />

EAST-0507446 NRTH-1336978<br />

DEED BOOK 647 PG-272<br />

FULL MARKET VALUE 10,000<br />

******************************************************************************************************* 149.-1-5 *******************<br />

248 Cole Hollow Rd 405J182016<br />

149.-1-5 210 1 Family Res RES STAR 41854 0 0 22,500<br />

Engle Eugene E Middleburgh 433801 9,000 COUNTY TAXABLE VALUE 49,000<br />

Fisher Kandi A Small 1 Sty - Older 49,000 TOWN TAXABLE VALUE 49,000<br />

248 Cole Hollow Rd FRNT 675.00 DPTH SCHOOL TAXABLE VALUE 26,500<br />

West Fulton, NY 12194 ACRES 2.00<br />

EAST-0507890 NRTH-1336821<br />

DEED BOOK 617 PG-191<br />

FULL MARKET VALUE 61,250<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 31<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 191.-1-13.1 ****************<br />

Quarry Rd Off 405J190001<br />

191.-1-13.1 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 32<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 180.-1-4 *******************<br />

483 Cornell Rd 405J101062<br />

180.-1-4 210 1 Family Res WAR VET/CT 41121 6,150 6,150 0<br />

Ericson Richard Jefferson 433601 18,400 SR STAR 41834 0 0 41,000<br />

Ericson Kathleen 1 Sty Hse 41,000 COUNTY TAXABLE VALUE 34,850<br />

483 Cornell Rd FRNT 1200.00 DPTH TOWN TAXABLE VALUE 34,850<br />

Stamford, NY 12167 ACRES 18.30 SCHOOL TAXABLE VALUE 0<br />

EAST-0486512 NRTH-1319792<br />

DEED BOOK 344 PG-219<br />

FULL MARKET VALUE 51,250<br />

******************************************************************************************************* 170.-4-1.1 *****************<br />

498 Welch Rd 405J101055<br />

170.-4-1.1 240 Rural res COUNTY TAXABLE VALUE 165,000<br />

Ericson Richard C Jefferson 433601 80,000 TOWN TAXABLE VALUE 165,000<br />

Ericson George H Older Abandoned Farm 165,000 SCHOOL TAXABLE VALUE 165,000<br />

c/o John R Ericson Farm House<br />

528 Welch Rd FRNT 4680.00 DPTH<br />

Stamford, NY 12167 ACRES 127.20<br />

EAST-0493102 NRTH-1323151<br />

DEED BOOK 645 PG-97<br />

FULL MARKET VALUE 206,250<br />

******************************************************************************************************* 136.-2-5 *******************<br />

603 Eminence Rd 405J186010<br />

136.-2-5 210 1 Family Res WAR VET/C 41122 6,750 0 0<br />

Etzl Julius Coblskll-Richmn 432602 10,400 WAR VET/T 41123 0 9,000 0<br />

Etzl Martha Mud Room & Basement 70,000 RES STAR 41854 0 0 22,500<br />

603 Eminence Rd 12x64 Deck COUNTY TAXABLE VALUE 63,250<br />

Summit, NY 12175 FRNT 200.00 DPTH TOWN TAXABLE VALUE 61,000<br />

ACRES 3.78 SCHOOL TAXABLE VALUE 47,500<br />

EAST-0485383 NRTH-1343956<br />

DEED BOOK 418 PG-227<br />

FULL MARKET VALUE 87,500<br />

******************************************************************************************************* 159.-3-2 *******************<br />

827 North Rd 405J184052<br />

159.-3-2 270 Mfg housing COUNTY TAXABLE VALUE 42,800<br />

Ezzo John Jefferson 433601 41,600 TOWN TAXABLE VALUE 42,800<br />

Piersante Michael Older Trialer & Camp 42,800 SCHOOL TAXABLE VALUE 42,800<br />

Piersante Peter FRNT 490.00 DPTH<br />

2192 River Rd ACRES 60.33<br />

Schenectady, NY 12309 EAST-0484306 NRTH-1330134<br />

DEED BOOK 545 PG-182<br />

FULL MARKET VALUE 53,500<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 33<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Blenheim OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432000 UNIFORM PERCENT OF VALUE IS 080.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 169.-3-2 *******************<br />

Ethel Wood Rd Off 405J101063<br />

169.-3-2 910 Priv forest FORST LND 47460 52,000 52,000 52,000<br />

Faeth, Karl J. Irrevoc Trust Jefferson 433601 65,000 COUNTY TAXABLE VALUE 13,000<br />

Moulton Marie H Mostly Wooded 65,000 TOWN TAXABLE VALUE 13,000<br />

202 Porter Rd Karl Faeth sole beneficia SCHOOL TAXABLE VALUE 13,000<br />

Jefferson, NY 12093 ACRES 111.50<br />

EAST-0477939 NRTH-1326984<br />