Reconciliation of Tesco Bank Income Statement from Tesco PLC ...

Reconciliation of Tesco Bank Income Statement from Tesco PLC ...

Reconciliation of Tesco Bank Income Statement from Tesco PLC ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

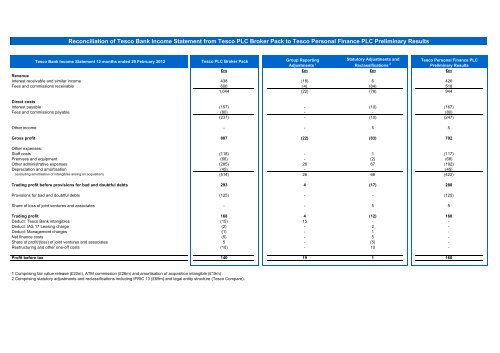

<strong>Reconciliation</strong> <strong>of</strong> <strong>Tesco</strong> <strong>Bank</strong> <strong>Income</strong> <strong>Statement</strong> <strong>from</strong> <strong>Tesco</strong> <strong>PLC</strong> Broker Pack to <strong>Tesco</strong> Personal Finance <strong>PLC</strong> Preliminary Results<br />

<strong>Tesco</strong> <strong>Bank</strong> <strong>Income</strong> <strong>Statement</strong> 12 months ended 29 February 2012<br />

Statutory Adjustments and<br />

Reclassifications 2<br />

<strong>Tesco</strong> <strong>PLC</strong> Broker Pack<br />

Group Reporting<br />

Adjustments<br />

<strong>Tesco</strong> Personal Finance <strong>PLC</strong><br />

Preliminary Results<br />

£m £m £m £m<br />

Revenue<br />

Interest receivable and similar income 438 (18) 6 426<br />

Fees and commissions receivable 606 (4) (84) 518<br />

1,044 (22) (78) 944<br />

1<br />

Direct costs<br />

Interest payable (157) - (10) (167)<br />

Fees and commissions payable (80) - - (80)<br />

(237) - (10) (247)<br />

Other income - - 5 5<br />

Gross pr<strong>of</strong>it 807 (22) (83) 702<br />

Other expenses: -<br />

Staff costs (118) - 1 (117)<br />

Premises and equipment (66) - (2) (68)<br />

Other administrative expenses (285) 26 67 (192)<br />

Depreciation and amortisation (45) - - (45)<br />

(excluding amortisation <strong>of</strong> intangibles arising on acquisition) (514) 26 66 (422)<br />

Trading pr<strong>of</strong>it before provisions for bad and doubtful debts 293 4 (17) 280<br />

Provisions for bad and doubtful debts (125) - - (125)<br />

Share <strong>of</strong> loss <strong>of</strong> joint ventures and associates - - 5 5<br />

Trading pr<strong>of</strong>it 168 4 (12) 160<br />

Deduct: <strong>Tesco</strong> <strong>Bank</strong> intangibles (15) 15 - -<br />

Deduct: IAS 17 Leasing charge (2) - 2 -<br />

Deduct: Management charges (1) - 1 -<br />

Net finance costs (5) - 5 -<br />

Share <strong>of</strong> pr<strong>of</strong>it/(loss) <strong>of</strong> joint ventures and associates 5 - (5) -<br />

Restructuring and other one-<strong>of</strong>f costs (10) - 10 -<br />

Pr<strong>of</strong>it before tax 140 19 1 160<br />

1 Comprising fair value release (£22m), ATM commission (£26m) and amortisation <strong>of</strong> acquisition intangible (£15m) .<br />

2 Comprising statutory adjustments and reclassifications including IFRIC 13 (£65m) and legal entity structure (<strong>Tesco</strong> Compare).

<strong>Reconciliation</strong> <strong>of</strong> <strong>Tesco</strong> <strong>Bank</strong> Balance Sheet <strong>from</strong> <strong>Tesco</strong> <strong>PLC</strong> Broker Pack to <strong>Tesco</strong> Personal Finance <strong>PLC</strong> Preliminary Results<br />

<strong>Tesco</strong> <strong>Bank</strong> Balance Sheet as at 29 February 2012<br />

Group Reporting<br />

Adjustments ¹<br />

Statutory Adjustments and<br />

Reclassifications<br />

Non-current assets<br />

£m £m £m £m<br />

Intangible assets 383 (45) (1) 337<br />

Property, plant and equipment 110 - - 110<br />

Investments in joint ventures and associates 72 - - 72<br />

Other investments 1,526 - 70 2,3<br />

1,596<br />

Loans and advances to customers 1,901 9 - 1,910<br />

Derivative financial instruments 18 - - 18<br />

Current assets<br />

4,010 (36) 69 4,043<br />

Loans and advances to customers 2,502 12 - 2,514<br />

Loans and advances to banks - - 93 2<br />

93<br />

Trade and other receivables 537 - (39) 2,3<br />

498<br />

Derivative financial instruments 1 - - 1<br />

Cash and cash equivalents 580 - (124) 2,5,6<br />

<strong>Tesco</strong> <strong>PLC</strong> Broker Pack<br />

<strong>Tesco</strong> Personal Finance <strong>PLC</strong><br />

Preliminary Results<br />

456<br />

3,620 12 (70) 3,562<br />

Current liabilities<br />

Trade and other payables (242) 28 (27) 4,5,6<br />

(241)<br />

Financial liabilities - -<br />

- Borrowings - - - -<br />

- Derivative financial instruments (8) - - (8)<br />

Deposits by banks (78) - - (78)<br />

Provisions (78) - - (78)<br />

Customer deposits (5,087) - (3) 6<br />

(5,090)<br />

(5,493) 28 (30) (5,495)<br />

Net current liabilities (1,873) 40 (100) (1,933)<br />

Non-current liabilities<br />

Financial liabilities<br />

- Borrowings (198) - (330) 4<br />

(528)<br />

- Derivative financial instruments (63) - - (63)<br />

Deferred tax liabilities (38) 6 3 (29)<br />

Customer Deposits (300) - - (300)<br />

Net assets 1,538 10 (358) 1,190<br />

1 Comprising acquisition intangible (£45m), fair value provision (£21m), ATM commission (£26m), other payables (£2m) and deferred tax (£6m)<br />

2 Cash and cash equivalents (£123m) are reported within other investments (£35m), loans and advances to banks (£93m), and other receivables (£(5m)) in the <strong>Tesco</strong> Personal Finance <strong>PLC</strong> Preliminary Results<br />

3 Loan to associate (£34m) is reported within investment securities in the <strong>Tesco</strong> Personal Finance <strong>PLC</strong> Preliminary Results<br />

4 Within the <strong>Tesco</strong> <strong>PLC</strong> Broker Pack the <strong>Tesco</strong> <strong>Bank</strong> balance sheet is presented excluding intra-group liabilities - other payables (£25m) and borrowings (£330m).<br />

5 Arises as a result <strong>of</strong> <strong>Tesco</strong> Compare not being consolidated as part <strong>of</strong> the <strong>Tesco</strong> Personal Finance <strong>PLC</strong> Preliminary Results<br />

6 Arises as a result <strong>of</strong> consolidation adjustments for the <strong>Tesco</strong> Personal Finance Group, not included as part <strong>of</strong> <strong>Tesco</strong> Personal Finance <strong>PLC</strong> Preliminary Results

<strong>Reconciliation</strong> <strong>of</strong> <strong>Tesco</strong> <strong>Bank</strong> Cashflow <strong>Statement</strong> <strong>from</strong> <strong>Tesco</strong> <strong>PLC</strong> Broker Pack to <strong>Tesco</strong> Personal Finance <strong>PLC</strong> Preliminary Results<br />

<strong>Tesco</strong> <strong>Bank</strong> Cashflow <strong>Statement</strong> 12 months ended 29 February 2012<br />

<strong>Tesco</strong> <strong>PLC</strong> Broker Pack<br />

Group Reporting<br />

Adjustments 1<br />

£m £m £m £m<br />

Pr<strong>of</strong>it before tax 140 19 1 160<br />

ATM commission 26 (26) - -<br />

Net finance costs 5 - (1) 4<br />

Share <strong>of</strong> post-tax pr<strong>of</strong>its <strong>of</strong> joint ventures and associates (5) - - (5)<br />

Operating pr<strong>of</strong>it 166 (7) - 159<br />

Depreciation and amortisation 60 (15) - 45<br />

Pr<strong>of</strong>it arising on sale <strong>of</strong> other investments (5) - - (5)<br />

Share-based payments 2 - 5 7<br />

<strong>Tesco</strong> <strong>Bank</strong> non-cash items included in pr<strong>of</strong>it before tax 166 22 5 193<br />

Cashflow <strong>from</strong> operations excluding working capital 389 - 10 399<br />

Decrease in working capital 241 - (11) 230<br />

Cash generated <strong>from</strong> operations 630 - (1) 629<br />

Interest paid (4) - 4 -<br />

Corporation tax paid (18) - - (18)<br />

Net cash generated <strong>from</strong> operating activities 608 - 3 611<br />

Purchase <strong>of</strong> property, plant and equipment, and intangible assets (166) - - (166)<br />

Net proceeds <strong>from</strong> sale <strong>of</strong> / (investments in) short-term investments (546) - - (546)<br />

Net cash used in investing activities (712) - - (712)<br />

Proceeds <strong>from</strong> issue <strong>of</strong> ordinary share capital 112 - - 112<br />

Dividends paid to equity owners (100) - (9) (109)<br />

Net repayment <strong>of</strong> borrowings (34) - 9 (25)<br />

Interest paid - - (4) (4)<br />

Net cash used in financing activities (22) - (4) (26)<br />

Net decrease in cash and cash equivalents (126) - (1) (127)<br />

Cash and cash equivalents at the beginning <strong>of</strong> the period 706 - - 706<br />

Cash and cash equivalents at the end <strong>of</strong> the period 580 - (1) 579<br />

1 Comprising ATM commission (£26m), amortisation <strong>of</strong> acquisition intangible (£15m) and fair value release (£22m).<br />

Statutory Adjustments and<br />

Reclassifications 2<br />

<strong>Tesco</strong> Personal Finance <strong>PLC</strong><br />

Preliminary Results<br />

2 Comprising statutory adjustments and reclassifications including cashflow presentational differences such as share based payment, interest paid and further detail on balance sheet movements and legal entity structure (<strong>Tesco</strong> Compare).