Mortgage Arrears- a brief guide to your options - Sefton Council

Mortgage Arrears- a brief guide to your options - Sefton Council

Mortgage Arrears- a brief guide to your options - Sefton Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Mortgage</strong> <strong>Arrears</strong>- a <strong>brief</strong> <strong>guide</strong> <strong>to</strong> <strong>your</strong> <strong>options</strong><br />

This leaflet is intended as a <strong>brief</strong> <strong>guide</strong> only not an exhaustive description of<br />

the full legal process. To obtain specific legal advice please contact the<br />

organisations listed at the bot<strong>to</strong>m of this leaflet.<br />

The following information given is on the basis of frequently asked questions<br />

and will hopefully assist you. Please refer <strong>to</strong> the organisations listed at the<br />

bot<strong>to</strong>m of this leaflet for additional advice.<br />

What is a mortgage? What are my rights? What are my duties?<br />

The mortgage company (the lender) has lent you money <strong>to</strong> either buy <strong>your</strong><br />

home and/or for additional borrowing and has secured this debt on <strong>your</strong> home<br />

(“a secured loan”).<br />

There are many different types of mortgages and the interest rates charged<br />

by the lender can also vary greatly.<br />

You are legally obliged <strong>to</strong> make the payments <strong>to</strong> the lender as part of the<br />

agreement you signed when accepting the loan. This obligation also applies<br />

when interest rates change and <strong>your</strong> monthly repayments change (increase or<br />

decrease).<br />

A mortgage or extra borrowing is a “secured loan”. This means that if you<br />

don’t make the payments as demanded the lender can take legal action <strong>to</strong><br />

take possession of <strong>your</strong> home, evict you and <strong>your</strong> family and sell <strong>your</strong> home<br />

<strong>to</strong> reclaim the debt you owe. This process is called “repossession”.<br />

What should I do if I am having difficulty paying my mortgage?<br />

Don’t panic! You should contact <strong>your</strong> lender and explain why you can’t pay or<br />

the difficulty you are having. You should always continue <strong>to</strong> make payments<br />

of whatever you can afford whether the lender agrees or not.<br />

Do lenders have <strong>to</strong> go <strong>to</strong> Court? Will they always repossess homes?<br />

The lenders will not apply <strong>to</strong> the court if the arrears are cleared or if you have<br />

made and kept up <strong>to</strong> date with an arrangement with them. Most reputable<br />

lenders will allow you some time <strong>to</strong> establish whether <strong>your</strong> payments are<br />

made as agreed. See below “What should I do about making an offer <strong>to</strong> repay my<br />

arrears?”<br />

Sef<strong>to</strong>n MBC Homelessness Services<br />

<strong>Mortgage</strong> <strong>Arrears</strong> version 2<br />

January 2008<br />

Version 2<br />

1

What is repossession?<br />

Repossession is a legal process that comprises a number of stages that, if<br />

followed <strong>to</strong> the full process, will result in you and <strong>your</strong> family being evicted<br />

from <strong>your</strong> home by the court and <strong>your</strong> home being sold <strong>to</strong> pay off the debts<br />

secured on <strong>your</strong> home. The property will often be sold at less than the market<br />

valuation as the lender only needs <strong>to</strong> get the price <strong>to</strong> pay off <strong>your</strong> debts and<br />

any costs he has incurred.<br />

Repossession is a legal process- how long will it take?<br />

The process normally begins when <strong>your</strong> lender sends you warning notices or<br />

letters telling you that you are in arrears. If you are unable <strong>to</strong> pay the arrears<br />

or come <strong>to</strong> a satisfac<strong>to</strong>ry agreement the lender will apply <strong>to</strong> the County Court.<br />

You will receive copies of all correspondence from the lender and the Court.<br />

It may be a few months before the Court can organise a date <strong>to</strong> hear the<br />

lenders application.<br />

If the Court arranges a hearing date you should attend- this will show the<br />

court that you take the proceedings seriously and that you want <strong>to</strong> prevent the<br />

repossession. You should always try <strong>to</strong> get legal representation from the CAB<br />

or a legally aided solici<strong>to</strong>r. You should also be prepared <strong>to</strong> make an offer of<br />

payments that will pay the monthly amount and something <strong>to</strong>wards the<br />

arrears.<br />

The judge can either give repossession <strong>to</strong> the lender or suspend proceedings<br />

if you make an arrangement.<br />

If the judge gives possession <strong>to</strong> the lender you can ask for a postponement so<br />

you can sell <strong>your</strong> home <strong>your</strong>self.<br />

Can I sell my property before repossession or before eviction?<br />

Yes- generally there is no legal reason why you shouldn’t sell <strong>your</strong> home. In<br />

some cases the Courts are prepared <strong>to</strong> allow postponement of possession or<br />

eviction <strong>to</strong> allow you time <strong>to</strong> sell <strong>your</strong> home. If you sell <strong>your</strong> home you may be<br />

able <strong>to</strong> achieve the best price rather than the lender selling for a lower<br />

amount. This is normally an option <strong>to</strong> be considered if you have equity in <strong>your</strong><br />

home. Equity means that the value of <strong>your</strong> home is greater than all <strong>your</strong><br />

outstanding secured loan(s). The amount of <strong>your</strong> equity also means that<br />

remortgage is possible- see below I have been <strong>to</strong>ld I can remortgage and avoid<br />

repossession- is this true?<br />

What should I do about making an offer <strong>to</strong> repay my arrears?<br />

You must make an offer that you can stick <strong>to</strong>- one you can afford <strong>to</strong> pay<br />

regularly now and in the future. To do so you should create a financial<br />

statement of all <strong>your</strong> income and expenditure (outgoings) that will show what<br />

you can afford <strong>to</strong> pay <strong>to</strong> the lender and that you are serious about repaying<br />

the debt. You should also look carefully at <strong>your</strong> outgoings <strong>to</strong> see if you can<br />

reduce them- how much you spend on various items and can you reduce<br />

them any further or s<strong>to</strong>p paying all <strong>to</strong>gether.<br />

Maximising <strong>your</strong> income may also help- e.g. are you receiving benefits or tax<br />

credits? Are they the right amount?<br />

Sef<strong>to</strong>n MBC Homelessness Services<br />

<strong>Mortgage</strong> <strong>Arrears</strong> version 2<br />

January 2008<br />

Version 2<br />

2

The Citizens Advice Bureau (as well as other debt advisors) can help with<br />

budgeting and claiming benefits- see their details at the bot<strong>to</strong>m of this leaflet.<br />

I have been <strong>to</strong>ld I can remortgage and avoid repossession- is this true?<br />

This procedure may assist some people in debt- it allows you <strong>to</strong> add <strong>your</strong><br />

mortgage debt <strong>to</strong> any other debts you may have (loans, credit cards etc) in<strong>to</strong><br />

a single repayable loan.<br />

You need <strong>to</strong> be extremely careful when considering remortgage as the<br />

amount of charges, interest rates and penalties are often extremely high. This<br />

may only be a short-term solution as the higher interest rates of some “less<br />

reputable” companies can actually make <strong>your</strong> longer-term financial situation<br />

worse. Higher rates are often charged because you may be seen as a “bad<br />

risk”.<br />

Please seek independent financial advice and make sure the remortgage is<br />

affordable now and in the future. Make sure you get a number of different<br />

quotes and consider all <strong>options</strong> before agreeing <strong>to</strong> and signing any<br />

documents.<br />

What can I do if I feel I was mis-sold my loan or it wasn’t properly<br />

explained <strong>to</strong> me?<br />

This is a common problem- often people are confused by the words used in<br />

mortgages for example legal jargon, different types of mortgages, interest<br />

rates, penalties, administration charges, equity.<br />

There are a number of organisations that can help you- the Citizens Advice<br />

Bureau or organisations such as the National Association <strong>Mortgage</strong> Victims.<br />

If I lose my job and claim benefits will I get any help?<br />

If you claim Income Support you may be entitled <strong>to</strong> get assistance against the<br />

“interest” part of <strong>your</strong> mortgage. Ordinarily this assistance is only available <strong>to</strong><br />

Income Support claimants who have been on the benefit for more than 39<br />

weeks. The amount of assistance may also be restricted based on the size of<br />

<strong>your</strong> mortgage. The Benefits Agency calculates interest payments based on<br />

an “average” interest rate rather than the rate you are being charged.<br />

If my home is repossessed what help is available?<br />

The <strong>Council</strong> has a duty <strong>to</strong> provide advice and assistance <strong>to</strong> all residents that<br />

are potentially homeless- this leaflet has been produced <strong>to</strong> give you a <strong>brief</strong><br />

<strong>guide</strong> of the legal process.<br />

If <strong>your</strong> home is repossessed and if you have children in full-time education<br />

and/or you or a member of <strong>your</strong> family is physically disabled and/or a member<br />

of <strong>your</strong> family is mentally ill the <strong>Council</strong> will/may provide you with temporary<br />

accommodation for a short period while we determine if the <strong>Council</strong> has any<br />

greater duty <strong>to</strong> you e.g. finding you alternative accommodation.<br />

Sef<strong>to</strong>n MBC Homelessness Services<br />

<strong>Mortgage</strong> <strong>Arrears</strong> version 2<br />

January 2008<br />

Version 2<br />

3

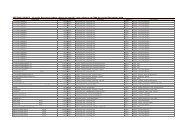

Organisations that may help you<br />

Homelessness and housing advice<br />

Sef<strong>to</strong>n <strong>Council</strong>’s Homeless Team<br />

Housing Advice Centre<br />

(Health and Social Care Direc<strong>to</strong>rate)<br />

Ground floor, Mer<strong>to</strong>n House<br />

Stanley Road<br />

Bootle<br />

L20 3UT<br />

Opening Hours: Monday <strong>to</strong> Thursday 10 am <strong>to</strong> 4 pm<br />

Friday 10 am <strong>to</strong> 3pm<br />

By Telephone: 0151 934 3541/3630/2686<br />

Fax: 0151 934 3910<br />

e-mail: homeless.team@sef<strong>to</strong>n.gov.uk<br />

Shelter<br />

www.shelter.org.uk<br />

0808 800 4444<br />

Citizens Advice Bureaux and CLS solici<strong>to</strong>rs as below<br />

Citizens Advice Bureaux in Sef<strong>to</strong>n and Liverpool area<br />

Bootle Crosby<br />

297 Knowsley Road Prince Street<br />

Bootle Waterloo<br />

0151 922 1114 0151 928 9702<br />

Formby Southport<br />

11 Duke Street 24 Wright Street<br />

Formby Southport<br />

01704 873009 01704 531456<br />

Liverpool Central CAB<br />

State House<br />

0870 1212032<br />

Sef<strong>to</strong>n MBC Homelessness Services<br />

<strong>Mortgage</strong> <strong>Arrears</strong> version 2<br />

January 2008<br />

Version 2<br />

4

Citizens Advice Bureaux at the County Court<br />

Liverpool County Court Southport County Court<br />

Liverpool Civil Courts Dukes House<br />

35 Vernon Street Southport<br />

Liverpool 01704 531541<br />

L2 2BX<br />

0151 296 2200<br />

Citizen Advice Centre<br />

Nationwide web-site www.citizensadvice.org.uk<br />

Community Legal Services (legal aided) solici<strong>to</strong>rs<br />

As well as the CABx contacts above there are a number of CLS funded<br />

solici<strong>to</strong>r firms in the Merseyside area. Please note- legal aid is “means<br />

tested” so you may not be entitled <strong>to</strong> free advice dependent on <strong>your</strong> income.<br />

CLS Direct<br />

0845 3454345<br />

James Murray & Co Solici<strong>to</strong>rs Jackson & Canter Solici<strong>to</strong>rs<br />

41 Mer<strong>to</strong>n Road 88 Church Street<br />

Bootle Liverpool<br />

0151 933 3333 0151 282 1700<br />

Fanshaw Porter & Hazlehurst Solici<strong>to</strong>rs<br />

11-12 Hamil<strong>to</strong>n Square<br />

Birkenhead<br />

0151 647 4051<br />

Sef<strong>to</strong>n MBC Homelessness Services<br />

<strong>Mortgage</strong> <strong>Arrears</strong> version 2<br />

January 2008<br />

Version 2<br />

5

Mis-sold mortgages or unfair terms<br />

Citizens Advice Bureau and solici<strong>to</strong>rs as above plus<br />

National Association of <strong>Mortgage</strong> Victims<br />

01889 507394<br />

www.namv.org.uk<br />

Financial Services Authority (FSA)<br />

25 The North Colonnade<br />

London<br />

E14 5HS<br />

020 70661000<br />

0845 606 1234<br />

www.moneymadeclear.fsa.gov.uk<br />

Debt management<br />

Citizens Advice bureaux as above plus<br />

Debt Advice Trust<br />

Registered charity: 1095705<br />

0800 954 6259<br />

National Debtline<br />

0808 808 4000<br />

www.nationaldebtline.co.uk<br />

Consumer Credit Counselling Service<br />

0800 138 1111<br />

www.cccs.co.uk<br />

Sef<strong>to</strong>n MBC Homelessness Services<br />

<strong>Mortgage</strong> <strong>Arrears</strong> version 2<br />

January 2008<br />

Version 2<br />

6