Mozambique - Mining Journal

Mozambique - Mining Journal

Mozambique - Mining Journal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

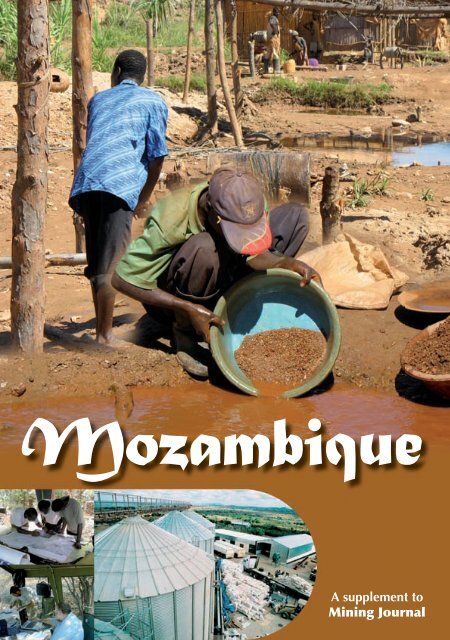

<strong>Mozambique</strong><br />

A supplement to<br />

<strong>Mining</strong> <strong>Journal</strong>

2<br />

INTRODUCTION<br />

Open to investment<br />

WELCOME to this supplement,<br />

which provides you with some<br />

information about the mining<br />

opportunities in <strong>Mozambique</strong>,<br />

and the companies that are<br />

active in the country. The government of <strong>Mozambique</strong><br />

welcomes investment by mining companies.<br />

Our country is well endowed with mineral<br />

resources, and has a favourable political and legal<br />

environment, based on the <strong>Mining</strong> Law of 2002. This<br />

provides an adequate framework for the successful<br />

development of projects in our country.<br />

The <strong>Mining</strong> Cadastre under our Ministry is well<br />

documented and easily accessible to any interested<br />

party. The mining titles are granted on the basis of<br />

‘fi rst come, fi rst served’.<br />

Among other resources there is confi rmed<br />

prospective mining potential for gold, iron, niobium<br />

and tantalum, limestone, clays, gemstones, heavy<br />

minerals sands, coal and uranium. Vale (from Brazil),<br />

Riverdale (Australia), Kenmare (Ireland) and BHP<br />

Billiton (Australia-UK) are among the companies active<br />

Beira<br />

Inhambane<br />

Maputo<br />

0 100 200 300km<br />

July 2008 <strong>Mining</strong> <strong>Journal</strong> special publication <strong>Mozambique</strong><br />

in exploration and develop-ment projects. As the<br />

government, our role is to facilitate, regulate and<br />

monitor these mining activities.<br />

Minister of Mineral Resources, Esperança Laurinda Francisco<br />

Nhiuane Bias<br />

Quelimane<br />

Pemba<br />

CONTACTS<br />

Ministry of Mineral Resources,<br />

Minister of Mineral Resources,<br />

Esperança Laurinda Francisco Nhiuane Bias,<br />

34, Avenida Fernão de Magalhães - 1st Floor,<br />

PO Box 2904,<br />

Maputo, Moçambique<br />

Tel: +258 1 42 96 15 /42 56 82/ 32 0618<br />

Fax: +258 1 42 56 80 /42 93 53<br />

Direcção Nacional de Geologia<br />

National Director, Elias Xavier Felix Daudi<br />

380, Praça 25 de Junho - 4th Floor,<br />

PO Box 2904,<br />

Maputo, Moçambique<br />

Fax: +258 21 429216<br />

E-mail: geologia@tvcabo.co.mz<br />

Direcção Nacional de Minas<br />

National Director, Fatima Jussub Momade<br />

380, Praça 25 de Junho - R/C,<br />

PO Box 2904,<br />

Maputo, Moçambique<br />

Tel: +258 21 32 00 24 /32 59 34<br />

Fax: +258 21 42 71 21<br />

E-mail: fmomade@tvcabo.co.mz<br />

Websites: www.mirem.gov.mz<br />

www.dng.gov.mz<br />

www.inp.gov.mz<br />

CONTENTS<br />

Introduction 2-3<br />

Geology and mineral potential 4<br />

Country overview 5<br />

Exploration 6-7<br />

Profi les:<br />

ABM Resources NL 8<br />

Baobab Resources plc 9<br />

Central American <strong>Mining</strong> &<br />

Exploration Co 10<br />

Riversdale <strong>Mining</strong> Ltd 11<br />

Published in July 2008 by:<br />

<strong>Mining</strong> Communications Ltd<br />

Albert House, 1 Singer Street<br />

London EC2A 4BQ<br />

Tel: +44 (0)20 7216 6060 Fax: +44 (0)20 7216 6050<br />

E-mail: editorial@mining-journal.com<br />

Website: www.mining-journal.com<br />

Supplement editor: Chris Hinde<br />

Design and production: Tim Peters, Sharon Evans<br />

Printed by Stephens & George, Merthyr Tydfi l, UK<br />

© <strong>Mining</strong> Communications Ltd 2008

Developing a<br />

corner of Africa<br />

Although it has suffered from years of strife, and<br />

many of the population are below the poverty<br />

line, there are now signs of economic recovery in<br />

<strong>Mozambique</strong>, with mining at the forefront<br />

LOCATED in southeastern Africa,<br />

Portuguese-speaking <strong>Mozambique</strong> has a<br />

strategically-important 2,500km coastline<br />

on the Indian Ocean, with a population of<br />

over 21 million and total area of<br />

801,600km 2 . The capital city is Maputo, with the other<br />

major towns being Beira and Nampula, and the ports<br />

of Quelimane and Nacala.<br />

<strong>Mozambique</strong> is bound by the Indian Ocean to the<br />

east, Swaziland to the south, South Africa to the<br />

southwest, Zimbabwe to the west, Zambia and Malawi<br />

to the northwest, and Tanzania to the north.<br />

The country has three lakes (Niassa or Malawi,<br />

Chiuta and Shirwa), all in the north, and is drained by<br />

fi ve principal rivers and several smaller ones. The<br />

largest and most important river is the Zambezi,<br />

which divides <strong>Mozambique</strong> into two topographical<br />

regions. To the north the narrow coastline becomes<br />

hilly inland, with a low plateau, and further west to<br />

rugged highlands (which include the Niassa, Namuli or<br />

Shire, Angonia and Tete highlands) and the Makonde<br />

plateau. To the south of the Zambezi the lowlands are<br />

broader, with the Mashonaland plateau and Lebomo<br />

mountains located in the deep south.<br />

<strong>Mozambique</strong> has a tropical climate with two<br />

seasons: a wet season from October to March, and a<br />

dry season from April to September. Climatic<br />

conditions vary however, depending on the altitude.<br />

Rainfall is heavy along the coast and decreases in the<br />

north and south. Annual precipitation varies from<br />

500-900mm, depending on the region, with an average<br />

of 590mm. Average temperature in Maputo is 13-24°C<br />

in July to 22-31°C in February.<br />

IMPROVING ECONOMY<br />

At independence in 1975, <strong>Mozambique</strong> was one of<br />

the world’s poorest countries. Socialist mismanagement<br />

and a brutal civil war from 1977-92 exacerbated<br />

the situation. In 1987, the government embarked on a<br />

series of macroeconomic reforms designed to<br />

stabilise the economy.<br />

These steps, combined with donor assistance and<br />

with political stability since the multi-party elections<br />

in 1994, have led to dramatic improvements in the<br />

country’s growth rate. Infl ation was reduced to single<br />

digits during the late 1990s and, although it returned<br />

to double digits in 2000-06, infl ation slowed to 8% last<br />

year, while GDP growth reached 7.5%.<br />

Fiscal reforms, including the introduction of a<br />

value-added tax and reform of the customs service,<br />

have improved the government’s revenue-collection<br />

abilities. In spite of these gains, <strong>Mozambique</strong> remains<br />

dependent upon foreign assistance for much of its<br />

annual budget, and the majority of the population<br />

remains below the poverty line.<br />

Subsistence agriculture continues to employ the<br />

vast majority of the country’s workforce. Because of<br />

this, a substantial trade imbalance persists, although<br />

the opening of the Mozal aluminium smelter, the<br />

country’s largest foreign investment project to date,<br />

has increased export earnings.<br />

At the end of 2007, and after years of negotiations,<br />

the government took over Portugal’s majority share<br />

of the Cahora Bassa hydroelectricity company; a dam<br />

that was not transferred to <strong>Mozambique</strong> at<br />

independence because of the ensuing civil war and<br />

unpaid debts.<br />

<strong>Mozambique</strong>’s once substantial foreign debt has<br />

been reduced through forgiveness and rescheduling<br />

under IMF initiatives. Debt is now described by the<br />

World Bank as being at a “manageable level”.<br />

MINING’S CONTRIBUTION<br />

Although <strong>Mozambique</strong> has an agriculturally-based<br />

economy it has suffi cient other natural resources to<br />

sustain development of the forestry, fi shing and mining<br />

INTRODUCTION<br />

industries. It is in an ideal trading location, particularly<br />

because of its proximity to South Africa, but<br />

development has been slow because of the civil war<br />

that destroyed the transport system and other<br />

infrastructure.<br />

The country is not an historically important<br />

producer of minerals, and the chaos and confl ict that<br />

followed the Portuguese departure in 1974 is only<br />

now being reversed. However, <strong>Mozambique</strong>’s<br />

geographical position has made it an attractive<br />

location to set up mineral-processing plants for<br />

markets inland, and the country could be about to<br />

enter a period of signifi cant growth in the mining<br />

sector.<br />

Indeed, the country is developing a true mining<br />

industry, with Kenmare Resources plc having brought<br />

the US$450 million Moma mineral-sands mine (in the<br />

northern province of Nampula) into production in<br />

May 2007, with the fi rst shipment of ilmenite last<br />

December.<br />

BHP Billiton owns the even larger Corridor Sands<br />

titanium-slag project, although full production is not<br />

envisaged until 2015. <strong>Mozambique</strong>’s other major<br />

resource is coal in the Zambesi Valley, which is<br />

thought to contain over 2,000Mt, much of this being<br />

of coking quality. Brazil’s Companhia Vale do Rio Doce<br />

(Vale) has acquired the centrepiece property at<br />

Moatize.<br />

In May last year, <strong>Mozambique</strong> proposed changes<br />

to its mining and oil sector taxes, setting separate<br />

rates for mining activities, production and concession<br />

areas. <strong>Mining</strong> production tax rates would be 10%<br />

of the value of diamonds and precious metals, 6%<br />

of semi-precious stones, 5% of base-metals and<br />

3% of coal and other minerals. A bill revising<br />

fi nancial incentives for mining activities was also<br />

introduced.<br />

After many years of faltering existence, <strong>Mozambique</strong>’s<br />

mining sector may fi nally be on the cusp of<br />

change.<br />

PROVINCES<br />

Cabo Delgado<br />

Gaza<br />

Inhambane<br />

Manica<br />

Maputo (city)<br />

Maputo<br />

Nampula<br />

Niassa<br />

Sofala<br />

Tete<br />

Zambezia<br />

July 2008 <strong>Mining</strong> <strong>Journal</strong> special publication <strong>Mozambique</strong> 3

4<br />

GEOLOGY AND MINERAL POTENTIAL<br />

Prospective terrain<br />

AIRBORNE GEOPHYSICS<br />

■ A regional airborne geophysical survey was<br />

successful completed (areas A and B of<br />

26,292km 2 and C of 141,897km 2 )<br />

■ High-density airborne geophysical survey was<br />

successful completed (blocks 1 to 6, covering<br />

136,218km 2 )<br />

■ Geophysical data is stored on a Geosoft DAP<br />

Server, which can be accessed through the<br />

MIS.<br />

July 2008 <strong>Mining</strong> <strong>Journal</strong> special publication <strong>Mozambique</strong><br />

MOZAMBIQUE has a highly<br />

prospective terrain for the<br />

discovery of metals and minerals.<br />

The country is covered by<br />

Precambrian and Phanerozoic<br />

terrains. The former contains occurrences of<br />

tantalum-niobium, rare earths, gemstones (related to<br />

pegmatites), greenstone-hosted gold, banded iron<br />

formations and graphite. The mineral potential of the<br />

Phanerozoic cover, by contrast, centres on clays, sands,<br />

refractory minerals, heavy minerals, coal and natural<br />

gas. Alluvial diamonds may also occur.<br />

The Precambrian terrains include igneous and<br />

metamorphic rocks of Archaean to Upper Proterozoic<br />

age. In general these older rocks underlie the<br />

northern and western parts of the country, and can<br />

be divided into three large structural units: Archaean<br />

and Paleo-Meso Proterozoic terrains that outcrop<br />

near the Zimbabwe border; and rocks of the<br />

Katanguian orogeny.<br />

The greenstone-hosted gold deposits form a major<br />

target for the application of modern exploration<br />

techniques. The Archaean Manica greenstone belt,<br />

which extends from western <strong>Mozambique</strong> into<br />

Zimbabwe, has hosted gold production on both sides<br />

of the border, yet knowledge of the fundamental<br />

controls to mineralisation remains largely incomplete.<br />

Similarly, the Tete Complex in north-western<br />

<strong>Mozambique</strong> offers untested potential for platinumgroup<br />

metals, and in 2006-07 there were reports of<br />

a major fi nd of a mineralised ultra-mafi c intrusive.<br />

In addition, old uranium deposits there have been<br />

re-examined, and airborne radiometry has picked up<br />

some interesting<br />

anomalies.<br />

“Investment in E&D<br />

reached US$220 million<br />

in 2007, compared<br />

with only US$33 million<br />

in 2004”<br />

1 2 0 0<br />

1 0 0 0<br />

8 0 0<br />

6 0 0<br />

4 0 0<br />

2 0 0<br />

0<br />

E&D INVESTMENT<br />

This prospective environment, and the increased<br />

political stability, has led to a sharp increase in<br />

exploration during the past few years. Investment in<br />

exploration and development reached an estimated<br />

US$220 million in 2007, compared with only<br />

US$33 million in 2004.<br />

Airborne geophysical work (see box on left) has<br />

included general surveys of three regions and highdensity<br />

surveys of six blocks.<br />

The government has assisted this effort by commissioning<br />

new geological maps (at scales of 1:250,00<br />

and 1:50,000). These are available in hard copy, PDF<br />

and ArcGIS formats, and include<br />

data on magnetic and radiometric<br />

surveys.<br />

Geochemical maps of the central<br />

area (Gondola and Nhamatanda) are<br />

also available, as are reports on<br />

industrial minerals (for Maputo,<br />

Inhambane, Manica, Tete and Cabo<br />

Delgado provinces).<br />

RESULTS - EVOLUTION OF MINING REGISTER<br />

2000 2001 2002 2003 2004 2005 2006<br />

Valid licenses New Requests Time of Issue Days

Political environment FAST FACTS<br />

MOZAMBIQUE is divided into ten<br />

provinces (as illustrated on p3),<br />

with the capital city also having<br />

provincial status. These provinces<br />

are subdivided into a total of 129<br />

districts, which are further divided into 405<br />

administrative posts and then into ‘localities’.<br />

The political situation in <strong>Mozambique</strong> has stabilised.<br />

The opposition Renamo party has tended to<br />

dominate the north (which has most of the mineral<br />

resources), and the governing Frelimo party (with<br />

whom Renamo fought a bitter civil war until 1992)<br />

has its principal support in the south of the country.<br />

Fortunately, there has been no repetition of the<br />

violent clashes of 2005 that led to about 50 deaths.<br />

There was, however, an explosion in the army’s<br />

principal arsenal in Maputo in March 2006 that<br />

resulted in over 100 deaths and 500 injuries. Political<br />

tension fl ared up, with accusations of Renamo<br />

sabotage, to the point where South Africa Airways<br />

cancelled fl ights to Maputo, citing “the political<br />

situation”. It was made clear by an independent<br />

investigation immediately afterwards that the cause<br />

was poor maintenance and the situation was<br />

successfully defused.<br />

The Frelimo government is the inheritor of the<br />

disastrous socialism of the 1980s and still clings to<br />

populist aspects of this policy. Land was nationalised<br />

immediately after Mozambican independence in 1975,<br />

and none of the constitutional changes since that date<br />

have changed the legal position that land cannot be<br />

bought and sold.<br />

POLITICAL SYSTEM<br />

<strong>Mozambique</strong> is a multi-party democracy under the<br />

1990 constitution. The executive branch comprises a<br />

president, prime minister and council of ministers,<br />

with a national assembly and 33 municipal assemblies.<br />

In February 2005, Armando Guebuza (from the<br />

ruling Frelimo party) succeeded <strong>Mozambique</strong>’s longtime<br />

leader, Joaquim Chissano (who had became<br />

president in 1986 after the death of founding<br />

president Samora Machel). Although Renamo disputed<br />

MOZAL’S POWER<br />

BHP Billiton, with 47% ownership, is operator of the<br />

Mozal primary aluminium smelter located near<br />

Maputo. The other partners are Mitsubishi Corp<br />

with 25%, Industrial Development Corp of South<br />

Africa Ltd (24%) and the <strong>Mozambique</strong> government<br />

(4%).<br />

Phase I of the project was completed in the<br />

record time of 31 months, from project go-ahead in<br />

May 1998 to full commissioning in December 2000,<br />

six months ahead of schedule and US$100 million<br />

below the budget of US$1.2 billion.<br />

Phase II, a doubling of capacity by constructing a<br />

second potline with a capacity of 253,000t/y, was<br />

completed in 26 months, from go-ahead in June<br />

2001 to full commissioning of all 288 pots in August<br />

2003, seven months ahead of schedule and some<br />

US$195 million under the budget of US$860 million.<br />

This expansion was offi cially opened in October 2003.<br />

the outcome, international monitors concluded that<br />

the irregularities were “probably not suffi cient” to<br />

have changed the outcome.<br />

Mr Guebuza, a wealthy businessman, said he would<br />

continue the economic reforms started by his<br />

predecessor. On taking offi ce he promised to fi ght<br />

corruption, bureaucracy and poverty.<br />

The fi rst local elections in <strong>Mozambique</strong> were held<br />

in 1998, after some delays, but these were boycotted<br />

by Renamo, citing fl aws in the registration process.<br />

Working through the National Assembly, the<br />

electoral law was rewritten and passed by consensus<br />

in December 1998. Financed largely by international<br />

donors, a very successful voter registration was<br />

conducted in late 1999, providing voter registration<br />

cards to 85% of the seven million potential electorate.<br />

The second local elections, involving some<br />

2.4 million registered voters, took place in November<br />

2003. This was the fi rst time that the main parties had<br />

Mozal has amongst the lowest aluminium<br />

smelting costs in the world, and BHPB is looking for<br />

a further expansion at the facility.<br />

This will depend, however, on securing further<br />

secure power capacity in the region, and BHPB has<br />

been talking to oil and chemical group Sasol<br />

regarding using natural gas from the latter’s<br />

<strong>Mozambique</strong> gas pipeline.<br />

In the meantime, <strong>Mozambique</strong>’s production and<br />

export of aluminium will be lower than expected in<br />

2008, due to the electricity shortages earlier this<br />

year. Raitt Marshall, Mozal’s managing director, said<br />

at the end of January that the company had<br />

received instructions to reduce its electricity<br />

consumption by 10% (normal consumption at the<br />

smelter is around 950MW, which makes Mozal<br />

by far the largest consumer of electricity in<br />

<strong>Mozambique</strong>).<br />

COUNTRY OVERVIEW<br />

Offi cial language - Portuguese<br />

Currency - Metical<br />

Time zone - GMT+2<br />

Dialling code - 258<br />

Entry restrictions - Visa required<br />

participated without signifi cant boycotts. With a 24%<br />

turnout, Frelimo won 28 mayoral positions and the<br />

majority in 29 municipal assemblies, while Renamo<br />

won fi ve mayoral positions and the majority in four<br />

municipal assemblies. In May 2004 the government<br />

approved a new general-election law that contained<br />

innovations based on the experience of the 2003<br />

municipal elections. Presidential and National<br />

Assembly elections took place on December 2004,<br />

and Frelimo candidate Armando Guebuza won with<br />

64% of the popular vote.<br />

This power comes from Motraco, a company<br />

formed by the South African, Mozambican and<br />

Swazi electricity companies (Eskom, EDM and SEB,<br />

respectively), but Motraco draws its power from<br />

Eskom. However, because of the chronic underinvestment<br />

in new plant in South Africa, Eskom is no<br />

longer able to meet the demand from all its clients.<br />

To achieve the required 10% cut in January, Mozal<br />

was obliged to switch off 47 of its 500 pots.<br />

Subsequent negotiations with Eskom has led to a<br />

concentration of pot closures in the oldest smelter<br />

(South Africa’s Bayside plant), so that more power<br />

could be spared for the more modern smelters at<br />

Hillside and Mozal. Nevertheless, the <strong>Mozambique</strong><br />

plant is braced for further disruption, and Mr<br />

Marshall confi rmed that the company has been told<br />

by Eskom that it will be fi ve years before the power<br />

supplies are normalised.<br />

July 2008 <strong>Mining</strong> <strong>Journal</strong> special publication <strong>Mozambique</strong> 5

6<br />

EXPLORATION<br />

<strong>Mining</strong> potential<br />

THERE are only two major operating<br />

mines in the country at the moment:<br />

the Marropino tantalum operation and<br />

the Moma heavy-minerals operation.<br />

Marropino, which has been in<br />

production since 2003, is operated by Noventa Ltd.<br />

This company raised £8 million in March 2007 after<br />

placing 4.6 million shares at £1.75 each in a listing on<br />

London’s AIM. At that time, Noventa said that it aimed<br />

to become one of the world’s largest and lowest-cost<br />

suppliers of tantalum, and that it already had longterm<br />

offtake agreements over a signifi cant proportion<br />

of the tantalum production from Marropino, as well as<br />

run-of-mine morganite (pink beryl) production.<br />

Noventa was expected to produce around<br />

300,000lb of tantalum from Marropino in 2007 at an<br />

average cash cost of under US$27/lb (the mine was<br />

developed at a cost of US$15 million) and to treble<br />

output to more than 900,000lb within two years. This<br />

would make the company the world’s second-largest<br />

producer, accounting for about 15% of global market<br />

share.<br />

The Marropino operation is ramping up to full<br />

production of 440,000-550,000t/y and the deposit<br />

contains suffi cient reserves to support this level for<br />

seven years. The balance of the forecast production<br />

increase would come from the company’s Morrua<br />

operation. One of 12 licences in total, Morrua is due<br />

to come on stream in 2009, producing 350,000lb/y of<br />

tantalum over a ten-year mine life.<br />

Wholly-owned by London-listed Kenmare<br />

Resources plc, the Moma mine entered production at<br />

the end of April 2007. The US$460 million heavyminerals<br />

mine is located on the coast of the northern<br />

province of Nampula.<br />

Development of this project took nearly a decade,<br />

but it is set to be the world’s third-largest, single-mine<br />

titanium-dioxide producer with an annual ilmenite<br />

concentrate output of about 1.2Mt. Sales will be well<br />

over US$100 million annually.<br />

Kenmare made its fi rst shipment of ilmenite from<br />

Moma in December 2007. Charles Carvill, Kenmare’s<br />

chairman, said the shipment (23,000t) was “the big<br />

step which we have all been waiting for”, describing<br />

the event as a “major milestone” for the company.<br />

The Moma project has suffered a series of delays in<br />

achieving production and shipment, with forecasts fi ve<br />

years ago suggesting initial production as early as the<br />

second half of 2006. The mine is designed to produce<br />

800,000t/y of ilmenite, 56,000t/y of zircon and<br />

21,000t/y of rutile.<br />

MINES UNDER DEVELOPMENT<br />

There is considerable exploration and development<br />

activity in <strong>Mozambique</strong>. One of the most active of<br />

these companies is ArcelorMittal. The world’s largest<br />

steel company signed a memorandum of co-operation<br />

in November 2007 with the government to develop<br />

the country’s steel industry, as well as to invest in<br />

iron-ore and coal mining. The company said that<br />

<strong>Mozambique</strong> would be a “strategic location to extend<br />

the company’s footprint in Africa”. In return, the<br />

<strong>Mozambique</strong> Ministry of Industry and Commerce said<br />

ArcelorMittal was a “role model for responsible<br />

development”, and that the ministry fully supported<br />

ArcelorMittal’s developments in <strong>Mozambique</strong>.<br />

July 2008 <strong>Mining</strong> <strong>Journal</strong> special publication <strong>Mozambique</strong><br />

In addition to the memorandum, ArcelorMittal<br />

signed a joint-venture agreement with <strong>Mozambique</strong>based<br />

Black Gold <strong>Mining</strong> Ltd to earn a 35% interest in<br />

the latter’s coal projects in the country. Under the<br />

arrangement, ArcelorMittal agreed to pay<br />

US$2.5 million for the initial interest and to earn a<br />

majority share by paying a further US$2.5 million, and<br />

confi rming proven and probable coking-coal reserves<br />

on the properties.<br />

Another signifi cant player in <strong>Mozambique</strong> is Brazil’s<br />

Cia Vale do Rio Doce, which in a partnership in<br />

November 2004 with American Metals and Coal<br />

International (Vale: AMCI 95:5), bid US$122 million to<br />

win a tender to develop the Moatize coal deposit in<br />

the central province of Tete (north of the town of the<br />

same name that straddles the Zambesi river). The<br />

government was advised in the tender process by<br />

International Finance Corp, the private-sector arm of<br />

the World Bank. The resource at Moatize is believed<br />

to be well over 2,000Mt, much of it coking coal.<br />

The US$1.4 billion Moatize mine will commence<br />

operations in 2011, with production rising to an<br />

eventual 21Mt/y, which will be washed to produce<br />

about 14Mt/y of export-quality coal. The approximately<br />

7Mt/y of washery rejects would be used as a<br />

power-station feedstock, suggesting a unit capable of<br />

generating over 2,000MW.<br />

This scheme will be dependent on the reconstruction<br />

of the railway from Moatize to Beira, which is<br />

860km long and was comprehensively sabotaged by<br />

Renamo, including the destruction of the kilometrelong<br />

bridge over the Zambezi. In August 2007,<br />

<strong>Mozambique</strong> announced plans to spend<br />

US$200 million on rebuilding the railway. The<br />

estimated total cost of rebuilding the railway is now<br />

US$375 million, with a scheduled completion date of<br />

mid-2009.<br />

Vale’s studies at Moatzie began in 2004, and after<br />

two years (in November 2006) the company<br />

presented the technical and fi nancial feasibility reports<br />

to the government. This was a major investigation by<br />

any standard: according to a Brazilian media story<br />

these studies contained 22,500 pages and 500<br />

specialists were involved in their compilation. (Vale<br />

has also invested US$6.5 million in several social<br />

programmes in Tete and Moatize.)<br />

One reason for the scale of the study is that Vale<br />

hopes to combine the project with a new primary aluminium<br />

smelter with an annual capacity of more than<br />

500,000t. The project would integrate with its<br />

Aluminio Brasileiro SA (Albras) operations and use<br />

alumina shipped from Brazil (a country that is<br />

attracted by the cheap electric power that the<br />

Moatize project would generate because of Brazil’s<br />

limited coal reserves).<br />

However, <strong>Mozambique</strong> is currently short of<br />

electricity and construction of the third stage of the<br />

Mozal aluminium plant has been delayed because of<br />

this. As a consequence, in addition to Vale’s powerstation<br />

proposals, the government is currently seeking<br />

investment for new hydroelectric schemes. Of these<br />

the largest is the projected Mepanda Nkua dam, which<br />

would be located on the Zambezi river some 70km<br />

downstream from the existing dam at Cahora Bassa.<br />

This could generate 1,300MW and Chinese interests<br />

are reported to be studying this option.<br />

In October 2007, Vale gave details of its fi ve-year,<br />

US$59 billion global investment plan, which is nearly<br />

three times more than its previous fi ve-year plan,<br />

which spent US$18 billion in 2003-2007. The<br />

programme includes funding for 27 major projects in<br />

nine nations. The new investment budget includes<br />

US$390 million on coal, with most of this being devoted<br />

to Moatize.<br />

OTHER COAL PLAYS<br />

Sydney-based Riversdale <strong>Mining</strong> Ltd has emerged as a<br />

leading company in <strong>Mozambique</strong>’s prospective coal<br />

region. This follows the acquisition of extensive new<br />

properties, including 16 tenements (covering an area<br />

of 203,460ha) in the Lower Zambezi Coal Basin<br />

(acquired in October 2006) and seven tenements<br />

(covering an area of 86,620ha) in <strong>Mozambique</strong>’s Tete<br />

province (acquired August 2007). The tenements are<br />

contiguous with properties already held by Riversdale<br />

and those of Vale.<br />

The combined tenement size now held by<br />

Riversdale is in excess of 290,000ha and makes the<br />

company the largest tenement holder in the Tete-<br />

Moatize area.<br />

During November 2007, Riversdale announced a<br />

major coal resource in its <strong>Mozambique</strong> coal project.<br />

This follows several months of exploration and drilling<br />

at what the company describes as its “highly<br />

prospective” Benga licence in the Moatize district of<br />

<strong>Mozambique</strong>.<br />

Based on the drilling results undertaken by<br />

Riversdale, the total inferred coal resource is<br />

estimated at 1,940Mt (in accordance with JORC). Of<br />

this, a total of 1,070Mt is considered to have the<br />

potential to be extracted by open-cut methods.<br />

According to the initial wash-analysis results, the<br />

potential coal products, after benefi ciation, that could<br />

CORRIDOR SANDS<br />

Development of the (Limpopo) Corridor Sands<br />

titanium-slag project was delayed by new owners<br />

BHP Billiton Ltd (following its acquisition of WMC<br />

Resources). This project, located at Chibuto,<br />

180km north of the capital of Maputo, originally<br />

encompassed a port, roads and power lines.<br />

However, BHPB announced early last year that it<br />

was re-examining the capital cost of the project.<br />

BHPB now plans a smaller operation that will<br />

relocate the smelters close to its Mozal<br />

aluminium operation, with only mining and<br />

concentration taking place at Chibuto. Even so,<br />

the company does not plan to move quickly: the<br />

reconfi gured project feasibility study will start<br />

shortly, with full production not envisaged until<br />

after 2015. The new feasibility study will consider<br />

an operation producing 250,000t/y of titanium<br />

slag at the mine site. This will be transported by<br />

truck and rail to the Mozal operation, where a<br />

smelter would be built close to the required<br />

infrastructure.<br />

In March 2007, Alberto Calderon, president of<br />

BHPB’s diamonds and speciality products group,<br />

said that despite reducing the scale of the<br />

minerals sands project, it could still cost up to<br />

US$2 billion. Mr Calderon said the fi rst stage<br />

could cost US$500-550 million.

e produced from Benga include a hard coking coal at<br />

10% ash, a secondary thermal coal product (consisting<br />

of an export thermal coal of approximately 20% ash)<br />

and/or a domestic thermal coal (about 35% ash).<br />

The company has also confi rmed two distinct areas<br />

in the northern part of the licence area as having<br />

open-pit potential. The Benga licence covers an area<br />

of 4,560ha and represents less than 2% of Riversdale’s<br />

total tenement areas.<br />

Riversdale signed a shareholders’ agreement with<br />

the global steel group Tata Steel Ltd in November 2007.<br />

Under the JV, Tata will acquire a 35% interest in the<br />

Benga and Tete exploration tenements, which cover an<br />

area of 24,960ha. A special purpose joint-venture<br />

vehicle has been established to develop the coal<br />

project. Consideration for the acquisition was<br />

A$100 million, for which Tata secures a key position in<br />

the joint venture, as well as a 40% share of the coking<br />

coal off-take and the option to participate on<br />

commercial terms above this level. Tata will also be<br />

strategically positioned to participate with Riversdale in<br />

any future opportunities on the surrounding<br />

tenements.<br />

In May 2008, Central African <strong>Mining</strong> & Exploration<br />

Co plc (CAMEC) announced that it has discovered a<br />

new coal deposit on its licence area in the Tete<br />

province. CAMEC said the new deposit had been<br />

identifi ed on the L871 concession and resource<br />

drilling was under way to establish a South Africa<br />

Mineral Resource Committee-compliant resource.<br />

Drilling and exploration mapping so far has<br />

indentifi ed eight coal zones on the concession, which<br />

extend to a depth of 250m and remain open-ended,<br />

CAMEC said. The company’s geologists have estimated<br />

that fi ve of these zones, numbers three to seven,<br />

could contain up to 868Mt of in-situ coal comprising<br />

estimated measured and indicated resources of 680Mt<br />

and estimated inferred resources of 188Mt. This has<br />

yet to be verifi ed by consultant SRK Consulting.<br />

Further drilling and geological modelling to increase<br />

and better understand the resource are under way.<br />

Other recent coal-based activity in the country has<br />

included the announcement in September 2007 that<br />

Mumbai-based Gremach Infrastructure Equipments<br />

Projects Ltd had taken a 75% stake in 11 <strong>Mozambique</strong><br />

coal mines.<br />

In February 2008, Global Steel Holdings Ltd was<br />

awarded a US$116 million coal licence in Tete<br />

province. According to <strong>Mozambique</strong>’s mining director,<br />

STRATEGIC PROJECT<br />

In May this year, Vale entered into a strategic<br />

partnership with Japan Oil, Gas and Metals<br />

National Co-operation (JOGMEC) on technology<br />

development for exploration in Africa.<br />

Vale and JOGMEC have agreed to share<br />

information gained at a remote sensing centre to<br />

be established by JOGMEC, the Republic of<br />

Botswana and the Southern African Development<br />

Community (SADC; an alliance of 14 Southern<br />

African countries). The centre, to be located in<br />

Gaborone, Botswana, is being developed in order<br />

to improve basic geological information on the<br />

region by employing Japan’s remote-sensing<br />

techniques. It will also be used to improve the<br />

skills of technical experts in Africa.<br />

Fatima Momade, the Indian company has been given a<br />

fi ve-year prospecting licence for two blocks. She said<br />

it will be possible to extend the licence for a further<br />

fi ve years, but mining would have to commence after<br />

ten years. The licence covers an area of approximately<br />

300km 2 , which has proven reserves of 70Mt.<br />

METALS SEARCH<br />

Australia-based ABM Resources NL has acquired an<br />

interest in the highly prospective Mimosa gold project.<br />

This consists of three exploration licences totalling<br />

960ha in the Odzi-Mutare Achaean greenstone belt in<br />

<strong>Mozambique</strong>’s central Manica Province.<br />

Artisanal miners have been mining gold from<br />

shallow-sheeted quartz veins at Mimosa for over 20<br />

years, but ABM has reached an agreement to include<br />

their tenements in the project for a royalty.<br />

Geological mapping and sampling by ABM has<br />

identifi ed mineralisation with grades up to 30.1g/t Au<br />

and 0.2% Cu over a strike length of more than 4km.<br />

An RC drilling programme commenced recently.<br />

In June last year, CAMEC withdrew an all-share bid<br />

for ASX-listed uranium company OmegaCorp Ltd<br />

(which was subsequently acquired by Denison Mines<br />

Corp). This was because of OmegaCorp’s decision to<br />

spin off its assets in <strong>Mozambique</strong> into Mavuzi Resources<br />

Ltd, whose main asset is the eponymous gold-uranium<br />

project, covering 700km 2 around the historic Mavuzi<br />

uranium mine in north-western <strong>Mozambique</strong>.<br />

Mavuzi has identifi ed a 7km x 1km gold anomaly in<br />

the property through stream-sediment sampling.<br />

Results of soil sampling at the target are pending, and<br />

mapping and ground radiometric work are in<br />

progress. An additional property called Meponda in<br />

the north of the country covers 472km 2 on the<br />

Meponda alkaline igneous complex, which Mavuzi<br />

considers prospective for uranium.<br />

Other metal explorers in <strong>Mozambique</strong> include<br />

AIM-listed Baobab Resources plc, which (through<br />

wholly-owned Capitol Resources) holds 23<br />

prospecting licences in <strong>Mozambique</strong>. The principal<br />

assets in the country are the Tete polymetallic deposit<br />

and the Mundonguara copper-gold deposit.<br />

Mundonguara (based on Manica licence 1022L) is<br />

the company’s most advanced exploration project and<br />

includes the Mundonguara copper-gold mine that was<br />

closed in 1989. A prime focus is to defi ne high-grade<br />

copper resources, quantify the copper-gold oxide cap<br />

and determine the extent of haloes, with the intention<br />

of returning the mine to production.<br />

The Tete mafi c complex is described by the<br />

company as being “highly prospective” for hydrothermal<br />

replacement deposits of gold, copper, uranium,<br />

titanium, iron and tungsten.<br />

Baobab’s prospecting licences 1021L, 1025L, 1028L,<br />

1337L and 581L make up the Sussundenga project.<br />

The Bandire gold workings are located to the south<br />

of prospecting licence 1021L, immediately outside the<br />

eastern boundary, but trending into prospecting<br />

licence 581L. The gold mineralisation at Bandire (the<br />

site of an historic gold mine) has been opened up in<br />

extensive diggings by artisanal miners.<br />

In May, Sierra Leone’s largest landholder, African<br />

Minerals Ltd, acquired a strategic interest in Baobab<br />

Resources. African Minerals’ purchase of 11.44 million<br />

Baobab shares represented a 17.6% holding in the<br />

company. Following the purchase, African Minerals’<br />

executive chairman Frank Timis described <strong>Mozambique</strong><br />

as “a country which has an investor-friendly<br />

EXPLORATION<br />

GEMSTONE WEALTH<br />

Until recently the northern provinces of<br />

<strong>Mozambique</strong> were known only for their<br />

pegmatite minerals. The gemstones associated<br />

with them are principally tourmalines and<br />

aquamarines, and there is evidence of<br />

considerable smuggling into South Africa and<br />

beyond.<br />

In addition, there are signifi cant tantalite<br />

resources, and over the years a number of small<br />

mines have opened and closed. Indeed,<br />

<strong>Mozambique</strong> was once the world’s third-largest<br />

producer of tantalite, mainly from the Muiane<br />

mine and the nearby Morrua mine, but both<br />

were shut down in the 1980s. Muiane is now<br />

being redeveloped at a reported capital cost of<br />

US$11 million.<br />

mining code and which actively encourages foreign<br />

investment”.<br />

Speaking at a conference in London in May, Pan<br />

African Resources Ltd’s chief executive offi cer, Jan<br />

Nelson, commented that in addition to its 74% stake<br />

in three operating gold mines in South Africa (New<br />

Consort, Fairview and Sheba) the company is also<br />

exploring in other African countries. This activity<br />

includes <strong>Mozambique</strong>, where a prefeasibility study on<br />

the 80%-owned Manica project is under way following<br />

20,000m of drilling on the greenstone belt (Pangea<br />

Exploration Ltd retains a 20% free-carried ownership<br />

in the project).<br />

Pan African Resources increased the resource<br />

estimate at Manica last August by 10% to 1.7Moz of<br />

contained gold. This follows a 56% increase in grade<br />

from 2.96g/t Au to 4.61g/t Au, although the total<br />

tonnage for the resource fell from 16.2Mt to 11.4Mt.<br />

Pan African noted that the increase in grade was due to<br />

an ‘optimisation’ of the width of the mineralised zone,<br />

resulting in narrower widths but higher grades, and the<br />

addition of high-grade zones along strike and to depth.<br />

The in-situ resource grade at the Fair Bride<br />

deposit, the most advanced prospect on the deposit,<br />

has also almost doubled from 2.83g/t Au to 5.49g/t Au,<br />

with the total mineral resource for the deposit<br />

currently estimated at 7.9Mt at a grade of 5.49g/t Au.<br />

The company noted that the Manica resource has<br />

been realised at a discovery cost of only US$1.30/oz.<br />

Speaking at a nickel seminar in London last November,<br />

the managing director of Lithic Metals & Energy<br />

Ltd, Jim Kerr, told delegates that the company is<br />

continuing its exploration activities in <strong>Mozambique</strong>,<br />

where Lithic owns 100% of the Mavita nickel-sulphide<br />

deposit.<br />

In April 2008, Asia Thai <strong>Mining</strong> Co announced plans<br />

to acquire all of Pan African <strong>Mining</strong> Corp’s Madagascan<br />

interests for about C$142 million. Under the deal, Pan<br />

African’s non-Madagascan operations in Botswana,<br />

Namibia and <strong>Mozambique</strong>, along with C$2.5 million in<br />

cash, would be transferred into a new company.<br />

Other companies active in <strong>Mozambique</strong> include<br />

African Eagle Resources plc, which is also involved in<br />

Zambia and Tanzania, and African Precious Minerals<br />

Ltd, whose projects include the Monarch project,<br />

where it is earning a 65% stake.<br />

Rio Tinto has heavy sands projects in Xai-Xai,<br />

Chongoene in Gaza province and at Dongane,<br />

Jangamo and Ravene in Inhambane.<br />

July 2008 <strong>Mining</strong> <strong>Journal</strong> special publication <strong>Mozambique</strong><br />

7

PROFILE<br />

ABM to explore<br />

at Mimosa<br />

ABM Resources NL is an Australianbased<br />

public company focused on<br />

acquisition and exploration of quality<br />

projects with the potential for major<br />

mineral discoveries in Australia and<br />

Africa. The company has acquired interests in the<br />

highly-prospective Mimosa gold project in <strong>Mozambique</strong><br />

and iron oxide copper gold (IOCG) projects at<br />

Kandole Hill and Myunga in the copper belt of<br />

Zambia. In addition to its African projects, ABM has<br />

joint ventures in Western Australia on an advanced<br />

volcanic massive sulphide (VMS) exploration project<br />

for zinc at Erayinia, a gold project at Broads Dam, a<br />

base-metals project at Gascoyne and 100% ownership<br />

of greenfi eld base-metal projects at Earaheedy and<br />

Harbutt Range.<br />

The highly-prospective Mimosa gold project<br />

consists of three exploration licences totalling 960ha<br />

and lies in an under-explored Achaean greenstone belt<br />

in Manica Province in central <strong>Mozambique</strong>. This eastwest<br />

trending Odzi-Mutare greenstone belt extends<br />

into Zimbabwe and has historically produced an<br />

estimated 2.5Moz of gold, mostly from the Zimbabwean<br />

side of the border.<br />

Local artisanal miners have been mining gold by hand<br />

in shallow-sheeted quartz veins and stockworks on<br />

part of the tenements at Mimosa for approximately 20<br />

years. An agreement has been reached with the<br />

artisans to include their ground in the project for a<br />

royalty and there are plans for ongoing support for the<br />

local community in a number of areas. The stockwork<br />

zone, as exposed by the artisanal mining, extends<br />

throughout an area at least 1,000m long x 300m wide.<br />

The veining is not confi ned to a particular narrow<br />

8<br />

ABM Resources is<br />

building a quality<br />

portfolio of exploration<br />

projects in Africa and<br />

Australia<br />

Historic artisanal workings at Mimosa, <strong>Mozambique</strong><br />

July 2008 <strong>Mining</strong> <strong>Journal</strong> special publication <strong>Mozambique</strong><br />

shear but rather extends over a broad area and is<br />

considered to have potential to extend to considerable<br />

depth. More recent geological mapping and sampling by<br />

ABM has identifi ed mineralisation with grades up to<br />

30.1g/t Au and 2,050ppm Cu over a strike length of<br />

more than 4km.<br />

The conceptual model developed for Mimosa is<br />

similar to the deposit at Boddington in Western<br />

Australia. The concept entails a series of deformations<br />

in a brittle granitic rock which provides a favourable<br />

site for hydrothermal alteration and quartz (-sulphide)<br />

-gold veining and a possible copper porphyry system<br />

at depth. An RC drilling programme commenced in<br />

June 2008.<br />

The exploration programme to date has been<br />

employing many local Mozambican people and passing<br />

on exploration knowledge to them. ABM is setting up<br />

its headquarters in the town of Manica, a half hour by<br />

road from Mimosa. Working with local leaders, a<br />

community health centre is planned by ABM.<br />

ABM’s other fl agship project is at Erayinia, which is<br />

located in an underexplored Archaean greenstone belt<br />

southeast of Kalgoorlie, Australia. Extensive RC and<br />

diamond drilling, aeromagnetic and DHTEM surveys by<br />

ABM since 2005 have confi rmed the presence of a<br />

VMS zone at the King prospect.<br />

This is only one of a total of 25 drill targets within<br />

the project area that have been identifi ed within the<br />

40km long greenstone belt, based on geophysical and<br />

geochemical anomalism.<br />

Exploration to date has concentrated on the King<br />

prospect where a mineralised lens of massive sulphides<br />

extending over a strike length of 450m and down-dip<br />

350m has been identifi ed. The lens varies in thickness<br />

from 4-8m with the best assay being 17.9% zinc with<br />

1.6% lead. Recent drilling provided an intercept of 5m<br />

at 10.6% zinc and a diamond drilling programme is<br />

currently underway to test for extension of the<br />

mineralised zone, which remains open along strike and<br />

at depth.<br />

Preliminary drilling and geophysical surveys have<br />

been carried out at several other targets within the<br />

project and all exhibit<br />

anomalism similar<br />

to that encountered at King, reinforcing the view that<br />

Erayinia has the potential to become a new and<br />

extensive base metal province, previously undiscovered.<br />

In Zambia, ABM is preparing to commence<br />

exploration on two IOCG concessions in the copper<br />

belt, totalling 800ha. The joint venture project areas lie<br />

within the Lufi lian Arc, close to recognised copper<br />

producing areas such as Kitwe and Ndola. ABM<br />

intends to undertake detailed geological mapping and<br />

rock chip sampling programmes followed by fi rst pass<br />

drilling in order to test the conceptual IOCG model.<br />

The Gascoyne joint venture base-metal project in<br />

central Western Australia covers an area of mid-<br />

Proterozoic, metamorphosed sediments and volcanic<br />

rocks and is targeting Broken Hill, SEDEX-style, base<br />

metal deposits. A recent RC drilling programme<br />

returned anomalous results of up to 2.9% lead and<br />

0.9% copper.<br />

The Broads Dam joint venture, 40km northwest of<br />

Kalgoorlie, is another quality gold project located along<br />

the highly-prospective auriferous Zuleika shear zone,<br />

which is also host to a number of nearby working<br />

open-cut and underground gold mines. Two drill targets<br />

have been identifi ed at the boundary of volcanogenic<br />

sediments and greenstone rocks that have the potential<br />

to host high-grade gold deposits similar to those<br />

delineated at the nearby Kundana mine.<br />

Over the past two years ABM Resources has built<br />

up an impressive portfolio of highly-prospective<br />

projects, many with potential to become world-class<br />

resources. 2008 will be an exciting year for the<br />

company as many of these projects undergo modern<br />

and systematic exploration for the fi rst time.<br />

CONTACTS<br />

ABM Resources NL<br />

1/141 Broadway<br />

Nedlands<br />

Western Australia 6009<br />

E-mail: admin@abmresources.com.au<br />

Website: www.abmresources.com.au<br />

Tel: +61 8 9423 9777<br />

Fax: +61 8 9423 9733<br />

Ticker: ASX:ABU

Baobab committed<br />

to <strong>Mozambique</strong><br />

SINCE listing in February 2007 on AIM in<br />

London, Baobab Resources plc (BAO) has<br />

been hard at work exploring its highquality<br />

project portfolio in <strong>Mozambique</strong>.<br />

Baobab holds, through its Mozambican<br />

subsidiary Capitol Resources Lda, 25 prospecting<br />

licences spanning six project areas which are<br />

prospective for a range of commodities.<br />

Baobab’s work has focused initially on its two key<br />

assets: the decommissioned Mundonguara coppergold-silver<br />

mine at Manica and the Tete Mafi c<br />

Complex project where extensive vanadiferous<br />

titano-magnetite deposits are being assessed.<br />

MUNDONGUARA PROJECT<br />

The Mundonguara mine recorded production<br />

between 1902 and 1989 when resources were<br />

exploited over 1km of strike to depths of 200m<br />

below surface. The resource grades at the close of<br />

mine ranged between 1.6% and 4.6% Cu, 0.15g/t and<br />

2.99g/t Au, and 1.00g/t and 63.0g/t Ag, and it is<br />

estimated that 500,000t of copper ore were mined<br />

and processed during the production period.<br />

The project is located within the Archaean Odzi-<br />

Mutari greenstone belt near the Zimbabwe border,<br />

approximately 10km from the town of Manica. The<br />

mine is located 2km from the international railway<br />

and 5km from the highway, linking the project to the<br />

deep sea port of Beira and international markets.<br />

Power lines from the Cahora Bassa hydroelectric<br />

scheme pass within 40km of the mine with a spur<br />

running to Manica.<br />

Over the past 12 months Baobab has completed<br />

almost 3,600m of underground diamond drilling and<br />

1,838m of underground channel sampling within the<br />

mine. The channel sampling has been important in<br />

developing the company’s understanding of the mine<br />

geology and mineralisation. Work to date has<br />

warranted the commissioning of a preliminary<br />

resource estimate by international consultancy Coffey<br />

<strong>Mining</strong>.<br />

This work has been complemented with trenching,<br />

approximately 4000m of reverse circulation (RC) drilling,<br />

extensive MMI soil sampling and an airborne<br />

radiometric/magnetic survey over the broader area of<br />

the prospecting licence. Results and interpretation<br />

have lead to an extension of the strike potential of<br />

the mineralised system to 5km from the initial 1km<br />

strike recognition.<br />

Baobab plans to launch an aggressive pre-feasibility<br />

drilling campaign as soon as is practicable, comprehensively<br />

testing both the mine at depth and its along<br />

strike continuations. On progress made at Mundonguara,<br />

managing director Brett Townsend commented:<br />

“The results to date from the Mundonguara project<br />

warrant the commissioning of a preliminary resource<br />

estimate which we look forward to receiving in the<br />

coming months.”<br />

TETE MAFIC COMPLEX<br />

Baobab holds three contiguous exploration licences<br />

over the Tete Mafi c Complex which are being<br />

explored for Bushveld-style iron ore, base and<br />

precious metal deposits. High-resolution geophysics<br />

has been fl own over these licences indicating near<br />

surface, steeply dipping, highly magnetic bodies<br />

coincident with the Massamba Group of vanadiferous<br />

titano-magnetite deposits. These bodies range in width<br />

from 50m to 450m over strike lengths of 2.5km to<br />

3.5km (the combined strike length is in excess of<br />

8km) and appear at surface as magnetite outcrops<br />

assaying average grades of 49% Fe, 21% TiO2 and 0.3% V,<br />

with bulk density determinations returning an average<br />

in-ground specifi c gravity of 4.3 g/cm3 .<br />

Consultants have been commissioned to determine<br />

the metallurgical characteristics of the deposits and<br />

the economic viability and potential processes for<br />

recovering either a vanadium product or a combination<br />

of pig iron, vanadium and titanium products.<br />

Ben James, the company’s technical director,<br />

commented that: “We believe the results of the<br />

geophysical interpretation signifi cantly upgrade the<br />

potential of the Massamba area to host large tonnages<br />

of ore. Findings of the recent fi eld verifi cation<br />

programme have reinforced the fact that this highly<br />

prospective terrain has experienced limited previous<br />

economic exploration, presenting the opportunity for<br />

making major new discoveries.”<br />

The Tete area is fast becoming a major mining hub<br />

as Vale and Riversdale bring their Moatise and Benga<br />

coal deposits into production, with signifi cant<br />

investment streaming into the development and<br />

refurbishment of the railway linking the coal fi elds<br />

with the port of Beira. The existing Cahora Bassa<br />

hydroelectric scheme, coupled with additional<br />

proposed hydro schemes on the Zambezi and<br />

Riversdale’s planned thermal power plant at Benga,<br />

means that affordable power solutions will be readily<br />

available in the future.<br />

PROFILE<br />

OTHER PROJECTS<br />

The company holds four prospecting licences<br />

overlying lower Proterozoic rocks fl anking the<br />

northeastern margin of the Zimbabwe craton. Baobab<br />

considers this Changara project to be highly<br />

prospective for Broken Hill-type polymetallic base and<br />

precious metal mineralisation. The area hosts<br />

numerous occurrences and deposits of zinc, lead,<br />

manganese, iron ore, fl uorite, copper and silver.<br />

Orientation soil geochemistry has identifi ed<br />

multiple zinc-lead anomalies. An extensive soil<br />

sampling programme has been designed and will be<br />

carried out during 2008 to defi ne drill and VTEM<br />

targets.<br />

The company also has three greenfi eld projects<br />

that are being assessed through extensive streamsediment<br />

sampling campaigns and aeromagnetic<br />

surveys during 2008.<br />

RESPONSIBLE DEVELOPMENT<br />

Baobab embraces its corporate social<br />

responsibility and, amongst its initial work<br />

programmes in <strong>Mozambique</strong>, it commissioned an<br />

environmental and social baseline study at<br />

Mundonguara. The company is fi rmly committed<br />

to the retention and promotion of staff through<br />

formal and informal training and mentoring<br />

programmes, and it has nurtured a successful<br />

culture of safety that, to date, has seen zero lost<br />

time incidents.<br />

Baobab endorses the UN Millennium<br />

Development Goals and seeks to implement<br />

sustainable initiatives that will assist the local<br />

community in achieving these goals.<br />

Baobab is fi rmly committed to its future in<br />

<strong>Mozambique</strong> and considers the country to be an<br />

attractive investment destination on both a corporate<br />

and technical level. The country’s revised mining act<br />

and licensing system guarantees security of tenure<br />

while its fi scal policies provide signifi cant investor<br />

up-side. The government’s initiatives in upgrading<br />

infrastructure underline its commitment to encourage<br />

foreign investment in developing the mining sector.<br />

<strong>Mozambique</strong> hosts highly prospective geological<br />

terrains that have experienced little or no historical<br />

exploration and therefore has the potential for<br />

discovering world-class mineral deposits.<br />

CONTACTS<br />

Baobab Resources plc<br />

Brett Townsend (acting managing director)<br />

brett.townsend@baobabresources.com<br />

Ben James (technical director)<br />

ben.james@baobabresources.com<br />

www.baobabresources.com<br />

Tel: +61 8 9430 7151<br />

Fax: +61 8 9430 7664<br />

July July 2008<br />

2008 <strong>Mining</strong> <strong>Mining</strong> <strong>Journal</strong> <strong>Journal</strong> special special publication<br />

publication <strong>Mozambique</strong><br />

<strong>Mozambique</strong><br />

9

PROFILE<br />

CAMEC in <strong>Mozambique</strong><br />

In addition to its mining<br />

concerns, CAMEC’s<br />

business in maize and<br />

sugar cane benefi ts the<br />

local population<br />

CENTRAL African <strong>Mining</strong> & Exploration<br />

Co, the mining exploration and<br />

production company, has been<br />

operational in <strong>Mozambique</strong> since 2003.<br />

Its interests include 21 coal exploration<br />

licences covering 381,000ha in the Tete Province and a<br />

growing agricultural business.<br />

COAL<br />

The coal fi elds of the Tete Province, <strong>Mozambique</strong>, have<br />

long been recognised but development has been<br />

stifl ed in the past by economic and political<br />

circumstance. The various sub-basins that make up the<br />

Karoo stratigraphy occupy an area stretching over<br />

350km from Cahora Bassa lake to the Malawi border.<br />

The best known of these is the Moatize basin, where<br />

mining has historically taken place, principally on the<br />

Chipanga seam. Reserves of the Moatize sub-basin are<br />

estimated at 2,400Mt. A further 3,800Mt of coal have<br />

been estimated in two of the remaining sub-basins<br />

(the Mucanha-Vusi and Ncondezi sub-basins) and<br />

there are estimates that this coalfi eld is one of the<br />

largest unexplored coal provinces on the planet.<br />

The fi rst phase of CAMEC’s exploration drilling<br />

delineated approximately 195Mt of coal across three<br />

licences: L842, L876 and L877. As recently announced,<br />

a further large outcropping coal deposit has now been<br />

identifi ed on L871. CAMEC’s geologists have<br />

estimated these fi ve horizons could contain up to<br />

868Mt of potentially mineable in situ coal. Further<br />

drilling along strike is expected to increase this<br />

resource substantially, substantially and the company expects to be<br />

in a position to announce a SAMREC-compliant<br />

resource estimate for licence L871 in the fourth<br />

quarter of 2008.<br />

In addition, CAMEC is particularly interested in the<br />

concessions on the north side of Cahora Bassa lake.<br />

Previous work here by two parties in the 1960s to<br />

1980s involved signifi cant amounts of drilling and<br />

resulted in the estimation of a 3,600Mt resource.<br />

CAMEC’s concessions cover a large part of this<br />

10 July 2008 <strong>Mining</strong> <strong>Journal</strong> special publication <strong>Mozambique</strong><br />

10<br />

resource and will be evaluated in due course.<br />

Coal in <strong>Mozambique</strong> occurs primarily in the<br />

‘productive series’ rocks within the lower part of the<br />

Ecca Group. Comparisons are made with the South<br />

African Karoo stratigraphy, although the <strong>Mozambique</strong><br />

coals were deposited in more tectonically-active<br />

basins and variations can therefore be expected. The<br />

coal structures were deposited in a cold climate<br />

following a period of glaciation.<br />

AGRICULTURE<br />

CAMEC believes that contributing benefi cially to the<br />

countries in which it operates is key to being<br />

successful. The company’s agricultural business in<br />

<strong>Mozambique</strong>, DECA, is an example of this approach.<br />

The agricultural operation is going from strength to<br />

strength and has been supported by Armando<br />

Guebuza, the president of <strong>Mozambique</strong>, who opened<br />

the new facility at Chimoio.<br />

DECA’s grower base exceeds 300,000 farmers and<br />

it currently employs over 250 people. The company<br />

has injected over US$3 million into the local economy<br />

buying maize, which is a substantial uplift for the local<br />

communities and economy. By using its pan-African<br />

trucking and logistics operation, CAMEC offered<br />

subsidence farmers a route to market and also offered<br />

them a decent price for their produce. As a result,<br />

these farmers had an incentive to increase production<br />

and transform their farms into small businesses.<br />

Last year DECA again expanded signifi cantly with<br />

the construction of a further nine 1,000t silos, a<br />

1,000m 2 warehouse for grain storage and a new<br />

continuous-fl ow maize dryer. Storage capacity now<br />

stands at 25,000t on site. In 2007 the company<br />

doubled the amount of grain purchased and at yearend<br />

it had a stock of 23,000t.<br />

Two adjoining properties were purchased recently<br />

to facilitate an expansion programme. This gives DECA<br />

an additional 8ha of land and buildings comprising<br />

houses, warehouses, workshops, etc. DECA’s total land<br />

holding now stands at some 16ha.<br />

Milling continues on a 24-hour basis and a second<br />

mill has been ordered, which is due for installation in<br />

September 2008. This will increase DECA’s capacity to<br />

200t maize meal and 50t cattle feed per day. Demand<br />

is currently exceeding supply, and DECA maize meal,<br />

which is now rated the best in the country, is<br />

penetrating the Maputo market as well as being<br />

available throughout central and southern<br />

<strong>Mozambique</strong>.<br />

Grinding maize<br />

Going forward, CAMEC intends to expand the<br />

operation into two other provinces by replicating the<br />

installations at Chimoio.<br />

BIOFUEL PLANT<br />

On the back of the success of DECA, CAMEC has<br />

been chosen by the government of <strong>Mozambique</strong> to be<br />

involved in its US$500 million biofuels project,<br />

Procana. This project will involve the construction of a<br />

plant with the capacity to produce 120 million litres<br />

of ethanol a year. In addition to producing ethanol for<br />

the domestic and regional market, the project will also<br />

produce electricity for local use. CAMEC’s role will<br />

be to demarcate the land for the sugar cane<br />

plantation and make a start on building the ethanol<br />

factory.<br />

<strong>Mozambique</strong> is just one of a number of African<br />

countries in which CAMEC operates but it is a key<br />

region for the company. The country has great<br />

potential, which is fi nally being realised, and there are<br />

signifi cant opportunities ahead.<br />

CONTACTS<br />

Central African <strong>Mining</strong> & Exploration<br />

Co plc<br />

18 Park Street, London W1K 2HQ<br />

E-mail: info@camec-plc.com<br />

Website: www.camec-plc.com<br />

Tel: +44 (0) 845 108 6060<br />

Fax: +44 (0) 845 108 0606

Positioned for growth<br />

<strong>Mozambique</strong> drives shareholder interest for ASX-listed Riversdale <strong>Mining</strong><br />

WITH signifi cant holdings in<br />

some of the country’s most<br />

prospective regions, Riversdale<br />

<strong>Mining</strong> Ltd is well positioned<br />

to participate in the growth of<br />

<strong>Mozambique</strong>’s mining industry. Shareholders in the<br />

ASX-listed mining company are also set to gain from<br />

the exposure, and the company’s strong and sustained<br />

share-price appreciation over the past year clearly<br />

illustrates the point.<br />

Initially established to develop as a diversifi ed<br />

mining fi nance house, Riversdale has fast-tracked its<br />

growth to become an S&P/ASX100 company and a<br />

US$2 billion stock through strategic investment in a<br />

range of mining opportunities in southern Africa.<br />

At the end of 2005, Riversdale completed the<br />

acquisition of an operating underground anthracite<br />

mine, located in the Zululand coalfi eld of northern<br />

Kwa-Zulu Natal, South Africa (RIV 74%). Product sales<br />

for 2007 were around 785,000t and the mine<br />

currently has a coal resource of over 40.7Mt, with a<br />

mine life of some 16 years at current production<br />

levels.<br />

While the anthracite colliery in South Africa drives<br />

cash fl ow and has helped to put Riversdale on the<br />

investment radar, it has been the more recent<br />

acquisition and development of the world-class<br />

<strong>Mozambique</strong> coal project that has undoubtedly been<br />

the source of recent shareholder interest.<br />

<strong>Mozambique</strong>’s railway and related infrastructure is<br />

undergoing a major rehabilitation programme<br />

LARGEST TENEMENT HOLDER<br />

In total, the combined tenement size held by<br />

Riversdale is in excess of 290,000ha. This positions<br />

the company as the largest tenement holder in the<br />

Tete-Moatize area, with an extensive area capable<br />

of supporting long-life operations, and including<br />

tenements contiguous with those held by<br />

Companhia Vale do Rio Doce.<br />

“We see signifi cant opportunities for our coal<br />

Riversdale is running an aggressive drill campaign including<br />

four drill rigs being fully operational around the clock<br />

project in <strong>Mozambique</strong>, not only for coking-coal<br />

exports but also for thermal coal to be an integral<br />

component of the power-generation sector in the<br />

years ahead. This includes local demand, but will also<br />

involve supplying the increasing needs of the South<br />

African economy,” said Riversdale executive chairman<br />

and CEO Michael O’Keeffe.<br />

During November 2007, Riversdale announced a<br />

major coal resource in its <strong>Mozambique</strong> coal project.<br />

This followed several months of exploration and<br />

drilling programmes at the company’s highlyprospective<br />

Benga licence in the Moatize district of<br />

<strong>Mozambique</strong>. Based on the drilling results undertaken<br />

by Riversdale, the total inferred coal resource is now<br />

estimated at 1,940Mt (in accordance with JORC).<br />

Of this, a total of 1,070Mt is considered to have the<br />

potential to be extracted by open-cut methods, with<br />

the confi rmation of two distinct areas in the northern<br />

part of the licence area as having open-pit potential.<br />

Mr O’Keeffe said: “Importantly, and with clear<br />

implications for future growth potential, the stated<br />

resource refers only to the northern section of the<br />

Benga licence. In fact, the Benga licence covers an area<br />

of around 4,560ha and represents less than 2% of the<br />

company’s total tenement areas.”<br />

The company believes that, based on initial<br />

washability analysis results, the potential coal<br />

products, after benefi ciation, that could be produced<br />

from Benga include an export hard coking coal as well<br />

as a secondary thermal coal product.<br />

AGREEMENT WITH TATA STEEL<br />

In November 2007, the company’s view on the<br />

prospectivity of the region was endorsed by one of<br />

the world’s leading steel groups when Riversdale<br />

<strong>Mining</strong> signed a shareholders agreement with Tata<br />

Steel Ltd. Under the joint venture, Tata acquired a 35%<br />

interest in the Benga and Tete exploration tenements,<br />

which cover an area of 24,960ha in <strong>Mozambique</strong> for<br />

A$100 million (US$94 million). For the 35% project<br />

interest, Tata has secured a key position in the joint<br />

venture, as well as a 40% share of the coking coal<br />

off-take and the option to participate at commercial<br />

terms above this level.<br />

COAL-FIRED POWER STATION<br />

In other signifi cant developments, in looking to<br />

develop a market for any thermal coal generated from<br />

its future operations, Riversdale signed a memorandum<br />

of understanding (MoU) with Elgas SARL to<br />

review the development of a thermal coal-fi red power<br />

PROFILE<br />

Riversdale <strong>Mining</strong> was a lead sponsor of MMEC 2008, the<br />

major mining and exploration conference in Maputo<br />

station near Riversdale’s coal tenements. As part of<br />

this project, Riversdale and Elgas will also review the<br />

terms under which Riversdale may sell and deliver<br />

coal produced from its <strong>Mozambique</strong> coal project to<br />

the new power station.<br />

Any proposed power station would be ideally<br />

placed to service some of the rapidly-increasing<br />

demand for power in the wider region and could also<br />

contribute to overcoming some of the supply issues<br />

that governments and industry in the region are<br />

currently facing. Power provided from this source will<br />

also be used by Riversdale for its Benga coal operations.<br />

KEY INFRASTRUCTURE<br />

Riversdale has been active in progressing discussions<br />

regarding key infrastructure in <strong>Mozambique</strong>. In<br />

September 2007, the company formally commenced<br />

planning for the transport of any future production<br />

from its prospective coal-mining operations in<br />

<strong>Mozambique</strong> by the signing of an MoU for rail access<br />

and transportation, and a separate MoU for access to<br />

port facilities at Beira with relevant government<br />

agencies and private sector interests.<br />

The resulting agreements and completed<br />

infrastructure will provide Riversdale with the ability<br />

to transport via rail up to 2Mt of coal in 2010,<br />

increasing to 6Mt by 2015, and ensure access to key<br />

export markets, including India and Europe via new<br />

port infrastructure.<br />

CONTACTS<br />

Riversdale <strong>Mining</strong> Ltd<br />

Level 1, 50 Margaret Street<br />

Sydney NSW 2000<br />

Australia<br />

E-mail: sinta@rivmining.com.au<br />

Website: www.riversdalemining.com.au<br />

Tel: +61 2 8299 7900<br />

Fax: +61 2 8299 7999<br />

Ticker: ASX: RIV<br />

11<br />

July 2008 <strong>Mining</strong> <strong>Journal</strong> special publication <strong>Mozambique</strong><br />

11

RIVERSDALE MINING LIMITED (ASX: RIV)<br />

PROUD TO BE PART OF THE<br />

RAPIDLY EXPANDING MINING<br />