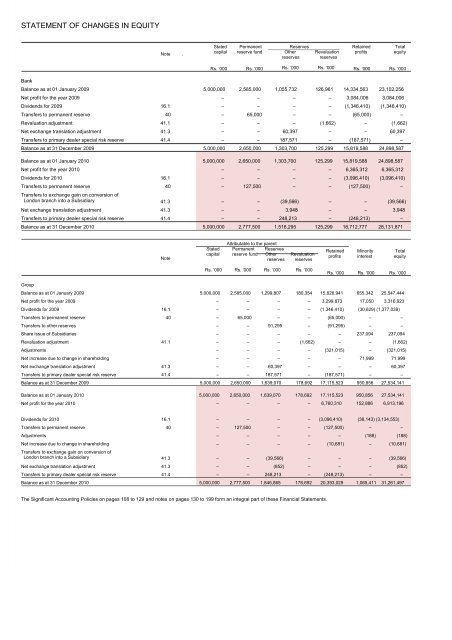

STATEMENT OF CHANGES IN EQUITY Bank Balance as at 01 January 2009 Net profit <strong>for</strong> <strong>the</strong> year 2009 Dividends <strong>for</strong> 2009 Transfers to permanent reserve Revaluation adjustment Net exchange translation adjustment Transfers to primary dealer special risk reserve Balance as at 31 December 2009 Balance as at 01 January 2010 Net profit <strong>for</strong> <strong>the</strong> year 2010 Dividends <strong>for</strong> 2010 Transfers to permanent reserve Transfers to exchange gain on conversion of London branch into a Subsidiary Net exchange translation adjustment Transfers to primary dealer special risk reserve Balance as at 31 December 2010 Group Balance as at 01 January 2009 Net profit <strong>for</strong> <strong>the</strong> year 2009 Dividends <strong>for</strong> 2009 Transfers to permanent reserve Transfers to o<strong>the</strong>r reserves Share issue of Subsidiaries Revaluation adjustment Adjustments Net increase due to change in shareholding Net exchange translation adjustment Transfers to primary dealer special risk reserve Balance as at 31 December 2009 Balance as at 01 January 2010 Net profit <strong>for</strong> <strong>the</strong> year 2010 Dividends <strong>for</strong> 2010 Transfers to permanent reserve Adjustments Net increase due to change in shareholding Transfers to exchange gain on conversion of London branch into a Subsidiary Net exchange translation adjustment Transfers to primary dealer special risk reserve Balance as at 31 December 2010 Note . 16.1 40 41.1 41.3 41.4 16.1 40 41.3 41.3 41.4 Note 16.1 40 41.1 41.3 41.4 16.1 40 41.3 41.3 41.4 Stated capital Rs. ’000 5,000,000 – – – – – – 5,000,000 5,000,000 – – – – – – 5,000,000 Permanent reserve fund Rs. ’000 2,585,000 – – 65,000 – – – 2,650,000 2,650,000 – – 127,500 – – – 2,777,500 Reserves O<strong>the</strong>r Revaluation reserves reserves Rs. ’000 Rs. ’000 1,055,732 – – – – 60,397 187,571 1,303,700 1,303,700 – – – (39,566) 3,948 248,213 1,516,295 Attributable to <strong>the</strong> parent Stated Permanent Reserves capital reserve fund O<strong>the</strong>r Revaluation reserves reserves Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000 5,000,000 – – – – – – – – – – 5,000,000 5,000,000 – – – – – – – – 5,000,000 2,585,000 – – 65,000 – – – – – – – 2,650,000 2,650,000 – – 127,500 – – – – – 2,777,500 1,299,807 – – – 91,295 – – – – 60,397 187,571 1,639,070 1,639,070 – – – – – (39,566) (852) 248,213 1,846,865 180,354 – – – – – (1,662) – – – – 178,692 178,692 – – – – – – – – 178,692 The Significant Accounting Policies on pages 108 to 129 and notes on pages 130 to 199 <strong>for</strong>m an integral part of <strong>the</strong>se Financial Statements. 126,961 – – – (1,662) – – 125,299 125,299 – – – – – – 125,299 Retained profits Rs. ’000 15,826,941 3,299,873 (1,346,410) (65,000) (91,295) – – (321,015) – – (187,571) 17,115,523 17,115,523 6,760,310 (3,096,410) (127,500) – (10,681) – – (248,213) Retained profits Rs. ’000 14,334,563 3,084,006 (1,346,410) (65,000) – – (187,571) 15,819,588 15,819,588 6,365,312 (3,096,410) (127,500) – – (248,213) 18,712,777 Minority interest Rs. ’000 655,342 17,050 – – 237,094 – – 71,999 – – 950,856 950,856 152,886 Total equity Rs. ’000 23,102,256 3,084,006 (1,346,410) – (1,662) 60,397 – 24,898,587 24,898,587 6,365,312 (3,096,410) – (39,566) 3,948 – 28,131,871 Total equity Rs. ’000 25,547,444 3,316,923 (30,629) (1,377,039) – – 237,094 (1,662) (321,015) 71,999 60,397 – 27,534,141 27,534,141 6,913,196 (38,143) (3,134,553) – – (188) (188) – (10,681) – – – 20,393,029 1,065,411 (39,566) (852) – 31,261,497

CASH FLOW STATEMENT For <strong>the</strong> year ended 31 December Note 2010 Rs. ’000 Cash flows from operating activities Interest receipts Interest payments Commissions, fees and receipts from o<strong>the</strong>r operating activities Premium received from policyholders Claims and benefits paid Reinsurance premium paid Reinsurance receipts in respect of claims Cash paid to and on behalf of employees Cash payments to suppliers Recovery of loans written-off in previous years Value added tax on financial services paid Cash flows from operating activities be<strong>for</strong>e changes in operating assets and liabilities (Increase)/decrease in operating assets Deposits held <strong>for</strong> regulatory purposes Funds advanced to customers Net increase in credit card receivable Short-term marketable securities O<strong>the</strong>r operating assets Increase/(decrease) in operating liabilities Deposits from o<strong>the</strong>r banks Deposits from customers O<strong>the</strong>r operating liabilities Net cash from/(used in) operating activities be<strong>for</strong>e income tax Income tax paid Net cash from/(used in) operating activities Cash flows from investing activities Net increase in Treasury bills and o<strong>the</strong>r eligible bills Proceeds from sale of investment securities Dividends received Purchase of investment securities Net cash effect on investment in Subsidiaries and Associates Net cash effect on investment in Bank of Ceylon (UK) <strong>Limited</strong> Net cash effect on acquisition of Subsidiaries Net cash effect on investment in o<strong>the</strong>r Subsidiaries and Associates Purchase of property, plant & equipment Purchase of intangible assets Purchase of leasehold lands Purchase of investment properties Purchase of securities purchased under re-sale agreements Proceeds from sale of property, plant & equipment Net cash from/(used in) investing activities Cash flows from financing activities Proceeds from issue of shares Proceeds from issue of securities sold under re-purchase agreements Proceeds from issue/(redemption) of debentures Net increase/(decrease) in o<strong>the</strong>r borrowings Dividends paid to Government of <strong>Sri</strong> Lanka Dividends to minority shareholders Net cash from financing activities Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents at <strong>the</strong> beginning of <strong>the</strong> year Cash and cash equivalents at <strong>the</strong> end of year II (a) II (b) II (c) 48,958,295 (32,236,920) 9,121,713 – – – – (9,544,644) (5,813,787) 70,866 (3,667,377) I 6,888,146 (9,630,998) (107,937,795) (259,654) (1,324,765) 900,628 (118,252,584) 179,675 117,571,827 (1,611,323) 4,775,741 (1,692,034) 3,083,707 (16,668,014) 23,571,307 468,998 (31,567,092) (1,893,873) – – (1,043,502) (107,887) (16,521) – (34,225,046) 89,179 (61,392,451) – 19,318,786 20,678,813 18,642,032 (2,923,205) – 55,716,426 (2,592,318) 59,375,919 III 56,783,601 Bank 2009 Rs. ’000 52,699,040 (36,221,614) 4,917,426 – – – – (9,868,539) (4,165,318) 102,013 (2,933,948) 4,529,060 (634,388) 5,520,355 60,376 (704,119) (961,357) 3,280,867 420,101 92,117,775 1,378,267 101,726,070 (1,611,027) 100,115,043 (2,748,295) 777,133 347,878 (13,917,685) – – (433,954) (1,390,830) (55,548) – – (4,855,545) 110,617 (22,166,229) – (15,597,955) – (28,199,518) (1,346,410) – (45,143,883) 32,804,931 26,570,988 59,375,919 2010 Rs. ’000 51,048,298 (33,076,221) 10,154,963 558,840 (210,662) (80,676) 4,897 (10,265,315) (6,433,716) 97,452 (3,793,085) 8,004,775 (9,630,998) (110,018,536) (259,654) (1,581,389) 2,376,806 (119,113,771) 418,628 117,440,490 (1,481,636) 5,268,486 (1,927,120) 3,341,366 (16,684,808) 23,735,457 257,910 (32,050,072) – (23,625) (187,186) (1,106,282) (109,473) (16,521) (2,659) (34,172,166) 98,738 (60,260,687) – 20,000,746 20,338,953 21,664,892 (2,923,205) (38,143) 59,043,243 2,123,922 59,404,321 61,528,243 Group 2009 Rs. ’000 54,790,121 (37,191,635) 5,335,677 264,405 (126,668) (47,696) 8,557 (10,350,930) (4,262,472) 108,086 (3,015,485) 5,511,960 (634,388) 4,388,370 60,376 (793,699) (713,922) 2,306,737 420,101 92,861,829 1,171,716 102,272,343 (1,858,874) 100,413,469 (3,221,280) 777,133 150,456 (14,262,931) – (134,800) (126,048) (1,430,799) (56,707) – (110,398) (4,908,425) 120,878 (23,202,921) 237,094 (15,751,965) (88,750) (27,453,459) (1,346,410) (30,629) (44,434,119) 32,776,429 26,627,892 59,404,321

- Page 2 and 3:

` ISSUE OF 40,000,000 UNSECURED SUB

- Page 4 and 5:

This Prospectus is dated 15 th Nove

- Page 6 and 7:

CORPORATE INFORMATION Issuer : Bank

- Page 8 and 9:

Opening Date : 29 th November 2011

- Page 10 and 11:

7 Corporate Management 54 8. Proper

- Page 12 and 13:

LKR : Sri Lankan Rupees MN : Millio

- Page 14 and 15:

2.2 Subscription List Subject to th

- Page 16 and 17:

Repayment before the maturity of th

- Page 18 and 19:

2.12 Listing b. The Debentures shal

- Page 20 and 21:

c) Only one type of Debentures shou

- Page 22 and 23:

3. Any application form, which does

- Page 24 and 25:

4. OVERVIEW OF THE BANK Vision of t

- Page 26 and 27:

Board of Directors Operational Stru

- Page 28 and 29:

2006 - Wins IBM/FISERV prize for th

- Page 30 and 31:

PERFORMANCE SNAPSHOT Total assets v

- Page 32 and 33:

4.2 Principal activities The Bank p

- Page 34 and 35:

Note 01- Details of Debenturs I. Un

- Page 36 and 37:

(iii) Contingencies and Commitments

- Page 38 and 39:

Other Accounts Resident Non-Nationa

- Page 40 and 41:

4.5 Key Customers and suppliers BOC

- Page 42 and 43:

4.8 Employees The permanent staff s

- Page 44 and 45:

5. THE BOARD OF DIRECTORS 5.1 The d

- Page 46 and 47:

Mr. K. L. Hewage ( Director ) Bache

- Page 48 and 49:

6. EXTRACTS FROM THE CORPORATE GOVE

- Page 50 and 51:

c) Identify the principal risks and

- Page 52 and 53:

(b) In this context, the following

- Page 54 and 55:

3 (5) (iii) The Board shall disclos

- Page 56 and 57:

(l) The Chief Finance Officer, the

- Page 58 and 59:

(b) The creation of any liabilities

- Page 60 and 61:

3 (9) (ii) In respect of the banks

- Page 62 and 63:

Opportunities and threats; Risks an

- Page 64 and 65: 7. CORPORATE MANAGEMENT NAME DESIGN

- Page 66 and 67: 8. PROPERTIES Details of the Proper

- Page 68 and 69: Declaration by the Directors We the

- Page 70 and 71: EXTRACTS FROM THE BANK OF CEYLON OR

- Page 72 and 73: To lend and (e) To lend and advance

- Page 74 and 75: in certain accommodation or that su

- Page 76 and 77: (c) The proceedings and resolutions

- Page 78 and 79: Person acting in his place. Remuner

- Page 80 and 81: NOW THIS DEED WITNESSETH AND IT IS

- Page 82 and 83: shall be notified by BOC to the Col

- Page 84 and 85: (i) As an when Debentures ought to

- Page 86 and 87: In the case of Approved Provident F

- Page 88 and 89: Clause above. In the event BOC defa

- Page 90 and 91: (vi) Whether or not there has been

- Page 92 and 93: 14. APPLICATION OF MONIES RECEIVED

- Page 94 and 95: (j) The Trustee shall not be liable

- Page 96 and 97: (iv) The Trustee is in the situatio

- Page 98 and 99: (ii) in order to comply with any of

- Page 100 and 101: B O C DEBENTURE PROSPECTUS 90

- Page 102 and 103: NORTH WESTERN PROVINCE Alawwa 037-2

- Page 104 and 105: MEMBERS AND TRADING MEMBERS OF THE

- Page 106 and 107: TRADING MEMBERS - DEBT First Capita

- Page 108 and 109: Kandy 2 nd City Branch 22, Dalada v

- Page 110 and 111: Nikaweratiya Branch & Managers Quar

- Page 112 and 113: INCOME STATEMENT For the year ended

- Page 116 and 117: CASH FLOW STATEMENT For the year en

- Page 118 and 119: SIGNIFICANT ACCOUNTING POLICIES 1.

- Page 120 and 121: Transnational Lanka Records Solutio

- Page 122 and 123: Assets and liabilities are translat

- Page 124 and 125: those countries. 3.7.2 Deferred Tax

- Page 126 and 127: Period outstanding Classification r

- Page 128 and 129: 4.3.1 Investments in Subsidiaries I

- Page 130 and 131: Freehold Building Over 40 years Off

- Page 132 and 133: ‘Investment Property’, in accou

- Page 134 and 135: minimum of ten years of continuous

- Page 136 and 137: 6.1.6 Dividend Income Dividend inco

- Page 138 and 139: 7. ISLAMIC BANKING POLICIES Islamic

- Page 140 and 141: NOTES TO THE FINANCIAL STATEMENTS F

- Page 142 and 143: NOTES TO THE FINANCIAL STATEMENTS F

- Page 144 and 145: NOTES TO THE FINANCIAL STATEMENTS (

- Page 146 and 147: NOTES TO THE FINANCIAL STATEMENTS F

- Page 148 and 149: NOTES TO THE FINANCIAL STATEMENTS 1

- Page 150 and 151: NOTES TO THE FINANCIAL STATEMENTS A

- Page 152 and 153: NOTES TO THE FINANCIAL STATEMENTS A

- Page 154 and 155: NOTES TO THE FINANCIAL STATEMENTS A

- Page 156 and 157: NOTES TO THE FINANCIAL STATEMENTS A

- Page 158 and 159: NOTES TO THE FINANCIAL STATEMENTS A

- Page 160 and 161: NOTES TO THE FINANCIAL STATEMENTS A

- Page 162 and 163: NOTES TO THE FINANCIAL STATEMENTS A

- Page 164 and 165:

NOTES TO THE FINANCIAL STATEMENTS 2

- Page 166 and 167:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 168 and 169:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 170 and 171:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 172 and 173:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 174 and 175:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 176 and 177:

NOTES TO THE FINANCIAL STATEMENTS 2

- Page 178 and 179:

NOTES TO THE FINANCIAL STATEMENTS N

- Page 180 and 181:

NOTES TO THE FINANCIAL STATEMENTS N

- Page 182 and 183:

NOTES TO THE FINANCIAL STATEMENTS 2

- Page 184 and 185:

NOTES TO THE FINANCIAL STATEMENTS 3

- Page 186 and 187:

NOTES TO THE FINANCIAL STATEMENTS F

- Page 188 and 189:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 190 and 191:

NOTES TO THE FINANCIAL STATEMENTS 3

- Page 192 and 193:

NOTES TO THE FINANCIAL STATEMENTS S

- Page 194 and 195:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 196 and 197:

NOTES TO THE FINANCIAL STATEMENTS 4

- Page 198 and 199:

NOTES TO THE FINANCIAL STATEMENTS 4

- Page 200 and 201:

NOTES TO THE FINANCIAL STATEMENTS F

- Page 202 and 203:

NOTES TO THE FINANCIAL STATEMENTS 4

- Page 204 and 205:

NOTES TO THE FINANCIAL STATEMENTS 4

- Page 206 and 207:

NOTES TO THE FINANCIAL STATEMENTS N

- Page 208 and 209:

NOTES TO THE FINANCIAL STATEMENTS P

- Page 210 and 211:

204

- Page 212 and 213:

Total revenue 32,767,904 29,537,920

- Page 214 and 215:

For the six months ended Stated Cap

- Page 216 and 217:

As at 30-Jun-2011 31-Dec-2010 (Audi

- Page 218 and 219:

DEBENTURE INFORMATION Description I

- Page 220 and 221:

SEGMENTAL ANALYSIS - GROUP Banking

- Page 222 and 223:

DIRECTORS’ INTERESTS IN CONTRACTS

- Page 224:

DIRECTORS’ INTERESTS IN CONTRACTS