Prospectus for the Debenture - Asha Phillip Securities Limited - Sri ...

Prospectus for the Debenture - Asha Phillip Securities Limited - Sri ...

Prospectus for the Debenture - Asha Phillip Securities Limited - Sri ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

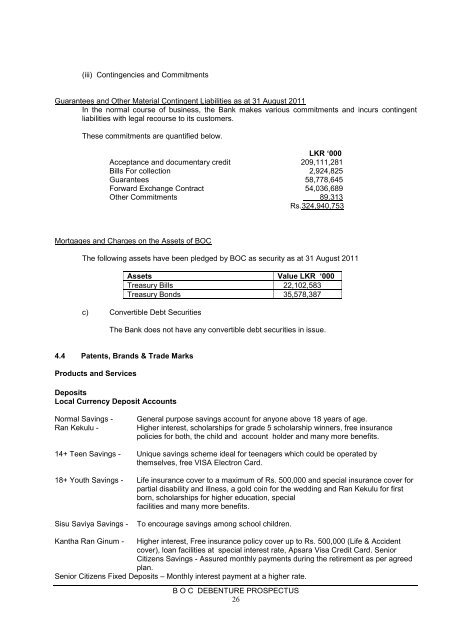

(iii) Contingencies and Commitments<br />

Guarantees and O<strong>the</strong>r Material Contingent Liabilities as at 31 August 2011<br />

In <strong>the</strong> normal course of business, <strong>the</strong> Bank makes various commitments and incurs contingent<br />

liabilities with legal recourse to its customers.<br />

These commitments are quantified below.<br />

LKR ‘000<br />

Acceptance and documentary credit 209,111,281<br />

Bills For collection 2,924,825<br />

Guarantees 58,778,645<br />

Forward Exchange Contract 54,036,689<br />

O<strong>the</strong>r Commitments 89,313<br />

Rs.324,940,753<br />

Mortgages and Charges on <strong>the</strong> Assets of BOC<br />

The following assets have been pledged by BOC as security as at 31 August 2011<br />

Assets Value LKR ‘000<br />

Treasury Bills 22,102,583<br />

Treasury Bonds 35,578,387<br />

c) Convertible Debt <strong>Securities</strong><br />

The Bank does not have any convertible debt securities in issue.<br />

4.4 Patents, Brands & Trade Marks<br />

Products and Services<br />

Deposits<br />

Local Currency Deposit Accounts<br />

Normal Savings - General purpose savings account <strong>for</strong> anyone above 18 years of age.<br />

Ran Kekulu - Higher interest, scholarships <strong>for</strong> grade 5 scholarship winners, free insurance<br />

policies <strong>for</strong> both, <strong>the</strong> child and account holder and many more benefits.<br />

14+ Teen Savings - Unique savings scheme ideal <strong>for</strong> teenagers which could be operated by<br />

<strong>the</strong>mselves, free VISA Electron Card.<br />

18+ Youth Savings - Life insurance cover to a maximum of Rs. 500,000 and special insurance cover <strong>for</strong><br />

partial disability and illness, a gold coin <strong>for</strong> <strong>the</strong> wedding and Ran Kekulu <strong>for</strong> first<br />

born, scholarships <strong>for</strong> higher education, special<br />

facilities and many more benefits.<br />

Sisu Saviya Savings - To encourage savings among school children.<br />

Kantha Ran Ginum - Higher interest, Free insurance policy cover up to Rs. 500,000 (Life & Accident<br />

cover), loan facilities at special interest rate, Apsara Visa Credit Card. Senior<br />

Citizens Savings - Assured monthly payments during <strong>the</strong> retirement as per agreed<br />

plan.<br />

Senior Citizens Fixed Deposits – Monthly interest payment at a higher rate.<br />

B O C DEBENTURE PROSPECTUS<br />

26