STATE OF NEW YORK 2 0 1 2 ... - Schoharie County

STATE OF NEW YORK 2 0 1 2 ... - Schoharie County

STATE OF NEW YORK 2 0 1 2 ... - Schoharie County

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

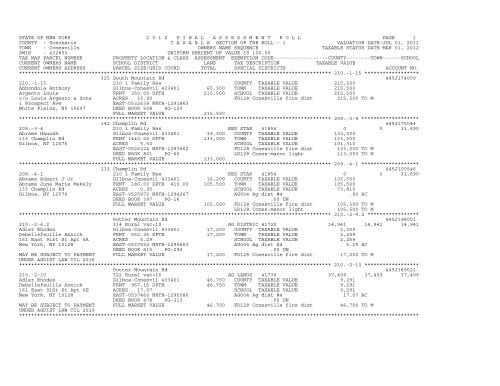

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 1<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 210.-1-15 ******************<br />

325 South Mountain Rd 445J174009<br />

210.-1-15 210 1 Family Res COUNTY TAXABLE VALUE 215,500<br />

Abbondola Anthony Gilboa-Conesvil 433401 65,300 TOWN TAXABLE VALUE 215,500<br />

Argento Louis FRNT 350.00 DPTH 215,500 SCHOOL TAXABLE VALUE 215,500<br />

c/o Louis Argento & Sons ACRES 15.90 FD128 Conesville fire dist 215,500 TO M<br />

1 Prospect Ave EAST-0532639 NRTH-1291863<br />

White Plains, NY 10607 DEED BOOK 508 PG-120<br />

FULL MARKET VALUE 215,500<br />

******************************************************************************************************* 209.-3-4 *******************<br />

142 Champlin Rd 445J175044<br />

209.-3-4 210 1 Family Res RES STAR 41854 0 0 31,690<br />

Abrams Hannah Gilboa-Conesvil 433401 39,300 COUNTY TAXABLE VALUE 133,000<br />

133 Champlin Rd FRNT 1440.00 DPTH 133,000 TOWN TAXABLE VALUE 133,000<br />

Gilboa, NY 12076 ACRES 5.50 SCHOOL TAXABLE VALUE 101,310<br />

EAST-0526224 NRTH-1293662 FD128 Conesville fire dist 133,000 TO M<br />

DEED BOOK 801 PG-60 LD128 Cones-manor light 113,050 TO M<br />

FULL MARKET VALUE 133,000<br />

******************************************************************************************************* 209.-4-1 *******************<br />

133 Champlin Rd 445J100546<br />

209.-4-1 210 1 Family Res RES STAR 41854 0 0 31,690<br />

Abrams Robert J Jr Gilboa-Conesvil 433401 16,200 COUNTY TAXABLE VALUE 105,500<br />

Abrams June Marie Makely FRNT 180.00 DPTH 410.00 105,500 TOWN TAXABLE VALUE 105,500<br />

133 Champlin Rd ACRES 0.90 SCHOOL TAXABLE VALUE 73,810<br />

Gilboa, NY 12076 EAST-0525972 NRTH-1294267 AG004 Ag dist #4 .90 AC<br />

DEED BOOK 397 PG-16 .00 UN<br />

FULL MARKET VALUE 105,500 FD128 Conesville fire dist 105,500 TO M<br />

LD128 Cones-manor light 105,500 TO M<br />

******************************************************************************************************* 210.-2-4.2 *****************<br />

Potter Mountain Rd 445J198001<br />

210.-2-4.2 314 Rural vac10 AG LANDS 41730 37,409 37,409 37,409<br />

Adler Rhodes Gilboa-Conesvil 433401 46,700 COUNTY TAXABLE VALUE 9,291<br />

Debellefeuille Annick FRNT 967.16 DPTH 46,700 TOWN TAXABLE VALUE 9,291<br />

161 East 91St St Apt 6E ACRES 17.07 SCHOOL TAXABLE VALUE 9,291<br />

New York, NY 10128 EAST-0537460 NRTH-1295086 AG004 Ag dist #4 17.07 AC<br />

DEED BOOK 478 PG-313 .00 UN<br />

MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 46,700 FD128 Conesville fire dist 46,700 TO M<br />

UNDER AGDIST LAW TIL 2019<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 2<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 210.-2-11 ******************<br />

569 Potter Mountain Rd 445J188007<br />

210.-2-11 210 1 Family Res COUNTY TAXABLE VALUE 170,000<br />

Adler Rhodes Gilboa-Conesvil 433401 43,300 TOWN TAXABLE VALUE 170,000<br />

Debellefeuille Annick FRNT 640.00 DPTH 170,000 SCHOOL TAXABLE VALUE 170,000<br />

161 East 91st St Apt 6E ACRES 7.10 AG004 Ag dist #4 7.10 AC<br />

New York, NY 10128 EAST-0537117 NRTH-1295723 .00 UN<br />

DEED BOOK 453 PG-290 FD128 Conesville fire dist 170,000 TO M<br />

FULL MARKET VALUE 170,000<br />

******************************************************************************************************* 208.-3-10 ******************<br />

780 State Route 990V 445J100477<br />

208.-3-10 210 1 Family Res COUNTY TAXABLE VALUE 58,000<br />

Aguanno Nicola Gilboa-Conesvil 433401 5,200 TOWN TAXABLE VALUE 58,000<br />

Gucciardo Rosa FRNT 145.20 DPTH 112.20 58,000 SCHOOL TAXABLE VALUE 58,000<br />

c/o Antonia Aguanno ACRES 0.29 FD128 Conesville fire dist 58,000 TO M<br />

62-19 61st St EAST-0512659 NRTH-1291259 LD128 Cones-manor light 58,000 TO M<br />

Ridgewood, NY 11385 DEED BOOK 930 PG-108<br />

FULL MARKET VALUE 58,000<br />

******************************************************************************************************* 196.-2-8 *******************<br />

Pucker St 445J100199<br />

196.-2-8 321 Abandoned ag COUNTY TAXABLE VALUE 67,100<br />

Albers John W Middleburgh 433801 67,100 TOWN TAXABLE VALUE 67,100<br />

Albers Brigitte L FRNT 1055.39 DPTH 67,100 SCHOOL TAXABLE VALUE 67,100<br />

450 Maple Ave Ext ACRES 60.93 FD128 Conesville fire dist 67,100 TO M<br />

Greenville, NY 12083 EAST-0555396 NRTH-1309510<br />

DEED BOOK 863 PG-217<br />

FULL MARKET VALUE 67,100<br />

******************************************************************************************************* 202.-1-51 ******************<br />

414 Bull Hill Rd 445J187026<br />

202.-1-51 210 1 Family Res RES STAR 41854 0 0 31,690<br />

Aleksejczyk Susan Gilboa-Conesvil 433401 40,000 COUNTY TAXABLE VALUE 143,800<br />

414 Bull Hill Rd FRNT 335.00 DPTH 143,800 TOWN TAXABLE VALUE 143,800<br />

Gilboa, NY 12076 ACRES 5.78 BANKWELLFAR SCHOOL TAXABLE VALUE 112,110<br />

EAST-0517333 NRTH-1298203 AG004 Ag dist #4 5.78 AC<br />

DEED BOOK 822 PG-227 .00 UN<br />

FULL MARKET VALUE 143,800 FD128 Conesville fire dist 143,800 TO M<br />

******************************************************************************************************* 208.-2-15 ******************<br />

108 Bull Hill Rd 445J100176<br />

208.-2-15 210 1 Family Res COUNTY TAXABLE VALUE 65,000<br />

Allan David E Gilboa-Conesvil 433401 14,400 TOWN TAXABLE VALUE 65,000<br />

108 Bull Hill Rd FRNT 200.00 DPTH 162.03 65,000 SCHOOL TAXABLE VALUE 65,000<br />

Gilboa, NY 12076 ACRES 0.80 FD128 Conesville fire dist 65,000 TO M<br />

EAST-0513293 NRTH-1291254 LD128 Cones-manor light 65,000 TO M<br />

DEED BOOK 927 PG-101<br />

FULL MARKET VALUE 65,000<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 3<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 194.-1-23 ******************<br />

115 Deer Run Rd 445J182029<br />

194.-1-23 210 1 Family Res COUNTY TAXABLE VALUE 121,300<br />

Allan Robert Gilboa-Conesvil 433401 38,300 TOWN TAXABLE VALUE 121,300<br />

Allan Alicia ACRES 5.13 121,300 SCHOOL TAXABLE VALUE 121,300<br />

Lafayette College EAST-0530039 NRTH-1309210 FD128 Conesville fire dist 121,300 TO M<br />

PO Box 9440 DEED BOOK 391 PG-647<br />

Easton, PA 18042 FULL MARKET VALUE 121,300<br />

******************************************************************************************************* 204.-2-19 ******************<br />

1068 Potter Mountain Rd 445J100397<br />

204.-2-19 270 Mfg housing COUNTY TAXABLE VALUE 21,000<br />

Amato Salvatore Gilboa-Conesvil 433401 7,000 TOWN TAXABLE VALUE 21,000<br />

Amato Linda FRNT 230.00 DPTH 80.00 21,000 SCHOOL TAXABLE VALUE 21,000<br />

3153 Judith Dr ACRES 0.30 FD128 Conesville fire dist 21,000 TO M<br />

Bellmore, NY 11710 EAST-0548354 NRTH-1300053<br />

DEED BOOK 894 PG-43<br />

FULL MARKET VALUE 21,000<br />

******************************************************************************************************* 204.-2-20 ******************<br />

1058 Potter Mountain Rd 445J100031<br />

204.-2-20 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 4<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 202.-1-1.1 *****************<br />

Bull Hill Rd 445J187021<br />

202.-1-1.1 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 5<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 211.-1-56 ******************<br />

Durham Rd Off 445J182065<br />

211.-1-56 312 Vac w/imprv COUNTY TAXABLE VALUE 31,900<br />

Angeletta Joseph Gilboa-Conesvil 433401 16,600 TOWN TAXABLE VALUE 31,900<br />

418 Fifth St ACRES 5.05 31,900 SCHOOL TAXABLE VALUE 31,900<br />

Mamaroneck, NY 10543 EAST-0543760 NRTH-1294076 FD128 Conesville fire dist 31,900 TO M<br />

DEED BOOK 603 PG-273<br />

FULL MARKET VALUE 31,900<br />

******************************************************************************************************* 211.-1-57 ******************<br />

Durham Rd Off 445J182056<br />

211.-1-57 314 Rural vac10 COUNTY TAXABLE VALUE 29,700<br />

Angst Arthur H Jr Gilboa-Conesvil 433401 29,700 TOWN TAXABLE VALUE 29,700<br />

Angst Mary J ACRES 10.26 29,700 SCHOOL TAXABLE VALUE 29,700<br />

447 Ackerson Blvd EAST-0541602 NRTH-1292278 FD128 Conesville fire dist 29,700 TO M<br />

Brightwaters, NY 11718 DEED BOOK 782 PG-228<br />

FULL MARKET VALUE 29,700<br />

******************************************************************************************************* 202.-4-3 *******************<br />

325 Robinson Rd 445J183034<br />

202.-4-3 260 Seasonal res COUNTY TAXABLE VALUE 30,000<br />

Anselmo Giacoma Gilboa-Conesvil 433401 25,000 TOWN TAXABLE VALUE 30,000<br />

50 Warren St inground house 30,000 SCHOOL TAXABLE VALUE 30,000<br />

New Rochelle, NY 10801 ACRES 5.80 FD128 Conesville fire dist 30,000 TO M<br />

EAST-0522672 NRTH-1299263<br />

DEED BOOK 484 PG-177<br />

FULL MARKET VALUE 30,000<br />

******************************************************************************************************* 204.-3-7.2 *****************<br />

1244 Potter Mountain Rd 445J199001<br />

204.-3-7.2 240 Rural res COUNTY TAXABLE VALUE 170,000<br />

Anton Michael P Gilboa-Conesvil 433401 167,400 TOWN TAXABLE VALUE 170,000<br />

Lee Soo J 204-3-7.5 D&c W/this 2/02 170,000 SCHOOL TAXABLE VALUE 170,000<br />

469 Elkwood Terr FRNT 2095.26 DPTH FD128 Conesville fire dist 170,000 TO M<br />

Englewood, NJ 07631 ACRES 98.49<br />

EAST-0552115 NRTH-1300215<br />

DEED BOOK 634 PG-200<br />

FULL MARKET VALUE 170,000<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 6<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 211.-1-36 ******************<br />

744 South Mountain Rd 445J177051<br />

211.-1-36 271 Mfg housings RES STAR 41854 0 0 31,690<br />

Antonucci Cosimo Gilboa-Conesvil 433401 50,000 COUNTY TAXABLE VALUE 155,000<br />

Antonucci Arlene FRNT 294.00 DPTH 155,000 TOWN TAXABLE VALUE 155,000<br />

54 Lake Ave ACRES 7.00 SCHOOL TAXABLE VALUE 123,310<br />

Midland Park, NJ 07432 EAST-0543265 NRTH-1289691 FD128 Conesville fire dist 155,000 TO M<br />

DEED BOOK 375 PG-25<br />

FULL MARKET VALUE 155,000<br />

******************************************************************************************************* 204.-3-11 ******************<br />

Potter Mountain Rd Off 445J182052<br />

204.-3-11 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 7<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 194.-4-10 ******************<br />

551 East Conesville Rd 445J186002<br />

194.-4-10 210 1 Family Res COUNTY TAXABLE VALUE 69,500<br />

Armstrong William P Gilboa-Conesvil 433401 31,000 TOWN TAXABLE VALUE 69,500<br />

12 Donegal Ave FRNT 216.00 DPTH 69,500 SCHOOL TAXABLE VALUE 69,500<br />

Troy, NY 12180 ACRES 3.60 FD128 Conesville fire dist 69,500 TO M<br />

EAST-0539825 NRTH-1306807<br />

DEED BOOK 413 PG-159<br />

FULL MARKET VALUE 69,500<br />

******************************************************************************************************* 209.-3-47 ******************<br />

162 Bear Kill Rd 445J188008<br />

209.-3-47 210 1 Family Res RES STAR 41854 0 0 31,690<br />

Assini Matthew A Gilboa-Conesvil 433401 20,100 COUNTY TAXABLE VALUE 89,800<br />

Assini Joan T FRNT 315.00 DPTH 89,800 TOWN TAXABLE VALUE 89,800<br />

162 Bearkill Rd ACRES 1.41 SCHOOL TAXABLE VALUE 58,110<br />

Gilboa, NY 12076 EAST-0526287 NRTH-1296269 FD128 Conesville fire dist 89,800 TO M<br />

DEED BOOK 695 PG-129<br />

FULL MARKET VALUE 89,800<br />

******************************************************************************************************* 216.-1-5 *******************<br />

225 Haner Rd 445J100171<br />

216.-1-5 240 Rural res COUNTY TAXABLE VALUE 168,600<br />

Augello Angelo J Gilboa-Conesvil 433401 143,600 TOWN TAXABLE VALUE 168,600<br />

Vitale Salvatore 216-1-6.2 D&c W/ths 2/00 168,600 SCHOOL TAXABLE VALUE 168,600<br />

Vitale Emanuele FRNT 620.00 DPTH FD128 Conesville fire dist 168,600 TO M<br />

PO Box 39 ACRES 105.64<br />

Gilboa, NY 12076 EAST-0529702 NRTH-1288742<br />

DEED BOOK 649 PG-341<br />

FULL MARKET VALUE 168,600<br />

******************************************************************************************************* 217.-2-5 *******************<br />

277 Bluebird Rd 445J100015<br />

217.-2-5 260 Seasonal res COUNTY TAXABLE VALUE 90,000<br />

Autieri August S Gilboa-Conesvil 433401 87,100 TOWN TAXABLE VALUE 90,000<br />

1 Anna Ct Also See Bk 525 Pg 337 90,000 SCHOOL TAXABLE VALUE 90,000<br />

Carmel, NY 10512 217-2-6 D&c W/this 2/96 FD128 Conesville fire dist 90,000 TO M<br />

FRNT 912.02 DPTH<br />

ACRES 39.41<br />

EAST-0549906 NRTH-1287688<br />

DEED BOOK 919 PG-108<br />

FULL MARKET VALUE 90,000<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 8<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 211.-1-38.1 ****************<br />

707 South Mountain Rd 445J100079<br />

211.-1-38.1 210 1 Family Res Fire/EMS 41690 3,000 3,000 3,000<br />

Bailey Wayne A Gilboa-Conesvil 433401 41,200 RES STAR 41854 0 0 31,690<br />

707 South Mountain Rd FRNT 241.94 DPTH 124,200 COUNTY TAXABLE VALUE 121,200<br />

Gilboa, NY 12076 ACRES 6.29 BANKWELLFAR TOWN TAXABLE VALUE 121,200<br />

EAST-0542190 NRTH-1290336 SCHOOL TAXABLE VALUE 89,510<br />

DEED BOOK 751 PG-38 FD128 Conesville fire dist 121,200 TO M<br />

FULL MARKET VALUE 124,200 3,000 EX<br />

******************************************************************************************************* 202.-4-30 ******************<br />

Robinson Rd 445J184047<br />

202.-4-30 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 9<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 196.-1-3.112 ***************<br />

Pucker St off 445J206023<br />

196.-1-3.112 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 10<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 204.-2-23 ******************<br />

958 Potter Mountain Rd 445J100132<br />

204.-2-23 270 Mfg housing COUNTY TAXABLE VALUE 60,000<br />

Bambury Jeremiah J Gilboa-Conesvil 433401 44,100 TOWN TAXABLE VALUE 60,000<br />

Bambury Barbara A FRNT 213.00 DPTH 60,000 SCHOOL TAXABLE VALUE 60,000<br />

30-02 82nd St ACRES 7.45 AG004 Ag dist #4 7.45 AC<br />

East Elmhurst, NY 11370 EAST-0545597 NRTH-1299519 .00 UN<br />

DEED BOOK 487 PG-121 FD128 Conesville fire dist 60,000 TO M<br />

FULL MARKET VALUE 60,000<br />

******************************************************************************************************* 209.-4-14 ******************<br />

143 Carrillo Pl 445J174018<br />

209.-4-14 210 1 Family Res COUNTY TAXABLE VALUE 83,900<br />

Barbaro Donna Gilboa-Conesvil 433401 39,800 TOWN TAXABLE VALUE 83,900<br />

Carhart Susan ACRES 5.70 83,900 SCHOOL TAXABLE VALUE 83,900<br />

c/o Susan Carhart EAST-0528917 NRTH-1292625 FD128 Conesville fire dist 83,900 TO M<br />

11 Bruce Ln N DEED BOOK 742 PG-240<br />

Kings Park, NY 11754 FULL MARKET VALUE 83,900<br />

******************************************************************************************************* 204.-1-21 ******************<br />

Potter Mountain Rd Off 445J177001<br />

204.-1-21 322 Rural vac>10 COUNTY TAXABLE VALUE 40,400<br />

Bariso Nicole R Gilboa-Conesvil 433401 40,400 TOWN TAXABLE VALUE 40,400<br />

3930 Southwood Dr ACRES 14.56 BANKWELLFAR 40,400 SCHOOL TAXABLE VALUE 40,400<br />

Easton, PA 18045-6118 EAST-0542718 NRTH-1295841 FD128 Conesville fire dist 40,400 TO M<br />

DEED BOOK 636 PG-289<br />

FULL MARKET VALUE 40,400<br />

******************************************************************************************************* 211.-1-3 *******************<br />

235 Durham Rd 445J178017<br />

211.-1-3 210 1 Family Res COUNTY TAXABLE VALUE 121,300<br />

Bariso Nicole R Gilboa-Conesvil 433401 30,500 TOWN TAXABLE VALUE 121,300<br />

3930 Southwood Dr FRNT 500.00 DPTH 121,300 SCHOOL TAXABLE VALUE 121,300<br />

Easton, PA 18045-6118 ACRES 3.50 BANKWELLFAR FD128 Conesville fire dist 121,300 TO M<br />

EAST-0543093 NRTH-1295190<br />

DEED BOOK 636 PG-289<br />

FULL MARKET VALUE 121,300<br />

******************************************************************************************************* 204.-2-11 ******************<br />

1033 Potter Mountain Rd 445J100024<br />

204.-2-11 260 Seasonal res COUNTY TAXABLE VALUE 66,100<br />

Barrell Terence Gilboa-Conesvil 433401 33,000 TOWN TAXABLE VALUE 66,100<br />

79 Morris St FRNT 410.00 DPTH 66,100 SCHOOL TAXABLE VALUE 66,100<br />

Jersey City, NJ 07302 ACRES 4.00 FD128 Conesville fire dist 66,100 TO M<br />

EAST-0547342 NRTH-1300271<br />

DEED BOOK 349 PG-557<br />

FULL MARKET VALUE 66,100<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 11<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 203.-1-40 ******************<br />

324 Brand Rd 445J178106<br />

203.-1-40 314 Rural vac10 COUNTY TAXABLE VALUE 29,300<br />

Barry Jason J Gilboa-Conesvil 433401 29,300 TOWN TAXABLE VALUE 29,300<br />

Barry Catherine F see also 736/157 29,300 SCHOOL TAXABLE VALUE 29,300<br />

260 Beaver Hill Rd FRNT 210.00 DPTH FD128 Conesville fire dist 29,300 TO M<br />

Gilboa, NY 12076 ACRES 29.30<br />

EAST-0539047 NRTH-1292707<br />

DEED BOOK 573 PG-178<br />

FULL MARKET VALUE 29,300<br />

******************************************************************************************************* 210.-4-10.2 ****************<br />

102 Maple Ln 445J194006<br />

210.-4-10.2 210 1 Family Res RES STAR 41854 0 0 31,690<br />

Barry Michael Gilboa-Conesvil 433401 35,200 COUNTY TAXABLE VALUE 155,000<br />

Barry Bethany FRNT 358.00 DPTH 155,000 TOWN TAXABLE VALUE 155,000<br />

102 Maple Ln ACRES 4.43 BANKWELLFAR SCHOOL TAXABLE VALUE 123,310<br />

Gilboa, NY 12076 EAST-0538756 NRTH-1293422 FD128 Conesville fire dist 155,000 TO M<br />

DEED BOOK 864 PG-262<br />

FULL MARKET VALUE 155,000<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 12<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 210.-4-9 *******************<br />

117 Maple Ln 445J175010<br />

210.-4-9 270 Mfg housing RES STAR 41854 0 0 31,690<br />

Barry Ronald L Gilboa-Conesvil 433401 12,600 COUNTY TAXABLE VALUE 51,300<br />

Barry Wilma Also See Deed Bk 560/136 51,300 TOWN TAXABLE VALUE 51,300<br />

117 Maple Ln FRNT 170.00 DPTH 183.00 SCHOOL TAXABLE VALUE 19,610<br />

Gilboa, NY 12076 ACRES 0.70 FD128 Conesville fire dist 51,300 TO M<br />

EAST-0539183 NRTH-1293623<br />

DEED BOOK 399 PG-417<br />

FULL MARKET VALUE 51,300<br />

******************************************************************************************************* 210.-4-10.3 ****************<br />

Beaver Hill Rd 445J194007<br />

210.-4-10.3 311 Res vac land COUNTY TAXABLE VALUE 7,800<br />

Barry Ronald L Gilboa-Conesvil 433401 7,800 TOWN TAXABLE VALUE 7,800<br />

Barry Wilma D FRNT 450.00 DPTH 7,800 SCHOOL TAXABLE VALUE 7,800<br />

117 Maple Ln ACRES 1.50 FD128 Conesville fire dist 7,800 TO M<br />

Gilboa, NY 12076 EAST-0539061 NRTH-1293660<br />

DEED BOOK 860 PG-135<br />

FULL MARKET VALUE 7,800<br />

******************************************************************************************************* 216.-2-5.11 ****************<br />

551 South Mountain Rd 445J174016<br />

216.-2-5.11 240 Rural res COUNTY TAXABLE VALUE 190,000<br />

Barry Steven J Gilboa-Conesvil 433401 77,500 TOWN TAXABLE VALUE 190,000<br />

Barry Geraldine H FRNT 1060.00 DPTH 190,000 SCHOOL TAXABLE VALUE 190,000<br />

551 South Mountain Rd ACRES 20.80 BANKWELLFAR FD128 Conesville fire dist 190,000 TO M<br />

PO Box 73 EAST-0538981 NRTH-1289699<br />

Gilboa, NY 12076 DEED BOOK 877 PG-130<br />

FULL MARKET VALUE 190,000<br />

******************************************************************************************************* 217.-2-3 *******************<br />

295 Bluebird Rd 445J100398<br />

217.-2-3 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 13<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 194.-3-1 *******************<br />

Hubbard Rd 445J185021<br />

194.-3-1 322 Rural vac>10 COUNTY TAXABLE VALUE 181,900<br />

Bauer Hans J Gilboa-Conesvil 433401 181,900 TOWN TAXABLE VALUE 181,900<br />

Gaspari Str 10 FRNT 3000.00 DPTH 181,900 SCHOOL TAXABLE VALUE 181,900<br />

81479 Munchen ACRES 142.80 FD128 Conesville fire dist 181,900 TO M<br />

, Germany EAST-0531883 NRTH-1310629<br />

DEED BOOK 611 PG-318<br />

FULL MARKET VALUE 181,900<br />

******************************************************************************************************* 194.-3-3 *******************<br />

Hubbard Rd 445J100189<br />

194.-3-3 322 Rural vac>10 COUNTY TAXABLE VALUE 81,900<br />

Bauer Hans-Jurgen Gilboa-Conesvil 433401 81,900 TOWN TAXABLE VALUE 81,900<br />

Gaspari Str 10 See Also 409/49 81,900 SCHOOL TAXABLE VALUE 81,900<br />

81479 Munchen FRNT 1190.00 DPTH FD128 Conesville fire dist 81,900 TO M<br />

, Germany ACRES 59.50<br />

EAST-0533877 NRTH-1311480<br />

DEED BOOK 611 PG-318<br />

FULL MARKET VALUE 81,900<br />

******************************************************************************************************* 211.-1-2 *******************<br />

209 Durham Rd 445J100387<br />

211.-1-2 210 1 Family Res COUNTY TAXABLE VALUE 137,200<br />

Bayer Hans Gilboa-Conesvil 433401 45,500 TOWN TAXABLE VALUE 137,200<br />

Bayer Joyce FRNT 1010.00 DPTH 137,200 SCHOOL TAXABLE VALUE 137,200<br />

3517 Bay Front Dr ACRES 8.00 FD128 Conesville fire dist 137,200 TO M<br />

Baldwin, NY 11510 EAST-0542484 NRTH-1295098<br />

DEED BOOK 397 PG-548<br />

FULL MARKET VALUE 137,200<br />

******************************************************************************************************* 209.-4-11 ******************<br />

130 South Mountain Rd 445J100166<br />

209.-4-11 240 Rural res COUNTY TAXABLE VALUE 183,400<br />

Bayer Richard Gilboa-Conesvil 433401 96,500 TOWN TAXABLE VALUE 183,400<br />

Bayer Johanna See Also 628/267 183,400 SCHOOL TAXABLE VALUE 183,400<br />

2304 Legion St 209-4-9 D&c W/this 3/99 FD128 Conesville fire dist 183,400 TO M<br />

Bellmore, NY 11710 FRNT 180.00 DPTH<br />

ACRES 28.39<br />

EAST-0528425 NRTH-1293579<br />

DEED BOOK 594 PG-126<br />

FULL MARKET VALUE 183,400<br />

******************************************************************************************************* 204.-1-8 *******************<br />

East Conesville Rd 445J182047<br />

204.-1-8 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 14<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 204.-1-7 *******************<br />

162 East Conesville Rd 445J180605<br />

204.-1-7 270 Mfg housing COUNTY TAXABLE VALUE 60,000<br />

Beale Mary R Gilboa-Conesvil 433401 46,750 TOWN TAXABLE VALUE 60,000<br />

Beale John J Life Est Mary R Beale 60,000 SCHOOL TAXABLE VALUE 60,000<br />

105 Dawson Cir FRNT 555.00 DPTH AG004 Ag dist #4 8.50 AC<br />

Staten Isalnd, NY 10314 ACRES 8.50 .00 UN<br />

EAST-0543813 NRTH-1301151 FD128 Conesville fire dist 60,000 TO M<br />

DEED BOOK 849 PG-77<br />

FULL MARKET VALUE 60,000<br />

******************************************************************************************************* 193.-2-47.111 **************<br />

Leroy Rd 445J189007<br />

193.-2-47.111 322 Rural vac>10 COUNTY TAXABLE VALUE 28,700<br />

Becker Bradley Gilboa-Conesvil 433401 28,700 TOWN TAXABLE VALUE 28,700<br />

79 Valley View Dr Will Filed Del Co 89-172 28,700 SCHOOL TAXABLE VALUE 28,700<br />

Chester, NY 10918 FRNT 300.00 DPTH AG004 Ag dist #4 14.33 AC<br />

ACRES 14.33 .00 UN<br />

EAST-0524997 NRTH-1307010 FD128 Conesville fire dist 28,700 TO M<br />

DEED BOOK 596 PG-77<br />

FULL MARKET VALUE 28,700<br />

******************************************************************************************************* 205.-2-2 *******************<br />

South Mountain Rd Off 445J176009<br />

205.-2-2 321 Abandoned ag COUNTY TAXABLE VALUE 189,000<br />

Becker Edward-John Cairo-Durham 192401 189,000 TOWN TAXABLE VALUE 189,000<br />

Becker Carol-Ann ACRES 157.50 189,000 SCHOOL TAXABLE VALUE 189,000<br />

24 Brookside Dr EAST-0558311 NRTH-1298842 FD128 Conesville fire dist 189,000 TO M<br />

Baldwin, NY 11510 DEED BOOK 606 PG-307<br />

FULL MARKET VALUE 189,000<br />

******************************************************************************************************* 211.-1-23 ******************<br />

813 South Mountain Rd 445J185009<br />

211.-1-23 270 Mfg housing COUNTY TAXABLE VALUE 60,000<br />

Begley James C Gilboa-Conesvil 433401 46,800 TOWN TAXABLE VALUE 60,000<br />

Begley Sarah T FRNT 488.11 DPTH 60,000 SCHOOL TAXABLE VALUE 60,000<br />

25 Gazebo Ln ACRES 8.53 FD128 Conesville fire dist 60,000 TO M<br />

Smithtown, NY 11787 EAST-0544843 NRTH-1290495<br />

DEED BOOK 852 PG-20<br />

FULL MARKET VALUE 60,000<br />

******************************************************************************************************* 211.-1-24 ******************<br />

794 South Mountain Rd 445J187010<br />

211.-1-24 270 Mfg housing COUNTY TAXABLE VALUE 55,000<br />

Begley James C Gilboa-Conesvil 433401 53,500 TOWN TAXABLE VALUE 55,000<br />

Begley Sarah T Also 800 South Mountain R 55,000 SCHOOL TAXABLE VALUE 55,000<br />

25 Gazebo Ln FRNT 515.16 DPTH FD128 Conesville fire dist 55,000 TO M<br />

Smithtown, NY 11787 ACRES 11.21<br />

EAST-0544586 NRTH-1290162<br />

DEED BOOK 652 PG-248<br />

FULL MARKET VALUE 55,000<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 15<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 216.-2-31 ******************<br />

199 Lost Mountain Rd 445J180301<br />

216.-2-31 260 Seasonal res COUNTY TAXABLE VALUE 52,000<br />

Belies John W Gilboa-Conesvil 433401 38,000 TOWN TAXABLE VALUE 52,000<br />

Belies Tami ACRES 5.00 52,000 SCHOOL TAXABLE VALUE 52,000<br />

199 Lost Mountain Rd EAST-0541486 NRTH-1288439 FD128 Conesville fire dist 52,000 TO M<br />

PO Box 237 DEED BOOK 906 PG-85<br />

Gilboa, NY 12076 FULL MARKET VALUE 52,000<br />

******************************************************************************************************* 202.-2-25 ******************<br />

427 Robinson Rd 445J180601<br />

202.-2-25 210 1 Family Res COUNTY TAXABLE VALUE 89,900<br />

Bellingham Aileen Gilboa-Conesvil 433401 47,400 TOWN TAXABLE VALUE 89,900<br />

PO Box 43 FRNT 250.00 DPTH 89,900 SCHOOL TAXABLE VALUE 89,900<br />

Johnson, NY 10933 ACRES 8.76 FD128 Conesville fire dist 89,900 TO M<br />

EAST-0523535 NRTH-1301376<br />

DEED BOOK 386 PG-951<br />

FULL MARKET VALUE 89,900<br />

******************************************************************************************************* 216.-2-5.21 ****************<br />

365 Lost Mountain Rd 445J191014<br />

216.-2-5.21 240 Rural res COUNTY TAXABLE VALUE 110,000<br />

Benevento Scott Gilboa-Conesvil 433401 100,600 TOWN TAXABLE VALUE 110,000<br />

2221 Palmer Ave Apt 1C 216-2-2 D&c W/this 2/02 110,000 SCHOOL TAXABLE VALUE 110,000<br />

New Rochelle, NY 10801 ACRES 30.02 FD128 Conesville fire dist 110,000 TO M<br />

EAST-0540092 NRTH-1285821<br />

DEED BOOK 896 PG-146<br />

FULL MARKET VALUE 110,000<br />

******************************************************************************************************* 195.-1-18 ******************<br />

Ray Bates Rd Off 445J209006<br />

195.-1-18 321 Abandoned ag COUNTY TAXABLE VALUE 6,400<br />

Bennett (Estate) William Gilboa-Conesvil 433401 6,400 TOWN TAXABLE VALUE 6,400<br />

Last Known Owner Found parcel-Last Known O 6,400 SCHOOL TAXABLE VALUE 6,400<br />

Ray Bates Rd Off ACRES 0.98 FD128 Conesville fire dist 6,400 TO M<br />

Gilboa, NY 12076 EAST-0546755 NRTH-1309215<br />

DEED BOOK 29 PG-443<br />

FULL MARKET VALUE 6,400<br />

******************************************************************************************************* 209.-2-8.2 *****************<br />

State Route 990V 445J212001<br />

209.-2-8.2 210 1 Family Res RES STAR 41854 0 0 31,690<br />

Berger Brenda Gilboa-Conesvil 433401 20,000 COUNTY TAXABLE VALUE 186,000<br />

1184 State Route 990V File 1 Map 5376 186,000 TOWN TAXABLE VALUE 186,000<br />

Gilboa, NY 12076 FRNT 200.00 DPTH SCHOOL TAXABLE VALUE 154,310<br />

ACRES 1.46 FD128 Conesville fire dist 186,000 TO M<br />

EAST-0522151 NRTH-1293424<br />

DEED BOOK 925 PG-172<br />

FULL MARKET VALUE 186,000<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 16<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 209.-1-2 *******************<br />

1184 State Route 990V 445J100026<br />

209.-1-2 210 1 Family Res COUNTY TAXABLE VALUE 5,000<br />

Berger Thomas J Gilboa-Conesvil 433401 2,000 TOWN TAXABLE VALUE 5,000<br />

PO Box 243 FRNT 100.00 DPTH 140.00 5,000 SCHOOL TAXABLE VALUE 5,000<br />

Gilboa, NY 12076 ACRES 0.34 FD128 Conesville fire dist 5,000 TO M<br />

EAST-0522529 NRTH-1293253<br />

DEED BOOK 498 PG-329<br />

FULL MARKET VALUE 5,000<br />

******************************************************************************************************* 202.-2-14.1 ****************<br />

321 Wood Rd 445J100027<br />

202.-2-14.1 260 Seasonal res COUNTY TAXABLE VALUE 110,000<br />

Berleth Frank Gilboa-Conesvil 433401 90,000 TOWN TAXABLE VALUE 110,000<br />

Berleth Liesel FRNT 2117.00 DPTH 110,000 SCHOOL TAXABLE VALUE 110,000<br />

257 Park Ave ACRES 50.00 FD128 Conesville fire dist 110,000 TO M<br />

Huntington, NY 11743 EAST-0528157 NRTH-1302788<br />

DEED BOOK 741 PG-111<br />

FULL MARKET VALUE 110,000<br />

******************************************************************************************************* 202.-2-14.2 ****************<br />

Wood Rd 445J193004<br />

202.-2-14.2 322 Rural vac>10 COUNTY TAXABLE VALUE 29,600<br />

Berleth Frank Gilboa-Conesvil 433401 29,600 TOWN TAXABLE VALUE 29,600<br />

Berleth Liesel FRNT 980.00 DPTH 29,600 SCHOOL TAXABLE VALUE 29,600<br />

257 Park Ave ACRES 10.25 FD128 Conesville fire dist 29,600 TO M<br />

Huntington, NY 11743 EAST-0528795 NRTH-1301828<br />

DEED BOOK 343 PG-294<br />

FULL MARKET VALUE 29,600<br />

******************************************************************************************************* 216.-1-7 *******************<br />

211 Haner Rd 95 PCT <strong>OF</strong> VALUE USED FOR EXEMPTION PURPOSES 445J100450<br />

216.-1-7 210 1 Family Res COM VET/CT 41131 15,000 15,000 0<br />

Bernard Carl A Jr Gilboa-Conesvil 433401 25,600 SR STAR 41834 0 0 65,700<br />

Bernard Gabriella See Also 396/828 131,900 COUNTY TAXABLE VALUE 116,900<br />

PO Box 62 FRNT 550.00 DPTH TOWN TAXABLE VALUE 116,900<br />

Gilboa, NY 12076 ACRES 2.52 BANK FARETS SCHOOL TAXABLE VALUE 66,200<br />

EAST-0530366 NRTH-1289415 FD128 Conesville fire dist 131,900 TO M<br />

DEED BOOK 731 PG-72<br />

FULL MARKET VALUE 131,900<br />

******************************************************************************************************* 204.-1-5 *******************<br />

214 East Conesville Rd 445J175005<br />

204.-1-5 260 Seasonal res COUNTY TAXABLE VALUE 60,000<br />

Besold Frederick A Jr Gilboa-Conesvil 433401 49,000 TOWN TAXABLE VALUE 60,000<br />

Besold Stacey Joyce FRNT 890.00 DPTH 60,000 SCHOOL TAXABLE VALUE 60,000<br />

39 Locust Rd ACRES 9.40 FD128 Conesville fire dist 60,000 TO M<br />

Wading River, NY 11792 EAST-0544047 NRTH-1301964<br />

DEED BOOK 393 PG-900<br />

FULL MARKET VALUE 60,000<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 17<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 193.-2-4 *******************<br />

Blakesley Rd 445J184019<br />

193.-2-4 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 18<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 216.-2-20 ******************<br />

South Mountain Rd 445J179711<br />

216.-2-20 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 19<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 202.-1-38 ******************<br />

Caulkins Rd 445J188019<br />

202.-1-38 322 Rural vac>10 COUNTY TAXABLE VALUE 24,000<br />

Bodnar David Gilboa-Conesvil 433401 24,000 TOWN TAXABLE VALUE 24,000<br />

Bodnar Judith FRNT 290.55 DPTH 24,000 SCHOOL TAXABLE VALUE 24,000<br />

11 Prime Ave ACRES 12.05 AG004 Ag dist #4 12.05 AC<br />

Huntington, NY 11743 EAST-0520156 NRTH-1299201 .00 UN<br />

DEED BOOK 466 PG-235 FD128 Conesville fire dist 24,000 TO M<br />

FULL MARKET VALUE 24,000<br />

******************************************************************************************************* 202.-3-9 *******************<br />

Caulkins Rd 445J100164<br />

202.-3-9 322 Rural vac>10 COUNTY TAXABLE VALUE 31,300<br />

Bodnar David Gilboa-Conesvil 433401 31,300 TOWN TAXABLE VALUE 31,300<br />

Bodnar Judith FRNT 266.00 DPTH 31,300 SCHOOL TAXABLE VALUE 31,300<br />

11 Prime Ave ACRES 15.67 FD128 Conesville fire dist 31,300 TO M<br />

Huntington, NY 11743 EAST-0520510 NRTH-1299056<br />

DEED BOOK 568 PG-238<br />

FULL MARKET VALUE 31,300<br />

******************************************************************************************************* 209.-2-7.1 *****************<br />

148 Robinson Rd 445J100038<br />

209.-2-7.1 270 Mfg housing SR STAR 41834 0 0 65,700<br />

Boettcher Fritz Gilboa-Conesvil 433401 66,000 COUNTY TAXABLE VALUE 91,000<br />

Boettcher Emmy FRNT 810.00 DPTH 91,000 TOWN TAXABLE VALUE 91,000<br />

148 Robinson Rd ACRES 24.20 SCHOOL TAXABLE VALUE 25,300<br />

PO Box 18 EAST-0522839 NRTH-1294422 FD128 Conesville fire dist 91,000 TO M<br />

Gilboa, NY 12076 DEED BOOK 736 PG-233<br />

FULL MARKET VALUE 91,000<br />

******************************************************************************************************* 209.-2-7.2 *****************<br />

State Route 990V 445J197009<br />

209.-2-7.2 322 Rural vac>10 COUNTY TAXABLE VALUE 15,750<br />

Boettcher Fritz Gilboa-Conesvil 433401 15,750 TOWN TAXABLE VALUE 15,750<br />

Boettcher Emmy FRNT 390.00 DPTH 15,750 SCHOOL TAXABLE VALUE 15,750<br />

148 Robinson Rd ACRES 10.50 FD128 Conesville fire dist 15,750 TO M<br />

PO Box 18 EAST-0522958 NRTH-1293735<br />

Gilboa, NY 12076 DEED BOOK 736 PG-233<br />

FULL MARKET VALUE 15,750<br />

******************************************************************************************************* 208.-1-37 ******************<br />

107 Twin Pines Dr 445J179831<br />

208.-1-37 240 Rural res COUNTY TAXABLE VALUE 156,500<br />

Bohn Peter W Gilboa-Conesvil 433401 61,400 TOWN TAXABLE VALUE 156,500<br />

600 W 115th St Apt 94 208-1-38 & 35 d&c w/ths 2 156,500 SCHOOL TAXABLE VALUE 156,500<br />

New York, NY 10025 FRNT 938.76 DPTH FD128 Conesville fire dist 156,500 TO M<br />

ACRES 14.34<br />

EAST-0515727 NRTH-1297005<br />

DEED BOOK 649 PG-242<br />

FULL MARKET VALUE 156,500<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 20<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 211.-1-47 ******************<br />

Cook Rd 445J189053<br />

211.-1-47 312 Vac w/imprv COUNTY TAXABLE VALUE 31,800<br />

Bonet Barrin Gilboa-Conesvil 433401 16,500 TOWN TAXABLE VALUE 31,800<br />

Sumie Tanaka FRNT 800.00 DPTH 31,800 SCHOOL TAXABLE VALUE 31,800<br />

376 President St Apt 3E ACRES 5.01 FD128 Conesville fire dist 31,800 TO M<br />

Brooklyn, NY 11231-5041 EAST-0542357 NRTH-1292908<br />

DEED BOOK 487 PG-301<br />

FULL MARKET VALUE 31,800<br />

******************************************************************************************************* 195.3-2-11 *****************<br />

476 East Conesville Rd 445J100007<br />

195.3-2-11 210 1 Family Res COUNTY TAXABLE VALUE 79,600<br />

Bonn George E Gilboa-Conesvil 433401 5,200 TOWN TAXABLE VALUE 79,600<br />

1551 10th St FRNT 153.00 DPTH 70.00 79,600 SCHOOL TAXABLE VALUE 79,600<br />

West Babylon, NY 11704 ACRES 0.29 FD128 Conesville fire dist 79,600 TO M<br />

EAST-0541387 NRTH-1306311<br />

DEED BOOK 366 PG-1033<br />

FULL MARKET VALUE 79,600<br />

******************************************************************************************************* 194.-1-17 ******************<br />

Bohlen Rd 445J182059<br />

194.-1-17 311 Res vac land COUNTY TAXABLE VALUE 8,400<br />

Bonnes Ondes Inc Gilboa-Conesvil 433401 8,400 TOWN TAXABLE VALUE 8,400<br />

414 Peace St FRNT 392.52 DPTH 8,400 SCHOOL TAXABLE VALUE 8,400<br />

Pelle, IA 50219 ACRES 1.74 FD128 Conesville fire dist 8,400 TO M<br />

EAST-0529376 NRTH-1310191<br />

DEED BOOK 708 PG-10<br />

FULL MARKET VALUE 8,400<br />

******************************************************************************************************* 193.-2-36 ******************<br />

Leroy Rd 445J190022<br />

193.-2-36 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 21<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 193.-2-35 ******************<br />

Leroy Rd 445J190023<br />

193.-2-35 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 22<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 209.-3-9 *******************<br />

1248 State Route 990V 445J100041<br />

209.-3-9 210 1 Family Res SR STAR 41834 0 0 65,700<br />

Brand Alton Gilboa-Conesvil 433401 28,500 COUNTY TAXABLE VALUE 186,300<br />

Brand Alice E FRNT 460.00 DPTH 186,300 TOWN TAXABLE VALUE 186,300<br />

1248 State Route 990V ACRES 3.80 SCHOOL TAXABLE VALUE 120,600<br />

Gilboa, NY 12076 EAST-0524023 NRTH-1293188 FD128 Conesville fire dist 186,300 TO M<br />

DEED BOOK 334 PG-93 LD128 Cones-manor light 186,300 TO M<br />

FULL MARKET VALUE 186,300<br />

******************************************************************************************************* 210.-3-24 ******************<br />

110 Durham Rd 445J100044<br />

210.-3-24 210 1 Family Res AGED - ALL 41800 32,500 32,500 32,500<br />

Brandow Arvessa M Gilboa-Conesvil 433401 18,200 SR STAR 41834 0 0 32,500<br />

110 Durham Rd See BLA 881/45 65,000 COUNTY TAXABLE VALUE 32,500<br />

Gilboa, NY 12076 FRNT 223.26 DPTH TOWN TAXABLE VALUE 32,500<br />

ACRES 1.03 SCHOOL TAXABLE VALUE 0<br />

EAST-0540229 NRTH-1295226 FD128 Conesville fire dist 65,000 TO M<br />

DEED BOOK 294 PG-308 LD128 Cones-manor light 65,000 TO M<br />

FULL MARKET VALUE 65,000<br />

******************************************************************************************************* 210.-1-4.113 ***************<br />

397 South Mountain Rd 445J194009<br />

210.-1-4.113 210 1 Family Res RES STAR 41854 0 0 31,690<br />

Brandow Byron Gilboa-Conesvil 433401 38,100 COUNTY TAXABLE VALUE 54,000<br />

104 Durham Rd FRNT 47.04 DPTH 54,000 TOWN TAXABLE VALUE 54,000<br />

Gilboa, NY 12076 ACRES 5.01 SCHOOL TAXABLE VALUE 22,310<br />

EAST-0534522 NRTH-1290495 AG004 Ag dist #4 5.01 AC<br />

DEED BOOK 786 PG-297 .00 UN<br />

FULL MARKET VALUE 54,000 FD128 Conesville fire dist 54,000 TO M<br />

******************************************************************************************************* 210.-3-2.2 *****************<br />

Durham Rd Off 445J192007<br />

210.-3-2.2 312 Vac w/imprv COUNTY TAXABLE VALUE 15,500<br />

Brandow Donald M Gilboa-Conesvil 433401 10,000 TOWN TAXABLE VALUE 15,500<br />

109 Durham Rd ACRES 2.90 15,500 SCHOOL TAXABLE VALUE 15,500<br />

Gilboa, NY 12076 EAST-0540692 NRTH-1295328 FD128 Conesville fire dist 15,500 TO M<br />

DEED BOOK 533 PG-25<br />

FULL MARKET VALUE 15,500<br />

******************************************************************************************************* 210.-3-3 *******************<br />

109 Durham Rd 445J175007<br />

210.-3-3 210 1 Family Res RES STAR 41854 0 0 31,690<br />

Brandow Donald M Gilboa-Conesvil 433401 6,000 COUNTY TAXABLE VALUE 98,800<br />

109 Durham Rd FRNT 84.00 DPTH 203.00 98,800 TOWN TAXABLE VALUE 98,800<br />

Gilboa, NY 12076 ACRES 0.37 SCHOOL TAXABLE VALUE 67,110<br />

EAST-0540453 NRTH-1295417 FD128 Conesville fire dist 98,800 TO M<br />

DEED BOOK 510 PG-52 LD128 Cones-manor light 98,800 TO M<br />

FULL MARKET VALUE 98,800<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 23<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 208.-3-4 *******************<br />

814 State Route 990V 445J100045<br />

208.-3-4 210 1 Family Res COUNTY TAXABLE VALUE 65,000<br />

Brandow Donald W Gilboa-Conesvil 433401 7,200 TOWN TAXABLE VALUE 65,000<br />

814 State Route 990V FRNT 90.00 DPTH 210.00 65,000 SCHOOL TAXABLE VALUE 65,000<br />

Gilboa, NY 12076 ACRES 0.40 FD128 Conesville fire dist 65,000 TO M<br />

EAST-0513318 NRTH-1290732 LD128 Cones-manor light 65,000 TO M<br />

DEED BOOK 794 PG-66<br />

FULL MARKET VALUE 65,000<br />

******************************************************************************************************* 210.-3-23 ******************<br />

104 Durham Rd 445J100499<br />

210.-3-23 270 Mfg housing RES STAR 41854 0 0 31,690<br />

Brandow Larry Gilboa-Conesvil 433401 9,000 COUNTY TAXABLE VALUE 32,500<br />

Brandow Judy FRNT 120.00 DPTH 286.04 32,500 TOWN TAXABLE VALUE 32,500<br />

104 Durham Rd ACRES 0.50 SCHOOL TAXABLE VALUE 810<br />

Gilboa, NY 12076 EAST-0540199 NRTH-1295353 FD128 Conesville fire dist 32,500 TO M<br />

DEED BOOK 381 PG-1144 LD128 Cones-manor light 32,500 TO M<br />

FULL MARKET VALUE 32,500<br />

******************************************************************************************************* 203.-1-53 ******************<br />

Brand Rd Off 445J178101<br />

203.-1-53 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 24<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 216.-2-28 ******************<br />

351 Lost Mountain Rd 445J180998<br />

216.-2-28 312 Vac w/imprv COUNTY TAXABLE VALUE 42,000<br />

Brennan Joseph Gilboa-Conesvil 433401 25,800 TOWN TAXABLE VALUE 42,000<br />

Brennan Eileen 351 Lost Mountain Rd 42,000 SCHOOL TAXABLE VALUE 42,000<br />

77 Hewlett Ave ACRES 8.73 FD128 Conesville fire dist 42,000 TO M<br />

Point Lookout, NY 11569 EAST-0540635 NRTH-1285799<br />

DEED BOOK 802 PG-181<br />

FULL MARKET VALUE 42,000<br />

******************************************************************************************************* 212.-2-2 *******************<br />

Durham Rd Off 445J100052<br />

212.-2-2 314 Rural vac

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 25<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 195.3-2-29 *****************<br />

157 Horseshoe Rd 445J177045<br />

195.3-2-29 210 1 Family Res COUNTY TAXABLE VALUE 128,200<br />

Brown Christopher Gilboa-Conesvil 433401 12,600 TOWN TAXABLE VALUE 128,200<br />

Brown Roberta FRNT 151.00 DPTH 160.00 128,200 SCHOOL TAXABLE VALUE 128,200<br />

4 Zuydhoek Rd ACRES 0.70 FD128 Conesville fire dist 128,200 TO M<br />

Briarcliff Manor, NY 10510 EAST-0541928 NRTH-1307267<br />

DEED BOOK 755 PG-216<br />

FULL MARKET VALUE 128,200<br />

******************************************************************************************************* 193.-1-6.6 *****************<br />

Leroy Rd 445J199019<br />

193.-1-6.6 314 Rural vac10 COUNTY TAXABLE VALUE 7,500<br />

Bruno Joseph K Gilboa-Conesvil 433401 7,500 TOWN TAXABLE VALUE 7,500<br />

439 Brand Rd ACRES 15.00 7,500 SCHOOL TAXABLE VALUE 7,500<br />

Gilboa, NY 12076 EAST-0533135 NRTH-1304332 FD128 Conesville fire dist 7,500 TO M<br />

DEED BOOK 900 PG-1<br />

FULL MARKET VALUE 7,500<br />

******************************************************************************************************* 203.-2-35 ******************<br />

430 Brand Rd 445J179005<br />

203.-2-35 270 Mfg housing COUNTY TAXABLE VALUE 48,500<br />

Bruno Michael Gilboa-Conesvil 433401 38,000 TOWN TAXABLE VALUE 48,500<br />

2 Schoolcraft St FRNT 300.00 DPTH 48,500 SCHOOL TAXABLE VALUE 48,500<br />

Guilderland, NY 12084 ACRES 5.02 FD128 Conesville fire dist 48,500 TO M<br />

EAST-0533785 NRTH-1303556<br />

DEED BOOK 469 PG-44<br />

FULL MARKET VALUE 48,500<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 26<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 193.-2-13 ******************<br />

139 Blakesley Rd 445J184010<br />

193.-2-13 210 1 Family Res COUNTY TAXABLE VALUE 154,300<br />

Bryson Gerald Gilboa-Conesvil 433401 23,500 TOWN TAXABLE VALUE 154,300<br />

Bryson Helen ACRES 2.10 154,300 SCHOOL TAXABLE VALUE 154,300<br />

66 Poet St EAST-0527421 NRTH-1311615 FD128 Conesville fire dist 154,300 TO M<br />

North Babylon, NY 11703 DEED BOOK 397 PG-47<br />

FULL MARKET VALUE 154,300<br />

******************************************************************************************************* 208.-1-8 *******************<br />

103 Briggs Rd 445J100061<br />

208.-1-8 210 1 Family Res RES STAR 41854 0 0 31,690<br />

Buel Clayton Gilboa-Conesvil 433401 18,000 COUNTY TAXABLE VALUE 150,000<br />

103 Briggs Rd FRNT 145.00 DPTH 138.00 150,000 TOWN TAXABLE VALUE 150,000<br />

Gilboa, NY 12076 ACRES 1.00 SCHOOL TAXABLE VALUE 118,310<br />

EAST-0513819 NRTH-1292427 FD128 Conesville fire dist 150,000 TO M<br />

DEED BOOK 404 PG-60<br />

FULL MARKET VALUE 150,000<br />

******************************************************************************************************* 209.-1-4 *******************<br />

1061 State Route 990V 445J100059<br />

209.-1-4 210 1 Family Res COUNTY TAXABLE VALUE 30,000<br />

Buel Clayton Gilboa-Conesvil 433401 20,500 TOWN TAXABLE VALUE 30,000<br />

Buel Eileen S FRNT 330.00 DPTH 30,000 SCHOOL TAXABLE VALUE 30,000<br />

103 Briggs Rd ACRES 1.50 AG004 Ag dist #4 1.50 AC<br />

Gilboa, NY 12076 EAST-0519563 NRTH-1292229 .00 UN<br />

DEED BOOK 879 PG-127 FD128 Conesville fire dist 30,000 TO M<br />

FULL MARKET VALUE 30,000<br />

******************************************************************************************************* 209.-1-11 ******************<br />

1066 State Route 990V 445J178250<br />

209.-1-11 312 Vac w/imprv AG DISTRIC 41720 222,723 222,723 222,723<br />

Buel Clayton A Gilboa-Conesvil 433401 289,200 COUNTY TAXABLE VALUE 68,477<br />

103 Briggs Rd ... 291,200 TOWN TAXABLE VALUE 68,477<br />

Gilboa, NY 12076 FRNT 1185.00 DPTH SCHOOL TAXABLE VALUE 68,477<br />

ACRES 252.70 AG004 Ag dist #4 252.70 AC<br />

MAY BE SUBJECT TO PAYMENT EAST-0520146 NRTH-1290734 .00 UN<br />

UNDER AGDIST LAW TIL 2016 DEED BOOK 404 PG-56 FD128 Conesville fire dist 291,200 TO M<br />

FULL MARKET VALUE 291,200<br />

******************************************************************************************************* 194.-3-22 ******************<br />

275 Hubbard Rd 445J180550<br />

194.-3-22 210 1 Family Res Fire/EMS 41690 3,000 3,000 3,000<br />

Buel Heidi Gilboa-Conesvil 433401 38,600 RES STAR 41854 0 0 31,690<br />

275 Hubbard Rd FRNT 315.00 DPTH 135,000 COUNTY TAXABLE VALUE 132,000<br />

Gilboa, NY 12076 ACRES 5.22 TOWN TAXABLE VALUE 132,000<br />

EAST-0534225 NRTH-1308856 SCHOOL TAXABLE VALUE 100,310<br />

DEED BOOK 598 PG-182 FD128 Conesville fire dist 132,000 TO M<br />

FULL MARKET VALUE 135,000 3,000 EX<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 27<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 202.-4-22.1 ****************<br />

198 Brand Rd 46 PCT <strong>OF</strong> VALUE USED FOR EXEMPTION PURPOSES 445J100064<br />

202.-4-22.1 112 Dairy farm AG LANDS 41730 43,959 43,959 43,959<br />

Buel Legrand Gilboa-Conesvil 433401 190,000 SR STAR 41834 0 0 65,700<br />

Buel Leone FRNT 5440.00 DPTH 248,000 AGED - ALL 41800 57,040 57,040 57,040<br />

198 Brand Rd ACRES 146.50 COUNTY TAXABLE VALUE 147,001<br />

Gilboa, NY 12076 EAST-0528980 NRTH-1300146 TOWN TAXABLE VALUE 147,001<br />

DEED BOOK 538 PG-162 SCHOOL TAXABLE VALUE 81,301<br />

MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 248,000 AG004 Ag dist #4 146.50 AC<br />

UNDER AGDIST LAW TIL 2019 .00 UN<br />

FD128 Conesville fire dist 248,000 TO M<br />

******************************************************************************************************* 208.-2-37 ******************<br />

Pangman Rd 445J189039<br />

208.-2-37 322 Rural vac>10 COUNTY TAXABLE VALUE 34,000<br />

Buel Leslie A Gilboa-Conesvil 433401 34,000 TOWN TAXABLE VALUE 34,000<br />

Buel Roma M FRNT 335.00 DPTH 34,000 SCHOOL TAXABLE VALUE 34,000<br />

147 Pangman Rd ACRES 12.00 AG004 Ag dist #4 12.00 AC<br />

Gilboa, NY 12076 EAST-0514826 NRTH-1289297 .00 UN<br />

DEED BOOK 676 PG-215 FD128 Conesville fire dist 34,000 TO M<br />

FULL MARKET VALUE 34,000<br />

******************************************************************************************************* 209.-1-10.11 ***************<br />

147 Pangman Rd 445J100065<br />

209.-1-10.11 112 Dairy farm SR STAR 41834 0 0 65,700<br />

Buel Leslie A Gilboa-Conesvil 433401 328,900 COUNTY TAXABLE VALUE 460,000<br />

Buel Roma M Life Est Leslie & Roma Bu 460,000 TOWN TAXABLE VALUE 460,000<br />

147 Pangman Rd Also 197 Pangman Rd SCHOOL TAXABLE VALUE 394,300<br />

Gilboa, NY 12076 FRNT 315.00 DPTH AG004 Ag dist #4 263.50 AC<br />

ACRES 263.50 .00 UN<br />

EAST-0517991 NRTH-1289609 FD128 Conesville fire dist 460,000 TO M<br />

DEED BOOK 907 PG-165<br />

FULL MARKET VALUE 460,000<br />

******************************************************************************************************* 202.-4-24 ******************<br />

269 Bear Kill Rd 445J100063<br />

202.-4-24 112 Dairy farm Fire/EMS 41690 3,000 3,000 3,000<br />

Buel Raymond Gilboa-Conesvil 433401 166,320 Fire/EMS 41690 3,000 3,000 3,000<br />

Buel Betty 202-4-25.11 d&c w/this 2/ 220,000 AG DISTRIC 41720 114,240 114,240 114,240<br />

269 Bearkill Rd FRNT 2580.00 DPTH SR STAR 41834 0 0 65,700<br />

Gilboa, NY 12076 ACRES 129.60 COUNTY TAXABLE VALUE 99,760<br />

EAST-0528438 NRTH-1297376 TOWN TAXABLE VALUE 99,760<br />

MAY BE SUBJECT TO PAYMENT DEED BOOK 538 PG-160 SCHOOL TAXABLE VALUE 34,060<br />

UNDER AGDIST LAW TIL 2016 FULL MARKET VALUE 220,000 AG004 Ag dist #4 129.60 AC<br />

.00 UN<br />

FD128 Conesville fire dist 214,000 TO M<br />

6,000 EX<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 28<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Conesville OWNERS NAME SEQUENCE TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 432800 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 209.-1-5 *******************<br />

1099 State Route 990V 445J100066<br />

209.-1-5 210 1 Family Res COM VET/CT 41131 15,000 15,000 0<br />

Buel Ross Gilboa-Conesvil 433401 19,300 AGED - ALL 41800 41,150 41,150 48,650<br />

Buel Galen life use Ross/Beatrice Bu 97,300 SR STAR 41834 0 0 48,650<br />

c/o Daryl Buel FRNT 238.00 DPTH COUNTY TAXABLE VALUE 41,150<br />

110 Broome Center Rd ACRES 1.25 TOWN TAXABLE VALUE 41,150<br />

Gilboa, NY 12076 EAST-0520375 NRTH-1292427 SCHOOL TAXABLE VALUE 0<br />

DEED BOOK 784 PG-132 AG004 Ag dist #4 1.25 AC<br />

FULL MARKET VALUE 97,300 .00 UN<br />

FD128 Conesville fire dist 97,300 TO M<br />

******************************************************************************************************* 202.-4-19 ******************<br />

188 Wood Rd 445J100291<br />

202.-4-19 210 1 Family Res Fire/EMS 41690 3,000 3,000 3,000<br />

Buel Thomas R Gilboa-Conesvil 433401 49,500 RES STAR 41854 0 0 31,690<br />

188 Wood Rd FRNT 415.00 DPTH 70,000 COUNTY TAXABLE VALUE 67,000<br />

Gilboa, NY 12076 ACRES 9.60 BANKWELLFAR TOWN TAXABLE VALUE 67,000<br />

EAST-0526916 NRTH-1299594 SCHOOL TAXABLE VALUE 35,310<br />

DEED BOOK 739 PG-72 FD128 Conesville fire dist 67,000 TO M<br />

FULL MARKET VALUE 70,000 3,000 EX<br />

******************************************************************************************************* 202.-2-23 ******************<br />

403 Robinson Rd 445J179902<br />

202.-2-23 312 Vac w/imprv COUNTY TAXABLE VALUE 29,500<br />

Buffolino Agastino Gilboa-Conesvil 433401 27,689 TOWN TAXABLE VALUE 29,500<br />

Buffolino Giovani FRNT 365.93 DPTH 29,500 SCHOOL TAXABLE VALUE 29,500<br />

30 Harned Rd ACRES 10.00 FD128 Conesville fire dist 29,500 TO M<br />

Commack, NY 11725 EAST-0523553 NRTH-1300839<br />

DEED BOOK 437 PG-282<br />

FULL MARKET VALUE 29,500<br />

******************************************************************************************************* 194.-1-15 ******************<br />

107 Deer Run Rd 445J182045<br />

194.-1-15 210 1 Family Res RES STAR 41854 0 0 31,690<br />

Bundy Connie S Gilboa-Conesvil 433401 23,800 COUNTY TAXABLE VALUE 185,000<br />

Spanhake Roy A FRNT 230.00 DPTH 185,000 TOWN TAXABLE VALUE 185,000<br />

107 Deer Run Rd ACRES 2.16 BANK GRECO SCHOOL TAXABLE VALUE 153,310<br />

Gilboa, NY 12076 EAST-0530032 NRTH-1309782 FD128 Conesville fire dist 185,000 TO M<br />

DEED BOOK 818 PG-175<br />

FULL MARKET VALUE 185,000<br />

******************************************************************************************************* 195.3-2-20 *****************<br />

129 Lake Of Seven Birches Rd 445J100502<br />

195.3-2-20 210 1 Family Res COUNTY TAXABLE VALUE 92,400<br />