Town Assessment Roll - Schoharie County

Town Assessment Roll - Schoharie County

Town Assessment Roll - Schoharie County

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

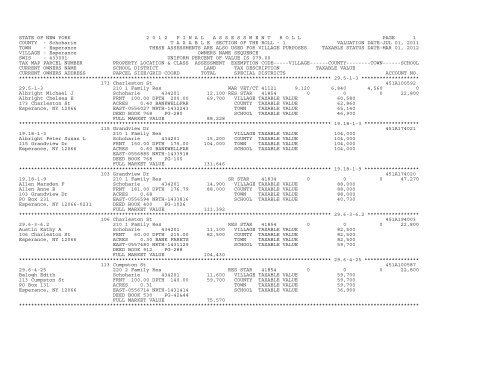

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 1<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.5-1-3 *******************<br />

173 Charleston St 451A100592<br />

29.5-1-3 210 1 Family Res WAR VET/CT 41121 9,120 6,840 4,560 0<br />

Albright Michael J <strong>Schoharie</strong> 434201 12,100 RES STAR 41854 0 0 0 22,800<br />

Albright Chelsea E FRNT 100.00 DPTH 200.00 69,700 VILLAGE TAXABLE VALUE 60,580<br />

173 Charleston St ACRES 0.40 BANKWELLFAR COUNTY TAXABLE VALUE 62,860<br />

Esperance, NY 12066 EAST-0556027 NRTH-1432243 TOWN TAXABLE VALUE 65,140<br />

DEED BOOK 768 PG-280 SCHOOL TAXABLE VALUE 46,900<br />

FULL MARKET VALUE 88,228<br />

******************************************************************************************************* 19.18-1-3 ******************<br />

115 Grandview Dr 451A174021<br />

19.18-1-3 210 1 Family Res VILLAGE TAXABLE VALUE 104,000<br />

Albright Peter Susan L <strong>Schoharie</strong> 434201 15,200 COUNTY TAXABLE VALUE 104,000<br />

115 Grandview Dr FRNT 150.00 DPTH 175.00 104,000 TOWN TAXABLE VALUE 104,000<br />

Esperance, NY 12066 ACRES 0.60 BANKWELLFAR SCHOOL TAXABLE VALUE 104,000<br />

EAST-0556885 NRTH-1433918<br />

DEED BOOK 768 PG-100<br />

FULL MARKET VALUE 131,646<br />

******************************************************************************************************* 19.18-1-9 ******************<br />

103 Grandview Dr 451A174020<br />

19.18-1-9 210 1 Family Res SR STAR 41834 0 0 0 47,270<br />

Allen Marsden F <strong>Schoharie</strong> 434201 14,900 VILLAGE TAXABLE VALUE 88,000<br />

Allen Anne B FRNT 181.00 DPTH 176.79 88,000 COUNTY TAXABLE VALUE 88,000<br />

103 Grandview Dr ACRES 0.68 TOWN TAXABLE VALUE 88,000<br />

PO Box 231 EAST-0556594 NRTH-1433816 SCHOOL TAXABLE VALUE 40,730<br />

Esperance, NY 12066-0231 DEED BOOK 400 PG-1026<br />

FULL MARKET VALUE 111,392<br />

******************************************************************************************************* 29.6-3-6.2 *****************<br />

106 Charleston St 451A194003<br />

29.6-3-6.2 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Austin Kathy A <strong>Schoharie</strong> 434201 11,100 VILLAGE TAXABLE VALUE 82,500<br />

106 Charleston St FRNT 60.00 DPTH 215.00 82,500 COUNTY TAXABLE VALUE 82,500<br />

Esperance, NY 12066 ACRES 0.30 BANK FARETS TOWN TAXABLE VALUE 82,500<br />

EAST-0557480 NRTH-1431129 SCHOOL TAXABLE VALUE 59,700<br />

DEED BOOK 912 PG-288<br />

FULL MARKET VALUE 104,430<br />

******************************************************************************************************* 29.6-4-25 ******************<br />

113 Cumpston St 451A100587<br />

29.6-4-25 220 2 Family Res RES STAR 41854 0 0 0 22,800<br />

Balogh Edith <strong>Schoharie</strong> 434201 11,600 VILLAGE TAXABLE VALUE 59,700<br />

113 Cumpston St FRNT 100.00 DPTH 140.00 59,700 COUNTY TAXABLE VALUE 59,700<br />

PO Box 131 ACRES 0.31 TOWN TAXABLE VALUE 59,700<br />

Esperance, NY 12066 EAST-0556714 NRTH-1431414 SCHOOL TAXABLE VALUE 36,900<br />

DEED BOOK 530 PG-42&44<br />

FULL MARKET VALUE 75,570<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 2<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.5-1-28 ******************<br />

125 Lord North Dr 451A100697<br />

29.5-1-28 270 Mfg housing SR STAR 41834 0 0 0 47,270<br />

Barbic Mary <strong>Schoharie</strong> 434201 14,100 VILLAGE TAXABLE VALUE 55,500<br />

125 Lord North Dr 29.05-1-29 D&c W/this 10/ 55,500 COUNTY TAXABLE VALUE 55,500<br />

PO Box 181 FRNT 180.00 DPTH 107.00 TOWN TAXABLE VALUE 55,500<br />

Esperance, NY 12066 ACRES 0.50 SCHOOL TAXABLE VALUE 8,230<br />

EAST-0555854 NRTH-1431278<br />

DEED BOOK 602 PG-27<br />

FULL MARKET VALUE 70,253<br />

******************************************************************************************************* 19.18-1-1.115 **************<br />

Feuz Ter 451A206003<br />

19.18-1-1.115 311 Res vac land VILLAGE TAXABLE VALUE 10,000<br />

Becker Randall F Jr <strong>Schoharie</strong> 434201 10,000 COUNTY TAXABLE VALUE 10,000<br />

Becker Barbara E FRNT 390.00 DPTH 10,000 TOWN TAXABLE VALUE 10,000<br />

187 Feuz Ter ACRES 1.70 SCHOOL TAXABLE VALUE 10,000<br />

Esperance, NY 12066 EAST-0556097 NRTH-1434520<br />

DEED BOOK 796 PG-348<br />

FULL MARKET VALUE 12,658<br />

******************************************************************************************************* 19.18-1-2 ******************<br />

187 Feuz Ter 451A186004<br />

19.18-1-2 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Becker Randall F Jr <strong>Schoharie</strong> 434201 28,800 VILLAGE TAXABLE VALUE 274,900<br />

Becker Barbara E FRNT 392.94 DPTH 274,900 COUNTY TAXABLE VALUE 274,900<br />

187 Feuz Ter ACRES 3.54 TOWN TAXABLE VALUE 274,900<br />

Esperance, NY 12066 EAST-0556201 NRTH-1434227 SCHOOL TAXABLE VALUE 252,100<br />

DEED BOOK 763 PG-169<br />

FULL MARKET VALUE 347,975<br />

******************************************************************************************************* 29.10-1-16 *****************<br />

112 Steuben St 451A100590<br />

29.10-1-16 210 1 Family Res RES STAR 41854 0 0 0 20,000<br />

Belfance Edward Jr <strong>Schoharie</strong> 434201 11,200 VILLAGE TAXABLE VALUE 20,000<br />

Belfance Charlotte FRNT 40.00 DPTH 250.00 20,000 COUNTY TAXABLE VALUE 20,000<br />

PO Box 63 ACRES 0.10 TOWN TAXABLE VALUE 20,000<br />

Esperance, NY 12066-0063 EAST-0556495 NRTH-1430325 SCHOOL TAXABLE VALUE 0<br />

DEED BOOK 329 PG-146<br />

FULL MARKET VALUE 25,316<br />

******************************************************************************************************* 29.5-1-12 ******************<br />

121 Church St 451A100660<br />

29.5-1-12 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Benninger Dawn Michele <strong>Schoharie</strong> 434201 11,700 VILLAGE TAXABLE VALUE 51,000<br />

Attn: Dawn Roosevelt Partial Value 51,000 COUNTY TAXABLE VALUE 51,000<br />

121 Church St FRNT 50.00 DPTH 313.00 TOWN TAXABLE VALUE 51,000<br />

Esperance, NY 12066 ACRES 0.40 BANKWELLFAR SCHOOL TAXABLE VALUE 28,200<br />

EAST-0556257 NRTH-1431167<br />

DEED BOOK 574 PG-217<br />

FULL MARKET VALUE 64,557<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 3<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.6-2-7 *******************<br />

124 Charleston St 451A100594<br />

29.6-2-7 210 1 Family Res VETS EFCL 41002 0 62,800 0 0<br />

Benson Oscar P <strong>Schoharie</strong> 434201 14,300 COM VET/T 41133 0 0 7,600 0<br />

Benson Helen H FRNT 68.00 DPTH 62,800 COM VET/V 41137 15,200 0 0 0<br />

124 Charleston St ACRES 1.00 DIS VET/T 41143 0 0 15,200 0<br />

PO Box 135 EAST-0557225 NRTH-1431610 DIS VET/V 41147 15,700 0 0 0<br />

Esperance, NY 12066-0135 DEED BOOK 271 PG-173 AGED - ALL 41800 0 0 20,000 31,400<br />

FULL MARKET VALUE 79,494 SR STAR 41834 0 0 0 31,400<br />

VILLAGE TAXABLE VALUE 31,900<br />

COUNTY TAXABLE VALUE 0<br />

TOWN TAXABLE VALUE 20,000<br />

SCHOOL TAXABLE VALUE 0<br />

******************************************************************************************************* 29.5-1-15 ******************<br />

111 Church St 451A100641<br />

29.5-1-15 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Benson Paul W <strong>Schoharie</strong> 434201 10,800 VILLAGE TAXABLE VALUE 66,000<br />

Sossei Joan Partial Value 66,000 COUNTY TAXABLE VALUE 66,000<br />

111 Church St FRNT 70.00 DPTH 90.00 TOWN TAXABLE VALUE 66,000<br />

PO Box 103 ACRES 0.10 BANK NBT SCHOOL TAXABLE VALUE 43,200<br />

Esperance, NY 12066-0103 EAST-0556421 NRTH-1430935<br />

DEED BOOK 644 PG-92<br />

FULL MARKET VALUE 83,544<br />

******************************************************************************************************* 29.10-1-7 ******************<br />

126 Main St 451A100593<br />

29.10-1-7 210 1 Family Res WAR VET/C 41122 0 6,840 0 0<br />

Bottomley Brian D <strong>Schoharie</strong> 434201 10,900 WAR VET/T 41123 0 0 4,560 0<br />

126 Main St FRNT 30.00 DPTH 250.00 52,500 WAR VET/V 41127 7,875 0 0 0<br />

Esperance, NY 12066 ACRES 0.20 BANK FARETS RES STAR 41854 0 0 0 22,800<br />

EAST-0556072 NRTH-1430410 VILLAGE TAXABLE VALUE 44,625<br />

DEED BOOK 562 PG-237 COUNTY TAXABLE VALUE 45,660<br />

FULL MARKET VALUE 66,456 TOWN TAXABLE VALUE 47,940<br />

SCHOOL TAXABLE VALUE 29,700<br />

******************************************************************************************************* 29.10-1-13 *****************<br />

138 Main St 451A181013<br />

29.10-1-13 220 2 Family Res VILLAGE TAXABLE VALUE 54,000<br />

Bouck Daniel A <strong>Schoharie</strong> 434201 11,700 COUNTY TAXABLE VALUE 54,000<br />

186 Ragan Rd FRNT 60.00 DPTH 250.00 54,000 TOWN TAXABLE VALUE 54,000<br />

Sloansville, NY 12160 ACRES 0.34 SCHOOL TAXABLE VALUE 54,000<br />

EAST-0556413 NRTH-1430474<br />

DEED BOOK 739 PG-75<br />

FULL MARKET VALUE 68,354<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 4<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.10-1-4 ******************<br />

122 Main St 451A100663<br />

29.10-1-4 210 1 Family Res SR STAR 41834 0 0 0 47,270<br />

Brown Esther J <strong>Schoharie</strong> 434201 11,600 AGED T&S 41806 0 0 11,535 11,535<br />

Brown Paul W Life Est Esther 76,900 VILLAGE TAXABLE VALUE 76,900<br />

Attn: Esther J Brown FRNT 60.00 DPTH 250.00 COUNTY TAXABLE VALUE 76,900<br />

PO Box 101 ACRES 0.30 TOWN TAXABLE VALUE 65,365<br />

Esperance, NY 12066 EAST-0555938 NRTH-1430388 SCHOOL TAXABLE VALUE 18,095<br />

DEED BOOK 710 PG-166<br />

FULL MARKET VALUE 97,342<br />

******************************************************************************************************* 29.6-4-24 ******************<br />

112 Cumpston St 451A100601<br />

29.6-4-24 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Burman Howard <strong>Schoharie</strong> 434201 12,400 VILLAGE TAXABLE VALUE 73,000<br />

Burman Angela FRNT 79.15 DPTH 260.00 73,000 COUNTY TAXABLE VALUE 73,000<br />

PO Box 128 ACRES 0.56 TOWN TAXABLE VALUE 73,000<br />

Esperance, NY 12066 EAST-0556822 NRTH-1431175 SCHOOL TAXABLE VALUE 50,200<br />

DEED BOOK 710 PG-80<br />

FULL MARKET VALUE 92,405<br />

******************************************************************************************************* 29.10-1-18 *****************<br />

120 Steuben St 451A100690<br />

29.10-1-18 311 Res vac land VILLAGE TAXABLE VALUE 10,000<br />

Carroll Scott E <strong>Schoharie</strong> 434201 10,000 COUNTY TAXABLE VALUE 10,000<br />

6791 Dunnsville Rd FRNT 275.00 DPTH 10,000 TOWN TAXABLE VALUE 10,000<br />

Altamont, NY 12009-5312 ACRES 1.60 SCHOOL TAXABLE VALUE 10,000<br />

EAST-0556530 NRTH-1430010<br />

PRIOR OWNER ON 3/01/2012 DEED BOOK 896 PG-86<br />

Carroll Scott E FULL MARKET VALUE 12,658<br />

******************************************************************************************************* 29.6-4-7.2 *****************<br />

183 Main St 451A201005<br />

29.6-4-7.2 483 Converted Re VILLAGE TAXABLE VALUE 60,000<br />

Cass Andrew <strong>Schoharie</strong> 434201 11,000 COUNTY TAXABLE VALUE 60,000<br />

Cass Deborah FRNT 84.51 DPTH 94.59 60,000 TOWN TAXABLE VALUE 60,000<br />

636 Creek Rd ACRES 0.20 SCHOOL TAXABLE VALUE 60,000<br />

Esperance, NY 12066 EAST-0557329 NRTH-1430974<br />

DEED BOOK 683 PG-298<br />

FULL MARKET VALUE 75,949<br />

******************************************************************************************************* 29.6-2-17 ******************<br />

116 Feuz Ter 451A100614<br />

29.6-2-17 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Collison Deanna L <strong>Schoharie</strong> 434201 15,300 VILLAGE TAXABLE VALUE 79,400<br />

116 Feuz Ter FRNT 150.00 DPTH 175.00 79,400 COUNTY TAXABLE VALUE 79,400<br />

Esperance, NY 12066 ACRES 65.00 BANK FARETS TOWN TAXABLE VALUE 79,400<br />

EAST-0556614 NRTH-1432354 SCHOOL TAXABLE VALUE 56,600<br />

DEED BOOK 720 PG-171<br />

FULL MARKET VALUE 100,506<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 5<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.6-4-15 ******************<br />

155 Main St 451C176024<br />

29.6-4-15 220 2 Family Res RES STAR 41854 0 0 0 22,800<br />

Conover Cody R <strong>Schoharie</strong> 434201 11,900 VILLAGE TAXABLE VALUE 52,500<br />

155 Main St FRNT 43.50 DPTH 370.00 52,500 COUNTY TAXABLE VALUE 52,500<br />

PO Box 336 ACRES 0.50 TOWN TAXABLE VALUE 52,500<br />

Esperance, NY 12066-0336 EAST-0556725 NRTH-1430960 SCHOOL TAXABLE VALUE 29,700<br />

DEED BOOK 668 PG-90<br />

FULL MARKET VALUE 66,456<br />

******************************************************************************************************* 29.10-1-8 ******************<br />

128 Main St 451A100718<br />

29.10-1-8 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Crammond John C <strong>Schoharie</strong> 434201 13,000 VILLAGE TAXABLE VALUE 61,400<br />

Crammond Barbara H FRNT 60.00 DPTH 370.00 61,400 COUNTY TAXABLE VALUE 61,400<br />

128 Main St ACRES 0.73 TOWN TAXABLE VALUE 61,400<br />

PO Box 67 EAST-0556149 NRTH-1430332 SCHOOL TAXABLE VALUE 38,600<br />

Esperance, NY 12066-0067 DEED BOOK 389 PG-916<br />

FULL MARKET VALUE 77,722<br />

******************************************************************************************************* 29.6-1-6 *******************<br />

117 Feuz Ter 451A100620<br />

29.6-1-6 210 1 Family Res COM VET/CT 41131 15,200 11,400 7,600 0<br />

Crane Gary E <strong>Schoharie</strong> 434201 15,200 DIS VET/CT 41141 30,400 22,800 15,200 0<br />

Crane Maria E FRNT 150.00 DPTH 175.00 120,700 RES STAR 41854 0 0 0 22,800<br />

117 Feuz Ter ACRES 0.60 BANK BAC VILLAGE TAXABLE VALUE 75,100<br />

Esperance, NY 12066 EAST-0556386 NRTH-1432358 COUNTY TAXABLE VALUE 86,500<br />

DEED BOOK 873 PG-1 TOWN TAXABLE VALUE 97,900<br />

FULL MARKET VALUE 152,785 SCHOOL TAXABLE VALUE 97,900<br />

******************************************************************************************************* 29.6-1-8.2 *****************<br />

172 Charleston St 451A194007<br />

29.6-1-8.2 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Cravotta Randolph J <strong>Schoharie</strong> 434201 12,900 VILLAGE TAXABLE VALUE 86,800<br />

Gregory Joanne E FRNT 437.25 DPTH 214.07 86,800 COUNTY TAXABLE VALUE 86,800<br />

172 Charleston St ACRES 0.88 TOWN TAXABLE VALUE 86,800<br />

PO Box 27 EAST-0556227 NRTH-1432335 SCHOOL TAXABLE VALUE 64,000<br />

Esperance, NY 12066 DEED BOOK 648 PG-57<br />

FULL MARKET VALUE 109,873<br />

******************************************************************************************************* 29.10-2-11 *****************<br />

162 Main St 451A100627<br />

29.10-2-11 210 1 Family Res AGED - ALL 41800 0 30,250 30,250 30,250<br />

Croote Janet L <strong>Schoharie</strong> 434201 11,300 SR STAR 41834 0 0 0 30,250<br />

162 Main St FRNT 30.00 DPTH 370.00 60,500 VILLAGE TAXABLE VALUE 60,500<br />

PO Box 93 ACRES 0.30 COUNTY TAXABLE VALUE 30,250<br />

Esperance, NY 12066-0093 EAST-0557015 NRTH-1430545 TOWN TAXABLE VALUE 30,250<br />

DEED BOOK 846 PG-189 SCHOOL TAXABLE VALUE 0<br />

FULL MARKET VALUE 76,582<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 6<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.6-4-22 ******************<br />

106 Cumpston St 451A100714<br />

29.6-4-22 210 1 Family Res Fire/EMS 41690 2,280 2,280 2,280 2,280<br />

Cummings Carl E <strong>Schoharie</strong> 434201 11,400 RES STAR 41854 0 0 0 22,800<br />

Cummings Bonnie L FRNT 60.00 DPTH 195.00 71,900 VILLAGE TAXABLE VALUE 69,620<br />

106 Compton St ACRES 0.27 COUNTY TAXABLE VALUE 69,620<br />

PO Box 62 EAST-0556618 NRTH-1431172 TOWN TAXABLE VALUE 69,620<br />

Esperance, NY 12066-0062 DEED BOOK 370 PG-436 SCHOOL TAXABLE VALUE 46,820<br />

FULL MARKET VALUE 91,013<br />

******************************************************************************************************* 29.10-1-27 *****************<br />

139 Steuben St 451A100643<br />

29.10-1-27 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Cummings Darryl S <strong>Schoharie</strong> 434201 13,000 VILLAGE TAXABLE VALUE 25,000<br />

Cummings Sandra C FRNT 235.00 DPTH 130.00 25,000 COUNTY TAXABLE VALUE 25,000<br />

PO Box 81 ACRES 0.60 TOWN TAXABLE VALUE 25,000<br />

Esperance, NY 12066 EAST-0556638 NRTH-1429644 SCHOOL TAXABLE VALUE 2,200<br />

DEED BOOK 457 PG-221<br />

FULL MARKET VALUE 31,646<br />

******************************************************************************************************* 29.5-1-10.1 ****************<br />

133 Church St 451A100591<br />

29.5-1-10.1 210 1 Family Res SR STAR 41834 0 0 0 47,270<br />

Cummings Valerie A <strong>Schoharie</strong> 434201 12,000 VILLAGE TAXABLE VALUE 74,700<br />

Fancher Jacqueline M 183 x 188.48 74,700 COUNTY TAXABLE VALUE 74,700<br />

133 Church St 29.5-1-10.21 d&c w/this 2 TOWN TAXABLE VALUE 74,700<br />

PO Box 133 ACRES 0.67 SCHOOL TAXABLE VALUE 27,430<br />

Esperance, NY 12066 EAST-0556140 NRTH-1431444<br />

DEED BOOK 767 PG-220<br />

FULL MARKET VALUE 94,557<br />

******************************************************************************************************* 29.5-1-10.22 ***************<br />

Church St off 451A205004<br />

29.5-1-10.22 312 Vac w/imprv VILLAGE TAXABLE VALUE 5,000<br />

Cummings Valerie A <strong>Schoharie</strong> 434201 500 COUNTY TAXABLE VALUE 5,000<br />

122 Lord North Dr 95.96 x 167.38 5,000 TOWN TAXABLE VALUE 5,000<br />

PO Box 133 ACRES 0.36 BANK FARETS SCHOOL TAXABLE VALUE 5,000<br />

Esperance, NY 12066 EAST-0556220 NRTH-1431269<br />

DEED BOOK 770 PG-267<br />

FULL MARKET VALUE 6,329<br />

******************************************************************************************************* 29.5-1-25 ******************<br />

122 Lord North Dr 451A100656<br />

29.5-1-25 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Cummings Valerie A <strong>Schoharie</strong> 434201 12,500 VILLAGE TAXABLE VALUE 83,000<br />

122 Lord North Dr FRNT 75.00 DPTH 112.52 83,000 COUNTY TAXABLE VALUE 83,000<br />

PO Box 133 ACRES 0.68 BANK FARETS TOWN TAXABLE VALUE 83,000<br />

Esperance, NY 12066 EAST-0556099 NRTH-1431252 SCHOOL TAXABLE VALUE 60,200<br />

DEED BOOK 770 PG-267<br />

FULL MARKET VALUE 105,063<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 7<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.10-2-20 *****************<br />

182 Main St 451A100625<br />

29.10-2-20 220 2 Family Res RES STAR 41854 0 0 0 20,000<br />

Darrah James C Jr <strong>Schoharie</strong> 434201 11,200 VILLAGE TAXABLE VALUE 20,000<br />

228 Brookhaven Dr FRNT 155.00 DPTH 170.00 20,000 COUNTY TAXABLE VALUE 20,000<br />

East Berne, NY 12059 ACRES 0.23 TOWN TAXABLE VALUE 20,000<br />

EAST-0557433 NRTH-1430782 SCHOOL TAXABLE VALUE 0<br />

DEED BOOK 624 PG-149<br />

FULL MARKET VALUE 25,316<br />

******************************************************************************************************* 29.10-2-14 *****************<br />

168 Main St 451C177067<br />

29.10-2-14 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Debell Curtis H <strong>Schoharie</strong> 434201 11,100 VILLAGE TAXABLE VALUE 70,600<br />

Bradt Patricia A FRNT 30.00 DPTH 305.00 70,600 COUNTY TAXABLE VALUE 70,600<br />

168 Main St ACRES 0.20 TOWN TAXABLE VALUE 70,600<br />

PO Box 86 EAST-0557119 NRTH-1430609 SCHOOL TAXABLE VALUE 47,800<br />

Esperance, NY 12066 DEED BOOK 679 PG-23<br />

FULL MARKET VALUE 89,367<br />

******************************************************************************************************* 29.5-1-2 *******************<br />

177 Charleston St 451A100726<br />

29.5-1-2 210 1 Family Res VILLAGE TAXABLE VALUE 66,800<br />

Deffer Timothy R <strong>Schoharie</strong> 434201 12,400 COUNTY TAXABLE VALUE 66,800<br />

Deffer Amy B FRNT 100.00 DPTH 280.00 66,800 TOWN TAXABLE VALUE 66,800<br />

PO Box 51 ACRES 0.60 BANK FARETS SCHOOL TAXABLE VALUE 66,800<br />

Esperance, NY 12066 EAST-0555948 NRTH-1432324<br />

DEED BOOK 870 PG-194<br />

FULL MARKET VALUE 84,557<br />

******************************************************************************************************* 29.6-1-1 *******************<br />

145 Feuz Ter 451A100648<br />

29.6-1-1 210 1 Family Res WAR VET/CT 41121 0 6,840 4,560 0<br />

DeSarbo Raymond <strong>Schoharie</strong> 434201 16,100 SR STAR 41834 0 0 0 47,270<br />

DeSarbo Kathy S FRNT 200.00 DPTH 195.30 115,500 VILLAGE TAXABLE VALUE 115,500<br />

PO Box 58 ACRES 0.66 COUNTY TAXABLE VALUE 108,660<br />

Esperance, NY 12066 EAST-0556387 NRTH-1433098 TOWN TAXABLE VALUE 110,940<br />

DEED BOOK 732 PG-220 SCHOOL TAXABLE VALUE 68,230<br />

FULL MARKET VALUE 146,203<br />

******************************************************************************************************* 29.5-1-37 ******************<br />

115 Main St 451A100671<br />

29.5-1-37 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Diamond Cecil I <strong>Schoharie</strong> 434201 11,900 VILLAGE TAXABLE VALUE 64,800<br />

Saddlemire Charlene A FRNT 80.00 DPTH 260.00 64,800 COUNTY TAXABLE VALUE 64,800<br />

115 Main St ACRES 0.60 BANK FARETS TOWN TAXABLE VALUE 64,800<br />

PO Box 212 EAST-0555697 NRTH-1430668 SCHOOL TAXABLE VALUE 42,000<br />

Esperance, NY 12066 DEED BOOK 669 PG-139<br />

FULL MARKET VALUE 82,025<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 8<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.10-1-5 ******************<br />

124 Main St 451A100615<br />

29.10-1-5 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Diamond James E <strong>Schoharie</strong> 434201 11,700 VILLAGE TAXABLE VALUE 72,900<br />

Diamond Edith E FRNT 60.00 DPTH 250.00 72,900 COUNTY TAXABLE VALUE 72,900<br />

PO Box 40 ACRES 0.30 TOWN TAXABLE VALUE 72,900<br />

Esperance, NY 12066-0040 EAST-0555997 NRTH-1430397 SCHOOL TAXABLE VALUE 50,100<br />

DEED BOOK 361 PG-912<br />

FULL MARKET VALUE 92,278<br />

******************************************************************************************************* 29.10-1-6 ******************<br />

Main St 451C174001<br />

29.10-1-6 311 Res vac land VILLAGE TAXABLE VALUE 200<br />

Diamond James F <strong>Schoharie</strong> 434201 200 COUNTY TAXABLE VALUE 200<br />

Diamond Edith E FRNT 30.00 DPTH 250.00 200 TOWN TAXABLE VALUE 200<br />

PO Box 40 ACRES 0.20 SCHOOL TAXABLE VALUE 200<br />

Esperance, NY 12066-0040 EAST-0556042 NRTH-1430402<br />

DEED BOOK 637 PG-105<br />

FULL MARKET VALUE 253<br />

******************************************************************************************************* 29.5-1-31 ******************<br />

123 Lord North Dr 451A100673<br />

29.5-1-31 270 Mfg housing RES STAR 41854 0 0 0 22,800<br />

Dillon Cathy <strong>Schoharie</strong> 434201 11,000 VILLAGE TAXABLE VALUE 26,100<br />

Attn: Laila Kulikoff FRNT 75.00 DPTH 107.00 26,100 COUNTY TAXABLE VALUE 26,100<br />

1483 West Duane Lake Rd ACRES 0.20 TOWN TAXABLE VALUE 26,100<br />

Duanesburg, NY 12056 EAST-0555881 NRTH-1431152 SCHOOL TAXABLE VALUE 3,300<br />

DEED BOOK 395 PG-440<br />

FULL MARKET VALUE 33,038<br />

******************************************************************************************************* 29.6-2-15 ******************<br />

152 Charleston St 451A100630<br />

29.6-2-15 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Dingee Ian F <strong>Schoharie</strong> 434201 11,800 VILLAGE TAXABLE VALUE 71,900<br />

Dingee Rebekah L FRNT 100.00 DPTH 167.50 71,900 COUNTY TAXABLE VALUE 71,900<br />

152 Charleston St ACRES 0.36 BANK BAC TOWN TAXABLE VALUE 71,900<br />

Esperance, NY 12066 EAST-0556522 NRTH-1431953 SCHOOL TAXABLE VALUE 49,100<br />

DEED BOOK 853 PG-55<br />

FULL MARKET VALUE 91,013<br />

******************************************************************************************************* 19.14-1-6 ******************<br />

130 Rock Ledge Ln 451A209002<br />

19.14-1-6 311 Res vac land VILLAGE TAXABLE VALUE 15,000<br />

Donzelli Joseph D <strong>Schoharie</strong> 434201 15,000 COUNTY TAXABLE VALUE 15,000<br />

131 Rock Ledge Ln ACRES 2.81 15,000 TOWN TAXABLE VALUE 15,000<br />

Esperance, NY 12066 EAST-0556054 NRTH-1435442 SCHOOL TAXABLE VALUE 15,000<br />

DEED BOOK 927 PG-250<br />

FULL MARKET VALUE 18,987<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 9<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 19.14-1-7 ******************<br />

Rock Ledge Ln 451A209003<br />

19.14-1-7 311 Res vac land VILLAGE TAXABLE VALUE 20,000<br />

Donzelli Joseph D <strong>Schoharie</strong> 434201 20,000 COUNTY TAXABLE VALUE 20,000<br />

131 Rock Ledge Ln FRNT 50.00 DPTH 20,000 TOWN TAXABLE VALUE 20,000<br />

Esperance, NY 12066 ACRES 2.28 SCHOOL TAXABLE VALUE 20,000<br />

EAST-0556052 NRTH-1435204<br />

DEED BOOK 927 PG-250<br />

FULL MARKET VALUE 25,316<br />

******************************************************************************************************* 19.18-1-1.2 ****************<br />

111 Rock Ledge Ln 451A191006<br />

19.18-1-1.2 311 Res vac land VILLAGE TAXABLE VALUE 20,700<br />

Donzelli Joseph D <strong>Schoharie</strong> 434201 20,700 COUNTY TAXABLE VALUE 20,700<br />

131 Rock Ledge Ln FRNT 430.00 DPTH 20,700 TOWN TAXABLE VALUE 20,700<br />

Esperance, NY 12066 ACRES 2.76 SCHOOL TAXABLE VALUE 20,700<br />

EAST-0556059 NRTH-1434895<br />

PRIOR OWNER ON 3/01/2012 DEED BOOK 934 PG-12<br />

Rockwell Lawrence F FULL MARKET VALUE 26,203<br />

******************************************************************************************************* 29.6-4-19 ******************<br />

112 Church St 451A100585<br />

29.6-4-19 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Dougherty Rebecca J <strong>Schoharie</strong> 434201 11,200 VILLAGE TAXABLE VALUE 76,000<br />

112 Church St FRNT 150.00 DPTH 60.00 76,000 COUNTY TAXABLE VALUE 76,000<br />

Esperance, NY 12066 ACRES 0.22 BANKWELLFAR TOWN TAXABLE VALUE 76,000<br />

EAST-0556538 NRTH-1430990 SCHOOL TAXABLE VALUE 53,200<br />

DEED BOOK 828 PG-256<br />

FULL MARKET VALUE 96,203<br />

******************************************************************************************************* 29.10-1-20 *****************<br />

121 Penny Ln 451A175001<br />

29.10-1-20 210 1 Family Res SR STAR 41834 0 0 0 47,270<br />

Dunn Catherine A <strong>Schoharie</strong> 434201 11,500 VILLAGE TAXABLE VALUE 97,900<br />

121 Penny Ln new garage 97,900 COUNTY TAXABLE VALUE 97,900<br />

PO Box 22 FRNT 100.00 DPTH 168.00 TOWN TAXABLE VALUE 97,900<br />

Esperance, NY 12066 ACRES 0.30 SCHOOL TAXABLE VALUE 50,630<br />

EAST-0555624 NRTH-1430046<br />

DEED BOOK 749 PG-289<br />

FULL MARKET VALUE 123,924<br />

******************************************************************************************************* 29.10-1-1 ******************<br />

119 Penny Ln 451A100599<br />

29.10-1-1 210 1 Family Res VILLAGE TAXABLE VALUE 11,400<br />

Dunn Michael <strong>Schoharie</strong> 434201 10,800 COUNTY TAXABLE VALUE 11,400<br />

Schmidt Veronica ACRES 0.20 11,400 TOWN TAXABLE VALUE 11,400<br />

c/o Veronica Schmidt EAST-0555596 NRTH-1430132 SCHOOL TAXABLE VALUE 11,400<br />

PO Box 140 DEED BOOK 558 PG-277<br />

Esperance, NY 12066 FULL MARKET VALUE 14,430<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 10<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.5-1-34 ******************<br />

109 Lord North Dr 451A178221<br />

29.5-1-34 270 Mfg housing RES STAR 41854 0 0 0 22,800<br />

Dunston Kalman E <strong>Schoharie</strong> 434201 11,800 VILLAGE TAXABLE VALUE 28,100<br />

Dunston Alisha M FRNT 150.00 DPTH 112.50 28,100 COUNTY TAXABLE VALUE 28,100<br />

109 Lord North Dr ACRES 0.40 TOWN TAXABLE VALUE 28,100<br />

PO Box 125 EAST-0555949 NRTH-1430817 SCHOOL TAXABLE VALUE 5,300<br />

Esperance, NY 12066 DEED BOOK 766 PG-49<br />

FULL MARKET VALUE 35,570<br />

******************************************************************************************************* 29.5-1-16 ******************<br />

145 Main St 451A100640<br />

29.5-1-16 210 1 Family Res VILLAGE TAXABLE VALUE 155,900<br />

East-West Enterprises Trust <strong>Schoharie</strong> 434201 11,900 COUNTY TAXABLE VALUE 155,900<br />

Lahr Jerry Robert FRNT 88.10 DPTH 200.00 155,900 TOWN TAXABLE VALUE 155,900<br />

c/o Conaway ACRES 0.50 SCHOOL TAXABLE VALUE 155,900<br />

145 Main St EAST-0556449 NRTH-1430802<br />

PO Box 208 DEED BOOK 731 PG-157<br />

Esperance, NY 12066 FULL MARKET VALUE 197,342<br />

******************************************************************************************************* 29.5-1-23 ******************<br />

112 Lord North Dr 451C100617<br />

29.5-1-23 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Easton Ruth M <strong>Schoharie</strong> 434201 11,100 VILLAGE TAXABLE VALUE 50,200<br />

Easton, Ruth M Living Trust land contract w/ Eric Dic 50,200 COUNTY TAXABLE VALUE 50,200<br />

c/o Amber & Eric Dickson and Amber McDermatt-Dicks TOWN TAXABLE VALUE 50,200<br />

PO Box 127 FRNT 75.00 DPTH 118.00 SCHOOL TAXABLE VALUE 27,400<br />

Esperance, NY 12066 ACRES 0.20<br />

EAST-0556084 NRTH-1430959<br />

DEED BOOK 916 PG-187<br />

FULL MARKET VALUE 63,544<br />

******************************************************************************************************* 19.18-1-1.12 ***************<br />

161 Feuz Ter 451A193004<br />

19.18-1-1.12 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Eaton Paul H <strong>Schoharie</strong> 434201 14,800 VILLAGE TAXABLE VALUE 110,900<br />

Eaton Patricia J Life Est Paul & Pat Eaton 110,900 COUNTY TAXABLE VALUE 110,900<br />

161 Fuez Ter FRNT 192.20 DPTH 197.90 TOWN TAXABLE VALUE 110,900<br />

Esperance, NY 12066 ACRES 0.82 SCHOOL TAXABLE VALUE 88,100<br />

EAST-0556385 NRTH-1433472<br />

DEED BOOK 849 PG-284<br />

FULL MARKET VALUE 140,380<br />

******************************************************************************************************* 19.18-1-1.114 **************<br />

Feuz Ter 451A204003<br />

19.18-1-1.114 311 Res vac land VILLAGE TAXABLE VALUE 10,000<br />

Eaton Paul H <strong>Schoharie</strong> 434201 10,000 COUNTY TAXABLE VALUE 10,000<br />

Eaton Patricia J Life Est Paul & Pat Eaton 10,000 TOWN TAXABLE VALUE 10,000<br />

161 Fuez Ter FRNT 175.00 DPTH 195.30 SCHOOL TAXABLE VALUE 10,000<br />

Esperance, NY 12066 ACRES 0.75<br />

EAST-0556380 NRTH-1433281<br />

DEED BOOK 849 PG-284<br />

FULL MARKET VALUE 12,658<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 11<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.5-1-19 ******************<br />

137 Main St 451A100722<br />

29.5-1-19 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Epting Brandon J <strong>Schoharie</strong> 434201 11,900 VILLAGE TAXABLE VALUE 52,000<br />

Epting Katherine R FRNT 45.00 DPTH 420.00 52,000 COUNTY TAXABLE VALUE 52,000<br />

137 Main St ACRES 0.40 BANK FARETS TOWN TAXABLE VALUE 52,000<br />

Esperance, NY 12066 EAST-0556235 NRTH-1430866 SCHOOL TAXABLE VALUE 29,200<br />

DEED BOOK 787 PG-301<br />

FULL MARKET VALUE 65,823<br />

******************************************************************************************************* 29.6-4-1 *******************<br />

143 Charleston St 451A100610<br />

29.6-4-1 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Epting Michael J <strong>Schoharie</strong> 434201 13,900 VILLAGE TAXABLE VALUE 57,700<br />

143 Charleston St FRNT 220.00 DPTH 150.00 57,700 COUNTY TAXABLE VALUE 57,700<br />

PO Box 294 ACRES 84.00 BANKWELLFAR TOWN TAXABLE VALUE 57,700<br />

Esperance, NY 12066 EAST-0556617 NRTH-1431559 SCHOOL TAXABLE VALUE 34,900<br />

DEED BOOK 813 PG-5<br />

FULL MARKET VALUE 73,038<br />

******************************************************************************************************* 29.10-1-26 *****************<br />

145 Steuben St 451A100626<br />

29.10-1-26 311 Res vac land VILLAGE TAXABLE VALUE 5,000<br />

Ernest Charles Jr <strong>Schoharie</strong> 434201 5,000 COUNTY TAXABLE VALUE 5,000<br />

Ernest Shirley M FRNT 100.00 DPTH 100.00 5,000 TOWN TAXABLE VALUE 5,000<br />

2652 Burtonsville Rd ACRES 0.30 SCHOOL TAXABLE VALUE 5,000<br />

Esperance, NY 12066 EAST-0556504 NRTH-1429565<br />

DEED BOOK 562 PG-275<br />

FULL MARKET VALUE 6,329<br />

******************************************************************************************************* 29.10-2-19.2 ***************<br />

180 Main St 451A194001<br />

29.10-2-19.2 484 1 use sm bld VILLAGE TAXABLE VALUE 50,000<br />

Evans, Warren Trust <strong>Schoharie</strong> 434201 20,000 COUNTY TAXABLE VALUE 50,000<br />

Evans David M FRNT 79.50 DPTH 325.23 50,000 TOWN TAXABLE VALUE 50,000<br />

700 St David's Ln ACRES 0.56 SCHOOL TAXABLE VALUE 50,000<br />

Schenectady, NY 12309 EAST-0557385 NRTH-1430689<br />

DEED BOOK 595 PG-345<br />

FULL MARKET VALUE 63,291<br />

******************************************************************************************************* 29.10-2-15 *****************<br />

170 Main St 451A100623<br />

29.10-2-15 464 Office bldg. VILLAGE TAXABLE VALUE 79,500<br />

Feuz Edward Living Trust <strong>Schoharie</strong> 434201 12,000 COUNTY TAXABLE VALUE 79,500<br />

c/o Ramona Feuz 29.10-2-18.2 & 19.11 D&c 79,500 TOWN TAXABLE VALUE 79,500<br />

PO Box 190 W/this 2/97 Jb SCHOOL TAXABLE VALUE 79,500<br />

Esperance, NY 12066-0190 FRNT 60.00 DPTH 305.00<br />

ACRES 0.60<br />

EAST-0557184 NRTH-1430601<br />

DEED BOOK 605 PG-110<br />

FULL MARKET VALUE 100,633<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 12<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 19.18-1-1.113 **************<br />

240 Feuz Ter 451A201002<br />

19.18-1-1.113 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Feuz Kirtland D <strong>Schoharie</strong> 434201 16,000 VILLAGE TAXABLE VALUE 157,900<br />

Feuz Linda L FRNT 240.00 DPTH 157,900 COUNTY TAXABLE VALUE 157,900<br />

240 Feuz Ter ACRES 1.47 TOWN TAXABLE VALUE 157,900<br />

Esperance, NY 12066 EAST-0556734 NRTH-1434903 SCHOOL TAXABLE VALUE 135,100<br />

DEED BOOK 674 PG-56<br />

FULL MARKET VALUE 199,873<br />

******************************************************************************************************* 19.18-1-1.111 **************<br />

2704 Burtonsville Rd 451A177010<br />

19.18-1-1.111 312 Vac w/imprv VILLAGE TAXABLE VALUE 92,700<br />

Feuz Ramona Living Trust <strong>Schoharie</strong> 434201 71,400 COUNTY TAXABLE VALUE 92,700<br />

Feuz Ramona R FRNT 3497.00 DPTH 92,700 TOWN TAXABLE VALUE 92,700<br />

c/o Ramona Feuz ACRES 58.20 SCHOOL TAXABLE VALUE 92,700<br />

PO Box 190 EAST-0557152 NRTH-1433463<br />

Esperance, NY 12066-0190 DEED BOOK 569 PG-61<br />

FULL MARKET VALUE 117,342<br />

******************************************************************************************************* 19.18-1-1.116 **************<br />

Grandview Dr 451A206006<br />

19.18-1-1.116 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 13<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.6-2-2.113 ***************<br />

Burtonsville Rd 451A207002<br />

29.6-2-2.113 311 Res vac land VILLAGE TAXABLE VALUE 10,500<br />

Film Amanda <strong>Schoharie</strong> 434201 10,500 COUNTY TAXABLE VALUE 10,500<br />

2760 Burtonsville Rd FRNT 616.37 DPTH 10,500 TOWN TAXABLE VALUE 10,500<br />

Esperance, NY 12066 ACRES 6.10 SCHOOL TAXABLE VALUE 10,500<br />

EAST-0557714 NRTH-1432607<br />

DEED BOOK 810 PG-22<br />

FULL MARKET VALUE 13,291<br />

******************************************************************************************************* 29.6-2-2.111 ***************<br />

Burtonsville Rd 451A100694<br />

29.6-2-2.111 322 Rural vac>10 VILLAGE TAXABLE VALUE 19,500<br />

Film William F <strong>Schoharie</strong> 434201 19,500 COUNTY TAXABLE VALUE 19,500<br />

Film Cheryl A FRNT 902.70 DPTH 19,500 TOWN TAXABLE VALUE 19,500<br />

2760 Burtonsville Rd ACRES 11.25 SCHOOL TAXABLE VALUE 19,500<br />

Esperance, NY 12066 EAST-0557533 NRTH-1432314<br />

DEED BOOK 766 PG-254<br />

FULL MARKET VALUE 24,684<br />

******************************************************************************************************* 29.6-2-2.112 ***************<br />

2760 Burtonsville Rd 451A206005<br />

29.6-2-2.112 210 1 Family Res WAR VET/CT 41121 9,120 6,840 4,560 0<br />

Film William F <strong>Schoharie</strong> 434201 25,300 RES STAR 41854 0 0 0 22,800<br />

Film Cheryl A FRNT 195.21 DPTH 135,300 VILLAGE TAXABLE VALUE 126,180<br />

2760 Burtonsville Rd ACRES 3.83 COUNTY TAXABLE VALUE 128,460<br />

Esperance, NY 12066 EAST-0557553 NRTH-1432859 TOWN TAXABLE VALUE 130,740<br />

DEED BOOK 805 PG-341 SCHOOL TAXABLE VALUE 112,500<br />

FULL MARKET VALUE 171,266<br />

******************************************************************************************************* 29.6-2-8 *******************<br />

126 Charleston St 451A100629<br />

29.6-2-8 210 1 Family Res SR STAR 41834 0 0 0 47,270<br />

Fink John <strong>Schoharie</strong> 434201 11,700 VILLAGE TAXABLE VALUE 80,500<br />

Fink Joan E FRNT 60.00 DPTH 250.00 80,500 COUNTY TAXABLE VALUE 80,500<br />

126 Charleston St ACRES 0.30 BANKVALUTRE TOWN TAXABLE VALUE 80,500<br />

PO Box 145 EAST-0557067 NRTH-1431517 SCHOOL TAXABLE VALUE 33,230<br />

Esperance, NY 12066 DEED BOOK 843 PG-81<br />

FULL MARKET VALUE 101,899<br />

******************************************************************************************************* 19.17-1-4 ******************<br />

205 Charleston St 451A100635<br />

19.17-1-4 210 1 Family Res VILLAGE TAXABLE VALUE 78,300<br />

Finke Fletcher T <strong>Schoharie</strong> 434201 11,900 COUNTY TAXABLE VALUE 78,300<br />

Hall Maureen A FRNT 90.00 DPTH 200.00 78,300 TOWN TAXABLE VALUE 78,300<br />

205 Charleston St ACRES 0.40 SCHOOL TAXABLE VALUE 78,300<br />

Esperance, NY 12066 EAST-0555646 NRTH-1432969<br />

DEED BOOK 880 PG-87<br />

FULL MARKET VALUE 99,114<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 14<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.10-1-14 *****************<br />

142 Main St 451A100682<br />

29.10-1-14 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Fox Joan <strong>Schoharie</strong> 434201 11,700 VILLAGE TAXABLE VALUE 65,400<br />

53 Main St FRNT 60.00 DPTH 250.00 65,400 COUNTY TAXABLE VALUE 65,400<br />

PO Box 17 ACRES 0.30 TOWN TAXABLE VALUE 65,400<br />

Esperance, NY 12066-0017 EAST-0556473 NRTH-1430485 SCHOOL TAXABLE VALUE 42,600<br />

DEED BOOK 379 PG-1160<br />

FULL MARKET VALUE 82,785<br />

******************************************************************************************************* 19.18-2-1.1 ****************<br />

Burtonsville Rd 451A100639<br />

19.18-2-1.1 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 15<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 19.14-1-5 ******************<br />

263 Feuz Ter 451A206008<br />

19.14-1-5 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Gerstenberger Conrad C <strong>Schoharie</strong> 434201 20,000 VILLAGE TAXABLE VALUE 179,000<br />

Gerstenberger Kimberlee M FRNT 223.00 DPTH 179,000 COUNTY TAXABLE VALUE 179,000<br />

263 Feuz Ter ACRES 2.00 TOWN TAXABLE VALUE 179,000<br />

Esperance, NY 12066 EAST-0557246 NRTH-1435273 SCHOOL TAXABLE VALUE 156,200<br />

DEED BOOK 804 PG-239<br />

FULL MARKET VALUE 226,582<br />

******************************************************************************************************* 19.14-1-2 ******************<br />

233 Feuz Ter 451A192007<br />

19.14-1-2 210 1 Family Res SR STAR 41834 0 0 0 47,270<br />

Giuliano Dominic <strong>Schoharie</strong> 434201 20,700 VILLAGE TAXABLE VALUE 140,000<br />

Giuliano Louise FRNT 226.15 DPTH 140,000 COUNTY TAXABLE VALUE 140,000<br />

233 Feuz Ter ACRES 2.70 TOWN TAXABLE VALUE 140,000<br />

Esperance, NY 12066-3215 EAST-0556429 NRTH-1435314 SCHOOL TAXABLE VALUE 92,730<br />

DEED BOOK 534 PG-207<br />

FULL MARKET VALUE 177,215<br />

******************************************************************************************************* 29.6-2-12 ******************<br />

142 Charleston St 451A100645<br />

29.6-2-12 210 1 Family Res SR STAR 41834 0 0 0 47,270<br />

Graves Lois <strong>Schoharie</strong> 434201 14,300 VILLAGE TAXABLE VALUE 90,000<br />

PO Box 15 FRNT 100.00 DPTH 90,000 COUNTY TAXABLE VALUE 90,000<br />

Esperance, NY 12066-0015 ACRES 1.00 TOWN TAXABLE VALUE 90,000<br />

EAST-0556820 NRTH-1431860 SCHOOL TAXABLE VALUE 42,730<br />

DEED BOOK 335 PG-537<br />

FULL MARKET VALUE 113,924<br />

******************************************************************************************************* 29.6-4-13.1 ****************<br />

163 Main St 451A100727<br />

29.6-4-13.1 414 Hotel VILLAGE TAXABLE VALUE 150,000<br />

Grinmanis Michael A <strong>Schoharie</strong> 434201 14,800 COUNTY TAXABLE VALUE 150,000<br />

PO Box 216 FRNT 137.22 DPTH 286.48 150,000 TOWN TAXABLE VALUE 150,000<br />

Altamont, NY 12009 ACRES 0.87 SCHOOL TAXABLE VALUE 150,000<br />

EAST-0556898 NRTH-1430921<br />

DEED BOOK 727 PG-237<br />

FULL MARKET VALUE 189,873<br />

******************************************************************************************************* 29.6-4-26 ******************<br />

107 Cumpston St 451A100605<br />

29.6-4-26 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Grosse David P <strong>Schoharie</strong> 434201 12,100 VILLAGE TAXABLE VALUE 66,000<br />

Todd Dana FRNT 125.00 DPTH 175.00 66,000 COUNTY TAXABLE VALUE 66,000<br />

107 Cumpston St ACRES 0.50 BANKWELLFAR TOWN TAXABLE VALUE 66,000<br />

Esperance, NY 12066 EAST-0556599 NRTH-1431405 SCHOOL TAXABLE VALUE 43,200<br />

DEED BOOK 801 PG-96<br />

FULL MARKET VALUE 83,544<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 16<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.5-1-33 ******************<br />

113 Lord North Dr 451A100607<br />

29.5-1-33 210 1 Family Res VILLAGE TAXABLE VALUE 67,500<br />

Guardian Preservation LLC <strong>Schoharie</strong> 434201 11,000 COUNTY TAXABLE VALUE 67,500<br />

123 Saratoga Rd Ste 100-360 FRNT 75.00 DPTH 112.00 67,500 TOWN TAXABLE VALUE 67,500<br />

Glenville, NY 12302 ACRES 0.20 BANK BAC SCHOOL TAXABLE VALUE 67,500<br />

EAST-0555927 NRTH-1430926<br />

DEED BOOK 929 PG-127<br />

FULL MARKET VALUE 85,443<br />

******************************************************************************************************* 29.10-2-16 *****************<br />

176 Main St 451A100664<br />

29.10-2-16 210 1 Family Res VILLAGE TAXABLE VALUE 49,000<br />

Gusse Alan P Sr <strong>Schoharie</strong> 434201 10,400 COUNTY TAXABLE VALUE 49,000<br />

Gusse Mary FRNT 30.00 DPTH 90.10 49,000 TOWN TAXABLE VALUE 49,000<br />

200 Giffords Church Rd ACRES 0.06 SCHOOL TAXABLE VALUE 49,000<br />

Schenectady, NY 12306 EAST-0557201 NRTH-1430746<br />

DEED BOOK 582 PG-95<br />

FULL MARKET VALUE 62,025<br />

******************************************************************************************************* 29.10-2-17 *****************<br />

Main St 451A179265<br />

29.10-2-17 312 Vac w/imprv VILLAGE TAXABLE VALUE 1,500<br />

Gusse Alan P Sr <strong>Schoharie</strong> 434201 1,000 COUNTY TAXABLE VALUE 1,500<br />

Gusse Mary FRNT 50.00 DPTH 90.13 1,500 TOWN TAXABLE VALUE 1,500<br />

200 Gifford Church Rd ACRES 0.10 SCHOOL TAXABLE VALUE 1,500<br />

Schenectady, NY 12306 EAST-0557239 NRTH-1430758<br />

DEED BOOK 582 PG-95<br />

FULL MARKET VALUE 1,899<br />

******************************************************************************************************* 29.10-2-23 *****************<br />

172 Main St 451A184001<br />

29.10-2-23 483 Converted Re VILLAGE TAXABLE VALUE 65,800<br />

Gusse Alan P Sr <strong>Schoharie</strong> 434201 10,400 COUNTY TAXABLE VALUE 65,800<br />

Gusse Mary FRNT 30.00 DPTH 90.08 65,800 TOWN TAXABLE VALUE 65,800<br />

200 Gifford Church Rd ACRES 0.06 SCHOOL TAXABLE VALUE 65,800<br />

Schenectady, NY 12306 EAST-0557172 NRTH-1430738<br />

DEED BOOK 582 PG-95<br />

FULL MARKET VALUE 83,291<br />

******************************************************************************************************* 29.6-2-20 ******************<br />

110 Lakeview Dr 451A205002<br />

29.6-2-20 210 1 Family Res WAR VET/CT 41121 9,120 6,840 4,560 0<br />

Helfrich Thomas J <strong>Schoharie</strong> 434201 16,700 SR STAR 41834 0 0 0 47,270<br />

Helfrich Judith M FRNT 300.00 DPTH 120,700 VILLAGE TAXABLE VALUE 111,580<br />

110 Lakeview Dr ACRES 1.20 COUNTY TAXABLE VALUE 113,860<br />

Esperance, NY 12066 EAST-0556876 NRTH-1432841 TOWN TAXABLE VALUE 116,140<br />

DEED BOOK 760 PG-252 SCHOOL TAXABLE VALUE 73,430<br />

FULL MARKET VALUE 152,785<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 17<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.10-2-3 ******************<br />

150 Main St 451A100595<br />

29.10-2-3 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Houlihan Brendan <strong>Schoharie</strong> 434201 11,300 VILLAGE TAXABLE VALUE 68,600<br />

150 Main St FRNT 43.00 DPTH 250.00 68,600 COUNTY TAXABLE VALUE 68,600<br />

Esperance, NY 12066 ACRES 0.25 BANK FARETS TOWN TAXABLE VALUE 68,600<br />

EAST-0556694 NRTH-1430526 SCHOOL TAXABLE VALUE 45,800<br />

DEED BOOK 789 PG-137<br />

FULL MARKET VALUE 86,835<br />

******************************************************************************************************* 29.6-3-10 ******************<br />

146 Brandywine Ln 451A100680<br />

29.6-3-10 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Howland Jeremy C <strong>Schoharie</strong> 434201 11,300 VILLAGE TAXABLE VALUE 65,200<br />

Howland Renee D ACRES 0.20 65,200 COUNTY TAXABLE VALUE 65,200<br />

146 Brandywine Ln EAST-0558648 NRTH-1432731 TOWN TAXABLE VALUE 65,200<br />

PO Box 291 DEED BOOK 647 PG-71 SCHOOL TAXABLE VALUE 42,400<br />

Esperance, NY 12066 FULL MARKET VALUE 82,532<br />

******************************************************************************************************* 29.6-3-8 *******************<br />

Brandywine Ln 451A100633<br />

29.6-3-8 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 18<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.5-1-22 ******************<br />

110 Lord North Dr 451A100646<br />

29.5-1-22 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Intelisano Lawrence D <strong>Schoharie</strong> 434201 11,000 VILLAGE TAXABLE VALUE 86,400<br />

Intelisano Linda A FRNT 65.00 DPTH 119.42 86,400 COUNTY TAXABLE VALUE 86,400<br />

110 Lord North Dr ACRES 0.18 BANK FARETS TOWN TAXABLE VALUE 86,400<br />

PO Box 257 EAST-0556099 NRTH-1430888 SCHOOL TAXABLE VALUE 63,600<br />

Esperance, NY 12066-0257 DEED BOOK 689 PG-234<br />

FULL MARKET VALUE 109,367<br />

******************************************************************************************************* 29.5-1-36 ******************<br />

121 Main St 451A100647<br />

29.5-1-36 483 Converted Re VILLAGE TAXABLE VALUE 250,000<br />

Ionta David R <strong>Schoharie</strong> 434201 16,300 COUNTY TAXABLE VALUE 250,000<br />

Ionta Kimberly A FRNT 178.00 DPTH 260.00 250,000 TOWN TAXABLE VALUE 250,000<br />

131 Red Oak Dr ACRES 1.10 SCHOOL TAXABLE VALUE 250,000<br />

<strong>Schoharie</strong>, NY 12157 EAST-0555829 NRTH-1430695<br />

DEED BOOK 762 PG-195<br />

FULL MARKET VALUE 316,456<br />

******************************************************************************************************* 29.10-2-1 ******************<br />

107 Steuben St 451A100711<br />

29.10-2-1 311 Res vac land VILLAGE TAXABLE VALUE 11,100<br />

Johnson Dorlian A <strong>Schoharie</strong> 434201 11,100 COUNTY TAXABLE VALUE 11,100<br />

9898 Western Tpke FRNT 140.00 DPTH 65.00 11,100 TOWN TAXABLE VALUE 11,100<br />

Delanson, NY 12053 ACRES 0.20 SCHOOL TAXABLE VALUE 11,100<br />

EAST-0556652 NRTH-1430462<br />

DEED BOOK 780 PG-168<br />

FULL MARKET VALUE 14,051<br />

******************************************************************************************************* 29.6-4-18 ******************<br />

149 Main St 451C100688<br />

29.6-4-18 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Johnston Charles <strong>Schoharie</strong> 434201 11,400 VILLAGE TAXABLE VALUE 116,000<br />

Johnston Susie FRNT 60.00 DPTH 195.00 116,000 COUNTY TAXABLE VALUE 116,000<br />

149 Main St ACRES 0.30 BANK NBT TOWN TAXABLE VALUE 116,000<br />

PO Box 134 EAST-0556576 NRTH-1430822 SCHOOL TAXABLE VALUE 93,200<br />

Esperance, NY 12066 DEED BOOK 609 PG-309<br />

FULL MARKET VALUE 146,835<br />

******************************************************************************************************* 19.14-1-1 ******************<br />

239 Feuz Ter 451A189003<br />

19.14-1-1 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Jones Kenneth M <strong>Schoharie</strong> 434201 20,000 VILLAGE TAXABLE VALUE 110,000<br />

Jones Kathleen A FRNT 200.00 DPTH 110,000 COUNTY TAXABLE VALUE 110,000<br />

239 Feuz Ter ACRES 1.95 TOWN TAXABLE VALUE 110,000<br />

PO Box 99 EAST-0556671 NRTH-1435315 SCHOOL TAXABLE VALUE 87,200<br />

Esperance, NY 12066-0099 DEED BOOK 481 PG-51<br />

FULL MARKET VALUE 139,241<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 19<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 19.14-1-4 ******************<br />

257 Feuz Ter 451A206001<br />

19.14-1-4 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Jones Kenneth R <strong>Schoharie</strong> 434201 20,000 VILLAGE TAXABLE VALUE 163,900<br />

Jones Mary C FRNT 200.00 DPTH 163,900 COUNTY TAXABLE VALUE 163,900<br />

257 Feuz Ter ACRES 1.91 BANK FARETS TOWN TAXABLE VALUE 163,900<br />

Esperance, NY 12066 EAST-0557073 NRTH-1435286 SCHOOL TAXABLE VALUE 141,100<br />

DEED BOOK 813 PG-35<br />

FULL MARKET VALUE 207,468<br />

******************************************************************************************************* 29.5-1-32 ******************<br />

117 Lord North Dr 451A100652<br />

29.5-1-32 210 1 Family Res COM VET/C 41132 0 11,400 0 0<br />

Jones Marion W <strong>Schoharie</strong> 434201 11,800 COM VET/T 41133 0 0 7,600 0<br />

Schilling Beverly L Life Est Marion Jones 75,500 COM VET/V 41137 15,200 0 0 0<br />

c/o Beverly Schilling FRNT 150.00 DPTH 112.00 AGED - ALL 41800 0 32,050 33,950 37,750<br />

53 Terrace Ave ACRES 0.40 SR STAR 41834 0 0 0 37,750<br />

Albany, NY 12203 EAST-0555903 NRTH-1431038 VILLAGE TAXABLE VALUE 60,300<br />

DEED BOOK 899 PG-46 COUNTY TAXABLE VALUE 32,050<br />

FULL MARKET VALUE 95,570 TOWN TAXABLE VALUE 33,950<br />

SCHOOL TAXABLE VALUE 0<br />

******************************************************************************************************* 29.10-2-12 *****************<br />

164 Main St 451A100654<br />

29.10-2-12 210 1 Family Res COM VET/C 41132 0 11,400 0 0<br />

Kearney Michelle R <strong>Schoharie</strong> 434201 11,300 COM VET/T 41133 0 0 7,600 0<br />

164 Main St FRNT 30.00 DPTH 350.00 54,900 COM VET/V 41137 13,725 0 0 0<br />

PO Box 88 ACRES 0.30 RES STAR 41854 0 0 0 22,800<br />

Esperance, NY 12066-0088 EAST-0557043 NRTH-1430558 VILLAGE TAXABLE VALUE 41,175<br />

DEED BOOK 719 PG-79 COUNTY TAXABLE VALUE 43,500<br />

FULL MARKET VALUE 69,494 TOWN TAXABLE VALUE 47,300<br />

SCHOOL TAXABLE VALUE 32,100<br />

******************************************************************************************************* 29.10-1-2 ******************<br />

116 Main St 451A100719<br />

29.10-1-2 411 Apartment VILLAGE TAXABLE VALUE 79,800<br />

Kemmet Kathleen <strong>Schoharie</strong> 434201 12,100 COUNTY TAXABLE VALUE 79,800<br />

PO Box 2392 FRNT 140.00 DPTH 200.00 79,800 TOWN TAXABLE VALUE 79,800<br />

Albany, NY 12220 ACRES 0.50 BANK BAC SCHOOL TAXABLE VALUE 79,800<br />

EAST-0555779 NRTH-1430388<br />

DEED BOOK 832 PG-140<br />

FULL MARKET VALUE 101,013<br />

******************************************************************************************************* 29.6-4-3 *******************<br />

123 Charleston St 451A100717<br />

29.6-4-3 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

King Matthew K <strong>Schoharie</strong> 434201 13,400 VILLAGE TAXABLE VALUE 69,800<br />

Harps Joanna H FRNT 125.00 DPTH 215.00 69,800 COUNTY TAXABLE VALUE 69,800<br />

PO Box 232 ACRES 0.80 BANK FARETS TOWN TAXABLE VALUE 69,800<br />

Esperance, NY 12066 EAST-0556933 NRTH-1431246 SCHOOL TAXABLE VALUE 47,000<br />

DEED BOOK 807 PG-157<br />

FULL MARKET VALUE 88,354<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 20<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 29.10-1-10 *****************<br />

132 Main St 451A100650<br />

29.10-1-10 210 1 Family Res VILLAGE TAXABLE VALUE 55,700<br />

Kolnick Kelly M <strong>Schoharie</strong> 434201 12,000 COUNTY TAXABLE VALUE 55,700<br />

PO Box 161 FRNT 55.00 DPTH 370.00 55,700 TOWN TAXABLE VALUE 55,700<br />

Esperance, NY 12066 ACRES 0.50 SCHOOL TAXABLE VALUE 55,700<br />

EAST-0556246 NRTH-1430384<br />

DEED BOOK 814 PG-14<br />

FULL MARKET VALUE 70,506<br />

******************************************************************************************************* 29.6-1-3 *******************<br />

137 Feuz Ter 451A100728<br />

29.6-1-3 210 1 Family Res COM VET/C 41132 0 11,400 0 0<br />

Kwiatkowski Alex S <strong>Schoharie</strong> 434201 15,300 COM VET/T 41133 0 0 7,600 0<br />

Kwiatkowski Jean FRNT 150.00 DPTH 185.27 86,000 COM VET/V 41137 15,200 0 0 0<br />

137 Feuz Ter ACRES 0.71 RES STAR 41854 0 0 0 22,800<br />

Esperance, NY 12066-0290 EAST-0556381 NRTH-1432924 VILLAGE TAXABLE VALUE 70,800<br />

DEED BOOK 422 PG-250 COUNTY TAXABLE VALUE 74,600<br />

FULL MARKET VALUE 108,861 TOWN TAXABLE VALUE 78,400<br />

SCHOOL TAXABLE VALUE 63,200<br />

******************************************************************************************************* 19.17-1-3 ******************<br />

209 Charleston St 451A100702<br />

19.17-1-3 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Kwiatowski Janice A <strong>Schoharie</strong> 434201 12,300 VILLAGE TAXABLE VALUE 85,000<br />

PO Box 5 FRNT 120.00 DPTH 200.00 85,000 COUNTY TAXABLE VALUE 85,000<br />

Esperance, NY 12066 ACRES 0.50 TOWN TAXABLE VALUE 85,000<br />

EAST-0555596 NRTH-1433061 SCHOOL TAXABLE VALUE 62,200<br />

DEED BOOK 527 PG-222<br />

FULL MARKET VALUE 107,595<br />

******************************************************************************************************* 29.6-2-6 *******************<br />

122 Charleston St 451A100609<br />

29.6-2-6 220 2 Family Res VILLAGE TAXABLE VALUE 69,900<br />

Lang Robert F <strong>Schoharie</strong> 434201 12,100 COUNTY TAXABLE VALUE 69,900<br />

Lang Diane M FRNT 72.30 DPTH 300.00 69,900 TOWN TAXABLE VALUE 69,900<br />

393 Shunpike Rd ACRES 0.40 SCHOOL TAXABLE VALUE 69,900<br />

Sloansville, NY 12160-9705 EAST-0557181 NRTH-1431448<br />

DEED BOOK 402 PG-300<br />

FULL MARKET VALUE 88,481<br />

******************************************************************************************************* 29.6-2-19 ******************<br />

112 Charleston St 451A178209<br />

29.6-2-19 411 Apartment VILLAGE TAXABLE VALUE 71,400<br />

Lang Robert F <strong>Schoharie</strong> 434201 11,500 COUNTY TAXABLE VALUE 71,400<br />

Lang Diane M FRNT 70.00 DPTH 186.00 71,400 TOWN TAXABLE VALUE 71,400<br />

393 Shunpike Rd ACRES 0.25 SCHOOL TAXABLE VALUE 71,400<br />

Sloansville, NY 12160-9705 EAST-0557338 NRTH-1431227<br />

DEED BOOK 613 PG-254<br />

FULL MARKET VALUE 90,380<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 21<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - Esperance OWNERS NAME SEQUENCE<br />

SWIS - 433001 UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 19.17-1-1 ******************<br />

221 Charleston St 451A100658<br />

19.17-1-1 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Largeteau Brian <strong>Schoharie</strong> 434201 31,100 VILLAGE TAXABLE VALUE 81,500<br />

221 Charleston St FRNT 275.00 DPTH 81,500 COUNTY TAXABLE VALUE 81,500<br />

PO Box 322 ACRES 7.80 TOWN TAXABLE VALUE 81,500<br />

Esperance, NY 12066-0322 EAST-0555336 NRTH-1433022 SCHOOL TAXABLE VALUE 58,700<br />

DEED BOOK 486 PG-56<br />

FULL MARKET VALUE 103,165<br />

******************************************************************************************************* 19.18-1-7 ******************<br />

Charleston St 451A190010<br />

19.18-1-7 311 Res vac land VILLAGE TAXABLE VALUE 14,800<br />

Largeteau Brian D <strong>Schoharie</strong> 434201 14,800 COUNTY TAXABLE VALUE 14,800<br />

221 Charleston St FRNT 160.00 DPTH 14,800 TOWN TAXABLE VALUE 14,800<br />

PO Box 322 ACRES 4.90 SCHOOL TAXABLE VALUE 14,800<br />

Esperance, NY 12066-0322 EAST-0556089 NRTH-1433216<br />

DEED BOOK 441 PG-206<br />

FULL MARKET VALUE 18,734<br />

******************************************************************************************************* 29.5-1-21 ******************<br />

133 Main St 451A100657<br />

29.5-1-21 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Largeteau Donald <strong>Schoharie</strong> 434201 12,700 VILLAGE TAXABLE VALUE 85,000<br />

Largeteau Jeannette FRNT 120.00 DPTH 230.00 85,000 COUNTY TAXABLE VALUE 85,000<br />

133 Main St ACRES 0.60 TOWN TAXABLE VALUE 85,000<br />

PO Box 178 EAST-0556129 NRTH-1430744 SCHOOL TAXABLE VALUE 62,200<br />

Esperance, NY 12066-0178 DEED BOOK 302 PG-163<br />

FULL MARKET VALUE 107,595<br />

******************************************************************************************************* 29.5-1-35 ******************<br />

127 Main St 451A100707<br />

29.5-1-35 433 Auto body VILLAGE TAXABLE VALUE 80,800<br />