Town Assessment Roll - Schoharie County

Town Assessment Roll - Schoharie County

Town Assessment Roll - Schoharie County

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

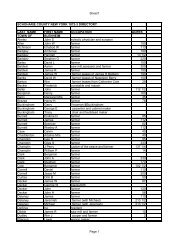

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 71<br />

COUNTY - <strong>Schoharie</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - Esperance TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 433089 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 079.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 37.-3-3.23 *****************<br />

129 Sanitarium Rd 455J204007<br />

37.-3-3.23 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Bryant James J <strong>Schoharie</strong> 434201 26,000 COUNTY TAXABLE VALUE 195,000<br />

Bryant Susan FRNT 251.19 DPTH 195,000 TOWN TAXABLE VALUE 195,000<br />

129 Sanitarium Rd ACRES 3.63 BANK FARETS SCHOOL TAXABLE VALUE 172,200<br />

Esperance, NY 12066 EAST-0541746 NRTH-1420019 FP130 Esperance fire prot 195,000 TO M<br />

DEED BOOK 816 PG-250<br />

FULL MARKET VALUE 246,835<br />

******************************************************************************************************* 17.-3-11 *******************<br />

State Route 30A 455J100144<br />

17.-3-11 114 Sheep farm AG DISTRIC 41720 0 39,321 39,321 39,321<br />

Brynda William J <strong>Schoharie</strong> 434201 52,600 COUNTY TAXABLE VALUE 83,279<br />

Biederman-Brynda Diane R Farmer: Self 122,600 TOWN TAXABLE VALUE 83,279<br />

1606 State Route 30A FRNT 555.00 DPTH SCHOOL TAXABLE VALUE 83,279<br />

Esperance, NY 12066 ACRES 52.00 BANK NBT AG003 Ag dist #3 52.00 AC<br />

EAST-0536766 NRTH-1436334 .00 UN<br />

MAY BE SUBJECT TO PAYMENT DEED BOOK 741 PG-128 FP130 Esperance fire prot 122,600 TO M<br />

UNDER AGDIST LAW TIL 2016 FULL MARKET VALUE 155,190<br />

******************************************************************************************************* 17.-3-12 *******************<br />

1606 State Route 30A 455J100092<br />

17.-3-12 210 1 Family Res RES STAR 41854 0 0 0 22,800<br />

Brynda William J <strong>Schoharie</strong> 434201 10,000 COUNTY TAXABLE VALUE 104,000<br />

Biederman-Brynda Diane R FRNT 264.00 DPTH 104,000 TOWN TAXABLE VALUE 104,000<br />

1606 State Route 30A ACRES 1.00 BANK NBT SCHOOL TAXABLE VALUE 81,200<br />

Esperance, NY 12066 EAST-0535845 NRTH-1436357 AG003 Ag dist #3 1.00 AC<br />

DEED BOOK 741 PG-128 .00 UN<br />

FULL MARKET VALUE 131,646 FP130 Esperance fire prot 104,000 TO M<br />

******************************************************************************************************* 17.-4-5 ********************<br />

State Route 30A 455J100105<br />

17.-4-5 314 Rural vac