Minutes of the Trading Book Standing Group meeting held on 16 ...

Minutes of the Trading Book Standing Group meeting held on 16 ...

Minutes of the Trading Book Standing Group meeting held on 16 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

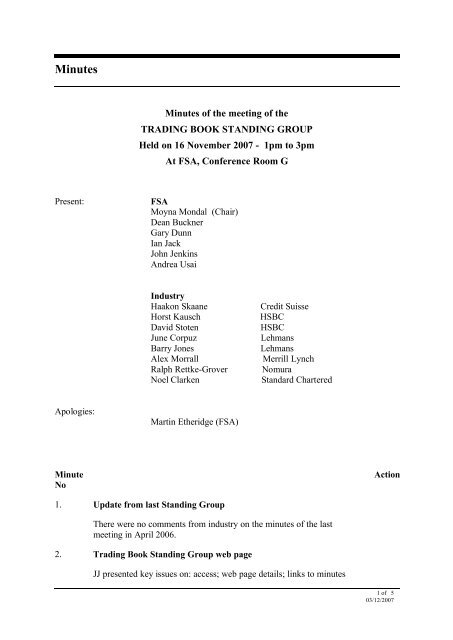

<str<strong>on</strong>g>Minutes</str<strong>on</strong>g><br />

<str<strong>on</strong>g>Minutes</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> <str<strong>on</strong>g>meeting</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

TRADING BOOK STANDING GROUP<br />

Held <strong>on</strong> <strong>16</strong> November 2007 - 1pm to 3pm<br />

At FSA, C<strong>on</strong>ference Room G<br />

Present: FSA<br />

Moyna M<strong>on</strong>dal (Chair)<br />

Dean Buckner<br />

Gary Dunn<br />

Ian Jack<br />

John Jenkins<br />

Andrea Usai<br />

Apologies:<br />

Minute<br />

No<br />

Industry<br />

Haak<strong>on</strong> Skaane Credit Suisse<br />

Horst Kausch HSBC<br />

David Stoten HSBC<br />

June Corpuz Lehmans<br />

Barry J<strong>on</strong>es Lehmans<br />

Alex Morrall Merrill Lynch<br />

Ralph Rettke-Grover Nomura<br />

Noel Clarken Standard Chartered<br />

Martin E<str<strong>on</strong>g>the</str<strong>on</strong>g>ridge (FSA)<br />

1. Update from last <str<strong>on</strong>g>Standing</str<strong>on</strong>g> <str<strong>on</strong>g>Group</str<strong>on</strong>g><br />

There were no comments from industry <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> minutes <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> last<br />

<str<strong>on</strong>g>meeting</str<strong>on</strong>g> in April 2006.<br />

2. <str<strong>on</strong>g>Trading</str<strong>on</strong>g> <str<strong>on</strong>g>Book</str<strong>on</strong>g> <str<strong>on</strong>g>Standing</str<strong>on</strong>g> <str<strong>on</strong>g>Group</str<strong>on</strong>g> web page<br />

JJ presented key issues <strong>on</strong>: access; web page details; links to minutes<br />

Acti<strong>on</strong><br />

1 <str<strong>on</strong>g>of</str<strong>on</strong>g> 5<br />

03/12/2007

Minute<br />

No<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> past <str<strong>on</strong>g>meeting</str<strong>on</strong>g>s and papers available for viewing.<br />

MM asked for feedback <strong>on</strong> our group sites generally. No members<br />

present at <str<strong>on</strong>g>the</str<strong>on</strong>g> <str<strong>on</strong>g>Trading</str<strong>on</strong>g> <str<strong>on</strong>g>Book</str<strong>on</strong>g> <str<strong>on</strong>g>Standing</str<strong>on</strong>g> <str<strong>on</strong>g>Group</str<strong>on</strong>g> used <str<strong>on</strong>g>the</str<strong>on</strong>g> website. The<br />

FSA sought industry's views <strong>on</strong> how <str<strong>on</strong>g>the</str<strong>on</strong>g> site could be improved.<br />

Industry suggested:<br />

· Inclusi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> more useful papers<br />

· Links to o<str<strong>on</strong>g>the</str<strong>on</strong>g>r useful websites<br />

· <str<strong>on</strong>g>Minutes</str<strong>on</strong>g> to be published within 3 weeks <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>meeting</str<strong>on</strong>g>s<br />

· Use <str<strong>on</strong>g>of</str<strong>on</strong>g> issues log<br />

· Emails to group members when an update to <str<strong>on</strong>g>the</str<strong>on</strong>g> site has been<br />

made.<br />

3. Interest Rate Risk in <str<strong>on</strong>g>the</str<strong>on</strong>g> N<strong>on</strong> <str<strong>on</strong>g>Trading</str<strong>on</strong>g> <str<strong>on</strong>g>Book</str<strong>on</strong>g><br />

JJ presented key issues: access to web page covering waiver <str<strong>on</strong>g>of</str<strong>on</strong>g> report<br />

FSA017; c<strong>on</strong>tent <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> web pages; overview <str<strong>on</strong>g>of</str<strong>on</strong>g> our expectati<strong>on</strong>s<br />

regarding waivers.<br />

4. Counterparty Credit Risk (CPCR) – Standard Approach for n<strong>on</strong><br />

linear products without CAD model approval.<br />

MM presented an issue raised at <str<strong>on</strong>g>the</str<strong>on</strong>g> Credit Risk <str<strong>on</strong>g>Standing</str<strong>on</strong>g> <str<strong>on</strong>g>Group</str<strong>on</strong>g> for<br />

reference <strong>on</strong>ly to <str<strong>on</strong>g>the</str<strong>on</strong>g> <str<strong>on</strong>g>Trading</str<strong>on</strong>g> <str<strong>on</strong>g>Book</str<strong>on</strong>g> <str<strong>on</strong>g>Standing</str<strong>on</strong>g> <str<strong>on</strong>g>Group</str<strong>on</strong>g>. The paper,<br />

attached at <str<strong>on</strong>g>the</str<strong>on</strong>g> end <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> minutes, proposes how firms who have no<br />

market risk but <strong>on</strong>ly counterparty risk can utilise <str<strong>on</strong>g>the</str<strong>on</strong>g> standardised<br />

approach to credit risk when <str<strong>on</strong>g>the</str<strong>on</strong>g>ir portfolios have a lot <str<strong>on</strong>g>of</str<strong>on</strong>g> n<strong>on</strong> linear<br />

risk factors without gaining CAD1 or CAD2 model approval.<br />

The FSA at present feels that <str<strong>on</strong>g>the</str<strong>on</strong>g>re are <strong>on</strong>ly a handful <str<strong>on</strong>g>of</str<strong>on</strong>g> firms who will<br />

want to use this approach, but we seek guidance from industry as to<br />

whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r our assumpti<strong>on</strong> is correct.<br />

This paper will be discussed fur<str<strong>on</strong>g>the</str<strong>on</strong>g>r at <str<strong>on</strong>g>the</str<strong>on</strong>g> Credit Risk <str<strong>on</strong>g>Standing</str<strong>on</strong>g> <str<strong>on</strong>g>Group</str<strong>on</strong>g><br />

in <str<strong>on</strong>g>the</str<strong>on</strong>g> first week <str<strong>on</strong>g>of</str<strong>on</strong>g> December. The final decisi<strong>on</strong> <strong>on</strong> whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r and how<br />

firms can utilise <str<strong>on</strong>g>the</str<strong>on</strong>g> standardised approach without CAD model<br />

approval will reside with <str<strong>on</strong>g>the</str<strong>on</strong>g> Credit Risk <str<strong>on</strong>g>Standing</str<strong>on</strong>g> <str<strong>on</strong>g>Group</str<strong>on</strong>g>. We will<br />

update <str<strong>on</strong>g>the</str<strong>on</strong>g> <str<strong>on</strong>g>Trading</str<strong>on</strong>g> <str<strong>on</strong>g>Book</str<strong>on</strong>g> <str<strong>on</strong>g>Standing</str<strong>on</strong>g> <str<strong>on</strong>g>Group</str<strong>on</strong>g> <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> discussi<strong>on</strong> and <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

decisi<strong>on</strong> reached.<br />

Points raised by <str<strong>on</strong>g>the</str<strong>on</strong>g> <str<strong>on</strong>g>Trading</str<strong>on</strong>g> <str<strong>on</strong>g>Book</str<strong>on</strong>g> <str<strong>on</strong>g>Standing</str<strong>on</strong>g> <str<strong>on</strong>g>Group</str<strong>on</strong>g> to be forwarded to<br />

Acti<strong>on</strong><br />

2 <str<strong>on</strong>g>of</str<strong>on</strong>g> 5<br />

03/12/2007

Minute<br />

No<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> Credit Risk <str<strong>on</strong>g>Standing</str<strong>on</strong>g> <str<strong>on</strong>g>Group</str<strong>on</strong>g>:<br />

· There would be a need for comm<strong>on</strong> standards<br />

· There may be many firms who have no market risk yet very<br />

significant n<strong>on</strong> linear risks in counterparty credit risk. These<br />

firms should be assessed just as stringently as for CAD model<br />

recogniti<strong>on</strong>. If <str<strong>on</strong>g>of</str<strong>on</strong>g>f <str<strong>on</strong>g>the</str<strong>on</strong>g> shelf models are used <str<strong>on</strong>g>the</str<strong>on</strong>g>ir methodology<br />

should not just be approved as standard "black box" technology<br />

that works, but <str<strong>on</strong>g>the</str<strong>on</strong>g> model should be validated to ensure it<br />

captures all <str<strong>on</strong>g>the</str<strong>on</strong>g> risks needed to calculate counterparty credit<br />

risk.<br />

5. VAR Models IDRC update and discussi<strong>on</strong><br />

GD explained that <str<strong>on</strong>g>the</str<strong>on</strong>g> final draft guidelines had been published <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

BIS website in October. In additi<strong>on</strong> BIS have also issued <str<strong>on</strong>g>the</str<strong>on</strong>g>ir own<br />

impact study which will cover IDRC and EPE modelling. The impact<br />

study questi<strong>on</strong>naire is not <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> public BIS website, but has been sent<br />

to supervisors to invite <str<strong>on</strong>g>the</str<strong>on</strong>g>ir regulated firms to take part. They have<br />

requested IDRC data to be calculated for 31 Oct 2007, and <str<strong>on</strong>g>the</str<strong>on</strong>g> final<br />

data submissi<strong>on</strong> date is <str<strong>on</strong>g>the</str<strong>on</strong>g> end <str<strong>on</strong>g>of</str<strong>on</strong>g> January 2008.<br />

Firms had been asked to produce IDRC charges using <str<strong>on</strong>g>the</str<strong>on</strong>g>ir current<br />

IDRC models and VaR with <str<strong>on</strong>g>the</str<strong>on</strong>g> additi<strong>on</strong>al request that <str<strong>on</strong>g>the</str<strong>on</strong>g>y use <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

adjusted approach set out in <str<strong>on</strong>g>the</str<strong>on</strong>g> documentati<strong>on</strong> if possible. The data<br />

sought relates to <str<strong>on</strong>g>the</str<strong>on</strong>g> top 500 holdings by issuer toge<str<strong>on</strong>g>the</str<strong>on</strong>g>r with all <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

l<strong>on</strong>gs and shorts for that positi<strong>on</strong> aggregated, regardless <str<strong>on</strong>g>of</str<strong>on</strong>g> maturities<br />

and o<str<strong>on</strong>g>the</str<strong>on</strong>g>r details.<br />

Portfolio informati<strong>on</strong> and assumpti<strong>on</strong>s for each firm's IDRC is to be<br />

sent to Basel for analysis. BIS plans to run <str<strong>on</strong>g>the</str<strong>on</strong>g> portfolio <strong>on</strong> <strong>on</strong>e or more<br />

"assessment models" using <str<strong>on</strong>g>the</str<strong>on</strong>g> firms' assumpti<strong>on</strong>s and also Basel<br />

assumpti<strong>on</strong>s.<br />

Industry pointed out that banks not invited to participate have not had<br />

access to <str<strong>on</strong>g>the</str<strong>on</strong>g> questi<strong>on</strong>naire and <str<strong>on</strong>g>the</str<strong>on</strong>g> instructi<strong>on</strong>s. GD is to establish<br />

whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r <str<strong>on</strong>g>the</str<strong>on</strong>g> document can be published <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> BIS website.<br />

We explained that BIS wanted to have <str<strong>on</strong>g>the</str<strong>on</strong>g> guidance as open as possible<br />

so that all types <str<strong>on</strong>g>of</str<strong>on</strong>g> models could incorporate <str<strong>on</strong>g>the</str<strong>on</strong>g> guidelines, and that<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> impact study would be a good test <str<strong>on</strong>g>of</str<strong>on</strong>g> this approach. We added that<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> BIS had set an end <str<strong>on</strong>g>of</str<strong>on</strong>g> January 2008 deadline, however, UK banks<br />

had been asked to return <str<strong>on</strong>g>the</str<strong>on</strong>g> IDRC impact study data by end-December<br />

if possible. The current aim was to publish guidelines by mid 2008.<br />

Industry asked how <str<strong>on</strong>g>the</str<strong>on</strong>g> guidelines would be turned into Handbook text.<br />

We explained that Policy would look at <str<strong>on</strong>g>the</str<strong>on</strong>g> questi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> incorporati<strong>on</strong><br />

Acti<strong>on</strong><br />

3 <str<strong>on</strong>g>of</str<strong>on</strong>g> 5<br />

03/12/2007

Minute<br />

No<br />

into <str<strong>on</strong>g>the</str<strong>on</strong>g> CRD.<br />

Industry was interested that fur<str<strong>on</strong>g>the</str<strong>on</strong>g>r c<strong>on</strong>siderati<strong>on</strong> be given to<br />

transiti<strong>on</strong>al guidelines and <str<strong>on</strong>g>the</str<strong>on</strong>g> potential overlap <str<strong>on</strong>g>of</str<strong>on</strong>g> IDRC and Large<br />

Exposure charges which it felt led to double counting.<br />

GD said that issues such as c<strong>on</strong>centrati<strong>on</strong> floors have attracted some<br />

discussi<strong>on</strong> between regulators and firms. They were introduced in <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

FSA interim approach, and <str<strong>on</strong>g>the</str<strong>on</strong>g> draft guidelines for c<strong>on</strong>sultati<strong>on</strong> as a<br />

reas<strong>on</strong>ableness test <str<strong>on</strong>g>of</str<strong>on</strong>g> model output. We added that when <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

guidelines were finalised <str<strong>on</strong>g>the</str<strong>on</strong>g>y should rectify this aspect.<br />

Industry said that timing was important and that a website entry would<br />

be useful.<br />

6. Update <strong>on</strong> hypo<str<strong>on</strong>g>the</str<strong>on</strong>g>tical P&L<br />

DB explained <str<strong>on</strong>g>the</str<strong>on</strong>g> background <str<strong>on</strong>g>of</str<strong>on</strong>g> a new rule and reporting standard and<br />

acknowledged <str<strong>on</strong>g>the</str<strong>on</strong>g> burden <strong>on</strong> firms.<br />

In April FSA wrote to all CAD 2 firms and all those proposing to move<br />

to CAD 2 setting out our requirement and how <str<strong>on</strong>g>the</str<strong>on</strong>g> hypo<str<strong>on</strong>g>the</str<strong>on</strong>g>tical P&L<br />

should be computed, toge<str<strong>on</strong>g>the</str<strong>on</strong>g>r with specific questi<strong>on</strong>s.<br />

Discussi<strong>on</strong>s had now been <str<strong>on</strong>g>held</str<strong>on</strong>g> with some <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> firms that had<br />

resp<strong>on</strong>ded.<br />

Our expectati<strong>on</strong> is that within <str<strong>on</strong>g>the</str<strong>on</strong>g> next two weeks an open letter will be<br />

published <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> website. It should include:<br />

· Our main findings, including <str<strong>on</strong>g>the</str<strong>on</strong>g> wide differences between<br />

firms<br />

· Comment <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> questi<strong>on</strong>s we raised.<br />

DB explained that we see <str<strong>on</strong>g>the</str<strong>on</strong>g> exercise as valuable feedback and a<br />

str<strong>on</strong>g test <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>sistency, or o<str<strong>on</strong>g>the</str<strong>on</strong>g>rwise, am<strong>on</strong>gst firms.<br />

Two resp<strong>on</strong>ses were c<strong>on</strong>sistent relating to:<br />

· Using historic or product centred prices.<br />

· Trades opened <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> day after a VaR portfolio has been<br />

defined for that day, must not be included.<br />

Acti<strong>on</strong><br />

4 <str<strong>on</strong>g>of</str<strong>on</strong>g> 5<br />

03/12/2007

Minute<br />

No<br />

There were significant differences in resp<strong>on</strong>ses to <str<strong>on</strong>g>the</str<strong>on</strong>g> o<str<strong>on</strong>g>the</str<strong>on</strong>g>r questi<strong>on</strong>s<br />

including:<br />

· Handling <str<strong>on</strong>g>of</str<strong>on</strong>g> amended trades, refixes and resets.<br />

· Opti<strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g>ta should be included where significant<br />

· Hypo<str<strong>on</strong>g>the</str<strong>on</strong>g>tical calculati<strong>on</strong> should correctly include any closed<br />

trades in VaR at T (i.e. must include p&l from close <str<strong>on</strong>g>of</str<strong>on</strong>g> business<br />

at T, to close <str<strong>on</strong>g>of</str<strong>on</strong>g> business at T+1).<br />

· Reserve valuati<strong>on</strong> adjustments.<br />

7. Any O<str<strong>on</strong>g>the</str<strong>on</strong>g>r business<br />

One group member raised an issue regarding <str<strong>on</strong>g>the</str<strong>on</strong>g> multipliers in BIPRU<br />

7.11. MM reminded <str<strong>on</strong>g>the</str<strong>on</strong>g> group that <str<strong>on</strong>g>the</str<strong>on</strong>g> Credit Risk Mitigati<strong>on</strong> <str<strong>on</strong>g>Standing</str<strong>on</strong>g><br />

<str<strong>on</strong>g>Group</str<strong>on</strong>g> was <str<strong>on</strong>g>the</str<strong>on</strong>g> best forum for this, but since <str<strong>on</strong>g>the</str<strong>on</strong>g>re had been no <str<strong>on</strong>g>meeting</str<strong>on</strong>g><br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> this forum for a while, we would be prepared to listen to <str<strong>on</strong>g>the</str<strong>on</strong>g> issue at<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> <str<strong>on</strong>g>Trading</str<strong>on</strong>g> <str<strong>on</strong>g>Book</str<strong>on</strong>g> <str<strong>on</strong>g>Standing</str<strong>on</strong>g> <str<strong>on</strong>g>Group</str<strong>on</strong>g>.<br />

The group member raised c<strong>on</strong>cerns that <str<strong>on</strong>g>the</str<strong>on</strong>g> multiplier in standard rules<br />

was *2*3 (for VaR), which was equivalent to *6 multiplier. He<br />

questi<strong>on</strong>ed why this had been incorporated into BIPRU without a<br />

c<strong>on</strong>sultati<strong>on</strong> process and c<strong>on</strong>sidered this to be both burdensome to<br />

firms and super-equivalent to CRD. He asked for this to be reassessed<br />

and changed in time for 1 Jan 08 when BIPRU 7.11 comes into force.<br />

We resp<strong>on</strong>ded by explaining <str<strong>on</strong>g>the</str<strong>on</strong>g> practicalities <str<strong>on</strong>g>of</str<strong>on</strong>g> potential changes to<br />

BIPRU and asked <str<strong>on</strong>g>the</str<strong>on</strong>g> group member to submit a detailed statement <strong>on</strong><br />

this issue that we could c<strong>on</strong>sider with colleagues handling this part <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

BIPRU. This is a topic which <strong>on</strong>e member <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> group is keen to<br />

discuss fur<str<strong>on</strong>g>the</str<strong>on</strong>g>r at <str<strong>on</strong>g>the</str<strong>on</strong>g> next standing group and recommended <str<strong>on</strong>g>the</str<strong>on</strong>g>y<br />

rec<strong>on</strong>vene in early December. MM agreed in principal with this timing<br />

subject to receiving a positive resp<strong>on</strong>se <strong>on</strong> this from o<str<strong>on</strong>g>the</str<strong>on</strong>g>r members <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> group. She reminded <str<strong>on</strong>g>the</str<strong>on</strong>g> group that <str<strong>on</strong>g>the</str<strong>on</strong>g> multiplier issue would need<br />

a wider discussi<strong>on</strong>.<br />

Industry expressed <str<strong>on</strong>g>the</str<strong>on</strong>g> view that <str<strong>on</strong>g>the</str<strong>on</strong>g>re should be a <str<strong>on</strong>g>Standing</str<strong>on</strong>g> <str<strong>on</strong>g>Group</str<strong>on</strong>g><br />

covering liquidity. We will relay this questi<strong>on</strong> to our liquidity policy<br />

colleagues.<br />

Acti<strong>on</strong><br />

5 <str<strong>on</strong>g>of</str<strong>on</strong>g> 5<br />

03/12/2007