PERS Model financial statements - AXP Solutions

PERS Model financial statements - AXP Solutions

PERS Model financial statements - AXP Solutions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

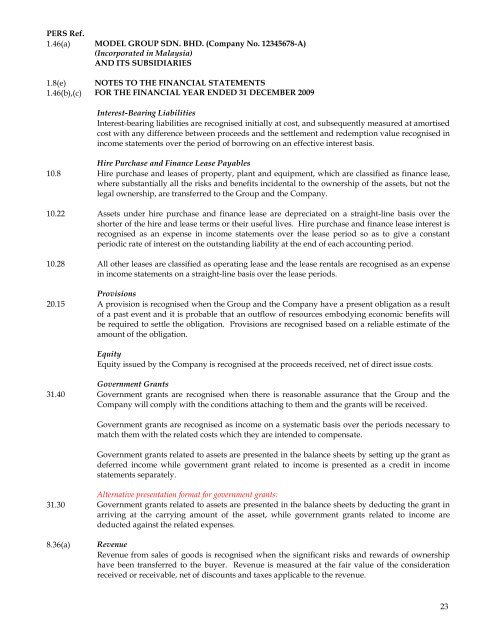

<strong>PERS</strong> Ref.<br />

1.46(a) MODEL GROUP SDN. BHD. (Company No. 12345678-A)<br />

(Incorporated in Malaysia)<br />

AND ITS SUBSIDIARIES<br />

1.8(e)<br />

1.46(b),(c)<br />

10.8<br />

10.22<br />

10.28<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2009<br />

Interest-Bearing Liabilities<br />

Interest-bearing liabilities are recognised initially at cost, and subsequently measured at amortised<br />

cost with any difference between proceeds and the settlement and redemption value recognised in<br />

income <strong>statements</strong> over the period of borrowing on an effective interest basis.<br />

Hire Purchase and Finance Lease Payables<br />

Hire purchase and leases of property, plant and equipment, which are classified as finance lease,<br />

where substantially all the risks and benefits incidental to the ownership of the assets, but not the<br />

legal ownership, are transferred to the Group and the Company.<br />

Assets under hire purchase and finance lease are depreciated on a straight-line basis over the<br />

shorter of the hire and lease terms or their useful lives. Hire purchase and finance lease interest is<br />

recognised as an expense in income <strong>statements</strong> over the lease period so as to give a constant<br />

periodic rate of interest on the outstanding liability at the end of each accounting period.<br />

All other leases are classified as operating lease and the lease rentals are recognised as an expense<br />

in income <strong>statements</strong> on a straight-line basis over the lease periods.<br />

Provisions<br />

20.15 A provision is recognised when the Group and the Company have a present obligation as a result<br />

of a past event and it is probable that an outflow of resources embodying economic benefits will<br />

be required to settle the obligation. Provisions are recognised based on a reliable estimate of the<br />

amount of the obligation.<br />

31.40<br />

31.30<br />

Equity<br />

Equity issued by the Company is recognised at the proceeds received, net of direct issue costs.<br />

Government Grants<br />

Government grants are recognised when there is reasonable assurance that the Group and the<br />

Company will comply with the conditions attaching to them and the grants will be received.<br />

Government grants are recognised as income on a systematic basis over the periods necessary to<br />

match them with the related costs which they are intended to compensate.<br />

Government grants related to assets are presented in the balance sheets by setting up the grant as<br />

deferred income while government grant related to income is presented as a credit in income<br />

<strong>statements</strong> separately.<br />

Alternative presentation format for government grants:<br />

Government grants related to assets are presented in the balance sheets by deducting the grant in<br />

arriving at the carrying amount of the asset, while government grants related to income are<br />

deducted against the related expenses.<br />

8.36(a) Revenue<br />

Revenue from sales of goods is recognised when the significant risks and rewards of ownership<br />

have been transferred to the buyer. Revenue is measured at the fair value of the consideration<br />

received or receivable, net of discounts and taxes applicable to the revenue.<br />

23