PERS Model financial statements - AXP Solutions

PERS Model financial statements - AXP Solutions

PERS Model financial statements - AXP Solutions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>PERS</strong> Ref.<br />

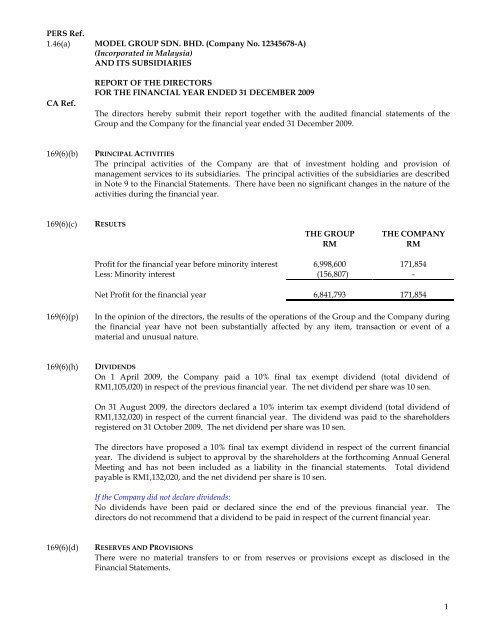

1.46(a) MODEL GROUP SDN. BHD. (Company No. 12345678-A)<br />

(Incorporated in Malaysia)<br />

AND ITS SUBSIDIARIES<br />

CA Ref.<br />

REPORT OF THE DIRECTORS<br />

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2009<br />

The directors hereby submit their report together with the audited <strong>financial</strong> <strong>statements</strong> of the<br />

Group and the Company for the <strong>financial</strong> year ended 31 December 2009.<br />

169(6)(b) PRINCIPAL ACTIVITIES<br />

The principal activities of the Company are that of investment holding and provision of<br />

management services to its subsidiaries. The principal activities of the subsidiaries are described<br />

in Note 9 to the Financial Statements. There have been no significant changes in the nature of the<br />

activities during the <strong>financial</strong> year.<br />

169(6)(c) RESULTS<br />

169(6)(p)<br />

THE GROUP THE COMPANY<br />

RM RM<br />

Profit for the <strong>financial</strong> year before minority interest 6,998,600 171,854<br />

Less: Minority interest (156,807) -<br />

Net Profit for the <strong>financial</strong> year<br />

6,841,793<br />

171,854<br />

In the opinion of the directors, the results of the operations of the Group and the Company during<br />

the <strong>financial</strong> year have not been substantially affected by any item, transaction or event of a<br />

material and unusual nature.<br />

169(6)(h) DIVIDENDS<br />

On 1 April 2009, the Company paid a 10% final tax exempt dividend (total dividend of<br />

RM1,105,020) in respect of the previous <strong>financial</strong> year. The net dividend per share was 10 sen.<br />

On 31 August 2009, the directors declared a 10% interim tax exempt dividend (total dividend of<br />

RM1,132,020) in respect of the current <strong>financial</strong> year. The dividend was paid to the shareholders<br />

registered on 31 October 2009. The net dividend per share was 10 sen.<br />

The directors have proposed a 10% final tax exempt dividend in respect of the current <strong>financial</strong><br />

year. The dividend is subject to approval by the shareholders at the forthcoming Annual General<br />

Meeting and has not been included as a liability in the <strong>financial</strong> <strong>statements</strong>. Total dividend<br />

payable is RM1,132,020, and the net dividend per share is 10 sen.<br />

If the Company did not declare dividends:<br />

No dividends have been paid or declared since the end of the previous <strong>financial</strong> year. The<br />

directors do not recommend that a dividend to be paid in respect of the current <strong>financial</strong> year.<br />

169(6)(d) RESERVES AND PROVISIONS<br />

There were no material transfers to or from reserves or provisions except as disclosed in the<br />

Financial Statements.<br />

1