Oklahoma Small Business Resource Guide - SBA

Oklahoma Small Business Resource Guide - SBA

Oklahoma Small Business Resource Guide - SBA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

other assets to be free of liens and<br />

available to secure other needed<br />

financing.<br />

• Long-term real estate loans are up to<br />

20-year term, heavy equipment 10 - or<br />

20-year term and are self-amortizing.<br />

<strong>Business</strong>es that receive 504 loans are:<br />

• <strong>Small</strong> — net worth under $15 million,<br />

net profit after taxes under $5 million, or<br />

meet other <strong>SBA</strong> size standards.<br />

• Organized for-profit.<br />

• Most types of business — retail, service,<br />

wholesale or manufacturing.<br />

The <strong>SBA</strong>’s 504 certified development<br />

companies serve their communities by<br />

financing business expansion needs.<br />

Their professional staffs work directly<br />

with borrowers to tailor a financing<br />

package that meets program guidelines<br />

and the credit capacity of the borrower’s<br />

business. For information, visit<br />

www.sba.gov/504.<br />

Certified Development Companies<br />

Metro Area Development Corporation<br />

Dan Fitzpatrick<br />

6412 N. Santa Fe Ave., Ste. C<br />

<strong>Oklahoma</strong> City, OK 73116<br />

405-424-5181 • 405-424-1781 Fax<br />

madco@rhess.com<br />

<strong>Small</strong> <strong>Business</strong> Capital Corporation<br />

Peggy Rice<br />

Judy Roach<br />

15 W. Sixth St., Ste. 1214<br />

Tulsa, OK 74119-5406<br />

918-584-3638 • 918-599-8339 Fax<br />

peggyrice@sbcc-ok.com<br />

jroach@sbcc-ok.com<br />

www.sbcc-ok.com<br />

Tulsa Economic Development Corporation<br />

Rose Washington<br />

Peggy Prudom<br />

125 W. Third St.<br />

Tulsa, OK 74103<br />

918-585-8332 • 918-585-2473 Fax<br />

rose@tedcnet.com<br />

peggy@tedcnet.com<br />

www.tedcnet.com<br />

Rural Enterprises of <strong>Oklahoma</strong>, Inc.<br />

P.O. Box 1335<br />

Durant, OK 74702<br />

800-658-2823 • 580-920-2745 Fax<br />

www.ruralenterprises.com<br />

Alva Office<br />

Contact TBD<br />

580-327-2095<br />

Durant Office<br />

Contact Susan Bates<br />

580-924-5094<br />

susan@ruralenterprises.com<br />

Lawton Office<br />

Contact Gilmer Capps<br />

580-327-2095<br />

gcapps@ruralenterprises.com<br />

<strong>Oklahoma</strong> City Office<br />

Contact Katherine Faison<br />

405-319-8190<br />

kfaison@ruralenterprises.com<br />

Tulsa Office<br />

Contact Sam Vaverka<br />

918-994-4370<br />

svaverka@ruralenterprises.com<br />

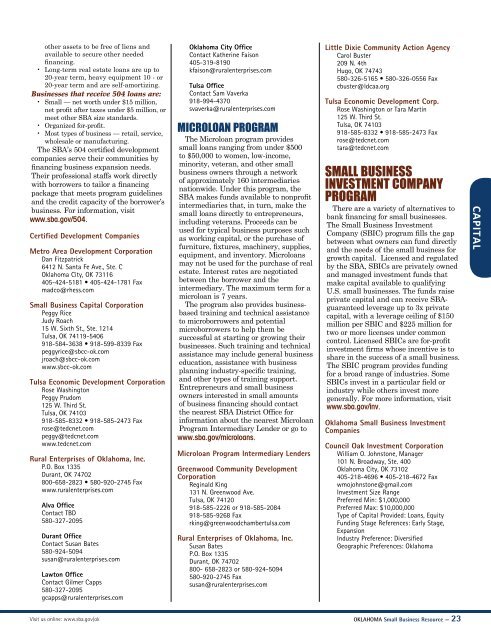

MICROLOAN PROGRAM<br />

The Microloan program provides<br />

small loans ranging from under $500<br />

to $50,000 to women, low-income,<br />

minority, veteran, and other small<br />

business owners through a network<br />

of approximately 160 intermediaries<br />

nationwide. Under this program, the<br />

<strong>SBA</strong> makes funds available to nonprofit<br />

intermediaries that, in turn, make the<br />

small loans directly to entrepreneurs,<br />

including veterans. Proceeds can be<br />

used for typical business purposes such<br />

as working capital, or the purchase of<br />

furniture, fixtures, machinery, supplies,<br />

equipment, and inventory. Microloans<br />

may not be used for the purchase of real<br />

estate. Interest rates are negotiated<br />

between the borrower and the<br />

intermediary. The maximum term for a<br />

microloan is 7 years.<br />

The program also provides businessbased<br />

training and technical assistance<br />

to microborrowers and potential<br />

microborrowers to help them be<br />

successful at starting or growing their<br />

businesses. Such training and technical<br />

assistance may include general business<br />

education, assistance with business<br />

planning industry-specific training,<br />

and other types of training support.<br />

Entrepreneurs and small business<br />

owners interested in small amounts<br />

of business financing should contact<br />

the nearest <strong>SBA</strong> District Office for<br />

information about the nearest Microloan<br />

Program Intermediary Lender or go to<br />

www.sba.gov/microloans.<br />

Microloan Program Intermediary Lenders<br />

Greenwood Community Development<br />

Corporation<br />

Reginald King<br />

131 N. Greenwood Ave.<br />

Tulsa, OK 74120<br />

918-585-2226 or 918-585-2084<br />

918-585-9268 Fax<br />

rking@greenwoodchambertulsa.com<br />

Rural Enterprises of <strong>Oklahoma</strong>, Inc.<br />

Susan Bates<br />

P.O. Box 1335<br />

Durant, OK 74702<br />

800- 658-2823 or 580-924-5094<br />

580-920-2745 Fax<br />

susan@ruralenterprises.com<br />

Little Dixie Community Action Agency<br />

Carol Buster<br />

209 N. 4th<br />

Hugo, OK 74743<br />

580-326-5165 • 580-326-0556 Fax<br />

cbuster@ldcaa.org<br />

Tulsa Economic Development Corp.<br />

Rose Washington or Tara Martin<br />

125 W. Third St.<br />

Tulsa, OK 74103<br />

918-585-8332 • 918-585-2473 Fax<br />

rose@tedcnet.com<br />

tara@tedcnet.com<br />

SMALL BUSINESS<br />

INVESTMENT COMPANY<br />

PROGRAM<br />

There are a variety of alternatives to<br />

bank financing for small businesses.<br />

The <strong>Small</strong> <strong>Business</strong> Investment<br />

Company (SBIC) program fills the gap<br />

between what owners can fund directly<br />

and the needs of the small business for<br />

growth capital. Licensed and regulated<br />

by the <strong>SBA</strong>, SBICs are privately owned<br />

and managed investment funds that<br />

make capital available to qualifying<br />

U.S. small businesses. The funds raise<br />

private capital and can receive <strong>SBA</strong>guaranteed<br />

leverage up to 3x private<br />

capital, with a leverage ceiling of $150<br />

million per SBIC and $225 million for<br />

two or more licenses under common<br />

control. Licensed SBICs are for-profit<br />

investment firms whose incentive is to<br />

share in the success of a small business.<br />

The SBIC program provides funding<br />

for a broad range of industries. Some<br />

SBICs invest in a particular field or<br />

industry while others invest more<br />

generally. For more information, visit<br />

www.sba.gov/inv.<br />

<strong>Oklahoma</strong> <strong>Small</strong> <strong>Business</strong> Investment<br />

Companies<br />

Council Oak Investment Corporation<br />

William O. Johnstone, Manager<br />

101 N. Broadway, Ste. 400<br />

<strong>Oklahoma</strong> City, OK 73102<br />

405-218-4696 • 405-218-4672 Fax<br />

wmojohnstone@gmail.com<br />

Investment Size Range<br />

Preferred Min: $1,000,000<br />

Preferred Max: $10,000,000<br />

Type of Capital Provided: Loans, Equity<br />

Funding Stage References: Early Stage,<br />

Expansion<br />

Industry Preference: Diversified<br />

Geographic Preferences: <strong>Oklahoma</strong><br />

Visit us online: www.sba.gov/ok OKLAHOMA <strong>Small</strong> <strong>Business</strong> <strong>Resource</strong> — 23<br />

CAPITAL