Oklahoma Small Business Resource Guide - SBA

Oklahoma Small Business Resource Guide - SBA

Oklahoma Small Business Resource Guide - SBA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

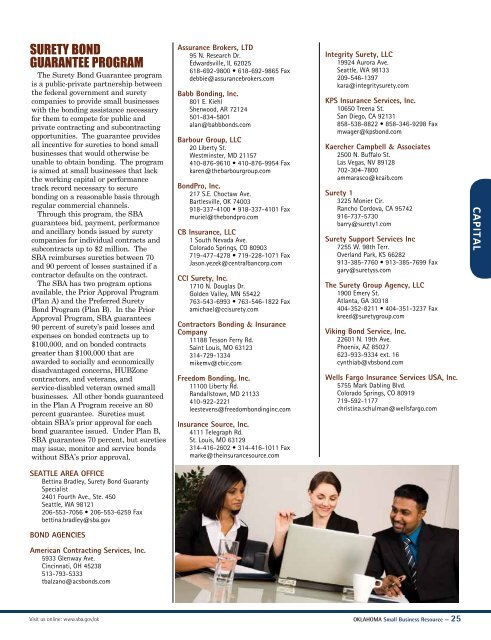

SURETY BOND<br />

GUARANTEE PROGRAM<br />

The Surety Bond Guarantee program<br />

is a public-private partnership between<br />

the federal government and surety<br />

companies to provide small businesses<br />

with the bonding assistance necessary<br />

for them to compete for public and<br />

private contracting and subcontracting<br />

opportunities. The guarantee provides<br />

all incentive for sureties to bond small<br />

businesses that would otherwise be<br />

unable to obtain bonding. The program<br />

is aimed at small businesses that lack<br />

the working capital or performance<br />

track record necessary to secure<br />

bonding on a reasonable basis through<br />

regular commercial channels.<br />

Through this program, the <strong>SBA</strong><br />

guarantees bid, payment, performance<br />

and ancillary bonds issued by surety<br />

companies for individual contracts and<br />

subcontracts up to $2 million. The<br />

<strong>SBA</strong> reimburses sureties between 70<br />

and 90 percent of losses sustained if a<br />

contractor defaults on the contract.<br />

The <strong>SBA</strong> has two program options<br />

available, the Prior Approval Program<br />

(Plan A) and the Preferred Surety<br />

Bond Program (Plan B). In the Prior<br />

Approval Program, <strong>SBA</strong> guarantees<br />

90 percent of surety’s paid losses and<br />

expenses on bonded contracts up to<br />

$100,000, and on bonded contracts<br />

greater than $100,000 that are<br />

awarded to socially and economically<br />

disadvantaged concerns, HUBZone<br />

contractors, and veterans, and<br />

service-disabled veteran owned small<br />

businesses. All other bonds guaranteed<br />

in the Plan A Program receive an 80<br />

percent guarantee. Sureties must<br />

obtain <strong>SBA</strong>’s prior approval for each<br />

bond guarantee issued. Under Plan B,<br />

<strong>SBA</strong> guarantees 70 percent, but sureties<br />

may issue, monitor and service bonds<br />

without <strong>SBA</strong>’s prior approval.<br />

SEATTLE AREA OFFICE<br />

Bettina Bradley, Surety Bond Guaranty<br />

Specialist<br />

2401 Fourth Ave., Ste. 450<br />

Seattle, WA 98121<br />

206-553-7056 • 206-553-6259 Fax<br />

bettina.bradley@sba.gov<br />

BOND AGENCIES<br />

American Contracting Services, Inc.<br />

5933 Glenway Ave.<br />

Cincinnati, OH 45238<br />

513-793-5333<br />

tbalzano@acsbonds.com<br />

Assurance Brokers, LTD<br />

95 N. Research Dr.<br />

Edwardsville, IL 62025<br />

618-692-9800 • 618-692-9865 Fax<br />

debbie@assurancebrokers.com<br />

Babb Bonding, Inc.<br />

801 E. Kiehl<br />

Sherwood, AR 72124<br />

501-834-5801<br />

alan@babbbonds.com<br />

Barbour Group, LLC<br />

20 Liberty St.<br />

Westminster, MD 21157<br />

410-876-9610 • 410-876-9954 Fax<br />

karen@thebarbourgroup.com<br />

BondPro, Inc.<br />

217 S.E. Choctaw Ave.<br />

Bartlesville, OK 74003<br />

918-337-4100 • 918-337-4101 Fax<br />

muriel@thebondpro.com<br />

CB Insurance, LLC<br />

1 South Nevada Ave.<br />

Colorado Springs, CO 80903<br />

719-477-4278 • 719-228-1071 Fax<br />

Jason.yezek@centralbancorp.com<br />

CCI Surety, Inc.<br />

1710 N. Douglas Dr.<br />

Golden Valley, MN 55422<br />

763-543-6993 • 763-546-1822 Fax<br />

amichael@ccisurety.com<br />

Contractors Bonding & Insurance<br />

Company<br />

11188 Tesson Ferry Rd.<br />

Saint Louis, MO 63123<br />

314-729-1334<br />

mikemv@cbic.com<br />

Freedom Bonding, Inc.<br />

11100 Liberty Rd.<br />

Randallstown, MD 21133<br />

410-922-2221<br />

leestevens@freedombondinginc.com<br />

Insurance Source, Inc.<br />

4111 Telegraph Rd.<br />

St. Louis, MO 63129<br />

314-416-2602 • 314-416-1011 Fax<br />

marke@theinsurancesource.com<br />

Integrity Surety, LLC<br />

19924 Aurora Ave.<br />

Seattle, WA 98133<br />

209-546-1397<br />

kara@integritysurety.com<br />

KPS Insurance Services, Inc.<br />

10650 Treena St.<br />

San Diego, CA 92131<br />

858-538-8822 • 858-346-9298 Fax<br />

mwager@kpsbond.com<br />

Kaercher Campbell & Associates<br />

2500 N. Buffalo St.<br />

Las Vegas, NV 89128<br />

702-304-7800<br />

ammarasco@kcaib.com<br />

Surety 1<br />

3225 Monier Cir.<br />

Rancho Cordova, CA 95742<br />

916-737-5730<br />

barry@surety1.com<br />

Surety Support Services Inc<br />

7255 W. 98th Terr.<br />

Overland Park, KS 66282<br />

913-385-7760 • 913-385-7699 Fax<br />

gary@suretyss.com<br />

The Surety Group Agency, LLC<br />

1900 Emery St.<br />

Atlanta, GA 30318<br />

404-352-8211 • 404-351-3237 Fax<br />

kreed@suretygroup.com<br />

Viking Bond Service, Inc.<br />

22601 N. 19th Ave.<br />

Phoenix, AZ 85027<br />

623-933-9334 ext. 16<br />

cynthiab@vbsbond.com<br />

Wells Fargo Insurance Services USA, Inc.<br />

5755 Mark Dabling Blvd.<br />

Colorado Springs, CO 80919<br />

719-592-1177<br />

christina.schulman@wellsfargo.com<br />

Visit us online: www.sba.gov/ok OKLAHOMA <strong>Small</strong> <strong>Business</strong> <strong>Resource</strong> — 25<br />

CAPITAL