Jennifer E. Bethel - the Babson College Faculty Web Server

Jennifer E. Bethel - the Babson College Faculty Web Server

Jennifer E. Bethel - the Babson College Faculty Web Server

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

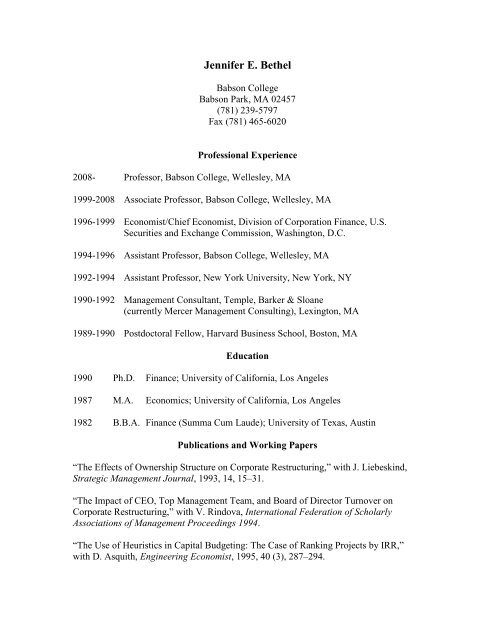

<strong>Jennifer</strong> E. <strong>Be<strong>the</strong>l</strong><br />

<strong>Babson</strong> <strong>College</strong><br />

<strong>Babson</strong> Park, MA 02457<br />

(781) 239-5797<br />

Fax (781) 465-6020<br />

Professional Experience<br />

2008- Professor, <strong>Babson</strong> <strong>College</strong>, Wellesley, MA<br />

1999-2008 Associate Professor, <strong>Babson</strong> <strong>College</strong>, Wellesley, MA<br />

1996-1999 Economist/Chief Economist, Division of Corporation Finance, U.S.<br />

Securities and Exchange Commission, Washington, D.C.<br />

1994-1996 Assistant Professor, <strong>Babson</strong> <strong>College</strong>, Wellesley, MA<br />

1992-1994 Assistant Professor, New York University, New York, NY<br />

1990-1992 Management Consultant, Temple, Barker & Sloane<br />

(currently Mercer Management Consulting), Lexington, MA<br />

1989-1990 Postdoctoral Fellow, Harvard Business School, Boston, MA<br />

Education<br />

1990 Ph.D. Finance; University of California, Los Angeles<br />

1987 M.A. Economics; University of California, Los Angeles<br />

1982 B.B.A. Finance (Summa Cum Laude); University of Texas, Austin<br />

Publications and Working Papers<br />

“The Effects of Ownership Structure on Corporate Restructuring,” with J. Liebeskind,<br />

Strategic Management Journal, 1993, 14, 15–31.<br />

“The Impact of CEO, Top Management Team, and Board of Director Turnover on<br />

Corporate Restructuring,” with V. Rindova, International Federation of Scholarly<br />

Associations of Management Proceedings 1994.<br />

“The Use of Heuristics in Capital Budgeting: The Case of Ranking Projects by IRR,”<br />

with D. Asquith, Engineering Economist, 1995, 40 (3), 287–294.

“Diversification and <strong>the</strong> Legal Organization of <strong>the</strong> Firm,” with J. Liebeskind,<br />

Organization Science, 1998, 9 (1), 49–67. Academy of Management Best Papers<br />

Proceedings 1994.<br />

“Block Share Purchases and Corporate Performance,” with J. Liebeskind and T. Opler,<br />

Journal of Finance, 1998, 53 (2), 605–634. Nominated for “Best Paper” of 1998 in <strong>the</strong><br />

Journal of Finance; Reprinted in The International Library of Critical Writings in<br />

Financial Economics, Series Editor - Richard Roll, Volume Editor - Michael J. Brennan.<br />

Edward Elgar Publishing Limited, Cheltonham, U.K., 2000.<br />

“Express Lane or Tollbooth in <strong>the</strong> Desert? The SEC’s Framework for Security Issuance,”<br />

with E. Sirri, Journal of Applied Corporate Finance, 1998, 11 (1), 25–38.<br />

“The Impact of <strong>the</strong> Institutional and Regulatory Environment on Shareholder Voting”<br />

with S. Gillan, Financial Management, 31 (4), Winter, 2002, 29-54. (Previous version,<br />

“Does Managerial Control of <strong>the</strong> Proxy Process Disenfranchise Shareholders”). Winner<br />

of <strong>the</strong> McGraw-Hill/Irwin “Best Paper in Business Finance” for <strong>the</strong> Financial<br />

Management Association 2000 Annual Meeting<br />

“Corporate Voting’s Dimpled Chad? The Broker Vote and Beyond,” with S. Gillan,<br />

Corporate Governance Bulletin, Volume XXII (1), March-May 2004, 10-12.<br />

“Recent Changes in Disclosure Regulation: Description and Evidence” Journal of<br />

Corporate Finance, 13, 2007, 335–342.<br />

“Policy Issues Raised by Structured Products,” with A. Ferrell, Brookings-Nomura<br />

Papers on Financial Services, Yasuki Fuchita, Robert E. Litan, eds., Brookings<br />

Institution Press, 2007.<br />

“Managing <strong>the</strong> Costs of Issuing Common Equity: The Role of Registration Choice,” with<br />

L. Krigman, Quarterly Journal of Finance and Accounting, 47 (4), 2009, 57-85.<br />

“The Market for Shareholder-Voting Rights Around Mergers and Acquisitions: Evidence<br />

from Institutional Daily Trading and Voting,” with G. Hu and Q. Wang, Journal of<br />

Corporate Finance, 15, 2009, 129-145. (Received grant from Yale University’s Millstein<br />

Center for Corporate Governance and Performance).<br />

“Legal and Economic Issues in Litigation Arising from <strong>the</strong> 2007-2008 Credit Crisis,”<br />

with A. Ferrell and G. Hu, Forthcoming in Brookings-Nomura Papers on Financial<br />

Services, Brookings Institution Press, 2009 (Translated into Japanese. Translated into<br />

Chinese: Comparative Studies, 39, December 2008, 54-96, China CITIC Press).<br />

“The Contribution of Investment Bank and Investor Incentives to Boom-and-Bust<br />

Cycles,” with L. Krigman, Under review at Financial Review.<br />

“Relationship Investing, Corporate Change, and Shareholder Value,” with S. Gillan.<br />

2

Case Studies and Notes<br />

Technical Note: Accounting for <strong>the</strong> Purchase or Sale of Stock in a Subsidiary<br />

The Boston Beer Company (A), BAB026, 1997, Revised 2002<br />

The Boston Beer Company (B), BAB027, 1997, Revised 2002<br />

The Boston Beer Company, Teaching Note, BAB026 and BAB027, 2002<br />

Selected Professional Activities and Service<br />

Member of American Finance Association; Financial Management Association; Western<br />

Finance Association.<br />

Work presented at Brookings-Tokyo Club-Wharton Conference on Securitzation after <strong>the</strong><br />

2008 Financial Crisis, Brookings Institution (2008), Harvard Law School (2008), Duff &<br />

Phelps Subprime Summit (2008), Federalist Society (2008), Financial Management<br />

Association Meetings (2008), CRA International (2008), Cornerstone Research (2008),<br />

Skadden, Arps, Slate, Meagher & Flom, LLP (2008), Corporate Control, Mergers and<br />

Acquisitions conference sponsored by Journal of Corporate Finance (2008), Midwest<br />

Finance Association Meetings (2008), Shareholders and Corporate Governance:<br />

Research Agenda and Conference at Oxford University (2007), Structured Products<br />

Association (2007), U.S. Securities & Exchange Commission - Training series for Office<br />

of Compliance and Inspection (2007), Boston Securities Analysis Society (2007), Bond<br />

Desk Group (2007), Boundaries of SEC Regulation Conference at Claremont McKenna<br />

<strong>College</strong> (2006), Brookings-Tokyo Club-Wharton Conference on New Financial<br />

Instruments and Institutions, Brookings Institution (2006), Western Finance Association<br />

Meetings (2002), University of Delaware (2001), Contemporary Corporate Governance<br />

Issues Conference at Dartmouth’s Tuck School of Business (2000), Financial<br />

Management Association Meetings (2000), Council of Institutional Investors Annual<br />

Meeting (2000), New York University (2000), Rutgers University (2000), U.S. Securities<br />

& Exchange Commission (2000), Vanderbilt University conference on Financial Markets<br />

and <strong>the</strong> Corporation (1998), Boston <strong>College</strong> (1995), Financial Management Association<br />

Meetings (1995), French Finance Association Meetings (1995), Strategic Management<br />

Society Meetings (1995), Academy of Management Conference (1994), Academy of<br />

Management Conference (1994), Strategic Management Society Meetings (1993),<br />

Restructuring Conference at The Wharton School, University of Pennsylvania (1992),<br />

Financial Management Association Meetings (1991), Symposium at <strong>the</strong> Academy of<br />

Management Conference (1991), Strategic Management Society Meetings (1989).<br />

Session Chair, Financial Management Association Meeting (2000-2005); Program<br />

Committee, Financial Management Association Meeting (2000-2005, 2007, 2008).<br />

Served on “Best Paper in Corporate Finance” Review Committee for Financial<br />

Management Association Meeting (2003) and “Best Paper in Investments” Review<br />

Committee for Financial Management Association Meeting (2004).<br />

3

Selected “Who’s Who in Business Higher Education” (2003).<br />

Recipient of “Capital Markets Award,” U.S. Securities and Exchange Commission<br />

(1998).<br />

Selected for “Women in <strong>the</strong> History of <strong>the</strong> SEC” by <strong>the</strong> U.S. Securities and Exchange<br />

Commission (2003).<br />

Member of Advisory Council for <strong>the</strong> Sarbanes-Oxley Act Task Force, sponsored by <strong>the</strong><br />

American Health Lawyers Association. (2003-2006).<br />

Ad Hoc Reviewer for <strong>the</strong> Journal of Finance, Financial Management Journal, Journal of<br />

Business, Journal of Corporate Finance, Journal of Financial Research, Academy of<br />

Management Journal, Academy of Management Review, Strategic Management Journal,<br />

Journal of Management, Organization Science, and National Science Foundation.<br />

Selected Consulting and Board Activities<br />

Arthur Andersen, L.L.P., U.S. Securities & Exchange Commission, AT&T, New England<br />

Business Systems, everpath, Inc.; Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C.;<br />

Todd & Weld, LLC; Skadden, Arps, Slate, Meagher & Flom, LLP, BondDesk.<br />

Finance Division Chairperson (2000-2003)<br />

Selected <strong>Babson</strong> <strong>College</strong> Service<br />

<strong>Faculty</strong> Program Director, Lucent Technologies Masters of Science in Management with<br />

a Concentration in Finance, <strong>Babson</strong> <strong>College</strong> (2000-2001)<br />

Member of Board of Trustees Undergraduate School Committee (2005-2007)<br />

<strong>Babson</strong> <strong>Faculty</strong> Research Fund (2005-2008)<br />

Ad Hoc Task Forces<br />

Dean of <strong>Faculty</strong> Nominating Committee (2003)<br />

Provost Nominating Committee (2005)<br />

4