Hindoostan Mills Limited - BSE

Hindoostan Mills Limited - BSE

Hindoostan Mills Limited - BSE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Foreign Direct Investment (FDI) policy<br />

Efforts to boost roll manufacturing<br />

business<br />

Labour problems<br />

Declining profitability<br />

Quarterly results<br />

Initiative of the <strong>BSE</strong> Investors’ Protection Fund<br />

<strong>Hindoostan</strong> <strong>Mills</strong> <strong>Limited</strong><br />

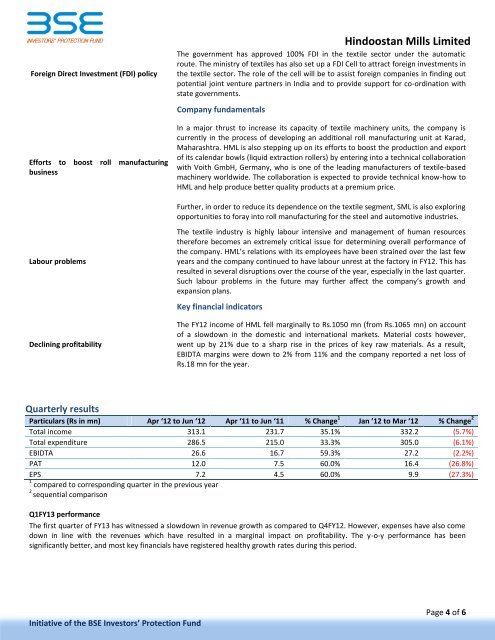

Particulars (Rs in mn) Apr ‘12 to Jun ‘12 Apr ‘11 to Jun ‘11 % Change 1<br />

Jan ’12 to Mar ‘12 % Change 2<br />

Total income 313.1 231.7 35.1% 332.2 (5.7%)<br />

Total expenditure 286.5 215.0 33.3% 305.0 (6.1%)<br />

EBIDTA 26.6 16.7 59.3% 27.2 (2.2%)<br />

PAT 12.0 7.5 60.0% 16.4 (26.8%)<br />

EPS 7.2 4.5 60.0% 9.9 (27.3%)<br />

1<br />

compared to corresponding quarter in the previous year<br />

2 sequential comparison<br />

The government has approved 100% FDI in the textile sector under the automatic<br />

route. The ministry of textiles has also set up a FDI Cell to attract foreign investments in<br />

the textile sector. The role of the cell will be to assist foreign companies in finding out<br />

potential joint venture partners in India and to provide support for co-ordination with<br />

state governments.<br />

Company fundamentals<br />

In a major thrust to increase its capacity of textile machinery units, the company is<br />

currently in the process of developing an additional roll manufacturing unit at Karad,<br />

Maharashtra. HML is also stepping up on its efforts to boost the production and export<br />

of its calendar bowls (liquid extraction rollers) by entering into a technical collaboration<br />

with Voith GmbH, Germany, who is one of the leading manufacturers of textile-based<br />

machinery worldwide. The collaboration is expected to provide technical know-how to<br />

HML and help produce better quality products at a premium price.<br />

Further, in order to reduce its dependence on the textile segment, SML is also exploring<br />

opportunities to foray into roll manufacturing for the steel and automotive industries.<br />

The textile industry is highly labour intensive and management of human resources<br />

therefore becomes an extremely critical issue for determining overall performance of<br />

the company. HML’s relations with its employees have been strained over the last few<br />

years and the company continued to have labour unrest at the factory in FY12. This has<br />

resulted in several disruptions over the course of the year, especially in the last quarter.<br />

Such labour problems in the future may further affect the company’s growth and<br />

expansion plans.<br />

Key financial indicators<br />

The FY12 income of HML fell marginally to Rs.1050 mn (from Rs.1065 mn) on account<br />

of a slowdown in the domestic and international markets. Material costs however,<br />

went up by 21% due to a sharp rise in the prices of key raw materials. As a result,<br />

EBIDTA margins were down to 2% from 11% and the company reported a net loss of<br />

Rs.18 mn for the year.<br />

Q1FY13 performance<br />

The first quarter of FY13 has witnessed a slowdown in revenue growth as compared to Q4FY12. However, expenses have also come<br />

down in line with the revenues which have resulted in a marginal impact on profitability. The y-o-y performance has been<br />

significantly better, and most key financials have registered healthy growth rates during this period.<br />

Page 4 of 6