Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Shree</strong> <strong>Bhawani</strong> <strong>Paper</strong> <strong>Mills</strong> <strong>Limited</strong><br />

Quarterly Update – Jul – Sep 2012<br />

06 February 2013<br />

CMP: Rs.4.99<br />

Industry: <strong>Paper</strong><br />

<strong>BSE</strong> group: B<br />

Promoters<br />

Girish Tandon and family, Om Prakash<br />

Goenka and family<br />

Key Data (as on 21 Jan’ 13)<br />

<strong>BSE</strong> 502563<br />

ISIN<br />

INE688C01010<br />

Face Value (Rs.) 10.0<br />

Mkt Cap (Rs. mn) 173.8<br />

Current P/E<br />

negative<br />

Current P/BV 6.8<br />

52 week low-high 4.66-10.80<br />

30 days avg daily trading<br />

volume<br />

1282<br />

Equity capital (Rs mn) 348.1<br />

Net worth (Rs mn) 25.3<br />

Note - The current P/E is negative on account of<br />

an overall negative EPS for the trailing twelve<br />

months (TTM).<br />

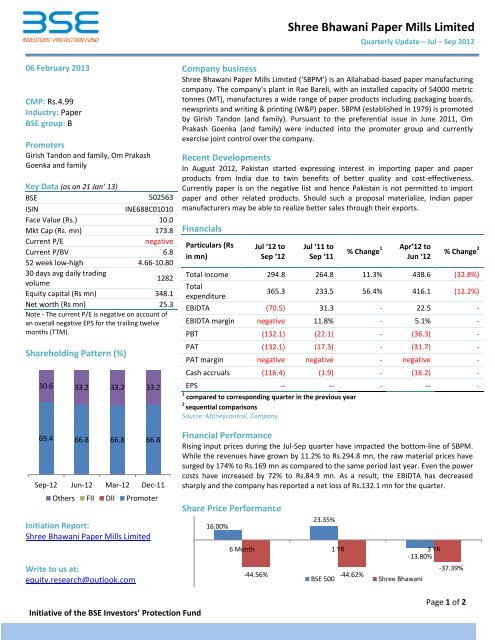

Shareholding Pattern (%)<br />

30.6 33.2 33.2 33.2<br />

Company business<br />

<strong>Shree</strong> <strong>Bhawani</strong> <strong>Paper</strong> <strong>Mills</strong> <strong>Limited</strong> (‘SBPM’) is an Allahabad-based paper manufacturing<br />

company. The company’s plant in Rae Bareli, with an installed capacity of 54000 metric<br />

tonnes (MT), manufactures a wide range of paper products including packaging boards,<br />

newsprints and writing & printing (W&P) paper. SBPM (established in 1979) is promoted<br />

by Girish Tandon (and family). Pursuant to the preferential issue in June 2011, Om<br />

Prakash Goenka (and family) were inducted into the promoter group and currently<br />

exercise joint control over the company.<br />

Recent Developments<br />

In August 2012, Pakistan started expressing interest in importing paper and paper<br />

products from India due to twin benefits of better quality and cost-effectiveness.<br />

Currently paper is on the negative list and hence Pakistan is not permitted to import<br />

paper and other related products. Should such a proposal materialize, Indian paper<br />

manufacturers may be able to realize better sales through their exports.<br />

Financials<br />

Particulars (Rs<br />

in mn)<br />

Jul ‘12 to<br />

Sep ‘12<br />

Jul ‘11 to<br />

Sep ‘11<br />

% Change 1 Apr’12 to<br />

Jun ‘12<br />

% Change 2<br />

Total income 294.8 264.8 11.3% 438.6 (32.8%)<br />

Total<br />

expenditure<br />

365.3 233.5 56.4% 416.1 (12.2%)<br />

EBIDTA (70.5) 31.3 - 22.5 -<br />

EBIDTA margin negative 11.8% - 5.1% -<br />

PBT (132.1) (22.1) - (36.3) -<br />

PAT (132.1) (17.3) - (31.7) -<br />

PAT margin negative negative - negative -<br />

Cash accruals (116.4) (1.9) - (16.2) -<br />

EPS -- -- - -- -<br />

1 compared to corresponding quarter in the previous year<br />

2<br />

sequential comparisons<br />

Source: Moneycontrol, Company<br />

69.4 66.8 66.8 66.8<br />

Sep-12 Jun-12 Mar-12 Dec-11<br />

Others FII DII Promoter<br />

Initiation Report:<br />

<strong>Shree</strong> <strong>Bhawani</strong> <strong>Paper</strong> <strong>Mills</strong> <strong>Limited</strong><br />

Write to us at:<br />

equity.research@outlook.com<br />

Financial Performance<br />

Rising input prices during the Jul-Sep quarter have impacted the bottom-line of SBPM.<br />

While the revenues have grown by 11.2% to Rs.294.8 mn, the raw material prices have<br />

surged by 174% to Rs.169 mn as compared to the same period last year. Even the power<br />

costs have increased by 72% to Rs.84.9 mn. As a result, the EBIDTA has decreased<br />

sharply and the company has reported a net loss of Rs.132.1 mn for the quarter.<br />

Share Price Performance<br />

16.00%<br />

23.35%<br />

6 Month 1 YR 3 YR<br />

-13.80%<br />

-44.56% -44.62%<br />

<strong>BSE</strong> 500<br />

<strong>Shree</strong> <strong>Bhawani</strong><br />

-37.39%<br />

Initiative of the <strong>BSE</strong> Investors’ Protection Fund<br />

Page 1 of 2

Financials<br />

<strong>Shree</strong> <strong>Bhawani</strong> <strong>Paper</strong> <strong>Mills</strong> <strong>Limited</strong><br />

Quarterly Update – Jul – Sep 2012<br />

P&L (Rs. mn) FY10 FY11 FY12 Balance Sheet (Rs. mn) FY10 FY11 FY12<br />

Total income 1,280 1,251 970 Share Capital 164 164 348<br />

EBITDA 112 91 (82) Reserves & Surplus (48) (103) (323)<br />

Depreciation 59 61 62 Net worth 116 61 25<br />

EBIT 53 30 (144) Borrowings 1,109 1,341 1,791<br />

Interest 117 142 166 Other liabilities 231 298 292<br />

PBT (65) (113) (310) Total liabilities 1,456 1,700 2,108<br />

Tax (18) (8) (140) Net fixed assets 946 1,070 1,147<br />

PAT (47) (105) (170) Other non-current assets - - 140<br />

Loans and Advances 34 73 140<br />

Valuation ratios FY10 FY11 FY12 Current Assets 476 557 680<br />

P/E neg neg neg Total assets 1,456 1,700 2,108<br />

P/BV 0.93 1.76 9.02<br />

Cash Flow (Rs.mn) FY10 FY11 FY12<br />

PBT (65) (113) (310)<br />

CF from Operation 38 42 (270)<br />

CF from Investment (54) (179) (137)<br />

CF from Financing 10 147 424<br />

Inc/(dec) Cash (5) 10 18<br />

Closing Balance 8 18 36<br />

Disclaimer<br />

The information contained herein is from publicly available data or other sources believed to be reliable, but we do not represent that it is accurate<br />

or complete and it should not be relied on as such. Our company shall not be in any way responsible for any loss or damage that may arise to any<br />

person from any inadvertent error in the information contained in this report. This document is provided for assistance only and is not intended to<br />

be and must not alone be taken as the basis for any investment decision. The user assumes the entire risk of any use made of this information.<br />

Each recipient of this document should make such investigation as it deems necessary to arrive at an independent evaluation which may affect<br />

their investment in the securities of companies referred to in this document (including the merits and risks involved). The discussions or views<br />

expressed may not be suitable for all investors. This information is strictly confidential and is being furnished to you solely for your information.<br />

Initiative of the <strong>BSE</strong> Investors’ Protection Fund<br />

Page 2 of 2