Disciplinary Board Disciplinary Actions - Virginia State Bar

Disciplinary Board Disciplinary Actions - Virginia State Bar

Disciplinary Board Disciplinary Actions - Virginia State Bar

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 6<br />

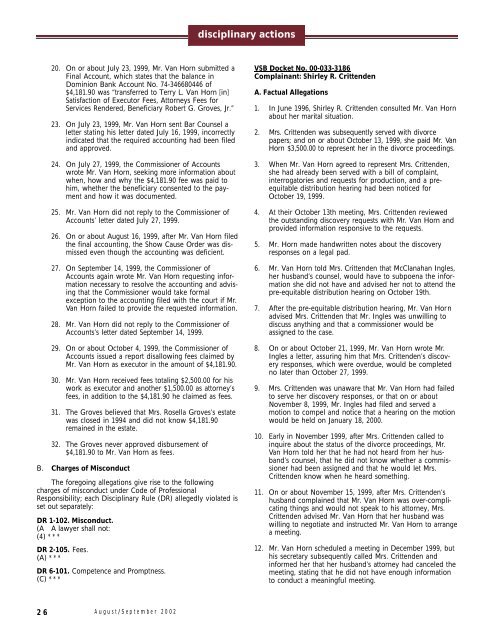

20. On or about July 23, 1999, Mr. Van Horn submitted a<br />

Final Account, which states that the balance in<br />

Dominion Bank Account No. 74-346680446 of<br />

$4,181.90 was “transferred to Terry L. Van Horn [in]<br />

Satisfaction of Executor Fees, Attorneys Fees for<br />

Services Rendered, Beneficiary Robert G. Groves, Jr.”<br />

23. On July 23, 1999, Mr. Van Horn sent <strong>Bar</strong> Counsel a<br />

letter stating his letter dated July 16, 1999, incorrectly<br />

indicated that the required accounting had been filed<br />

and approved.<br />

24. On July 27, 1999, the Commissioner of Accounts<br />

wrote Mr. Van Horn, seeking more information about<br />

when, how and why the $4,181.90 fee was paid to<br />

him, whether the beneficiary consented to the payment<br />

and how it was documented.<br />

25. Mr. Van Horn did not reply to the Commissioner of<br />

Accounts’ letter dated July 27, 1999.<br />

26. On or about August 16, 1999, after Mr. Van Horn filed<br />

the final accounting, the Show Cause Order was dismissed<br />

even though the accounting was deficient.<br />

27. On September 14, 1999, the Commissioner of<br />

Accounts again wrote Mr. Van Horn requesting information<br />

necessary to resolve the accounting and advising<br />

that the Commissioner would take formal<br />

exception to the accounting filed with the court if Mr.<br />

Van Horn failed to provide the requested information.<br />

28. Mr. Van Horn did not reply to the Commissioner of<br />

Accounts’s letter dated September 14, 1999.<br />

29. On or about October 4, 1999, the Commissioner of<br />

Accounts issued a report disallowing fees claimed by<br />

Mr. Van Horn as executor in the amount of $4,181.90.<br />

30. Mr. Van Horn received fees totaling $2,500.00 for his<br />

work as executor and another $1,500.00 as attorney’s<br />

fees, in addition to the $4,181.90 he claimed as fees.<br />

31. The Groves believed that Mrs. Rosella Groves’s estate<br />

was closed in 1994 and did not know $4,181.90<br />

remained in the estate.<br />

32. The Groves never approved disbursement of<br />

$4,181.90 to Mr. Van Horn as fees.<br />

B. Charges of Misconduct<br />

The foregoing allegations give rise to the following<br />

charges of misconduct under Code of Professional<br />

Responsibility; each <strong>Disciplinary</strong> Rule (DR) allegedly violated is<br />

set out separately:<br />

DR 1-102. Misconduct.<br />

(A A lawyer shall not:<br />

(4) * * *<br />

DR 2-105. Fees.<br />

(A) * * *<br />

DR 6-101. Competence and Promptness.<br />

(C) * * *<br />

A u g u s t / S e p t e m b e r 2 0 0 2<br />

disciplinary actions<br />

VSB Docket No. 00-033-3186<br />

Complainant: Shirley R. Crittenden<br />

A. Factual Allegations<br />

1. In June 1996, Shirley R. Crittenden consulted Mr. Van Horn<br />

about her marital situation.<br />

2 . Mrs. Crittenden was subsequently served with divorc e<br />

papers; and on or about October 13, 1999, she paid Mr. Va n<br />

H o rn $3,500.00 to re p resent her in the divorce pro c e e d i n g s .<br />

3. When Mr. Van Horn agreed to represent Mrs. Crittenden,<br />

she had already been served with a bill of complaint,<br />

interrogatories and requests for production, and a preequitable<br />

distribution hearing had been noticed for<br />

October 19, 1999.<br />

4. At their October 13th meeting, Mrs. Crittenden reviewed<br />

the outstanding discovery requests with Mr. Van Horn and<br />

provided information responsive to the requests.<br />

5. Mr. Horn made handwritten notes about the discovery<br />

responses on a legal pad.<br />

6. Mr. Van Horn told Mrs. Crittenden that McClanahan Ingles,<br />

her husband’s counsel, would have to subpoena the information<br />

she did not have and advised her not to attend the<br />

pre-equitable distribution hearing on October 19th.<br />

7. After the pre-equitable distribution hearing, Mr. Van Horn<br />

advised Mrs. Crittenden that Mr. Ingles was unwilling to<br />

discuss anything and that a commissioner would be<br />

assigned to the case.<br />

8. On or about October 21, 1999, Mr. Van Horn wrote Mr.<br />

Ingles a letter, assuring him that Mrs. Crittenden’s discovery<br />

responses, which were overdue, would be completed<br />

no later than October 27, 1999.<br />

9. Mrs. Crittenden was unaware that Mr. Van Horn had failed<br />

to serve her discovery responses, or that on or about<br />

November 8, 1999, Mr. Ingles had filed and served a<br />

motion to compel and notice that a hearing on the motion<br />

would be held on January 18, 2000.<br />

10. Early in November 1999, after Mrs. Crittenden called to<br />

inquire about the status of the divorce proceedings, Mr.<br />

Van Horn told her that he had not heard from her husband’s<br />

counsel, that he did not know whether a commissioner<br />

had been assigned and that he would let Mrs.<br />

Crittenden know when he heard something.<br />

11. On or about November 15, 1999, after Mrs. Crittenden’s<br />

husband complained that Mr. Van Horn was over-complicating<br />

things and would not speak to his attorney, Mrs.<br />

Crittenden advised Mr. Van Horn that her husband was<br />

willing to negotiate and instructed Mr. Van Horn to arrange<br />

a meeting.<br />

12. Mr. Van Horn scheduled a meeting in December 1999, but<br />

his secretary subsequently called Mrs. Crittenden and<br />

informed her that her husband’s attorney had canceled the<br />

meeting, stating that he did not have enough information<br />

to conduct a meaningful meeting.