Annual Report - voestalpine

Annual Report - voestalpine

Annual Report - voestalpine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

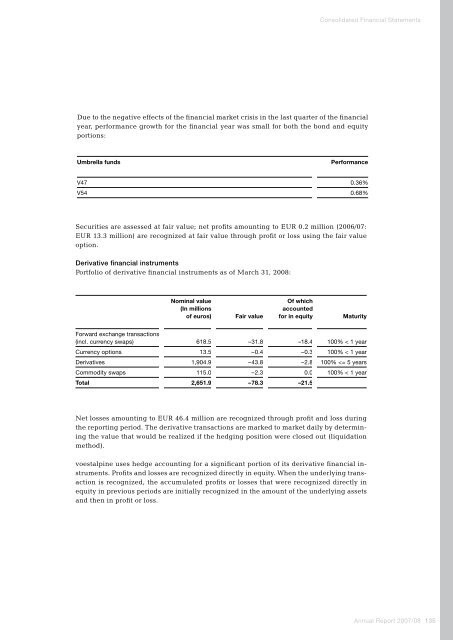

Due to the negative effects of the financial market crisis in the last quarter of the financial<br />

year, performance growth for the financial year was small for both the bond and equity<br />

portions:<br />

Umbrella funds Performance<br />

V47 0.36%<br />

V54 0.68%<br />

Securities are assessed at fair value; net profits amounting to EUR 0.2 million (2006/07:<br />

EUR 13.3 million) are recognized at fair value through profit or loss using the fair value<br />

option.<br />

Derivative financial instruments<br />

Portfolio of derivative financial instruments as of March 31, 2008:<br />

Nominal value Of which<br />

(In millions accounted<br />

of euros) Fair value for in equity Maturity<br />

Forward exchange transactions<br />

(incl. currency swaps) 618.5 –31.8 –18.4 100% < 1 year<br />

Currency options 13.5 –0.4 –0.3 100% < 1 year<br />

Derivatives 1,904.9 –43.8 –2.8 100%