National CAPLines Authorization Boilerplate - SBA

National CAPLines Authorization Boilerplate - SBA

National CAPLines Authorization Boilerplate - SBA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

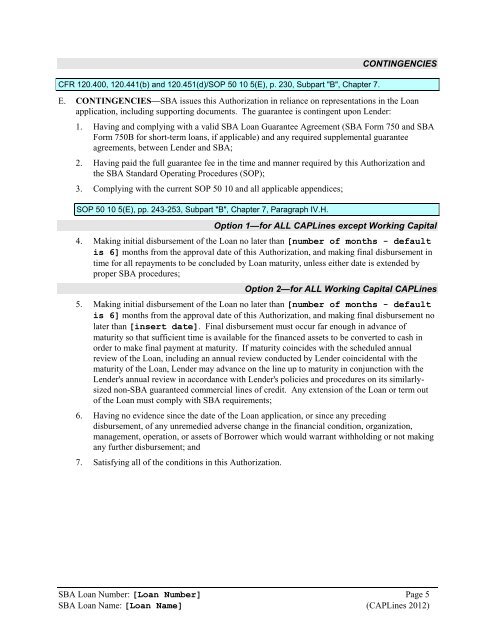

CFR 120.400, 120.441(b) and 120.451(d)/SOP 50 10 5(E), p. 230, Subpart "B", Chapter 7.<br />

CONTINGENCIES<br />

E. CONTINGENCIES—<strong>SBA</strong> issues this <strong>Authorization</strong> in reliance on representations in the Loan<br />

application, including supporting documents. The guarantee is contingent upon Lender:<br />

1. Having and complying with a valid <strong>SBA</strong> Loan Guarantee Agreement (<strong>SBA</strong> Form 750 and <strong>SBA</strong><br />

Form 750B for short-term loans, if applicable) and any required supplemental guarantee<br />

agreements, between Lender and <strong>SBA</strong>;<br />

2. Having paid the full guarantee fee in the time and manner required by this <strong>Authorization</strong> and<br />

the <strong>SBA</strong> Standard Operating Procedures (SOP);<br />

3. Complying with the current SOP 50 10 and all applicable appendices;<br />

SOP 50 10 5(E), pp. 243-253, Subpart "B", Chapter 7, Paragraph IV.H.<br />

Option 1—for ALL <strong>CAPLines</strong> except Working Capital<br />

4. Making initial disbursement of the Loan no later than [number of months - default<br />

is 6] months from the approval date of this <strong>Authorization</strong>, and making final disbursement in<br />

time for all repayments to be concluded by Loan maturity, unless either date is extended by<br />

proper <strong>SBA</strong> procedures;<br />

Option 2—for ALL Working Capital <strong>CAPLines</strong><br />

5. Making initial disbursement of the Loan no later than [number of months - default<br />

is 6] months from the approval date of this <strong>Authorization</strong>, and making final disbursement no<br />

later than [insert date]. Final disbursement must occur far enough in advance of<br />

maturity so that sufficient time is available for the financed assets to be converted to cash in<br />

order to make final payment at maturity. If maturity coincides with the scheduled annual<br />

review of the Loan, including an annual review conducted by Lender coincidental with the<br />

maturity of the Loan, Lender may advance on the line up to maturity in conjunction with the<br />

Lender's annual review in accordance with Lender's policies and procedures on its similarlysized<br />

non-<strong>SBA</strong> guaranteed commercial lines of credit. Any extension of the Loan or term out<br />

of the Loan must comply with <strong>SBA</strong> requirements;<br />

6. Having no evidence since the date of the Loan application, or since any preceding<br />

disbursement, of any unremedied adverse change in the financial condition, organization,<br />

management, operation, or assets of Borrower which would warrant withholding or not making<br />

any further disbursement; and<br />

7. Satisfying all of the conditions in this <strong>Authorization</strong>.<br />

<strong>SBA</strong> Loan Number: [Loan Number] Page 5<br />

<strong>SBA</strong> Loan Name: [Loan Name] (<strong>CAPLines</strong> 2012)