National CAPLines Authorization Boilerplate - SBA

National CAPLines Authorization Boilerplate - SBA

National CAPLines Authorization Boilerplate - SBA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

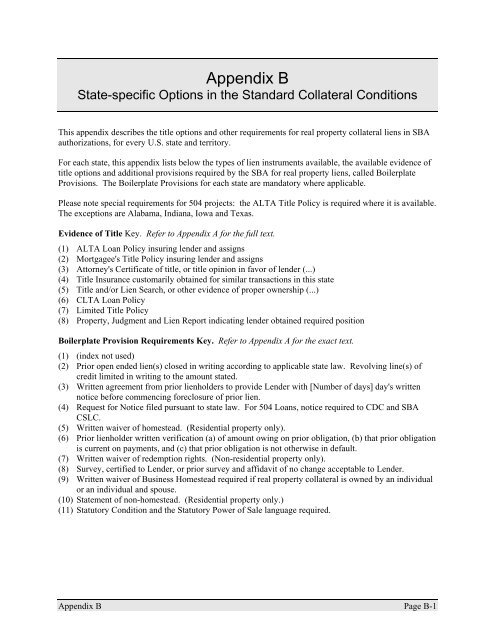

Appendix B<br />

State-specific Options in the Standard Collateral Conditions<br />

This appendix describes the title options and other requirements for real property collateral liens in <strong>SBA</strong><br />

authorizations, for every U.S. state and territory.<br />

For each state, this appendix lists below the types of lien instruments available, the available evidence of<br />

title options and additional provisions required by the <strong>SBA</strong> for real property liens, called <strong>Boilerplate</strong><br />

Provisions. The <strong>Boilerplate</strong> Provisions for each state are mandatory where applicable.<br />

Please note special requirements for 504 projects: the ALTA Title Policy is required where it is available.<br />

The exceptions are Alabama, Indiana, Iowa and Texas.<br />

Evidence of Title Key. Refer to Appendix A for the full text.<br />

(1) ALTA Loan Policy insuring lender and assigns<br />

(2) Mortgagee's Title Policy insuring lender and assigns<br />

(3) Attorney's Certificate of title, or title opinion in favor of lender (...)<br />

(4) Title Insurance customarily obtained for similar transactions in this state<br />

(5) Title and/or Lien Search, or other evidence of proper ownership (...)<br />

(6) CLTA Loan Policy<br />

(7) Limited Title Policy<br />

(8) Property, Judgment and Lien Report indicating lender obtained required position<br />

<strong>Boilerplate</strong> Provision Requirements Key. Refer to Appendix A for the exact text.<br />

(1) (index not used)<br />

(2) Prior open ended lien(s) closed in writing according to applicable state law. Revolving line(s) of<br />

credit limited in writing to the amount stated.<br />

(3) Written agreement from prior lienholders to provide Lender with [Number of days] day's written<br />

notice before commencing foreclosure of prior lien.<br />

(4) Request for Notice filed pursuant to state law. For 504 Loans, notice required to CDC and <strong>SBA</strong><br />

CSLC.<br />

(5) Written waiver of homestead. (Residential property only).<br />

(6) Prior lienholder written verification (a) of amount owing on prior obligation, (b) that prior obligation<br />

is current on payments, and (c) that prior obligation is not otherwise in default.<br />

(7) Written waiver of redemption rights. (Non-residential property only).<br />

(8) Survey, certified to Lender, or prior survey and affidavit of no change acceptable to Lender.<br />

(9) Written waiver of Business Homestead required if real property collateral is owned by an individual<br />

or an individual and spouse.<br />

(10) Statement of non-homestead. (Residential property only.)<br />

(11) Statutory Condition and the Statutory Power of Sale language required.<br />

Appendix B Page B-1