National CAPLines Authorization Boilerplate - SBA

National CAPLines Authorization Boilerplate - SBA

National CAPLines Authorization Boilerplate - SBA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

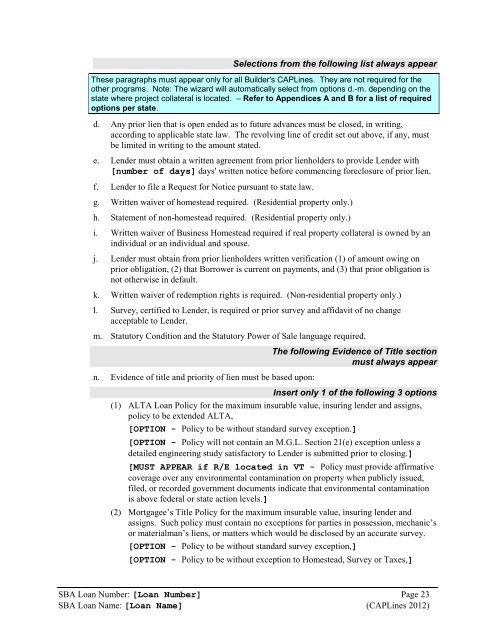

Selections from the following list always appear<br />

These paragraphs must appear only for all Builder's <strong>CAPLines</strong>. They are not required for the<br />

other programs. Note: The wizard will automatically select from options d.-m. depending on the<br />

state where project collateral is located. – Refer to Appendices A and B for a list of required<br />

options per state.<br />

d. Any prior lien that is open ended as to future advances must be closed, in writing,<br />

according to applicable state law. The revolving line of credit set out above, if any, must<br />

be limited in writing to the amount stated.<br />

e. Lender must obtain a written agreement from prior lienholders to provide Lender with<br />

[number of days] days' written notice before commencing foreclosure of prior lien.<br />

f. Lender to file a Request for Notice pursuant to state law.<br />

g. Written waiver of homestead required. (Residential property only.)<br />

h. Statement of non-homestead required. (Residential property only.)<br />

i. Written waiver of Business Homestead required if real property collateral is owned by an<br />

individual or an individual and spouse.<br />

j. Lender must obtain from prior lienholders written verification (1) of amount owing on<br />

prior obligation, (2) that Borrower is current on payments, and (3) that prior obligation is<br />

not otherwise in default.<br />

k. Written waiver of redemption rights is required. (Non-residential property only.)<br />

l. Survey, certified to Lender, is required or prior survey and affidavit of no change<br />

acceptable to Lender.<br />

m. Statutory Condition and the Statutory Power of Sale language required.<br />

n. Evidence of title and priority of lien must be based upon:<br />

The following Evidence of Title section<br />

must always appear<br />

Insert only 1 of the following 3 options<br />

(1) ALTA Loan Policy for the maximum insurable value, insuring lender and assigns,<br />

policy to be extended ALTA,<br />

[OPTION - Policy to be without standard survey exception.]<br />

[OPTION - Policy will not contain an M.G.L. Section 21(e) exception unless a<br />

detailed engineering study satisfactory to Lender is submitted prior to closing.]<br />

[MUST APPEAR if R/E located in VT - Policy must provide affirmative<br />

coverage over any environmental contamination on property when publicly issued,<br />

filed, or recorded government documents indicate that environmental contamination<br />

is above federal or state action levels.]<br />

(2) Mortgagee’s Title Policy for the maximum insurable value, insuring lender and<br />

assigns. Such policy must contain no exceptions for parties in possession, mechanic’s<br />

or materialman’s liens, or matters which would be disclosed by an accurate survey.<br />

[OPTION - Policy to be without standard survey exception,]<br />

[OPTION - Policy to be without exception to Homestead, Survey or Taxes,]<br />

<strong>SBA</strong> Loan Number: [Loan Number] Page 23<br />

<strong>SBA</strong> Loan Name: [Loan Name] (<strong>CAPLines</strong> 2012)