Download the document (10.54 MB) - Hillsborough Independent Panel

Download the document (10.54 MB) - Hillsborough Independent Panel

Download the document (10.54 MB) - Hillsborough Independent Panel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26<br />

Where America leads, Europe<br />

usually follows. If <strong>the</strong> old<br />

adage holds good for <strong>the</strong> car.<br />

rental business, <strong>the</strong>n Avis<br />

Europe is a stock for 1992 and<br />

beyond.<br />

At present, <strong>the</strong> business on<br />

this side of <strong>the</strong> Atlantic is<br />

fragmented. The four largest-<br />

companies haye only 50 per.<br />

cent of <strong>the</strong> market. In <strong>the</strong>, US<br />

<strong>the</strong> quartet of leaders accounts<br />

for no less than. 85 per cent of;<br />

<strong>the</strong> sector.<br />

Industry, sources expect <strong>the</strong><br />

big four in Europe to bring<br />

<strong>the</strong>ir slice of <strong>the</strong> market up a<br />

fur<strong>the</strong>r 10 percentage points to<br />

60 per cent by <strong>the</strong> time <strong>the</strong><br />

unified market dawns. That<br />

should mean a substantial<br />

boost for Avis’s present 14 per<br />

cent share. -<br />

Analysts have been raising<br />

<strong>the</strong>ir expectations after last<br />

week’s figures.,The more <strong>the</strong>y<br />

look <strong>the</strong> more <strong>the</strong>y seem to<br />

find. On <strong>the</strong> rental side, where<br />

Avis" has a fleet of: 76,000<br />

vehicles operating from 1,800<br />

locations across Europe, rental<br />

volume grew 19 per cent last<br />

year. The: margin improvement<br />

from 14.2 per cent to<br />

17.2 per cent is seen as fur<strong>the</strong>r<br />

proof that <strong>the</strong> management is<br />

worth backing. The long-term<br />

ambition here is to open an<br />

outlet in every European town<br />

with a population greater than<br />

50,000.<br />

The second leg to <strong>the</strong> group,<br />

fleet leasing and contract hire,<br />

is a ls o underdeveloped in<br />

Europe compared with <strong>the</strong><br />

US, and concentrated mainly<br />

in Britain, France and Belgium.<br />

Avis sees excellent<br />

scope for expansion, especially<br />

in Italy and West<br />

Germany. The record of last<br />

year seems’ to bear'that out,<br />

with organic growth of almost<br />

a quarter.<br />

Vehicle dealerships appear<br />

a sideshow even jhough <strong>the</strong>y<br />

produced a healthy £1 million.<br />

rise to £5.5 million profit last<br />

year. In <strong>the</strong> context of a total<br />

£72 million group profit and<br />

with little likelihood of a push<br />

to expand across <strong>the</strong> Channel,<br />

Avis’s future lies with its o<strong>the</strong>r<br />

two main operations.<br />

As with most leasing companies,<br />

gearing is high at about<br />

400 per cent. But interest<br />

cover of 3.2 times suggests<br />

that <strong>the</strong>re is little problem in<br />

financing future growth.<br />

■Since <strong>the</strong>ir-debut-in late<br />

1986 Avis shares' have left <strong>the</strong>'<br />

FT-SE 100 index in <strong>the</strong> rear<br />

to<br />

Dresdner Bank of West Germany<br />

said it wants to build a<br />

defence against hostile takeover<br />

attempts by limiting <strong>the</strong><br />

voting rights granted to individual<br />

shareholders.<br />

Herr Wolfgang . Roeller,<br />

Dresdner management board<br />

chairman, said <strong>the</strong> bank<br />

would limit voting rights to 10<br />

per cent per shareholder, irrespective<br />

of <strong>the</strong> stake-holding.<br />

However, Herr Roeller said'<br />

<strong>the</strong> measure would only take<br />

BUSINESS AND FINANCE<br />

C TEMPUS<br />

E u r o p e s e t t o<br />

NEXT<br />

SHARE<br />

PRICE<br />

Under current legislation Friendly<br />

Societies are allowed ta invest monies, an<br />

your behalf, FREE OF ALL TAX. .-,■<br />

Because <strong>the</strong>.L9 ncashire.8 1 Yorkshire<br />

W J *<br />

.> ........<br />

I ^ ^<br />

Next shares not for selling: George Davies, who left <strong>the</strong> retail chain last year<br />

SMiSffi&s Relative to!<br />

FTA Index'<br />

fund is exempt from tax, anyone between<br />

1 8 an d .7 0 sav in g am ax im u m af£ 9 a 1<br />

month ar £ 1 0 0 ayear, ar a lump sum af ,<br />

£791 with Lancashire & Yorkshire,' can<br />

receive <strong>the</strong> benefits af paying N O income<br />

tax and N O capital gains tax an <strong>the</strong>ir<br />

investment. As a result, your returns are .<br />

substantially iricreosed. You will olso receive<br />

life cover with no medical examination.<br />

Lancashire & Yorkshire is one of <strong>the</strong><br />

largest Friendly Societies and has is excess<br />

of £ 4 0 milliop under management on<br />

behalf of over 50,000 investors.<br />

THE TAX FREE PLAN<br />

.1984 .1985 1986 1987 1988,1989<br />

view mirror, , rising well over<br />

50 per cent against a: market<br />

gain of little more than 20 per<br />

cent.<br />

At 375p, <strong>the</strong>y sell for 11.4<br />

times earnings, according to<br />

forecasters at County Natwest<br />

WoodMac and Smith New<br />

Court. Well worth tucking<br />

away. ', ■<br />

Quadrant<br />

It is'a peculiar misfortune of<br />

fast-track, fast-growth mini-<br />

conglomerates that if <strong>the</strong>ir<br />

appetite for corporate acquisitions<br />

slackens, <strong>the</strong> market<br />

is- inclined to , forget <strong>the</strong>y<br />

■ exist* \ j<br />

• - Quadrant Group’s1 dash for<br />

"growtK. came to a pause last<br />

November with a.£22 million<br />

Investment with Lancashire &<br />

Yorkshire's TAX FREE PLAN is on our Unit .<br />

Builder Fund which is one.of <strong>the</strong> highest<br />

performing Friendly Society Unit-Linked<br />

funds open to n e w investment over <strong>the</strong> last<br />

three years. (Source: "Money Management"<br />

3 yr fund performance tables). However<br />

unit prices can fall as well as rise, and past<br />

By Our City Staff:,,<br />

effect if <strong>the</strong>re were signs that<br />

an individual shareholder<br />

controlled, or was about to<br />

gain control of, more than 10<br />

per cent of <strong>the</strong> company’s<br />

shares. Shareholders will be<br />

asked to approve <strong>the</strong> measure<br />

at Dresdrier’s annual meeting<br />

on May 26.<br />

Limiting <strong>the</strong> number of<br />

voting rights is a fairly standard<br />

practice in West Germany.<br />

Many firms introduced<br />

such clauses during <strong>the</strong> 1970s,<br />

.. t<br />

Holding Next shares was proving<br />

a severe pain in <strong>the</strong> wallet<br />

even before Mr George Davies,<br />

<strong>the</strong> retail chain's leading<br />

light, left last year. They<br />

slumped from a pre-crash high<br />

of 370p to 170p just before his<br />

departure and plunged fur<strong>the</strong>r<br />

to 125p when <strong>the</strong> boardroom<br />

dispute ■ surfaced. But <strong>the</strong>y<br />

have re-traced most of that<br />

and, despite a grim profits fall<br />

last week, perked up 6p on<br />

Friday to close at 152p.<br />

Could it be that bears such<br />

as WI Carr, <strong>the</strong> broker, which<br />

urged a sell at 144p after <strong>the</strong><br />

profits news, are losing <strong>the</strong><br />

battle with those who say that<br />

cash call and three fur<strong>the</strong>r<br />

acquisitions. The rights isslie<br />

price was 215p; by. <strong>the</strong> start of<br />

this year <strong>the</strong> shares were<br />

becalmed; at 220p, and <strong>the</strong>y,<br />

have since missed out on <strong>the</strong><br />

15 per cent rise in <strong>the</strong> FTSE<br />

100, closing at 224p on Friday.<br />

On this basis <strong>the</strong> former<br />

Sangers Photographic, built<br />

up by Mr Jeremy . Peace, <strong>the</strong><br />

youthful former stockbroker,<br />

starts to look lfke good longterm<br />

value, given earnings per<br />

.share growth in <strong>the</strong> current<br />

financial year and <strong>the</strong> next<br />

whicli is unlikely to drop<br />

much below 25 per cent.<br />

' The market’s caution is not<br />

to foil1 Arab takeover bids at<br />

<strong>the</strong> height of <strong>the</strong> oil price<br />

boom..:■<br />

Companies with limited<br />

voting rights include Bayer,<br />

<strong>the</strong> chemicals group, Deutsche<br />

Bank and Continental, <strong>the</strong><br />

tyre manufacturer.<br />

Earlier, Dresdner Bank announced<br />

that group partial<br />

operating profit haid risen to<br />

DM1.6 billion (£503 million)<br />

in 1988, from DM1:53 billion<br />

previously.<br />

' The Plan, a minimum tenryear whole .<br />

of life tax-exempt policy, is limited by <strong>the</strong><br />

Revenue to ONE per adult so make-sure you<br />

have your TAX-FREE entitlement, contact us<br />

free, by telephoning anytime or fill out <strong>the</strong><br />

performance is not necessarily a guide to . coupon COupon today and ana post posi it ir ■ i. ij - j r i<br />

future growth. .. . without charge. fv O ln r<br />

PHONE FREE<br />

NOW<br />

0 8 0 0<br />

OR ASK THE OPERATOR FOR<br />

FREEPHONE<br />

5 0 9 3<br />

TODAY<br />

~ ~ O lf F R E E P O S T T O D A Y<br />

: LANCASHIRE&YORKSHIRE,<br />

FREEPOST, ROTHERHAM S60 2BR<br />

Name—-<br />

Address<br />

N o stamp is required.'.No salesman.will call.<br />

__________________________________ _ Postcode .<br />

I<br />

Lancashire & Yo r k shire |<br />

ASSURANCE SOCIETY Amemberof laUTKuJ<br />

THE TIMES MONDAY APRIL 17 1989<br />

Next shares are in <strong>the</strong> basement,)<br />

if not yet especially<br />

bargain priced?<br />

A prospective yield of almost<br />

7 per cent and a 125p asset<br />

value, given some disposals,<br />

are powerful props to any<br />

bombed-out stock. The new<br />

management has swept: <strong>the</strong><br />

stockroom clean with writeoffs<br />

and o<strong>the</strong>r prudent housekeeping.<br />

This should ensure a<br />

bounce in profits even if trading<br />

prospects reinain subdued.<br />

Burton group,. like Next,<br />

once had its traumas. Afterwards,<br />

Burton shares paid off<br />

handsomely. At <strong>the</strong>se prices,<br />

Next . is not for selling.<br />

businesses look exposed to an<br />

economic slow-down. Quadrant<br />

supplies estate agents<br />

with photographs while distributing<br />

photographic products<br />

to retailers.<br />

Although <strong>the</strong> , tw o' photographic<br />

operations continue to<br />

\ supply <strong>the</strong> lion’s share of<br />

profits, its fast-growing business<br />

supplying airtime on <strong>the</strong><br />

Cellnet and Vodafone networks<br />

looks <strong>the</strong> key to <strong>the</strong><br />

future. It is <strong>the</strong> 12th largest<br />

service provider by subscriber<br />

numbers in <strong>the</strong> country,- and<br />

<strong>the</strong> sixth largest for Vodafone<br />

alone.<br />

Quadrant retains £10 million<br />

in <strong>the</strong> ‘bank from '<strong>the</strong><br />

rights and' caif afford to be<br />

selective about acquisitions.<br />

RTZ, which announced in<br />

early January that it was<br />

prepared to buy BP Minerals’<br />

world-wide mining assets for<br />

$4.32 billion (£2.5 billion), is<br />

still involved in its preliminary<br />

investigations, <strong>the</strong> group<br />

said yesterday.<br />

There is no indication of<br />

when <strong>the</strong> study, which covers<br />

extensive mining interests<br />

across <strong>the</strong> world, and involves<br />

complex pre-emptive rights<br />

issues, will be completed.<br />

Stock market circles had expected<br />

an RTZ statement by<br />

early April.<br />

The “due diligence” and<br />

investigation of assets to be<br />

purchased — which range from<br />

<strong>the</strong> copper/gold Bingham<br />

Canyon deposit in <strong>the</strong> United<br />

States, to <strong>the</strong> uranium/copper/gold<br />

Olympic<br />

Dam project in Western<br />

Australia - was scheduled,<br />

under an internal RTZ time-<br />

I<br />

I<br />

I<br />

I<br />

\<br />

I<br />

By Our Gity Staff<br />

Concern is growing about <strong>the</strong><br />

boom in foreign currency<br />

mortgages as hard-pressed<br />

home buyers switch to cheaper<br />

forms of financing.<br />

Interest rates on mark or<br />

Swiss franc loans are roughly<br />

half those on conventional<br />

mortgages and are especially<br />

attractive to first-time buyers<br />

caught out by last year’s severe<br />

rise in interest rates.<br />

“These are not mortgages<br />

for <strong>the</strong> novice,” said Mr Jeff<br />

Wagland, of <strong>the</strong> Nationwide<br />

Anglia Building Society.<br />

“Unless borrowers are sophisticated<br />

<strong>the</strong>y could find,<br />

<strong>the</strong>mselves coming seriously ,<br />

unstuck.<br />

. “People may be attracted by<br />

<strong>the</strong> much lower cost of foreign<br />

currency borrowing, but unless<br />

<strong>the</strong>y happen to be foreign<br />

exchange dealers <strong>the</strong>y will find<br />

it difficult to understand <strong>the</strong><br />

risks involved.”<br />

The risks arise from <strong>the</strong><br />

normal fluctuations of-foreign<br />

exchange markets which mean<br />

that <strong>the</strong> foreign capital borrowed<br />

at low interest rates<br />

may increase sharply in sterling<br />

terms. Unlucky homeowners<br />

could find that- even<br />

though <strong>the</strong>y meet <strong>the</strong>ir repayments<br />

regularly, <strong>the</strong> amounts<br />

<strong>the</strong>y owe may be rising instead<br />

of falling.<br />

The favourite “hard” cur-<br />

Preliminary figures for <strong>the</strong><br />

year to end-February are due<br />

in <strong>the</strong> week beginning May .8,<br />

a n d should show a pre-tax<br />

advance from £2.17:million to<br />

£4.3 million.<br />

But it is in <strong>the</strong> current<br />

financial year that progress<br />

from <strong>the</strong> communications<br />

side should be seen, earnings<br />

coming from virtually nothing<br />

in 1987-88 to £2.75.million.<br />

With photographic chipping<br />

in £3.8 million, <strong>the</strong> company<br />

is on course for perhaps ,£8.5<br />

million pre-tax, putting it on a<br />

prospective; , multiple of 12.<br />

Fur<strong>the</strong>r equity issues can be<br />

ruled out at <strong>the</strong> shares’ current<br />

low level, and <strong>the</strong> shares could<br />

start to advance again once <strong>the</strong><br />

figures are announced.<br />

Whim Creek<br />

London . shareholders in<br />

Whim Creek, <strong>the</strong> Australian<br />

gold mining company (one of<br />

: The Times five mining shares<br />

for 1989), can safely sit on<br />

<strong>the</strong>ir hands and make Dominion<br />

. Mining sweat ahead of<br />

tomorrow’s closing date of its<br />

bid.<br />

Dominion has offered takeover<br />

terms of nine-for-five for<br />

a company which currently<br />

produces twice as much gold<br />

as. <strong>the</strong> bidder, but on terms<br />

which are variously dismissed<br />

as being nei<strong>the</strong>r, fair nor<br />

reasonable.<br />

Dominion, which is a<br />

promising investment situation<br />

in its own right, currently<br />

holds 28.8 per cent of Whim<br />

Creek and — in private — both<br />

managements admit a regard<br />

for each o<strong>the</strong>r.<br />

An independent report by<br />

Rothschild Australia concludes<br />

<strong>the</strong> worth offered to<br />

Whim Creek is A$1.50 a<br />

Whim Creek share - equivalent<br />

to a 26 per cent discount.<br />

For its side Dominion ar<br />

gues that <strong>the</strong> combined company<br />

would have a. gold<br />

production of 350,000 ozs in<br />

1990 rising to 400,000 ozs in<br />

1991, which would put <strong>the</strong> two<br />

companies toge<strong>the</strong>r in aworld<br />

class comparable with BHP<br />

Gold or Newmont Australia.<br />

However, if Dominion<br />

wishes to expand along <strong>the</strong><br />

Whim Creek path <strong>the</strong>n it must<br />

be prepared to raise its bid -r<br />

and London shareholders can<br />

best demonstrate that message<br />

•by sitting tight. Ano<strong>the</strong>r■ bidder<br />

may well come along later.<br />

By Colin Campbell<br />

table, to have been completed<br />

by April ,1.<br />

While RTZ is still expected'<br />

to go ahead with its deal to buy<br />

BP Minerals, <strong>the</strong> overall package<br />

first put up for sale in<br />

January has yet to be fully<br />

defined.<br />

The question of preemptive<br />

rights held by current<br />

fellow partners with BP Minerals<br />

has yet to be resolved.<br />

The most notable of <strong>the</strong>se<br />

rights is at <strong>the</strong> Olympic Dani<br />

project in Australia, in' which<br />

Western Mining holds a 51 per<br />

cent stake.<br />

Under <strong>the</strong> joint venture<br />

agreement with BP Minerals,<br />

Western Mining has first right<br />

to buy BP Minerals’ 49 per.<br />

cent stake in Olympic Dam.<br />

A decision by Western Mining<br />

on whe<strong>the</strong>r it wishes to<br />

exercise <strong>the</strong> right has yet to be<br />

made.<br />

There is also some un<br />

Many gilt market<br />

participants must<br />

be wondering why<br />

<strong>the</strong> Chancellor is so reluctant<br />

to raise base rates to 14 per<br />

cent, given <strong>the</strong>:, pronounced'<br />

deterioration in <strong>the</strong> inflation<br />

outlook and <strong>the</strong> failure of <strong>the</strong><br />

current account deficit to<br />

narrow significantly.<br />

Evidence of a real economic<br />

slowdown is emerging<br />

in both M0 (down 1.7 per<br />

ceiit in <strong>the</strong> past three months<br />

annualized) , arid; retail sales<br />

(virtually static in <strong>the</strong> past<br />

three months). In fact, real<br />

growth in M0 has been<br />

■ negative in this period.<br />

One obvious policy switch<br />

.has been <strong>the</strong> Chancellor’s increased<br />

emphasis on M0,<br />

whereas in <strong>the</strong> first half of ,<br />

1988 he favoured stabilizing<br />

<strong>the</strong> nominal exchange rate.<br />

But although M0 growth has<br />

slowed, sterling’s depreciation<br />

in <strong>the</strong> first quarter of<br />

1989 is giving different monetary<br />

signals; <strong>the</strong> trade index<br />

has fallen by 2.7. per cent<br />

since <strong>the</strong> beginning of 1989<br />

— hardly evidence of a firm<br />

exchange rate policy.<br />

Nor is <strong>the</strong>re convincing<br />

evidence of broad money<br />

growth slowing rapidly; despite<br />

falling personal lending,<br />

corporate borrowing remains<br />

buoyant. Evidence<br />

from <strong>the</strong> housing market is<br />

alsoambiguous. House price<br />

inflation, is rising at a national<br />

rate of 31, per cent a<br />

year and <strong>the</strong> deceleration in<br />

<strong>the</strong> South-east is offset by 50<br />

per cent rises in some nor<strong>the</strong>rn<br />

regions.<br />

Comparison with previous<br />

cyclical downturns<br />

show that substantial falls in.<br />

real as opposed to nominal<br />

house prices were often asso- 1<br />

ciated with monetary, tightening<br />

(real house prices fell<br />

by about 10 per cent in 1973-<br />

74 and 1980-81). This suggests<br />

<strong>the</strong> monetary stance required<br />

to secure a sustainable<br />

and significant drop in<br />

core inflation implies a fur<strong>the</strong>r<br />

increase in base rates<br />

and that <strong>the</strong> authorities’<br />

fears of monetary overkill<br />

are misguided.<br />

The monetary rule of<br />

thumb <strong>the</strong> Treasury was supposed<br />

to be using in <strong>the</strong> first<br />

thalf of 1988 equated <strong>the</strong><br />

monetary impact on <strong>the</strong><br />

economy of a 4 per cent<br />

sterling movement in <strong>the</strong><br />

trade weighted index (TWI)<br />

with a 1 per cent change in<br />

baserates:.onthis,basis,<strong>the</strong><br />

TWI slippage of 2;7 per cent<br />

certainty over o<strong>the</strong>r .preemptive<br />

rights agreements,<br />

notably those concerning <strong>the</strong><br />

promising Lihir Island gold<br />

project in Papua New Guinea,<br />

in which BP Minerals holds 80<br />

percent. , ., ;<br />

The balance in <strong>the</strong> Lihir<br />

project is held by Australia-<br />

quoted Niugini Mining. The<br />

Niugini directors flew to<br />

London last month to tackle<br />

directly <strong>the</strong> heads of RTZ and.<br />

BP Minerals over what <strong>the</strong>y<br />

believe to be Niugini’s right to<br />

increase it stake in <strong>the</strong> Lihir<br />

project.<br />

Lihir is potentially one of<br />

<strong>the</strong> largest, and richest, gold<br />

mining projects outside South<br />

Africa.<br />

RTZ is understood to have<br />

a “ relaxed” attitude to<br />

Niugini’s claims, and believes<br />

that under current arrangements<br />

RTZ'will retain <strong>the</strong><br />

: lion’s share of Lihir.<br />

( GILT-EDGED )<br />

to<br />

so far this year should be<br />

offset by a rise of a least 0.5<br />

per cent in base rates.<br />

Fur<strong>the</strong>rmore, simulations<br />

on <strong>the</strong> Treasury model show<br />

that a slippage of 5 per cent ,<br />

in <strong>the</strong> sterling TWI (if sustained)<br />

adds 3 per cent to<br />

retail price inflation over<br />

three years.<br />

Slippage in <strong>the</strong> monetary<br />

stance has occurred when<br />

cost-push pressures have increased<br />

in <strong>the</strong> labour and ;<br />

energy markets. Average<br />

earnings growth of 9.25 per<br />

cent, a sharp acceleration in<br />

<strong>the</strong> growth of unit labour<br />

costs (up 3.4 per cent econ-<br />

omy-wide. in <strong>the</strong> year to<br />

1988, fourth quarter) and :<br />

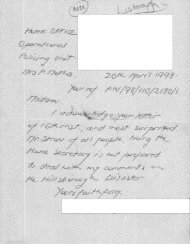

Exchange rates can exceed saving on mortgages<br />

The soaring value of a<br />

eiOiOOO mark mortgage<br />

£<br />

40.000<br />

35.000<br />

30.000<br />

25.000<br />

20.000<br />

15,000<br />

r 10,000<br />

1:1 t.:, r., ■ , | I M l.l|ia KI.RU. 5,000<br />

1964 65, 67 69 71 73 75 ’ 77' 79 8 1 ' 83 85 87 89<br />

rencies mainly used for this<br />

growing form of mortgage<br />

lending are <strong>the</strong> yen, Swiss<br />

franc and mark. In <strong>the</strong> long<br />

run <strong>the</strong>se low interest rate<br />

currencies have appreciated<br />

strongly against <strong>the</strong> pound.,<br />

A loan of £10,000 taken out<br />

in marks 25 years ago would<br />

now amount to more than.<br />

£34,500 due to <strong>the</strong> relative<br />

weakness of sterling 'over <strong>the</strong><br />

period.<br />

John Charcol, a leading firm<br />

in this business, has arranged<br />

advances . of more than £70<br />

million in currency loans since<br />

last year and says it has turned<br />

down thousands of applicants<br />

as unsuitable.<br />

“We prefer to do business<br />

with people who are financially<br />

aware and,understand<br />

<strong>the</strong> risks <strong>the</strong>y are taking on<br />

t .<br />

board,” said Mr Ian Darby,<br />

<strong>the</strong> marketing director.<br />

“The kind of person we<br />

favour might be a dealer in <strong>the</strong><br />

market who is watching curre<br />

n c y movements in <strong>the</strong><br />

course of his work.”<br />

The boom in foreign currency<br />

lending has been ignored<br />

by <strong>the</strong> leading high<br />

street banks, fearful of bad<br />

publicity which might arise if<br />

unsophisticated borrowers are<br />

caught out by. exchange<br />

fluctuations.<br />

Charcol is offering loans at<br />

rates which look like bargains<br />

to most British home buyers.<br />

Yen-based mortgages cost about<br />

6.75 per cent while mark<br />

a n d Swiss franc loans are<br />

available at l xh per cent.<br />

Dutch guilders can be borrowed<br />

at-10 per cent while dollar<br />

tion in National Insurance<br />

contributions — from October<br />

1989 - also appears to be<br />

a safety net in <strong>the</strong> event o f a<br />

hard, or crash, landing for<br />

domestic demand.- But <strong>the</strong><br />

Treasury’s published, fore-:<br />

cast does not square with <strong>the</strong>'<br />

model-based forecast on ei<strong>the</strong>r<br />

<strong>the</strong> current account<br />

• (where we find Micawberish :<br />

optimism in <strong>the</strong> published<br />

forecast) or <strong>the</strong> PSDR ■<br />

(where we find Scrooge-like<br />

pessimism).<br />

he current account<br />

and PSDR; forecasts'<br />

may have been subject ■<br />

to greater judgemental influence<br />

than usual in <strong>the</strong> .Bud^-<br />

' get forecast. Using main--:<br />

rising pay settlements sug stream assumptions’ on ingest<br />

<strong>the</strong> labour market re terest rates and unchanged<br />

mains <strong>the</strong> Achilles’ heel of exchanges, we found it easy<br />

counter-inflation strategy. to generate rising current ac-!<br />

Declining labour force count deficits over <strong>the</strong> medgrowth<br />

over <strong>the</strong> medium: . iiim term on <strong>the</strong>'Treasury ;<br />

term and evidence that trade model between £16 billion; |<br />

unions still have a utility and £20 billion for 1990-91.<br />

function in which real -wage Conversely; <strong>the</strong> PSDR.<br />

gains are favoured relative to numbers show, an increasing<br />

employment, suggest that trend from <strong>the</strong> likely 1988-;<br />

upward pressure on real 89 result ofabout £15 bilwages<br />

will persist^ despite lionj whereas <strong>the</strong> ChanMllor,<br />

<strong>the</strong> contraction in real eco is projecting <strong>the</strong>m falling<br />

nomic growth. It is also not sharply from £14 billion ip<br />

clear that an increase in 1989-90 to. £3 billion in<br />

unemployment, likely in 1992-93, accompanied by.<br />

1989-90, will restrain real fiscal, adjustments, amount<br />

wages, given ihese-factorS. ing to only £6 billion. ; .<br />

Apart from <strong>the</strong> Chancel What does this mean for<br />

lor’s pro-growth bias and gilts in 1989? The reluctant<br />

poor inflation record, his re and gradualist monetary,,<br />

luctance to raise short inter stance may prolong <strong>the</strong> perest<br />

rates.again may reflect iod of 13 per cent base rates ,<br />

<strong>the</strong> increased interest-rate because <strong>the</strong> Chancellor, insensitivity<br />

of real economic ,'sists on trying to fine-tune<br />

growth in <strong>the</strong> Treasury’s new monetary policy when'stern-;,<br />

“slim” model; a 1 per cent ©r measures are requiredtoincrease<br />

in rates reduces real lower inflation expectations.<br />

growth by. 1 per cent after Since we expect <strong>the</strong> current:<br />

four quarters.<br />

account deficit to widen to at<br />

But it would seem sen least £18 billion in 1989, an<br />

sible for <strong>the</strong> Chan increased interest rate precellor<br />

to squeeze real mium will probably be regrowth<br />

and inflation aggres quired to preserve a stable |<br />

sively at this stage to drive exchange rate, let alone to<br />

<strong>the</strong> economy on to a lower permit appreciation.<br />

inflation and real growth This makes <strong>the</strong> short end<br />

plane in 1990. This would still vulnerable to fur<strong>the</strong>r in<br />

give him a base from which creases in both international<br />

to expand <strong>the</strong> economy for and even British short rates,<br />

an election in 1991.<br />

particularly as' global infla- .<br />

The Chancellor’s Budget tion has yet to peak. Interest<br />

forecast reflects <strong>the</strong> belief rate peaks often follow' out-| T I<br />

that 13 per cent base rates put peaks by some months;; 1<br />

are sufficient to slow infla- thus <strong>the</strong> traditional adverse,'_;<br />

tion to 5.5 per cent in <strong>the</strong> seasonal pattern in gilt yields<br />

fourth quarter of 1989, to from April to September . I<br />

reduce <strong>the</strong> current account may well be repeated in 1989 ;I<br />

deficit to £12 billion an before better buying op^ 1<br />

nualized in. <strong>the</strong> first half of portunities emerge. :<br />

1990 and cut domestic de Robin Marshall ana<br />

mand growth to 1.5 per cent Neil MacKinnon<br />

in <strong>the</strong> same period. - v<br />

The timing of <strong>the</strong> reduc C h ^ e l h v ^ m e n t B a n k " :<br />

Shorts in<br />

avert strike aetilWi<br />

By Robert Rodwell<br />

Contacts between manage- „ past two years.,. Shorts lost<br />

ment and unions were contin £142 millibn in 1987-88; as ‘<br />

uing over <strong>the</strong> weekend in <strong>the</strong> government accountants'<br />

hope of averting an indefinite cleared' <strong>the</strong> financialdecks,<br />

strike by 3,500 manual work involving both accumulated<br />

ers being DClllg called tailCU today at Short<br />

and anticipated losses; -in<br />

1 _ •_..A<br />

UJW4JT<br />

_ __ .J<br />

WIV"*?** : - — * U A 'p n 10 1- V;m<br />

Bro<strong>the</strong>rs’ aircraft and missile preparation for <strong>the</strong> sale;<br />

factories in Belfast. One-day strikes- <strong>the</strong> larg-<br />

An all-out stoppage could est last Friday.- have im- ,,,<br />

threaten <strong>the</strong> chances of <strong>the</strong> peded production“ at'-j<br />

state-owned company being normal work<br />

sold successfully to one of two plant is not possible, Shorts .<br />

potential bidders. Bombard- says. It has virtually.suspenier,<br />

<strong>the</strong> Canadian transport ded production ° r its .own<br />

equipment,group, « ( , . « » “ I S<br />

sortium of GEC and Fokker,<br />

<strong>the</strong> Dutch aerospace com structure work, and limit <strong>the</strong>;■_.<br />

pany, are finalizing <strong>the</strong>ir res effect on big airframe'compopective<br />

bid proposals, due at nent contracts for Boeing and<br />

<strong>the</strong> Nor<strong>the</strong>rn Ireland Office, Fokker. The workers being<br />

and its financial adviser, laid off are those who, cannot,<br />

Kleinwort Benson, by April be transferred. Protective no<br />

30, in time for <strong>the</strong> sale to be tice has also been issued to .<br />

concluded in June.<br />

about 500 staff.<br />

Staff Man at ax Shorts, oiioiu»s Ulster’s uiaici o lar- Shop stewards advised . » all<br />

gest manufacturing employer 3,500 manual workers to-rewith<br />

17,700 workers, say <strong>the</strong>y port normally today, to enable<br />

have had no increases in <strong>the</strong> <strong>the</strong>m to seek fur<strong>the</strong>r talks.<br />

loans are on offer at 12,per<br />

cent. These rates vary from<br />

day to day. Most building<br />

society rates are 13.5 per cent.<br />

Some lenders offer hedging<br />

facilities to minimize <strong>the</strong> effect<br />

of moving exchange rates<br />

but <strong>the</strong>se are often expensive<br />

and offer only partial protection<br />

for borrowers.<br />

“In our experience <strong>the</strong> three<br />

possible hedging contracts,<br />

forward covering, futures contracts<br />

and options are all<br />

counter-productive,” said Mr<br />

Michael Petley, who heads<br />

Petley and Co, a private client<br />

broker in futures and options.<br />

“If <strong>the</strong>re were a ,loophole<br />

allowing you to borrow at a<br />

reduced rate and protect yourself,<br />

<strong>the</strong> entire London foreign<br />

exchange market would be in<br />

<strong>the</strong>re within a split second.”<br />

The cost of <strong>the</strong> hedge can be<br />

equal to or greater than <strong>the</strong><br />

saving in interest rates.<br />

“Hedgers are unwittingly<br />

locking in guaranteed losses.”<br />

John Charcol structures its<br />

contracts to include a switching<br />

option so that borrowers<br />

may convert <strong>the</strong>ir loans back<br />

into sterling within 48 hours.<br />

“This is essential in our<br />

opinion,” said Mr Darby.<br />

There is also a “stop-loss”<br />

provision which allows <strong>the</strong>,<br />

lender to switch back <strong>the</strong> loans<br />

into sterling if <strong>the</strong>y have<br />

grown to 70 per cent of <strong>the</strong><br />

value of a house.<br />

THE TIMES<br />

08 9 8 141141<br />

• Stockwatch gives- instant<br />

access to more than<br />

10,000 share, unit trust<br />

and bond prices; The' inf;<br />

formation you, require, is<br />

on <strong>the</strong> following telephone<br />

numbers:<br />

• Stock market ; comment:<br />

general. market<br />

0898 121220; cqmpariy<br />

news 089812122,1; active,<br />

shares 0898 121225 •<br />

• Calls charged 5p for 8<br />

seconds peak, 12 seconds<br />

off -peak, inc. VAT.<br />

i N o w<br />

L e a d t o j g<br />

L e a s i n g<br />

f r o m<br />

I x H i d o r i .<br />

R JH O A K E<br />

West Garden Huce,.Kendal Street<br />

London WS22.VQ.<br />

Tel. 014034H)77.Fax:^01