You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

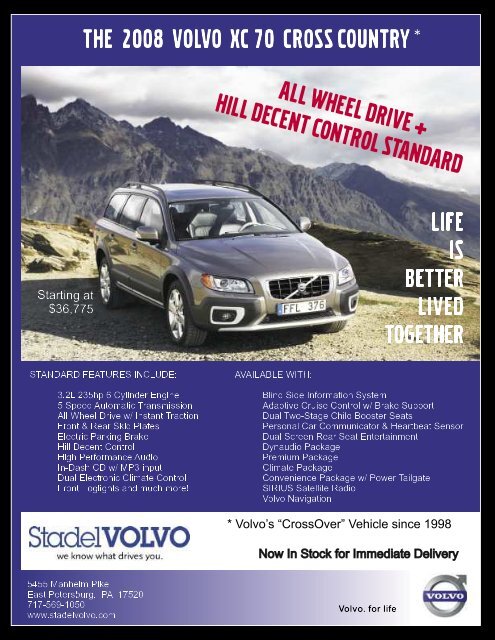

Starting at<br />

$ 36, 775<br />

THE 2008 VOLVO XC 70 CROSS COUNTRY *<br />

STANDARD FEATURES INCLUDE:<br />

3.2L 235hp 6 Cylinder Engine<br />

5 Speed Automatic Transmission<br />

All Wheel Drive w/ Instant Traction<br />

Front & Rear Skid Plates<br />

Electric Parking Brake<br />

Hill Decent Control<br />

High Performance Audio<br />

In-Dash CD w/ MP3 input<br />

Dual Electronic Climate Control<br />

Front Foglights and much more!<br />

5455 Manheim Pike<br />

East Petersburg, PA 17520<br />

717-569-1050<br />

www.stadelvolvo.com<br />

ALL WHEE L DRIVE +<br />

HILL DECENT CONTR OL STANDA RD<br />

AVAILABLE WITH:<br />

Blind Side Information System<br />

Adaptive Cruise Control w/ Brake Support<br />

Dual Two-Stage Child Booster Seats<br />

Personal Car Communicator & Heartbeat Sensor<br />

Dual Screen Rear Seat Entertainment<br />

Dynaudio Package<br />

Premium Package<br />

Climate Package<br />

Convenience Package w/ Power Tailgate<br />

SIRIUS Satellite Radio<br />

Volvo Navigation<br />

Now In Stock for Immediate Delivery<br />

Volvo. for life<br />

LIFE<br />

IS<br />

BETTER<br />

LIVED<br />

TOGETHER<br />

* Volvo’s “CrossOver” Vehicle since 1998<br />

Savers, Investors, and Speculators<br />

By Matthew G. Zanowiak, ChFC<br />

The Planners in our Practice meet<br />

with many different types of people<br />

every week. The younger Planners<br />

often meet with couples who are relatively<br />

just starting out. They have young children<br />

or no children, a house, two incomes,<br />

day care expenses and tons of dreams<br />

and ambitions. We may help them with<br />

some life or disability insurance, establishing<br />

an initial emergency fund, a college 529<br />

Investment Plan or a Roth IRA.<br />

The next group of people we help is fairly<br />

well established and full throttle into their<br />

goals and desires. They’ve been putting<br />

money away for college (or have children<br />

who have graduated), their retirement<br />

plan at work has a couple of zeros after it;<br />

they’re at the back-end of their mortgage<br />

and starting to put away more money on a<br />

regular basis. We typically help these folks<br />

with the initial stages of Estate Planning,<br />

make sure their Asset Allocation (which<br />

eggs in which baskets?) is consistent with<br />

their tolerance for risk, and analyze what<br />

their retirement income is likely to be.<br />

At the opposite end of the spectrum we<br />

help clients who are a pitching wedge<br />

away from retiring from their full time<br />

positions. These folks usually have<br />

grandchildren or some in the making; their<br />

homes are close to being paid off, and<br />

more and more they are caring for their<br />

parents. Their larger concern is more often<br />

the return of their money rather than the<br />

return on their money.<br />

This introduction is kind of a long way to<br />

go for a drink of water, but what do all<br />

of these folks have in common? Answer:<br />

They have a need to balance future income<br />

and asset goals with current available cash<br />

flow and account balances. The difference,<br />

however, may lie in the ways they<br />

complete this task.<br />

Some people are Savers; some are<br />

Investors, and some are Speculators. While<br />

these labels may seem like the same thing,<br />

the differences can be substantial. Take the<br />

couple who has decided to squirrel away<br />

$25 every month for Junior’s college bill.<br />

While certainly admirable, this less-than-adollar-a-day<br />

commitment should hardly be<br />

called Investing; this is Saving. While it can<br />

be argued that saving will lead to investing<br />

and, at least initially, the habit of regularly<br />

setting money aside is more important<br />

than the amount you are setting aside,<br />

this is still Saving. Unfortunately, you will<br />

not Save your way to a large dollar (aka<br />

College or Retirement) goal in a relatively<br />

short time frame.<br />

Permit me, if you will, to make an illadvised<br />

leap from Saving to Speculating.<br />

Know anyone who watches their<br />

investments several times a day and<br />

changes their holdings more frequently<br />

than the Convention Center move-in date?<br />

This is a form of Speculator. He is trying<br />

to time the market, get in and get out<br />

based on the illogical, emotional whims of<br />

the stock market. The Market’s been up<br />

for three days so he switches to bonds.<br />

It’s been twenty years since the Market’s<br />

largest single day decline (October, 1987)<br />

so I’m going to cash. The moon is full<br />

under Aquarius so I’m buying water stocks.<br />

All are positively ludicrous reasons to make<br />

wholesale changes to a portfolio. Yet many<br />

Speculators will do just that while chasing<br />

the Holy Grail of one half of one percent<br />

extra rate of return. The fact of the<br />

matter is that the deck is stacked heavily<br />

against this person. Case in point: over a<br />

year’s time, if you were to miss the five<br />

best days in the market (because you<br />

speculated out) your actual returns for said<br />

year would be decimated.<br />

Cradled comfortably between the Saver<br />

and the Speculator is the Investor. This<br />

person has a big picture view of what he<br />

wants to accomplish. With the help of<br />

an accredited, seasoned Professional, he<br />

carefully assesses his situation. After this<br />

assestment, he chooses a path on which to<br />

travel and then does something astonishing:<br />

he resists any paralysis-by-analysis, avoids<br />

the “on your mark...get-set...get-set...getset...get-set”<br />

syndrome and actually begins.<br />

Novel concept? You’d be surprised. The<br />

road away from success is studded with<br />

reasons not to do something.<br />

Although two of my best friends are<br />

Rocket Scientists, this, folks, is not Rocket<br />

Science. With the help of a guide to design<br />

the course as well as watch his back, the<br />

Investor set a target, chose the best tool<br />

to hit that target, started down the path<br />

realizing there will be road blocks and<br />

detours along the way, and is loath to<br />

make wholesale changes based on shortterm<br />

distractions.<br />

The game plan? Once you have started,<br />

review your progress regularly. Make<br />

minor adjustments along the way and<br />

major changes only when absolutely<br />

necessary. Ponder this: When a 747 takes<br />

off from Lancaster Airport (Check that.<br />

That’s speculating). When a jet leaves<br />

Harrisburg heading to Chicago, for fully<br />

95% of the journey the pilot cannot see<br />

his target. He knows the Windy City is out<br />

there, but he cannot see it. In fact most of<br />

the time, his aircraft is off course. It is with<br />

subtle corrections along the way that he<br />

is able to arrive safely in Chicago relatively<br />

on time.<br />

Your Investment Portfolio should be the<br />

same. Discover where you are today,<br />

choose a direction, design a game plan,<br />

implement your strategy, make subtle<br />

corrections as necessary, and avoid<br />

the temptation to jump in and out of<br />

the market. It might even help to have<br />

someone who has been there before to<br />

give you some guidance.<br />

As we head into the New Year, I can’t<br />

resist the time tattered tradition of helping<br />

you get organized. Therefore, here are a<br />

few tips (in no particular order) to help you<br />

solve some Financial Problems you may be<br />

wrestling with or accomplish some Financial<br />

Goals you’ve had in mind:<br />

1. Avoid Water Cooler Financial Planning.<br />

The guy at the office usually is not the<br />

guru he professes to be. Take the rate<br />

of return he proudly broadcasts and cut<br />

it in half. Now you’re getting closer to<br />

the truth.<br />

2. Do not marry an investment. At some<br />

point it will be time to get out of the<br />

mutual fund. It’s an investment strategy,<br />

not a tattoo.<br />

3. Stay on track and stay invested.<br />

4. Resist the urge to change just because<br />

everyone else is. Remember the<br />

proverbial bridge your mother used<br />

to ask you about jumping off with your<br />

friends?<br />

5. Ignore external, short-term distractions.<br />

It’s just noise.<br />

6. Realize you are investing for the long<br />

term. Act that way.<br />

7. Measure with your odometer not a<br />

micrometer. It is forty-four miles from<br />

our office in Oregon Commons to<br />

Harrisburg. I can measure that distance<br />

with the odometer in my car, a tape<br />

measure, a yard stick, or a ruler. Each<br />

will work. Which is more practical?<br />

Watching and changing your investments<br />

on a daily basis is tantamount to<br />

measuring the trip to our Capital with<br />

a ruler. Use the odometer and enjoy<br />

the trip.<br />

8. Avoid the “on your mark...get-set...getset...get-set”<br />

syndrome.<br />

9. Begin today.<br />

<strong>FLL</strong><br />

Matthew G. Zanowiak is a Chartered Financial<br />

Consultant with Lancaster Financial Services.<br />

With over twenty-four years in the Financial<br />

Service Industry his practice focuses on Total<br />

Financial Planning, emphasizing on Retirement<br />

Planning and College Planning. You can visit him<br />

at www.lancasterfinancialgroup.com or call him<br />

at 717-569-4004.<br />

Plan<br />

7