- Page 1 and 2: COMPREHENSIVE ECONOMIC COOPERATION

- Page 3 and 4: List of Annexes Annex 2-1 Schedules

- Page 5 and 6: CHAPTER 1 INITIAL PROVISIONS AND GE

- Page 7 and 8: (CC) any area extending beyond the

- Page 9 and 10: Article 2.7 Administrative Fees and

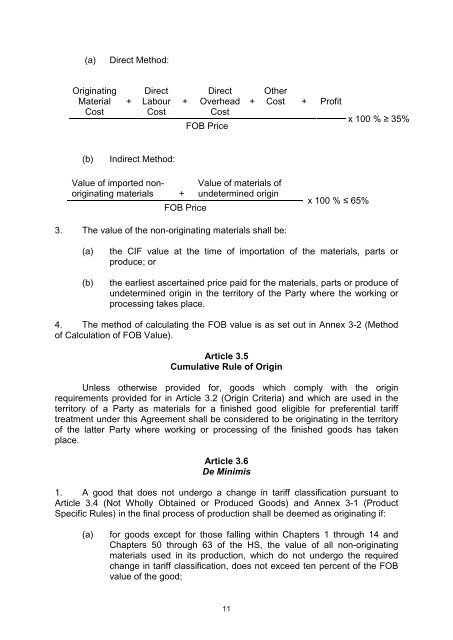

- Page 11 and 12: For the purposes of this Chapter: C

- Page 13: (g) goods of sea-fishing and other

- Page 17 and 18: (iii) the goods have not undergone

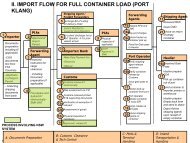

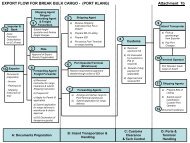

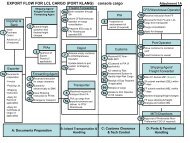

- Page 19 and 20: CHAPTER 4 CUSTOMS COOPERATION Artic

- Page 21 and 22: (b) provide for advance electronic

- Page 23 and 24: (a) whether goods imported into the

- Page 25 and 26: For the purposes of this Section: C

- Page 27 and 28: 9. On the termination of a bilatera

- Page 29 and 30: 5. A Party proposing to apply or ex

- Page 31 and 32: Section C General Provisions Articl

- Page 33 and 34: 2. Notwithstanding paragraph 1, the

- Page 35 and 36: areas are, and are likely to remain

- Page 37 and 38: (b) in the event that the checks re

- Page 39 and 40: Article 6.16 Exchange of Informatio

- Page 41 and 42: (a) technical specifications prepar

- Page 43 and 44: 2. The Parties shall cooperate with

- Page 45 and 46: 3. The Parties shall seek to ensure

- Page 47 and 48: the other Party, a Party may consul

- Page 49 and 50: technical consultations within thir

- Page 51 and 52: 5. New services shall be considered

- Page 53 and 54: (i) is a citizen of that other Part

- Page 55 and 56: numerical units in the form of quot

- Page 57 and 58: Article 8.8 Review The Parties shal

- Page 59 and 60: or arrangement, or to negotiate a c

- Page 61 and 62: consultations with that Party on su

- Page 63 and 64: CHAPTER 9 MOVEMENT OF NATURAL PERSO

- Page 65 and 66:

(ii) a goods seller, being a natura

- Page 67 and 68:

(ii) is employed by a juridical per

- Page 69 and 70:

4. Each Party shall maintain or ins

- Page 71 and 72:

(b) enterprise of a Party means any

- Page 73 and 74:

Article 10.5 Minimum Standard of Tr

- Page 75 and 76:

(f) payments arising out of the set

- Page 77 and 78:

Article 10.12 Reservations 1. Artic

- Page 79 and 80:

Treatment), Article 10.6 (Compensat

- Page 81 and 82:

opportunity to present their views

- Page 83 and 84:

Parties otherwise agree. These disc

- Page 85 and 86:

(e) Tourism; (f) Small and Medium E

- Page 87 and 88:

CHAPTER 12 GENERAL EXCEPTIONS Artic

- Page 89 and 90:

of restrictions to ensure, inter al

- Page 91 and 92:

(b) such persons are afforded a rea

- Page 93 and 94:

CHAPTER 14 DISPUTE SETTLEMENT Artic

- Page 95 and 96:

2. If the Parties agree, good offic

- Page 97 and 98:

Article 14.10 Proceedings of Arbitr

- Page 99 and 100:

Article 14.13 Time Frame All time f

- Page 101 and 102:

(b) the complaining Party may suspe

- Page 103 and 104:

(f) consult third parties on any ma

- Page 105 and 106:

(f) develop conditions and provisio

- Page 107 and 108:

2. Each Party shall provide to the

- Page 109 and 110:

Article 16.6 Confidentiality Where

- Page 111 and 112:

Annex 2-1 Schedules of Tariff Commi

- Page 113 and 114:

(i) Category 1: reduction of applie

- Page 115 and 116:

3. For tariff lines subject to spec

- Page 117 and 118:

Schedule of Tariff Commitments Mala

- Page 119 and 120:

“RVC(XX)” means that the good m

- Page 121 and 122:

Column 1 Column 2 Column 3 Column 4

- Page 123 and 124:

(CC) factory security (DD) insuranc

- Page 125 and 126:

(c) the other statements of the CO

- Page 127 and 128:

(b) For multiple goods declared und

- Page 129 and 130:

(v) the Issuing Authority receiving

- Page 131 and 132:

(ii) the exporter has sold the good

- Page 133 and 134:

OVERLEAF NOTES Original /Duplicate

- Page 135 and 136:

Annex 6-1 (List of Products for Req

- Page 137 and 138:

Annex 7-2 Mutual Recognition Agreem

- Page 139 and 140:

Modes of supply: 1) Cross-border su

- Page 141 and 142:

Modes of supply: 1) Cross-border su

- Page 143 and 144:

Modes of supply: 1) Cross-border su

- Page 145 and 146:

Modes of supply: 1) Cross-border su

- Page 147 and 148:

Modes of supply: 1) Cross-border su

- Page 149 and 150:

Modes of supply: 1) Cross-border su

- Page 151 and 152:

Modes of supply: 1) Cross-border su

- Page 153 and 154:

Modes of supply: 1) Cross-border su

- Page 155 and 156:

Modes of supply: 1) Cross-border su

- Page 157 and 158:

Modes of supply: 1) Cross-border su

- Page 159 and 160:

Modes of supply: 1) Cross-border su

- Page 161 and 162:

Modes of supply: 1) Cross-border su

- Page 163 and 164:

Modes of supply: 1) Cross-border su

- Page 165 and 166:

- the capability of implementing in

- Page 167 and 168:

Annex 8-1 Schedule of Malaysia Expl

- Page 169 and 170:

Modes of supply: 1) Cross-border su

- Page 171 and 172:

Modes of supply: 1) Cross-border su

- Page 173 and 174:

Modes of supply: 1) Cross-border su

- Page 175 and 176:

Modes of supply: 1) Cross-border su

- Page 177 and 178:

Modes of supply: 1) Cross-border su

- Page 179 and 180:

Modes of supply: 1) Cross-border su

- Page 181 and 182:

Modes of supply: 1) Cross-border su

- Page 183 and 184:

Modes of supply: 1) Cross-border su

- Page 185 and 186:

Modes of supply: 1) Cross-border su

- Page 187 and 188:

Modes of supply: 1) Cross-border su

- Page 189 and 190:

Modes of supply: 1) Cross-border su

- Page 191 and 192:

Modes of supply: 1) Cross-border su

- Page 193 and 194:

Modes of supply: 1) Cross-border su

- Page 195 and 196:

Modes of supply: 1) Cross-border su

- Page 197 and 198:

Modes of supply: 1) Cross-border su

- Page 199 and 200:

Modes of supply: 1) Cross-border su

- Page 201 and 202:

Modes of supply: 1) Cross-border su

- Page 203 and 204:

Modes of supply: 1) Cross-border su

- Page 205 and 206:

Modes of supply: 1) Cross-border su

- Page 207 and 208:

Modes of supply: 1) Cross-border su

- Page 209 and 210:

Modes of supply: 1) Cross-border su

- Page 211 and 212:

Modes of supply: 1) Cross-border su

- Page 213 and 214:

Modes of supply: 1) Cross-border su

- Page 215 and 216:

Modes of supply: 1) Cross-border su

- Page 217 and 218:

(d) cost-oriented rates means based

- Page 219 and 220:

3. Access to and Use of Public Tele

- Page 221 and 222:

4.3 Each Party shall endeavour to e

- Page 223 and 224:

(b) Options for Interconnecting wit

- Page 225 and 226:

links and submarine cable capacity

- Page 227 and 228:

services, unless the requirement is

- Page 229 and 230:

Business Visitors ANNEX 9-1 (a) Mal

- Page 231 and 232:

(ii) documentation demonstrating th

- Page 233 and 234:

Annex 12-1 Security Exceptions The