Shipping Statistics and Market Review - Institut für ...

Shipping Statistics and Market Review - Institut für ...

Shipping Statistics and Market Review - Institut für ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Container <strong>and</strong> general cargo fleet, supply/dem<strong>and</strong>, ports<br />

SUPPLY / DEMAND PATTERNS IN<br />

CONTAINER AND GENERAL CARGO<br />

SHIPPING<br />

Global Insight - World trade outlook <strong>and</strong> world<br />

contaierised trade development up to 2006 9<br />

Pages<br />

49-61<br />

Nowhere has the building momentum in the global<br />

recovery been more joyously received than among<br />

shipowners. Liner operators are making money, <strong>and</strong><br />

they are euphoric about it. Box rates are increasing<br />

steadily, <strong>and</strong> the full ships have encouraged a sharp<br />

increase in the orderbook stretching deliveries out to<br />

2007, despite rising new build prices.<br />

Since the bursting of the IT bubble in 2000, the world<br />

has had three years to adjust <strong>and</strong> absorb the resulting<br />

damage to the economy. Terrorist attacks, the<br />

Afghanistan <strong>and</strong> Iraq wars, escalating energy prices,<br />

<strong>and</strong> corporate accounting sc<strong>and</strong>als have diverted<br />

economic resources, raised social costs, <strong>and</strong> reduced<br />

investors’ <strong>and</strong> consumers’ confidence <strong>and</strong>, therefore,<br />

slowed the economic recovery process. Continuing<br />

technology progress, population growth, <strong>and</strong><br />

government monetary <strong>and</strong> fiscal stimulus have helped<br />

to keep the global recovery on track. Entering 2004,<br />

although the recovery has not yet played out, the<br />

economies of most major countries have returned to<br />

healthy conditions, with the structure <strong>and</strong> sustained<br />

strength to continue growing. Non-Japan Asia <strong>and</strong> the<br />

United States are taking the lead in this new round of<br />

economic expansion, followed by Australia, New<br />

Zeal<strong>and</strong>, Canada, the United Kingdom, <strong>and</strong> then<br />

Japan. Even Germany has returned to positive growth,<br />

<strong>and</strong> the whole Eurozone has climbed out of recession.<br />

Other economies, whether they experienced a<br />

recession or maintained economic growth, are all<br />

boosted by the recovery of the world’s major<br />

economies. Global Insight’s latest forecast for the<br />

world as a whole is for real GDP in 2004 to increase<br />

by 4 per cent.<br />

World full-container traffic is predicted to reach 69.7<br />

million TEUs in 2004, an increase of 6.4 per cent<br />

over last year. This is only a slightly slower growth<br />

than in 2003 (which was 6.8 per cent), but far<br />

superior to the meagre 1.1per cent growth in 2001.<br />

With economic growth strong in most importing<br />

regions, <strong>and</strong> with China exporting so much liner<br />

cargo, the drivers of this increase are clear. Its<br />

container exports are more than double those of the<br />

9 The contribution is based on the World Trade Service published<br />

by Global Insight. Compare www.globalinsight.com<br />

10 SSMR June 2004<br />

United States. Also, the growth of China's exports is<br />

projected to be one of the fastest in the world.<br />

The amazing dominance of China as an exporter of<br />

containerised cargo can be seen in table 11; China's<br />

exports in 2005 will be more than double its exports<br />

in 2000. Its average annual growth of 6 per cent will<br />

keep it in the top position throughout the forecast<br />

period.<br />

This year, China will gain another 5 per cent share of<br />

total container exports over 2003, an amazing feat.<br />

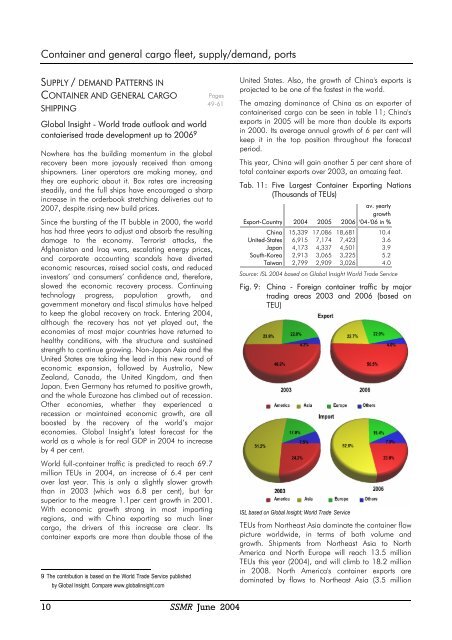

Tab. 11: Five Largest Container Exporting Nations<br />

(Thous<strong>and</strong>s of TEUs)<br />

av. yearly<br />

growth<br />

Export-Country 2004 2005 2006 '04-'06 in %<br />

China 15,339 17,086 18,681 10.4<br />

United-States 6,915 7,174 7,423 3.6<br />

Japan 4,173 4,337 4,501 3.9<br />

South-Korea 2,913 3,065 3,225 5.2<br />

Taiwan 2,799 2,909 3,026 4.0<br />

Source: ISL 2004 based on Global Insight World Trade Service<br />

Fig. 9: China - Foreign container traffic by major<br />

trading areas 2003 <strong>and</strong> 2006 (based on<br />

TEU)<br />

ISL based on Global Insight; World Trade Service<br />

TEUs from Northeast Asia dominate the container flow<br />

picture worldwide, in terms of both volume <strong>and</strong><br />

growth. Shipments from Northeast Asia to North<br />

America <strong>and</strong> North Europe will reach 13.5 million<br />

TEUs this year (2004), <strong>and</strong> will climb to 18.2 million<br />

in 2008. North America's container exports are<br />

dominated by flows to Northeast Asia (3.5 million