Merrion%20Capital%20June2011

Merrion%20Capital%20June2011

Merrion%20Capital%20June2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Reuters PCI.L / Bloomberg PCI LN<br />

Petroceltic International<br />

Muna Muleya CFA<br />

+353 1 240 4137<br />

muna.muleya@merrion-capital.com<br />

Rating<br />

Target price<br />

Buy 18.0p<br />

Date 22 nd June 2011 IRELAND Oil & Gas Exploration and Production<br />

Addressing its challenges<br />

We initiate coverage of Petroceltic International with a Buy recommendation<br />

and target price of 18.0p share, representing 76% upside from current levels.<br />

With Petroceltic trading at 43% discount to its core NAV, which is very well<br />

underpinned by farm out transactions, we see limited downside and<br />

significant upside. However, the company faces challenges to realise its full<br />

potential valuation<br />

Deep discount to core NAV, limited downside<br />

Petroceltic is one of the value plays in the oil and gas sector. It is trading at a 43%<br />

discount to its core NAV. The core NAV is underpinned by the recent ENEL farm out<br />

transaction which values the share between a minimum of 13.8p and maximum of<br />

20.7p. With a further farm out expected to be concluded at a later stage on terms we<br />

expect to be more favourable than the ENEL transaction, we see limited downside and<br />

significant upside potential from these levels.<br />

Duration and timing of appraisal more certain<br />

The appraisal programme was expanded and accelerated following the farm out<br />

agreement with ENEL. As a result, the duration and timing of the appraisal programme is<br />

more certain. We believe that the completion of the appraisal programme will be positive<br />

for Petroceltic. It will better define the recoverable reserves which should, in turn,<br />

improve the valuation, accelerate the project to development stage and attract bigger<br />

operators requiring large long term gas assets, as well as improving the frequency of<br />

news flow.<br />

Opportunity to pursue exploration projects<br />

Advancing the Algerian project to development stage and the possible transfer of<br />

operatorship to a major player should give management the time and resources to pursue<br />

exploration projects both within the existing portfolio and through acquisitions and<br />

green field projects. We believe that management has the expertise to identify and<br />

evaluate these opportunities.<br />

Key challenges<br />

The company faces a number of regulatory and other challenges in its Algerian<br />

operations. Bureaucratic delays meant the recent farm out agreement with ENEL took<br />

months to approve and may take months more to ratify. With further regulatory approval<br />

required for the final discovery report and possible further farm out, the timing of these<br />

is uncertain and, therefore, poses operational challenges to the company. The equity<br />

structure and funding for gas development in Algeria also poses a challenge. The<br />

Production Sharing Contract (PSC) requiring that Petroceltic holds at least 51% of its<br />

original holding to first gas may make it unattractive to bigger operators which are<br />

necessary to fund and operate the potentially large gas development. Although the<br />

company is confident of addressing these issues, it may create uncertainty and delay the<br />

attainment of Petroceltic’s full valuation.<br />

Target price points to 76% upside<br />

We value Petroceltic on core NAV basis with a target price of 18.0p, implying 76% upside<br />

from the current level. 25% of this is currently represented by cash or near cash and the<br />

rest by the key Algerian operation.<br />

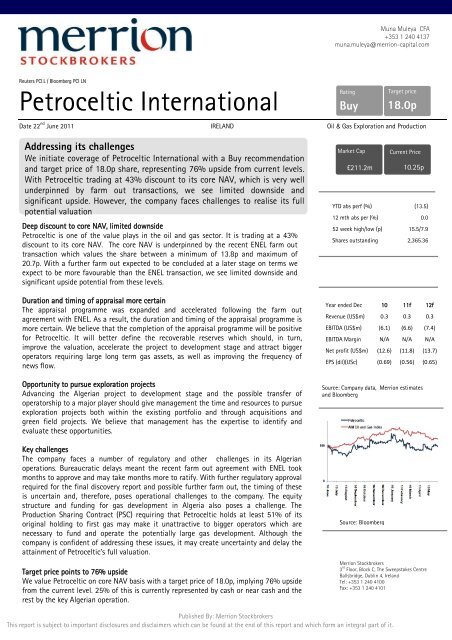

Market Cap<br />

£211.2m<br />

Published By: Merrion Stockbrokers<br />

This report is subject to important disclosures and disclaimers which can be found at the end of this report and which form an integral part of it.<br />

Current Price<br />

10.25p<br />

YTD abs perf (%) (13.5)<br />

12 mth abs per (%) 0.0<br />

52 week high/low (p) 15.5/7.9<br />

Shares outstanding 2,365.36<br />

Year ended Dec 10 11f 12f<br />

Revenue (US$m) 0.3 0.3 0.3<br />

EBITDA (US$m) (6.1) (6.6) (7.4)<br />

EBITDA Margin N/A N/A N/A<br />

Net profit (US$m) (12.6) (11.8) (13.7)<br />

EPS (dil)(USc) (0.69) (0.56) (0.65)<br />

Source: Company data, Merrion estimates<br />

and Bloomberg<br />

Source: Bloomberg<br />

Merrion Stockbrokers<br />

3 rd Floor, Block C, The Sweepstakes Centre<br />

Ballsbridge, Dublin 4, Ireland<br />

Tel: +353 1 240 4100<br />

Fax: +353 1 240 4101

Contents<br />

Investment case ------------------------------------------------------------ 3<br />

Offering clear value at current levels ------------------------------------ 3<br />

At a discount to core NAV ---------------------------------------------- 3<br />

Enel farm out strategically important and underpins valuation --------- 4<br />

Expanded and accelerated appraisal programme ------------------------- 4<br />

Better reserve definition ----------------------------------------- 5<br />

Accelerate project to development stage -------------------------- 6<br />

Improved newsflow ---------------------------------------------- 6<br />

Opportunities beyond Algeria ------------------------------------------- 8<br />

Key challenges -------------------------------------------------------------- 8<br />

Bureaucratic delays in Algeria ------------------------------------------ 8<br />

Funding structure for gas development ---------------------------------- 8<br />

Lack of exploration pipeline -------------------------------------------- 9<br />

Funding -------------------------------------------------------------------- 9<br />

Valuation and target price -------------------------------------------------- 10<br />

Company overview --------------------------------------------------------- 11<br />

Algeria -------------------------------------------------------------- 11<br />

Po Valley ------------------------------------------------------------ 12<br />

Central Adriatic ------------------------------------------------------ 13<br />

Management -------------------------------------------------------------- 13<br />

Financial forecasts --------------------------------------------------------- 15

Merrion Stockbrokers 3<br />

Investment case<br />

Petroceltic is an international oil and gas exploration and production company founded<br />

in 2003 and quoted on the AIM and ESM exchanges. Its focus area is the Mediterranean<br />

and North Africa regions (MENA). It currently has exploration assets in Algeria and Italy.<br />

Petroceltic’s main operating asset is the gas find in the Isarene permit area in Algeria,<br />

with additional assets in Italy’s Adriatic Sea and Po Valley. The share price has<br />

underperformed the AIM Oil and Gas Index by 22.5% over the last 12 months as the<br />

company encountered several setbacks. These include disappointing exploration results<br />

in Tunisia leading to the relinquishment of its licence, the suspension of exploration<br />

activity in the Adriatic Sea due to changes in environmental regulations and<br />

bureaucratic delays in obtaining approval for a farm out agreement in Algeria. The<br />

recent unrest in North Africa and the Middle East has not helped either.<br />

Offering clear value at current levels<br />

We believe that Petroceltic’s share price does not fully reflect the company’s value at<br />

these levels:<br />

The share is trading at a 43% discount to our core NAV valuation, 25% of which<br />

is cash or near cash. This is underpinned by the implied valuation from the<br />

recently completed farm down, with a further farm out expected by Q2 of 2012.<br />

The Isarene permit area appraisal programme has been expanded and accelerated<br />

following farm out to ENEL, with certainty on the duration and timing of its<br />

completion.<br />

Following farm, out management will have the resources to address what we<br />

believe is one of Petroceltc’s shortcomings: the lack of a near term exploration<br />

pipeline.<br />

Trading at a discount to Core NAV<br />

Exhibit 1 is a summary of our valuation of core NAV. The core NAV includes the P50<br />

estimate of Isarene permit area’s reserves in Algeria, cash and part of the outstanding<br />

ENEL consideration for hydrocarbons. The ENEL farm out transaction includes a<br />

maximum of $75m payment determined by the level of hydrocarbon reserves approved<br />

by the Algerian authorities. We have included 50% of this amount in our valuation.<br />

Exhibit 1 – Petroceltic - Core NAV<br />

Risked Valuation Value per share<br />

US$m p<br />

Isarene permit area - Algeria 463 13.6<br />

Further Enel cash receipt (50%) 38 1.2<br />

Cash 110 3.2<br />

Source: Merrion estimates<br />

620 18.0<br />

The share is currently trading at a 43% discount to our estimate of its Core NAV<br />

valuation of 18.0p per share. This does not include additional upside potential from<br />

Petroceltic’s P10 resources from the Isarene permit area, the potential upside from the<br />

suspended Elsa prospect in the Adriatic sea or the highly prospective Rovasenda<br />

prospect in Italy’s Po Valley. Including these prospects, our NAV valuation would be<br />

23p/share.<br />

Given its deep discount to its core NAV, we believe the share price offers value with<br />

limited downside and significant upside potential.

Merrion Stockbrokers 4<br />

Enel farm out strategically important and underpins valuation<br />

The recently completed farm out agreement with ENEL was a good strategic deal for<br />

Petroceltic. It secured ENEL, one of Europe’s largest utilities, as an important strategic<br />

partner. It is a major buyer of Algerian gas and may give it a higher profile when dealing<br />

with the Algerian government.<br />

The transaction also underpins the valuation for Petroceltic’s Isarene permit area asset.<br />

Exhibit 2 is a summary of the ENEL transaction (refer to page 9 for details of the<br />

transaction). $101m refers to both past and future costs exploration cost. Of this, $101m is<br />

effectively committed and is the minimum payment to be received when the deal is ratified<br />

by the Algerian government. It therefore represents a floor for the valuation of the<br />

transaction. An extra $75m may be paid depending on the level of hydrocarbons approved<br />

by the Algerian authorities following the submission of a final discovery report.<br />

The transaction implies a value for the Isarene assets ranging from 9.5p to a maximum of<br />

16.1p per share, compared to our valuation for the Isarene asset of 13.6p per share<br />

(including cash or near cash, the implied valuation for Petroceltic from the transaction is<br />

between 13.8p and 20.7p per share).<br />

Exhibit 2 – Petroceltic - Implied valuation from ENEL farm out<br />

Amount<br />

% ENEL<br />

Holding<br />

Implied<br />

Value<br />

Value per<br />

share<br />

Value per<br />

share<br />

$m<br />

$m USc p<br />

Back costs and future<br />

exploration costs<br />

Additional for<br />

108 18.375% 333 15.9 9.7<br />

hydrocarbons 75 18.375% 231 11.1 6.8<br />

183<br />

Source: Company data and Merrion estimates<br />

564 27.0 16.5<br />

Petroceltic is planning a further farm out of 18.375% of the Isarene asset. The second farm<br />

out is likely to be to an operator already currently active in Algeria. As this is likely to be<br />

concluded after the appraisal period has been completed, we expect it to be on better<br />

terms than the ENEL transaction, further underpinning the share’s valuation. Were it to be<br />

concluded on the same terms as the ENEL transaction, the core NAV would increase to<br />

18.9p per share, of which more than 50% would be cash or near cash.<br />

Expanded and accelerated appraisal programme<br />

Following gas discoveries from its Isarene drilling programme in Algeria (five wells, four gas<br />

discoveries), Petroceltic embarked on a four well appraisal and testing programme in<br />

October 2010. The objective of the programme is to supply technical data to support the<br />

monetisation of the discovery by gaining increased certainty on the distribution of the gas<br />

initially in place (GIIP) and confirming well productivity. Following the farm out to ENEL,<br />

this programme was expanded and accelerated to include two additional wells, possibly a<br />

third, to bring the total programme to six or seven wells, with the submission of a final<br />

discovery report to the Algerian government scheduled for early 2012. An additional rig<br />

was contracted on 17 May 2011 to expand exploration drilling and meet these targets.<br />

Petroceltic released a revised timetable for the appraisal programme incorporating two<br />

additional wells (AT8 and AT9). As a result, the appraisal programme is not only expanded<br />

and accelerated but the duration and timing is more certain.

Merrion Stockbrokers 5<br />

Exhibit 3 – Revised appraisal and testing programme<br />

Source: Petroceltic<br />

We believe that the completion of the revised appraisal programme will be positive for<br />

Petrocletic as it will lead to better reserve definition, accelerate the project towards<br />

development stage and provide better and more frequent news flow over the next 6 to 12<br />

months.<br />

Better reserve definition<br />

Exhibit 4 below shows Petroceltic’s estimated resources for the Isarene permit area as at<br />

September 2010. On a P50 basis, the total estimated hydrocarbons in place is estimated at<br />

6.3tcf.<br />

Exhibit 4 – Estimate of reserves and resources - September 2010<br />

Field<br />

Hydrocarbon<br />

Type<br />

Gross discovered Hydrocarbons in place,<br />

Estimates September 2010<br />

Low (p90) Medium (p50)<br />

High<br />

(p10)<br />

Ain Tsila Gas (BCF) 2,900 6,341 13,700<br />

Isarene North East Gas (BCF) 32 54 80<br />

Isarene North East Oils<br />

(MMbbls)<br />

17 64 139<br />

Isarene North<br />

West<br />

Gas (BCF) 13 36 82<br />

Hassi Tab Tab Gas (BCF) 35 151 421<br />

Totals Gas (BCF) 2,980 6,341 14,283<br />

Source: Petroceltic<br />

Oils<br />

(MMbbls)<br />

Cond.<br />

(MMbbls)<br />

Total<br />

(MMboe)<br />

17 64 139<br />

60 127 286<br />

573 1,248 2,805

Merrion Stockbrokers 6<br />

The expanded drilling programme should be positive for Petroceltic:<br />

It will move a large amount of resources into the P90 and P50 categories. As the<br />

size of reserves is important for the valuation of exploration companies, it will add<br />

to Petroceltic’s valuation.<br />

It will maximise the amount receivable from the ENEL farm out. $75m of the<br />

consideration from the farm out agreement depends on the extent of certified<br />

recoverable reserves. We have applied a 50% risk factor on our valuation of<br />

Petroceltic. The inclusion of 100% of this amount will add 1.1p per share (6.0%) to<br />

our valuation.<br />

Accelerate project to development stage<br />

Following the appraisal programme, a final discovery report is to be submitted to<br />

Sonatrach, the government owned Algerian partner in Q1 2012 and possibly approved by<br />

Q2 of 2012.<br />

The final discovery report will include the following:<br />

Description of all studies undertaken on the licence<br />

Description of the reservoir(s) and how much hydrocarbons it(they) contain<br />

Description of how the reservoir(s) will perform during production defining the<br />

number of wells, the plateau production rate and the reserves.<br />

Description of the facilities required to gather, process and export the produced<br />

hydrocarbons<br />

The economics of the project.<br />

We believe that the completion of the final discovery report will be value enhancing to<br />

Petroceltic as it will advance the project from exploration to development stage and hence<br />

monetisation. A clearly defined project will enable the completion of marketing<br />

arrangements for the final gas (with discussions already underway) and make it more<br />

attractive for a larger player. The most likely potential partner would be a current operator<br />

in Algeria. Total SA, Repsol, BP, Statoil and BHP Billiton are some of the operators in nearby<br />

gas fields and could all be potential suitors.<br />

Improved news flow<br />

The expansion and acceleration of the gas appraisal programme should improve company<br />

news flow during the second half of the year. The main exploration newsflow in the current<br />

year was the appraisal result for the AT 4 well. The result was mixed. While gas was<br />

encountered but, due to fracture design issues, the achieved gas flow rate on testing was<br />

disappointing at 1.35mmcf/day and associated with 250 bwpd. The company believed that<br />

it is likely the induced fractures in the well extended below the current field gas-water<br />

contact into an underlying aquifer resulting in the volumes of produced water seen.<br />

A second appraisal well, AT5, is taking a different approach. It will involve the drilling of<br />

both a vertical pilot hole, AT-5 followed by a horizontal section AT-5z. The horizontal<br />

section is intended to test a major “pop up” in the north of the field. The “pop-up” feature<br />

is one of many such structures typical of the northern part of the field anticipated to be<br />

associated with high natural fracture density and thus potentially enhanced un-stimulated<br />

gas productivity. The results of this approach will be crucial in determining whether it can<br />

be applied to the other structures indentified on the field. Drilling of AT 5 has been<br />

completed and test results are expected in early July.

Merrion Stockbrokers 7<br />

Exhibit 5 – AT5 - Pilot and horizontal well tracks<br />

Source: Petroceltic<br />

Four more appraisal wells are to be drilled and tested in the current year. Drill and test<br />

results will provide a clear indication of the extent of gas initially in place (GIIP) and<br />

associated gas flows and hence the extent of recoverable reserves. An expanded and<br />

accelerated drilling programme should increase the frequency of exploration updates.

Merrion Stockbrokers 8<br />

Opportunities beyond Algeria<br />

Besides Algeria, Petroceltic’s other significant assets are the Rovasenda prospect in Italy’s<br />

Po Valley and the Elsa project off the Adriatic Coast.<br />

Rovasenda is a Triassic exploration prospect estimated to have unrisked gross resources of<br />

270MMbbls. It is located close to the Villafortuna oil field which has been in production for<br />

decades. Petroceltic initially owned 95% of the prospect but it farmed out 47.5% of this,<br />

with operatorship, to ENI in exchange for 2D seismic data for the Carisio permit area as<br />

well as the adjacent Ronscecco permit area of which Petroceltic owns 100%.<br />

Exploration drilling is expected to commence in the first half of 2012. Should initial<br />

hydrocarbon estimates be confirmed, the prospect would add significant value to<br />

Petroceltic. We believe that Petroceltic is likely to announce a farm out prior to the<br />

commencement of the drilling programme. This may include a cash payment to Petroceltic<br />

as well as funding its share of the exploration cost.<br />

The Elsa prospect in the Adriatic coast is estimated at 34 – 187MMBoe. It was initially<br />

drilled in 1992 and encountered an oil column of 65 meters in the Lower Cretaceous at a<br />

depth of approximately 4500 meters. But ENI then decided it uneconomical to proceed.<br />

Peteroceltic’s reinterpretation of 3D seismic is that it may contain light oil. Drlling was<br />

scheduled for September 2010 but was suspended due to changes in Italy’s environmental<br />

regulations. Petroceltic and other Enegry producers are seeking ways of resolving this.<br />

Advancing the Algerian project to development stage and possible surrender of<br />

operatorship to a major player should give management the time and resources to address<br />

what we believe to be Petroceltic’s major weakness: the lack of a defined exploration<br />

project pipeline. The hiring of Tom Hickey, ex CFO at Tullow Oil, as director suggests that<br />

the company is trying to address this issue. We believe that management has the expertise<br />

to identify and evaluate these opportunities. Initial focus will be on the Mediterranean and<br />

North Africa (MENA) region. However, opportunities elsewhere may be pursued.<br />

Key Challenges<br />

Petroceltic faces regulatory and other challenges that may prevent near term attainment of<br />

its full valuation. These include bureaucratic delays in obtaining approvals in Algeria, the<br />

funding structure for its gas development in Algeria and the lack of an exploration project<br />

pipeline.<br />

Bureaucratic delays in Algeria<br />

The timing of official approvals from Algerian authorities is highly uncertain, posing<br />

operational challenges for the company. The ENEL transaction took months to approve and<br />

may take months more to be ratified. Over the next year, further official approval will be<br />

required for:<br />

the final discovery report prior to commencement of gas development<br />

a further farm out agreement<br />

The uncertainty with the timing of these regulatory approvals is uncertain and may affect<br />

the company’s operations.<br />

Funding Structure for gas development<br />

In terms of is PSC agreement with the Algerian government, Petroceltic is not permitted to<br />

decrease its holding below 51% of its original holding before first gas. As such, it must<br />

carry its working interest through the development stage. Following further farm out,<br />

Petroceltic will be responsible for approximately 38% of the development expenditure,<br />

estimated at $1.5bn to $2bn in total.<br />

We believe that Petroceltic does not have the operational capability or financial capacity to<br />

undertake the development. As such, the issue of funding for the development must be<br />

addressed. A possible solution could be to enter into an agreement with a more<br />

experienced operator to acquire a majority interest at first gas, similar to the transaction<br />

between Anadarko and Lasmo. Another possible solution is a takeover of Petroceltic itself.

Merrion Stockbrokers 9<br />

Both would require authorisation from Algerian authorities. There is no indication that this<br />

approval will be granted. This lack of clarity may create uncertainty in the<br />

commercialisation of the gas field.<br />

Lack of exploration pipeline<br />

Following changes to environmental regulations in Italy, hence, Petroceltic’s inability to<br />

appraise the Elsa discovery in the Adriatic Sea and its withdrawal from Tunisia, Petroceltic’s<br />

only exploration project is the Rovasenda prospect in Italy’s Po Valley where exploration<br />

drilling is scheduled for H1 of 2012. Management is yet to address the issue of an<br />

exploration pipeline but as we stated above, following farm out agreements in Algeria, they<br />

will have the resources to address it.<br />

Funding<br />

Petroceltic raised capital twice over the last year or so. In April 2010, $118m net was<br />

raised to fund its four well appraisal programme. Due to the uncertainty in the timing of<br />

the receipt from the ENEL transaction, a further $60m was raised in May 2011 to fund the<br />

expanded appraisal programme and the completion of the final discovery report. Both<br />

capital raising were strongly subscribed.<br />

We estimate that Petroceltic will have net cash of $110m as at the end of 2011. It had $66<br />

million as at April 2011. It then raised $60m from a share placement. We expect the<br />

company to receive about $100m for past and future exploration costs from the ENEL farm<br />

out agreement and that roughly the same amount ($100m) will be spent on exploration<br />

and operating costs, leaving a net cash balance of $120m by year end. This excludes any<br />

future receipts from ENEL for the level of approved hydrocarbons in Algeria (maximum<br />

$75m).<br />

Exhibit 5 – Petroceltic estimated cash flow<br />

$m<br />

Cash as at April 2011 (Merrion Estimate) 66<br />

Capital raising 60<br />

Estimated proceeds - ENEL transaction 100<br />

Exploration and other costs -116<br />

Net cash at end 2011 110<br />

Source: Merrion estimates<br />

With the development stage of the Isarene gas field yet to start, the company will have<br />

significant cash resources that it can use for acquisitions within the sector, or to pursue<br />

other exploration prospects.

Merrion Stockbrokers 10<br />

Exhibit 6 – Petroceltic NAV<br />

Cash and Farmout<br />

Cash<br />

ENEL further cash payment<br />

Total cash and farmout<br />

Isarene asset<br />

Ain Tsila<br />

Isarene Northeast<br />

Isarene Northwest<br />

Hassi Tab Tab<br />

Total Isarene asset<br />

Core NAV<br />

Exploration Projects<br />

Valuation and price target<br />

We value Petroceltic on the sum of the parts risk basis, with cash and the<br />

Algerian Isarene permit area assets forming its core NAV. We believe that core<br />

NAV provides a benchmark for the company’s valuation, with upside from<br />

exploration projects.<br />

We set our target price 18.0p, equal to its core NAV, or 76% upside to the current<br />

share price.<br />

We do not include a valuation higher than its core NAV because of:<br />

The lack of near term catalysts outside of its Algerian operations<br />

The uncertainty regarding options for the development of the Algerian asset<br />

and hence its monetisation. Bureaucratic delays in Algeria means the timing of<br />

any development work is highly uncertain.<br />

Total<br />

MMboe % Holding<br />

NAV<br />

unrisked<br />

Risk<br />

Factor<br />

Risked<br />

NAV £m<br />

US$ US$ @$1.61/£<br />

Risked<br />

p/sh<br />

Unrisked<br />

p/sh<br />

110 100 120 74 3.2 3.2<br />

75 50 37.5 23 1.2 2.2<br />

195<br />

158 97 4.4 5.4<br />

1,043 56.75% 1,184 38 450 276 13.2 34.7<br />

1,073<br />

22 56.75% 26 38 10 6 0.3 0.7<br />

2 56.75% 3 38 1 1 0.0 0.1<br />

6 56.75% 7 38 3 2 0.1 0.2<br />

1,218<br />

1,413<br />

152 463<br />

284<br />

13.6<br />

35.7<br />

620 380 18.0 41.1<br />

Italy - Elsa 250 55.00% 825 10 83 51 2.4 24<br />

Italy - Rovasenda 270 47.50% 770 10 77 47 2.3 23<br />

Total Exploration<br />

1,595<br />

159 98 4.7 47<br />

Total 3,008 780 478 22.7 88.1<br />

Source: Company data and Merrion estimates

Merrion Stockbrokers 11<br />

Source:Petroceltic<br />

Company overview<br />

Petroceltic is an international oil and gas exploration and production company founded in<br />

2003 and quoted on the AIM and ESM exchanges. Its focus area is the Mediterranean and<br />

North Africa regions (MENA). It currently has exploration assets in Algeria and Italy.<br />

Algeria<br />

Algeria supplies approximately 10% of Europe's natural gas via existing pipelines to Italy<br />

and Spain and to LNG projects. This supply capacity is set to expand with further gas<br />

pipelines currently under development.<br />

Petroceltic's Isarene permit area, awarded to the company in 2004, is located in the south<br />

of the Illizi Basin in South Eastern Algeria. Petroceltic is focused on four prospective areas<br />

on the Isarene permit area being Ain Tsila, Isarene Northeast, Isarene Northwest and Hassi<br />

Tab Tab. The Ain Tsila prospect is by far the largest and is the focus of the current appraisal<br />

programme.<br />

Petroceltic holds a 56.626% working interest and is the operator of the project with ENEL<br />

holding 18.375% and Sonatrach 25%.<br />

Exhibit 7 – Algeria overview Exhibit 8 – Isarene permit area<br />

Petroceltic undertook a successful drilling programme on the Isarene permit area,<br />

completed in January 2010. Five wells were drilled, with four gas discoveries. A two year<br />

extension was then obtained to undertake an appraisal programme of the four discoveries.<br />

The aim of the appraisal programme is to provide technical data to support<br />

commercialisation of the discovery. Following the farm out agreement with ENEL, the<br />

appraisal programme was expanded and accelerated.<br />

Farm out to ENEL<br />

On 28 April 2011, Petroceltic announced a farm out of 24.5% of its working interest (or<br />

18.375% of the total) to ENEL, the Italian utility and one of Europe's largest.<br />

Under the terms of the agreement ENEL:<br />

Agreed to pay up to US$ 36.75 million to Petroceltic, which equates to 24.5% of all<br />

back costs incurred from signing of the PSC in 2005 until the end of the exploration<br />

period in April 2010.

Merrion Stockbrokers 12<br />

Committed to fund 49% of the cost of the first six appraisal wells in an enlarged<br />

Isarene appraisal campaign (including AT-4 which has been completed and the<br />

second well of the campaign, AT-5, currently drilling the horizontal section) and of a<br />

contingent additional well, which costs are capped, in aggregate, at US$ 145<br />

million.<br />

Agreed to pay Petroceltic a contingent cash consideration, up to a maximum of US<br />

$75 million, determined by the level of recoverable hydrocarbon reserves approved<br />

by the Algerian Authorities in the Final Discovery Report, which is expected to be<br />

submitted by the parties in early 2012.<br />

The agreement is still subject to approval of the Amendment by Executive Decree in Algeria<br />

and subsequent publication of this decree in the Official Gazette. Management estimate<br />

that it will take 3 to 5 months for that approval to be obtained. Payments from ENEL,<br />

excluding the $75million contingent on the level of hydrocarbons, will be due 30 days<br />

following the gazette publication.<br />

Following the completion of the current appraisal programme, Petroceltic will complete a<br />

final discovery report and submit it by early 2012 to the Algerian authorities for approval.<br />

Po Valley<br />

Petroceltic operates four permits in the Western Po Valley in Italy. The Ronsecco permit<br />

was awarded in November 2010 and in March 2011 Petroceltic signed an agreement for<br />

the transfer of operatorship in the Carisio permit to ENI in exchange for seismic data in<br />

both the Ronsecco and Carisio permit areas. Drilling in the Carisio permit (Petroceltic<br />

47,5%, ENI 47,5%, Costruzioni Condotte 5%) is planned for the first half of 2012. The<br />

gross un-risked prospective recoverable resource is estimated at 270 MMbls.<br />

Exhibit 9 – Pol Valley

Merrion Stockbrokers 13<br />

Central Adriatic<br />

Petroceltic has a 55% operator working interest in the Elsa project of off Italy’s Adriatic<br />

cost. Following the Macondo well disaster, amendments were introduced to the Italian<br />

Environmental code prohibiting drilling within 5 nautical miles of the coastline and within<br />

12 miles of the perimeter of protected marine parks. The Elsa project lies within the<br />

prohibited zone. Petroceltic has obtained a decree suspending the timing obligations under<br />

the license until the issue is resolved.<br />

Exhibit 10 – Adriatic<br />

Other assets<br />

Petroceltic holds 4 permit application in the Sicily Chanel area and in the gulf of Taranto.<br />

Management<br />

Brian O'Cathain - Chief Executive<br />

Brian O'Cathain is a geologist and petroleum engineer with over 25 years experience in<br />

senior technical and commercial roles in upstream oil and gas exploration and production<br />

companies. Brian previously held the positions of Managing Director of Tullow Oil’s<br />

international business and Chief Executive of Afren plc. He has experience in working in<br />

West Africa, The North Sea, The Gulf of Mexico and South Asia. Brian served as Petroceltic<br />

Company Chairman for almost two years prior to his appointment as Chief Executive in<br />

February 2009.<br />

Alan McGettigan - Group Finance Director<br />

Alan McGettigan has over twenty years of experience in oil and gas exploration and<br />

production. Prior to joining Petroceltic, Alan worked for BG International where he held<br />

senior roles in Commercial and Group Business Development. His other experience includes<br />

roles at Shell International and BP as well as four years as a management consultant at<br />

McKinsey & Company. Alan holds B.Sc. and M.Sc. degrees in Engineering and a Master in<br />

Business Administration with distinction from the Harvard Business School.<br />

Tom Hickey - Corporate Development Director<br />

Tom is a qualified Chartered Accountant who has in excess of 10 years of experience in oil<br />

and gas exploration and production. Prior to joining Petroceltic, Tom was Chief Financial<br />

Officer and a director of Tullow Oil plc. Prior to this, he was an Associate Director of ABN<br />

AMRO Corporate Finance (Ireland) Limited. Tom is a commerce graduate of University<br />

College Dublin and a Fellow of the Irish Institute of Chartered Accountants. He is also a<br />

non-executive Director of PetroNeft Resources Plc.

Merrion Stockbrokers 14<br />

Dermot Corcoran - Head of Exploration<br />

Dermot Corcoran is a petroleum geologist/geophysicist with over 25 years’ experience in<br />

technical and managerial roles in upstream oil and gas exploration companies, including<br />

Exxon, Fina, Amerada Hess & Statoil. He has experience working in the North Sea, West<br />

Africa, North Africa, Chad, Syria, Pakistan, Norway and the U.S. As Head of Exploration,<br />

Dermot is responsible for technical leadership and coordination of the company’s<br />

exploration program. He also contributes to the identification and assessment of new<br />

business opportunities and to the development of the company’s strategy.<br />

Dave Scott - Head of Operations & Engineering<br />

Dave Scott is a mechanical engineer with 29 years experience in senior operations and<br />

management positions in upstream oil and gas exploration and production companies<br />

including Conoco, Enterprise, Hardy and Burlington Resources. He has experience of<br />

working in the UK, Algeria, Italy, Ukraine, India, Romania, and Australia. More recently he<br />

was Chief Operating officer of AIM listed Regal Petroleum and new start up Vanguard<br />

Energy. Reporting to the Chief Executive Officer, Dave is responsible for all aspects of<br />

Petroceltic’s operations including drilling, production and development projects. He will<br />

ensure that the company has the necessary expertise, systems and resources at its disposal<br />

to conduct operations safely and efficiently.<br />

David Slaven - General Manager Algeria<br />

David began his career in the oil and gas business in the late 70s in financial positions with<br />

El Paso Natural Gas in Paris and Algeria. This was followed by spells with Pennzoil in<br />

Tunisia and Morocco and Anadarko in Algeria as Finance and Administration Manager.<br />

David served as Country Manager with Burlington Resources in Algeria for nine years. David<br />

joined Petroceltic in November 2008 as Country Manager, Algeria.<br />

Pasquale Quattrone - General Manager Italy<br />

Pasquale is a Petroleum Engineer with 40 years experience in the Upstream Oil & Gas<br />

industry with Geophysicist, Senior Exploration Management and General Manager positions<br />

in Major and Independent companies such as ENI and JKX. His has experience working in<br />

Onshore and Offshore Italy, Libya and Tunisia and has participated in major oil and gas<br />

discoveries in these areas. As General Manager of Petroceltic Italy, Pasquale is responsible<br />

for the management of the daily business in Italy in accordance with Board’s objectives. He<br />

is also responsible for maintaining relations with the Italian Authorities in order to ensure<br />

that the Company complies with Italian regulation and for keeping the Board Members<br />

informed of Italian legislation. Due to his long experience in evaluating hydrocarbon<br />

potential in Mediterranean exploration areas, Pasquale contributes to the development of<br />

new business opportunities in Italy.

Merrion Stockbrokers 15<br />

Financial forecasts<br />

Income Statement<br />

December 2009 2010 2011f 2012f 2013f<br />

$'000 $'000 $'000 $'000 $'000<br />

Revenue 210 270 300 310 350<br />

Administrative expenses -5,522 -6,330 -6,900 -7,695 -8,570<br />

EBITDA -5,312 -6,060 -6,600 -7,385 -8,220<br />

Exploration expenses written off -1,321 -6,998 -5,521 -6,374 -7,355<br />

Depreciation and impairment -156 -312 -561 -620 -700<br />

Other expenses -1183 -1105 -1200 -1200 -1200<br />

Operating profit/(loss) -7,972 -14,475 -13,882 -15,579 -17,475<br />

Finance income and other income 1,856 1,914 2,105 1,890 1,560<br />

Profit before tax -6,116 -12,561 -11,777 -13,689 -15,915<br />

Taxation 0 0 0 0 1<br />

Profit for the year -6,116 -12,561 -11,777 -13,689 -15,914<br />

Earnings per share<br />

No of shares - diluted 1207.34 1817.926 2091.84 2091.84 2091.84<br />

EPS diluted ( c ) -0.51 -0.69 -0.56 -0.65 -0.76<br />

Cashflow statement<br />

December 2009 2010 2011f 2012f 2013f<br />

Operating cash flow<br />

$'000 $'000 $'000 $'000 $'000<br />

Profit/(loss) before tax -6,116 -12,561 -11,777 -13,689 -15,915<br />

Interest and other income -1,856 -1,914 -2,105 -1,890 -1,560<br />

Depreciation and impairment 156 312 561 620 700<br />

Exploration expenses written off 1,321 6,998 5,521 6,374 7,355<br />

Working capital adjustment 24,643 -20,496 1,160 1,287 1,426<br />

Other adjustment 1,183 1,130 1200 1200 1200<br />

Capital expenditure<br />

19,331 -26,531 -5,440 -6,098 -6,793<br />

Exploration -79,861 -45,811 -110,000 -50,000 -50,000<br />

Divestments 7,330 0 108,000<br />

Financing cashflows<br />

-72,531 -45,811 -2,000 -50,000 -50,000<br />

Capital raising 41,642 118,945 57000 0 0<br />

Interest and other income 760 1,034 2,105 1,890 1,560<br />

42,402 119,979 59,105 1,890 1,560<br />

Net cash flow -10,798 47,637 51,665 -54,208 -55,233<br />

Cash at the beginning of the year 43,429 33,727 82,244 133,909 79,701<br />

Forex adjustment 1096 880 0 0 0<br />

Cash at the end of the year 33,727 82,244 133,909 79,701 24,468

Merrion Stockbrokers 16<br />

Financial forecasts<br />

Balance Sheet<br />

December 2009 2010 2011f 2012f 2013f<br />

Non current assets<br />

$'000 $'000 $'000 $'000 $'000<br />

Intangible assets 156,724 194,539 189,818 231,624 272,370<br />

Other assets 435 745 184 184 184<br />

Current assets<br />

Trade and other receivables 1,037 4,223 4,434 4,656 4,889<br />

Cash and cash equivalents 33,727 82,244 133,909 79,701 24,468<br />

Total Assets 191,923 281,751 328,345 316,165 301,910<br />

Equity<br />

Share capital and premium 234,733 353,495 410,495 410,495 410,495<br />

Other reserves 8,007 7,252 7,252 7,252 7,252<br />

Retained earnings -83,903 -94,699 -106,476 -120,165 -136,079<br />

Attributable to equity shareholders 158,837 266,048 311,271 297,582 281,668<br />

Liabilities<br />

Trade and other payables 31,514 13,713 15,084 16,593 18,252<br />

Provisions 1,572 1,990 1,990 1,990 1,990<br />

Total liabilities 33,086 15,703 17,074 18,583 20,242<br />

Total equity and liabilities 191,923 281,751 328,345 316,165 301,910

Merrion Stockbrokers 17<br />

Disclosures<br />

Merrion Stockbrokers Limited ('Merrion') is a member firm of the Irish Stock Exchange and the London Stock Exchange and is regulated by the Central Bank of Ireland.<br />

For further information relating to research recommendations and conflict of interest management please refer to www.merrion-capital.com.<br />

The information contained in this publication was obtained from various sources believed to be reliable, but has not been independently verified by Merrion. Merrion does not warrant the completeness or accuracy of such<br />

information and does not accept any liability with respect to the accuracy or completeness of such information, except to the extent required by applicable law.<br />

This publication is a brief summary and does not purport to contain all available information on the subjects covered. Further information may be available on request. This report may not be reproduced for further publication<br />

unless the source is quoted.<br />

This publication is for information purposes only and shall not be construed as an offer or solicitation for the subscription or purchase or sale of any securities, or as an invitation, inducement or intermediation for the sale,<br />

subscription or purchase of any securities, or for engaging in any other transaction.<br />

Any opinions, projections, forecasts or estimates in this report are those of the author only, who has acted with a high degree of expertise. They reflect only the current views of the author at the date of this report and are<br />

subject to change without notice. Merrion has no obligation to update, modify or amend this publication or to otherwise notify a reader or recipient of this publication in the event that any matter, opinion, projection, forecast<br />

or estimate contained herein, changes or subsequently becomes inaccurate, or if research on the subject company is withdrawn. The analysis, opinions, projections, forecasts and estimates expressed in this report were in no<br />

way affected or influenced by the issuer. The author of this publication benefits financially from the overall success of Merrion.<br />

The investments referred to in this publication may not be suitable for all recipients. Recipients are urged to base their investment decisions upon their own appropriate investigations that they deem necessary. Any loss or<br />

other consequence arising from the use of the material contained in this publication shall be the sole and exclusive responsibility of the investor and Merrion accepts no liability for any such loss or consequence. In the event of<br />

any doubt about any investment, recipients should contact their own investment, legal and/or tax advisers to seek advice regarding the appropriateness of investing. Some of the investments mentioned in this publication may<br />

not be readily liquid investments. Consequently it may be difficult to sell or realize such investments. The past is not necessarily a guide to future performance of an investment. The value of investments and the income derived<br />

from them may fall as well as rise and investors may not get back the amount invested. Some investments discussed in this publication may have a high level of volatility. High volatility investments may experience sudden and<br />

large falls in their value which may cause losses. International investing includes risks related to political and economic uncertainties of foreign countries, as well as currency risk.<br />

To the extent permitted by applicable law, no liability whatsoever is accepted for any direct or consequential loss, damages, costs or prejudices whatsoever arising from the use of this publication or its contents.<br />

Merrion has written procedures designed to identify and manage potential conflicts of interest that arise in connection with its research business.<br />

United States: This report is only distributed in the US to major institutional investors as defined by S15a-6 of the Securities Exchange Act, 1934 as amended. By accepting this report, a US recipient warrants that it is a<br />

major institutional investor as defined and shall not distribute or provide this report or any part thereof, to any other person.<br />

Further details are available on our website http://www.merrion-capital.com/disclaimer.html and/or by contacting our Compliance Officer.<br />

Other countries: Laws and regulations of other countries may also restrict the distribution of this report. Persons in possession of this document should inform themselves about possible legal<br />

restrictions and observe them accordingly.

Merrion Stockbrokers 18<br />

Legal information<br />

The information contained in this publication was obtained from various sources believed to be reliable, but has not been independently verified by Merrion. Merrion does not warrant the completeness or accuracy of such<br />

information and does not accept any liability with respect to the accuracy or completeness of such information, except to the extent required by applicable law.<br />

This publication is a brief summary and does not purport to contain all available information on the subjects covered. Further information may be available on request. This report may not be reproduced for further publication<br />

unless the source is quoted.<br />

This publication is for information purposes only and shall not be construed as an offer or solicitation for the subscription or purchase or sale of any securities, or as an invitation, inducement or intermediation for the sale,<br />

subscription or purchase of any securities, or for engaging in any other transaction.<br />

Any opinions, projections, forecasts or estimates in this report are those of the author only, who has acted with a high degree of expertise. They reflect only the current views of the author at the date of this report and are<br />

subject to change without notice. Merrion has no obligation to update, modify or amend this publication or to otherwise notify a reader or recipient of this publication in the event that any matter, opinion, projection, forecast<br />

or estimate contained herein, changes or subsequently becomes inaccurate, or if research on the subject company is withdrawn. The analysis, opinions, projections, forecasts and estimates expressed in this report were in no<br />

way affected or influenced by the issuer. The author of this publication benefits financially from the overall success of Merrion.<br />

The investments referred to in this publication may not be suitable for all recipients. Recipients are urged to base their investment decisions upon their own appropriate investigations that they deem necessary. Any loss or<br />

other consequence arising from the use of the material contained in this publication shall be the sole and exclusive responsibility of the investor and Merrion accepts no liability for any such loss or consequence. In the event of<br />

any doubt about any investment, recipients should contact their own investment, legal and/or tax advisers to seek advice regarding the appropriateness of investing. Some of the investments mentioned in this publication may<br />

not be readily liquid investments. Consequently it may be difficult to sell or realize such investments. The past is not necessarily a guide to future performance of an investment. The value of investments and the income derived<br />

from them may fall as well as rise and investors may not get back the amount invested. Some investments discussed in this publication may have a high level of volatility. High volatility investments may experience sudden and<br />

large falls in their value which may cause losses. International investing includes risks related to political and economic uncertainties of foreign countries, as well as currency risk.<br />

To the extent permitted by applicable law, no liability whatsoever is accepted for any direct or consequential loss, damages, costs or prejudices whatsoever arising from the use of this publication or its contents.<br />

Merrion has written procedures designed to identify and manage potential conflicts of interest that arise in connection with its research business. Merrion’s research analysts and other<br />

staff involved in issuing and disseminating research reports operate independently to other areas of the business. Chinese Wall procedures are in place between the research analysts and<br />

staff involved in securities trading for the account of Merrion or clients to ensure that price sensitive information is handled according to applicable laws and regulations.<br />

United States: This report is only distributed in the US to major institutional investors as defined by S15a-6 of the Securities Exchange Act, 1934 as amended. By accepting this report, a US recipient warrants that it is a<br />

major institutional investor as defined and shall not distribute or provide this report or any part thereof, to any other person.<br />

Other countries: Persons in possession of this document should inform themselves about possible legal restrictions and observe them accordingly.<br />

Further details are available on our website http://www.merrion-capital.com/disclaimer.html and/or by contacting our Compliance Officer.<br />

Other countries: Laws and regulations of other countries may also restrict the distribution of this report. Persons in possession of this document should inform themselves about possible legal<br />

restrictions and observe them accordingly.

Merrion Capital Group<br />

3 rd Floor<br />

Block C<br />

The Sweepstakes Centre<br />

Ballsbridge<br />

Dublin 4<br />

Ireland<br />

Equity Research/Strategy<br />

Gerard Moore : Gerard.Moore@merrion-capital.com<br />

David Holohan : David.Holohan@merrion-capital.com<br />

Ross McEvoy: Ross.McEvoy@merrion-capital.com<br />

Aoife Wyer : Aoife.Wyer@merrion-capital.com<br />

Muna Muleya : Muna.Muleya@merrion-capital.com<br />

Institutional Sales<br />

Liam Boggan: Liam.Boggan@merrion-capital.com<br />

Martin Harte : Martin.Harte@merrion-capital.com<br />

Robert Murphy: Robert.Murphy@merrion-capital.com<br />

Private Client Account Managers<br />

Ken Costello: Ken.Costello@merrion-capital.com<br />

David Gorman : David.Gorman@merrion-capital.com<br />

Barry Relihan : Barry.Relihan@merrion-capital.com<br />

David Wilson : David.Wilson@merrion-capital.com<br />

Graham O’Donoghue : Graham.O’Donoghue@merrion-capital.com<br />

Cork :<br />

Jennifer Dennehy : Jennifer.Dennehy@merrion-capital.com<br />

Anthony Lynch : Anthony.Lynch@merrion-capital.com<br />

Traders<br />

Simon Tuthill: Simon.Tuthill@merrion-capital.com<br />

Aidan Cronin : Aidan.Cronin@merrion-capital.com<br />

Hannah Meyer: Hannah.Meyer@merrion-capital.com<br />

Jimmy Swaine: Jimmy.Swaine@merrion-capital.com<br />

Client Services<br />

Mary Ellen Holmes : Mary.Ellen.Holmes@merrion-capital.com<br />

Amy Kennedy : Amy.Kennedy@merrion-capital.com<br />

Switch: +353 1 240 4100<br />

Institutional Trading Desk: +353 1 240 4200<br />

Private Clients: +353 1 240 4111<br />

Fax: +353 1 240 4101<br />

Website: www.merrion-capital.com<br />

e-mail: info@merrion-capital.com<br />

Bloomberg: MSTK <br />

Wealth Advisory/Property<br />

Mark Roche : Mark.Roche@merrion-capital.com<br />

Jason Drennan: Jason.Drennan@merrion-capital.com<br />

Damien Conway : Damien.Conway@merrion-capital.com<br />

Cork :<br />

Claire Brosnan : Claire.Brosnan@merrion-capital.com<br />

Willie Cronin : Willie.Cronin@merrion-capital.com<br />

Pensions<br />

Laura Reidy: Laura.Reidy@merrion-capital.com<br />

Jean Masterson: Jean.Masterson@merrion-capital.com<br />

Cork :<br />

Claire Brosnan : Claire.Brosnan@merrion-capital.com<br />

Administration/Support<br />

Niamh Donnellan : Niamh.Donnellan@merrion-capital.com<br />

Patricia Lawlor : Patricia.Lawlor@merrion-capital.com<br />

Rory Connell : Rory.Connell@merrion-capital.com<br />

Cork :<br />

Marie Morton : Marie.Morton@merrion-capital.com<br />

Deirdre O’Brien : Deirdre.O’Brien@merrion-capital.com<br />

Institutional Trading Desk<br />

Phone: +353 1 240 4200<br />

Fax: +353 1 240 4242<br />

e-mail: research@merrion-capital.com<br />

Private Client Dealing Desk<br />

Phone: +353 1 240 4111<br />

Fax: +353 1 240 4286<br />

Cork Office: ` +353 21 4551950