rating for the Bank Loan Facilities of - Brickwork Ratings

rating for the Bank Loan Facilities of - Brickwork Ratings

rating for the Bank Loan Facilities of - Brickwork Ratings

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

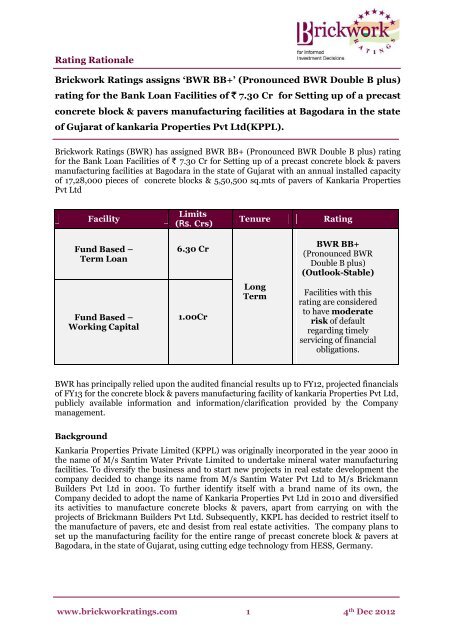

Rating Rationale<br />

<strong>Brickwork</strong> <strong>Ratings</strong> assigns ‘BWR BB+’ (Pronounced BWR Double B plus)<br />

<strong>rating</strong> <strong>for</strong> <strong>the</strong> <strong>Bank</strong> <strong>Loan</strong> <strong>Facilities</strong> <strong>of</strong> ` 7.30 Cr <strong>for</strong> Setting up <strong>of</strong> a precast<br />

concrete block & pavers manufacturing facilities at Bagodara in <strong>the</strong> state<br />

<strong>of</strong> Gujarat <strong>of</strong> kankaria Properties Pvt Ltd(KPPL).<br />

<strong>Brickwork</strong> <strong>Ratings</strong> (BWR) has assigned BWR BB+ (Pronounced BWR Double B plus) <strong>rating</strong><br />

<strong>for</strong> <strong>the</strong> <strong>Bank</strong> <strong>Loan</strong> <strong>Facilities</strong> <strong>of</strong> ` 7.30 Cr <strong>for</strong> Setting up <strong>of</strong> a precast concrete block & pavers<br />

manufacturing facilities at Bagodara in <strong>the</strong> state <strong>of</strong> Gujarat with an annual installed capacity<br />

<strong>of</strong> 17,28,000 pieces <strong>of</strong> concrete blocks & 5,50,500 sq.mts <strong>of</strong> pavers <strong>of</strong> Kankaria Properties<br />

Pvt Ltd<br />

Facility<br />

Fund Based –<br />

Term <strong>Loan</strong><br />

Fund Based –<br />

Working Capital<br />

BWR has principally relied upon <strong>the</strong> audited financial results up to FY12, projected financials<br />

<strong>of</strong> FY13 <strong>for</strong> <strong>the</strong> concrete block & pavers manufacturing facility <strong>of</strong> kankaria Properties Pvt Ltd,<br />

publicly available in<strong>for</strong>mation and in<strong>for</strong>mation/clarification provided by <strong>the</strong> Company<br />

management.<br />

Background<br />

Limits<br />

(Rs. Crs)<br />

6.30 Cr<br />

1.00Cr<br />

Tenure Rating<br />

Long<br />

Term<br />

BWR BB+<br />

(Pronounced BWR<br />

Double B plus)<br />

(Outlook-Stable)<br />

<strong>Facilities</strong> with this<br />

<strong>rating</strong> are considered<br />

to have moderate<br />

risk <strong>of</strong> default<br />

regarding timely<br />

servicing <strong>of</strong> financial<br />

obligations.<br />

Kankaria Properties Private Limited (KPPL) was originally incorporated in <strong>the</strong> year 2000 in<br />

<strong>the</strong> name <strong>of</strong> M/s Santim Water Private Limited to undertake mineral water manufacturing<br />

facilities. To diversify <strong>the</strong> business and to start new projects in real estate development <strong>the</strong><br />

company decided to change its name from M/s Santim Water Pvt Ltd to M/s Brickmann<br />

Builders Pvt Ltd in 2001. To fur<strong>the</strong>r identify itself with a brand name <strong>of</strong> its own, <strong>the</strong><br />

Company decided to adopt <strong>the</strong> name <strong>of</strong> Kankaria Properties Pvt Ltd in 2010 and diversified<br />

its activities to manufacture concrete blocks & pavers, apart from carrying on with <strong>the</strong><br />

projects <strong>of</strong> Brickmann Builders Pvt Ltd. Subsequently, KKPL has decided to restrict itself to<br />

<strong>the</strong> manufacture <strong>of</strong> pavers, etc and desist from real estate activities. The company plans to<br />

set up <strong>the</strong> manufacturing facility <strong>for</strong> <strong>the</strong> entire range <strong>of</strong> precast concrete block & pavers at<br />

Bagodara, in <strong>the</strong> state <strong>of</strong> Gujarat, using cutting edge technology from HESS, Germany.<br />

www.brickwork<strong>rating</strong>s.com 1 4 th Dec 2012

Management Pr<strong>of</strong>ile<br />

Mr. Subhas Chand Kankaria and his sons – Mr. Sandeep Kankaria & Mr. Aditya Kankaria ,<br />

are <strong>the</strong> company’s directors with ~40 years <strong>of</strong> experience in Real Estate Business.<br />

Shareholding Pattern<br />

Shareholding Pattern as on 31/03/2012-KPPL<br />

Sr. No. Names <strong>of</strong> <strong>the</strong> Shareholder No <strong>of</strong> shares Percentage <strong>of</strong> shares<br />

1 Mr. Sandeep Kankaria 7490000 20.41%<br />

2 Mrs. Manisha Kankaria 2700000 7.36%<br />

3 Mr. Subhas Chand Kankaria 10500000 28.61%<br />

4 Mrs. Kanchan kumara<br />

Kankaria<br />

4000000 10.90%<br />

5 Santim Knakaria Benefit Trust 500000 1.36%<br />

6 Vanishka Kankaria Benefit<br />

500000 1.36%<br />

Trust<br />

7 Aditya Kankaria 5000000 13.62%<br />

8 Priyanka Kankaria 2510000 6.84%<br />

9 Subhas Chand Kankaria (HUF) 3500000 9.54%<br />

Total 36700000 100.00<br />

Business Operations<br />

The company proposes to commence <strong>the</strong> commercial production <strong>of</strong> concrete pavers from<br />

Dec’12. The Company has procured Land measuring 6656 sq. m2 at Bagodara, Gujarat to set<br />

up <strong>the</strong> plant. The project implementation is reportedly on schedule. The Company has<br />

availed <strong>Bank</strong> <strong>Loan</strong> facilities <strong>of</strong> Rs. 7.30 Crs from <strong>Bank</strong> <strong>of</strong> Baroda.<br />

Project Cost and Means <strong>of</strong> Finance<br />

The Project Cost <strong>of</strong> Rs. 10.37 crores was met from <strong>the</strong> promoter’s contribution <strong>of</strong> `Rs. 3.66<br />

crores, unsecured loan from promoter <strong>of</strong> Rs. 0.41 crores and term loans from <strong>Bank</strong>s <strong>of</strong> `Rs.<br />

6.30 crores.<br />

Cost <strong>of</strong> Project Total Cost Margin<br />

(%)<br />

Prom.<br />

Contributio<br />

n<br />

www.brickwork<strong>rating</strong>s.com 2 4 th Dec 2012<br />

<strong>Bank</strong>'s<br />

Financ<br />

e<br />

Land & Land Development 0.71 45.00% 0.32 0.39<br />

Factory Building & O<strong>the</strong>r Civil<br />

works<br />

1.39 45.00% 0.63 0.76<br />

Administrative Building 0.03 25% 0.01 0.02<br />

Plant & Machineries 5.04 25% 1.26 3.78<br />

Electric Installation 0.26 25% 0.07 0.20<br />

Utilities 1.25 25% 0.31 0.94<br />

Furniture’s & Fixtures 0.03 25% 0.01 0.02<br />

Vehicles 0.15 25% 0.04 0.11<br />

Office Equipment 0.08 25% 0.02 0.06<br />

Computer & Peripherals 0.02 25% 0.01 0.02<br />

Contingencies @ 3% 0.24 100% 0.24 -<br />

Incidental Expenditure during<br />

construction<br />

0.5 100% 0.50<br />

Preliminary expenses 0.15 100% 0.15

Margin Money <strong>for</strong> WC 0.51 100% 0.51<br />

Total 10.36 4.07 6.30<br />

Means <strong>of</strong> Finance Rs. In Crs<br />

Promoter's Contribution & Unsecured <strong>Loan</strong>s from Friends &<br />

Relatives<br />

3.66<br />

Unsecured <strong>Loan</strong> from Directors, Friends & Relatives 0.41<br />

Term <strong>Loan</strong> from <strong>Bank</strong>/Financial Institution 6.3<br />

Total 10.37<br />

Working Capital Requirement 1.71<br />

Cash Credit from <strong>Bank</strong> 1.00<br />

As in<strong>for</strong>med, <strong>the</strong> promoters’ contribution has been met in full.<br />

Financial Per<strong>for</strong>mance<br />

The Pr<strong>of</strong>it after tax from <strong>the</strong> company’s unit is projected at Rs. 0.70 Crores on <strong>the</strong> projected<br />

Sales <strong>of</strong> Rs. 4.98 crores <strong>for</strong> FY13 with a projected PAT margin <strong>of</strong> 6.39%. The company’s<br />

projected Tangible Net worth Requirement <strong>of</strong> Rs. 4.07 Crs <strong>of</strong> which <strong>the</strong> promoters have<br />

brought Rs.3.66 Crs as share capital. Balance Rs.0.41 Crs is to be brought as unsecured loan<br />

from promoter & <strong>the</strong>ir relatives.<br />

Key Financials<br />

FY11 (A) FY12 (A) FY13 (Est) FY14<br />

(`Crores)<br />

(Proj)<br />

Gross Sales 0.46 0.20 4.98 13.89<br />

Less: Excise Duty 0.54 1.64<br />

O<strong>the</strong>r Ope<strong>rating</strong> Income - - - -<br />

Total Ope<strong>rating</strong> Income 0.46 0.20 4.44 12.25<br />

Cost <strong>of</strong> Sales 0.26 0.09 2.91 8.11<br />

Ope<strong>rating</strong> Pr<strong>of</strong>it be<strong>for</strong>e Interest,<br />

Depreciation and Tax<br />

0.07 0.03 1.35 3.55<br />

PAT 0.02 0.02 0.28 1.08<br />

Tangible Net worth 1.36 2.46 4.06 5.17<br />

(Historical data not significant, in view <strong>of</strong> change <strong>of</strong> activity)<br />

Rating Outlook<br />

The <strong>rating</strong> has factored, inter alia, <strong>the</strong> promoters experience in <strong>the</strong> manufacturing sector, <strong>the</strong><br />

team <strong>of</strong> pr<strong>of</strong>essionally equipped individuals. The <strong>rating</strong> is constrained by intense<br />

competition & change in <strong>the</strong> line <strong>of</strong> activities by <strong>the</strong> management thrice in a span <strong>of</strong> 12 years.<br />

The ability <strong>of</strong> <strong>the</strong> company to meet its sales, pr<strong>of</strong>itability and o<strong>the</strong>r financial projections <strong>for</strong><br />

FY13 and 14 and <strong>the</strong> government’s policy pertaining to concrete industry in general, shall<br />

remain <strong>the</strong> key <strong>rating</strong> sensitivities.<br />

www.brickwork<strong>rating</strong>s.com 3 4 th Dec 2012

Analyst Contact Relationship Contact<br />

1-8<br />

analyst@brickwork<strong>rating</strong>s.com<br />

0-425-2742<br />

bd@brickwork<strong>rating</strong>s.com<br />

Phone Media Contact<br />

1-860-425-2742 media@brickwork<strong>rating</strong>s.com<br />

Disclaimer: <strong>Brickwork</strong> <strong>Ratings</strong> (BWR) has assigned <strong>the</strong> <strong>rating</strong> based on <strong>the</strong> in<strong>for</strong>mation obtained from <strong>the</strong> issuer and o<strong>the</strong>r reliable sources,<br />

which are deemed to be accurate. BWR has taken considerable steps to avoid any data distortion; however, it does not examine <strong>the</strong> precision<br />

or completeness <strong>of</strong> <strong>the</strong> in<strong>for</strong>mation obtained. And hence, <strong>the</strong> in<strong>for</strong>mation in this report is presented “as is” without any express or implied<br />

warranty <strong>of</strong> any kind. BWR does not make any representation in respect to <strong>the</strong> truth or accuracy <strong>of</strong> any such in<strong>for</strong>mation. The <strong>rating</strong> assigned<br />

by BWR should be treated as an opinion ra<strong>the</strong>r than a recommendation to buy, sell or hold <strong>the</strong> rated instrument and BWR shall not be liable<br />

<strong>for</strong> any losses incurred by users from any use <strong>of</strong> this report or its contents. BWR has <strong>the</strong> right to change, suspend or withdraw <strong>the</strong> <strong>rating</strong>s at<br />

any time <strong>for</strong> any reasons.<br />

www.brickwork<strong>rating</strong>s.com 4 4 th Dec 2012