Complete 2012 Annual Report - Agra

Complete 2012 Annual Report - Agra

Complete 2012 Annual Report - Agra

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

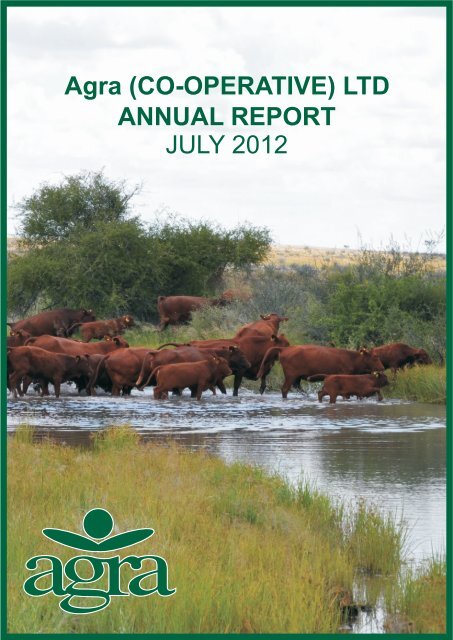

<strong>Agra</strong> (CO-OPERATIVE) LTD<br />

ANNUAL REPORT<br />

JULY <strong>2012</strong>

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

General Information<br />

Country of incorporation and domicile Namibia<br />

Nature of business and principal activities <strong>Agra</strong> (Co-operative) Limited is the largest multipurpose<br />

agricultural co-operative in the country. <strong>Agra</strong> has branches<br />

throughout Namibia providing farming inputs and equipment as<br />

well as pet accessories, camping equipment, gardening and<br />

household goods. <strong>Agra</strong> is also the largest livestock organisation<br />

in Namibia.<br />

Directors R van der Merwe (Chairman)<br />

BH Mouton (Vice chairman)<br />

LC van Wyk<br />

P Schonecke<br />

S Wilckens<br />

JW Visagie<br />

Supervisory committee JH Niewoudt (Chairman)<br />

H Stroh<br />

SK Shikongo<br />

Registered office 8 Bessemer Street<br />

Windhoek<br />

Namibia<br />

Postal address Private Bag 12011<br />

Windhoek<br />

Namibia<br />

Bankers Bank Windhoek Limited<br />

Standard Bank Namibia Limited<br />

First National Bank of Namibia Limited<br />

Auditors PricewaterhouseCoopers<br />

Registered Accountants and Auditors<br />

Chartered Accountants (Namibia)<br />

PwC, a partnership duly organised according to the laws of the<br />

Republic of Namibia (hereafter referred to as "PwC", "we", "us",<br />

our")<br />

Co-operative registration number F02/98<br />

1

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

General Information<br />

Management PM Kazmaier (Chief Executive Officer)<br />

PL de Bruyn (Finance)<br />

A Klein (Retail and Wholesale)<br />

G Beukes (Human Resources)<br />

T Koen (Livestock)<br />

H Tiemann (Properties and Business Development)<br />

D Grobler (Marketing)<br />

2

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

Contents<br />

The reports and statements set out below comprise the annual financial statements presented to the shareholders:<br />

Contents Page<br />

<strong>Report</strong> of the Supervisory Committee 4<br />

<strong>Report</strong> of the Chairman 5 - 6<br />

<strong>Report</strong> of the Chief Executive Officer 7 - 19<br />

Directors' Responsibilities and Approval 20<br />

Independent Auditors' <strong>Report</strong> 21 - 22<br />

Directors' <strong>Report</strong> 23 - 24<br />

Statement of Financial Position 25 - 26<br />

Statement of Comprehensive Income 27<br />

Statement of Changes in Equity 28 - 29<br />

Statement of Cash Flows 30<br />

Accounting Policies 31 - 46<br />

Notes to the <strong>Annual</strong> Financial Statements 47 - 84<br />

The following supplementary information does not form part of the annual financial statements and is unaudited:<br />

Detailed Statement of Comprehensive Income 85 - 86<br />

3

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

<strong>Report</strong> of the supervisory committee<br />

<strong>Report</strong> of the Supervisory Committee<br />

The year under review, much like the previous number<br />

of years, consisted of mostly good rainfall for farmers<br />

and good financial performance for <strong>Agra</strong>. Taking an<br />

analytical look however, it becomes clear that it did not<br />

go too well with farmers. The pressure on production<br />

costs increased while income decreased amongst<br />

others as a result of problems in the international<br />

economy. <strong>Agra</strong> also had its challenges, especially in the<br />

livestock division.<br />

During the year under review all three supervisory<br />

committee members attended all the meetings of the<br />

board of directors and were thus informed and had<br />

input into all matters discussed. In the competitive<br />

business environment in which we operate it is crucial<br />

to get maximum inputs and support of those who have<br />

been elected by members to serve on the board of<br />

directors. The supervisory committee can confirm that<br />

the essential research for business development and all<br />

the relevant actions are well considered, and are done<br />

with prudence.<br />

The board and management are congratulated with the<br />

financial performance of the past year. Members should<br />

take cognisance of the fact that it was not only business<br />

with members resulting in these achievements, but that<br />

diversification largely contributed to the success, for the<br />

benefit of the members.<br />

Lastly, I would like to state: business development does<br />

not only require innovation and planning – it also calls<br />

for financial inputs of a magnitude that is sometimes<br />

difficult to comprehend. As farmers, we know that you<br />

first have to sow before you can harvest; you first need<br />

to invest in a good quality herd of cattle or sheep,<br />

before you can market calves or lambs. <strong>Agra</strong> is at the<br />

point where new developments need to be done to be<br />

able to reap a good harvest in a number of years.<br />

We wish the board of directors, management and staff<br />

all the best for the exciting times ahead.<br />

J H Nieuwoudt<br />

SUPERVISORY COMMITTEE<br />

TOESIGHOUDENDE KOMITEE<br />

Verslag van Toesighoudende Komitee (TK)<br />

Die jaar onder oorsig het verloop soos die afgelope<br />

paar jare, met meestal goeie reëns vir boere en goeie<br />

prestasie op finansiële gebied vir <strong>Agra</strong>. Kyk mens<br />

egter analities daarna dan is dit duidelik die boere nie<br />

te goed gegaan het nie. Die druk op produksiekoste<br />

het toegeneem terwyl inkomste gedaal het,<br />

ondermeer as gevolg van probleme in die<br />

internasionale ekonomie. <strong>Agra</strong> het ook sy uitdagings<br />

gehad, veral in die lewende hawe afdeling.<br />

Gedurende die jaar het al drie TK lede al die direksie<br />

vergaderings bygewoon, en het dus insae gehad en<br />

insette gelewer in al die sake onder bespreking. In die<br />

kompeterende besigheids-omgewing waarin ons<br />

beweeg is dit nodig om maksimum insette en<br />

ondersteuning te kry van hulle wat deur lede<br />

aangewys is om op die direksie te dien. Die TK kan<br />

getuig dat die voetwerk wat nodig is met<br />

besigheidsontwikkeling en al die aksies wat daarmee<br />

gepaard gaan, werklik goed deurdag en beredeneerd<br />

gedoen word.<br />

Die bestuur en direksie word gelukgewens met die<br />

finansiële prestasie van die afgelope jaar. Dit is egter<br />

belangrik dat lede kennis neem van die feit dat dit nie<br />

net besigheid met lede was wat hierdie prestasies tot<br />

gevolg het nie, maar dat diversifikasie grootliks<br />

gehelp het om die boeke so goed te laat klop tot die<br />

voordeel van lede.<br />

Ten slotte net dit: besigheidsontwikkeling verg nie net<br />

innovasie en beplanning nie; dit vra ook finansiële<br />

insette van ‘n omvang wat mens soms laat duisel.<br />

Ons boere weet egter dat jy eers moet plant en saai<br />

voordat jy kan oes; dat jy eers in ‘n goeie<br />

kuddebeeste of skape moet belê voordat jy kalwers of<br />

lammers kan bemark. <strong>Agra</strong> is op daardie punt waar<br />

nuwe ontwikkelings noodsaaklik is om oor ‘n paar jaar<br />

goeie oeste te kan insamel.<br />

Baie sterkte en voorspoed word direksie, bestuur en<br />

personeel toegewens in die opwindende tye wat<br />

voorlê.<br />

4

<strong>Report</strong> of the chairman<br />

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

<strong>Report</strong> of the chairman<br />

As far as market-and price fluctuations are concerned,<br />

Namibia is not isolated from international tendencies.<br />

The financial crisis in certain countries has a negative<br />

effect on especially the hunting and tourism industry.<br />

The below average production conditions in certain<br />

stock farming areas of South Africa resulted in forced<br />

marketing. The increasing grain prices place the<br />

profitability of feedlots under pressure. The impact of<br />

the above mentioned factors caused a drastic decrease<br />

in prices of livestock at the beginning of <strong>2012</strong>. Prices for<br />

swakara pelts, charcoal and agronomy products are<br />

high while dairy producers’ profit margins are under<br />

pressure due to high input costs. In addition to producer<br />

prices, market access and the factors affecting it, are<br />

equally important. The animal health status of Namibia<br />

is absolutely crucial.<br />

During the year under review <strong>Agra</strong> has redefined its<br />

reason for existence by means of the following purpose<br />

statement:<br />

To create prosperity and improve quality of life is a<br />

noble purpose if:<br />

- we contributes towards socio-economic quality of<br />

life<br />

- we cares for the environment<br />

- we creates conditions for people to succeed and<br />

- we builds innovative and sustainable businesses<br />

There is huge potential in the agricultural sector which<br />

can be explored and developed to create employment<br />

and reduce poverty. Because 70% of Namibia’s<br />

population is directly or indirectly dependent on<br />

agriculture for their survival, this sector needs to be<br />

acknowledged and supported. Undeveloped and<br />

underdeveloped areas need to be a priority, integrated<br />

rural development programmes need to be<br />

implemented, natural resources need to be used<br />

sustainably and certainty with regard to land ownership<br />

and rights need to be created. Safety and security is a<br />

prerequisite for peace and stability and earns the trust<br />

of potential investors to invest locally. The Namibian<br />

Government has a huge responsibility to provide<br />

transparent investment policies and create a well<br />

regulated environment in which the private sector can<br />

do business.<br />

Verslag van die Voorsitter<br />

Ten opsigte van mark- en prysskommelings is<br />

Namibië nie geïsoleer van internasionale tendense<br />

nie. Die finansiële krisis in sekere lande het ‘n<br />

negatiewe invloed op veral die jag- en toerismebedryf.<br />

Die ondergemiddelde produksie-omstandighede in<br />

sekere veeboerderystreke van Suid-Afrika het<br />

drukbemarking tot gevolg gehad. Die stygende<br />

graanpryse plaas die winsgewendheid van voerkrale<br />

onder druk. Die impak van bogenoemde faktore het ‘n<br />

drastiese daling in lewende hawepryse aan die begin<br />

van <strong>2012</strong> tot gevolg gehad. Pryse vir Swakara pelse,<br />

houtskool- en akkerbouprodukte is hoog terwyl<br />

suiwel`-produsente se winsmarges as gevolg van hoë<br />

insetkostes onder druk verkeer. Behalwe vir pryse is<br />

marktoegang en die faktore wat dit beïnvloed net so<br />

belangrik. Die dieregesondheidstatus van Namibië is<br />

ononderhandelbaar.<br />

<strong>Agra</strong> het gedurende die afgelope jaar die rede vir sy<br />

bestaan herformuleer en stel sy doel:<br />

Om welvaart te skep en lewenskwaliteit te verbeter.<br />

Dit is ‘n edel doel as ons:<br />

- bydra tot sosio-ekonomiese lewenskwaliteit<br />

- die omgewing in ag neem<br />

- omstandighede skep vir mense om sukses te<br />

behaal en<br />

- innoverende en volhoubare besighede bou.<br />

Daar is baie potensiaal in die landbousektor wat<br />

ontwikkel en ontgin kan word om werk te skep en<br />

armoede te verlig. Omdat 70% van Namibië se<br />

bevolking direk of indirek afhanklik is van landbou vir<br />

hul voortbestaan, moet die sektor erkenning en<br />

ondersteuning kry. On- en onderontwikkelde gebiede<br />

behoort ‘n prioriteit te wees, geïntegreerde landelike<br />

ontwikkelingsprogramme moet implementeer word,<br />

natuurlike hulpbronne moet volhoubaar benut word en<br />

sekerheid oor grondeienaarskap en regte moet<br />

uitgeklaar word. Veiligheid en sekuriteit is ‘n<br />

voorvereiste vir vrede en stabiliteit en skep vertroue<br />

by potensiële beleggers om te investeer. Die<br />

Namibiese regering het ‘n groot verantwoordelikheid<br />

om deursigtige beleggingsbeleide te voorsien en ‘n<br />

goed gereguleerde omgewing te skep waarbinne die<br />

privaatsektor besigheid kan doen.<br />

5

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

<strong>Report</strong> of the chairman<br />

<strong>Agra</strong> converts to a public company on 1 February 2013.<br />

<strong>Agra</strong> will continue to invest in the Namibian Agriculture<br />

sector and will also continue its efforts to improve the<br />

knowledge and skills in the various agricultural<br />

disciplines by providing training, assistance and support<br />

through our Professional Services Division and our<br />

support of agricultural projects and initiatives.<br />

The opening of the Oshivelo retail branch on 3 August<br />

<strong>2012</strong> was a huge milestone in the history of <strong>Agra</strong>. This<br />

shows <strong>Agra</strong>’s confidence of investing into the rural<br />

areas of Namibia and its endeavours to create<br />

opportunities for the community to benefit from both the<br />

availability of products as well as advice and expertise<br />

regarding the optimal use of the various products.<br />

<strong>Agra</strong> is an important partner in the Namibian economy<br />

to create employment, offer training, support projects<br />

and provide products and services to clients in order to<br />

create prosperity.<br />

We are however aware that agriculture is of a cyclic<br />

nature due to the climate, prices and input costs. Our<br />

producers must, in the good years such as the past<br />

number of year, make provision for the more difficult<br />

times. <strong>Agra</strong> must position itself strategically for this.<br />

Thank you very much to my co-directors and members<br />

of the supervisory committee for your sincerity and<br />

dedication to make <strong>Agra</strong> a successful business. Thank<br />

you to all loyal clients who conducted business with<br />

<strong>Agra</strong>.<br />

The board of directors takes pride in the financial<br />

results of the past year. It was a challenging budget,<br />

which could only have been achieved as a result of a<br />

motivated and focused team. I would like to<br />

congratulate Mr. Peter Kazmaier, Chief Executive<br />

Officer, the management team and staff of <strong>Agra</strong>, with<br />

the excellent financial results. We are proud of the<br />

contribution of each employee to the success of <strong>Agra</strong>.<br />

R VAN DER MERWE<br />

CHAIRMAN OF THE BOARD OF DIRECTORS<br />

(VOORSITTER VAN DIE RAAD VAN DIREKTEURE)<br />

<strong>Agra</strong> omskep op 1 Februarie 2013 in ‘n openbare<br />

maatskappy. <strong>Agra</strong> sal voortgaan om in die Namibiese<br />

landbousektor te belê en ons sal ook ons pogings<br />

voortsit om die kennis en vaardighede van verskeie<br />

landboudissiplines te verbeter deur opleiding, leiding<br />

en ondersteuning te verskaf deur middel van ons<br />

Professionele Dienste Afdeling en ons ondersteuning<br />

aan landbouprojekte en inisiatiewe<br />

Die opening van Oshivelo handelstak op 3 Augustus<br />

<strong>2012</strong> is a groot mylpaal in die geskiedenis van <strong>Agra</strong>.<br />

Dit is ‘n bewys van <strong>Agra</strong> se vertroue om in die<br />

landelike gebiede van Namibië te belê en <strong>Agra</strong> se<br />

pogings om geleenthede te skep vir gemeenskappe<br />

om toegang te hê tot produkte sowel as raad en<br />

kundigheid vir die optimale gebruik van die<br />

onderskeie produkte.<br />

<strong>Agra</strong> is ‘n belangrike vennoot in die namibiese<br />

ekonomie om werk te skep, opleiding te verskaf,<br />

projekte te ondersteun en ‘n diens en produkte te<br />

verskaf aan kliënte om sodoende welvaart te skep.<br />

Ons is egter bewus dat landbou as gevolg van die<br />

klimaat, pryse en insetkostes, siklies van aard is. Ons<br />

produsente moet in goeie jare soos die afgelope paar<br />

jaar, voorsiening maak vir moeiliker tye. <strong>Agra</strong> moet<br />

homself hiervoor strategies posisioneer.<br />

Baie dankie aan die mededirekteure en lede van die<br />

toesighoudende komitee vir die toegewydheid en erns<br />

om van <strong>Agra</strong> ‘n suksesvolle besigheid te maak.<br />

Dankie aan lojale kliente wat met <strong>Agra</strong> besigheid<br />

gedoen het.<br />

Die direksie is trots op die afgelope jaar se finansiële<br />

resultate.Dit was ‘n uitdagende begroting wat slegs<br />

bereik kon word deur ‘n gemotiveerde span wat<br />

gefokus is. Ek wil namens die direksie vir mnr. Peter<br />

Kazmaier, Hoof Uitvoerende Beampte, die<br />

bestuurspan en personeel gelukwens met die puik<br />

finansiële resultate. Ons is trots op die bydrae van<br />

elke werknemer tot <strong>Agra</strong> se sukses.<br />

6

<strong>Report</strong> of the Chief Executive Officer<br />

INTRODUCTION<br />

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

This will be the last report of the Chief Executive Officer<br />

of <strong>Agra</strong> Co-operative, seeing that conversion into a<br />

public company will take place on 1 February 2013.<br />

With great pride and gratitude we therefore report that<br />

<strong>Agra</strong> has once again experienced good growth and<br />

improved results.<br />

Group turnover grew by 13,6% in the Retail division.<br />

This exciting growth was achieved against fierce<br />

competition from South African based companies. Our<br />

thanks go to our motivated staff who delivered great<br />

service, and to our loyal customers who made this<br />

possible. In the Livestock division turnover declined by<br />

14.9%, mostly as a result of a lower number of cattle<br />

marketed.<br />

Total gross group turnover increased by 3% to N$1,83<br />

billion.<br />

FINANCIAL OVERVIEW<br />

It is once again a pleasure to report on remarkable<br />

results achieved. Net turnover for the group increased<br />

by 13% from N$953 million in 2011 to N$1,073 million<br />

in <strong>2012</strong>. Net profit before tax for the group improved by<br />

22% from N$36,3 million in 2011 to N$44,4 million in<br />

<strong>2012</strong>. Net profit after tax for the group improved by<br />

28% from N$24,5 million in 2011 to N$31,4 million in<br />

<strong>2012</strong>. No dividend has been declared due to the fact<br />

that various capital expenditure projects are envisaged<br />

for the <strong>2012</strong>/2013 financial year and beyond. Some of<br />

these projects will be financed from own resources.<br />

Total equity now amounts to N$134 million.<br />

<strong>Report</strong> of the Chief Executive Officer<br />

Verslag van die Hoof Uitvoerende Beampte<br />

INLEIDING<br />

Hierdie sal die laaste verslag van die Hoof<br />

Uitvoerende Beampte van <strong>Agra</strong> Koöperatief wees,<br />

gesien die omskepping na ‘n openbare maatskappy<br />

op 1 Februarie 2013. Dit is dus met groot trots en<br />

dankbaarheid dat ons rapporteer dat <strong>Agra</strong> weer eens<br />

goeie groei getoon het en verbeterde resultate behaal<br />

het.<br />

Die groepomset in die handelsafdeling het met 13,6%<br />

gegroei. Hierdie opwindende groei is bereik ondanks<br />

sterk kompetisie van Suid-Afrikaans gebaseerde<br />

maatskappye. Ons dank gaan aan ons gemotiveerde<br />

personeel wat uitstaande diens gelewer het en aan<br />

ons lojale kliënte wat dit moontlik gemaak het. In die<br />

lewende hawe afdeling het omset verminder met<br />

14,9%, hoofsaaklik as gevolg van ‘n laer getal beeste<br />

wat bemark is.<br />

Totale bruto omset vir die groep het met 3%<br />

toegeneem tot N$1,83 biljoen.<br />

FINANSIËLE OORSIG<br />

Dit is weer eens ‘n plesier om te kan verslag gee oor<br />

merkwaardige resultate wat behaal is. Netto omset vir<br />

die groep het met 13% toegeneem, van N$953<br />

miljoen in 2011 tot N$1,073 miljoen in <strong>2012</strong>. Netto<br />

wins voor belasting vir die groep het verbeter met<br />

22%, van N$36,3 miljoen in 2011 tot N$44,4 miljoen<br />

in <strong>2012</strong>. Netto wins na belasting vir die groep het<br />

verbeter met 28%, van N$24,5 miljoen in 2011 tot<br />

N$31,4miljoen in <strong>2012</strong>. Geen dividende is verklaar nie<br />

vanweë die feit dat verskeie kapitaalprojekte in die<br />

vooruitsig gestel is vir die <strong>2012</strong>/2013 finansiële jaar<br />

en daarna. Sommige van hierdie projekte sal uit eie<br />

bronne finansier word.<br />

Totale ekwiteit beloop tans N$134 miljoen.<br />

7

1. LIVESTOCK DIVISION<br />

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

The number of animals marketed during the 2011/12<br />

year were as follows:<br />

Average prices per head achieved in the various<br />

categories were as follows:<br />

<strong>2012</strong><br />

N$/Head<br />

<strong>Report</strong> of the Chief Executive Officer<br />

2011<br />

N$/Head<br />

1. LEWENDE HAWE AFDELING<br />

Die aantal diere wat bemark is gedurende die<br />

2011/12 jaar was soos volg:<br />

Gemiddelde pryse per kop behaal in die verskeie<br />

kategorieë was soos volg:<br />

% verandering<br />

Cattle 4,947 4,099 20,7% Beeste<br />

Sheep 710 630 12,7% Skape<br />

Goat 711 686 3,6% Bokke<br />

Game 7,402 7,059 4,9% Wild<br />

Total gross N$ turnover achieved for the various<br />

categories was as follows:<br />

<strong>2012</strong><br />

N$<br />

(million)<br />

2011<br />

N$<br />

(million)<br />

Totale N$ omset vir die verskillende kategorieë was<br />

soos volg:<br />

% verandering<br />

Cattle 527,4 619,1 (14,8%) Beeste<br />

Sheep 129,6 121,8 6,4% Skape<br />

Goat 51,9 63,6 (18,4%) Bokke<br />

Game 13,5 4,7 185,1% Wild<br />

Total 722,4 809,2 -10,7% Totaal<br />

Net turnover achieved for the livestock division<br />

amounted to N$39,1 million compared to N$43,6<br />

million in 2011, a decrease of 10,3%.<br />

1.1 Overall Livestock Division<br />

Livestock marketing and selling remains a huge credit<br />

risk for the organisation due to the informal way in<br />

which this industry operates. Provision for bad debts<br />

for the year under review totalled N$2,5 million.<br />

Much stricter controls have been implemented toward<br />

the end of the financial year in order to manage the<br />

credit risk.<br />

<strong>2012</strong><br />

Heads<br />

2011<br />

Heads<br />

% verandering<br />

Cattle 106,603 151,037 (29,4%) Beeste<br />

Sheep 182,650 193,328 (5,5%) Skape<br />

Goat 73,045 92,611 (21,1%) Bokke<br />

Game 1,830 660 177,3% Wild<br />

Netto omset behaal in die lewende hawe afdeling,<br />

het N$39,1 miljoen beloop vergeleke met N$43,6<br />

miljoen in 2011, ‘n daling van 10,3%<br />

1.1 Algehele lewende hawe afdeling<br />

Lewende hawe bemarking en verkope bly ‘n groot<br />

kredietrisiko vir die organisasie as gevolg van die<br />

informele manier waarop die industrie werk.<br />

Voorsiening vir slegte skulde vir die jaar onder oorsig<br />

beloop N$2,5 miljoen. Baie strenger<br />

beheermaatreëls is geimplementeer teen die einde<br />

van die finansiële jaar om die kredietrisiko te beheer.<br />

8

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

Notwithstanding the fact that turnover decreased by<br />

10,7% the net profit before head office costs for this<br />

division improved dramatically from N$2,6 million in<br />

2011 to N$9,2 million in <strong>2012</strong>. This is mostly as a<br />

result of lower costs incurred for livestock agents in<br />

the Central Region.<br />

1.2 Swakara<br />

Pelt quantities sold at the two auctions in<br />

Copenhagen during September 2011 and April <strong>2012</strong><br />

amounted to 114,618 pelts, which reflects a decrease<br />

of 8% compared to 124,261 pelts sold during the year<br />

ending July 2011.<br />

Unit prices per pelt increased from an average of<br />

N$422.37 in the previous financial period to N$594.95<br />

in <strong>2012</strong>, an increase of 41%, mainly as a result of the<br />

demand for white Swakara pelts. The average price<br />

of white pelts amounted to N$763.29 with the highest<br />

price at N$2,348.55.<br />

2. RETAIL AND WHOLESALE DIVISION<br />

This division comprises the <strong>Agra</strong> retail branches,<br />

Auas Wholesalers, Auas Vet Med and Safari Den.<br />

We are proud to report an improvement in turnover<br />

from N$872,7 million in 2011 to N$991,1 million in<br />

<strong>2012</strong>, an increase of 13,6%.<br />

At the same time gross profit increased from N$107,4<br />

million in 2011 to N$121,8 million in <strong>2012</strong> (13,4%).<br />

Operational expenses increased from N$79,1 million<br />

in 2011 to N$87,4 million in <strong>2012</strong>, an increase of<br />

10,5%.<br />

As a result the net operating surplus before head<br />

office expenses increased from N$49,3 million in<br />

2011 to N$58,2 million in <strong>2012</strong>, a percentage<br />

improvement of 18%.<br />

<strong>Report</strong> of the Chief Executive Officer<br />

Nieteenstaande die feit dat die omset verminder het<br />

met 10,7%, het die netto wins vir hierdie afdeling,<br />

voor hoofkantoorkostes, dramaties verhoog van<br />

N$2,6 miljoen in 2011 tot N$9,2 miljoen in <strong>2012</strong>. Dit<br />

is hoofsaaklik as gevolg van laer onkostes vir agente<br />

in die Sentraalstreek.<br />

1.2 Swakara<br />

‘n Totaal van 114,618 pelse is by die twee veilings in<br />

Kopenhagen gedurende September 2011 en April<br />

<strong>2012</strong> verkoop, wat ‘n afname van 8% is in<br />

vergelyking met die 124,261 pelse wat gedurende<br />

die jaar geëindig Julie 2011 verkoop is.<br />

Eenheidspryse per pels het gestyg vanaf ‘n<br />

gemiddeld van N$422.37 in die vorige finansiële<br />

periode tot N$594.95 in <strong>2012</strong>, ‘n styging van 41%,<br />

hoofsaaklik as gevolg van die hoë vraag na wit<br />

Swakara pelse. Die gemiddelde prys vir wit pelse<br />

was N$763.29 en die hoogste prys N$2,348.55.<br />

2. KLEIN- EN GROOTHANDELSAFDELING<br />

Hierdie afdeling bestaan uit die <strong>Agra</strong><br />

kleinhandelstakke, Auas Wholesalers, Auas Vet<br />

Med en Safari Den.<br />

Ons is trots om te rapporteer dat die omset<br />

verbeter het vanaf N$872,7 miljoen in 2011 tot<br />

N$991,1 miljoen in <strong>2012</strong>, ‘n verhoging van 13,6%.<br />

Terselftertyd het bruto winste toegeneem vanaf<br />

N$107,4 miljoen in 2011 tot N$121,8 miljoen in<br />

<strong>2012</strong> (13,4%).<br />

Operasionele uitgawes het toegeneem vanaf<br />

N$79,1 miljoen in 2011 tot N$87,4 miljoen in <strong>2012</strong>,<br />

‘n verhoging van 10,5%.<br />

Die netto bedryfssurplus het dienooreenkomstig<br />

toegeneem vanaf N$49,3 miljoen in 2011 tot<br />

N$58,2 miljoen in <strong>2012</strong>, ‘n persentasieverbetering<br />

van 18%.<br />

9

3. PROPERTY DIVISION<br />

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

Gross income declined from N$24,6 million in 2011 to<br />

N$19,6 million in the year under review.<br />

The major reason for this decline is the fact that in<br />

2011 a fair value adjustment of N$3.7 million was<br />

included in the gross income for that year.<br />

It is important to mention that the Auas Valley<br />

Shopping Mall complex in Windhoek was fully let for<br />

the full period. A number of vacancies existed in the<br />

rural areas.<br />

Total expenses for the division increased from<br />

N$10,1 million in 2011 to N$11,5 million in <strong>2012</strong>, an<br />

increase of 11,8%.<br />

The operating surplus thus decreased from N$14,5<br />

million in 2011 to N$8,1 million in <strong>2012</strong>.<br />

4. PROFESSIONAL SERVICES (PSD)<br />

This division was established in 2009 as an integral<br />

part of <strong>Agra</strong>, with the aim of growing <strong>Agra</strong>’s market by<br />

being the prime provider of professional support<br />

services to the agricultural sector in Namibia.<br />

PSD has been focusing on four objectives namely:<br />

(i) to enhance the competence, knowledge, skills<br />

and attitudes of farmers, <strong>Agra</strong> staff and others<br />

related to agriculture<br />

(ii) to position PSD in the sector in such a way that<br />

it is visible, recognized, accepted and relevant<br />

(iii) to conduct consultancy services in order to<br />

generate income, focusing on donor/<br />

government funded development projects and<br />

(iv) to render support to the Swakara industry.<br />

<strong>Report</strong> of the Chief Executive Officer<br />

3. EIENDOMSAFDELING<br />

Bruto inkomste vir hierdie afdeling beloop N$19,6<br />

miljoen in vergelyking met N$24,6 miljoen in 2011<br />

(‘n daling van 20%).<br />

Die bruto inkomste van 2011 sluit egter ‘n billike<br />

waarde aanpassing op beleggingseiendomme in<br />

van N$3,7 miljoen.<br />

Dit is ook belangrik om te wys daarop dat die Auas<br />

Valley inkoopsentrum ten volle verhuur was<br />

gedurende die finansiële jaar. In die platteland was<br />

‘n aantal eiendomme vakant.<br />

Die totale uitgawes van hierdie afdeling het ‘n<br />

styging getoon van 11,8%, vanaf N$10.1 miljoen in<br />

2011 tot N$11,5 miljoen in <strong>2012</strong>.<br />

Die bedryfsurplus het gedaal vanaf N$14,5 miljoen<br />

in 2011 tot N$8,1 miljoen in <strong>2012</strong>.<br />

4. PROFESSIONELE DIENSTE (PSD)<br />

Hierdie afdeling is in 2009 daargestel as ‘n<br />

integrale deel van <strong>Agra</strong>, met die doel om <strong>Agra</strong> se<br />

mark te groei deur die vernaamste voorsiener van<br />

professionele onder-steuningsdienste aan die<br />

landbousektor in Namibië te wees.<br />

PSD fokus op vier doelwitte naamlik:<br />

(i) om die bevoegdheid, kennis, vaardighede en<br />

gesindheid van boere, <strong>Agra</strong> personeel en<br />

ander landboubelanghebbendes, te verbeter.<br />

(ii) om PSD so te posisioneer in die sektor dat dit<br />

sigbaar, gereken, aanvaar en relevant is<br />

(iii) om konsultasiedienste te verrig om sodoende<br />

‘n inkomste te genereer, gefokus op skenker/<br />

regeringbefondste projekte en<br />

(iv) om ondersteuning te verleen aan die Swakara<br />

industrie<br />

10

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

This division continued to grow its activities during the<br />

year under review in all subdivisions (consultancies,<br />

training, research, Swakara services and networking)<br />

managing to conclude the year by reducing the<br />

budgeted year to date loss of N$910 000 by N$<br />

241 000 to end at a net loss figure of N$669 000.<br />

5. SUBSIDIARIES AND OTHER INVESTMENTS<br />

5.1 Ondangwa Service station (Pty) Ltd<br />

The turnover of this company, in which <strong>Agra</strong> holds<br />

70% of the issued share capital, increased from<br />

N$35,5 million to N$41,3 million (16,3%).<br />

The attributable profit after tax decreased from<br />

N$394,274 in 2011 to N$264,223 in <strong>2012</strong>.<br />

5.2 <strong>Agra</strong> Properties (Pty) Ltd<br />

The company, in which <strong>Agra</strong> holds 100% of the<br />

issued share capital, was established during<br />

September 2010<br />

The gross income of this company increased from<br />

N$71,334 in 2011 to N$489,406 in <strong>2012</strong>.<br />

The attributable profit after tax increased from<br />

N$24,488 in 2011 to N$240,020 in <strong>2012</strong><br />

5.3 Hartlief Corporation Ltd<br />

<strong>Agra</strong> holds 11% of the shares in this company.<br />

Dividends of N$89,439 were received during the year<br />

under review.<br />

5.4 <strong>Agra</strong> Oshivelo Retail (Pty) Ltd<br />

The company, in which <strong>Agra</strong> holds 84% of the issued<br />

share capital, was established during February 2011.<br />

The company has not traded for the period ending 31<br />

July <strong>2012</strong>.<br />

<strong>Report</strong> of the Chief Executive Officer<br />

Hierdie afdeling se aktiwiteite het in al hul<br />

onderafdelings (konsultasies, opleiding, navorsing,<br />

Swakaradienste- en skakeling) deurlopend<br />

toegeneem gedurende die jaar in oënskou, en kon<br />

daarin slaag om die jaar af te sluit deur die jaar-tot-<br />

datum verlies van N$910 000 wat begroot is, met<br />

N$241 000 te verminder tot ‘n verliessyfer van<br />

N$669 000.<br />

5. FILIALE EN ANDER BELEGGINGS<br />

5.1 Ondangwa Diensstasie (Edms) Bpk<br />

Hierdie maatskappy, waarin <strong>Agra</strong> 70% van die<br />

uitgereikte aandele hou, se omset het gestyg vanaf<br />

N$35,5 miljoen na N$41,3 miljoen (16,3%)<br />

Die toedeelbare wins na belasting het gedaal van<br />

N$394,274 in 2011 tot N$264,223 in <strong>2012</strong>.<br />

5.2 <strong>Agra</strong> Eiendomme (Edms) Bpk<br />

Hierdie maatskappy, waarin <strong>Agra</strong> 100% van die<br />

uitgereikte aandele hou, is gestig in September<br />

2010.<br />

Die bruto inkomste van die maatskappy het gestyg<br />

van N$71,334 in 2011 tot N$489,406 in <strong>2012</strong>.<br />

Die toedeelbare wins na belasting het toegeneem<br />

van N$24,488 in 2011 tot N$240,020 in <strong>2012</strong>.<br />

5.3 Hartlief Korporasie Bpk<br />

<strong>Agra</strong> hou 11% van die aandele in hierdie<br />

maatskappy. Dividende ter waarde van N$89,439<br />

is ontvang gedurende die oorsigjaar.<br />

5.4 <strong>Agra</strong> Oshivelo Handel (Edms) Bpk<br />

Hierdie maatskappy, waarin <strong>Agra</strong> 84% van die<br />

uitgereikte aandele hou, is gestig in Februarie<br />

2011.<br />

Die maatskappy het tot en met 31 Julie <strong>2012</strong> nog<br />

geen handel gedryf nie.<br />

11

6. FINANCIAL RESULTS<br />

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

Gross profits increased by 8,3% for the group and by<br />

8,2% for the co-operative to N$185,5 million and<br />

N$182,6 million respectively.<br />

The <strong>Agra</strong> group achieved an increase of 22% in net<br />

profit before tax and distribution to members, of<br />

N$44,4 million (2011: N$36,3 million) and the co-<br />

operative an increase of 28% in net profit of N$43,9<br />

million (2011: N$34,2 million).<br />

6.1 Other income<br />

Increased by N$9,2 million as a result of:<br />

<strong>Report</strong> of the Chief Executive Officer<br />

(Decrease)/Increase<br />

<strong>2012</strong><br />

N$<br />

(million)<br />

2011<br />

N$<br />

(million)<br />

6. FINANSIELE RESULTATE<br />

Brutowinste het met 8,3% vir die groep en met<br />

8,2% vir die koöperasie toegeneem tot N$185,5<br />

miljoen en N$182,6 miljoen onderskeidelik.<br />

Die <strong>Agra</strong> groep het ‘n nettowins voor belasting en<br />

toedeling aan lede, van N$44,4 miljoen (2011:<br />

N$36,3 miljoen) behaal en die koöperasie ‘n netto<br />

wins van N$43,9 miljoen (2011: N$34,2 miljoen).<br />

6.1 Ander inkomste<br />

‘n Styging van N$9,2 miljoen as gevolg van:<br />

Difference<br />

Members loan adjustments 0,0 (0,9) 0,9 Ledefondse aanpassings<br />

Fair value adjustment on<br />

properties 0,0 3,7 (3,7)<br />

Fair value adjustment on<br />

financial assets 8,0 0,0 8,0<br />

Billike waarde aanpassing op<br />

eiendomme<br />

Billike waarde aanpassing op<br />

finansiele bates<br />

Rent received 8,3 7,5 0,8 Huur ontvang<br />

Interest received 5,3 4,5 0,8 Rente ontvang<br />

Bad debts recovered 1,3 1,2 0,1 Slegte skulde verhaal<br />

Other income 12,9 10,6 2,3 Ander inkomste<br />

6.2 Selling and marketing expenses<br />

Group selling and marketing expenses decreased<br />

by 12% (2011: an increase of 16%).<br />

6.3 Administrative Expenses<br />

Administration costs which consists mainly of<br />

computer, printing and administrative costs,<br />

increased by 14% (2011: 14%).<br />

6.4 Income tax<br />

The income tax charges amount to N$13,0 million<br />

for the group (2011: N$11,7 million) and N$12,4<br />

million for the co-operative (2011: N$11,1 million).<br />

35,8 26,6 9,2<br />

6.2 Verkoops- en bemarkingskoste<br />

Die groep se verkoops- en bemarkingskostes het<br />

afgeneem met 12% (2011: ’n toename van 16%).<br />

6.3 Administratiewe uitgawes<br />

Administratiewe uitgawes wat meestal bestaan uit<br />

rekenaar-, drukwerk- en administratiewe koste het<br />

gestyg met 14% (2011: 14%).<br />

6.4 Inkomstebelasting<br />

Die inkomstebelastingkoste beloop N$13,0 miljoen<br />

vir die groep (2011: N$11,7 miljoen) en N$12,4<br />

miljoen vir die koöperasie (2011: N$11,1 miljoen).<br />

12

6.5 Declaration of bonuses to members<br />

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

In accordance with the decision taken by the board<br />

of directors in November 2009, the full amount of<br />

net profit after tax is to be retained as part of the<br />

reserves which will be transferred to the public<br />

company “<strong>Agra</strong> Limited”, during the conversion<br />

process.<br />

7. CONSOLIDATED BALANCE SHEET<br />

7.1 Assets<br />

7.1.1 Property, plant and equipment<br />

The net value of property, plant and equipment for<br />

the group increased by N$9,8 million as a result of:<br />

Additions to land and buildings:<br />

Auas Valley shopping mall<br />

Oshivelo branch<br />

Okahandja auction pens<br />

Otjiwarongo branch<br />

Keetmanshoop branch<br />

Other retail branches<br />

Tsumeb branch<br />

Additions to vehicles<br />

Additions to operational equipment (shelving)<br />

Less depreciation charges<br />

Net additions<br />

7.1.2 Investment properties<br />

The value of investment properties increased by<br />

N$0,04 million to N$15,14 million (2011 N$15,1<br />

million.)<br />

<strong>Report</strong> of the Chief Executive Officer<br />

<strong>2012</strong><br />

N$<br />

6.5 Verklaring van bonusse aan lede<br />

Volgens die besluit van die raad van direkteure in<br />

November 2009, is die volle bedrag van nettowins<br />

na belasting, behou as deel van reserwes en sal<br />

oorgedra word na die openbare maatskappy “<strong>Agra</strong><br />

Beperk”, wanneer die omskeppingsproses<br />

afgehandel is.<br />

(million) Auas Valley inkoopsentrum<br />

0,2<br />

3,9<br />

0,5<br />

1,0<br />

0,2<br />

0,3<br />

0,2<br />

6,3<br />

1,5<br />

4,6<br />

(2,6)<br />

9,8<br />

7. GEKONSOLIDEERDE BALANSSTAAT<br />

7.1 Bates<br />

7.1.1 Eiendom, aanleg en toerusting<br />

Die netto waarde van die eiendom, aanleg en<br />

toerusting vir die groep het toegeneem met N$9,8<br />

miljoen as gevolg van:<br />

Toevoegings tot grond en geboue:<br />

Oshivelo tak<br />

Okahandja veilingskrale<br />

Otjiwarongo tak<br />

Keetmanshoop tak<br />

Ander handelstakke<br />

Tsumeb tak<br />

Toevoeging tot voertuie<br />

Toevoegings tot operasionele toerusting (rakke)<br />

Minus waardeverminderingskostes<br />

Netto toevoegings<br />

7.1.2 Beleggingseiendomme<br />

Die waarde van beleggingseiendomme het<br />

verhoog met N$0,04 miljoen na N$15,14 miljoen<br />

(2011 N$15,1 miljoen).<br />

13

7.1.3 Current assets<br />

Inventories:<br />

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

Stock on hand increased by N$23,1 million for the<br />

group and N$22,9 million for the co-operative in line<br />

with increased turnover figures and improved stock<br />

availability.<br />

Trade and other receivables:<br />

Trade and other receivables decreased by N$15,1<br />

million for the group and N$15,1 million for the co-<br />

operative due to an improvement in credit control<br />

mechanisms.<br />

7.2 Equity<br />

The group’s debt to equity ratio at 13% compared<br />

to 24% for the previous year reflects a great<br />

improvement on last year. Cognisance must be<br />

taken of the envisaged Capital Expenditure for the<br />

new year which will have a major influence on this<br />

Ratio.<br />

7.3 Cash Flow<br />

The <strong>Agra</strong> group reports a negative cash flow for<br />

<strong>2012</strong> of N$2,5 million, compared to a positive cash<br />

flow in 2011 of N$11,7 million. This is mainly as a<br />

result of an increased investment in inventories of<br />

N$23 million, an additional investment in Hartlief of<br />

N$4 million and a prepayment on the Lafrenz<br />

property of N$3,6 million made during the year.<br />

<strong>Report</strong> of the Chief Executive Officer<br />

7.1.3 Bedryfsbates<br />

Voorraad:<br />

Voorraad het toegeneem met N$23,1 miljoen vir<br />

die groep en met N$22,9 miljoen vir die<br />

koöperasie in ooreenstemming met verhoogde<br />

omsetsyfers en verbeterde voorraad op hande.<br />

Handelsrekeninge ontvangbaar:<br />

Die afname in handelsrekeninge ontvangbaar met<br />

N$15,1 miljoen vir die groep en N$15,1 miljoen vir<br />

die koöperasie was grootliks weens ‘n verbetering<br />

in die terugbetaling van debiteure voor jaareinde<br />

en die afname in omset van die lewende hawe<br />

afdeling vir die jaar.<br />

7.2 Ekwiteit<br />

Die groep se skuld tot ekwiteitsverhouding is 13%<br />

vergeleke met 24% die vorige jaar. Dit is ‘n<br />

verbetering op die vorige jaar. Die voorgenome<br />

kapitaaluitgawe vir die nuwe jaar moet in ag<br />

geneem word aangesien dit ‘n groot invloed het op<br />

hierdie verhouding.<br />

7.3 Kontantvloei<br />

Die <strong>Agra</strong> groep rapporteer ‘n negatiewe<br />

kontantvloei vir <strong>2012</strong> van N$2,5 miljoen, in<br />

vergelyking met ‘n positiewe kontantvloei in 2011<br />

van N$11,7 miljoen. Dit is hoofsaaklik as gevolg<br />

van verhoogde investering in voorraad van N$23<br />

miljoen, ‘n addisionele belegging van N$4 miljoen<br />

in Hartlief en ‘n vooruitbetaling van N$3,6 miljoen<br />

op die Lafrenz eiendom gedurende die jaar.<br />

14

8. FUTURE OUTLOOK<br />

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

The most important issue facing us in the near<br />

future is the conversion of <strong>Agra</strong> Cooperative Limited<br />

into a public company on 1 February 2013.<br />

Challenges are the physical handover of the share<br />

certificates to each and every <strong>Agra</strong> member who<br />

will be a shareholder of <strong>Agra</strong> Limited as from the<br />

date of conversion, as well as putting processes<br />

into place to identify those members whose address<br />

and other details have changed without informing<br />

<strong>Agra</strong>.<br />

The balance sheet of <strong>Agra</strong> will be strengthened<br />

considerably from a shareholders base of<br />

N$403 000 in <strong>Agra</strong> Cooperative Limited to N$102<br />

million in <strong>Agra</strong> Limited.<br />

It is also very important to realise that the net asset<br />

value of one <strong>Agra</strong> share has improved from an<br />

amount of N$1.17 in 2009 to N$1.70 at 31 July<br />

<strong>2012</strong>.<br />

Due to the very satisfactory growth of <strong>Agra</strong>’s<br />

operations in all divisions, it has become necessary<br />

to enlarge and upgrade most of our facilities, as<br />

most of our branches have outgrown their current<br />

available space. This means that major investments<br />

need to be initiated to ensure that our customer<br />

service and customer satisfaction is maintained and<br />

improved.<br />

The first of such major investments has been made<br />

as a consequence of the Windhoek branch having<br />

outgrown its existing facilities in the Auas Valley<br />

Shopping Mall. The fact that no more land could be<br />

acquired at acceptable costs, led to the decision to<br />

relocate the Windhoek branch to the Lafrenz<br />

extension in the North of Windhoek. <strong>Agra</strong> has<br />

purchased four erven, which will be consolidated<br />

and a brand new structure will be erected with<br />

adequate expansion possibilities and a design<br />

which will ensure a much improved service to all<br />

our customers. The completion date is expected to<br />

be November 2013.<br />

<strong>Report</strong> of the Chief Executive Officer<br />

8. TOEKOMSVERWAGTINGE<br />

Die belangrikste aangeleentheid wat in die nabye<br />

toekoms voorlê, is die omskepping van <strong>Agra</strong><br />

Koöperatief in ‘n openbare maatskappy op 1<br />

Februarie 2013. Uitdagings sluit in die fisiese<br />

oorhandiging van die aandelesertifikate aan elke<br />

enkele <strong>Agra</strong> lid wat ‘n aandeelhouer van <strong>Agra</strong><br />

Beperk sal wees vanaf die datum van omskepping,<br />

sowel as om prosesse daar te stel om die lede op<br />

te spoor wie se addresse en ander besonderhede<br />

verander het sonder dat <strong>Agra</strong> ingelig is.<br />

Die balansstaat van <strong>Agra</strong> sal aansienlik versterk<br />

word van ‘n aandeelhouersbasis van N$403 000 in<br />

<strong>Agra</strong> Koöperatief Beperk tot N$102 miljoen in <strong>Agra</strong><br />

Beperk.<br />

Dit is ook baie belangrik om te besef dat die netto<br />

bate waarde van een <strong>Agra</strong>-aandeel verbeter het<br />

van ‘n bedrag van N$1.17 in 2009 tot N$1.70 op 31<br />

Julie <strong>2012</strong>.<br />

Die bevredigende groei in <strong>Agra</strong> se bedrywe in alle<br />

afdelings, het dit genoodsaak om die meeste van<br />

ons fasiliteite te vergroot en te verbeter, aangesien<br />

die meeste van ons takke uit hul huidige<br />

beskikbare spasie gegroei het. Dit beteken dat<br />

grootskaalse beleggings geinisieer moet word om<br />

kliëntetevredenheid te handhaaf en te verbeter.<br />

Die eerste van hierdie groot beleggings is reeds<br />

geoden as gevolg van die feit dat die Windhoek-tak<br />

uit sy bestaande fasiliteite in die Auas Valley<br />

Inkoopsentrum gegroei het. Die feit dat geen grond<br />

verkry kon word teen aanvaarbare kostes nie, het<br />

gelei tot die besluit om die Windhoek-tak te verskuif<br />

na die Lafrenz uitbreiding in die noorde van<br />

Windhoek. <strong>Agra</strong> het vier erwe gekoop wat<br />

saamgevoeg sal word en ‘n nuwe struktuur sal<br />

opgerig word met voldoende uitbreidings-<br />

moontlikhede en ‘n uitleg wat ‘n baie beter diens<br />

aan al ons kliënte moontlik maak. Die verwagte<br />

voltooiingsdatum is November 2013.<br />

15

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

<strong>Agra</strong> is and will remain an agriculturally oriented<br />

organisation, which also means that it is very<br />

susceptible to changing climate conditions and its<br />

effect on the agricultural producer of Namibia.<br />

Weather patterns change each year and cycles of<br />

good rainfall and good producer prices, are followed<br />

by drier periods with lower producer prices. It has<br />

been <strong>Agra</strong>’s strategy for the last twelve years to<br />

diversify some of its business interests in non-<br />

agricultural investments, so as to counteract the<br />

agricultural cycles with steady income streams not<br />

dependant on the weather conditions.<br />

The upgrading project of the Auas Valley Shopping<br />

Mall in 1999 was one of those non-agricultural<br />

Investments which ensured a steady income for<br />

<strong>Agra</strong> over the last 12 years. It has now once again<br />

become necessary to embark on a major upgrading<br />

exercise for the Auas Valley Shopping Mall, so as<br />

to retain our current anchor tenants and to ensure<br />

the future existence of the mall.<br />

This major upgrade will add about 10 500 square<br />

meters of trading space. In addition it is envisaged<br />

to build a brand new six-storey office block to<br />

accommodate some of our existing tenants and to<br />

provide up-market office accommodation for new<br />

tenants, who are looking for space outside the city<br />

centre.<br />

<strong>Agra</strong> is currently in the process of obtaining the<br />

necessary funding for this very ambitious project,<br />

which will commence during February/March 2013<br />

9. BUDGETS FOR THE <strong>2012</strong>/2013 YEAR<br />

ENDING 31 JULY 2013<br />

9.1 Capital expenditure budget<br />

Fixed property upgrading and extensions to existing<br />

branches, Auas Valley Shopping mall and the new<br />

branch in the Lafrenz industrial area make up the<br />

bulk of <strong>Agra</strong>’s capital expenditure budget. Below<br />

the summary of the capital expenditure budget:<br />

<strong>Report</strong> of the Chief Executive Officer<br />

<strong>Agra</strong> is en sal ‘n landbougeoriënteerde organisasie<br />

bly, wat ook beteken dat dit baie onderhewig is aan<br />

veranderende klimaatsomstandighede en die effek<br />

daarvan op die landbouprodusent van Namibië.<br />

Weerpatrone verander elke jaar en siklusse van<br />

goeie reënval en goeie produsentepryse word<br />

gevolg deur droër periods met laer<br />

produsentepryse. Dit was <strong>Agra</strong> se strategie vir die<br />

afgelope twaalf jaar om sommige van ons<br />

besigheidsbelange te diversifiseer in nie-landbou<br />

beleggings, om landbousiklusse teen te werk met<br />

inkomstebronne wat nie afhanklik is van die<br />

weersomstandighede nie.<br />

Die opgradering van die Auas Valley<br />

Inkoopsentrum in 1999 was een van die nie-<br />

landboubeleggings wat vir <strong>Agra</strong> oor die afgelope 12<br />

jaar ‘n konstante inkomste ingebring het. Dit het<br />

nou weer eens nodig geword om ‘n grootskaalse<br />

opgraderingspoging vir die Auas Valley<br />

Inkoopsentrum aan te pak, om sodoende ons<br />

huidige ankerhuurders te behou en die<br />

voortbestaan van die sentrum te verseker.<br />

Hierdie grootskaalse opgradering sal ongeveer 10<br />

500 vierkante meter handelspasie byvoeg.<br />

Bykomend word beplan om ‘n splinternuwe ses-<br />

verdieping kantoorblok te bou wat sommige van<br />

ons huidige huurders sal akkommodeer en modern<br />

kantoorakkommodasie beskikbaar sal maak vir<br />

nuwe huurders wat spasie buite die middestad<br />

soek.<br />

<strong>Agra</strong> is tans in die proses om die nodige<br />

befondsing te kry vir hierdie baie ambisieuse projek<br />

wat gedurende Februarie/Maart 2013 sal begin.<br />

9. BEGROTINGS VIR DIE <strong>2012</strong>/2013 JAAR<br />

GEËINDIG 31 JULIE 2013<br />

9.1 Kapitale uitgawe begroting<br />

Die opgradering en uitbreiding van vaste eiendom,<br />

van bestaande takke, Auas Valley Inkoopsentrum<br />

en die nuwe tak in die Lafrenz industriële area,<br />

maak die grootste gedeelte uit van <strong>Agra</strong> se kapitale<br />

uitgawebegroting. Hier volg ‘n opsomming van die<br />

kapitale uitgawebegroting:<br />

16

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

Upgrading and development of fixed property 147,0<br />

<strong>Report</strong> of the Chief Executive Officer<br />

<strong>2012</strong>/2013 2011/<strong>2012</strong><br />

N$ million N$ million<br />

33,0<br />

Opgradering en ontwikkeling<br />

van vaste eiendom<br />

Information technology 1,9 2,5 Inligtingstegnologie<br />

Commercial vehicles 1,9 0,2 Handelsvoertuie<br />

Office furniture and equipment 0,3 0,2 Kantoormeubels en toerusting<br />

Operational assets 9,5 4,7 Operasionele bates<br />

Total 160,6 40,6 Totaal<br />

9.2 Operational budget<br />

The proposed operational budget for the year<br />

<strong>2012</strong>/2013 can be summarised as follows:<br />

Gross value of livestock transactions<br />

Retail/wholesale/division<br />

Professional services<br />

Total turnover<br />

Cost of sales<br />

Gross profit<br />

Other income<br />

Gross income<br />

Less:<br />

<strong>2012</strong>/<br />

2013<br />

N$<br />

Million<br />

667,2<br />

1072,6<br />

70,8<br />

1 810,6<br />

1 630,4<br />

180,2<br />

59,2<br />

239,4<br />

2011/<br />

<strong>2012</strong><br />

N$<br />

Million<br />

958,2<br />

839,7<br />

16,3<br />

1 814,2<br />

1 649,5<br />

164,7<br />

56,4<br />

221,1<br />

9.2 Operasionele begroting<br />

Die voorgestelde operasionele begroting vir die<br />

jaar <strong>2012</strong>/2013 kan soos volg opgesom word:<br />

Change<br />

(30.4)%<br />

27.7%<br />

334.4%<br />

(0.2)%<br />

(1.2)%<br />

9.4%<br />

5.0%<br />

8.3%<br />

Bruto waarde van lewendehawe<br />

transaksies<br />

Klein-/groothandel/afdeling<br />

Professionele dienste<br />

Totale omset<br />

Koste van verkope<br />

Bruto wins<br />

Ander inkomste<br />

Bruto inkomste<br />

Minus:<br />

Inventory costs 6,0 3,4 76.5% Voorraadkoste<br />

Marketing costs 4,9 4,3 14.0% Bemarkingskoste<br />

Selling and distribution cost 14,6 20,8 (29.8)% Verkoop en verspreidingskoste<br />

Building costs 32,0 26,6 20.3% Gebouekoste<br />

Transport costs 12,3 8,8 39.8% Vervoerkoste<br />

Personnel costs 115,1 95,1 21.0% Personeelkoste<br />

Directors costs 1,1 0,9 22.2% Direkteurskoste<br />

Administration costs 24,4 23,6 3.4% Administratiewe koste<br />

Total expenses<br />

210,4<br />

183,5<br />

14.7%<br />

Totale uitgawes<br />

17

Profit before finance charges<br />

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

<strong>Report</strong> of the Chief Executive Officer<br />

29,0<br />

37,6<br />

(22.9)%<br />

Wins voor finansieringskostes<br />

Finance charges 8,1 0,6 1 250.0% Finansieringskostes<br />

Net profit before tax<br />

10. CONCLUSION<br />

20,9<br />

<strong>Agra</strong> has once again been able to report satisfactory<br />

results to its members and shareholders. One of the<br />

highlights of the period under review was the opening<br />

of a fully-fledged <strong>Agra</strong> Branch in Oshivelo, which is<br />

the second <strong>Agra</strong> branch north of Tsumeb, the other<br />

being Opuwo, where a major upgrade is planned for<br />

the next financial year.<br />

The year ahead will once again be full of challenges<br />

but also opportunities. As management and staff of<br />

<strong>Agra</strong> we are prepared to live up to <strong>Agra</strong>’s newly<br />

defined purpose:<br />

Creating Prosperity, improving quality of life<br />

and our Vision 2015:<br />

to be a Resource for Growth<br />

gives us the direction and motivation to achieve our<br />

targets for 2015 :<br />

• Group turnover of N$3 600 million<br />

• Earnings before interest and tax of N$126 million<br />

• Increasing the number of employees to 850<br />

• Being among the top 3 “Best Company to Work<br />

For” in Namibia<br />

• Utilising 0.2% of turnover for corporate social<br />

investment<br />

37,0<br />

% Netto wins voor belasting<br />

10. SLOT<br />

<strong>Agra</strong> het weer eens daarin geslaag om<br />

bevredigende resultate aan sy lede en<br />

aandeelhouers te rapporteer. Een van die<br />

hoogtepunte in die jaar onder oorsig was die<br />

opening van 'n volwaardige <strong>Agra</strong> tak in Oshivelo,<br />

wat die tweede <strong>Agra</strong> tak noord van Tsumeb is – die<br />

ander tak is Opuwo, waar grootskaalse<br />

opgradering beplan word vir die volgende<br />

finansiële jaar.<br />

Die jaar vorentoe sal ook weer vol uitdagings wees,<br />

maar ook vol geleenthede. As bestuur en<br />

personeel van <strong>Agra</strong> is ons bereid om te streef na<br />

<strong>Agra</strong> se nuutgeformuleerde doel:<br />

Om welvaart te skep en lewenskwaliteit te<br />

verbeter,<br />

en ons Visie 2015:<br />

om 'n hulpbron vir groei te wees<br />

gee ons die rigting en motivering om ons doelwitte<br />

vir 2015 te bereik nl.:<br />

• ‘n Groepsomset van N$3 600 miljoen<br />

• Verdienste voor rente en belasting van N$126<br />

miljoen<br />

• Die aantal werknemers te vermeerder tot 850<br />

• Om binne die BCTWF (Beste Maatskappy om<br />

Voor te Werk) se Top 3 in Namibië te wees<br />

• Om 0,2% van ons omset in sosiale beleggings<br />

te herbelê<br />

18

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

Last but not least we would like to thank our members<br />

and customers for their support. Without you <strong>Agra</strong><br />

would not have been able to achieve another year of<br />

substantial growth.<br />

We are looking forward to being of service to you<br />

once again in the years to come.<br />

I would also like to thank the <strong>Agra</strong> Board of Directors<br />

for their input and guidance as well as my<br />

management team members, who were a continual<br />

source of inspiration and support.<br />

PM KAZMAIER<br />

CHIEF EXECUTIVE OFFICER<br />

(HOOF UITVOERENDE BEAMPTE)<br />

<strong>Report</strong> of the Chief Executive Officer<br />

Ten laaste wil ons, ons lede en kliënte bedank vir u<br />

ondersteuning. Sonder u sou <strong>Agra</strong> nie in staat<br />

wees om nog ‘n jaar van aansienlike groei te<br />

behaal nie.<br />

Ons sien uit daarna om u voorts tot diens te wees<br />

in die komende jare.<br />

Ek wil ook die <strong>Agra</strong> Raad van Direkteure bedank<br />

vir hul insette en leiding asook my<br />

bestuurspanlede, wat ‘n deurlopende bron van<br />

inspirasie en ondersteuning was.<br />

19

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

Directors' Responsibilities and Approval<br />

The directors are responsible for the preparation, integrity and fair presentation of the financial statements of <strong>Agra</strong><br />

(Co-operative) Limited and its subsidiaries.<br />

The annual financial statements are prepared in accordance with International Financial <strong>Report</strong>ing Standards and<br />

are based upon appropriate accounting policies consistently applied and supported by reasonable and prudent<br />

judgments and estimates.<br />

The directors acknowledge that they are ultimately responsible for the system of internal financial control<br />

established by the group and place considerable importance on maintaining a strong control environment. To<br />

enable the directors to meet these responsibilities, the board set standards for internal control aimed at reducing the<br />

risk of error or loss in a cost effective manner. The standards include the proper delegation of responsibilities within<br />

a clearly defined framework, effective accounting procedures and adequate segregation of duties to ensure an<br />

acceptable level of risk. These controls are monitored throughout the group and all employees are required to<br />

maintain the highest ethical standards in ensuring the group’s business is conducted in a manner that in all<br />

reasonable circumstances is above reproach. The focus of risk management in the group is on identifying,<br />

assessing, managing and monitoring all known forms of risk across the group. While operating risk cannot be fully<br />

eliminated, the group endeavours to minimise it by ensuring that appropriate infrastructure, controls, systems and<br />

ethical behaviour are applied and managed within predetermined procedures and constraints.<br />

The directors are of the opinion, based on the information and explanations given by management, that the system<br />

of internal control provides reasonable assurance that the financial records may be relied on for the preparation of<br />

the annual financial statements. However, any system of internal financial control can provide only reasonable, and<br />

not absolute, assurance against material misstatement or loss.<br />

The directors have reviewed the group’s cash flow forecast for the year to 31 July 2013 and, in the light of this<br />

review and the current financial position, they are satisfied that the group has or has access to adequate resources<br />

to continue in operational existence for the foreseeable future.<br />

The external auditors are responsible for independently reviewing and reporting on the group's annual financial<br />

statements. The annual financial statements have been examined by the group's external auditors and their report<br />

is presented on pages 21 to 22.<br />

The annual financial statements set out on pages 23 to 86, which have been prepared on the going concern basis,<br />

were approved by the board and were signed on its behalf by:<br />

Director Director<br />

Windhoek<br />

30 October <strong>2012</strong><br />

20

To the members of <strong>Agra</strong> (Co-operative) Limited<br />

Independent Auditors' <strong>Report</strong><br />

We have audited the consolidated annual financial statements of <strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

which comprise the consolidated and separate statement of financial position as at 31 July <strong>2012</strong>, and the<br />

consolidated and separate statement of comprehensive income, statement of changes in equity and consolidated<br />

and separate statement of cash flows for the year then ended, and a summary of significant accounting policies and<br />

other explanatory notes, and the directors' report, as set out on pages 23 to 84.<br />

Directors' Responsibility for the <strong>Annual</strong> Financial Statements<br />

The co-operative’s directors are responsible for the preparation and fair presentation of these annual financial<br />

statements in accordance with International Financial <strong>Report</strong>ing Standards, and for such internal control as the<br />

directors determine is necessary to enable the preparation of annual financial statements that are free from material<br />

misstatements, whether due to fraud or error.<br />

Auditors' Responsibility<br />

Our responsibility is to express an opinion on these annual financial statements based on our audit. We conducted<br />

our audit in accordance with International Standards on Auditing. Those standards require that we comply with<br />

ethical requirements and plan and perform the audit to obtain reasonable assurance whether the annual financial<br />

statements are free from material misstatement.<br />

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the annual<br />

financial statements. The procedures selected depend on the auditors' judgement, including the assessment of the<br />

risks of material misstatement of the annual financial statements, whether due to fraud or error. In making those<br />

risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of<br />

the annual financial statements in order to design audit procedures that are appropriate in the circumstances, but<br />

not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also<br />

includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates<br />

made by management, as well as evaluating the overall presentation of the annual financial statements.<br />

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit<br />

opinion.<br />

Opinion<br />

In our opinion, the annual financial statements present fairly, in all material respects, the consolidated and separate<br />

financial position of <strong>Agra</strong> (Co-operative) Limited and its subsidiaries as at 31 July <strong>2012</strong>, and its consolidated and<br />

separate financial performance and its consolidated and separate cash flows for the year then ended in accordance<br />

with International Financial <strong>Report</strong>ing Standards, and the requirements of the Companies Act of Namibia.<br />

Other matter<br />

Without qualifying our opinion, we draw attention to the fact that supplementary information set out on page 72 to<br />

73 does not form part of the annual financial statements and is presented as additional information. We have not<br />

audited this information and accordingly do not express an opinion thereon.<br />

21

Independent Auditors' <strong>Report</strong> (continued)<br />

________________________________<br />

PricewaterhouseCoopers<br />

Registered Accountants and Auditors<br />

Chartered Accountants (Namibia)<br />

Per: Louis van der Riet<br />

Partner<br />

Windhoek, 30 October <strong>2012</strong><br />

PricewaterhouseCoopers, 344 Independence Avenue, Windhoek, P O Box 1571, Windhoek, Namibia<br />

Practice Number 9406, T: 264 (61) 284 1000, F: +264 (61) 284 1001, www.pwc.com/na<br />

Managing Partner: R Nangula Uaandja<br />

Partners: Stephen D Viljoen, Carl P van der Merwe, Louis van der Riet (Chief Operating Officer), Ansie EJ Rossouw, Seretta N Lombaard, Stefan Hugo, Chantell N Husselmann<br />

22

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

Directors' <strong>Report</strong><br />

The directors submit their report for the year ended 31 July <strong>2012</strong>.<br />

1. Review of activities<br />

Main business and operations<br />

<strong>Agra</strong> (Co-operative) Limited is the largest multipurpose agricultural co-operative in the country. <strong>Agra</strong> has branches<br />

throughout Namibia providing farming inputs and equipment as well as pet accessories, camping equipment,<br />

gardening and household goods. <strong>Agra</strong> is also the largest livestock organisation in Namibia.<br />

The operating results and state of affairs of the co-operative are fully set out in the attached annual financial<br />

statements and do not in our opinion require any further comment.<br />

Net profit of the group was N$ 31.4 million (2011: N$ 24.5 million profit), after taxation of N$ 13 million (2011: N$<br />

11.7 million).<br />

Net profit of the co-operative was N$ 31.5 million (2011: N$ 23.1 million profit), after taxation of N$ 12.4<br />

million (2011: N$ 11.1 million).<br />

2. Going concern<br />

The annual financial statements have been prepared on the basis of accounting policies applicable to a going<br />

concern. This basis presumes that funds will be available to finance future operations and that the realisation of<br />

assets and settlement of liabilities, contingent obligations and commitments will occur in the ordinary course of<br />

business.<br />

3. Events after the reporting period<br />

The members of the co-operative instructed the board of directors to convert the co-operative into a public<br />

company.<br />

The Ministry announced the approval of the coversion of the co-operative into a public company during October<br />

<strong>2012</strong>. The conversion is effective 1 February 2013.<br />

Apart from the above, no circumstances have arisen, or events occurred, between the financial year end date and<br />

the date of this report in respect of matters which would require adjustment to, or disclosure in, the annual financial<br />

statements of the co-operative and the group, or which should be disclosed to the members through some other<br />

medium, except as disclosed elsewhere in the financial statements.<br />

4. Authorised and issued share capital<br />

Share capital of N$ 0 (2011: N$0,00) was raised and N$ 3,000 (2011: N$3,000 ) has been redeemed during the<br />

year.<br />

23

5. Directors<br />

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

Directors' <strong>Report</strong><br />

The directors of the co-operative during the year and to the date of this report are as follows:<br />

Name<br />

R van der Merwe (Chairman)<br />

BH Mouton (Vice chairman)<br />

LC van Wyk<br />

P Schonecke<br />

S Wilckens<br />

JW Visagie<br />

6. Supervisory committee<br />

Name<br />

JH Niewoudt (Chairman)<br />

SK Shikongo<br />

H Stroh<br />

7. Interest in subsidiaries<br />

Name of subsidiary Nature of business Percentage holding<br />

Ondangwa Service Station (Pty) Ltd Selling of retail products and fuel. 70 %<br />

Auas Veterinary and Medical Suppliers (Pty) Retailing and wholesale of<br />

100 %<br />

Ltd<br />

veterinary products.<br />

"A" Shares in Guard Risk Cell Insurance 100 %<br />

<strong>Agra</strong> Properties (Pty) Ltd Estate agency, auctioneering of<br />

property and property investors.<br />

100 %<br />

<strong>Agra</strong> Oshivelo Retail (Pty) Ltd General retail. 84 %<br />

The co-operative’s interest in the net profit after tax of the subsidiaries amounted to N$ 1.8 million (2011: N$ 0.4<br />

million). Please refer to note of the financial statements for more information concerning investments in<br />

subsidiaries.<br />

8. Auditors<br />

PricewaterhouseCoopers will continue in office in accordance with section 278(2) of the Companies Act of Namibia.<br />

24

Assets<br />

<strong>Agra</strong> (Co-operative) Limited and its subsidiaries<br />

<strong>Annual</strong> Financial Statements for the year ended 31 July <strong>2012</strong><br />

Statement of Financial Position<br />

Group Co-operative<br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Note(s) N$ '000 N$ '000 N$ '000 N$ '000<br />

Non-Current Assets<br />

Investment property 4 15,142 15,104 15,142 15,104<br />

Property, plant and equipment 5 95,318 85,523 95,214 85,452<br />

Intangible assets 6 743 622 743 622<br />