Time Value of Money Homework Solutions

Time Value of Money Homework Solutions

Time Value of Money Homework Solutions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

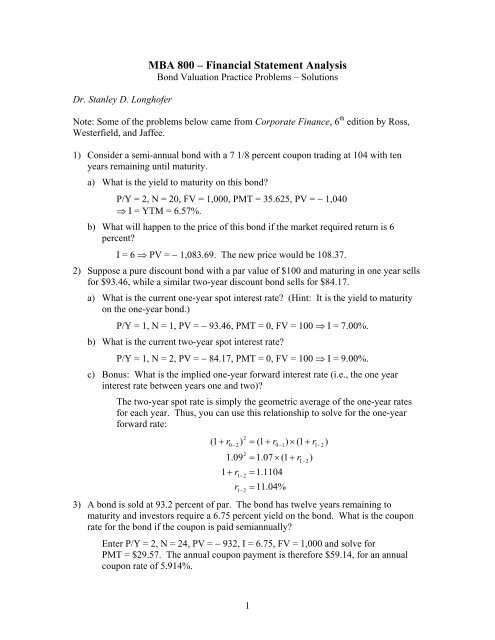

Dr. Stanley D. Longh<strong>of</strong>er<br />

MBA 800 – Financial Statement Analysis<br />

Bond Valuation Practice Problems – <strong>Solutions</strong><br />

Note: Some <strong>of</strong> the problems below came from Corporate Finance, 6 th edition by Ross,<br />

Westerfield, and Jaffee.<br />

1) Consider a semi-annual bond with a 7 1/8 percent coupon trading at 104 with ten<br />

years remaining until maturity.<br />

a) What is the yield to maturity on this bond?<br />

P/Y = 2, N = 20, FV = 1,000, PMT = 35.625, PV = − 1,040<br />

⇒ I = YTM = 6.57%.<br />

b) What will happen to the price <strong>of</strong> this bond if the market required return is 6<br />

percent?<br />

I = 6 ⇒ PV = − 1,083.69. The new price would be 108.37.<br />

2) Suppose a pure discount bond with a par value <strong>of</strong> $100 and maturing in one year sells<br />

for $93.46, while a similar two-year discount bond sells for $84.17.<br />

a) What is the current one-year spot interest rate? (Hint: It is the yield to maturity<br />

on the one-year bond.)<br />

P/Y = 1, N = 1, PV = − 93.46, PMT = 0, FV = 100 ⇒ I = 7.00%.<br />

b) What is the current two-year spot interest rate?<br />

P/Y = 1, N = 2, PV = − 84.17, PMT = 0, FV = 100 ⇒ I = 9.00%.<br />

c) Bonus: What is the implied one-year forward interest rate (i.e., the one year<br />

interest rate between years one and two)?<br />

The two-year spot rate is simply the geometric average <strong>of</strong> the one-year rates<br />

for each year. Thus, you can use this relationship to solve for the one-year<br />

forward rate:<br />

( 1<br />

+ r<br />

0−<br />

2<br />

)<br />

1.<br />

09<br />

1+<br />

r<br />

2<br />

2<br />

1−2<br />

r<br />

1−2<br />

1<br />

=<br />

( 1<br />

+ r<br />

0−1<br />

) × ( 1+<br />

r<br />

= 1.<br />

07 × ( 1+<br />

r<br />

= 1.<br />

1104<br />

= 11.<br />

04%<br />

3) A bond is sold at 93.2 percent <strong>of</strong> par. The bond has twelve years remaining to<br />

maturity and investors require a 6.75 percent yield on the bond. What is the coupon<br />

rate for the bond if the coupon is paid semiannually?<br />

Enter P/Y = 2, N = 24, PV = − 932, I = 6.75, FV = 1,000 and solve for<br />

PMT = $29.57. The annual coupon payment is therefore $59.14, for an annual<br />

coupon rate <strong>of</strong> 5.914%.<br />

1−2<br />

)<br />

1−2<br />

)

4) The Sue Fleming Corporation has two different bonds currently outstanding. Bond A<br />

has a face value <strong>of</strong> $40,000 and matures in 20 years. The bond makes no payments<br />

for the first six years and then pays $2,000 semiannually for the subsequent eight<br />

years, and finally pays $2,500 semiannually for the last six years. Bond B also has a<br />

face value <strong>of</strong> $40,000 and a maturity <strong>of</strong> 20 years; it makes no coupon payments over<br />

the life <strong>of</strong> the bond. If the required rate <strong>of</strong> return is 12 percent compounded<br />

semiannually, what is the current price <strong>of</strong><br />

a) Bond A?<br />

Use the irregular cash flow function in your financial calculator to value this<br />

bond:<br />

b) Bond B?<br />

Dates Payment Frequency<br />

1-12 0 12<br />

11-28 2,000 16<br />

29-39 2,500 11<br />

40 42,500 1<br />

There are several points to note about these entries. First, the periods are 6month<br />

intervals because <strong>of</strong> the semiannual payments. Second, it is important<br />

to put in the 12 periods without payments; otherwise, your financial calculator<br />

won’t discount the later payments correctly. Finally, when the bond matures<br />

it pays back its face value <strong>of</strong> $40,000. At the same time, it makes its final<br />

coupon payment. These two payments are added together and listed as the<br />

final cash flow. Don’t simply put the $40,000 payment as an additional cash<br />

flow in period 41. You will get the wrong answer!<br />

When you solve for the PV, you need to give your calculator the periodic rate,<br />

not the annual rate. This is because your payments occur at semiannual<br />

intervals. Solving for the PV <strong>of</strong> these cash flows with a 6 percent discount<br />

rate gives us PV = $18,033.86.<br />

You can use the TVM function in your calculator to solve for the value <strong>of</strong> this<br />

pure discount bond: P/Y = 2, N = 40, I = 12, PMT = 0, FV = 40,000 ⇒<br />

PV = − 3,888.89.<br />

5) Assume the following spot rates:<br />

Maturity Spot Rates (%)<br />

1 5<br />

2 7<br />

3 10<br />

What are the forward rates over each <strong>of</strong> the three years?<br />

f 5.<br />

00%<br />

, the current spot rate over the first year.<br />

1 =<br />

2

3<br />

%<br />

04<br />

.<br />

9<br />

1<br />

05<br />

.<br />

1<br />

07<br />

.<br />

1<br />

1<br />

)<br />

1<br />

(<br />

)<br />

1<br />

(<br />

2<br />

1<br />

2<br />

2<br />

2<br />

=<br />

−<br />

=<br />

−<br />

+<br />

+<br />

=<br />

r<br />

r<br />

f .<br />

%<br />

25<br />

.<br />

16<br />

1<br />

07<br />

.<br />

1<br />

10<br />

.<br />

1<br />

1<br />

)<br />

1<br />

(<br />

)<br />

1<br />

(<br />

2<br />

3<br />

2<br />

2<br />

3<br />

3<br />

3<br />

=<br />

−<br />

=<br />

−<br />

+<br />

+<br />

=<br />

r<br />

r<br />

f .