management - Towers Perrin

management - Towers Perrin

management - Towers Perrin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

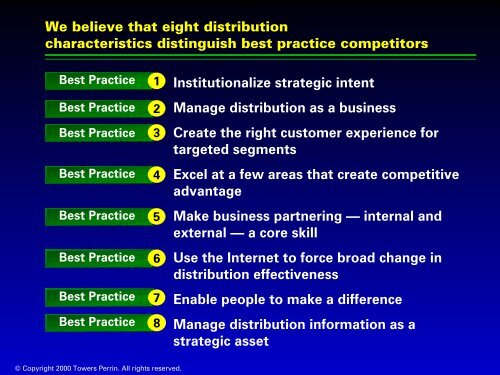

We believe that eight distribution<br />

characteristics distinguish best practice competitors<br />

Best Practice<br />

Best Practice<br />

Best Practice<br />

Best Practice<br />

Best Practice<br />

Best Practice<br />

Best Practice<br />

Best Practice<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

Institutionalize strategic intent<br />

Manage distribution as a business<br />

Create the right customer experience for<br />

targeted segments<br />

Excel at a few areas that create competitive<br />

advantage<br />

Make business partnering — internal and<br />

external — a core skill<br />

Use the Internet to force broad change in<br />

distribution effectiveness<br />

Enable people to make a difference<br />

Manage distribution information as a<br />

strategic asset

Best Practice<br />

1<br />

Make the firm’s strategic intent<br />

meaningful at every level of the organization<br />

A well-defined<br />

strategic intent<br />

is consistently<br />

communicated<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

Be the premier global<br />

retail financial services<br />

brand<br />

Empower individuals to<br />

become better investors;<br />

the Internet is the future<br />

for our customers<br />

Benefits<br />

Focuses on what is important<br />

Drives resource alignment and<br />

organization<br />

Bridges operational and<br />

<strong>management</strong> gaps<br />

Best practice firms institutionalize their<br />

strategic intent in their operating models and<br />

processes

Strategic intent is translated<br />

into detailed operating requirements that define<br />

how distribution activities are organized and managed<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

Strategy Operating Requirements — Examples<br />

The Internet is the future for<br />

our customers<br />

We will sell directly to customers<br />

Small business is a key business<br />

of the company<br />

Operating Requirements to Implement<br />

■ Define how value created for the<br />

customer/firm<br />

■ Reset role of phone/branches<br />

■ Change pricing structure for new competition<br />

■ Redefine distribution roles/relationships<br />

■ Design new channel<br />

■ Expand functionality of call centers<br />

■ Reset role of the sales force<br />

■ Reset role of the branch sales force<br />

■ How quality will be delivered<br />

■ Design dedicated phone channel

Translating strategy into operating practice requires<br />

attention to the details of sales and service processes<br />

Operational Excellence — One Bank’s Approach<br />

Bank’s Perspective Operating Requirements<br />

We strive for accuracy, we fix mistakes<br />

We manage systematically<br />

We understand quality and how to<br />

improve it it<br />

We are “customer service engineers”<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

Highly efficient problem resolution<br />

process<br />

Customer-centered process<br />

<strong>management</strong><br />

Customer satisfaction centered on<br />

specific sales/services experiences<br />

“Managing the quality and details of the sales and<br />

service processes will be a much more important job in<br />

the Retail Bank if if we are to deliver consistently on the<br />

value promise.” — CEO of a large U.S.<br />

bank

Sale<br />

Commission,<br />

Net Income<br />

Best Practice 2<br />

Distribution should be managed<br />

as a business with a distribution P&L<br />

180%<br />

Cumulative<br />

Value100<br />

Contribution<br />

Economic Contribution of Individual Branches<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

Not all customers create value . . .<br />

40% of customers =<br />

180% of value<br />

Traditional measures may not<br />

align with economic contribution<br />

High performers are<br />

overpaid<br />

New recruits destroy<br />

value<br />

Low producers do not<br />

cover costs<br />

15% = 100% of value<br />

0%<br />

0% 40%<br />

% of Customers<br />

80%<br />

0<br />

+<br />

5% destroy<br />

40%<br />

of value<br />

Value-added analysis is a better metric<br />

Value<br />

New Intermediaries<br />

Value-added<br />

Existing Intermediaries<br />

Expected 100 50<br />

■ Recruitment<br />

■ Productivity<br />

■ Retention<br />

■ Expenses<br />

Actual<br />

(20)<br />

15<br />

15<br />

(5)<br />

105<br />

–<br />

10<br />

5<br />

(10)<br />

55

Key performance indicators<br />

for distribution generally must go<br />

beyond traditional measures of financial performance<br />

Primary Initiative Key Performance Factors<br />

New Store<br />

Manager<br />

Greater<br />

Investment<br />

Product Sales<br />

Vigorous Platform<br />

Sales<br />

Teller<br />

Effectiveness<br />

End-to-End Sales/<br />

Service Process<br />

Systematic Design/<br />

Management<br />

Satisfying<br />

Customer<br />

Experience<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

Process/site audit<br />

Branch sales/growth<br />

Sales performance<br />

Sales volumes/revenues<br />

Cycle times<br />

Household penetration<br />

Customer satisfaction<br />

Employee/customer retention<br />

Productivity<br />

Cost to staff<br />

Turnover<br />

Teller retention<br />

Teller error rates<br />

Sales referrals<br />

Customer satisfaction/retention<br />

Sales productivity/efficiency<br />

Problem resolution metrics<br />

Cost of quality<br />

Site quality measures<br />

Site audit measures

A balanced scorecard that captures both<br />

results and the drivers of future performance<br />

strengthens focus and control of strategy implementation<br />

Revenue<br />

■ Growth<br />

from new<br />

business<br />

■ Growth<br />

from<br />

existing<br />

business<br />

Capacity<br />

■ Turnover<br />

ratio<br />

■ Availability<br />

rate<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

Example: Retail Banking<br />

Financial Results Operational Excellence<br />

Sales/Service<br />

Efficiency<br />

■ Cost to<br />

sell/<br />

revenue $<br />

■ Cost to<br />

service<br />

Talent Management<br />

Franchise<br />

Growth<br />

■ Net growth in<br />

households<br />

■ Household<br />

penetration<br />

of investment<br />

products<br />

Sales/Service<br />

Productivity Effectiveness<br />

■ Revenue per<br />

sales person<br />

■ Transactions<br />

per service<br />

person<br />

■ % in top two<br />

performance<br />

ratings<br />

■ % meeting<br />

minimum<br />

requirements<br />

Process<br />

Quality<br />

■ Score on sales<br />

process<br />

■ Partner agreement<br />

scores<br />

Profitable<br />

Customers<br />

■ Percent of<br />

profitable<br />

customers<br />

■ Retention<br />

of new<br />

customers<br />

Customer Franchise<br />

Relationship<br />

Quality<br />

■ Product<br />

family crosssell<br />

ratio<br />

Quality<br />

Management<br />

■ Score on problem<br />

resolution<br />

process<br />

■ Cost of poor<br />

quality<br />

Customer<br />

Satisfaction<br />

■ Customer<br />

experience<br />

satisfaction<br />

■ Site rating

Best Practice<br />

A well-designed customer<br />

experience changes the basis<br />

of competition from<br />

product/price to total value<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

3<br />

The essence of the distribution challenge is to deliver the right<br />

customer experience for targeted customer groups across all channels<br />

Recenter distribution to the Internet<br />

■ New added value, not self-service<br />

■ Integrated customer experience<br />

■ Reset functionality in other channels<br />

Benefits<br />

■ Complementarity of cross-channel<br />

customer experience<br />

■ Well-designed processes<br />

■ Complementary functionality in all<br />

channels<br />

■ Few master the requirements for distinctive customer experience<br />

■ Process design and vigorous <strong>management</strong> are first steps<br />

■ Reducing variation* across sales experiences builds customer<br />

confidence, improves efficiency, reduces the cost of poor quality and<br />

improves sales effectiveness<br />

* Frei, F.X., Harker, P.T., and Hunter L. (1999), “Process Performance and Customer Satisfaction: Evidence from Retail Banking<br />

Study,” Working Paper, The Wharton Financial Institutions Center, The Wharton School, University of Pennsylvania (Philadelphia, PA).

Financial services firms increasingly use<br />

the characteristics of individual channels to craft the<br />

dimensions of customer experience specific to their strategy<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

■ Highest-skilled financial advisers “in sites” for<br />

high net worth customers<br />

■ Single level of service over the phone<br />

■ Segmented service levels via phone<br />

■ Highly individualized service over the web<br />

■ Homogeneous service in the sites<br />

■ Homogeneous service in traditional sites<br />

■ Streamlined services for in-store sites<br />

■ Specialized services in designated sites (e.g.,<br />

Business Banking)<br />

■ Segment-specific phone channels

American<br />

Express<br />

CapOne<br />

Fidelity<br />

LendingTree<br />

Merrill Lynch<br />

Schwab<br />

Wal-Mart<br />

Wells Fargo<br />

Best Practice<br />

Our research shows best practice firms excel in a few areas that<br />

create competitive advantage specific to the firm and its strategies<br />

Planning Channels Sales Fulfillment CRM Scorecards<br />

■ Brand strategy<br />

■ Resource<br />

allocation<br />

■ Enterprise<br />

goals<br />

■ ROI<br />

X<br />

X<br />

X<br />

X<br />

■ Cross-channel<br />

■ Alignment<br />

■ Operating<br />

models<br />

■ Innovation<br />

■ Partners<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

4<br />

X<br />

X<br />

X<br />

X<br />

The Distribution Value Chain<br />

■ Sales<br />

processes<br />

■ Enabled<br />

staff<br />

■ Sales platform<br />

■ Value<br />

proposition<br />

X<br />

X<br />

X<br />

X<br />

X<br />

X<br />

■ Response time<br />

■ Follow-up<br />

■ Partner<br />

standards<br />

■ Relationship<br />

<strong>management</strong><br />

■ Share of of wallet<br />

■ Customer<br />

experience<br />

■ Learning<br />

capture<br />

■ Evaluation<br />

■ Business<br />

system<br />

changes<br />

Best practice firms carefully evaluate root causes of of performance gaps<br />

to to realign resources and strengthen execution capabilities<br />

X<br />

X<br />

X<br />

X<br />

X<br />

X<br />

X<br />

X<br />

X<br />

X<br />

X

Best practices firms finely tune<br />

investments in distribution capabilities: disinvest,<br />

continuously improve, or build/restructure to grow<br />

■ Managing to the requirements of each capability ensures<br />

resources are invested efficiently<br />

Organizational<br />

Performance<br />

Superior<br />

Parity<br />

Deficient<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

Surplus<br />

Capabilities Assessment<br />

Aligned<br />

Gaps<br />

To play To compete To win<br />

Distribution Importance<br />

Too much<br />

investment<br />

Protect<br />

investment<br />

Restructure<br />

Difficulty to<br />

remedy:<br />

High<br />

Medium<br />

Low

Best Practice<br />

5<br />

Business partnering — internal and<br />

external — is a core skill for the distribution organization<br />

■ External partners can improve the firm’s value proposition<br />

These are not traditional outsourcing<br />

relationships — they are strategic partnerships<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

■ Distribution relationships — KeyCorp, First Union<br />

■ FA network<br />

■ Washington Mutual — annuities/insurance products<br />

■ JP Morgan — IPO product<br />

■ Stock trading network — Schwab and others<br />

■ Merrill Lynch/Lehman — research<br />

■ Schwab — mutual funds distribution<br />

■ Internet site — Fingerhut/Books-A-Million<br />

■ Extraordinarily strong vendor relationships to manage<br />

inventory turn and financing costs

Internal partnering agreements are important in<br />

delivering the targeted customer experience profitably<br />

■ Multichannel, multiproduct distribution requires more<br />

disciplined <strong>management</strong> practices within and across lines of<br />

business<br />

■ Win-win partnerships create value for internal and external<br />

partners<br />

Business Goals<br />

■ Partner’s value added for<br />

distribution<br />

■ How value of partnership is<br />

measured<br />

■ Expected roles ⎯ planning,<br />

execution, evaluation, reporting<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

Distribution Internal<br />

Partner Requirements<br />

Financial, brand, strategic contributions<br />

Metrics for assessing value of partnership<br />

for both partners<br />

Specificity regarding roles in creating value<br />

■ Knowledge capture Key areas of distribution value chain where<br />

knowledge will be captured

Best Practice<br />

Firms’ ongoing efforts to remake or improve distribution<br />

must be carried out while adding Internet advantages and options<br />

Internet<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

6<br />

■ New business models and cross-LOB thinking<br />

■ Economic results are in the future; expenses are<br />

immediate<br />

■ Traditional channels have new roles while<br />

delivering on old roles more efficiently<br />

■ New cross-LOB integration for promotion/cross-sell<br />

■ Redesign customer information systems for cross-LOB<br />

leverage<br />

■ Same quality customer experience on web/phone<br />

■ Remake the operating model for the sites<br />

■ Center differentiated service levels on the phone<br />

■ Manage economic impact of new web-induced trading<br />

pricing

Best Practice 7<br />

Enable people to use distribution investments to<br />

make a difference in performance and competitiveness<br />

■ Align organization, total reward programs, sales and service<br />

processes and the firm’s culture to enhance customer satisfaction and<br />

sales effectiveness<br />

■ Align human resource systems — organization, job design, selection,<br />

training and total rewards — to the distribution strategy<br />

Process<br />

■ The design and efficiency of:<br />

■ Sales and service<br />

■ Customer problem solving<br />

■ Customer referrals and<br />

hand-offs<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

Structure<br />

■ Organization of key resources<br />

■ Clear roles<br />

Culture<br />

■ What motivates performance<br />

■ Sales and service values<br />

■ Guiding principles<br />

Technology<br />

■ Knowledge <strong>management</strong><br />

system<br />

People<br />

■ Skills<br />

■ Job design<br />

■ Selection<br />

■ Training<br />

■ Rewards and recognition

Best Practice 8<br />

Manage distribution information as a<br />

strategic asset of significant current and future value<br />

■ Using the right information to improve performance and competitiveness<br />

requires careful integration into business and operating models<br />

■ Best practice firms reinforce the key elements of their strategy to enhance<br />

competitive advantage<br />

© Copyright 2000 <strong>Towers</strong> <strong>Perrin</strong>. All rights reserved.<br />

Be ready to sell when the customer invites you into his/her space<br />

■ 60% – 70% chance they know why customer is calling<br />

■ Skills-based routing<br />

■ 24 pieces of information on the customer at the point of sale<br />

■ Alternative offers “whispered” to the CSR<br />

CVM tools can help maximize value and opportunity<br />

% change<br />

in deposits<br />

100%<br />

50%<br />

0%<br />

Price Elasticity<br />

0% 40% 80%<br />

% change in rates relative to competition<br />

On On a $10B portfolio, a 5bp 5bp rate rate increase can can add add $5M $5M to to the the bottom line line<br />

Price opportunistically<br />

by identifying pockets<br />

of price indifference