schedule db - part f - section 1 - TIAA-CREF

schedule db - part f - section 1 - TIAA-CREF

schedule db - part f - section 1 - TIAA-CREF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

STATEMENT AS OF SEPTEMBER 30, 2009 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICA<br />

NOTES TO FINANCIAL STATEMENTS<br />

D. As of September 30, 2009 and December 31, 2008, the net amount due to subsidiaries and affiliates was $81,356,925 and<br />

$13,140,520 respectively. The net amounts due are generally settled on a daily basis except for <strong>TIAA</strong> Realty, Inc. and ND<br />

Properties, Inc., Teachers Advisors, Inc., <strong>TIAA</strong>-<strong>CREF</strong> Tuition Financing, Inc., Teachers Personal Investors Services, Inc.,<br />

<strong>TIAA</strong>-<strong>CREF</strong> Individual and Institutional Services, and <strong>TIAA</strong>-<strong>CREF</strong> Enterprises, Inc. which are settled quarterly.<br />

J. During 3 rd quarter 2009, the Company recognized $156,951,240 in other-than-temporary impairments for investments in<br />

subsidiaries, controlled and affiliated companies.<br />

11. Debt<br />

See Note 20 C.<br />

12. Retirement Plans, Deferred Compensation, Post Employment Benefits and Compensated Absences and other Post Retirement<br />

Benefit Plans<br />

No Material Change.<br />

13. Capital and Surplus, Shareholders’ Dividend Restrictions and Quasi-Reorganization<br />

No Material Change.<br />

14. Contingencies<br />

A. Contingent Commitments<br />

15. Leases<br />

At September 30, 2009, outstanding forward commitments for future long-term bond investments were $1,208,772,095. Of this,<br />

$550,278,539 is <strong>schedule</strong>d for disbursement in 2009 and $658,493,556 in later years. The funding of bond commitments is<br />

contingent upon the continued favorable financial performance of the potential borrowers.<br />

At September 30, 2009, outstanding forward commitments for future mortgage loan investments were $234,554,561. Of this,<br />

$230,054,561 is <strong>schedule</strong>d for disbursement in 2009 and $4,500,000 in later years. The funding of mortgage loan commitments<br />

is contingent upon the underlying properties meeting specified requirements, including construction, leasing and occupancy.<br />

At September 30, 2009, outstanding obligations for future real estate investments were $4,013,207. Of which all are <strong>schedule</strong>d<br />

for disbursement in 2009. The funding of real estate investment obligations is contingent upon the properties meeting specified<br />

requirements, including construction, leasing and occupancy.<br />

At September 30, 2009, outstanding forward commitments for equity investments were $5,598,133,427. Of this, $515,442,323<br />

is <strong>schedule</strong>d for disbursement in 2009 and $5,082,691,104 in later years.<br />

Included in the forward commitments for equity investments is the Company’s limited <strong>part</strong>nership in the two Hines European<br />

Development Fund Limited Partnerships (“HEDF Fund I & II”) whose primary focus is the development and redevelopment of<br />

real estate projects in Western Europe. Each of the limited <strong>part</strong>ners made a specified commitment to the fund; the Company<br />

committed 130.0 million Euros which is approximately $189.8 million (in U.S. dollars) to Development Fund I and 100.0<br />

million Euros which is approximately $146.0 million (in U.S. dollars) to Development Fund II as of December 31, 2008. The<br />

limited <strong>part</strong>ners' commitments are pledged as collateral to facilitate the financing of the activities of the fund by third <strong>part</strong>ies<br />

through equity lines of credit. The limited <strong>part</strong>ners do not anticipate actually funding their commitments but remain committed<br />

to do so should it become necessary for the Fund to make cash capital calls.<br />

No Material Change.<br />

16. Information about Financial Instruments with Off-Balance Sheet Risk and Financial Instruments with Concentrations of Credit Risk<br />

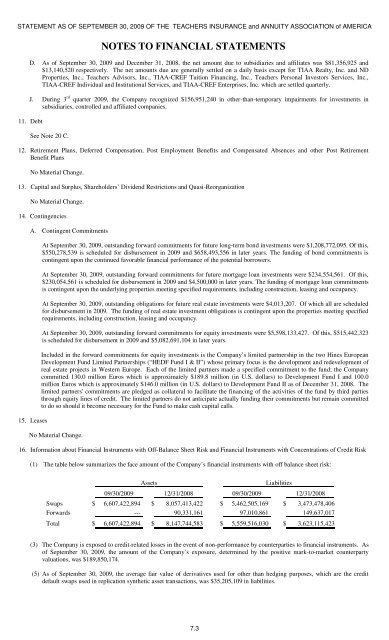

(1) The table below summarizes the face amount of the Company’s financial instruments with off balance sheet risk:<br />

Assets Liabilities<br />

09/30/2009 12/31/2008 09/30/2009 12/31/2008<br />

Swaps $ 6,607,422,894 $ 8,057,413,422 $ 5,462,505,169 $ 3,473,478,406<br />

Forwards --- 90,331,161 97,010,861 149,637,017<br />

Total $ 6,607,422,894 $ 8,147,744,583 $ 5,559,516,030 $ 3,623,115,423<br />

(3) The Company is exposed to credit-related losses in the event of non-performance by counter<strong>part</strong>ies to financial instruments. As<br />

of September 30, 2009, the amount of the Company’s exposure, determined by the positive mark-to-market counter<strong>part</strong>y<br />

valuations, was $189,850,174.<br />

(5) As of September 30, 2009, the average fair value of derivatives used for other than hedging purposes, which are the credit<br />

default swaps used in replication synthetic asset transactions, was $35,205,109 in liabilities.<br />

7.3