schedule db - part f - section 1 - TIAA-CREF

schedule db - part f - section 1 - TIAA-CREF

schedule db - part f - section 1 - TIAA-CREF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

STATEMENT AS OF SEPTEMBER 30, 2009 OF THE TEACHERS INSURANCE and ANNUITY ASSOCIATION of AMERICA<br />

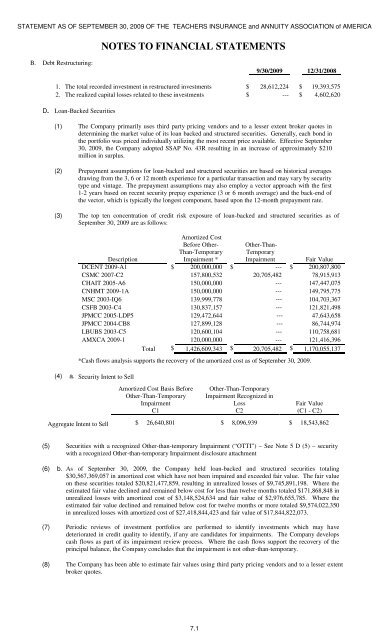

B. Debt Restructuring:<br />

NOTES TO FINANCIAL STATEMENTS<br />

7.1<br />

9/30/2009 12/31/2008<br />

1. The total recorded investment in restructured investments $ 28,612,224 $ 19,393,575<br />

2. The realized capital losses related to these investments $ --- $ 4,602,620<br />

D. Loan-Backed Securities<br />

(1) The Company primarily uses third <strong>part</strong>y pricing vendors and to a lesser extent broker quotes in<br />

determining the market value of its loan backed and structured securities. Generally, each bond in<br />

the portfolio was priced individually utilizing the most recent price available. Effective September<br />

30, 2009, the Company adopted SSAP No. 43R resulting in an increase of approximately $210<br />

million in surplus.<br />

(2) Prepayment assumptions for loan-backed and structured securities are based on historical averages<br />

drawing from the 3, 6 or 12 month experience for a <strong>part</strong>icular transaction and may vary by security<br />

type and vintage. The prepayment assumptions may also employ a vector approach with the first<br />

1-2 years based on recent security prepay experience (3 or 6 month average) and the back-end of<br />

the vector, which is typically the longest component, based upon the 12-month prepayment rate.<br />

(3) The top ten concentration of credit risk exposure of loan-backed and structured securities as of<br />

September 30, 2009 are as follows:<br />

Description<br />

Amortized Cost<br />

Before Other-<br />

Than-Temporary<br />

Impairment *<br />

Other-Than-<br />

Temporary<br />

Impairment<br />

Fair Value<br />

DCENT 2009-A1 $ 200,000,000 $ --- $ 200,807,800<br />

CSMC 2007-C2 157,800,532 20,705,482 78,915,913<br />

CHAIT 2005-A6 150,000,000 --- 147,447,075<br />

CNHMT 2009-1A 150,000,000 --- 149,795,775<br />

MSC 2003-IQ6 139,999,778 --- 104,703,367<br />

CSFB 2003-C4 130,837,157 --- 121,821,498<br />

JPMCC 2005-LDP5 129,472,644 --- 47,643,658<br />

JPMCC 2004-CB8 127,899,128 --- 86,744,974<br />

LBUBS 2003-C5 120,600,104 --- 110,758,681<br />

AMXCA 2009-1 120,000,000 --- 121,416,396<br />

Total $ 1,426,609,343 $ 20,705,482 $ 1,170,055,137<br />

*Cash flows analysis supports the recovery of the amortized cost as of September 30, 2009.<br />

(4) a. Security Intent to Sell<br />

Aggregate Intent to Sell<br />

Amortized Cost Basis Before<br />

Other-Than-Temporary<br />

Impairment<br />

C1<br />

$ 26,640,801<br />

Other-Than-Temporary<br />

Impairment Recognized in<br />

Loss<br />

C2<br />

$ 8,096,939<br />

Fair Value<br />

(C1 - C2)<br />

$ 18,543,862<br />

(5) Securities with a recognized Other-than-temporary Impairment (“OTTI”) – See Note 5 D (5) – security<br />

with a recognized Other-than-temporary Impairment disclosure attachment<br />

(6) b. As of September 30, 2009, the Company held loan-backed and structured securities totaling<br />

$30,567,369,057 in amortized cost which have not been impaired and exceeded fair value. The fair value<br />

on these securities totaled $20,821,477,859, resulting in unrealized losses of $9,745,891,198. Where the<br />

estimated fair value declined and remained below cost for less than twelve months totaled $171,868,848 in<br />

unrealized losses with amortized cost of $3,148,524,634 and fair value of $2,976,655,785. Where the<br />

estimated fair value declined and remained below cost for twelve months or more totaled $9,574,022,350<br />

in unrealized losses with amortized cost of $27,418,844,423 and fair value of $17,844,822,073.<br />

(7) Periodic reviews of investment portfolios are performed to identify investments which may have<br />

deteriorated in credit quality to identify, if any are candidates for impairments. The Company develops<br />

cash flows as <strong>part</strong> of its impairment review process. Where the cash flows support the recovery of the<br />

principal balance, the Company concludes that the impairment is not other-than-temporary.<br />

(8) The Company has been able to estimate fair values using third <strong>part</strong>y pricing vendors and to a lesser extent<br />

broker quotes.