Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Research Analysts<br />

Jack Yeung<br />

852 2101 6779<br />

jack.yeung@credit-suisse.com<br />

Contribution by<br />

Alex Yang<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong><br />

INITIATION<br />

Selectively accumulate in 2013<br />

08 January 2013<br />

Asia Pacific/<strong>China</strong><br />

Equity Research<br />

<strong>Auto</strong>mobile Manufacturers<br />

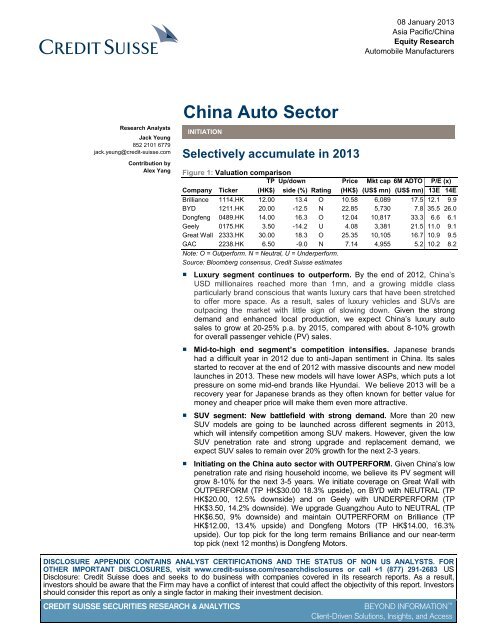

Figure 1: Valuation comparison<br />

TP Up/down Price Mkt cap 6M ADTO P/E (x)<br />

Company Ticker (HK$) side (%) Rating (HK$) (US$ mn) (US$ mn) 13E 14E<br />

Brilliance 1114.HK 12.00 13.4 O 10.58 6,089 17.5 12.1 9.9<br />

BYD 1211.HK 20.00 -12.5 N 22.85 5,730 7.8 35.5 26.0<br />

Dongfeng 0489.HK 14.00 16.3 O 12.04 10,817 33.3 6.6 6.1<br />

Geely 0175.HK 3.50 -14.2 U 4.08 3,381 21.5 11.0 9.1<br />

Great Wall 2333.HK 30.00 18.3 O 25.35 10,105 16.7 10.9 9.5<br />

GAC 2238.HK 6.50 -9.0 N 7.14 4,955 5.2 10.2 8.2<br />

Note: O = Outperform. N = Neutral, U = Underperform.<br />

Source: Bloomberg consensus, Credit Suisse estimates<br />

■ Luxury segment continues to outperform. By the end of 2012, <strong>China</strong>’s<br />

USD millionaires reached more than 1mn, and a growing middle class<br />

particularly brand conscious that wants luxury cars that have been stretched<br />

to offer more space. As a result, sales of luxury vehicles and SUVs are<br />

outpacing the market with little sign of slowing down. Given the strong<br />

demand and enhanced local production, we expect <strong>China</strong>’s luxury auto<br />

sales to grow at 20-25% p.a. by 2015, compared with about 8-10% growth<br />

for overall passenger vehicle (PV) sales.<br />

■ Mid-to-high end segment’s competition intensifies. Japanese brands<br />

had a difficult year in 2012 due to anti-Japan sentiment in <strong>China</strong>. Its sales<br />

started to recover at the end of 2012 with massive discounts and new model<br />

launches in 2013. These new models will have lower ASPs, which puts a lot<br />

pressure on some mid-end brands like Hyundai. We believe 2013 will be a<br />

recovery year for Japanese brands as they often known for better value for<br />

money and cheaper price will make them even more attractive.<br />

■ SUV segment: New battlefield with strong demand. More than 20 new<br />

SUV models are going to be launched across different segments in 2013,<br />

which will intensify competition among SUV makers. However, given the low<br />

SUV penetration rate and strong upgrade and replacement demand, we<br />

expect SUV sales to remain over 20% growth for the next 2-3 years.<br />

■ Initiating on the <strong>China</strong> auto sector with OUTPERFORM. Given <strong>China</strong>’s low<br />

penetration rate and rising household income, we believe its PV segment will<br />

grow 8-10% for the next 3-5 years. We initiate coverage on Great Wall with<br />

OUTPERFORM (TP HK$30.00 18.3% upside), on BYD with NEUTRAL (TP<br />

HK$20.00, 12.5% downside) and on Geely with UNDERPERFORM (TP<br />

HK$3.50, 14.2% downside). We upgrade Guangzhou <strong>Auto</strong> to NEUTRAL (TP<br />

HK$6.50, 9% downside) and maintain OUTPERFORM on Brilliance (TP<br />

HK$12.00, 13.4% upside) and Dongfeng Motors (TP HK$14.00, 16.3%<br />

upside). Our top pick for the long term remains Brilliance and our near-term<br />

top pick (next 12 months) is Dongfeng Motors.<br />

DISCLOSURE APPENDIX CONTAINS ANALYST CERTIFICATIONS AND THE STATUS OF NON US ANALYSTS. FOR<br />

OTHER IMPORTANT DISCLOSURES, visit www.credit-suisse.com/researchdisclosures or call +1 (877) 291-2683 US<br />

Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result,<br />

investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors<br />

should consider this report as only a single factor in making their investment decision.<br />

CREDIT SUISSE SECURITIES RESEARCH & ANALYTICS BEYOND INFORMATION <br />

Client-Driven Solutions, Insights, and Access

Focus charts and table<br />

Figure 2: Growth of <strong>China</strong> auto sales by segment Figure 3: Foreign brands’ PV market share in <strong>China</strong><br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

2004 2006 2008 2010 2012E 2014E 2016E 2018E 2020E<br />

<strong>Auto</strong> sales YoY % PV sales YoY % CV sales YoY %<br />

Source: CAAM, Credit Suisse estimates Source: CAAM<br />

08 January 2013<br />

0%<br />

Jan-09 Oct-09 Jul-10 Apr-11 Jan-12 Nov-12<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 2<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

Japanese German American<br />

Korean French<br />

Figure 4: Luxury PV sales in <strong>China</strong> Figure 5: SUV sales as % of <strong>China</strong>’s PV sales<br />

'000 Units<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

181<br />

39%<br />

22%<br />

252<br />

25%<br />

7%<br />

314<br />

53%<br />

76%<br />

1,551<br />

1,877<br />

2,252<br />

33%<br />

29%<br />

718<br />

1,272<br />

42%<br />

1,017<br />

25%<br />

5% 7%<br />

22% 21% 20%<br />

10% 10%<br />

407<br />

9%<br />

2006 2007 2008 2009 2010 2011 2012E 2013E 2014E 2015E<br />

Luxury PV sales (LHS) Luxury PV sales YoY (RHS)<br />

Total PV sales YoY (RHS)<br />

Source: Roland Berger, Credit Suisse estimates Source: CAAM<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

-20%<br />

Figure 6: Valuation comparison of major listed automakers<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Jan/04 Oct/05 Jul/07 Apr/09 Jan/11 Oct/12<br />

SUV sales as % of PV sales<br />

Upside/ Share Market Dividend<br />

Company Ticker TP downside price cap P/E (x) P/B (x) yield (%) ROE (%)<br />

(HK$) (%) (HK$) (US$mn) 11 12E 13E 14E 11 12E 13E 14E 11 12E 13E 14E 11 12E 13E 14E<br />

Brilliance 1114.HK 12.00 13.4 10.58 6,089 19.7 14.8 12.1 9.9 7.6 5.7 4.3 3.3 - 0.0 0.1 0.3 27.2 29.4 28.6 26.6<br />

BYD 1211.HK 20.00 -12.5 22.85 5,730 26.3 77.6 35.5 26.0 2.1 2.0 1.9 1.8 - 0.0 0.0 0.1 7.0 1.7 4.1 5.0<br />

Dongfeng Motors 0489.HK 14.00 16.3 12.04 10,817 8.0 9.6 6.6 6.1 2.2 1.9 1.7 1.4 1.5 1.3 1.5 1.6 25.0 17.6 18.0 17.3<br />

Geely 0175.HK 3.50 -14.2 4.08 3,381 16.1 12.9 11.0 9.1 2.6 2.3 1.9 1.7 0.7 0.9 1.1 1.3 18.6 17.1 17.6 17.3<br />

Great Wall Motor 2333.HK 30.00 18.3 25.35 10,105 16.3 12.7 10.9 9.5 3.8 3.0 2.5 2.1 1.4 1.9 2.1 2.4 25.6 24.9 23.3 21.6<br />

Guangzhou <strong>Auto</strong> 2238.HK 6.50 -9.0 7.14 4,955 7.8 15.0 10.2 8.2 1.5 1.4 1.3 1.2 2.8 1.5 2.2 2.6 15.6 8.3 10.5 12.1<br />

Mkt cap–wtd avg 16.0 22.4 13.7 11.1 3.6 2.9 2.4 2.0 0.9 1.0 1.2 1.3 22.1 19.1 19.0 18.1<br />

Source: Bloomberg consensus

Selectively accumulate<br />

PV growth remains solid in 2013<br />

<strong>China</strong>’s low auto penetration rate and strong income growth will further its growth in the<br />

passenger vehicles (PV) segment in the next 3-5 years. Low-tier cities and inland regions<br />

have lower-than-average auto penetration rates, higher income growth rate as well as<br />

higher GDP growth; we believe they will become major auto markets in the next 5-10<br />

years. Although automakers are expanding capacity aggressively, their overall utilization<br />

rate is still above 70%. <strong>Auto</strong>makers also have the flexibility to adjust their capacity plans to<br />

meet real demand growth.<br />

SUV segment: New battlefield with strong demand<br />

<strong>China</strong>’s sports utility vehicle (SUV) segment has maintained strong sales growth in recent<br />

years despite slowing PV sales in 2011 and 2012. Over 20 new SUV models are planned<br />

to be launched in 2013 across all segments. We expect competition within the SUV<br />

segment to intensify, as most JV players are equally competitive. However, we note that<br />

rising upgrade and replacement demand will mainly benefit the mid-to-low end SUV<br />

segment. We expect Great Wall to maintain its leadership in this segment due to lack of<br />

strong competitors.<br />

Mid-to-high end segment: Intensifying competition<br />

Due to anti-Japan protests in <strong>China</strong> in 2012, Japanese brands had a difficult year last year.<br />

Its sales started to recover at the end of 2012 with massive discounts and new model<br />

launches in 2013 in hoping to regain some of its lost market share. These new models will<br />

have lower ASPs, which will put a lot pressure on some of the mid-end brands like Korean<br />

brands. With cheaper price, we believe sales of Japanese brands will recover significantly<br />

in 2013 as they often known for better value for money.<br />

Luxury segment: Rising along with wealth in <strong>China</strong><br />

<strong>China</strong>’s luxury auto segment is still in its early growth stage, with a low penetration rate.<br />

We believe growing wealth will drive the country’s luxury auto sales. We also expect<br />

strong waves of replacement purchases to support luxury auto sales in the next 3-5 years.<br />

Many luxury brands have launched their economy models with prices close to the mid-tohigh<br />

end. We believe these models will become strong engines for luxury auto sales and<br />

help luxury automakers to gain market share from mid- to high-end players.<br />

Valuation and stock picks<br />

We are initiating <strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> with OUTPERFORM given <strong>China</strong>’s low penetration<br />

rate and rising household income. We initiate on Great Wall Motor with an OUTPERFORM<br />

(TP HK$30.00 based on 13x 2013E EPS) given its leading position in <strong>China</strong>’s SUV<br />

segment. For BYD, we initiate with NEUTRAL, (TP HK$20.00 based on a sum-of-the-parts<br />

valuation) as we believe its electric cars are yet to be commercialized. We initiate<br />

coverage on Geely with an UNDERPERFORM (TP HK$3.50 based on 10x 2013E EPS)<br />

as we believe it will face competition from JV brands moving toward low-end segment as it<br />

tries to move upward. We upgrade Guangzhou <strong>Auto</strong> to NEUTRAL from<br />

UNDERPERFORM (TP HK$6.50 based on 10x 2013E EPS) given recovering Japanese<br />

auto sales. Brilliance remains OUTPERFORM (TP HK$12.00, based on 14x 2013E EPS)<br />

as our long term top pick for the sector and Dongfeng Motors maintains OUTPERFORM,<br />

(TP HK$14.00, based on 9x 2013E EPS) as our near term (12 month) top pick for the<br />

sector.<br />

08 January 2013<br />

<strong>China</strong>’s low auto penetration<br />

rate and strong income<br />

growth will further its PV<br />

growth in the next 3-5 years<br />

We expect competition in<br />

the SUV segment to<br />

intensify but demand to<br />

remain strong<br />

Japanese brands’ new<br />

models in 2013 would help<br />

them to regain market share<br />

but intensify competition in<br />

mid-to-high end segment<br />

We believe rising wealth in<br />

<strong>China</strong> will continue to drive<br />

luxury auto sales<br />

We are positive on sector<br />

growth and initiate coverage<br />

on Great Wall Motor, BYD,<br />

and Geely. Brilliance and<br />

Dongfeng Motors remain<br />

our top picks<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 3

<strong>Sector</strong> valuation comparison<br />

Figure 7: <strong>Auto</strong> sector valuation table<br />

Share Dividend<br />

08 January 2013<br />

Ticker price Mkt cap P/E (x) P/B (x) yield (%) ROE (%)<br />

Company (local ccy) (US$ mn) 11 12E 13E 14E 11 12E 13E 14E 11 12E 13E 14E 11 12E 13E 14E<br />

H share automakers<br />

Brilliance <strong>China</strong> <strong>Auto</strong> 1114.HK 10.58 6,089 19.7 14.8 12.1 9.9 7.6 5.7 4.3 3.3 - 0.0 0.1 0.3 27.2 29.4 28.6 26.6<br />

BYD 1211.HK 22.85 5,730 26.3 77.6 35.5 26.0 2.1 2.0 1.9 1.8 - 0.0 0.0 0.1 7.0 1.7 4.1 5.0<br />

Dongfeng Motors 0489.HK 12.04 10,817 8.0 9.6 6.6 6.1 2.2 1.9 1.7 1.4 1.5 1.3 1.5 1.6 25.0 17.6 18.0 17.3<br />

Geely 0175.HK 4.08 3,381 16.1 12.9 11.0 9.1 2.6 2.3 1.9 1.7 0.7 0.9 1.1 1.3 18.6 17.1 17.6 17.3<br />

Great Wall Motor 2333.HK 25.35 10,105 16.3 12.7 10.9 9.5 3.8 3.0 2.5 2.1 1.4 1.9 2.1 2.4 25.6 24.9 23.3 21.6<br />

Guangzhou <strong>Auto</strong> 2238.HK 7.14 4,955 7.8 15.0 10.2 8.2 1.5 1.4 1.3 1.2 2.8 1.5 2.2 2.6 15.6 8.3 10.5 12.1<br />

Qingling Motors 1122.HK 2.05 599 11.1 11.7 10.2 9.9 0.6 0.6 0.6 0.6 7.1 6.4 6.9 7.0 4.9 4.6 5.1 5.5<br />

Sinotruk 3808.HK 6.2 1,632 11.1 29.4 13.9 10.1 0.8 0.8 0.8 0.8 1.6 1.1 1.4 1.6 5.4 2.8 3.8 5.0<br />

Weichai Power Co. 2338.HK 35.8 8,295 10.1 14.8 12.3 11.0 2.6 2.0 1.8 1.6 0.3 0.6 0.6 0.7 27.0 14.0 14.6 14.3<br />

Mkt cap–wtd avg 14.0 20.6 13.1 10.8 3.1 2.5 2.1 1.8 1.1 1.1 1.3 1.4 21.5 16.5 16.8 16.3<br />

Global automakers<br />

Honda Motor 7267 3270 65,635 10.4 20.4 9.4 7.9 1.3 1.3 1.3 1.2 1.7 1.8 2.3 2.6 12.2 4.8 10.1 10.7<br />

Nissan Motor 7201 854 36,558 9.1 10.3 9.9 6.6 1.2 1.1 1.0 0.9 1.2 2.3 2.9 3.5 11.3 11.2 10.9 11.9<br />

Toyota Motor 7203 4260 136,134 24.2 35.0 14.0 9.4 1.3 1.3 1.2 1.1 1.2 1.2 1.7 2.2 3.9 2.7 7.9 9.1<br />

Mitsubishi Motors 7211 94 4,995 32.3 21.1 23.1 8.6 (2.6) (2.9) 1.8 1.5 - - - 0.7 6.7 9.7 13.0 20.0<br />

Mitsubishi Corp 8058 1710 31,839 5.8 5.9 7.6 6.7 0.9 0.8 0.8 0.7 3.8 3.8 3.1 3.5 14.8 13.5 9.7 10.7<br />

Mazda Motor 7261 185 7,488 (3.1) (2.6) 45.8 10.5 0.8 1.2 1.2 1.1 - - - 0.5 1.9 6.2<br />

Hyundai Motor 005380.KS 206000 40,975 7.9 6.4 5.6 5.1 1.2 1.2 1.0 0.9 0.8 0.9 1.0 1.0 22.8 21.7 19.3 17.6<br />

Kia Motors 000270.KS 53600 22,181 6.8 5.7 5.3 4.6 1.6 1.3 1.0 0.8 1.1 1.2 1.3 1.4 29.1 27.4 23.0 20.8<br />

Ford Motor Co. F.N 13.46 52,711 7.3 8.4 8.0 6.4 3.4 2.7 2.3 1.9 0.4 1.7 1.8 2.2 85.3 33.0 28.4 27.9<br />

General Motors Corp. GM.N 29.82 39,918 6.6 7.8 6.6 5.2 1.5 1.3 1.1 - 0.2 0.4 18.7 18.6 19.9<br />

Fiat FIA.MI 3.946 6,112 12.9 7.6 4.9 3.4 0.6 0.5 0.5 0.4 - 1.4 2.2 3.9 3.6 5.3 8.8 12.3<br />

BMW AG BMWG.DE 75.61 57,409 9.7 8.4 9.2 8.0 1.6 1.4 1.3 3.0 3.5 3.6 3.9 20.5 17.1 15.6 14.7<br />

Porsche <strong>Auto</strong> PSHG_p.DE 63.19 9,911 6.2 4.5 4.0 0.6 0.6 0.5 0.4 1.2 1.9 2.6 5.6 20.2 10.8 10.4<br />

Daimler DAIGn.DE 42.455 49,794 7.6 8.9 7.4 7.5 1.1 1.0 0.9 5.2 5.0 4.9 5.3 15.5 12.5 12.4 13.0<br />

Mkt cap–wtd avg 12.1 15.9 9.9 7.4 1.1 1.4 1.3 1.1 1.7 2.0 2.2 2.6 18.4 13.2 13.8 14.2<br />

Source: Bloomberg consensus<br />

Figure 8: Comparison within our coverage—P/E vs RoE Figure 9: Comparison within our coverage—P/E vs P/B<br />

2013E ROE (%)<br />

35.0<br />

30.0<br />

25.0<br />

20.0<br />

15.0<br />

10.0<br />

5.0<br />

-<br />

Dongfeng<br />

Motors<br />

Brilliance<br />

Great Wall<br />

Motor<br />

Geely<br />

Guangzhou<br />

<strong>Auto</strong><br />

BYD<br />

- 10.0 20.0<br />

2013E P/E (x)<br />

30.0 40.0<br />

Dongfeng<br />

Motors<br />

Source: Bloomberg consensus Source: Bloomberg consensus<br />

Brilliance<br />

Great Wall<br />

Motor<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 4<br />

2013E P/B (x)<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

-<br />

Geely<br />

Guangzhou<br />

<strong>Auto</strong><br />

BYD<br />

- 10.0 20.0<br />

2013E P/E (x)<br />

30.0 40.0

Table of contents<br />

Selectively accumulate ........................................................................................................ 3<br />

PV growth remains solid in 2013 ..................................................................................... 3<br />

SUV segment: New battlefield with strong demand ........................................................ 3<br />

Mid-to-high end segment: Intensifying competition ......................................................... 3<br />

Luxury segment: Rising along with wealth in <strong>China</strong> ........................................................ 3<br />

Valuation and stock picks ................................................................................................ 3<br />

<strong>Sector</strong> valuation comparison ........................................................................................... 4<br />

PV growth remains solid in 2013 ......................................................................................... 6<br />

Low penetration rate suggests high growth potential ...................................................... 6<br />

Income growth is driving auto sales ................................................................................ 8<br />

Growing demand in low-tier cities and inland regions ..................................................... 9<br />

Risks of oversupply ....................................................................................................... 10<br />

SUV segment: New battlefield with strong demand........................................................... 11<br />

Low SUV penetration rate with strong sales ................................................................. 11<br />

Upgrade and replacement demand to boost sales ....................................................... 12<br />

New model launches to intensify competition ............................................................... 13<br />

Limited competition in mid-to-low end segment ............................................................ 16<br />

Mid-to-high end segment: Intensifying competition ........................................................... 17<br />

Slowdown of PV sales ................................................................................................... 17<br />

Intensifying competition in PV segment ........................................................................ 18<br />

Japanese brands to regain market share in 2013 ......................................................... 19<br />

Low-end segment is under pressure ............................................................................. 20<br />

Luxury segment: Rising alone with wealth in <strong>China</strong> .......................................................... 23<br />

Low luxury auto penetration rate ................................................................................... 23<br />

Growing wealth strengthens luxury auto demand ......................................................... 23<br />

Replacement demand drives luxury auto sales ............................................................ 24<br />

Proliferation of economy models ................................................................................... 25<br />

Restrictive policies won’t hurt luxury segment .............................................................. 28<br />

Great Wall Motor (2333.HK / 2333 HK) ............................................................................ 29<br />

BYD Co Ltd (1211.HK / 1211 HK) .................................................................................... 44<br />

Geely <strong>Auto</strong>mobile Holdings Ltd (0175.HK / 175 HK) ......................................................... 62<br />

Guangzhou <strong>Auto</strong>mobile Group (2238.HK / 2238 HK) ........................................................ 80<br />

Dongfeng Motors Group Co Ltd (0489.HK / 489 HK) ........................................................ 83<br />

Brilliance <strong>China</strong> <strong>Auto</strong>motive Holding (1114.HK / 1114 HK) ............................................... 86<br />

08 January 2013<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 5

PV growth remains solid in 2013<br />

Low penetration rate suggests high growth potential<br />

<strong>China</strong>’s auto penetration rate (number of vehicles owned by per 1,000 people) was around<br />

69 in 2011, much lower than mature auto markets such as Japan and Korea, Germany,<br />

and the US (Figure 10). It is also lower than the world’s average of around 140. Given<br />

<strong>China</strong>’s GDP per capita already exceeded US$5,000 in 2011, we believe its reasonable<br />

auto penetration rate is around 100 (Figure 10). However, most provincial regions in <strong>China</strong><br />

have penetrations rate below 100 (Figure 11), suggesting high potential for auto sales<br />

growth.<br />

Figure 10: 2011 auto penetration rate by country<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

(No. of autos per<br />

1,000 people)<br />

<strong>China</strong> (69)<br />

United states (815)<br />

Japan (622)<br />

Korea (381)<br />

Germany (567)<br />

0<br />

GDP per capita (USD)<br />

100 1,000 10,000 100,000<br />

Source: United Nation Statistics, Ward <strong>Auto</strong>, CEIC, IMF, Credit Suisse estimates<br />

Figure 11: 2011 <strong>China</strong> auto penetration rate by region<br />

250<br />

200<br />

150<br />

100<br />

50<br />

No. of autos / 1,000<br />

persons<br />

GDP per capita (RMB)<br />

0<br />

10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000<br />

Source: CEIC, Credit Suisse estimates<br />

Zhejiang<br />

08 January 2013<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 6<br />

Beijing<br />

Tianjin<br />

Shanghai<br />

<strong>China</strong>’s auto penetration<br />

rate is much lower than<br />

mature auto markets,<br />

suggesting high growth<br />

potential for auto sales

We plot the GDP per capita and auto penetration rate of more than 100 countries in Figure<br />

10. We find auto penetration rates generally grow with GDP per capita and follow an Sshaped<br />

curve. We note that <strong>China</strong> is entering a stage of high growth on this S curve<br />

(Figure 10). We also note that growth of <strong>China</strong>’s GDP per capita and its auto penetration<br />

from 2000-11 has generally followed the trend for Korea over 1978-89 (Figure 12). We<br />

expect <strong>China</strong> to continue to follow Korea’s growth trends of 1990-98 between 2012 and<br />

2020. According to International Monetary Fund (IMF) estimates, <strong>China</strong>’s GDP per capita<br />

is likely to exceed US$9,500 in 2017, similar to Korea’s in 1994 when Korea’s auto<br />

penetration rate reached 167. We assume <strong>China</strong>’s auto penetration rate will reach 160 in<br />

2017. Then we use Korea’s auto penetration rate for 1990-98 as a proxy to simulate<br />

<strong>China</strong>’s penetration rate over 2012-20 (Figure 12). This suggests <strong>China</strong>’s total number of<br />

autos would reach around 200 mn units in 2016 and its annual auto sales growth rate<br />

would be maintained at around 10% by 2015 then 8-9% up to 2020 (Figure 13 and Figure<br />

14).<br />

Figure 12: Growth of GDP per capita and auto penetration rate<br />

USD<br />

25,000<br />

20,000<br />

15,000<br />

10,000<br />

5,000<br />

-<br />

Korea<br />

1978-1989 1990-1998<br />

-<br />

1978 1981 1984 1987 1990 1993 1996 1999 2002 2005 2008 2011<br />

GDP per capita (LHS) <strong>Auto</strong> penetration rate (RHS)<br />

Source: World Bank, IMF, Credit Suisse estimates<br />

No. of vehilces<br />

per 1,000 people<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

08 January 2013<br />

-<br />

2000 2005 2010 2015E 2020E<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 7<br />

USD<br />

15,000<br />

12,000<br />

9,000<br />

6,000<br />

3,000<br />

-<br />

<strong>China</strong><br />

2000-2011 2012-2000<br />

GDP per capita (LHS) <strong>Auto</strong> penetration rate (RHS)<br />

Figure 13: Growth of auto sales and auto population Figure 14: Growth of auto sales by segment<br />

('000 units)<br />

350,000<br />

300,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

-<br />

-<br />

2004 2006 2008 2010 2012E 2014E 2016E 2018E 2020E<br />

<strong>Auto</strong> sales (RHS) Total No. of autos (LHS)<br />

('000 units)<br />

40,000<br />

35,000<br />

30,000<br />

25,000<br />

20,000<br />

15,000<br />

10,000<br />

5,000<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

No. of vehilces<br />

per 1,000 people<br />

2004 2006 2008 2010 2012E 2014E 2016E 2018E 2020E<br />

<strong>Auto</strong> sales YoY % PV sales YoY % CV sales YoY %<br />

Source: CAAM, Credit Suisse estimates Source: CAAM, Credit Suisse estimates<br />

We expect <strong>China</strong>’s annual<br />

auto sales growth rate to be<br />

around 10% by 2015 and 8-<br />

9% up to 2020<br />

250<br />

200<br />

150<br />

100<br />

50

Income growth is driving auto sales<br />

We expect <strong>China</strong>’s auto sales to exceed 19 mn units in 2012, representing a 2005-12<br />

CAGR of more than 20%. This remarkable growth was mainly driven by a fast-growing<br />

domestic economy and rising individual incomes, with real GDP growing by around 10%<br />

p.a. from 2005-11 and Chinese disposable incomes per capita also growing by double<br />

digits. According to the National Bureau of Statistics, <strong>China</strong>’s disposable income per capita<br />

for urban residents in 1H12 increased 13.3% YoY to Rmb13,679 or US$2,183, faster than<br />

1H11’s 11.2%. During the same period, cash income per capita for rural residents<br />

increased 16.1% to Rmb4,303 or US$687, much faster than the growth of disposable<br />

income per capita for urban residents. With this rise in income, <strong>China</strong>’s middle class—<br />

defined as individuals earning more than Rmb50,000 or US$7,978 annually—doubled<br />

2006’s scale of about 12% of the country’s total population in 2010 and may account for<br />

about 45% of the total population by 2020 (Figure 15). We believe the emergence of<br />

<strong>China</strong>’s middle class is the power engine that will drive <strong>China</strong>’s auto sales in the next few<br />

years.<br />

Figure 15: Growth of middle class in <strong>China</strong> Figure 16: Income growth of Chinese households<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

-<br />

million<br />

1952 1978 1988 1991 1999 2004 2008 2020E<br />

Number of middle class household or higher (LHS)<br />

Share of middle class & higher (RHS)<br />

%<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

-<br />

income YoY<br />

25%<br />

Source: CEIC, Credit Suisse estimates Source: CEIC<br />

Figure 17: Income distribution of Chinese urban households<br />

%<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 95 100<br />

2005 2007 2009 2011<br />

Source: National Bureau of Statistics, CEIC<br />

RMB '000<br />

08 January 2013<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 8<br />

20%<br />

15%<br />

10%<br />

%<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

5%<br />

0%<br />

-5%<br />

8<br />

6<br />

4<br />

2<br />

0<br />

1997 1999 2001 2003 2005 2007 2009 2011<br />

2.1<br />

3.0<br />

Urban household Rural household<br />

4.5<br />

We believe strong income<br />

growth and rising middle<br />

class will be major engines<br />

for <strong>China</strong>’s auto sales<br />

7.5<br />

9.5<br />

12.2<br />

18.1<br />

2005 2006 2007 2008 2009 2010 2011<br />

Share of urban households with annual income > RMB100,000

Growing demand in low-tier cities and inland regions<br />

The number of <strong>China</strong>’s urban residents exceeded rural residents for the first time in 2011.<br />

The Chinese government was anticipating an urbanization rate of 51.5% by 2015E, which<br />

seems to have been easily realized in 2012. Tier 2 and 3 cities are the major engine of<br />

<strong>China</strong>’s urbanization. Tier 2 cities accounted for around 16% of the country’s population,<br />

but generated about 30% of total GDP and consumed over half of its foreign direct<br />

investment (Figure 18). The GDP growth rate of Tier 2 cities is about 2% higher than the<br />

whole economy in 2011 (Figure 19). We estimate that new car sales in Tier 2 cities will<br />

grow more than 10% p.a. by 2015. This rate would be 5-8% higher in Tier 3 cities, but less<br />

than 5% in Tier 1 cities, mainly due to auto restrictive policies. Moreover, <strong>China</strong>’s inland<br />

regions have lower auto penetration rates, but higher income (indicated by GDP per capita)<br />

growth rates than the national average (Figure 20 and Figure 21). We believe auto sales<br />

growth in these regions will also be faster than other parts of <strong>China</strong>.<br />

08 January 2013<br />

Figure 18: GDP contribution of Tier 1 and 2 cities Figure 19: GDP growth rates of Tier 1 and 2 cities<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

65% 64% 63% 62%<br />

23% 23% 24% 23%<br />

60% 60% 60% 60% 60% 58% 58%<br />

26% 26% 26% 27% 27% 30% 30%<br />

12% 13% 13% 14% 14% 14% 14% 13% 13% 12% 12%<br />

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011<br />

Tier-1 cties Tier-2 cities Other cities<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 9<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

2,002 2,003 2,004 2,005 2,006 2,007 2,008 2,009 2,010 2,011<br />

<strong>China</strong> total Tier-1 cties Tier-2 cities<br />

Source: CREIS, CEIC, Credit Suisse estimates Source: CREIS, CEIC, Credit Suisse estimates<br />

Figure 20: PV penetration rate (number of PV per 1,000<br />

persons) by region<br />

National average = 55.3<br />

Figure 21: 2005-11 CAGR of GDP per capita by region<br />

National average = 16.3%<br />

Source: CEIC, Credit Suisse estimates Source: CEIC, Credit Suisse estimates<br />

We believe auto sales<br />

growth in low-tier cities and<br />

inland regions will be faster<br />

than the national average

Risks of oversupply<br />

The return to strong growth in Chinese vehicle sales has prompted a wave of investment<br />

in new capacity. It has raised concerns that the industry could be left with a supply glut<br />

when sales growth slows following the end of government incentive schemes. The<br />

National Development and Reform Commission (NDRC) estimated that the industry was<br />

using 80% of its installed capacity in 2011, while we expect this to drop to about 75% in<br />

2012 and less than 70% by 2013. Compared with JVs, domestic brands seem to be more<br />

aggressive on capacity expansion (Figure 22 and Figure 23). They also have much lower<br />

capacity utilization rates (Figure 24 and Figure 25). We expect domestic brands to be<br />

more rational facing the slowdown of demand in the low-end segment. As most new<br />

capacities are still being planned, there would be sufficient time for them to adjust their<br />

capacity expansion to fit the industry’s demand growth.<br />

08 January 2013<br />

Figure 22: Capacity expansion of major JVs Figure 23: Capacity expansion of major domestic brands<br />

DF Honda<br />

GAC Toyota<br />

Changan Ford Mazda<br />

GAC Honda<br />

DF PSA<br />

DF Yueda Kia<br />

FAW VW<br />

FAW VW<br />

SH VW<br />

SH GM<br />

JVs<br />

- 500 1,000 1,500 2,000<br />

2012E capacity 2015E capacity<br />

FAW Xiali<br />

Jianghuai<br />

Great Wall Motor<br />

- 500 1,000 1,500 2,000<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 10<br />

FAW Car<br />

Changan <strong>Auto</strong><br />

Brilliance <strong>Auto</strong><br />

Shanghai <strong>Auto</strong><br />

Source: Company data Source: Company data<br />

Geely<br />

BYD<br />

Chery<br />

Domestic brands<br />

2012E capacity 2015E capacity<br />

Figure 24: Capacity utilisation rate of JVs Figure 25: Capacity utilisation rate of domestic brands<br />

Million units<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

90% 88%<br />

9.8<br />

11.2<br />

JVs<br />

14.9<br />

75%<br />

15.0<br />

84%<br />

2012E 2013E 2014E 2015E<br />

PV capacity* (LHS) Capacity utilization rate (RHS)<br />

* Including capacities for sedan, SUV and MPV<br />

Source: Company data, Credit Suisse estimates<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

Million units<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

7.8<br />

56%<br />

Domestic brands<br />

8.8<br />

53%<br />

14.7<br />

34%<br />

16.6<br />

32%<br />

2012E 2013E 2014E 2015E<br />

PV capacity* (LHS) Capacity utilization rate (RHS)<br />

* Including capacities for sedan, SUV, and MPV<br />

Source: Company data, Credit Suisse estimates<br />

Domestic brands have<br />

higher risks of overcapacity.<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%

SUV segment: New battlefield with<br />

strong demand<br />

Low SUV penetration rate with strong sales<br />

SUVs are expected to contribute around 13% of <strong>China</strong>’s PV sales in 2012, compared with<br />

about 5% in 2004 (Figure 26). However, this ratio is still much lower than the more than<br />

30% in the US and Australia, and is also lower than <strong>China</strong>’s neighbor such as Russia<br />

(Figure 27). SUV sales have grown much stronger than the PV industry in recent years<br />

(Figure 28). This is probably due to Chinese customers’ preferences for a more spacious<br />

driving experience, better visibility, outdoor lifestyles and better handling over tough road<br />

conditions. Moreover, prices for SUVs seem to be more resilient compared with other PV<br />

products, implying a lucrative playground for automakers (Figure 29). Given the low<br />

penetration rate and strong demand, we believe <strong>China</strong>’s SUV sales will remain strong in<br />

the next few years, which should attract more players to enter the market.<br />

08 January 2013<br />

Figure 26: SUV sales as a % of <strong>China</strong>’s PV sales Figure 27: 2011 SUV sales as a % of PV sales (by country)<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Jan/04 Oct/05 Jul/07 Apr/09 Jan/11 Oct/12<br />

SUV sales as % of PV sales<br />

Source: CAAM Source: CAAM, VDA, FCAJ, SMMT<br />

Figure 28: PV sales growth by segment<br />

Sales YoY%<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

2005 2006 2007 2008 2009 2010 2011 2012E 2013E 2014E 2015E<br />

Source: CAAM, Credit Suisse estimates<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 11<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

Total PV Sedan MPV SUV<br />

5%<br />

0%<br />

11%<br />

32%<br />

16%<br />

25%<br />

30%<br />

<strong>China</strong> US* Germany Russia Australia<br />

SUV sales as % of taotal PV sales (RHS)<br />

<strong>China</strong>’s SUV penetration<br />

rate is lower than major<br />

economies. We believe the<br />

segment’s sales will remain<br />

strong in next few years.

Figure 29: PV prices by segment<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

Price change (%)<br />

vs. Jan 2008 price<br />

-12<br />

Jan-08 Dec-08 Nov-09 Nov-10 Oct-11 Oct-12<br />

Source: NDRC<br />

PV Sedan SUV Mini Bus<br />

Upgrade and replacement demand to boost sales<br />

The SUV segment grows the fastest among all PV segments in <strong>China</strong>. One of the main<br />

reasons for this increase is that Chinese customers tend to choose bigger vehicles to<br />

upgrade/replace their existing car. A family car is quickly becoming a desired, and<br />

attainable, consumer product in <strong>China</strong>. Many Chinese consumers have already purchased<br />

a first, entry-level car and will be ready to upgrade to newer, better models. According to<br />

Sinotrust’s latest survey done in November 2012 on Chinese car owners’ preferences on<br />

their second vehicle, over 80% of Chinese car owners have only one car, who will become<br />

the major engine for auto sales in the next few years. Moreover, around 40% of Chinese<br />

car owners have indicated that they are going to buy an SUV as their second car, just<br />

behind sedans 49% (Figure 30: ). Also, the majority of upgrade and replacement<br />

purchases focus on models with an engine size between 1.7 and 2.0L and prices of<br />

Rmb50,000-150,000 (Figure 31, Figure 32). These models are usually classified as the<br />

mid-end and mid-to-low end segments. Therefore, we believe the mid-end and mid- to<br />

low-end SUV segments will have high sales growth potential given rising upgrade and<br />

replacement demand.<br />

Figure 30: Preference on vehicle model for first vehicle<br />

vs. second vehicle in <strong>China</strong><br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

14.7%<br />

6.8%<br />

Hatchback<br />

sedan<br />

64.4%<br />

48.6%<br />

39.8%<br />

16.9%<br />

2.5% 1.4%<br />

1.8% 1.4%<br />

0.5%<br />

0.2%<br />

0.8%<br />

0.3%<br />

Sedan SUV MPV Cross-over Minibus Others<br />

1st vehicle 2nd vehicle<br />

08 January 2013<br />

Figure 31: Preference on engine size for first vehicle vs.<br />

second vehicle in <strong>China</strong><br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 12<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

1.2%<br />

0.6%<br />

57.8%<br />

38.1%<br />

32.2%<br />

26.3%<br />

7.1%<br />

23.9%<br />

7.1%<br />

1.0%<br />

2.9% 1.2%<br />

0.4% 0.4%<br />

4.0L<br />

1st vehicle 2nd vehicle<br />

Source: Sinotrust, Credit Suisse estimates Source: Sinotrust, Credit Suisse estimates<br />

We expect rising upgrade<br />

and replacement demand to<br />

mainly benefit mid-end and<br />

mid-to-low end SUV sales.

Figure 32: Preference on price of first vehicle vs. second vehicle in <strong>China</strong><br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

0.60% 0.30%<br />

3.3%<br />

0.7%<br />

72.6%<br />

38.5%<br />

12.9%<br />

19.0%<br />

08 January 2013<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 13<br />

7.5%<br />

22.6%<br />

3.0%<br />

19.0%<br />

Rmb 300k<br />

Source: Sinotrust, Credit Suisse estimates<br />

1st vehicle 2nd vehicle<br />

New model launches to intensify competition<br />

Attracted by the lucrative SUV market, many automakers launched their new models to<br />

gain market share. Generally, JVs have launched more new models than domestic brands,<br />

expanding their market share since 2008 (Figure 33). Four new models were launched in<br />

4Q12 and over 20 new models are in the 2013 pipeline across different segments (Figure<br />

34 through to Figure 38). In the high-end and luxury segments, Audi Q3 should become a<br />

strong competitor for the BMW X1, while the Land Rover Freelander 2 and Volvo XC60<br />

will likely compete with each other starting 4Q13 (Figure 35). In the mid-to-high end<br />

segment, new models account for almost 40% of the total number of models (Figure 36).<br />

JV producers are major players in this segment and we expect their average margins to<br />

decline as competition intensifies. Although new models also account for around 40% of<br />

total models in the mid-end segment (Figure 37), we believe that Great Wall will retain its<br />

position as the No.1 best-selling brand. Its competitors in the mid-end segment are mainly<br />

domestic players not specialized in SUVs and with tiny market shares (Figure 38).<br />

Figure 33: SUV sales by automaker type<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

45% 45%<br />

40% 38%<br />

48%<br />

59% 57%<br />

62% 59% 61% 63% 66%<br />

2004 2005 2006 2007 2008 2009 2010 2011 2012E 2013E 2014E 2015E<br />

Source: CAAM, Credit Suisse estimates<br />

JVs Domestic brands<br />

Over 20 new models are<br />

due to be launched in 2013,<br />

which will intensify<br />

competition in the SUV<br />

segment

Figure 34: Launch time of new models<br />

Buick Encore<br />

Changan CS35<br />

Mitsubishi ASX<br />

Beijing B40<br />

Ford Kuga<br />

Peugeot 3008<br />

JAC Rein II<br />

Geely Emgrand SX7<br />

Zotye T600<br />

Audi Q3<br />

Benteng X80<br />

Yongman T5<br />

Mitsubishi Pajero Sport<br />

Mazda CX-7<br />

Geely Emgrand EX8<br />

Ford Ecosport<br />

Geely Emgrand EX6<br />

Mazda CX-5<br />

Chery T21<br />

Great Wall H2<br />

Geely Gleagle GX5<br />

Haima C2<br />

Beijing SC20<br />

Volvo XC60<br />

Land Rover Freelander 2<br />

Skoda Yeti<br />

Chevrolet Orlando<br />

08 January 2013<br />

- 100,000 200,000 300,000 400,000 500,000 600,000 700,000<br />

Source: Company data, Credit Suisse estimates<br />

New models<br />

Figure 35: Price range of <strong>China</strong>-made SUV models in high-end and luxury segments<br />

Toyota Prado<br />

Nissan Murano<br />

Volvo XC60<br />

Benz GLK<br />

Audi Q5<br />

Land Rover Freelander 2<br />

BMW X1<br />

Toyota Highlander<br />

Audi Q3<br />

Mitsubishi Pajero<br />

Mitsubishi Pajero Sport<br />

Source: Company data<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 14<br />

4Q12<br />

1Q13<br />

2Q13<br />

3Q13<br />

4Q13<br />

200,000 300,000 400,000 500,000 600,000 700,000 800,000<br />

Existing models New models<br />

RMB<br />

RMB

Figure 36: Price range of <strong>China</strong>-made SUV models in mid-to-high end segment<br />

Mazda CX-7<br />

VW Tiguan<br />

Ford Kuga<br />

Chevrolet Captiva<br />

Nissan X-Trail<br />

Roewe W5<br />

Nissan Paladin<br />

Mazda CX-5<br />

Luxgen 7<br />

Toyota RAV4<br />

Honda CR-V<br />

Skoda Yeti<br />

Kia Sportage R<br />

Hyundai IX35<br />

Peugeot 3008<br />

Changfeng Leopard CS7<br />

Chevrolet Orlando<br />

Hyundai Tucson<br />

Nissan Qashqai<br />

Kia Sportage<br />

Trumpche GS5<br />

Benteng X80<br />

Hawtai Boliger<br />

Mitsubishi ASX<br />

Buick Encore<br />

Jiangling Yusheng<br />

Geely Emgrand EX8<br />

Source: Company data<br />

08 January 2013<br />

100,000 150,000 200,000 250,000 300,000 350,000<br />

Existing models New models<br />

Figure 37: Price range of <strong>China</strong>-made SUV models in mid-end segment<br />

75,000 100,000 125,000 150,000 175,000 200,000<br />

Beijing B40<br />

Changfeng Leopard CT5<br />

Zhonghua V5<br />

Dongfeng Oting<br />

Great Wall H5<br />

Landwind X Series<br />

Haima 7<br />

Great Wall H6<br />

Great Wall H3<br />

Ford Ecosport<br />

Yongman T5<br />

JAC Rein II<br />

Chery T21<br />

BYD S6<br />

Geely Gleagle GX7<br />

Geely Emgrand SX7<br />

Zotye T600<br />

JAC Rein<br />

Huanghai V3<br />

Chery Tiggo<br />

Great Wall H2<br />

Source: Company data<br />

Existing models New models<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 15<br />

RMB<br />

RMB

08 January 2013<br />

Figure 38: Price range of <strong>China</strong>-made SUV models in low-end segment<br />

50,000 75,000 100,000 125,000<br />

Hawtai Santa Fe<br />

Haima C2<br />

Changan CS35<br />

Lifan X60<br />

Geely Emgrand EX6<br />

Zotye 5008<br />

Beijing SC20<br />

Source: Company data<br />

Existing models New models<br />

Limited competition in mid-to-low end segment<br />

Top JVs have equal strengths in the mid-to-high end SUV segment (Figure 39). Many of<br />

them are launching new models in 2013 and competition would become tougher. In<br />

contrast, the mid-to-low end SUV segment is dominated by Great Wall Motor (Figure 40).<br />

More than ten new models will be launched in 2013 in this segment. However, we believe<br />

Great Wall will be able to keep its leadership given its traditional strength in SUV and its<br />

good brand image. We expect the mid-to-low end segment to have less intensive<br />

competition but higher sales growth potential, which will mainly benefit Great Wall Motor.<br />

Figure 39: Market share in mid-to-high end SUV segment<br />

FAW Toyota<br />

10%<br />

DF Yueda<br />

Kia<br />

12%<br />

DF Nissan<br />

14%<br />

Others<br />

11%<br />

Jan-Nov 2012<br />

Source: CAAM, Credit Suisse estimates<br />

SH VW<br />

19%<br />

DF Honda<br />

17%<br />

BJ Hyundai<br />

17%<br />

Figure 40: Market share in mid-to-low end SUV segment<br />

Hawtai<br />

4%<br />

Geely<br />

4%<br />

Brilliance<br />

<strong>Auto</strong><br />

6%<br />

Jiangnan<br />

6%<br />

BYD<br />

11%<br />

Jan-Nov 2012<br />

Others<br />

19%<br />

Source: CAAM, Credit Suisse estimates<br />

Chery<br />

14%<br />

Great Wall<br />

36%<br />

FAW Toyota<br />

9%<br />

DF Yueda<br />

Kia<br />

11%<br />

DF Nissan<br />

12%<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 16<br />

Hawtai<br />

4%<br />

Geely<br />

8%<br />

Brilliance<br />

<strong>Auto</strong><br />

5%<br />

Others<br />

20%<br />

Jiangnan<br />

7%<br />

Others<br />

21%<br />

2013E<br />

2013E<br />

BYD<br />

9%<br />

Chery<br />

13%<br />

SH VW<br />

17%<br />

DF Honda<br />

16%<br />

BJ Hyundai<br />

15%<br />

Great Wall<br />

33%<br />

RMB<br />

We believe Great Wall will<br />

continue to lead the mid-tolow<br />

end SUV segment due<br />

to lack of strong competitors

Mid-to-high end segment:<br />

Intensifying competition<br />

Slowdown of PV sales<br />

<strong>China</strong>’s auto sales slowed down after its high growth of 2009-10 (Figure 41). In the first 11<br />

months of 2012, <strong>China</strong>’s auto sales grew 3.9% YoY, rebounding a little from 2.6% for 2011.<br />

We expect its entire 2012 sales to reach around 19 mn units. The YoY growth rate of its<br />

quarterly sales has dropped to single digits since 1Q11 when most of the government’s<br />

stimulus policies faded (Figure 42). Mid-to-high end PV sales have closely followed the<br />

industrial trend in recent years (Figure 43). We expect them to keep growing in single<br />

digits by 2015 (Figure 43).<br />

Figure 41: <strong>Auto</strong> sales of major countries<br />

20,000<br />

18,000<br />

16,000<br />

14,000<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

'000 units<br />

2004 2005 2006 2007 2008 2009 2010 2011 2012E<br />

<strong>China</strong> India Japan Western Europe<br />

Russia USA (Light vehicles) Brazil<br />

Source: CAAM, Gasgoo, Wind, Credit Suisse estimates<br />

Figure 42: <strong>China</strong>’s passenger vehicle (PV) sales<br />

('000 units)<br />

4,500<br />

4,000<br />

3,500<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

-<br />

77%<br />

26%<br />

17%<br />

25%<br />

9%<br />

3%<br />

8%<br />

2% -2%<br />

1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12E<br />

Source: CAAM, Credit Suisse estimates<br />

08 January 2013<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 17<br />

17%<br />

<strong>China</strong>'s PV sales (LHS) <strong>China</strong>'s PV sales YoY (RHS)<br />

7%<br />

8%<br />

YoY<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

Given the slowdown of<br />

<strong>China</strong>’s PV sales, we<br />

believe the mid-to-high end<br />

segment will grow in the<br />

single digits by 2015

Figure 43: PV sales comparison by segment<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

-20%<br />

39%<br />

22%<br />

25%<br />

7%<br />

53%<br />

29%<br />

76%<br />

33%<br />

5%<br />

42%<br />

25%<br />

22% 21% 20%<br />

7% 10% 10%<br />

2007 2008 2009 2010 2011 2012E 2013E 2014E 2015E<br />

Mid-to-high end YoY Luxury YoY Ultra-luxury YoY Total PV YoY<br />

Source: Roland Berger, Credit Suisse estimates<br />

Intensifying competition in PV segment<br />

<strong>China</strong>’s auto sector is highly competitive and original equipment manufacturers (OEM) are<br />

flooding the market. There are more than 50 auto makers in <strong>China</strong> and the industry is<br />

relatively fragmented. Foreign brands dominate, with their Chinese JVs accounting for<br />

almost 70% of <strong>China</strong>’s PV sales. Among them, GM and Volkswagen had a joint market<br />

share of around 35% in the first 11 months of 2012 (Figure 44). Their market shares have<br />

improved quickly in recent years, as Japanese brands lost market share in the mid- to<br />

high-end segment, especially after the Diaoyu islands dispute in mid-September 2012.<br />

The joint market share of domestic auto brands has kept decreasing in recent years,<br />

mainly due to weakening low-end PV sales, and is now less than one-third in 2012.<br />

Meanwhile, auto prices have also kept falling in recent years due to intensifying<br />

competition, while luxury auto prices are much more resilient compared with other<br />

segments (Figure 46).<br />

Figure 44: PV market share of major foreign auto brands in <strong>China</strong><br />

20%<br />

18%<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

GM Volkswagen Nissan Hyundai Toyota Honda Ford Kia PSA<br />

Source: CAAM, Credit Suisse estimates<br />

2008 2009 2010 2011 Jan-Nov 2012<br />

08 January 2013<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 18<br />

9%<br />

JVs are gaining market<br />

share in <strong>China</strong>’s PV<br />

segment, while auto prices<br />

are declining due to<br />

intensifying competition.

Figure 45: PV market share of major domestic auto brands in <strong>China</strong><br />

6%<br />

5%<br />

4%<br />

3%<br />

2%<br />

1%<br />

0%<br />

Chery Geely Great Wall BYD Brilliance Changan Jianghuai Lifan<br />

Source: CAAM, Credit Suisse estimates<br />

2008 2009 2010 2011 Jan-Nov 2012<br />

Figure 46: Change of auto prices by segments<br />

(Jan 2008 price = 100)<br />

105<br />

100<br />

95<br />

90<br />

85<br />

80<br />

Jan-08 Jun-08 Dec-08 Jun-09 Nov-09 May-10 Nov-10 May-11 Oct-11 Apr-12 Oct-12<br />

PV Mini Small Medium Class High Class Luxury<br />

Source: Cheshi, Credit Suisse estimates<br />

Japanese brands to regain market share in 2013<br />

Probably due to conservative market strategies, Japanese auto brands’ market shares<br />

have kept declining in recent years. Moreover, they suffered strikes from the Japanese<br />

earthquake in March 2011 and the Diaoyu island dispute in September 2012. Top<br />

Japanese auto brands such as Nissan, Toyota, Honda, and Mazda saw their Sep-Nov<br />

2012 sales decline sharply from the previous year (Figure 47). Japanese brands’ joint<br />

market share in <strong>China</strong> has fallen below 20% in the first 11 months of 2012 from more than<br />

22% in 2010 (Figure 48). The market share losses of Japanese brands are mainly the<br />

gains of JV brands especially German brands such as Volkswagen (Figure 48). Domestic<br />

players have not gained much, as they do not have intensive overlap with Japanese<br />

brands, which primarily focus on the mid-to-high end segment. December 2012 shipment<br />

of major Japanese auto brands rebounded to around 75-85% of their December 2011<br />

levels, suggesting a recovery is on track (Figure 47). Through our channel checks, we also<br />

learn that inventories at dealers’ have dropped to 1.3-1.6 months from their peaks at 2-3<br />

months in October 2012. Retail of Japanese auto brands in December 2012 has also<br />

08 January 2013<br />

We expect Japanese<br />

brands’ new models to help<br />

them regain market share in<br />

2013<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 19

ecovered to similar level as in December 2011. Brands, such as Nissan and Honda, plan<br />

to launch their new generation of sedans in 2013, which we expect will help them improve<br />

sales and regain market share. We expect these models to have lower ASPs than existing<br />

ones, which will not only intensify competition in the mid-to-high end segment, but also<br />

post high price pressure on the mid-end segment. However, luxury brand economy<br />

models are priced close to Japanese brands’ high-end models. Facing this top-down price<br />

pressure from the luxury segment, we expect Japanese brands to encounter a tough<br />

recovery in 2013.<br />

Figure 47: <strong>China</strong> sales of major Japanese auto brands<br />

<strong>China</strong> sales YoY (%) Sep-12 Oct-12 Nov-12 Dec-12 2012<br />

Nissan -35.3 -41.0 -29.8 -24.0 -5.3<br />

Toyota -48.9 -44.1 -22.1 -15.9 -4.9<br />

Honda -40.5 -54.0 -29.2 -19.2 -3.1<br />

Source: Company data, Credit Suisse estimates<br />

Figure 48: Foreign brands’ PV market shares in <strong>China</strong><br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Jan-09 May-09 Oct-09 Feb-10 Jul-10 Dec-10 Apr-11 Sep-11 Jan-12 Jun-12 Nov-12<br />

Source: CAAM<br />

Japanese German American Korean French<br />

Low-end segment is under pressure<br />

Usually PVs with an engine size of less than 1.6L are classified as low-end vehicles in<br />

<strong>China</strong>. They achieved impressive sales growth in 2009, outpacing the country’s PV sector<br />

(Figure 49). However, since 2010 the sales of low-end PVs have generally<br />

underperformed the sector (Figure 49). And we expect the share of low-end sedans<br />

(including A00, A0 and A classes) in <strong>China</strong>’s total PV sales to drop to around 51% in 2012<br />

from over 53% in 2006 (Figure 50). Given the slowdown in sales, we believe the peak<br />

period of strong demand growth for low-end vehicles has already passed. <strong>Auto</strong>makers<br />

with a primary focus on low-end sedans, such as Geely and BYD, are therefore likely to be<br />

seriously affected.<br />

08 January 2013<br />

Low-end PV sales is slowing<br />

down as demand weakens.<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 20

Figure 49: <strong>China</strong>’s low-end PV sales growth vs. total PV sales growth<br />

140%<br />

120%<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

-20%<br />

-40%<br />

Jan, 2009<br />

y-y<br />

Apr, 2009<br />

Source: CEIC, Credit Suisse estimates<br />

Jul, 2009<br />

Figure 50: <strong>China</strong> PV sales by class<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

30%<br />

Oct, 2009<br />

Jan, 2010<br />

Apr, 2010<br />

Jul, 2010<br />

Oct, 2010<br />

Engine

Figure 51: Sedan market shares of top domestic automakers<br />

7.0%<br />

6.0%<br />

5.0%<br />

4.0%<br />

3.0%<br />

2.0%<br />

1.0%<br />

0.0%<br />

4.4%<br />

4.2%<br />

5.7%<br />

3.7%<br />

3.4%<br />

3.2%<br />

0.8%<br />

2.1%<br />

0.2%<br />

Geely <strong>Auto</strong> Chery <strong>Auto</strong> BYD Changan <strong>Auto</strong> Great Wall<br />

Motor<br />

Source: CAAM, Credit Suisse estimates<br />

3.5%<br />

2008 2009 2010 2011 Jan-Nov 2012<br />

08 January 2013<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 22<br />

2.4%<br />

1.8% 1.8% 1.7%<br />

Tianjin FAW<br />

<strong>Auto</strong><br />

0.2%<br />

1.2%<br />

FAW Car Jianghuai <strong>Auto</strong><br />

Figure 52: Official prices of major JV self-owned brands<br />

Self- Lowest Highest Lowest Highest<br />

owned price price Original price price<br />

Manufacturer brand (Rmb) (Rmb) platform (Rmb) (Rmb)<br />

GAC Honda Linian 69,800 99,800 Honda City 96,800 159,800<br />

SH GM Wuling Baojun 62,800 95,800 Chevrolet Spark 77,800 88,800<br />

DF Nissan Venucia 67,800 83,800 Nissan TIIDA 105,300 158,800<br />

DF Honda CIIMO 111,800 119,800 Honda Civic 131,800 135,800<br />

Source: Company data, Credit Suisse estimates

Luxury segment: Rising alone with<br />

wealth in <strong>China</strong><br />

Low luxury auto penetration rate<br />

Luxury PVs contribute to about 7% of total PV sales in <strong>China</strong>. This compares with 13% in<br />

the US and more than 20% in Europe (Figure 53). Luxury PVs account for about 9% of<br />

total automobiles in <strong>China</strong>, lower than most mature auto markets such as the US,<br />

Germany and the UK (Figure 54). Therefore, we believe that there is still large potential for<br />

luxury auto sales growth in <strong>China</strong>. We expect the luxury segment to keep growing at 20-<br />

25% p.a. by 2015 (Figure 56,Figure 57).<br />

Figure 53: Luxury* PV sales as % of total PV sales (2011) Figure 54: Luxury* PV as % of total number of autos<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

7%<br />

13%<br />

10%<br />

29%<br />

9%<br />

23%<br />

<strong>China</strong> US** Japan Germany Russia UK<br />

Luxury* PV sales as % of taotal PV sales<br />

* Includes both luxury and ultra-luxury models.<br />

** PV sales here refer to light vehicle sales.<br />

Source: CPCA, LMC <strong>Auto</strong>motive, AEB, Credit Suisse estimates<br />

(2011)<br />

08 January 2013<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 23<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

9%<br />

11%<br />

3%<br />

29%<br />

15%<br />

16%<br />

<strong>China</strong> US Japan Germany Russia UK<br />

Luxury* vehilce as % of total number of automobiles<br />

* Includes both luxury and ultra-luxury models<br />

Source: SXRB, Credit Suisse estimates<br />

Growing wealth strengthens luxury auto demand<br />

Figure 55: Growth of number of millionaires in <strong>China</strong><br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

320<br />

345<br />

7% 8%<br />

20%<br />

413<br />

364 343<br />

2005 2006 2007 2008 2009 2010 2011 1H12<br />

-12%<br />

-6%<br />

56%<br />

535<br />

562<br />

Number of millionaires (RHS) Number of millionaires y-y (LHS)<br />

5%<br />

'000 persons<br />

1,200<br />

72%<br />

Source: Capgemini, Merrill Lynch Global Wealth Management, RBC Wealth Management, Citi Private<br />

Bank, Credit Suisse Research Institute<br />

964<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

-<br />

We believe luxury auto<br />

sales have high growth<br />

potential in <strong>China</strong> mainly<br />

due to a low penetration rate

Figure 56: Luxury PV sales in <strong>China</strong><br />

'000 Units<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

181<br />

39%<br />

22%<br />

252<br />

25%<br />

7%<br />

314<br />

53%<br />

29%<br />

407<br />

76%<br />

33%<br />

718<br />

42%<br />

1,017<br />

1,272<br />

25%<br />

08 January 2013<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 24<br />

1,551<br />

1,877<br />

2,252<br />

22% 21% 20%<br />

5% 7% 10% 10%<br />

2006 2007 2008 2009 2010 2011 2012E 2013E 2014E 2015E<br />

Luxury PV sales (LHS) Luxury PV sales YoY (RHS) Total PV sales YoY (RHS)<br />

Source: Roland Berger, Credit Suisse estimates<br />

Figure 57: Ultra-luxury PV sales in <strong>China</strong><br />

'000 Units<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

4<br />

51%<br />

22%<br />

6<br />

83%<br />

7%<br />

11<br />

53%<br />

10<br />

17<br />

-12%<br />

79% 77%<br />

33%<br />

30<br />

5%<br />

35%<br />

41<br />

7%<br />

53<br />

30%<br />

66<br />

25%<br />

9%<br />

79<br />

20%<br />

10% 10% 9%<br />

2006 2007 2008 2009 2010 2011 2012E 2013E 2014E 2015E<br />

Ultra-luxury PV sales (LHS) Ultra-luxury PV sales YoY (RHS) Total PV sales YoY (RHS)<br />

Source: Roland Berger, Credit Suisse estimates<br />

Replacement demand drives luxury auto sales<br />

Most Chinese auto buyers are still first-time buyers and contributed more than 90% of total<br />

auto sales in 2011 (Figure 58). As the auto stock ages in <strong>China</strong>, people who bought their<br />

cars during 2009-10 should be looking to make a replacement purchase in the next few<br />

years. This trend may continue and we believe that replacement demand will gradually<br />

become the major driver of <strong>China</strong>’s auto sales in the next 5-10 years. It is difficult to<br />

describe the Chinese customers’ affinity for luxury goods, such as luxury cars. In particular,<br />

they love SUVs or luxury cars for their second car. Since about 2003, <strong>China</strong>'s affluent<br />

population has completely overtaken Americans with similar incomes in the purchase of<br />

luxury vehicles (Figure 59). For the same income bracket per 1,000 households, Chinese<br />

customers purchase nearly six times as many luxury cars as Americans do. We believe<br />

replacement demand will boost luxury auto sales in <strong>China</strong>, stronger than it did in other<br />

developed countries.<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

-20%<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

-20%<br />

We believe replacement<br />

demand will be the major<br />

driver of luxury auto sales in<br />

<strong>China</strong>

Figure 58: New demand vs. replacement demand<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

87%<br />

13%<br />

91%<br />

9%<br />

76%<br />

24%<br />

50%<br />

50%<br />

<strong>China</strong> (2010) <strong>China</strong> (2011) India Korea USA Japan UK German<br />

Source: JD Power, Wardsauto, <strong>China</strong> <strong>Auto</strong> Market<br />

25%<br />

75%<br />

Replacement demand 1st time demand<br />

Figure 59: Luxury car sales per 1,000 households with annual disposable incomes over US$100,000<br />

Unit US<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

68<br />

69<br />

75<br />

80<br />

84 84<br />

80 79<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011<br />

Source: Euromonitor, US Census Bureau, HIS, World Bank, TNS, Credit Suisse estimates<br />

Proliferation of economy models<br />

67<br />

53<br />

58<br />

53<br />

08 January 2013<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 25<br />

17%<br />

83%<br />

40<br />

6%<br />

94%<br />

72<br />

76<br />

5%<br />

95%<br />

Unit <strong>China</strong><br />

350<br />

Many luxury brands have launched their economy models with affordable prices. Some of<br />

them are selling below Rmb300,000, which is the traditional price range for the mid-to-high<br />

end segment (Figure 60 through to Figure 63). Major economy models, such as the<br />

Mercedes-Benz C class, BMW 3 series, Audi A4L and Volvo S60, are also the best-selling<br />

models for these luxury brands. We believe their good brand image and attractive prices<br />

will enable them to expand their customer base and gain market share from mid-to-high<br />

end players. This should fuel their sales growth in the next 3-5 years.<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

122<br />

97 93<br />

130<br />

161<br />

177<br />

231<br />

340 339<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011<br />

Luxury brands’ economy<br />

models will help them to<br />

boost sales and gain market<br />

share

Figure 60: Official prices of luxury brands’ economy models vs. key mid-to-high end models<br />

BMW New 3 Series<br />

Volvo S60<br />

BMW 3 Series<br />

Mercedes-Benz C Class<br />

Audi A4L<br />

Nissan Teana<br />

Buick LaCrosse<br />

Source: Company data<br />

Honda Accord<br />

Toyota Camry<br />

VW Passart<br />

08 January 2013<br />

100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 500,000 550,000 600,000<br />

Figure 61: Nov 12 retail prices of luxury brands’ economy models vs. key mid-to-high end models<br />

BMW New 3 Series<br />

Volvo S60<br />

BMW 3 Series<br />

Mercedes-Benz C Class<br />

Audi A4L<br />

Nissan Teana<br />

Buick LaCrosse<br />

Honda Accord<br />

Toyota Camry<br />

VW Passart<br />

Source: Channel checks with dealers<br />

100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 500,000 550,000 600,000<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 26<br />

RMB<br />

RMB

Figure 62: Comparison among cheapest economy models of major luxury brands<br />

Model<br />

Official price<br />

(’000 Rmb)<br />

Dec-12 Retail price<br />

(’000 Rmb)<br />

Mercedes-Benz<br />

C Class<br />

BMW 3 Series<br />

BMW New 3 Series<br />

(Long-wheelbase)<br />

08 January 2013<br />

Audi A4L Volvo S60<br />

C180 CGI Classic 318i Advance 320Li Fashion 30TFS I MT Comfort 2.0T Advance<br />

308.0 296.0 354.6 272.8 282.8<br />

158.0 241.0 354.6 217.8 212.8<br />

Size (m) 4.581/1.770/1.448 4.531/1.817/1.421 4.734/1.811/1.455 4.791/1.826/1.439 4.628/1.865/1.484<br />

Wheelbase (m) 2.76 2.76 2.92 2.869 2.776<br />

Trunk volume (litre) 475 460 480 480 380<br />

Tank volume (litre) 66 63 60 65 67.5<br />

Complete mass (kg) 1545 1465 1540 1550 1591<br />

Engine size (L) 1.796 1.995 1.997 1.798 1.984<br />

Max power (kW/rpm) 115/5000 100/5750 135/5000 118/4500-6200 132/5000<br />

Max toque (n.m/rpm) 250/1600-4200 180/3250 270/1250-4500 250/1500-4500 300/2700-4200<br />

Acceleration 0-100 km/h<br />

(seconds)<br />

8.9 10.8 7.9 8.3 8.7<br />

Transmission 7AT 6AT 8AT 6MT 6AT<br />

Fuel consumption<br />

(L/100km)<br />

7.7 8.5 6.9 6.5 8.3<br />

Warranty 2 years 2 years 2 years 2 years 2 years or 100,000 km<br />

Emission standard Euro IV Euro IV Euro IV National IV National IV<br />

Source: Xcar, Channel checks with dealers<br />

Figure 63: Major luxury models with retail prices below Rmb300,000<br />

Official Oct-12 Price Nov-12 Price Dec-12 Price<br />

price retail price cut retail price cut retail price cut<br />

Brand Model (’000 Rmb) (’000 Rmb) (%) (’000 Rmb) (%) (’000 Rmb) (%)<br />

Mercedes-Benz C180K CGI Classic 308.0 233.0 24 218.0 29 158.0 49<br />

C200 CGI 348.0 258.0 26 248.0 29 193.0 45<br />

C200 CGI Fashion 388.0 283.0 27 268.0 31 233.0 40<br />

BMW 318i 2.0 AT Advance 2012 296.0 249.0 16 246.0 17 241.0 55<br />

Audi A4L 1.8 30TFSI MT Comfort 2012 272.8 232.8 15 234.8 14 217.8 20<br />

A4L 1.8 30TFSI CVT Comfort 2012 291.0 251.0 14 253.0 13 236.0 19<br />

A4L 2.0 35TFSI CVT Standard<br />

2012<br />

309.8 269.8 13 271.8 12 254.8 18<br />

A4L 2.0 35TFSI CVT Comfort 2012 329.9 289.9 12 291.9 12 274.9 17<br />

Volvo S60 2.0T Advance 2013 282.8 242.8 14 222.8 21 257.8 9<br />

S60 2.0T T5 Smart 2013 299.8 259.8 13 239.8 20 274.8 8<br />

S60 2.0T T5 Comfort 2013 322.8 282.8 12 262.8 19 297.8 8<br />

S60 2.0T DCTT5 Smart 2012 249.8 199.8 20 189.8 24 199.8 20<br />

S60 2.0T DCTT5 Comfort 2012 319.9 269.9 16 259.9 19 264.9 17<br />

S60 1.6T DCTDRIVe Smart 2012 282.8 232.8 18 222.8 21 212.8 25<br />

S60 1.6T DCTDRIVe Comfort 2012 306.8 256.8 16 246.8 20 236.8 23<br />

S60 1.6T DCTDRIVe Smart 2012 334.8 284.8 15 274.8 18 264.8 21<br />

S60 2.0T DCTT5 Comfort 2012 339.8 259.8 24 264.8 22 259.8 24<br />

S60 2.0T DCTT5 Delux 2012 369.8 289.8 22 294.8 20 289.8 22<br />

Lexus CT200h 1.8 CVT Elite 2012 279.0 234.0 16 239.0 14 229.0 18<br />

CT200h 1.8 CVT Advance 2012 339.0 294.0 13 289.0 15 289.0 15<br />

Source: Channel checks with dealers<br />

<strong>China</strong> <strong>Auto</strong> <strong>Sector</strong> 27

Restrictive policies won’t hurt luxury segment<br />

Beijing and Guangzhou are adopting restrictive policies on auto sales to control<br />

congestion. Beijing announced the most strict restrictive policies on auto license plates in<br />

December 2010. The new measures set a 2011 annual quota for Beijing’s new PV<br />

licenses of only 240,000 units, compared with its 2010 total auto sales of around 900,000<br />

vehicles. Quotas for new car licenses are distributed by lottery draw, while<br />

upgrading/replacement purchases are not regulated by the new measures once an owner<br />

disposes of his/her old car. With this new license quota limit, car growth in Beijing has<br />

slowed down since 2011 (Figure 64). Accordingly, the CAGR for total number of autos in<br />

Beijing is expected to drop to about 3.7% in 2012-16E from over 11% for 2007-11. It is<br />