TAX SALE - Worcester County

TAX SALE - Worcester County

TAX SALE - Worcester County

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

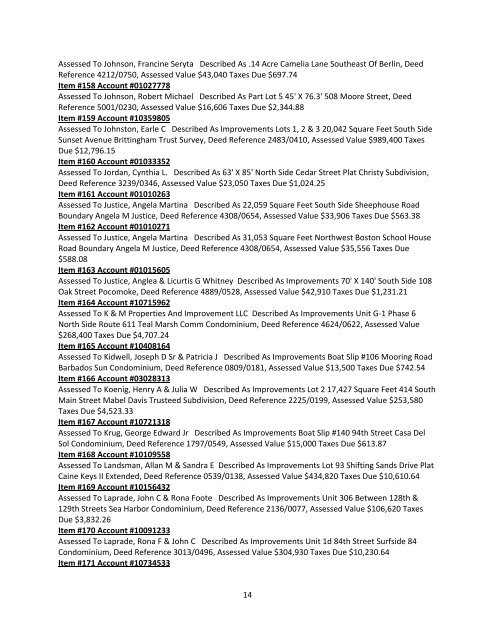

Assessed To Johnson, Francine Seryta Described As .14 Acre Camelia Lane Southeast Of Berlin, Deed<br />

Reference 4212/0750, Assessed Value $43,040 Taxes Due $697.74<br />

Item #158 Account #01027778<br />

Assessed To Johnson, Robert Michael Described As Part Lot 5 45' X 76.3' 508 Moore Street, Deed<br />

Reference 5001/0230, Assessed Value $16,606 Taxes Due $2,344.88<br />

Item #159 Account #10359805<br />

Assessed To Johnston, Earle C Described As Improvements Lots 1, 2 & 3 20,042 Square Feet South Side<br />

Sunset Avenue Brittingham Trust Survey, Deed Reference 2483/0410, Assessed Value $989,400 Taxes<br />

Due $12,796.15<br />

Item #160 Account #01033352<br />

Assessed To Jordan, Cynthia L. Described As 63' X 85' North Side Cedar Street Plat Christy Subdivision,<br />

Deed Reference 3239/0346, Assessed Value $23,050 Taxes Due $1,024.25<br />

Item #161 Account #01010263<br />

Assessed To Justice, Angela Martina Described As 22,059 Square Feet South Side Sheephouse Road<br />

Boundary Angela M Justice, Deed Reference 4308/0654, Assessed Value $33,906 Taxes Due $563.38<br />

Item #162 Account #01010271<br />

Assessed To Justice, Angela Martina Described As 31,053 Square Feet Northwest Boston School House<br />

Road Boundary Angela M Justice, Deed Reference 4308/0654, Assessed Value $35,556 Taxes Due<br />

$588.08<br />

Item #163 Account #01015605<br />

Assessed To Justice, Anglea & Licurtis G Whitney Described As Improvements 70' X 140' South Side 108<br />

Oak Street Pocomoke, Deed Reference 4889/0528, Assessed Value $42,910 Taxes Due $1,231.21<br />

Item #164 Account #10715962<br />

Assessed To K & M Properties And Improvement LLC Described As Improvements Unit G‐1 Phase 6<br />

North Side Route 611 Teal Marsh Comm Condominium, Deed Reference 4624/0622, Assessed Value<br />

$268,400 Taxes Due $4,707.24<br />

Item #165 Account #10408164<br />

Assessed To Kidwell, Joseph D Sr & Patricia J Described As Improvements Boat Slip #106 Mooring Road<br />

Barbados Sun Condominium, Deed Reference 0809/0181, Assessed Value $13,500 Taxes Due $742.54<br />

Item #166 Account #03028313<br />

Assessed To Koenig, Henry A & Julia W Described As Improvements Lot 2 17,427 Square Feet 414 South<br />

Main Street Mabel Davis Trusteed Subdivision, Deed Reference 2225/0199, Assessed Value $253,580<br />

Taxes Due $4,523.33<br />

Item #167 Account #10721318<br />

Assessed To Krug, George Edward Jr Described As Improvements Boat Slip #140 94th Street Casa Del<br />

Sol Condominium, Deed Reference 1797/0549, Assessed Value $15,000 Taxes Due $613.87<br />

Item #168 Account #10109558<br />

Assessed To Landsman, Allan M & Sandra E Described As Improvements Lot 93 Shifting Sands Drive Plat<br />

Caine Keys II Extended, Deed Reference 0539/0138, Assessed Value $434,820 Taxes Due $10,610.64<br />

Item #169 Account #10156432<br />

Assessed To Laprade, John C & Rona Foote Described As Improvements Unit 306 Between 128th &<br />

129th Streets Sea Harbor Condominium, Deed Reference 2136/0077, Assessed Value $106,620 Taxes<br />

Due $3,832.26<br />

Item #170 Account #10091233<br />

Assessed To Laprade, Rona F & John C Described As Improvements Unit 1d 84th Street Surfside 84<br />

Condominium, Deed Reference 3013/0496, Assessed Value $304,930 Taxes Due $10,230.64<br />

Item #171 Account #10734533<br />

14