BHARTI INFOTEL LIMITED - Airtel

BHARTI INFOTEL LIMITED - Airtel

BHARTI INFOTEL LIMITED - Airtel

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

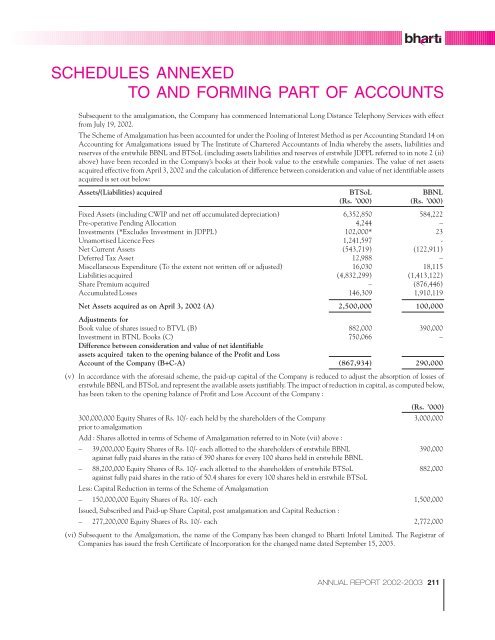

SCHEDULES ANNEXED<br />

TO AND FORMING PART OF ACCOUNTS<br />

Subsequent to the amalgamation, the Company has commenced International Long Distance Telephony Services with effect<br />

from July 19, 2002.<br />

The Scheme of Amalgamation has been accounted for under the Pooling of Interest Method as per Accounting Standard 14 on<br />

Accounting for Amalgamations issued by The Institute of Chartered Accountants of India whereby the assets, liabilities and<br />

reserves of the erstwhile BBNL and BTSoL (including assets liabilities and reserves of erstwhile JDPPL referred to in note 2 (ii)<br />

above) have been recorded in the Company’s books at their book value to the erstwhile companies. The value of net assets<br />

acquired effective from April 3, 2002 and the calculation of difference between consideration and value of net identifiable assets<br />

acquired is set out below:<br />

Assets/(Liabilities) acquired BTSoL BBNL<br />

(Rs. ’000) (Rs. ’000)<br />

Fixed Assets (including CWIP and net off accumulated depreciation) 6,352,850 584,222<br />

Pre-operative Pending Allocation 4,244 –<br />

Investments (*Excludes Investment in JDPPL) 102,000* 23<br />

Unamortised Licence Fees 1,241,597 -<br />

Net Current Assets (543,719) (122,911)<br />

Deferred Tax Asset 12,988 –<br />

Miscellaneous Expenditure (To the extent not written off or adjusted) 16,030 18,115<br />

Liabilities acquired (4,832,299) (1,413,122)<br />

Share Premium acquired – (876,446)<br />

Accumulated Losses 146,309 1,910,119<br />

Net Assets acquired as on April 3, 2002 (A)<br />

Adjustments for<br />

2,500,000 100,000<br />

Book value of shares issued to BTVL (B) 882,000 390,000<br />

Investment in BTNL Books (C)<br />

Difference between consideration and value of net identifiable<br />

assets acquired taken to the opening balance of the Profit and Loss<br />

750,066 –<br />

Account of the Company (B+C-A) (867,934) 290,000<br />

(v) In accordance with the aforesaid scheme, the paid-up capital of the Company is reduced to adjust the absorption of losses of<br />

erstwhile BBNL and BTSoL and represent the available assets justifiably. The impact of reduction in capital, as computed below,<br />

has been taken to the opening balance of Profit and Loss Account of the Company :<br />

(Rs. ’000)<br />

300,000,000 Equity Shares of Rs. 10/- each held by the shareholders of the Company<br />

prior to amalgamation<br />

Add : Shares allotted in terms of Scheme of Amalgamation referred to in Note (vii) above :<br />

3,000,000<br />

– 39,000,000 Equity Shares of Rs. 10/- each allotted to the shareholders of erstwhile BBNL<br />

against fully paid shares in the ratio of 390 shares for every 100 shares held in erstwhile BBNL<br />

390,000<br />

– 88,200,000 Equity Shares of Rs. 10/- each allotted to the shareholders of erstwhile BTSoL<br />

against fully paid shares in the ratio of 50.4 shares for every 100 shares held in erstwhile BTSoL<br />

882,000<br />

Less: Capital Reduction in terms of the Scheme of Amalgamation<br />

– 150,000,000 Equity Shares of Rs. 10/- each 1,500,000<br />

Issued, Subscribed and Paid-up Share Capital, post amalgamation and Capital Reduction :<br />

– 277,200,000 Equity Shares of Rs. 10/- each 2,772,000<br />

(vi) Subsequent to the Amalgamation, the name of the Company has been changed to Bharti Infotel Limited. The Registrar of<br />

Companies has issued the fresh Certificate of Incorporation for the changed name dated September 15, 2003.<br />

ANNUAL REPORT 2002-2003 211